Who receives the disability allowance?

You can receive the disability allowance if you can prove a certain degree of disability. A person is considered disabled if their physical, mental, or emotional health is impaired for more than six months.

The degree of disability is usually determined by the pension office. From a degree of disability of 50, you receive a severely disabled pass; up to a degree of 45, the office issues a notice of determination. The tax office is bound by these notices.

You can claim the disability allowance for yourself, your disabled spouse, or your disabled child. The allowance cannot be transferred from disabled parents or siblings.

Tip: If the degree of disability is determined retroactively for several years, you can claim the allowance retroactively for the years for which a degree of disability is recognised. However, you should register your tax claims as soon as possible after the degree of disability is determined, as certain deadlines must be observed.

Lohnsteuer kompakt

The disability allowance is an annual amount. It is granted in full even if the disability occurs or ceases during the year. If the degree of disability is increased or decreased during the year, the annual amount is based on the higher degree of disability (R 33b para. 7 EStR).

If multiple disabilities occur for different reasons, the disability that leads to the highest allowance is used. The disability allowance has a full tax-reducing effect, as no reasonable burden is deducted.

The question is whether care-related expenses can be deducted as extraordinary expenses under § 33 EStG in addition to the disability allowance, or whether the allowance must be waived for this. Since 2008, the following regulation applies:

If you claim the disability allowance under § 33b para. 3 EStG, care-related expenses are not additionally recognised as extraordinary expenses under § 33 EStG. The "either-or principle" applies (R 33.3 para. 4 EStR 2008).

You must decide: Either you apply for the disability allowance, or you claim the care-related costs as extraordinary expenses with proof. When providing proof, the care allowance from the care insurance must be deducted, and the tax office will also deduct the reasonable burden from the remaining amount. For consideration under § 33 EStG to be more advantageous, the expenses must be higher than the disability allowance, the care allowance received, and the reasonable burden.

But no rule or exception:

You can, for example, claim the following special expenses in addition to the allowance:

- extraordinary medical expenses caused by an acute event, such as costs of an operation, medical treatment, medication, and doctor’s fees,

- expenses for a health cure carried out based on a medical certificate issued before the start of the cure (the medical certificate from a medical service of the health insurance is equivalent to the official medical certificate),

- disability-related conversion costs for a car,

- disability-related renovation costs for the home,

- disability-related travel allowance (from 2021):

Up to and including 2020, travel costs related to a disability could be considered at 0.30 Euro per kilometre driven up to certain maximum amounts. This consideration regularly required proof of the kilometres driven. This proof is no longer required from 2021.

The disability-related travel allowance is:

- 900 Euro: for people with a degree of disability of at least 80 or a degree of disability of at least 70 and the mark "G" for walking disabled

- 4.500 Euro: for people with exceptional walking disability (mark "aG"), blind people (mark "BI"), deafblind people (mark "TBI"), helpless people (mark "H") or people for whom care level 4 or 5 has been determined.

The following special feature must be observed when considering the disability-related travel allowance:

Disability-related travel costs are part of the general extraordinary expenses. When calculating your income tax, the reduction by the reasonable burden is deducted from the total amount of extraordinary expenses, which also includes the disability-related travel allowance.

(2024): Who receives the disability allowance?

Which new care levels correspond to the condition of being helpless?

Disabled individuals are entitled to a disability allowance, which varies according to the degree of disability. In cases of helplessness (mark "H") and blindness (mark "Bl"), the disability allowance is 7,400 Euro regardless of the degree of disability (§ 33b EStG).

Until 2016, the classification as a person in need of severe care in care level III according to the notice from the care insurance fund was equivalent to the mark "H" (§ 65 Abs. 2 EStDV).

Carers who look after a person in need of care at home are entitled to the carer's allowance. The allowance is:

- for care level 2: 600 Euro

- for care level 3: 1.100 Euro

- for care level 4 or 5 or helplessness: 1.800 Euro

Since 2017, the assessment of care needs has been much more differentiated into five care levels instead of the previous three care levels. The focus is on the actual support needs, measured by the degree of independence - regardless of whether someone has a mental or physical impairment. Physical, mental, and psychological impairments are recorded and included in the assessment of care needs.

All individuals previously receiving care insurance benefits have been transferred to the new system without a new assessment since 1 January 2017. They do not need to apply for classification into a new care level. Previously, for tax purposes, care level III was equivalent to the mark "H" (helpless) in the severely disabled pass.

Since 2017, the mark "H" is equivalent to care levels 4 and 5. Therefore, if the person in need of care has care level 4 or 5,

- the person in need of care receives the increased disability allowance of 7,400 Euro and

- the carer receives the carer's allowance for home care (BMF letter dated 19.8.2016).

