What is the cost of Lohnsteuer kompakt?

The recommended retail price for Lohnsteuer kompakt can be found on the website. The price is only payable when you electronically submit your tax return to the tax authorities.

If a tax case has not yet been paid for, the payment process will start automatically when you click on the "Submit tax return" link in your tax case. The prices for the different versions will then be displayed. You can then choose a package and select from various payment methods (including PayPal, advance payment).

What is the cost of Lohnsteuer kompakt?

Where can I find my invoice?

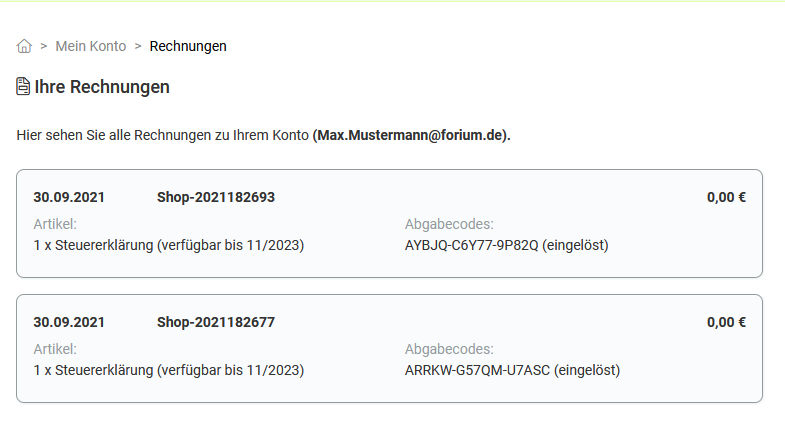

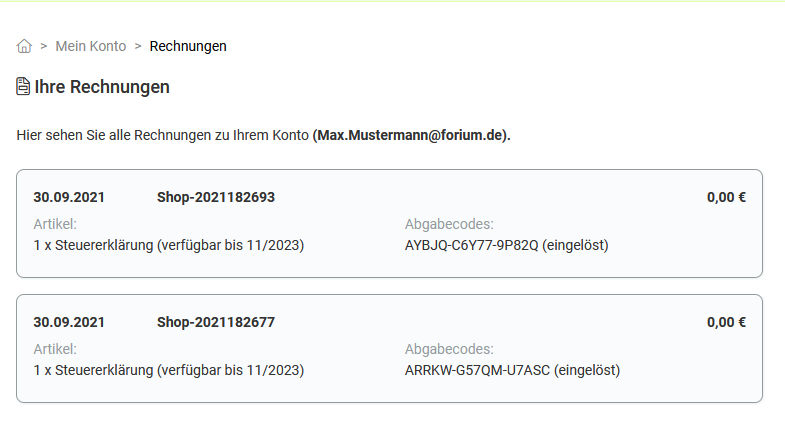

Regardless of the payment method chosen, an invoice will be sent to you by email after the payment has been successfully processed. As a simplified invoice, it contains all necessary details in accordance with § 33 UStDV. Unfortunately, it is not possible to send the invoice by post.

In the overview, you will find a list of all payments made to Lohnsteuer kompakt under the menu item "My account > Invoices", including the invoice view as a PDF file.

Where can I find my invoice?

How can I benefit from discounts?

There are regular discount promotions that offer you interesting savings opportunities. Of course, we inform all customers about current promotions so that everyone can benefit from our cost-effective service.

We publish information about current discount promotions in our newsletters and on the following social media platforms:

If you have a voucher, you can enter and redeem it during the payment process. The voucher can usually only be redeemed once and includes a discount that is deducted from the invoice amount to be paid.

Vouchers issued by Lohnsteuer kompakt are usually valid for a limited period. A cash payment of the voucher is not possible.

How can I benefit from discounts?

How does Trusted Shops Buyer Protection help me?

