How do you use electronic data retrieval with Lohnsteuer kompakt?

To import the electronic data from the pre-filled tax return (VaSt) into your income tax return, log in to Lohnsteuer kompakt and start a tax return.

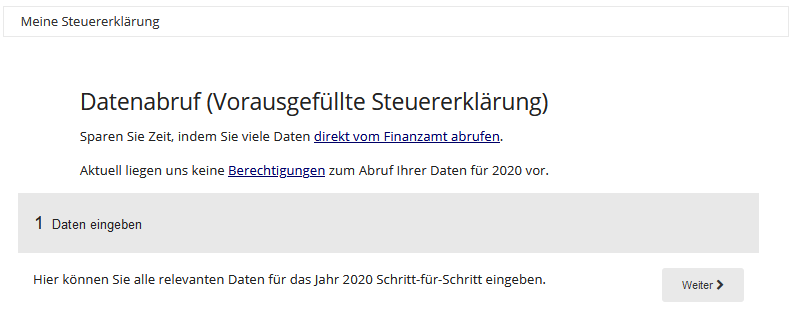

On the "My tax return" page, you will immediately see if electronic data is available for your customer account.

If you want to import the electronically available data into your tax return, click on "Check and import now". If you have set up authorisations for multiple people, you can select whose data should be imported on the next page.

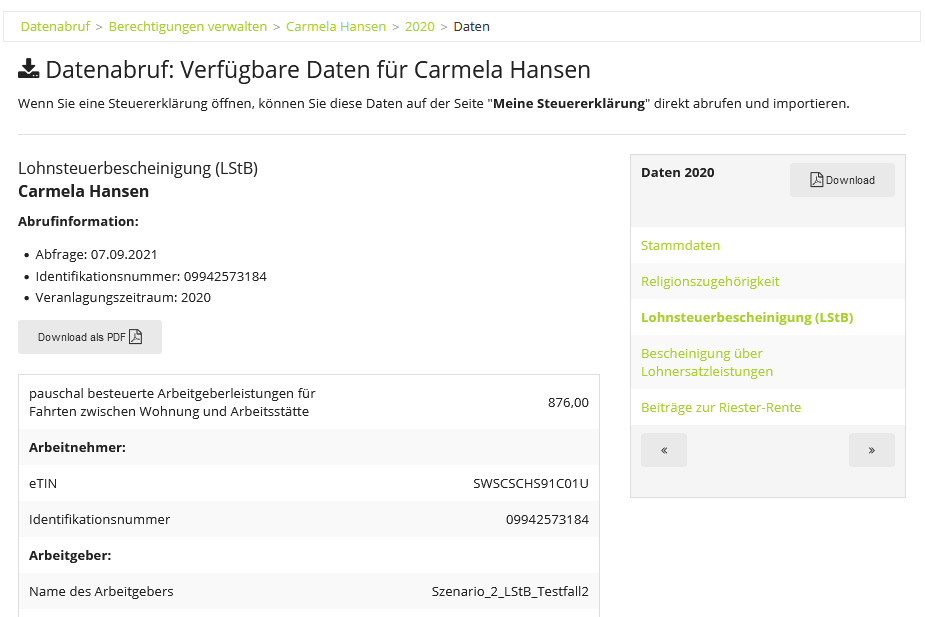

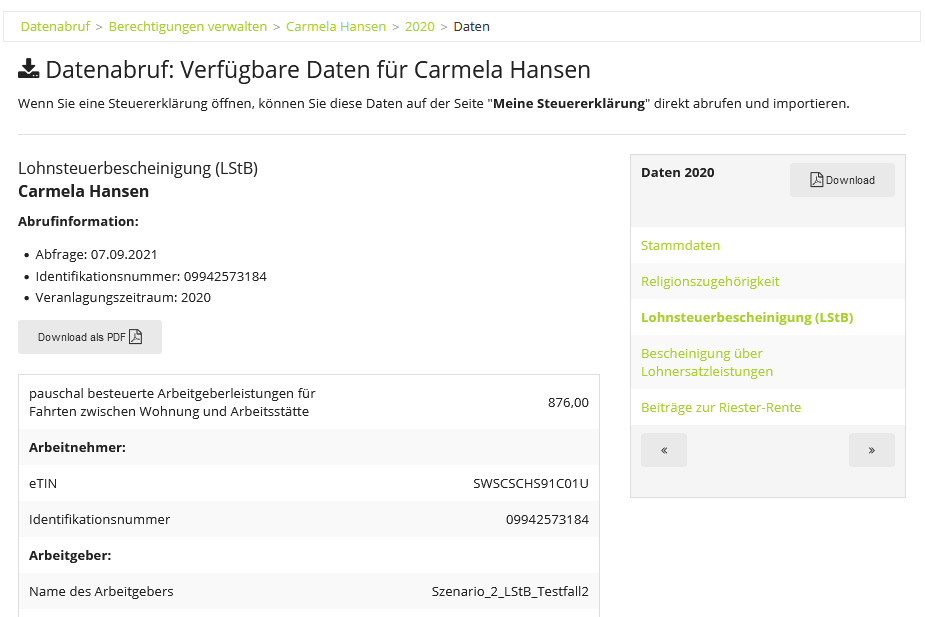

You can then individually decide for each available data record whether you want to import the data into your tax return. Alternatively, you can view the content of a data record online or download it as a PDF file.

