What new benefits are there for the disability pension?

If you can no longer work or can only work to a limited extent due to a chronic illness or accident, you may receive a disability pension from the statutory pension insurance under certain conditions. If the pension was approved before 1 July 2014, it was calculated as if the person concerned had been employed until the age of 60 with their previous average income (so-called credit period according to § 59 SGB VI).

On 1 July 2014, there were two positive changes for early retirees:

(1) For disability pensions approved since 1 July 2014, the credit period has been extended from age 60 to age 62. The pension is therefore calculated as if the person had worked until the age of 62. This results in a slightly higher pension.

(2) In addition to the duration of the credit period, the amount of earnings is also important for the disability pension. Previously, this period was calculated with the average income. Since 1 July 2014, the last four years before the onset of the disability are no longer taken into account if the salary had already decreased due to health problems. This means that giving up overtime or switching to part-time work no longer has a negative impact on the amount of the pension.

Important

Unfortunately, people who were already receiving a disability pension on 1 July 2014 do not benefit from the improved disability pension. Existing pensions are not recalculated. The new regulation only applies to disability pensions newly approved from 1 July 2014. The deductions for disability pensions of up to 10.8% remain unchanged.

From 1 January 2018, the credit period for the disability pension for new pension approvals has been gradually extended from age 62 to age 65 (§ 59 SGB VI).

- For pensions starting in 2018, the credit period ends at the age of 62 years and 3 months according to the previous legal situation.

- For pensions starting in 2019, the credit period is extended in one step to the age of 65 years and 8 months.

- For pensions starting between 2020 and 2031, the credit period - like the retirement age - is gradually extended to the age of 67. The gradual extension begins in 2020 with an increase of one month. The steps of the increase are also one month per calendar year until 2027. From 2028, the credit period will be increased by two months per calendar year.

- For pensions starting from 2031, the credit period ends at the age of 67.

(2024): What new benefits are there for the disability pension?

What is a statutory annuity?

