Welches Finanzamt ist für mich zuständig?

Die Zuständigkeit des Finanzamts richtet sich nach Ihrem Wohnort in Deutschland. Sollten Sie mehrere Wohnsitze haben (z. B. bei doppelter Haushaltsführung), ist bei Verheirateten der Wohnort maßgebend, an dem sich die Familie vorwiegend aufhält. Bei Ledigen ist der Wohnort maßgebend, an dem dieser sich vorwiegend aufhält. Das kann auch eine bescheidene Unterkunft sein, z. B. ein möbliertes Zimmer während der Zeit einer auswärtigen Beschäftigung oder Ausbildung.

Entscheidend ist der Wohnsitz zum Zeitpunkt der Abgabe der Steuererklärung, d. h. wenn Sie während des Jahres umziehen, ist das Finanzamt des neuen Wohnsitzes zuständig.

Sollten Sie sich von Ihrem Ehepartner getrennt haben, ist das Finanzamt zuständig, welches zuerst mit dem Steuerfall befasst war. Es ist also ausschlaggebend, welcher der Ehepartner zuerst seine Steuererklärung abgegeben hat. Lediglich bei der Einzelveranlagung ist das jeweilige Finanzamt am Wohnsitz des Ehegatten zuständig.

Wenn Sie als Rentner im Ausland leben und aus Deutschland nur Einkünfte aus Renten beziehen, müssen Sie Ihre Steuererklärung beim Finanzamt Neubrandenburg (Rentenempfänger im Ausland - RiA) in Mecklenburg-Vorpommern einreichen.

Erzielen Sie neben den Renteneinkünften noch weitere Einkünfte, kann auch ein anderes Finanzamt zuständig sein. Im Zweifelsfall setzen Sie sich bitte mit dem Finanzamt Neubrandenburg (Rentenempfänger im Ausland - RiA) in Verbindung.

Für die Zuständigkeitsbestimmung sind folgende Fälle zu unterscheiden:

A. Der Arbeitnehmer erzielt nach seinem Wegzug keine Einkünfte in Deutschland

In diesen Fällen liegt mangels beschränkt steuerpflichtiger Einkünfte kein Wechsel von der unbeschränkten zur beschränkten Steuerpflicht vor. Für die Veranlagungszeiträume der unbeschränkten Steuerpflicht verbleibt die Zuständigkeit beim letzten Wohnsitzfinanzamt.

B. Der Arbeitnehmer erzielt auch nach seinem Wegzug Einkünfte in Deutschland

Wenn der Arbeitnehmer nur noch im Wegzugsjahr inländische Einkünfte erzielt, ist im Wegzugsjahr noch das Finanzamt des letzten Wohnsitzes zuständig.

Erzielt der Arbeitnehmer auch nach dem Wegzugsjahr inländische Einkünfte, bestimmt sich die Zuständigkeit für die Veranlagung zur beschränkten Steuerpflicht nach § 50 Abs. 2 EStG (Betriebsstättenfinanzamt) bzw. § 19 Abs. 2 AO. Das dann zuständige Finanzamt ist auch für die früheren Veranlagungszeiträume zuständig, in denen noch unbeschränkte Steuerpflicht bestand. Bereits begonnene Verwaltungsverfahren können ggf. durch das bisher zuständige Finanzamt fortgeführt werden.

Welches Finanzamt ist für mich zuständig?

Was unterscheidet meine Steuernummer von der Steuer-Identifikationsnummer?

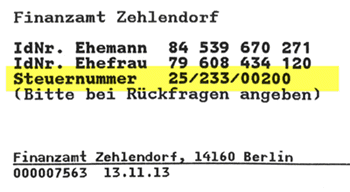

Die Steuernummer ist nicht zu verwechseln mit der lebenslang gültigen und bundeseinheitlich gleichen Steuer-Identifikationsnummer.

Was ist die Steuernummer?

Die Steuernummer wird vom Finanzamt an jede steuerpflichtige natürliche oder juristische Person vergeben und ist einem Steuerpflichtigen eindeutig zugeordnet. Eine Person kann mehrere Steuernummern in seinem Leben haben. Wer beispielsweise umzieht und dadurch in den Zuständigkeitsbereich eines anderen Finanzamtes gehört, wer heiratet oder eine Selbständigkeit anmeldet, erhält eine neue Steuernummer.

Früher richteten sich die Steuernummern an länderbezogenen Codes aus und bestanden je nach Bundesland aus zehn oder elf Ziffern. Im Laufe der Einführung des so genannten ELSTER-Verfahrens (ELektronische STeuerERklärung) wurde das Standardschema der Steuernummer jedoch bundesweit vereinheitlicht und hat nun 13 Ziffern.

Wo finde ich die Steuernummer?

Nach Einreichen der ersten Einkommensteuererklärung oder bei der Anmeldung einer selbständigen bzw. gewerblichen Tätigkeit wird die Nummer durch das zuständige Finanzamt ermittelt. Sie kann aber auch eigeninitiativ beantragt werden. Auf dem Einkommensteuerbescheid ist die Steuernummer links oben zu finden.

Wofür brauche ich die Steuernummer?

Die Steuernummer ist bei der Einreichung der Steuererklärung oder bei der Anmeldung einer selbständigen bzw. gewerblichen Tätigkeit, ebenso wie im Zahlungsverkehr anzugeben. Freiberufler und Gewerbetreibende müssen sie, sofern sie keine Umsatzsteueridentifikationsnummer haben, in ihrer Rechnung ausweisen. Zukünftig wird die Steuernummer von der Steueridentifikationsnummer abgelöst. Bisher existieren aber beide Nummern parallel.

Was ist die Steuer-Identifiktationsnummer?

Die steuerliche Identifikationsnummer (IdNr. oder auch Steuer-ID) ist seit 2008 eine bundeseinheitliche und dauerhafte Identifikationsnummer von in Deutschland gemeldeten Bürgern für Steuerzwecke. Sie ist ein Leben lang gültig. Kinder erhalten sie bereits nach der Geburt.

Die Identifikationsnummer ändert sich weder bei einem Ortswechsel noch bei einem Wechsel des zuständigen Finanzamts. Die Daten werden erst gelöscht, wenn sie von den Behörden nicht mehr benötigt werden, spätestens jedoch 20 Jahre nach dem Tod des Steuerpflichtigen.

Die Steuer-ID ist auch für das Kindergeld, für die Freistellungsaufträge bei allen Bankverbindungen in Deutschland, für die Gewährung des Pflege-Pauschbetrags sowie für den steuerlichen Abzug von Unterhaltsleistungen nötig und wird im Übrigen immer häufiger abgefragt.

Was unterscheidet meine Steuernummer von der Steuer-Identifikationsnummer?