The new care level 4 applies to the previous care level III and the previous care level II with significantly reduced everyday competence. The new care level 5 applies to the previous care level III with significantly reduced everyday competence and the hardship cases of care level III.

(2024): Which new care levels correspond to the condition of being helpless?

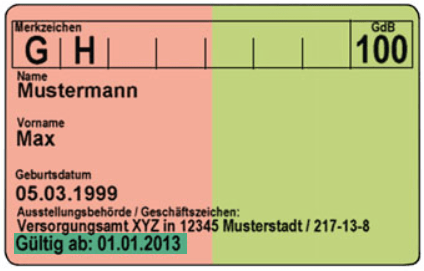

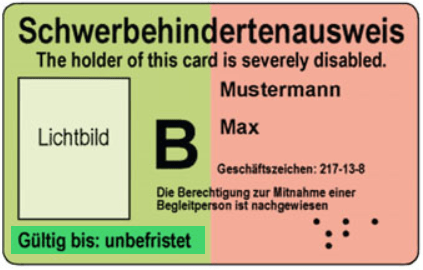

What special disability markers are there?

People with disabilities receive tax benefits under certain conditions. The basis for this is often the disability allowance according to § 33b Income Tax Act (EStG) or the application of extraordinary expenses, such as travel costs. The symbols entered in the disability pass are decisive. However, not all symbols are relevant for the tax return.

Which symbols are relevant for tax purposes?

In the 2024 tax return, only the symbols that have tax implications can be considered – particularly for the disability allowance or travel cost regulations. These include:

- G (significantly walking impaired): Entitles you under certain conditions to claim travel costs as extraordinary expenses (§ 33 EStG).

- aG (exceptionally walking impaired): Leads to an increased travel allowance; flat-rate mileage rates for private journeys can be applied.

- H (helpless): Leads to an increased disability allowance of 3,700 Euro annually (§ 33b Abs. 3 EStG).

- Bl (blind): Also entitled to the allowance of 3,700 Euro (§ 33b Abs. 3 EStG).

- Tbl (deafblind): Severe case – entitled to the highest disability allowance of 3,700 Euro annually.

These symbols must be indicated in the main form of the income tax return or in the form "Extraordinary Expenses". A corresponding notice from the pension office must be attached or already filed with the tax office.

Which symbols are not relevant for tax purposes?

Some symbols in the disability pass have no tax implications and are not requested in the income tax return:

- Gl (deaf): Deaf persons with the symbol "Gl" receive the disability allowance according to their determined degree of disability (GdB).

- RF (exemption from broadcasting fee): Only relevant for the broadcasting fee, has no impact on income tax.

- 1. Kl. (entitlement to 1st class rail travel): Only relates to railway regulations, not tax relevant.

- VB (entitled to benefits): Indicates benefits under the Federal Pensions Act, but no tax impact.

- ZB (supplementary pension): An administrative symbol that is not considered for tax purposes.

Note: The recognition of the symbols is carried out by the relevant pension office and should always be up to date. For tax purposes, a reference to the valid notice is usually sufficient, provided it is already available to the tax office.

(2024): What special disability markers are there?

What is the disability allowance?

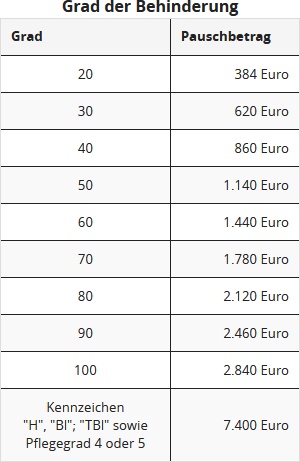

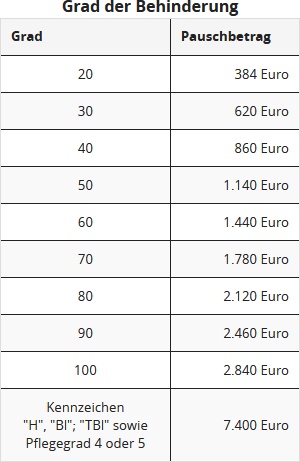

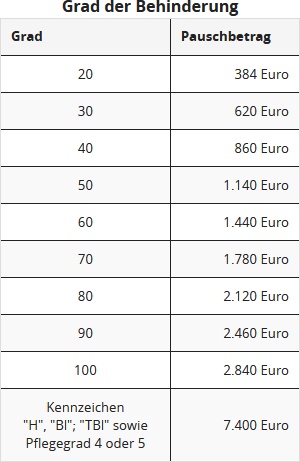

The amount of the disability allowance depends on the degree of disability. It is intended to cover additional expenses incurred due to the impairment.