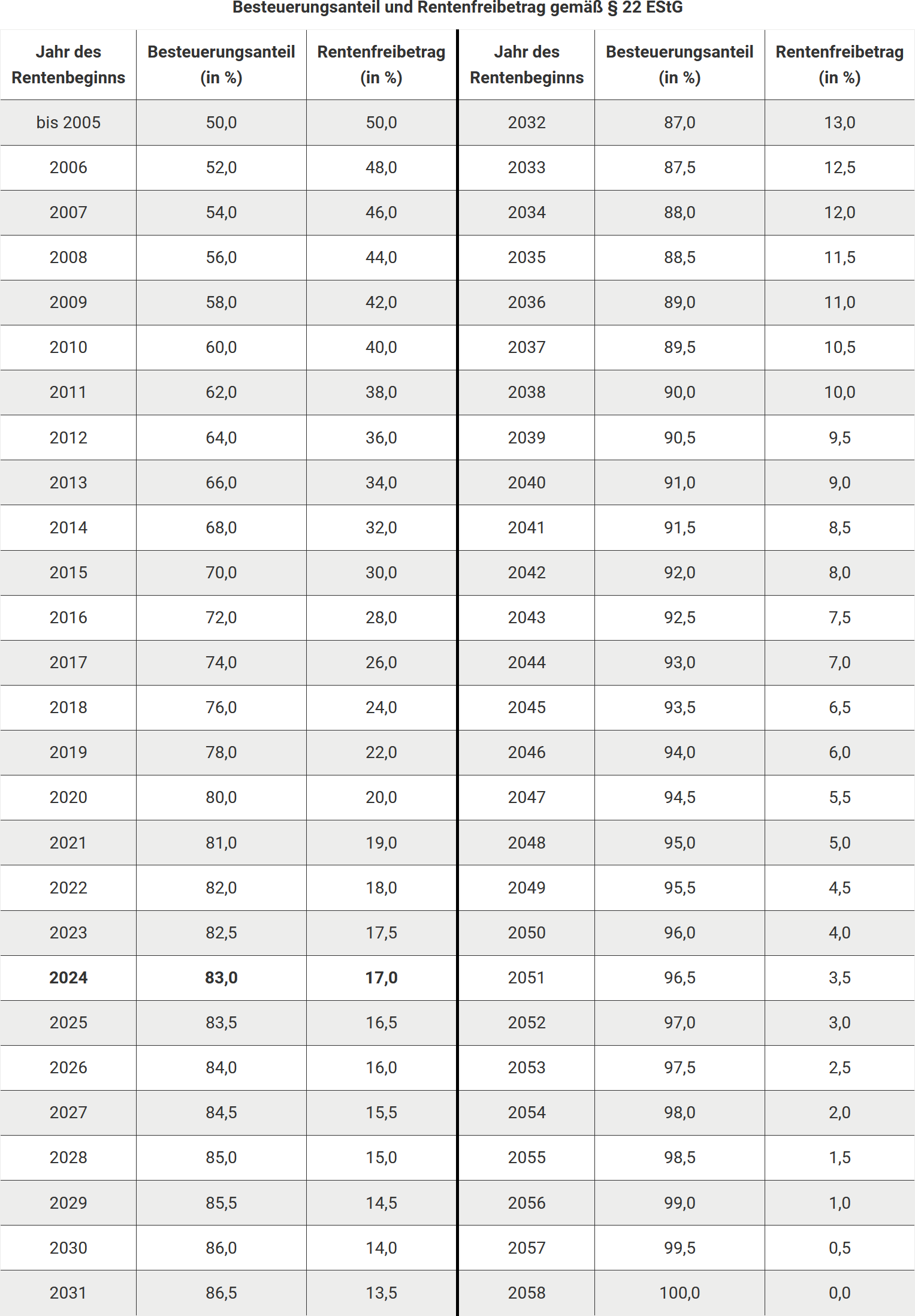

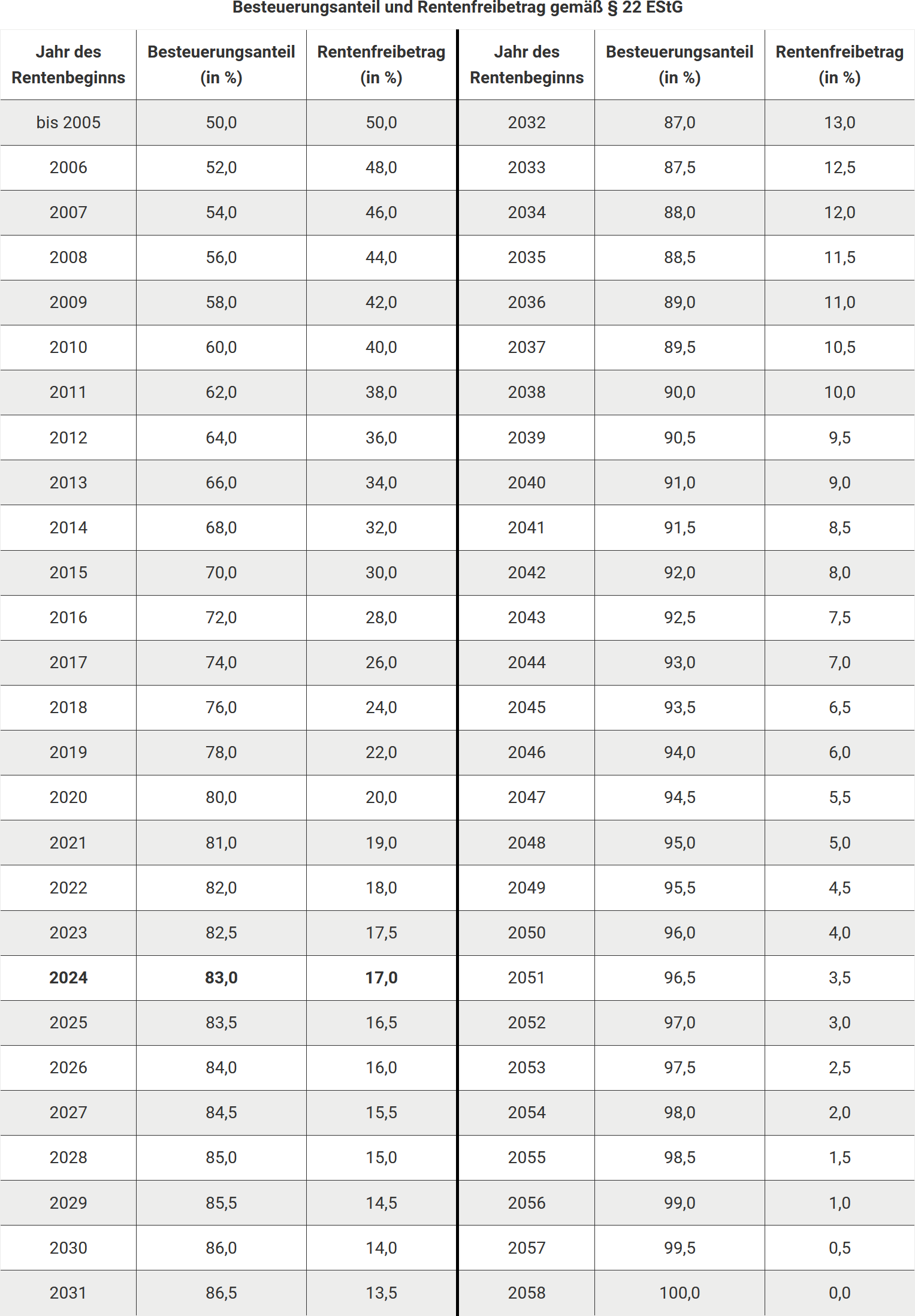

A statutory annuity is a fixed payment linked to a person's lifetime. This includes old-age, disability, and survivor pensions from the statutory pension insurance, the agricultural pension fund, or professional pension schemes. These pensions are only partially taxed, with the taxable portion depending on the year the pension begins.

Taxable portion and tax-free pension amount

If you retire in 2024, the taxable portion of your pension is 83%. The tax-free part of the pension is determined in the year following the start of the pension and remains unchanged for the entire duration of the pension. However, pension increases due to adjustments are fully taxed.

Notification to the tax office

Pensioners can request a “notification for submission to the tax office” from the statutory pension insurance. This notification contains the relevant data for the tax return and is automatically sent in subsequent years. An additional entry of the taxable portion in the tax return is not required.

Types of annuities

Annuities include in particular:

- Old-age pensions

- Disability pensions

- Occupational disability pensions

- Widow's/widower's pensions

- Orphan's pensions

- Parental pensions

One-off payments such as death benefits or settlements of small pensions must also be declared.

Special regulations for victims of the Nazi regime

If periods of persecution under § 1 of the Federal Compensation Act (BEG) were taken into account in the pension calculation, inform the tax office informally. This also applies to survivor's pensions if the deceased was recognised as a victim. The tax office will check whether these pensions are tax-free.

(2024): What is a statutory annuity?

How is the statutory pension taxed?

Since the Retirement Income Act of 2005, state pensions have been taxed according to the principle of deferred taxation. This means that part of the pension is taxable, while the rest remains tax-free. The taxable portion depends on the year of retirement.

Taxation percentage:

- Retirement before 2005: 50% tax-free portion.

- Retirement 2005 to 2024: The taxable portion increases each year. For 2024, it is 83%.

- Retirement from 2025: The portion increases annually by 0.5 percentage points and reaches 100% from 2058.

Calculation of the pension allowance:

- In the first and second year of retirement, the pension is taxed with the fixed taxable portion.

- From the third year, the pension allowance remains constant and unchanged for life.

- Pension increases are fully taxable from the third year.

