Discrimination: Employer's compensation completely tax-free

Under the General Equal Treatment Act (AGG), discrimination on grounds of race or ethnic origin, gender, religion or belief, disability, age, or sexual identity is prohibited (§ 1 AGG). If the prohibition of discrimination is violated, the employer is obliged to compensate for the resulting damage. The person affected can claim an appropriate monetary compensation (§ 15 para. 2 AGG). The question is how such compensation is treated for tax purposes. Recently, the Rhineland-Palatinate Fiscal Court ruled that compensation paid by an employer to an employee due to discrimination, bullying, or sexual harassment is tax-free and not taxable wages. This applies even if the employer denied the alleged discrimination and only agreed to the payment in a court settlement. Tax-free means that the payment is not subject to social security contributions (Rhineland-Palatinate Fiscal Court, 21.3.2017, 5 K 1594/14).

The case: An employee filed a unfair dismissal claim against the termination of her employment for "personal reasons", also seeking compensation for discrimination due to her disability. A few weeks before the dismissal, the Office for Social Affairs had determined a physical disability of 30%.

Before the Labour Court in Kaiserslautern, the employee and her employer reached a settlement in which "compensation according to § 15 AGG" of 10.000 Euro was agreed, and the employment relationship was terminated by mutual consent. The tax office wanted to treat the compensation as taxable wages.

According to the tax judges, the settlement reached at the Labour Court indicates that the payment was not compensation for material damages under § 15 para. 1 AGG (e.g. lost wages) but for non-material damages under § 15 para. 2 AGG due to discrimination against the claimant as a disabled person. Such compensation payments are tax-free and not to be classified as wages. The claimant's employer had denied the discrimination.

However, as part of the settlement, he was willing to pay compensation for (only) alleged discrimination. Such income does not have the character of wages and is therefore tax-free.

Lohnsteuer kompakt

The compensation is not only tax and social security-free, but it is also not included in the progression clause, so it does not lead to a higher tax rate for other income.

Altersdiskriminierende Besoldung?

The Federal Administrative Court has just awarded young civil servants compensation for age-discriminatory pay because their pay violated the prohibition of age discrimination. The court derived the entitlement to compensation from § 15 para. 2 AGG (Federal Administrative Court rulings of 6.4.2017, 2 C 11.16 and 2 C 12.16). The pay regulations disadvantaged younger civil servants solely because of their age (ECJ ruling of 19.6.2014, C-501/12).

(2024): Discrimination: Employer's compensation completely tax-free

How to save with a tax allowance in ELStAM!

Individuals with high income-related expenses, special expenses, or losses from other types of income (e.g. rental income, business operations, capital assets, etc.) pay too much income tax from their salary each month.

Only when the income tax return is completed can you reclaim the overpaid income tax from the tax office as part of the tax return.

With an application for income tax reduction, you can have the tax office enter an allowance for various tax deductions and your anticipated expenses in the electronic income tax deduction features (ELStAM). During payroll processing, your employer will then reduce your gross salary by the monthly allowance. As a result, income tax is calculated only on the reduced gross salary. This means you pay less tax, as well as less solidarity surcharge and church tax, during the year with an allowance.

(2024): How to save with a tax allowance in ELStAM!

How can I have the child allowance entered in the ELStAM?

The child allowance is granted retrospectively, but you can have it entered in your electronic wage tax deduction features (ELStAM). Although you will not pay less income tax in advance, the mid-year burden may still decrease. This is because the child allowance is taken into account when calculating church tax and the solidarity surcharge, which are then reduced. You must have the allowance entered at your tax office. You should bring the following documents:

- Identity card or passport

- Wage tax certificate

- Birth certificate

- If applicable, paternity recognition certificate if you are not married

- If applicable, certificate of life for children registered at a different address

The certificate of life must not be older than three years. If you cannot provide the certificate of life, e.g. because the child lives abroad, you must contact your tax office. The tax officer will enter the child allowance there.

Parents of children over 18 must also contact the tax office to have allowances entered.

(2024): How can I have the child allowance entered in the ELStAM?

How do I have allowances or changes entered in the ELStAM?

Taxpayers who wish to enter an allowance in their electronic payslip data (ELStAM) should contact the tax office. If you want to have a tax allowance for high work-related expenses taken into account, you can submit a corresponding application. The same applies to application-based deduction features, such as the consideration of adult children, foster children, tax class II for single parents.

