The deductibility of pensions or recurring burdens depends on the date of the respective contract. With the Annual Tax Act 2008, the distinction between pensions and recurring burdens was abolished (§ 10 para. 1a no. 2 EStG).

You purchased a house in 2006. At the time of sale, the seller was 65 years old. In addition to a one-off payment of 150,000 Euro, you also agreed on an annual pension of 15,000 Euro.

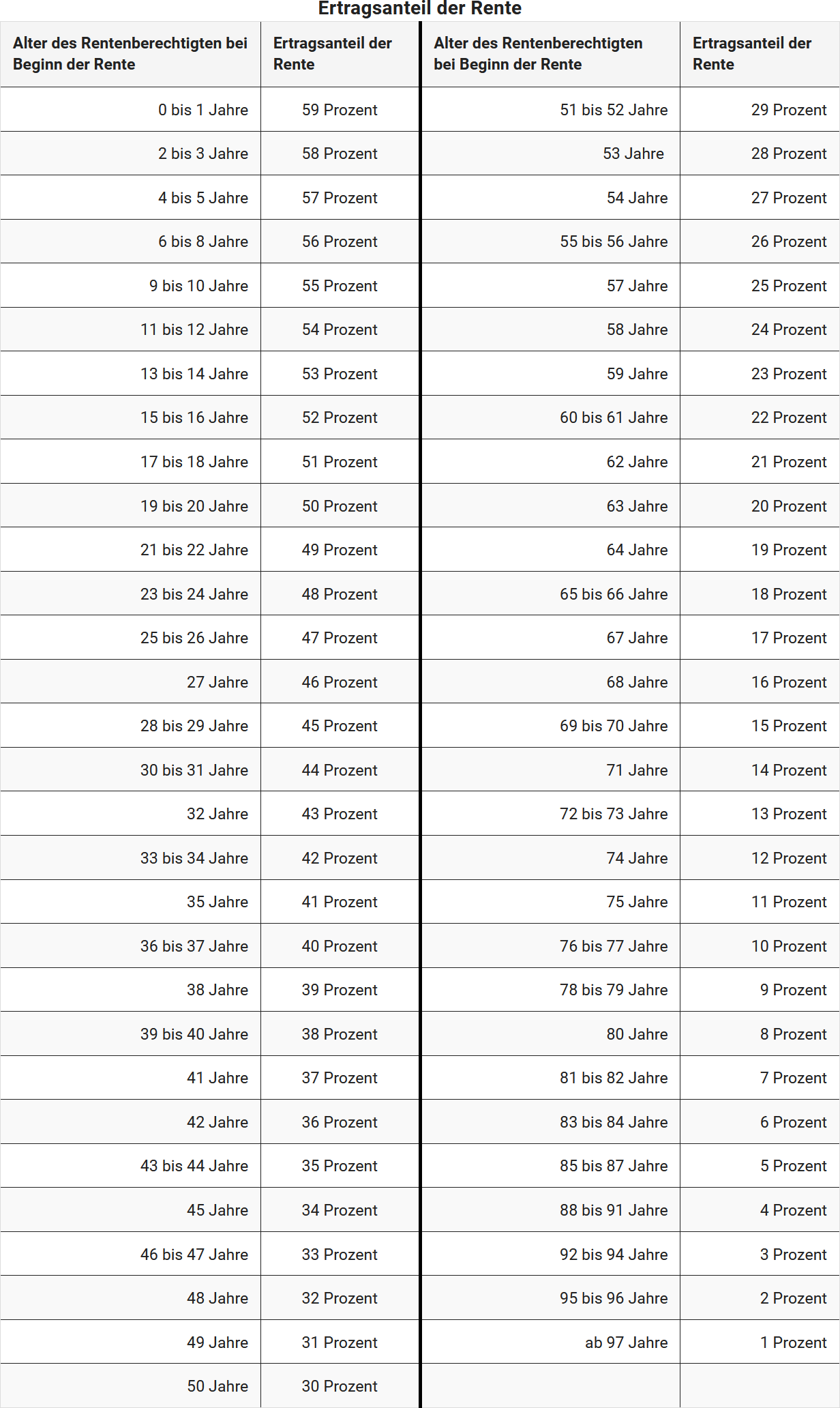

The amount you can claim as special expenses depends on the seller's age at the time of sale.

The so-called yield share is 18 percent of 15,000 Euro = 2,700 Euro.

Note: The deduction of pension payments as special expenses is only possible in the case of the transfer of businesses, partnership shares in partnerships, and shares in corporations (at least 50 percent). They must be "income-generating units". The transfer of real estate or securities is not eligible. However, the restriction to the transfer of businesses etc. does not apply to contracts concluded before 2008.

(2024): Up to what amount can I deduct pensions and permanent burdens?