(2023)

What relocation expenses can I deduct?

If your move is work-related, you can claim the following expenses as income-related expenses:

Transport costs

- This includes your expenses for a moving company in full for all moving goods. Fees for no-parking signs at the loading or unloading location can also be deducted as transport costs.

- If you move without a freight forwarder, you can deduct the costs for a rental vehicle including mileage allowance, expenses for using your own vehicle at the travel expense rate, and the cost of packaging materials. If you pay wages to friends who help, you can also deduct these expenses.

Travel expenses

- On the moving day, you can claim travel expenses as for an external activity. If you travel by your own vehicle, you can apply the business travel allowance of 30 cents per kilometre. If you travel by public transport, the tax office accepts the actual costs incurred with proof.

- During the move, you can also claim meal allowances for yourself and your household members moving with you at the rates for external activities as moving costs. If you can prove overnight costs incurred from the days of loading to unloading the moving goods, you can also deduct these.

Double rent payments

- If you have to pay double rent due to the notice period of your old rented flat, even though you already live in the new flat, you can deduct the rent payments for the old flat as income-related expenses from the day you move out until the end of the tenancy.

- This also applies to additional costs. If you have already rented the new flat but are not yet living in it, you can deduct the rent payments for the new flat as income-related expenses.

Furnishings

- Expenses previously covered by flat rates for a cooker or stoves for each room in a flat are included in the newly adjusted flat rate for other moving expenses (§ 10 BUKG) from 1.6.2020 and are therefore no longer listed separately. In particular, the abolition of the flat rates for heating stoves is necessary, as stove heating is no longer up-to-date and practically irrelevant.

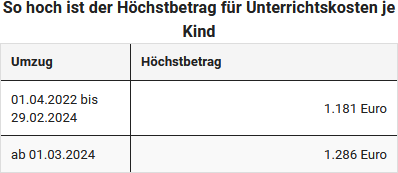

Relocation-related tutoring

- If your children need to change schools and tutoring is required, you can deduct the costs.

Lump sum for "other moving expenses"

- In addition to these actual costs, there is a moving expense allowance (lump sum for other moving expenses) for which no receipts are required. A table and detailed explanation are provided in the following section.

Bewertungen des Textes: What relocation expenses can I deduct?

4.00

von 5

Anzahl an Bewertungen: 10