Even if you have already used such an allowance in the previous year and the circumstances have not changed significantly, a new application for the new year is required. Only an already entered disability allowance will continue to be taken into account without a new application. The same applies if the disability allowance for a child has been transferred to the parents.

If the stored ELStAM are not correct, you must apply for a correction at the relevant local tax office. To do this, use the form "Correction application for electronic payslip data", which you can obtain from the tax office or online.

Caution

Since 1 January 2016, the tax allowance is generally valid for two years. If your circumstances change in your favour within the two years, you can have the allowance changed at the tax office. However, if your circumstances change to your disadvantage, you are obliged to have the allowance changed. A change may occur, for example, if you change employer, if the distance to your place of work or employment increases or decreases significantly, or if double housekeeping is established or ceases to exist (§ 39a para. 1 sentences 4-5 EStG).

(2024): How do I have allowances or changes entered in the ELStAM?

Who receives the inflation adjustment bonus?

If employers grant their employees an inflation bonus (inflation, inflation rate, rate of price increase), this is tax and social security-free up to an amount of 3,000 Euro. The condition for tax exemption is that the benefit is granted in addition to the salary already owed. The regulation applies to payments made between 26.10.2022 and 31.12.2024 (§ 3 No. 11c EStG).

Naturally, new regulations often raise questions, such as whether the payment of an inflation bonus is mandatory for employers. And, if it is paid, whether employers must distribute it equally to all employees of the company. The answer to the first question is "No, there is no obligation". The second question was answered by Parliamentary State Secretary Katja Hessel following an inquiry by Member of Parliament Fritz Güntzler (CDU/CSU) as follows:

"The tax exemption for the inflation bonus decided with § 3 No. 11 EStG does not include a regulation that the bonus must be paid to all employees. It is also a tax allowance that can be paid to employees in instalments within the benefit period" (Bundestag document 20/3987 of 14.10.2022).

Lohnsteuer kompakt

Even though both the basic payment of the inflation bonus and any distribution among employees are at the employer's discretion for tax purposes, different practices may arise from collective or employment law. Employers may not arbitrarily favour certain employees or disadvantage others. If not all employees receive a bonus or if it is paid in varying amounts, there must be objective reasons for the different treatment. Otherwise, the principle of equal treatment applies under employment law.

Lohnsteuer kompakt

Information on the inflation bonus can be found in the official Q&A catalogue of the Federal Ministry of Finance.

(2024): Who receives the inflation adjustment bonus?

Voluntary resignation: Is the severance payment subject to the one-fifth rule?

The early termination of employment by the employer is usually painful for the employee concerned. To ensure an amicable separation, the employee is often given a golden handshake. Compensation is provided for the loss of employment, which is also taken into account with tax benefits. But does this also apply if you resign yourself?

The severance payment is compensation within the meaning of § 24 No. 1a EStG and is therefore considered "extraordinary income". There is a tax benefit for this extraordinary income: the reduced taxation according to the so-called one-fifth rule (§ 34 EStG). However, this requires, among other things, that it is a "special event". This is assumed if the termination or amendment of the contract is initiated by the employer or if the employee acted under significant legal, economic, or factual pressure or at least in a conflict situation to avoid disputes when concluding a termination agreement.

Note: The tax benefit is not granted if you initiated the termination of the contract yourself, i.e., resigned without any prompting from the employer.

Currently, however, the Münster Finance Court has ruled in a case that a severance payment is also eligible for tax relief under the one-fifth rule according to § 34 para. 2 EStG if the employee concluded the termination agreement on their own initiative. In this case, the employee was under the significant factual pressure required by the BFH case law when concluding the termination agreement, as they acted in a conflict situation to avoid disputes about the continuation of the employment relationship and the promotion they sought (FG Münster of 17.3.2017, 1 K 3037/14 E, Revision IX R 16/17).

According to the finance judges, it is harmless for the tax benefit that the employee approached the employer and demanded the conclusion of a termination agreement with severance pay. For the assumption of a conflict situation, it is sufficient that there was an opposing interest between the employer and the employee, both parties contributed to the conflict, and the parties resolved the conflict by consensus.

These conditions were met because both parties resolved their conflicts of interest regarding early departure from service and promotion through the termination agreement.