Example

Hans Müller retired in 2009 and received a pension of 12.000 Euro in 2023. With a taxable portion of 58%, 6.960 Euro are taxable. His allowance is 5.040 Euro. As long as his income is below the basic allowance of 11.784 Euro (2024), he does not have to submit a tax return.

Income-related expenses:

- The tax office automatically deducts an income-related expenses allowance of 102 Euro.

- Higher expenses (e.g. tax advice or pension advice) can be claimed but must be proven.

Example for 2024

If Mr Müller only retires in 2024 and receives an annual pension of 15.000 Euro, 12.450 Euro would be taxable (83%). Since he exceeds the basic allowance, he would have to submit a tax return.

Important: The pension allowance remains the same even if the pension is adjusted and refers to a fixed amount. Future pension increases must therefore be fully taxed.

(2024): How is the statutory pension taxed?

What should I enter for the pension adjustment?

When adjusting your pension, you must state the difference between your current monthly pension and the pension you received in the year following the start of your pension. The tax-free pension allowance is set in the year after your pension begins and applies for life. This allowance remains unchanged despite later pension increases, which is why the pension adjustment is fully taxable.

Determining the pension adjustment

The pension adjustment is the difference between the pension payments of the current year and the payments from the year in which the pension allowance was set. You can find this difference in your pension adjustment statement or ask your pension provider.

Example:

- Pension payments 2014: 6 x 1.050 Euro + 6 x 1.056 Euro = 12.636 Euro

- Pension payments 2024: 6 x 1.380 Euro + 6 x 1.420 Euro = 16.800 Euro

- Pension adjustment: 16.800 Euro – 12.636 Euro = 4.164 Euro

Tip on pension adjustment

Irregular changes in the pension amount, e.g. due to the crediting of other income, do not count as a pension adjustment. Only regular increases, such as the annual pension adjustment on 1 July, are relevant.

(2024): What should I enter for the pension adjustment?

What does the opening clause mean?

What does the opening clause mean?

The opening clause relates to deferred taxation and aims to prevent unfair over-taxation. Self-employed individuals who have voluntarily paid higher contributions to an occupational pension scheme over several years can benefit from the opening clause if their contributions exceeded the contribution assessment limit of the statutory pension insurance.

Contribution assessment limit and voluntary payments

The contribution assessment limit is recalculated annually and determines the income up to which pension insurance contributions are levied. For income above this limit, contributions are usually not payable unless voluntary payments are made – for example, by self-employed individuals.

Tax issues

A self-employed person has voluntarily paid higher contributions from their taxed income and receives a higher pension in retirement. Without the opening clause, this pension would have to be taxed at the full tax rate (in 2024: 83%), which could lead to excessive taxation.

Using the opening clause

To avoid this, the pensioner can have the pension divided into a voluntary and a statutory part, provided they paid the higher contributions at least ten years before 31.12.2004. The portion of the pension based on the increased contributions is then taxed at the more favourable income share rate.

Example

A pensioner has been receiving a pension of 1.500 Euro per month since the age of 65. If they can prove that 30% of the pension is based on increased contributions, this division is made:

- 70% of the pension (1.050 Euro) is taxed normally.

- 30% of the pension (450 Euro) is taxed at an income share rate of 18%.

Result: Only 8.280 Euro need to be taxed, instead of 10.440 Euro without the opening clause.

Calculation of the income share rate

The income share rate depends on the age of the pensioner at the start of the pension payments:

- 64 years: 19%

- 65-66 years: 18%

- 67 years: 17%

Tip for using the opening clause

Those affected should ensure when applying for a pension that the part of the pension based on the increased contributions is correctly divided. The certificate from the pension insurance provider contains all the necessary information for the tax office.

(2024): What does the opening clause mean?

How is my pension from an occupational pension scheme taxed?