Lohnsteuer kompakt aims to provide you with the best possible service. However, if you are dissatisfied with our service and cannot resolve your issue with us, Trusted Shops can assist you.

The Trusted Shops Buyer Protection is a free guarantee service that Lohnsteuer kompakt can offer due to its Trusted Shops certification. Buyer Protection helps you in the following cases:

- Non-delivery: Have you paid for an ordered item but the online retailer has not delivered? Trusted Shops will refund the purchase price.

- Non-refund: If you return the ordered goods to the online shop within the legal withdrawal or return period, but the shop does not refund the purchase price on time, Trusted Shops Buyer Protection will apply and Trusted Shops will refund the purchase price.

- Credit card misuse: In the event of fraudulent purchases with your credit card, the guarantor will cover your possible excess up to 50 Euro.

Please note that you must take out a new, free guarantee for each individual payment with Lohnsteuer kompakt.

How does Trusted Shops Buyer Protection help me?

How do I pay using PayPal?

You pay the invoice amount via the online provider PayPal. You must be registered there or register first, authenticate with your login details and confirm the payment instruction to us (exception: guest access). You will receive further information during the ordering process.

If you select the payment method PayPal/PayPal Express, an additional 0,00 Euro will be charged.

How do I pay using PayPal?

How do I pay by SEPA direct debit?

If payment is made by SEPA Direct Debit, forium will inform the customer of the amount and due date by email ("Pre-Notification"). The period for your advance notice of the debit date (Pre-Notification period) is reduced to 1 day. The customer undertakes to ensure that the account is sufficiently funded. Costs incurred due to non-payment or reversal of the direct debit will be borne by the customer, unless the non-payment or reversal was caused by forium.

If you select the SEPA Direct Debit payment method, an additional 0.00 Euro will be charged.

How do I pay by SEPA direct debit?

How do I pay in advance?

If you pay in advance, you will receive an order confirmation with an order number and our bank details at the email address you provided.

Once payment has been received, the tax return will be activated for the selected functions.

How do I pay in advance?

How do I redeem a voucher?

Voucher Code

You can secure a discount immediately, even if you complete and pay for your tax return later. At the beginning of the payment process, you can enter a voucher code to benefit from current discounts. Enter the voucher code and have it verified. If the code is valid, the voucher value will be deducted directly from the purchase price to be paid. If the value of the voucher is higher than the purchase price, the excess credit will be forfeited.

Vouchers can only be redeemed once and include a discount that is deducted from the invoice amount to be paid. Vouchers issued by forium are usually time-limited. Cash payment of vouchers is generally not possible.

If you have purchased a voucher for processing a tax return with Lohnsteuer kompakt through a third party (Groupon or other providers), we recommend redeeming this voucher in our shop in advance! You will then receive a submission code with a remaining validity of at least one year.

Submission Code

If you have already purchased one or more submission codes for your tax return in our shop, they will be offered to you for redemption at the beginning of the payment process. Please check the correct display and redemption of the voucher, as it cannot be considered retrospectively. A submission code unlocks your tax case for submission. No further costs will be incurred.

How to redeem the voucher code:

- Open your tax case that you want to submit to the tax office.

- In the menu, select "Pay" to start the payment process.

- Now select the desired item.

- On the next page, click on "Redeem voucher/submission code" and enter your code.

- Complete the payment process.

How do I redeem a voucher?

How long is the objection period?

If the tax office has set the tax too high, you can appeal against the tax assessment. However, this is only possible until the end of the objection period.

The objection period ends one month after the tax assessment has been issued. The assessment is deemed to have been issued on the third day after it was sent by the tax office. If this day falls on a public holiday or weekend, the next working day is considered the date of issue. If the end of the objection period falls on a Sunday or weekend, the objection period ends on the next working day.

Even after the objection period has ended, it is possible to amend the tax assessment in exceptional cases, e.g. by applying for reinstatement of the previous status.

How long is the objection period?