Currently, the BFH has shared this view and dismissed the tax authorities' appeal. It follows that if an employer pays an employee a severance payment as part of the (amicable) termination of employment, actual findings on whether the employee was under actual pressure are usually unnecessary (BFH judgment of 13.03.2018, IX R 16/17, BStBl 2018 II p. 709):

Severance payments and tax benefits

If a severance payment is paid in different years, the tax reduction is forfeited, as ruled by the Federal Fiscal Court (BFH judgment of 6.12.2021, IX R 10/21).

The case: An employee received a severance payment in 2015 and a starting bonus in 2016 after losing their job. The tax office refused the tax reduction, which the BFH confirmed.

Reason: The one-fifth rule applies even if a main payment is made in one year and a partial payment in another year. The rule does not apply if the payments are compensation for the same event and there is no lump-sum payment.

Tip: Company agreements can be complex, especially with different benefits. Sprint bonuses, which are intended to motivate employees to terminate their employment early, are considered compensation and may be subject to the one-fifth rule (Hessian FG, court order of 31.5.2021, 10 K 1597/20).

(2024): Voluntary resignation: Is the severance payment subject to the one-fifth rule?

How much is the church tax?

The amount of church tax depends on your place of residence. In Bavaria and Baden-Württemberg, it is 8% of the assessed income tax; in other federal states, it is 9%. The calculation is based on the assessed income tax.

Withholding tax:

Church tax is also taken into account at the same rate within the framework of the withholding tax. If you have income from business operations or income taxed under the partial income procedure, the taxable income (zvE) for the calculation of church tax is determined separately.

Church tax and child allowances:

- Example without child allowance: You live in Berlin, have a gross monthly salary of 3.000 Euro in tax class IV. Your monthly church tax is 29.63 Euro.

- Example with two child allowances: With the same income and tax class, your monthly church tax is reduced to 11.21 Euro.

If child allowances are entered in your ELStAM (Electronic Wage Tax Deduction Features), the monthly wage tax is not reduced, only the church tax and the solidarity surcharge. This applies regardless of whether you receive child benefit during the year.

Child allowances in income tax assessment:

Child allowances only reduce the taxable income if the tax advantage is higher than the child benefit. However, for the calculation of church tax and solidarity surcharge, the allowances are taken into account fictitiously.

Advantage:

Even if children are only considered for part of the year (e.g. when finishing education or at birth), the full child allowance and BEA allowance are credited for the calculation of church tax and solidarity surcharge.

(2024): How much is the church tax?

How are short-time work benefits and maternity pay taxed?

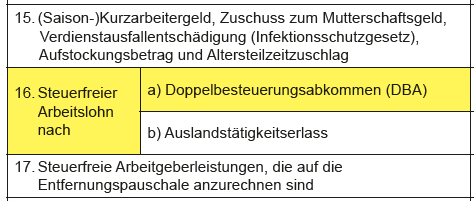

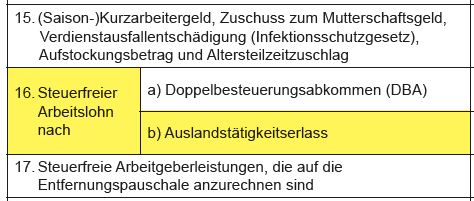

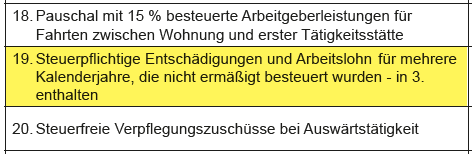

Short-time allowance and maternity pay are tax-free but subject to the progression clause. This means that these wage replacement benefits are used to determine the tax rate, even though they are not taxed themselves. The progression clause can lead to an increase in your tax rate and thus the tax burden on your taxable income.

How does the progression clause affect my tax rate?

Although wage replacement benefits such as short-time allowance and maternity pay are tax-free, they are added to your income to calculate your personal tax rate. This results in a higher tax rate, which is then applied to your actual taxable income. This may mean that you have to pay additional taxes or receive a lower tax refund.

Example

A single mother has an income of 26.000 Euro and receives an additional 6.000 Euro in parental allowance. The total income is therefore 32.000 Euro, and the tax rate for this is 15.70%. However, this tax rate is only applied to the income without parental allowance. As a result, the tax is 4.082 Euro. Without the progression clause, the tax on the income of 26.000 Euro would only be 3.328 Euro. The progression clause results in additional taxes of 754 Euro.

