What tax allowances or considerations apply for disabled children?

Child benefit, child allowance and BEA allowance

You can receive child benefit indefinitely for your disabled child beyond the age of 18 or 25, and use the child allowance and the allowance for care, education or training needs (BEA allowance) if your child's disability occurred before the age of 25. At the same time, you are also entitled to further tax benefits linked to child benefit for disabled children, e.g. the child supplement for pension allowance.

Disability allowance

Depending on the degree of disability, each disabled person is entitled to a disability allowance, which covers all ongoing, typical additional expenses directly related to the disability. This amount ranges from 384 to 7,400 Euro.

Tip: Parents can have the child's allowance transferred to them if their child has no taxable income.

Care allowance

In addition to the disability allowance, you can claim the care allowance. The allowance is granted directly to the caring parents. The allowance amounts to

- for care level 2: 600 Euro

- for care level 3: 1,100 Euro

- for care level 4 or 5 or helplessness: 1,800 Euro

Tip: The care allowance is an annual allowance. You will receive it in full even if you have not cared for your disabled child for the entire year. This may be the case, for example, if your child is accommodated in a home during the week.

Extraordinary burdens

Costs arising from your child's disability, e.g. accommodation in a home or costs for an outpatient care service, can be deducted as extraordinary burdens in the tax return.

Tip: This is worthwhile if the costs are much higher than the disability and care allowance, as you must forgo the allowance when deducting the costs as extraordinary burdens.

Childcare costs

Parents can deduct up to two-thirds of their childcare costs, up to a maximum of 4,000 Euro per child, as special expenses. This also applies to non-disabled children up to the age of 14. For disabled children, you can also claim childcare costs beyond this age. Proof is usually provided by the disability card, the notice from the pension office, the pension notice or a medical report. The disability must have occurred before the age of 25.

Tip

If the family benefits office rejects your application, but you believe you are entitled to child benefit, you should lodge an objection within the legally prescribed period. The decision of the family benefits office will then be reviewed again.

(2024): What tax allowances or considerations apply for disabled children?

Must the child's tax identification number be provided?

Parents can deduct their child's health insurance contributions as special expenses if they are entitled to child benefit or the child allowance. This also applies to children in vocational training.

From 1 January 2023, parents must provide their child's tax identification number in their tax return to claim the contributions as special expenses.

(2024): Must the child's tax identification number be provided?

When will I receive child benefit and allowances for my child?

To receive child benefit, the child allowance or the allowance for childcare, education or training needs (BEA), the same conditions as for child benefit must be met. There are two different legal bases for entitlement to child benefit:

- Taxpayers are entitled to child benefit under the Income Tax Act (§ 31 f. and § 62 ff. EStG).

- Persons who are not or only partially subject to tax are entitled under the Federal Child Benefit Act.

Germans with a residence or habitual abode in Germany can apply for child benefit. The same applies to Germans living abroad who are either subject to unlimited income tax in Germany or are treated as such. Foreigners living in Germany can apply for child benefit if they have a permanent residence permit.

Important: Child benefit that has been approved is paid retroactively only for the last six months before the beginning of the month in which the application for child benefit was received. Therefore, even if child benefit is approved retroactively for a whole year, it is actually only paid for the last six months.

(2024): When will I receive child benefit and allowances for my child?

Families received a 100-Euro child bonus per child in 2022

With the "Tax Relief Act 2022", a one-off child bonus of 100 Euro was paid in July 2022 in addition to child benefit for each child.

- There is an entitlement to the child bonus 2022 for each child for whom there is an entitlement to child benefit in July 2022. Children for whom there is no entitlement to child benefit in July 2022 are also considered if there is an entitlement to child benefit for them in another month of 2022.

- The child bonus is offset against the child allowance. This means that families with high incomes, for whom the tax advantage from the child allowance is higher than the child benefit, do not benefit from it. The bonus is taken into account together with the child benefit in the comparative calculation to be carried out as part of the income tax assessment in accordance with § 31 sentence 4 EStG. In this so-called favourable assessment, it is checked whether child benefit and child bonus or the relief from the child and care allowance have a more favourable effect. The higher the income, the more favourable the allowances for children are. In these cases, the child bonus is effectively reduced by the gradually increasing taxation.