Pensions from occupational pension schemes are part of the so-called basic provision and are taxed like pensions from the statutory pension insurance. The following points are important:

Taxable portion

The taxable portion of the pension depends on the year the pension begins. For pensions starting in 2024, it is 83%. This percentage increases annually by half a percentage point until it reaches the full 100% in 2058 (§ 22 No. 1. a) aa) EStG, amended by the "Growth Opportunities Act").

Pension allowance

In the second year of receiving the pension, the remaining amount after deducting the taxable portion is set as your personal pension allowance. This amount remains unchanged and tax-free for life.

Taxation from the third year

From the third year of receiving the pension, it is taxable after deducting the allowance and the standard allowance for income-related expenses of 102 Euro. Any pension increase is fully taxable.

Income-related expenses

The tax office automatically applies an allowance of 102 Euro. You can also declare higher expenses such as tax consultancy fees or pension advisory costs, but these must be proven.

Note: The pension allowance remains the same for life. Any amount above the allowance due to pension increases must be fully taxed.

Example:

Hans Müller retired in 2009 and receives a pension of 15.000 Euro in 2024. Of this, 3.000 Euro are pension increases added since 2009. His pension allowance, set in 2009, remains at 5.040 Euro. 58% of his original pension of 12.000 Euro, i.e. 6.960 Euro, is taxable.

Since the pension allowance remains unchanged, the 3.000 Euro pension increases are fully taxable. The taxable pension for 2024 is therefore:

- Taxable portion of the original pension: 6.960 Euro

- Plus pension increases: 3.000 Euro

In total, 9.960 Euro is taxable. As this is below the basic allowance of 11.784 Euro (2024), Hans Müller does not have to pay tax despite the pension increases.

If Hans Müller were to retire in 2024 and receive a pension of 15.000 Euro, 83% (12.450 Euro) would be taxable. In this case, he would have to submit a tax return.

(2024): How is my pension from an occupational pension scheme taxed?

How is the mother's pension taxed?

In July 2014, the child-raising period for pensioners with children born before 1992 was extended from 12 to 24 months. Instead of one earnings point, two earnings points are now granted as a supplement to the current pension. This means a pension increase of 28.61 Euro (West) or 26.39 Euro (East) per child. How is this pension increase, known as the "Mütterrente", taxed?

- In November 2014, a decree from the Ministry of Finance of Schleswig-Holstein provided - supposed - clarity: The pension increase due to additional child-raising periods is not considered a regular pension adjustment but an extraordinary re-determination of the annual pension amount. Therefore, the tax-free portion of the pension must be recalculated, and the previous pension allowance increased to raise the tax-free portion of the "Mütterrente" (Ministry of Finance Schleswig-Holstein, 10.11.2014, VI 307-S 2255-152).

- The officials from Schleswig-Holstein also provided an example: For a pensioner whose pension began before 2005, the taxable portion - as it was then for the old-age pension - is also 50% for the additional "Mütterrente", i.e., 50% of the pension paid! If the pension began in 2007, the taxable portion is 54%, and the pension allowance is 46%; if the pension began in 2010, the taxable portion is 60%, and the pension allowance is 40%, etc. Finally, a simple solution. This is how PC programs have calculated so far.

- But it would be surprising if the tax authorities did not find a way to make the calculation more complicated and take more money from pension mothers. Indeed, the tax assessments for 2014 unexpectedly show a higher tax share of the pension than previously assumed.

Currently, the Federal Ministry of Finance points out that the increase in the pension allowance is determined not only based on the taxable portion from the year the pension originally began but also on the pension value from which the previous pension allowance was calculated. The relevant year was the year following the start of the pension.

Since the pension value usually changes on 1 July of the year, an average pension value must be determined for the relevant following year. The taxable portion at that time is then applied to this value. The value ratios in the year the pension allowance was first fixed are decisive, and this is the year following the start of the pension (BMF, 23.7.2015).

This means that anyone who has been receiving a pension since 2005 or earlier will only receive the "Mütterrente" tax-free at 50% of the pension value at that time. The fictitious increases in the Mütterrente from 2005 to 2014 are treated as pension adjustment amounts and are fully taxable.