Impact on the basic allowance:

If your income, including wage replacement benefits, exceeds the basic allowance, the increased tax rate will be applied. If the total income is below the basic allowance, the wage replacement benefits remain tax-free.

Tip for repayment of wage replacement benefits:

If you have to repay overpaid unemployment benefit or short-time allowance, you should submit a tax return. The repayment can reduce your tax rate (negative progression), which may result in a tax refund.

Employer supplements to short-time allowance:

Many employers top up the short-time allowance to 80% or more. These top-up amounts were temporarily tax-free, provided they did not exceed 80% of the last net salary together with the short-time allowance (Corona Tax Assistance Act, until 30.06.2022). Since July 2022, employer supplements to short-time allowance are taxable again.

(2024): How are short-time work benefits and maternity pay taxed?

Are there wage replacement benefits that I won't find on my income tax statement?

Yes. Wage replacement benefits that you do not receive from your employer are also not shown on your income tax statement.

Wage or income replacement benefits include in particular:

- Unemployment benefit I,

- Short-time work allowance and seasonal short-time work allowance,

- Insolvency benefit in the event of employer insolvency,

- Parental allowance under the Federal Parental Allowance and Parental Leave Act,

- Maternity benefit, maternity benefit supplement,

- Sickness, injury, and transitional benefits for disabled persons or comparable wage replacement benefits,

- Top-up amounts and partial retirement bonuses under the Partial Retirement Act or civil service law,

- Wage subsidies for older employees from the employment agency.

Important: All wage or income replacement benefits subject to the progression clause must be entered exclusively in the main tax form and no longer in Form N since 2015. You can find the section in Lohnsteuer kompakt under "Other details > Income replacement benefits".

(2024): Are there wage replacement benefits that I won't find on my income tax statement?

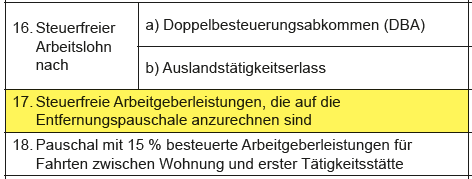

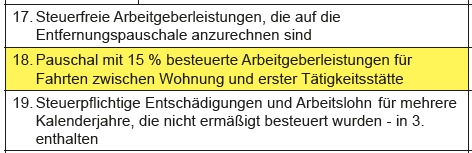

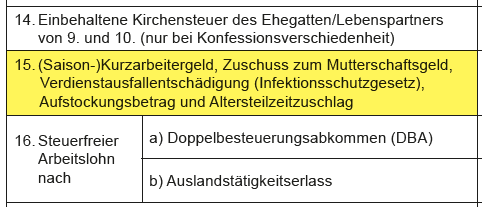

What can I deduct if my employer provides benefits for commuting to work?

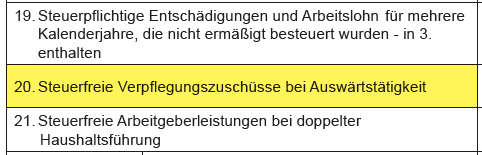

In principle, the following applies: Such a subsidy from the employer is taxable, but the employer can tax it at a flat rate of 15 percent (see the note below on the new regulation of a flat rate tax of 25 percent). The amount taxed at a flat rate is exempt from social security contributions. The employer must note the amount taxed at a flat rate in the payslip, and you must enter this amount as travel expense reimbursement in your tax return (Form N, reverse side).

The tax office will accordingly reduce the deductible travel expenses and only recognise the remaining travel expenses as business expenses. If your employer provides you with a job ticket for the journeys, this is a benefit in kind. If the employer's contribution does not exceed 50 Euro per month, this amount is tax and social security free.

New since 2019:

Since 1 January 2019, employer benefits - subsidies and job tickets - to employees are tax and social security free under the following conditions for the following journeys:

- Journeys between home and first place of work,

- Journeys to a collection point permanently designated by the employer (e.g. fixed meeting point, specific car park, bus or train depot, ferry port),

- Journeys to a large-scale work area (e.g. forest area, port area, but not factory premises) in accordance with § 9 para. 1 no. 4a sentence 3 EStG.

(§ 3 no. 15 EStG 2019, introduced by the "Act to Avoid VAT Losses in the Trade of Goods on the Internet and to Amend Other Tax Regulations" of 11 December 2018).

