What happens to my data at the tax office?

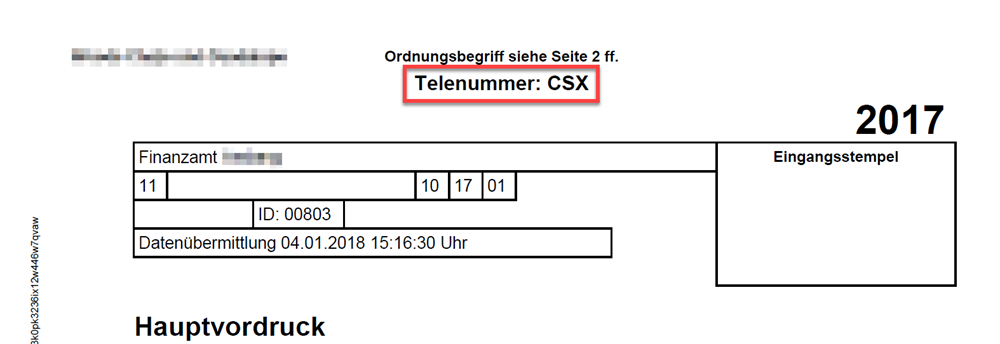

After receiving the electronic tax data, the tax office assigns a so-called Telenumber.

Once the tax return has been received by the tax office, the clerk can use the Telenumber and your tax number to retrieve the electronic data from the tax office's server and begin processing the tax return.

After processing by the tax officer, the data record is sent back to the data centre. An electronic version of your tax assessment is then made available for collection. More or less simultaneously, the tax assessment is automatically printed and sent to you by post.

What happens to my data at the tax office?

How do I submit my tax return with electronic data transfer?

You can submit your tax return directly to the tax office via Lohnsteuer kompakt. No additional software is required. Once you have completed your tax return, it will be validated, i.e. checked for errors.

If your tax return is correct, you can view the draft and then - if the information is complete and correct - send the data directly to the tax office.

For paper submission with electronic data transfer, the compressed tax return is provided in PDF format. You must print, sign, and send this "paper tax return" along with your documents to the tax office. The printout contains a generated tele number, which allows the tax officer to retrieve the printout with the electronic tax return.

Save a copy for your records.

How do I submit my tax return with electronic data transfer?

What happens if I don't send my signed tax return to the tax office?

In order for your tax return to be processed, it is necessary to send the printed and signed return to the tax office. This is the only way for the tax officer to retrieve and process the data you have submitted via ELSTER.

Another reason for printing the return is to clearly determine which tax return is valid in the event of multiple or erroneous data submissions.

If you do not send your tax return to the tax office, your data will be automatically deleted after six months at the latest.

Only the signed paper return can prevent misuse. The Telenumber links the electronic tax return with the paper document.

What happens if I don't send my signed tax return to the tax office?

What is the Telenumber (Telenummer)?

If you send your tax return electronically in a compressed form to the tax office, a Telenumber (Telenummer) will be assigned to you.

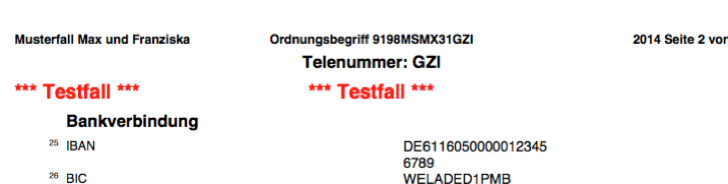

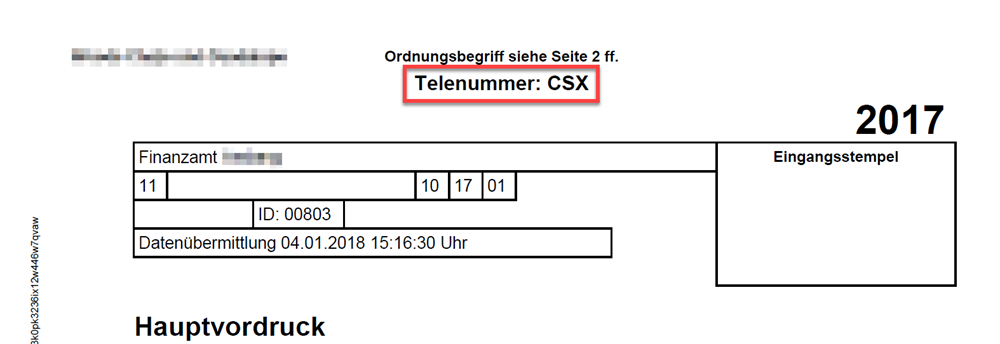

This three-digit combination of numbers and/or letters allows the tax officer to retrieve your tax documents for processing. You can find the Telenumber in the confirmation of receipt and in your compressed tax return at the top centre.

What is the Telenumber (Telenummer)?

What should you do if you notice an error in the data sent?