Example

Mrs Maier, who retired in 2007, receives a Mütterrente for one child from 1.7.2014 (1 earnings point x current pension value (West) = 28.61 Euro). Her pension thus increases by a total of 171.66 Euro in 2014 (6 x 28.61 Euro). For the taxable portion, the year 2007 is decisive, and for the pension allowance, the value ratios of 2008 are decisive, so a taxable portion of 54% applies, and the remaining 46% are tax-free.

In 2008, the pension value (West) was 26.27 Euro until 30.6. and 26.56 Euro from 1.7., averaging 26.42 Euro rounded up. Since the average pension value (West) in 2008 was 26.42 Euro, this leads to an increase in the pension allowance of 72.92 Euro ([6 x 26.42 Euro] x 46% tax-free portion). Previously, a pension allowance of 78.96 Euro was assumed (46% of 171.66 Euro).

In 2015, the Mütterrente for one child is 346.92 Euro (6 x 28.61 Euro + 6 x 29.21 Euro), and the pension allowance is 145.84 Euro (12 x 26.42 Euro x 46%).

Currently, with the "RV Performance Improvement and Stabilisation Act" since 1.1.2019, the child-raising period for mothers and fathers whose children were born before 1992 has been further improved and extended from 24 months to 30 months. Instead of 2 earnings points, 2.5 earnings points are now credited to the pension account or granted as a supplement to the current pension, known as "Mütterrente II".

According to the new regulation, the following applies:

- For mothers and fathers who retire from 1.1.2019, the child-raising period is extended by a further 6 months, or the pension entitlement is increased by 0.5 earnings points. Half an earnings point currently corresponds to around 16 Euro (West) and 15.35 Euro (East) per month.

- Mothers and fathers who are already receiving a pension at this time will receive a supplement equivalent to the pension yield of half a child-raising year from 1.1.2019.

- Mothers and fathers for whom a supplement for child-raising from the extension of the child-raising period in 2014 is already included in the pension will receive a supplement increased by half a personal earnings point in the future, provided they raised the child in the 24th calendar month after the month of birth. The regulation is essentially the same as the regulation that took place in 2014 with the extension of the child-raising periods to two years. This flat-rate crediting method is carried out, as was the extension of the child-raising period in 2014, for reasons of administrative simplification so that the pension insurance institutions do not have to reassess millions of pensions (§ 307d para. 1 SGB VI).

- From 1.1.2019, those who did not receive a supplement in 2014 (because they did not have a child-raising period in the pension insurance account in the 12th calendar month) but meet the specified requirements will also receive a supplement to personal earnings points.

- In deviation from the regulations made in 2014 when the child-raising periods were extended, a special right to apply is now intended to provide relief in cases where no supplement to personal earnings points has been received since 1.7.2014 due to child-raising or no supplement to personal earnings points is received with the current extension of the crediting of child-raising periods because it is based on child-raising in a specific calendar month (child-raising in the 12th or 24th calendar month). The new right to apply concerns, for example, adoptions or raising children in Germany after returning from abroad if the adoption or change of residence took place after the 12th or 24th calendar month after the month of birth. However, the prerequisite for recognition is that child-raising periods or supplements are not already credited to other insured persons or survivors for the same child, provided this is actually known to the pension insurance institution (§ 307d para. 5 SGB VI).

- For mothers born before 1.1.1921 who receive a child-raising benefit under § 294 SGB VI instead of child-raising periods, this benefit is also increased by the value of half a personal earnings point. This corresponds to the pension yield from extending the child-raising period by half a year (§ 295 SGB VI).

Tip

You do not need to submit a special application to receive the improved benefit. The revaluation of the periods for children born before 1992 is carried out ex officio and does not need to be applied for.