Which means of transport are subsidised?

- Employer benefits for employee journeys with public transport in scheduled services (1st alternative) are subsidised. This applies to employees in active employment and temporary workers at the hirer. Private journeys are not subsidised. This includes trains such as ICE, IC, EC of Deutsche Bahn, long-distance buses on fixed routes with stops and comparable high-speed trains.

- Employer benefits for these journeys as well as private journeys in local public transport (2nd alternative) are also subsidised and apply to all employees and temporary workers. This applies regardless of the type of journey, including private journeys. Local public transport includes the general transport of persons in urban, suburban or regional transport. This includes public transport that is not part of long-distance passenger transport. In some cases, taxis may also be included if they meet certain conditions.

Note: A taxi is not considered a subsidised public transport (BFH ruling of 9 June 2022, VI R 26/20).

Travel allowances for journeys with your own car are taxable from 2019, but can be taxed at a flat rate of 15% by the employer. The amount taxed at a flat rate is exempt from social security contributions (§ 40 para. 2 sentence 2 EStG). The travel allowance taxed at a flat rate does not increase the gross salary shown in the payslip. Only if the travel allowance is not taxed at a flat rate will it be added to the gross salary and taxed normally.

The flat rate taxation is only permissible if the allowance is paid in addition to the salary already owed and not if salary is converted into a travel allowance. However, it is often possible to pay travel allowances instead of a salary increase.

The following means of transport are not subsidised:

- Buses or trains specially rented or chartered for specific occasions,

- Taxis in occasional transport that do not operate on licensed lines or routes,

- Air transport.

Which employer benefits are subsidised?

The tax exemption includes

- Employer benefits in the form of free or discounted travel permits (benefits in kind, job ticket),

- Employer subsidies (cash wages) for travel permits purchased by employees themselves.

Subsidised are in particular travel permits in the form of single/multiple journey tickets, season tickets (e.g. monthly, annual tickets, Bahncard 100), general free travel permits, free travel permits for certain days (e.g. in case of smog alert) or discount cards (e.g. Bahncard 25).

Deutschlandticket

From 1 May 2023, the Deutschlandticket, often known as the 49-Euro-Ticket, will be available. With this ticket, citizens can use local public transport throughout Germany. Employers can offer this ticket as a job ticket. If the employer provides at least 25 percent of the ticket price as a subsidy, the transport company grants an additional five percent discount.

These employer subsidies for the Deutschlandticket are tax-free as long as they are in addition to the salary already owed. This means that employers can grant their employees tax-free subsidies for the use of the Deutschlandticket, provided this bonus is in addition to the normal salary.

The tax-free subsidies must be recorded in the payroll account and shown in the payslip. Employees can offset these tax-free subsidies against their deductible travel expenses, which means that the travel allowance is reduced accordingly.

Price advantages from third-party companies and group companies (subsidies and benefits in kind) that are granted in consideration of the employment relationship and would be treated as wages are also tax-free (according to BMF letter of 20 January 2015, BStBl. 2015 I p. 143).

Price advantages granted to employees by third parties are part of taxable wages if they represent a benefit of the employee's work for the employer and are related to the employment relationship, or if the employer has actively participated in obtaining these price advantages.

Such price advantages are tax and social security free if the third-party company has a predominantly self-economic interest in granting the discount, the third-party company usually grants the price advantage to third parties in the normal course of business, e.g. quantity discounts, or the granting of the advantage is in the overwhelming interest of the employer.

The monetary value of a job ticket is no longer offset against the 50 Euro exemption limit for benefits in kind. This benefit can now be used elsewhere (§ 8 para. 2 sentence 11 EStG). For employees of transport companies, the tax-free free travel entitlement is no longer offset against the employee discount allowance of 1,080 Euro (§ 8 para. 3 EStG).

If you receive a subsidy from your employer for journeys to work with your own car, the previous regulation remains in place, i.e. the subsidy can be taxed at a flat rate of 15% by the employer (§ 40 para. 2 sentence 2 EStG).

Lohnsteuer kompakt

Since 1 January 2019, employers have an option for job tickets and subsidies that are not tax-free under § 3 no. 15 EStG. They can choose a flat rate tax of 25 percent without reducing the travel allowance. The decision as to whether the 25 percent flat rate tax or the 15 percent tax is more advantageous depends on your individual situation.