- The child bonus is granted independently of subsistence-level social benefits. The one-off payment is not considered as income for social benefits whose payment depends on other income ("Act on the Non-Credit and Non-Consideration of the Child Bonus" of 2.3.2009, which still applies).

- Otherwise, all regulations that apply to the - monthly paid - child benefit also apply to the one-off payment. For example, the one-off payment can only be paid to one beneficiary per child. A written notice of amendment may be waived for the determination of the one-off payment.

(2024): Families received a 100-Euro child bonus per child in 2022

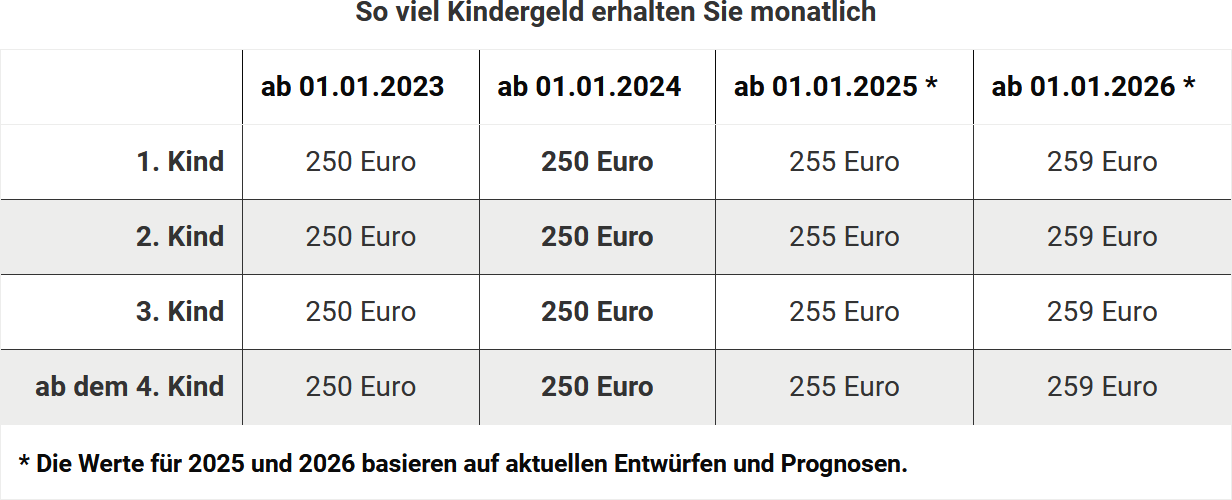

Do I receive the same amount of child benefit for all children?

In the past, if you had multiple children, you did not receive the same amount of child benefit for each child. However, since 2023, the rate has been standardised. The entitlement to child benefit is:

Child benefit is paid for children up to the age of 18. The child's income is irrelevant.

The entitlement continues for children over 18 until their 25th birthday, as long as they are in education or doing voluntary service. Child benefit is paid by the family benefits offices of the Federal Employment Agency. Public sector employees or recipients of pension payments receive the money from their employers.

Tipp

(2024): Do I receive the same amount of child benefit for all children?

Who is entitled to child benefit and tax allowances?

Child benefit is not income-dependent and is paid if there is an entitlement. One requirement is the child's age, the other is the so-called child relationship.

A child relationship generally exists for children who are directly related to you. These are primarily your biological children, whether legitimate or illegitimate. Adopted children are also directly related to you. A child relationship also exists for a foster child if they live in your household and you have a permanent supervisory, care, and educational relationship with them. The custody and care relationship with the biological parents must no longer exist. Occasional visits from the biological parents are harmless.

Child benefit is also paid if you have taken in a stepchild or grandchild in your household. In these cases, however, there is no child relationship in the sense of tax law. Therefore, step- or grandparents are not automatically entitled to a child allowance, but only if the biological parents transfer the child allowances to the new guardians.

They can then also benefit from other tax advantages, such as the training allowance. This can be useful if the biological parents pay little or no tax themselves, for example, because they are still studying.

Until the child's 18th birthday, no further requirements need to be met for the entitlement to child benefit and allowances other than the existing child relationship. From the child's 18th birthday, child benefit is only available for children who are in education or doing voluntary service. Child benefit may also be considered for unemployed children.

(2024): Who is entitled to child benefit and tax allowances?

What is the child allowance?

