Which tax office is responsible for me?

The jurisdiction of the tax office is determined by your place of residence in Germany. If you have multiple residences (e.g. due to maintaining two households), the residence where the family mainly stays is decisive for married couples. For single individuals, the residence where they mainly stay is decisive. This can also be a modest accommodation, e.g. a furnished room during a period of employment or training away from home.

The decisive factor is the place of residence at the time of submission of the tax return, i.e. if you move during the year, the tax office at your new place of residence is responsible.

If you have separated from your spouse, the tax office that was first involved with the tax case is responsible. It is therefore decisive which spouse submitted their tax return first. Only in the case of individual assessment is the respective tax office at the spouse's place of residence responsible.

Special case 1: Pensioners residing abroad

If you live abroad as a pensioner and only receive income from pensions from Germany, you must submit your tax return to the Neubrandenburg Tax Office (Pensioners Abroad - RiA) in Mecklenburg-Vorpommern.

If you earn additional income alongside your pension income, another tax office may be responsible. In case of doubt, please contact the Neubrandenburg Tax Office (Pensioners Abroad - RiA).

Special case 2: Moving abroad

The following cases must be distinguished for determining jurisdiction:

A. The employee does not earn any income in Germany after moving abroad

In these cases, there is no change from unlimited to limited tax liability due to the absence of limited taxable income. For the assessment periods of unlimited tax liability, jurisdiction remains with the tax office of the last place of residence.

B. The employee continues to earn income in Germany after moving abroad

If the employee only earns domestic income in the year of moving abroad, the tax office of the last place of residence is still responsible in the year of moving abroad.

If the employee continues to earn domestic income after the year of moving abroad, the jurisdiction for the assessment of limited tax liability is determined according to § 50 para. 2 EStG (business establishment tax office) or § 19 para. 2 AO. The tax office then responsible is also responsible for the previous assessment periods in which unlimited tax liability existed. Administrative procedures already started may be continued by the previously responsible tax office if necessary.

(2024): Which tax office is responsible for me?

What is the difference between my tax number and the tax identification number?

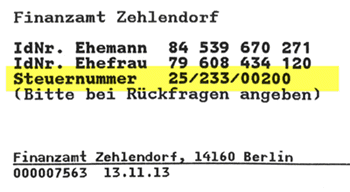

The tax number should not be confused with the permanent and nationwide tax identification number.

What is the tax number?

The tax number is issued by the tax office to each taxable individual or legal entity and is uniquely assigned to a taxpayer. A person may have several tax numbers during their lifetime. For example, if someone moves and falls under the jurisdiction of a different tax office, gets married, or registers as self-employed, they will receive a new tax number.

Previously, tax numbers were based on state-specific codes and consisted of ten or eleven digits, depending on the federal state. With the introduction of the so-called ELSTER procedure (ELektronische STeuerERklärung), the standard scheme for tax numbers was standardised nationwide and now has 13 digits.

Where can I find the tax number?

After submitting the first income tax return or registering a self-employed or business activity, the number is issued by the relevant tax office. However, it can also be applied for independently. The tax number can be found at the top left of the income tax assessment notice.

What do I need the tax number for?

The tax number must be provided when submitting a tax return or registering a self-employed or business activity, as well as in payment transactions. Freelancers and business owners must include it on their invoices if they do not have a VAT identification number. In the future, the tax number will be replaced by the tax identification number. However, both numbers currently exist in parallel.

What is the tax identification number?

The tax identification number (IdNr. or tax ID) has been a nationwide and permanent identification number for citizens registered in Germany for tax purposes since 2008. It is valid for life. Children receive it shortly after birth.

The identification number does not change if you move or change the responsible tax office. The data is deleted only when it is no longer needed by the authorities, but no later than 20 years after the taxpayer's death.

The tax ID is also required for child benefit, exemption orders for all bank accounts in Germany, the granting of the care allowance, and the tax deduction of maintenance payments, and is increasingly being requested.

(2024): What is the difference between my tax number and the tax identification number?

In which cases can I lodge an objection to the tax assessment notice?

You have the right to object to an incorrect tax assessment. However, according to Section 350 of the Fiscal Code, there must be appropriate grounds.

These may include:

- A tax amount that is too high has been set for you.

- Expenses (income-related expenses, special expenses or extraordinary burdens) or allowances have not been recognised by the tax office.

- You forgot to claim certain expenses in your tax return.

Pending proceedings at the highest federal courts (Federal Fiscal Court, Federal Constitutional Court) can also be cited as a reason for an objection with suspension, provided their circumstances relate to your own tax case. This allows you to benefit if a so-called test case is decided in favour of the claimant.

You have one month to lodge your objection. After the deadline, the tax assessment becomes legally binding.

(2024): In which cases can I lodge an objection to the tax assessment notice?

What should my objection look like?

Once you have identified the error in your income tax assessment, you should lodge an objection as soon as possible. You have one month from the date of notification of the tax assessment to do so. This period begins on the third day after the issue date. If the deadline falls on a weekend or public holiday, it ends on the next working day.

If you have missed the deadline through no fault of your own, for example due to a hospital stay or holiday, you may be able to extend the objection period under certain conditions.

Proceed as follows with your objection: In any case, submit your objection in writing to the relevant tax office. It must be clear from the letter that you are lodging an objection. Clearly state what you are objecting to in your tax assessment. The objection should also include a reason. In the case of jointly assessed spouses, both should always lodge the objection together. If one spouse writes the objection letter alone, they should state that they are also submitting it on behalf of their spouse.

Despite your objection, you must ensure that you pay your tax liability if you have received a request for additional payment. You must pay this within the specified period.

Anyone who refuses to pay their tax liability may incur a late payment penalty from the tax office. Otherwise, you should apply for a "suspension of enforcement" with the objection. However, this is generally not advisable, as it can be costly. The objection to the tax assessment is always free of charge. Costs only arise if you are not satisfied with the objection decision and take the matter to court.

(2024): What should my objection look like?