The travel allowance only applies if it exceeds the employee allowance of 1,230 Euro per year, provided no additional business expenses are incurred. For shorter distances, the 15 percent flat rate tax may therefore be more sensible, as in such cases the reduction of the travel allowance is less significant.

Do I also get the travel allowance if I use a company car?

You can also claim the travel allowance if you use a company car for the journey to work. Please note:

- You must tax a surcharge on the private use value for journeys between home and work.

- The travel allowance is 0.30 Euro per kilometre (from the 21st kilometre 0.38 Euro) and is deductible as business expenses.

- If your employer taxes the use value at a flat rate of 15 percent, deduct this amount from your business expenses.

(2024): What can I deduct if my employer provides benefits for commuting to work?

What is a pension?

According to the definition in sect. 229 of the Social Code Book V (SGB V), pension benefits are income comparable to pensions (pension payments), insofar as they are earned due to a reduction in earning capacity or for old-age or survivors' pensions.

Pension benefits include:

- Pensions from insurance and pension institutions established for members of certain professions (e.g., doctors, architects, lawyers),

- Pensions of the company pension scheme including the supplementary pension in the civil service and the supplementary pension of the miners,

- Remuneration from the pensions of deputies, parliamentary state secretaries and ministers,

- Pension payments from a public-law employment relationship or from an employment relationship with entitlement to pension payments in accordance with civil service regulations or principles.

(2024): What is a pension?

Are my pension payments taxable?

Pension payments (retirement pay, widow's pension, orphan's pension, maintenance payments or similar) are considered income from employment under the Income Tax Act and are subject to the wage tax deduction procedure upon payment.

Since 2013, instead of the wage tax card, the pension office can electronically retrieve your wage tax deduction details from a tax administration database using your tax identification number and date of birth via ELSTAM (Electronic Wage Tax Deduction Features).

The taxation of pension payments is generally the same as that of salaries. The only difference is that an additional pension allowance is granted.

Since 01.01.2005, the taxation of retirement income (pension payments and annuities) has been re-regulated by the Retirement Income Act – AltEinkG. The core element of the Retirement Income Act is the transition from the taxation of contributions paid into retirement provision during the working phase ("upstream" taxation) to the taxation of benefits during the payout phase ("downstream" taxation). This is being implemented gradually during the transition period up to 2040; thereafter, civil service pensions and annuities will be treated equally for tax purposes.

The previously granted pension allowance is reduced annually, i.e. the later the pension begins, the lower the allowance until no pension allowance is granted for pensions starting from 2040. The flat-rate allowance for income-related expenses is 102 Euro, as with pension income.

The decisive factor for the amount of the (lifetime) allowance and the supplementary bonus to the pension allowance is the year the pension begins. The relevant percentage, the maximum amount of the pension allowance and the bonus to the pension allowance can be found in the table mentioned in § 19 para. 2 Income Tax Act (EStG).

The pension allowance and the bonus to the pension allowance apply for the entire duration of the pension payments. Regular adjustments to the pension payments do not lead to a recalculation.

However, a recalculation must be made if the pension payments increase or decrease due to the application of credit, suspension, increase, or reduction regulations. In the calendar year of the change, the highest pension allowance and bonus to the pension allowance apply.

(2024): Are my pension payments taxable?

Severance Pay: The Most Important Information on the One-Fifth Rule

The early termination of employment by the employer is usually painful for the employee concerned. To ensure an amicable separation, the employee is often given a golden handshake. Compensation is provided for the loss of employment, which is also taken into account for tax purposes with tax benefits.

What amount of severance pay should be assumed?

According to Section 1a of the Employment Protection Act (KSchG), all employees are entitled to severance pay in the event of redundancy. A voluntary severance offer must be forwarded to the employee together with the notice of termination. However, the condition for receiving the severance pay is that the employee does not contest the termination. The amount of severance pay is based on the number of years of employment with the company.

There is usually an entitlement to half a month's salary for each year of employment. For ten years of service, there is an entitlement to an amount equivalent to five months' salary. In addition, there are claims from benefits in kind provided by the employer. If a company car or company laptop was provided, the value of use must be added to the calculation of the severance pay amount. Certainly, lower or higher severance payments are also possible, but these are usually not redundancy but rather a settlement or severance agreement.

