What costs can I deduct?

When purchasing new work-related items, you can deduct not only the pure purchase costs but also the following expenses:

- VAT,

- postage and packaging costs, and

- travel expenses (trips to purchase and to gather information before purchasing).

Immediate depreciation: If the purchase costs do not exceed the limit of 800 Euro (excluding VAT) or 952 Euro (including 19% VAT), you can deduct your expenses in full as business expenses in the year of purchase.

Depreciation for wear and tear (AfA): If the purchase costs exceed 800 Euro (excluding VAT) or 952 Euro (including 19% VAT), you must spread the costs over the expected useful life. You can then only claim the annual depreciation (AfA) as business expenses. Please note that you must specify the depreciation to the exact month in the year of purchase. The delivery date is decisive.

Examples of periods over which a work-related item is depreciated:

- Office furniture: 13 years

- Typewriter: 9 years

- Telephone system: 8 years

- Fax machines: 6 years

- Car: 6 years

- Shredder: 8 years

The depreciation period is set out in the so-called AfA tables of the Federal Ministry of Finance.

If you purchase several items, the 800 Euro limit applies to each item individually if it can be used independently.

Tip

If you cannot provide proof for the purchase of certain work-related items, you can hope for the non-objection limit of 110 Euro. Up to this amount, the tax office generally waives the requirement to provide receipts. In this case, however, you should still specify the work-related items with the purchase prices. However, you have no legal entitlement to this!

Incidentally, you can not only deduct work-related items that you have purchased new from tax. You can also claim the purchase of used items as business expenses. However, you must also provide proof of purchase here, especially if you bought the item from a private individual, a receipt is sufficient as proof. The 800 Euro limit also applies to the purchase of used items.

You can also deduct items that have been given to you as a gift or inherited if you use them for work purposes. From this point on, you can deduct the amount that the donor or testator could have deducted if they had used the item for work purposes. The decisive factor is the residual value of the item at the time of work-related use.

Lohnsteuer kompakt

Current: Since 1 January 2021, there has been a particularly advantageous new regulation for all types of computers and software: The Federal Ministry of Finance has very generously stipulated that the normal useful life is generally one year.

This means: The purchase costs of computers and software can now always be deducted in full as business expenses or operating costs in the year of purchase, regardless of the amount (BMF letter of 26 February 2021, IV C 3-S 2190/21/10002:013).

(2024): What costs can I deduct?

How can I depreciate work equipment?

Wenn Sie für ein Arbeitsmittel mehr als 800 Euro (ohne Mehrwertsteuer) oder 952 Euro (inkl. 19 Prozent MwSt.) ausgeben, müssen Sie die Kosten über die voraussichtliche Nutzungsdauer verteilen, d.h. abschreiben. In jedem Jahr können Sie dann nur die jeweilige Absetzung für Abnutzung (AfA) als Werbungskosten geltend machen. Arbeitnehmer nutzen hierfür die lineare Abschreibung. Die Dauer der Abschreibung wird in den sogenannten AfA-Tabellen des Bundesfinanzministeriums festgelegt.

Abschreibungsdauer verschiedener Arbeitsmittel:

- Mobilfunkendgeräte: 5 Jahre

- Foto-, Film-, Video- und Audiogeräte: 7 Jahre

- Schreibmaschinen: 9 Jahre

- Büromöbel: 13 Jahre

- Tresore: 23 Jahre

- Personenkraftwagen: 6 Jahre

Für das Jahr, in dem Sie das Arbeitsmittel gekauft haben, ist der errechnete AfA-Betrag nur monatsgenau absetzbar. Für jeden Monat ein Zwölftel.

Lohnsteuer kompakt

Aktuell: Seit dem 1.1.2021 gibt es eine besonders vorteilhafte Neuregelung für Computer aller Art und für Software: Das Bundesfinanzministerium legt äusserst grosszügig fest, dass die betriebsgewöhnliche Nutzungsdauer generell ein Jahr beträgt. Das bedeutet: Die Anschaffungskosten von Computern und Software können nun immer - unabhängig von der Höhe - im Jahr der Anschaffung in vollem Umfang als Werbungskosten oder Betriebsausgaben abgesetzt werden (BMF-Schreiben vom 26.2.2021, IV C 3-S 2190/21/10002:013).

(2024): How can I depreciate work equipment?

How can I claim work clothing as work-related items?

You can deduct expenses for work clothing from your taxes. However, you must note that not all clothing worn during work is considered work clothing. If the clothing can also be worn outside of work, it is not considered work clothing for tax purposes. If private use of the clothing is possible (as with everyday clothing), you cannot deduct the expenses as work-related expenses.

