Should I declare the actual costs or use the care allowance?

If you provide unpaid care for a person in need, you can claim the care allowance. The care allowance is

- for care level 2: 600 Euro

- for care level 3: 1.100 Euro

- for care level 4 or 5 or if the person is helpless: 1.800 Euro.

If you do not have higher expenses than a maximum of 1.800 Euro, this is also the best solution for you.

It is different if you have higher expenses, need to co-finance an additional carer or accommodation in a care home. In that case, it is more worthwhile to forgo the care allowance (also the disability allowance) and claim the actual expenses as extraordinary burdens.

These costs are then listed in the "Extraordinary Burdens" section as care costs (expenses due to care needs, expenses for caring for a relative or for accommodation in a care home).

If you have an income of 30.000 Euro per year, your reasonable burden as a married couple with one child is 746 Euro. If your expenses exceed this amount, it is worthwhile to declare them.

This can include various expenses such as food, laundry, cleaning or rent.

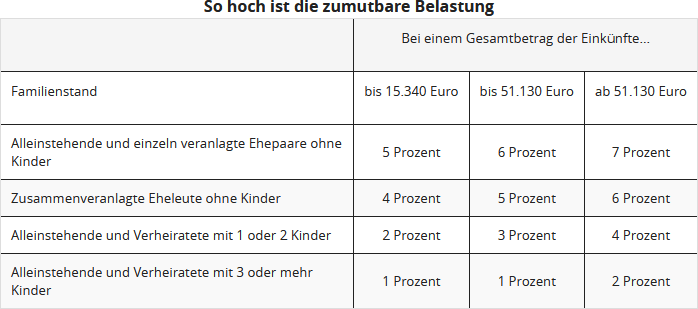

In your tax return, you can enter the actual expenses. However, these are not recognised in full. Your reasonable personal burden is deducted from this. This depends on your income, marital status and the number of your children and is calculated by the tax office. The reasonable personal burden is one to seven percent of the total income.

If your expenses are below the reasonable personal burden, it is not worthwhile to declare the costs in the tax return. If you are still above the maximum amount after deducting the personal burden, declare your care expenses as they actually occurred. However, you must then be able to prove the individual expenses. The care allowance can be claimed without individual proof.

Bewertungen des Textes: Should I declare the actual costs or use the care allowance?

2.50

von 5

Anzahl an Bewertungen: 2