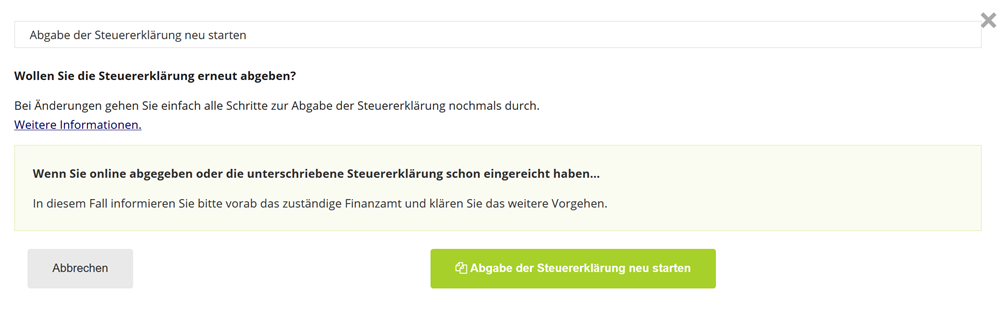

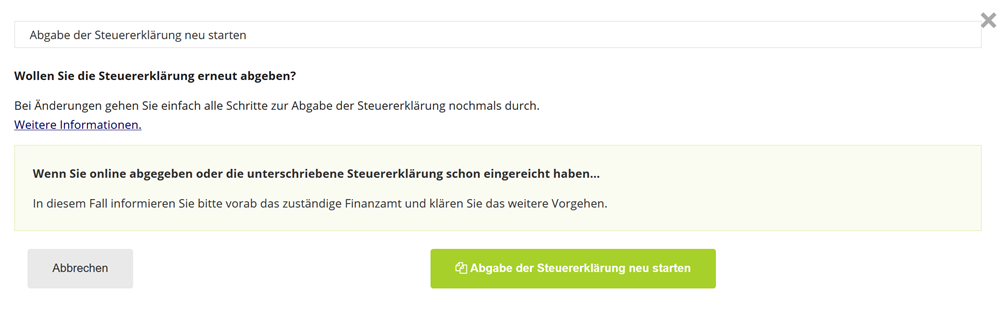

If you have found an error or added additional information to your tax return, this is not a problem. You can amend your tax return at any time and resubmit it to the tax office via ELSTER. The latest version will be used.

Download your compressed tax return again and send it by post to the tax office.

What should you do if you notice an error in the data sent?

What are the benefits of electronic tax returns?

For the income tax return, there is no need to print forms. However, for these tax returns, it is still necessary to print the so-called compressed (simplified) tax return, which must be signed and sent to the tax office. The name comes from the fact that only declaration texts relevant to the specific tax case are printed.

At the time of submission, the data is checked for formal accuracy, resulting in significantly fewer queries from the tax offices. Since the intermediate step of manual data entry is eliminated, the taxpayer can be sure that their correct data is accurately transferred. Due to the data already recorded, the processing time is usually reduced. This means you will receive your tax assessment notice faster.

What are the benefits of electronic tax returns?

What is the compressed tax return?

A particular issue with printing the tax return has been the official forms or their reproduction, including the required "cover sheet functionality".

Since the tax return is processed electronically within the administration as part of ELSTER, the submission of a compressed tax return is permitted. The name derives from the fact that only declaration texts relevant to the specific tax case are printed.

There are also further advantages for printing, such as the elimination of double-sided printing and adhesive binding. The printout also serves as a check for the taxpayer to see which data has been sent to the tax administration.

Personal signature

The compressed tax return must be personally signed and sent by post to the tax office.

The Telenumber to ensure the declaration intent

Another reason for printing the declaration is to clearly determine which tax return should be valid in the event of multiple or erroneous data transmissions. For each transmission, a unique Telenumber is generated, which is printed in the compressed declaration from page 2 and under which only this declaration can be accessed during processing at the tax office. This ensures that erroneous transmissions or incorrect data do not lead to an incorrect tax assessment.

What is the compressed tax return?

What is the purpose of the compressed tax return?

The compressed tax return contains only the data relevant to you, matches the structure of the official tax forms, and is officially accepted by the tax office. Lohnsteuer kompakt automatically organises your information into the correct structure and fills in all necessary forms.

The advantage of the compressed tax return compared to the traditional submission of paper forms is the preferential and faster processing by your tax office, and typing errors are reliably eliminated.

The compressed tax return is first transmitted to the tax office via the Internet and then printed, signed, and sent by you to the relevant tax office. Without this signed version, your data will not be processed by the tax office and will be automatically deleted after about 6 months.

If you notice an error after submitting the data, you can easily resubmit your corrected data to the tax office. It is important that you also submit the corresponding new signed printout to the tax office.

What is the purpose of the compressed tax return?

How can I change data that has already been sent?

If you have already submitted your tax return electronically to the tax office, but still need to change some of the information, this is not a problem. Just send the data to the tax office again.

By means of the individual telenumber (Telenummer), the new data is permanently linked to the compressed tax return that is then also newly created. This means that the tax officer can only process the data you sent that matches the tax return you submitted. The data sent before - no matter how much - is automatically deleted.

Always submit the compressed tax return to your tax office that corresponds to the last data sent via ELSTER. Only then it is guaranteed that the tax officer can retrieve the data for your tax case from the servers of the tax office.

How can I change data that has already been sent?

What should I do if the submission fails?

If an error occurs repeatedly when submitting your tax case, please contact our customer service with the following information ([email protected]):

- Are you receiving an error message? If so, please provide a brief description.

- Date and time when the error occurred

- Browser used (Internet Explorer, Firefox, Chrome, Opera, etc. including version number, if known)

- Operating system used (Windows 8/7/Vista/XP, Linux, Apple, etc.)

We recommend using the latest Mozilla Firefox or Google Chrome for working with Lohnsteuer kompakt.

What should I do if the submission fails?