Child benefit and child allowance are tax reliefs for expenses incurred by parents due to their children. The entitlement to child benefit exists automatically from birth but must be applied for in writing. It is not the children who are entitled to child benefit, but the parents or guardians responsible for the child's welfare.

Child benefit

Child benefit is a monthly payment that parents usually receive from the family benefits office. Child benefit is not taxable. The amount of child benefit depends on the number of children.

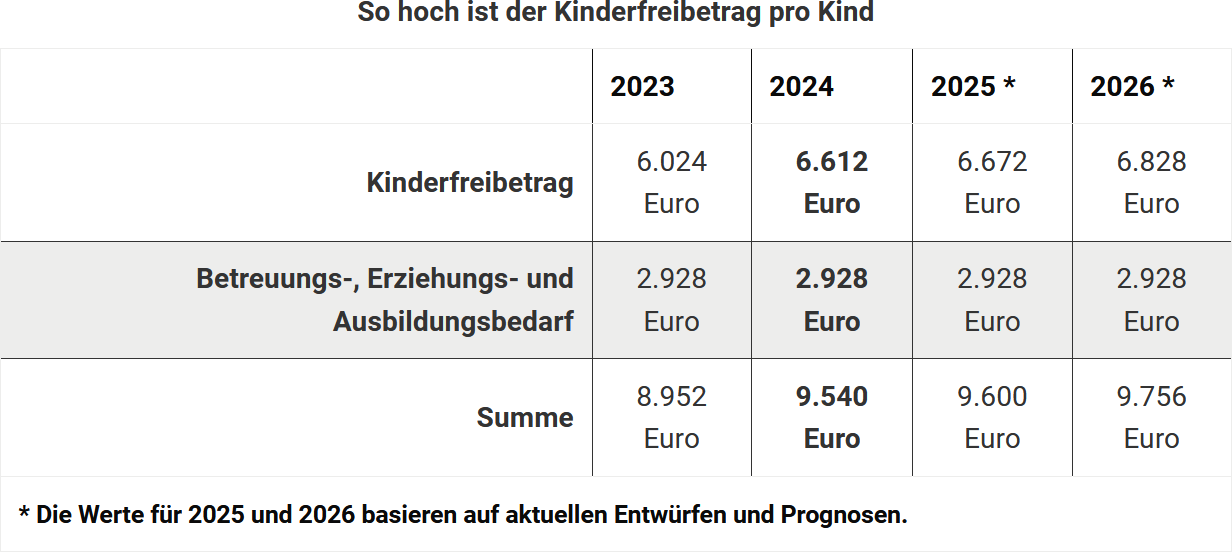

Child allowance

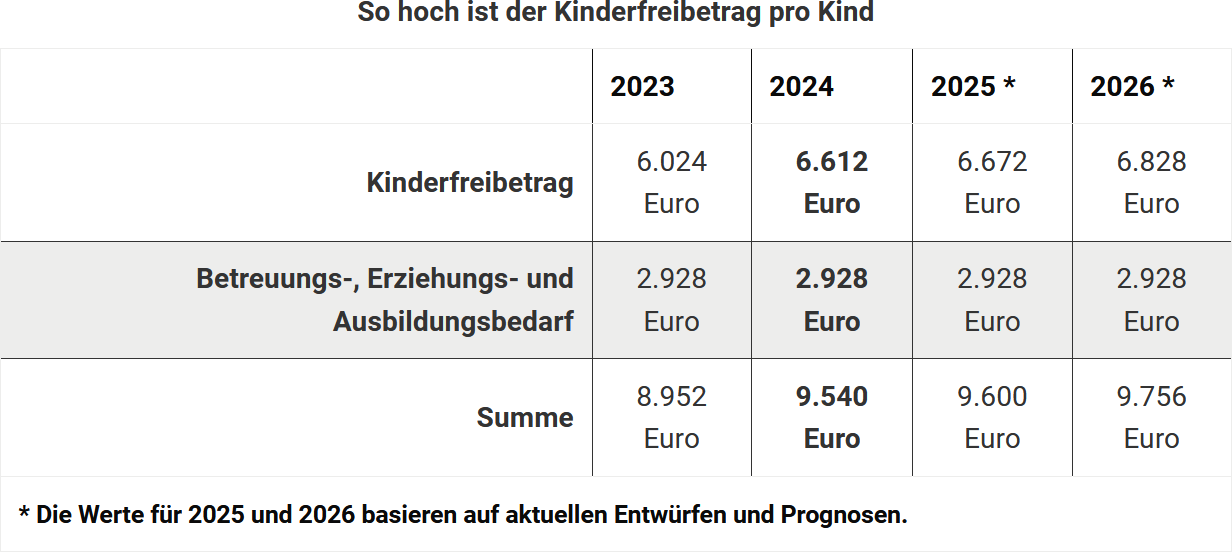

In contrast to child benefit, the child allowance is not paid out. The allowance is deducted from taxable income, thereby reducing income tax. The child benefit already paid monthly is an advance payment on the child allowance. In 2023, the child allowance is 6.024 Euro for jointly assessed parents, otherwise 3.012 Euro per parent. The BEA allowance (for care, education, and training needs) is 2.928 Euro.

Child benefit and child allowance are linked. The tax office automatically determines whether child benefit or the child allowance is more favourable for the taxpayer at the end of a tax year through a favourable assessment.

Entitlement to child allowance or child benefit

Parents are entitled to the child allowance from the birth of the child until the

- 18th birthday.

- 25th birthday if the child is still in education or training or doing voluntary service.

If the child is disabled and unable to support themselves, the entitlement to child benefit or child allowance is unlimited.

(2024): What is the child allowance?

What impact does my child's stay abroad have on the child allowance?

The child allowance and the BEA allowance (for care, education or training) are independent of the child's place of residence, as long as the parents are fully liable to income tax in Germany.

However, the child's place of residence affects the amount of the allowance: depending on the country, the allowance may be reduced by one, two or three quarters. The Federal Ministry of Finance classifies countries into groups to take into account the cost of living. This country grouping affects the child allowance, the BEA allowance, the training allowance and childcare costs.

Short-term stays abroad, such as holidays, do not lead to a reduction in the allowance, nor do temporary stays for training purposes.

For children living in the EU or EEA, there is still an entitlement to child benefit, provided that no comparable benefits are received abroad. Outside the EU and EEA, child benefit is only possible if the child retains a residence or stay in Germany.