Current Decision

The Federal Fiscal Court has ruled in a recent judgement (file number: X R 24/20) that the pension allowance for a pensioner must also be recalculated and increased if an increase in the current pension is due to the so-called Mütterrente. In this specific case, the claimant received a pension from the statutory pension insurance of 6.726 Euro in the year in dispute, 2014, with her pension increased by one pension earnings point per child due to the Mütterrente for two eligible children.

The calculation of the pension allowance by the Federal Fiscal Court is complex and considers the start of the pension in 2010, the fixing of the pension allowance in 2011, and the fictitious payment of the Mütterrente from 2010. Fictitious ongoing increases in personal earnings points are taken into account, and a new pension allowance is finally determined.

The tax authorities used a different calculation method and considered the average pension value at the first pension receipt instead of reducing the actual Mütterrente by the interim increases in personal earnings points. This led to lower pension allowances.

The German Pension Insurance states that its notifications to the tax offices are correct and that the tax offices have already recalculated the pension allowances. Nevertheless, affected pensioners who disagree with the amount of their pension allowance should contact their local tax office, as only it decides on the amount of the pension allowance.

It should be noted that the tax implications of this recalculation are likely to be minor for most taxpayers. Nevertheless, it is important to ensure that the calculation is carried out correctly to avoid missing out on any tax advantages.

(2024): How is the mother's pension taxed?

How is my pension from an agricultural pension fund taxed?

Taxation of Pension from an Agricultural Pension Fund

The pension from agricultural pension funds is taxed similarly to the state pension. Here are the key points:

Taxable Portion

Taxation is based on the taxable portion, which depends on the start date of the pension. This portion increases gradually. For pensions starting in 2024, it is 83% and will rise annually to 100% by 2058 (§ 22 No. 1. a) aa) EStG, amended by the "Growth Opportunities Act").

Pension Allowance

In the second year of retirement, the tax-free portion of the pension is set as the pension allowance. This remains unchanged for life.

Taxation from the Third Year

From the third year, the pension is taxed after deducting the pension allowance and a standard allowance for income-related expenses of 102 Euro. Pension increases are fully taxable.

Income-Related Expenses

The tax office automatically considers 102 Euro as income-related expenses. You can claim higher expenses, such as tax advice or pension advice, but you must provide evidence.

Note: The pension allowance remains the same for life. Therefore, pension increases must be fully taxed.

Example

Hans Müller retired in 2009 and received a pension of 15.000 Euro in 2024. Of this, 3.000 Euro are pension increases added since 2009. His pension allowance, set in 2009, remains at 5.040 Euro. 58% of his original pension of 12.000 Euro, i.e., 6.960 Euro, is taxable.

Since the pension allowance remains unchanged, the 3.000 Euro pension increases are fully taxable. The taxable pension for 2024 is therefore:

- Taxable part of the original pension: 6.960 Euro

- Plus pension increases: 3.000 Euro

In total, 9.960 Euro is taxable. Since this amount is below the basic allowance of 11.784 Euro (2024), Hans Müller does not have to pay tax despite the pension increases.

If Hans Müller were to retire in 2024 and receive a pension of 15.000 Euro, 83% (12.450 Euro) would be taxable. In this case, he would need to submit a tax return.

(2024): How is my pension from an agricultural pension fund taxed?

What does the 2005 Pension Income Act regulate?

The Pension Income Act of 2005 regulates the taxation of pensions and affects both pensioners who were already retired in 2005 and future pensioners. The tax burden for new pensioners increases every year, but there are also benefits for employees through tax-advantaged pension schemes.

Tax-advantaged pension schemes

In addition to the statutory pension insurance, private pension insurance is also recognised as a pension scheme, particularly the basic pension or Rürup pension. Contributions to private pension insurance are only tax-advantaged if they provide a lifelong pension. The insured person must be at least 60 years old at the start of the pension. For contracts from 2012 onwards, pension payments may not begin before the age of 62. This ensures that the products are used exclusively for retirement provision.