Work clothing must be typical workwear that is designed and necessary for professional use due to its nature and characteristics.

The following work clothing is recognised:

- Protective clothing of any kind (e.g. work coats, lab coats, work shoes, work boots, safety shoes),

- Uniforms and service clothing with service badges,

- Official attire (judges, prosecutors, lawyers, clergy)

- Sportswear for sports teachers

- Uniformly coloured suits and costumes for airline employees,

- White work clothing for doctors,

You can deduct the actual proven purchase costs for tax purposes. If the conditions for the deductibility of work clothing are met, you can also claim the cleaning costs.

Black suits and other service clothing

In previous rulings, the Federal Fiscal Court has recognised the following civilian clothing as work clothing: black suit for an undertaker (BFH ruling of 30.9.1970, I R 33/69), black suit and black trousers for a head waiter (BFH ruling of 9.3.1979, VI R 171/77), black suit for a Catholic clergyman (BFH ruling of 10.11.1989, VI R 159/86).

However, the Federal Fiscal Court has now changed its previous legal opinion and no longer recognises a black suit for a funeral orator as work clothing. The ruling will also affect other professional groups. A black suit that does not differ in any way from what a large part of the population wears as formal clothing on special occasions is not typical work clothing. The clothing can be used at any time for private formal occasions. This applies to all professions, including certain professional groups such as funeral orators, undertakers, Catholic clergy, and head waiters (BFH ruling of 16.3.2022, VIII R 33/18).

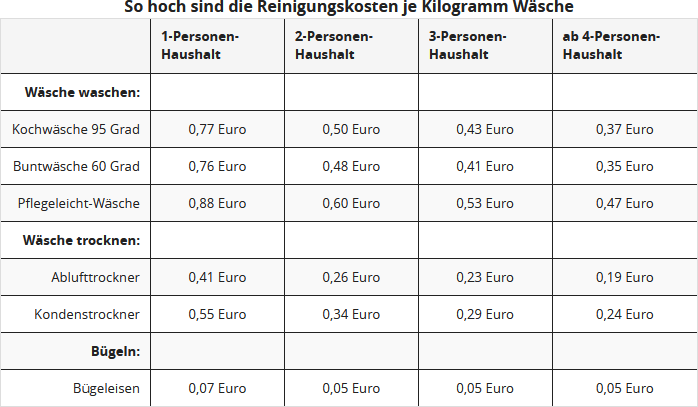

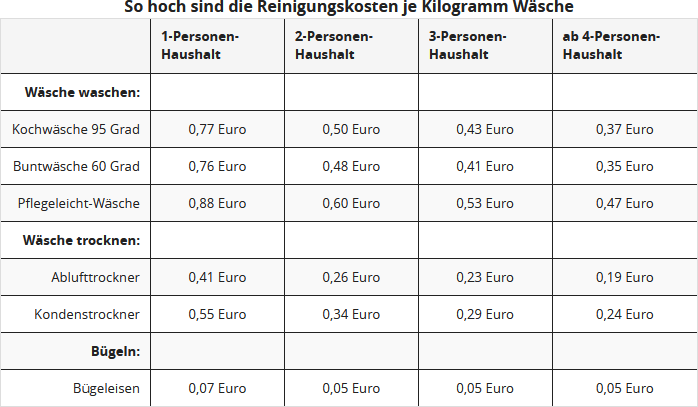

If you wash your work clothing yourself, you can estimate the costs. For the cleaning of work clothing, the tax authorities and the courts recognise the use of consumer association experience values (ruling of the Baden-Württemberg Finance Court, 3 K 202/04). The Consumer Association Working Group e.V., Bonn, has determined the costs for a wash cycle, based on one kg of laundry (as of Dec 2002):

To calculate the proportional annual costs for the care of "typical work clothing" from the table, multiply the above amounts (Euro/kg) in the respective treatment type by the annual amount (kg) of typical work clothing to be cleaned. Example: As a single person, with 40 wash cycles per year, each with 3 kg of boil wash at 0.77 Euro and 2 kg of easy-care wash at 0.88 Euro, you come to a total of 163 Euro deductible cleaning costs (92.40 Euro plus 70.40 Euro).

Important: The average calculation includes the purchase price of the washing machine, a maintenance allowance, and operating costs such as electricity, water, and detergent. According to the BFH, an annual flat rate for cleaning costs is not permitted.

(2024): How can I claim work clothing as work-related items?

How can I claim a computer as a tax deduction?

If you use your home computer for both private and professional purposes, you can claim a portion of the costs as business expenses for tax purposes. The ten per cent rule does not apply to computers, which states that an item is only recognised as a work-related item if it is used at least 90 per cent for work purposes. The amount you can deduct for the computer depends on the actual usage time for professional and private purposes.