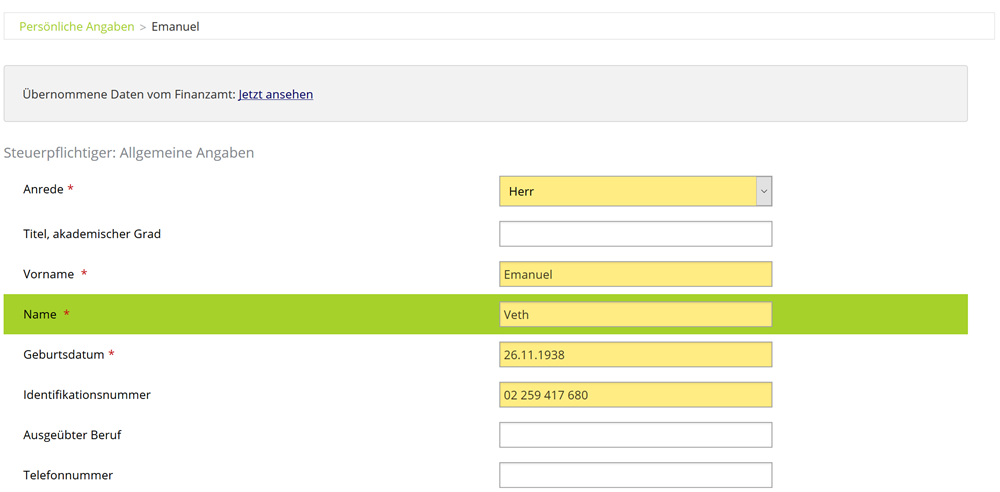

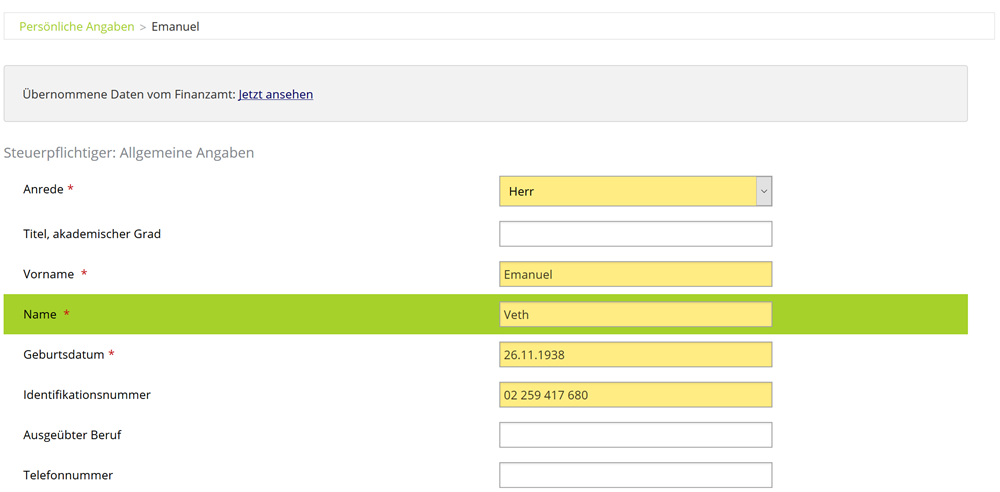

All input fields that have been filled with data from the electronic data retrieval in your tax return are highlighted in colour (yellow) the first time they are accessed. This allows you to quickly identify the imported data and easily check it.

How do you use electronic data retrieval with Lohnsteuer kompakt?

What should I do if the VaSt data is incorrect or incomplete?

Important: Although many data are already provided electronically by the tax authorities as part of the pre-filled tax return, your tax return is usually far from complete. Especially if you expect an optimal tax refund, you should add numerous additional details and, if necessary, submit proof of expenses incurred. This includes expenses such as travel costs, relocation costs, household services, or medical expenses.

Lohnsteuer kompakt supports you in claiming all your expenses in the tax return.

Incorrect data must be corrected by you. If you do not correct an error, you are generally responsible for it. Only data that has been transmitted to the tax authorities by, for example, your employer or your insurance company can be displayed to you.

If data is incorrect or incomplete, please contact the respective data transmitter directly (employer, insurance company, pension provider, etc.).

A correction by the tax office is usually not possible. Despite the provision of data by the tax authorities, they do not guarantee its accuracy! Therefore, consider the data retrieval as purely a support to process the tax return more quickly.

What should I do if the VaSt data is incorrect or incomplete?