Taxation of pensions

Since 2005, 50% of pension income has been taxed. Between 2006 and 2020, the taxable portion of pensions increased by two percentage points each year, and from 2021 by only one percentage point per year. However, from 2023, the taxable portion for new pensioners will only increase by half a percentage point annually. Pensions starting from 2024 will have a taxable portion of 83%. The full taxable portion of 100% will be reached for the first time in 2058.

Ruling on double taxation

In May 2021, the Federal Fiscal Court (BFH) ruled that double taxation of pensions is only possible in individual cases. The BFH considers the basic system of pension taxation to be lawful, including the limited deduction of pension contributions and the partial tax exemption of pensions. In November 2023, the Federal Constitutional Court (BVerfG) dismissed the constitutional complaints against the BFH rulings, as they were not sufficiently substantiated.

What does this mean for those affected?

It is likely that the provisional notes in income tax assessments will soon be removed. Anyone who believes that double taxation applies in their case should continue to appeal against current tax assessments and provide a calculation of double taxation. Appropriate evidence, such as insurance records or tax assessments from the contribution phase, must be attached to the appeal.

The BFH is currently re-examining possible double or excessive taxation of pensions (Ref. X R 9/24). Pensioners should therefore maintain or lodge new appeals.

(2024): What does the 2005 Pension Income Act regulate?

What income-related expenses can I claim as a pensioner?

Even as a pensioner, you can claim expenses related to your pension as income-related expenses in your tax return. If your income-related expenses total less than 102 Euro, it is not worth entering them. The tax office automatically applies an income-related expenses allowance of 102 Euro, which is immediately deducted from your income. This allowance is applied jointly for all pensions and all income that must be declared under other income. It is an annual amount that is not reduced, even if the conditions did not apply for the entire year or if there was no income for the whole year. The income-related expenses allowance is personal and is available to each spouse separately as soon as they have the relevant income.

Tip: If you have higher expenses exceeding the allowance of 102 Euro, it is definitely worth entering them. However, you should also have the evidence ready and enclose it with your tax return. If you have expenses for a tax advisor, the tax office will only recognise the costs as income-related expenses if they are related to your pension. Therefore, ask your tax advisor to specify separately in their invoice the part that directly relates to your pension.

You can claim the following as income-related expenses:

- pension advisor,

- lawyer in pension disputes,

- tax advisor (only for form R), and also

- costs related to applying for a pension (travel expenses, office supplies, postage, telephone costs)

- court fees if the case concerns your pension

- union fees you pay as a pensioner

- flat-rate account maintenance fee of 16 Euro per year

Tip

If you are unsure whether the tax office will recognise a particular expense, simply declare it and enclose the evidence. The tax officer will decide.

(2024): What income-related expenses can I claim as a pensioner?

How is interest on pension arrears treated?

Pensions are often approved at a later date and then paid retroactively in a larger sum, for example, due to legal disputes or after clarification of the facts. The insurance provider must pay additional interest on a pension back payment - in the case of pensions from the statutory pension insurance, this is 4% p.a. (§ 44 Abs. 1 SGB I).

This back payment interest is taxable as "income from capital assets" (BFH ruling of 9.6.2015, VIII R 18/12; also BMF letter of 4.7.2016, IV C 3-S 2255/15/10001).

Previously, the tax authorities treated the back payment interest as "other income" and taxed it, like the pensions and pension back payments of the basic provision (statutory pension, Rürup pension, pension from an occupational pension scheme), with the taxable portion as "other income". The taxable portion is determined by the year the annuity begins, e.g. in 2015 with 70%.

Tip

The new BFH ruling means that the interest on the pension back payment is now fully taxable as capital income, but remains tax-free within the saver’s allowance of 1.000 Euro or 2.000 Euro. Since the pension insurance provider does not withhold withholding tax, you must declare the interest in the "Anlage KAP" as part of your tax return.

Unlike before, you may no longer enter the interest in the "Anlage R". The pension back payment itself is tax-advantaged under the one-fifth rule (in accordance with § 34 EStG).

(2024): How is interest on pension arrears treated?