Beispiel

You use your computer for six hours a week for work and four hours for private purposes. Then 60 per cent of the expenses for your computer and peripherals are deductible.

If you can credibly demonstrate that the PC is used almost exclusively for work (at least 90 per cent), you can even claim the full costs. If proof is difficult or impossible, the proportion of professional use is estimated at 50 per cent, meaning you can deduct half of the costs. A computer is used privately if you handle your private correspondence, do online banking, or play games on it. Examples of professional use of a computer include completing work tasks at home (including research tasks), acquiring necessary basic IT knowledge, training, or creating job applications.

For the initial purchase, you must combine all computer components required for the operation of the PC and depreciate them together over the usage period if the purchase costs exceed the limit of 800 Euro (excluding VAT) or 952 Euro (including 19 per cent VAT). Computer, monitor, keyboard, and mouse constitute a single, independently usable asset "computer". The depreciation period for computers, notebooks, and peripherals is three years. An exception is made for devices that can also be used independently, such as all-in-one devices that are simultaneously printers, faxes, copiers, and scanners. If the purchase price is below the 800 Euro limit, you can deduct the entire cost immediately.

Work-related application programs and system software with purchase costs of up to 800 Euro (excluding VAT) can be fully deducted as business expenses immediately. If a program is more expensive, you must spread the purchase costs over the years of expected use, i.e., "depreciate" them. The usage and depreciation period is three years. Pay particular attention when purchasing work-related software that it can also be deducted as business expenses even if the computer is not recognised. If you purchase additional computer components at a later date, you must add the costs to the remaining value of the PC and spread the sum over the remaining useful life. If your computer has already been depreciated, you should fully deduct the costs if the purchase price does not exceed 800 Euro net. Otherwise, you can also depreciate the devices or software separately. If you replace existing components with new ones, you can deduct the purchase costs as maintenance expenses in full and regardless of the purchase price in the year of purchase.

Tipp

In addition to computers, software, and peripherals, expenses for computer accessories such as printer paper, toner cartridges, printer cartridges, CD/DVD blanks, USB sticks, cables, or batteries are also deductible.

The depreciation period is specified in the so-called AfA tables of the Federal Ministry of Finance.

Lohnsteuer kompakt

Current: Since 1 January 2021, there has been a particularly advantageous new regulation for all types of computers and software: The Federal Ministry of Finance has very generously stipulated that the normal service life is generally one year. This means that the purchase costs of computers and software can now always be fully deducted as business expenses or operating costs in the year of purchase, regardless of the amount (BMF letter dated 26 February 2021, IV C 3-S 2190/21/10002:013).

(2024): How can I claim a computer as a tax deduction?

When can I claim professional literature?

If you use specialist literature for your professional activities, you can deduct the expenses for books, journals, and newspapers. Specialist books with a clear title indicating professional use are readily accepted.

For general educational books, proving professional use is more difficult. However, you should know that a rejection by the tax office with the reason that it is not a specialist book is not sufficient. The actual use of the book is paramount. You must prove to the tax officer that you use the book professionally. You can also deduct magazines as specialist literature (professional magazine, professional journals) if they are professional journals that provide job-related information.

The deductibility of magazines is complicated by the fact that many magazines cover a wide range of topics and do not exclusively provide job-related information. In such cases, the magazines are not recognised. A similar issue arises with the deductibility of newspapers.

You cannot deduct typical daily newspapers due to their broad range of topics. However, non-typical daily newspapers, such as the Handelsblatt, can be deducted if you can prove predominantly professional use. Of course, you must also provide evidence of the expenses for specialist literature. If you have not collected the relevant receipts, you can enter the amount of 110 Euro without proof.

However, this is not an allowance to which you have a legal entitlement, but merely a non-objection limit. Up to this amount, tax officers are supposed to waive receipts. The non-objection limit applies to work-related items in general. So if you have already used the 110 Euro for work clothing, proof of expenses for specialist literature is still required.

(2024): When can I claim professional literature?

What work-related items can I deduct?

As work-related items, you can deduct objects from tax that you use almost exclusively for professional purposes or, if you are self-employed, for business purposes. You can claim the costs as income-related expenses or business expenses. Not all work-related items are always recognised by the tax office. The more specialised a work-related item is, the higher the chance that it will be recognised.

Whether you can deduct it from tax depends on your profession and the work-related item. The condition that you use a work-related item almost exclusively for professional purposes is met if it is used for at least 90 per cent for professional purposes. In this case, you may deduct the work-related item in full as income-related expenses.