According to Section 33 b (3) of the Income Tax Act, the following allowances are granted:

For helpless individuals and blind people, the allowance increases to 7,400 Euro.

The allowance is always considered an annual amount, even if the disability only occurred or ceased during the year. If the degree of disability changes during the year, the higher allowance is available. In the case of multiple disabilities, only one allowance is granted, covering all disabilities.

(2024): What is the disability allowance?

What is the disability-related travel allowance?

For travel expenses incurred due to a disability, a travel allowance for disability-related travel expenses is granted to the taxpayer upon application from 2021. The allowance is available to:

- people with walking and standing disabilities with a degree of disability of at least 80 or at least 70 with the "G" mark, amounting to 900 Euro

- people with severe walking disabilities with the "aG" mark, blind people, or disabled people with the "H" mark, amounting to 4.500 Euro

Beyond these travel allowances, no further disability-related travel expenses can be considered as extraordinary expenses.

Info

The tax office applies a reasonable burden to these allowances (§ 33 para. 2a EStG).

I N F O

How is a disability verified?

Proof of disability is provided by the pensions office. From a disability level of 50 percent, you will receive a severely disabled pass; up to a level of 45, the office issues a notice of assessment. The tax office is bound by these notices.

If you receive a pension or other benefits due to your disability, the pension statement or similar documents are usually sufficient as proof.

For the granting of the increased allowance for helpless or blind persons, the note "H" or "Bl" must be entered in the severely disabled pass. For helpless persons, the care fund's notice of classification as a care recipient of care level III (until 2016) or the granting of care level 4 or 5 (from 2017) is also sufficient.

(2024): How is a disability verified?

When is a person considered helpless?

Persons requiring assistance receive an increased disability allowance of 7.400 Euro. According to the Income Tax Act, a person is considered helpless "if they require permanent assistance from others for a number of frequently and regularly recurring activities to secure their personal existence in the course of each day" (33b para. 6 sentence 3 EStG). This assistance can include, for example, dressing and undressing, eating, and personal hygiene.

The allowance is not available for temporary helplessness, but only if the condition lasts for more than six months.

Proof of helplessness

Proof of helplessness is provided with the severely disabled person's pass, in which the mark "H" is entered. The notice from the pension office, on which the corresponding exemptions are noted, can also serve as proof. The mark 'H' corresponds to care level 4 or 5 (from 2017).

Tip: The increased disability allowance is independent of the degree of disability and can therefore also be granted for a degree of disability of less than 50.

In 2017, the mark "TBl" (deafblind) was newly introduced in social law to clarify equality with the mark "Bl". The extension is declaratory because people with the mark "Bl" and/or the mark "TBl" always also receive the mark "H".

(2024): When is a person considered helpless?

When is a person considered blind?

Blind individuals receive the increased disability allowance of 7,400 Euro per year. Blindness is defined as having no more than two percent vision in the better eye.

Deaf individuals do not receive the increased disability allowance.

The proof of helplessness is provided with the disability card showing the mark "Bl". Alternatively, the notice from the pension office with the relevant details can serve as proof.

Note

In 2017, the mark "TBl" (deafblind) was newly introduced in social law to clarify equal status with the mark "Bl". The extension is declaratory, as people with the mark "Bl" and/or the mark "TBl" always also receive the mark "H".

(2024): When is a person considered blind?

What happens if the degree of disability changes?

The disability allowance is always valid for a whole year. If the degree of disability (GdB) changes during the year, you will always be granted the allowance according to the highest degree determined by the medical assessor in the calendar year.

Example

Max has a GdB of 50. During the year, his health deteriorates. A medical assessor then increases his GdB to 65. Therefore, Max can expect the higher allowance of 1,780 Euro for this year.

(2024): What happens if the degree of disability changes?

Which expenses are covered by the disability allowance?

Many expenses typically incurred by disabled individuals are covered by the disability allowance. These include costs incurred to manage ordinary and regularly recurring tasks in daily life. This also includes care expenses, regardless of whether the care is provided at home or in a care home, or what level of care is required.

Tip

If the total of your expenses is higher than the allowance, you should waive it and instead deduct your costs as extraordinary expenses. However, you must note that extraordinary expenses are only recognised if they exceed the reasonable burden.

Also covered are the costs for medication, remedies and assistance, as well as the personal contribution for using public transport. Expenses for home dialysis are also included.