The Federal Fiscal Court has ruled that a child who lives outside the EU or EEA for more than a year only retains their residence in Germany if:

- They have permanently suitable rooms available at their parents' home,

- They can use them at any time, and

- They regularly use the home during non-term times (holidays) (BFH ruling of 28.4.2022, III R 12/20).

Tip

For the retention of a residence in Germany during multi-year stays abroad, short visits to the parents are generally not sufficient. Financial difficulties of the child for home visits cannot compensate for missing stays in Germany during the holidays (BFH ruling of 25.9.2014, III R 10/14). The decisive factor is whether the child regularly spends the holidays at home with the parents. To prove this, parents and child should keep evidence (including train or flight tickets, passport copies and study plans).

Tip

The Federal Fiscal Court has ruled that a child does not give up their residence at the parents' home if a study abroad (e.g. in Australia or the USA) is initially planned for only one year. The entitlement to child benefit remains in this case.

In the case of a multi-year stay abroad, the child only retains their residence in Germany if they spend the majority of the non-term time in Germany (BFH ruling of 21.6.2023, III R 11/21).

If the child decides during the first year to stay abroad longer, the stricter criteria apply only from the time of the extension. Child benefit remains for the first year, even if the child does not return to Germany during this time.

The decisive factor is whether the child spends more than half of the free time in Germany after the extension. Missing home visits due to lack of money or travel restrictions can jeopardise the entitlement to child benefit, as the Bremen Finance Court emphasised (ruling of 7.3.2023, 2 K 27/21).

Note: For the sake of good order, it should be noted that there are special features regarding child benefit in connection with countries with which a social security agreement exists (e.g. Turkey).

(2024): What impact does my child's stay abroad have on the child allowance?

Which costs cannot be deducted as school fees?

Not all costs can be claimed for tax purposes. For example, if your child attends a boarding school, the expenses for accommodation, care and meals for your child must be deducted. School clothing and travel to school are also not tax-deductible as school fees.

The same applies to learning materials, as well as school books or computers that you purchase yourself. Costs for additional courses or school trips cannot be included in the tax return either.

Finally, costs for individual private tuition, music schools, sports clubs, holiday courses and tutoring are not deductible.

(2024): Which costs cannot be deducted as school fees?