Tax treatment of the one-fifth rule

Since the Tax Amendment Act 2001, the consideration of the one-fifth rule no longer needs to be applied for. The tax office automatically checks whether normal taxation or the reduced taxation according to the one-fifth rule is more favourable for you.

Important: If severance pay or remuneration for work over several years has been taxed by the employer according to the one-fifth rule, you are obliged to submit a tax return.

This is how the tax liability is calculated with the one-fifth rule

- The taxable part of the extraordinary income (severance pay, jubilee bonus, remuneration for work over several years, etc.) is deducted from the taxable income.

- The income tax is calculated for the remaining taxable income according to the applicable tax rate.

- The severance pay is divided by 5 and one-fifth is added to the remaining taxable income.

- Income tax is calculated again for the sum according to the tax rate.

- The difference between the two tax amounts is calculated and multiplied by 5.

- The result is the income tax on the extraordinary income.

Example

A married employee receives severance pay of 50.000 Euro in the year 2024. The taxable income amounts to 70.000 Euro. The taxable income is increased by one-fifth of the severance pay (i.e. 10.000 Euro):

- Income tax (splitting rate) on 70.000: 11.850 Euro

- Income tax (splitting rate) on 80.000: 14.990 Euro

- Difference 3.140 Euro

- Income tax on the severance pay: (3.140 Euro x 5 =) 15.700 Euro

- Total income tax: (11.850 Euro + 15.700 Euro=) 27.550 Euro

Does the one-fifth rule also apply in the case of resignation?

The Münster Finance Court ruled in 2017 that severance pay is also eligible for tax relief under the one-fifth rule in accordance with Section 34 (2) EStG if the employee initiated the termination agreement. In the case under review, the employee was under the significant actual pressure required by the BFH case law when concluding the termination agreement, as he acted in a conflict situation to avoid disputes about the continuation of the employment relationship and the promotion he sought (FG Münster of 17.3.2017, 1 K 3037/14 E).

Currently, the BFH has shared this view and dismissed the tax authorities' appeal. It follows that if an employer pays an employee severance pay as part of the (amicable) termination of employment, actual findings on whether the employee was under actual pressure are generally unnecessary (BFH ruling of 13.03.2018, IX R 16/17, BStBl 2018 II p. 709).

(2024): Severance Pay: The Most Important Information on the One-Fifth Rule

When is severance pay taxed according to the one-fifth rule?

In the event of early termination of employment, the employees concerned are generally given a severance payment. Unfortunately, such payments have not benefited from a tax allowance since 2006, but they are still eligible for the one-fifth rule (in accordance with § 34 EStG).

To benefit from the reduced taxation under the one-fifth rule, the severance payment must be paid in a lump sum in one year, and the annual income with the severance payment must be higher than the income if the employment had continued uninterrupted. The tax concession is intended to mitigate the progressive effect of the income tax rate.

Currently, the Federal Fiscal Court has ruled that if the gross salary in the previous year was around 140,000 Euro, a severance payment of "only" 43,000 Euro cannot be taxed at a reduced rate. Therefore, the one-fifth rule does not apply. This is because when comparing the income from the previous year with the income in the year of the severance payment, there is no higher income, no progressive effect, and therefore no tax disadvantage that needs to be offset (BFH ruling of 8.4.2014, IX R 33/13).

As part of the comparative calculation, two figures must be compared: the "actual figure", i.e. what you received in the relevant year including the severance payment, and the "target figure", namely the income you would have received if the employment had continued uninterrupted. You can use the previous year's income as a basis. If the severance payment does not exceed the income lost by the end of the year, you can include other income that you would not otherwise have received, such as unemployment benefit.

(2024): When is severance pay taxed according to the one-fifth rule?

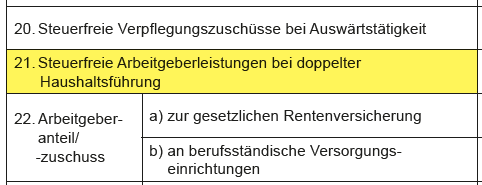

What are remunerations for multi-year work?

A payment or advance payment for multi-year employment (e.g. severance payments) can be taxed at a reduced rate in the year of payment using the five-year method. The key factor is that the employment spans two calendar years.

The so-called five-year rule benefits extraordinary income under German tax law (§ 34 EStG). These so-called "income subject to preferential tax rates" are income earned over several years but realised and taxed in a single year.

(2024): What are remunerations for multi-year work?