Until 2009, the all-or-nothing principle generally applied: either the costs were fully recognised or not at all. It was not permissible to apportion the costs according to their use for professional purposes - e.g. 70%. However, the Federal Fiscal Court overturned the prohibition on apportionment and deduction under § 12 No. 1 EStG in September 2009. The Grand Senate of the Federal Fiscal Court came to the conclusion, after a more detailed examination, that it had been mistaken for around 30 years and that the prohibition on apportionment and deduction could not be derived from the law (§ 12 No. 1 EStG) at all.

This means that today, in many cases, apportionment of costs is possible, which was previously refused with exactly this - incorrect - argument. The costs can be apportioned according to objective criteria if the professional usage shares are fixed and not of minor importance (BFH ruling of 21.9.2009, GrS 1/06, BStBl. 2010 II p. 672).

The following items (examples) can be deducted as income-related expenses depending on the occupational group:

- Typical work clothing

- Computer and software

- Specialist literature (trade magazine, trade magazines, professional journal, professional journals)

- Desk and office chair

- Filing cabinet

- Briefcase

- Photocopier

- Calculator

- Tools

- Telephone, fax, mobile phone costs

- Office supplies (stationery, pens, paper, files, etc.)

If you pay no more than 800 Euro (net) or 952 Euro (incl. 19 per cent VAT) for a work-related item, you can deduct the entire cost in the year of payment as income-related expenses. However, the work-related item must be independently usable. This is not the case, for example, with a monitor, printer or scanner. These can only be used together with a computer. If you spend more on a work-related item, you must spread the costs over the expected useful life.

Lohnsteuer kompakt

Current: Since 1.1.2021, there has been a particularly advantageous new regulation for all types of computers and software: The Federal Ministry of Finance has very generously stipulated that the normal business use is generally one year. This means that the purchase costs of computers and software can now always be deducted in full as income-related expenses or business expenses in the year of purchase, regardless of the amount (BMF letter of 26.2.2021, IV C 3-S 2190/21/10002:013).

(2024): What work-related items can I deduct?

Can I claim wear and tear on "normal" clothing for tax purposes?

Expenses for "normal" clothing are not deductible as income-related expenses if this clothing is subject to normal dirt and wear during work.

However, if the dirt, damage, or premature wear is due to a specific professional or business incident, the costs for cleaning, repair, or replacement are deductible as income-related expenses (BFH ruling of 24.7.1981, BStBl. 1981 II p. 781; FG Thuringia of 4.11.1999, EFG 2000 p. 211).

When replacing an item of clothing, the residual value of the damaged item is deductible.

(2024): Can I claim wear and tear on "normal" clothing for tax purposes?

What is the non-investigation limit?

Many tax officials may deny their existence. And taxpayers cannot rely on benefiting from them, as there is no legal entitlement to the non-detection limit.

Non-detection limits are amounts – usually small – in the tax return that tax officials generally do not scrutinise closely and accept without evidence.

Here are some examples:

- Working days for travel allowance: For a 5-day week, you can state 230 working days per year, and for a 6-day week, 280 days.

- Work-related items: You can usually claim costs up to 110 Euro for the purchase and maintenance of work-related items (purchase and cleaning of work clothing) in your tax return without receipts.

Home office vs. commuting: Overview of tax requirements

Journeys to the primary workplace can be deducted in your tax return (Form N) via the commuter allowance. You must specify the exact number of days you actually travelled to work, as the allowance only applies to these days. Holiday and sick days must also be stated. Since 2020, business travel days and home working days have been recorded in Form N.

Calculating the exact number of working days can be tedious. To make things easier for you, tax offices have previously set so-called non-detection limits. For a five-day week, this was 220 to 230 journeys, and for a six-day week, 260 to 280 journeys between home and workplace. However, these limits are internal and not legally binding. A court ruling stated that tax offices should accept 230 days (FG Munich of 12.12.2008, 13 K 4371/07).

But the pandemic has changed everything. Many employees worked and still work from home and do not commute daily. For these days, you can claim a flat rate of 5 Euro per day as work-related expenses or even the costs for a home office. However, you cannot claim travel expenses as no journeys take place.

Tax offices increasingly require an employer's certificate of the actual working days and especially the days on which the primary workplace was visited. The rule of 220 or 230 journeys per year no longer applies automatically!

(2024): What is the non-investigation limit?

Sichern Sie sich einfach die volle Steuererstattung, die Ihnen zusteht!

Nur Lohnsteuer kompakt bietet Ihnen:

- Persönliche Steuertipps im Wert von 312 Euro (Durchschnitt)

- Verständliche Eingabehilfen und Erklärungen

- Import aus jeder beliebigen anderen Steuersoftware

- Schnelle Antworten bei Fragen

Jetzt kostenlos testen