(2024): Which expenses are covered by the disability allowance?

How are the costs for building modifications due to a disability taken into account?

Renovations in your own home that are necessary due to a disability can be tax-deductible as exceptional expenses under § 33 EStG. It should be noted that the expenses are only deductible under certain conditions, and a reasonable personal contribution is applied by the tax office.

Basic information on tax deductibility:

- Medical necessity: The renovation costs must be due to the disability and considered medically necessary. Such measures are classified as medical expenses as they serve to alleviate suffering or maintain health.

- Compulsion due to disability: According to the case law of the Federal Fiscal Court (BFH), the expenses are so strongly justified by the disability that any potential value or increase in value of the house does not play a role in the deductibility (BFH rulings of 24.2.2011 and 22.10.2009).

Examples of recognised renovation costs:

- Shower renovation: The disability-friendly renovation of a shower, such as the installation of a floor-level shower element, is recognised as an exceptional expense because it is directly related to the disability. No value is credited, even if other family members can also use the renovation (FG Baden-Württemberg, ruling of 19.3.2014, 1 K 3301/12).

- Installation of a lift: The costs for installing a lift are recognised if the technical installation of a cheaper stairlift is not possible. The BFH considers such measures as a medical aid used exclusively by disabled persons (BFH ruling of 6.2.2014, VI R 61/12). Even high costs, such as 65.000 Euro for a lift, are considered reasonable if no cheaper alternatives exist (FG Köln, ruling of 27.8.2014, 14 K 2517/12).

- Additional rent for disability-friendly renovation: The Munich Fiscal Court has ruled that an increase in rent due to disability-related renovations is also deductible as an exceptional expense if the landlord carried out the renovation and passed on the costs through the rent (FG Munich, ruling of 27.10.2022, 10 K 3292/18). The Federal Fiscal Court still needs to clarify how the deductible rent increase is to be calculated (Ref. VI R 15/23).

Non-recognised renovation costs:

- Wheelchair-accessible path in the garden: The construction of a wheelchair-accessible path in the garden is not recognised if alternative access exists, such as via another terrace. In this case, only the craftsmen's services are deductible (BFH ruling of 26.10.2022, VI R 25/20).

Restrictions on tax deductibility:

- No distribution of costs over several years: High costs for disability-friendly renovations must be deducted in the year they are incurred. Distribution of costs over several years is not permitted, even if it would be advantageous for tax purposes (BFH ruling of 12.7.2017, VI R 36/15).

Tip:

If the exceptional expenses exceed the total income, the tax benefit may be lost. It is advisable to seek tax advice before undertaking major renovations to optimise the tax burden.

(2024): How are the costs for building modifications due to a disability taken into account?

Can high renovation costs be spread over five years?

Disabled individuals often face very high expenses that healthy individuals do not have. This is particularly true for adapting the living environment for disability needs, such as barrier-free modifications in the home, installation of a stair lift, addition of a lift, construction of a wheelchair ramp, vehicle conversion, etc.

As these are unavoidable expenses, they can be deducted as general extraordinary expenses under section 33 of the Income Tax Act, subject to a reasonable burden. Due to the tax cash principle, the expenses must be fully declared in the year of payment in the tax return.

However, the full deduction in the year of expenditure may be ineffective if the extraordinary expenses exceed the total income from which they are to be deducted. In this case, the tax deductibility does not provide the desired relief effect. For this situation, the Federal Fiscal Court suggested a leniency regulation (section 163 of the Fiscal Code): Affected individuals should have the option to spread the high expenses over several years (BFH ruling of 22.10.2009, VI R 7/09).

However, the tax authorities are resistant and still state in the 2015 income tax guidelines:

"A distribution over several years is not permitted" (R 33.4 paras. 4 and 5 EStR). Unfortunately, the Federal Fiscal Court confirmed the strict stance of the tax authorities and ruled that extraordinary expenses are generally deductible in the year they are incurred. High costs for disability-friendly home modifications cannot be spread over several years for reasons of leniency if they have only a very limited tax effect in the calendar year in which they were incurred (BFH ruling of 12.7.2017, VI R 36/15).

(2024): Can high renovation costs be spread over five years?

Sichern Sie sich einfach die volle Steuererstattung, die Ihnen zusteht!

Nur Lohnsteuer kompakt bietet Ihnen:

- Persönliche Steuertipps im Wert von 312 Euro (Durchschnitt)

- Verständliche Eingabehilfen und Erklärungen

- Import aus jeder beliebigen anderen Steuersoftware

- Schnelle Antworten bei Fragen

Jetzt kostenlos testen