How can I set up authorisation for electronic data retrieval?

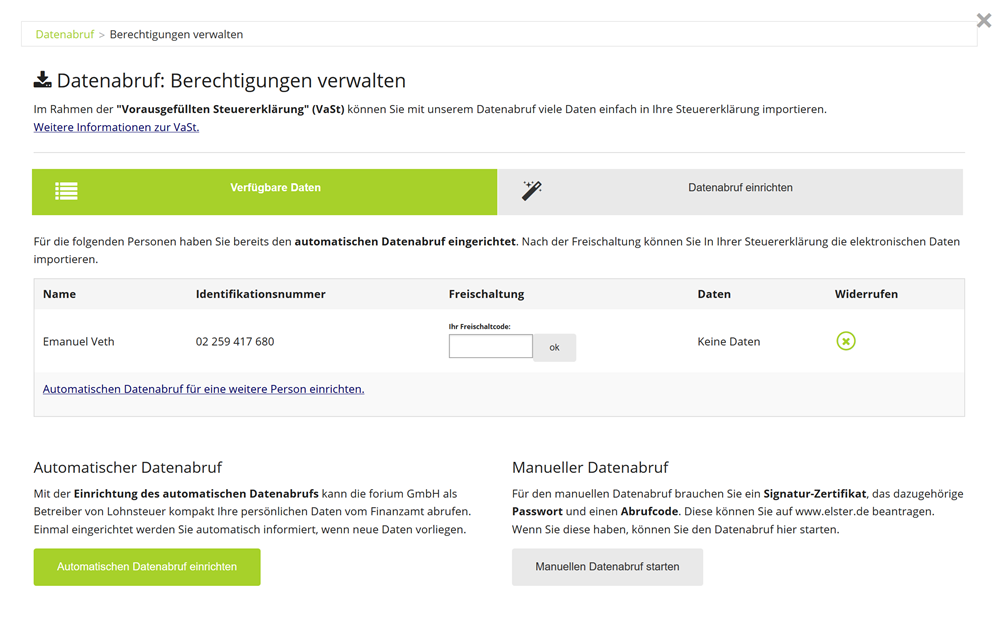

After logging in, open the "Data retrieval" menu item under "My tax return" in the overview. Here you can enter new authorisations for data retrieval and manage existing authorisations. Once set up, all available data can be loaded and conveniently transferred to the tax return.

With the set-up of data retrieval, forium GmbH as the operator of Lohnsteuer kompakt can electronically retrieve your personal data from the tax office and make it available in your customer account.

How can I set up authorisation for electronic data retrieval?

Set up the automatic data retrieval step by step!

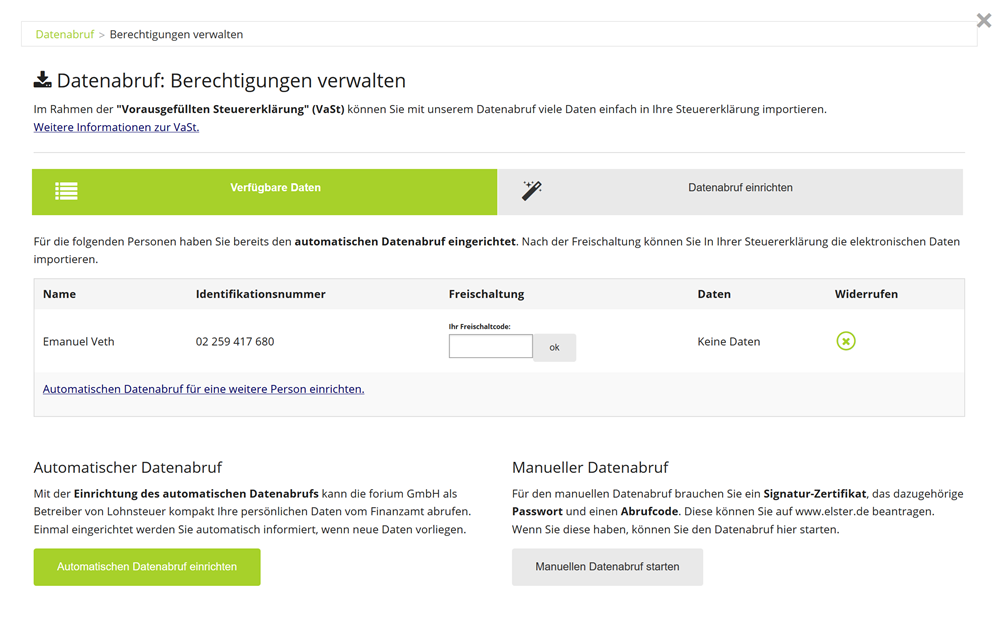

On this page, you will see an overview of all permissions already granted for automatic data retrieval.

If you have not yet granted permission for data retrieval in your customer account with Lohnsteuer kompakt, simply click on "Set up permission for data retrieval".

1. Set up permission for automatic data retrieval

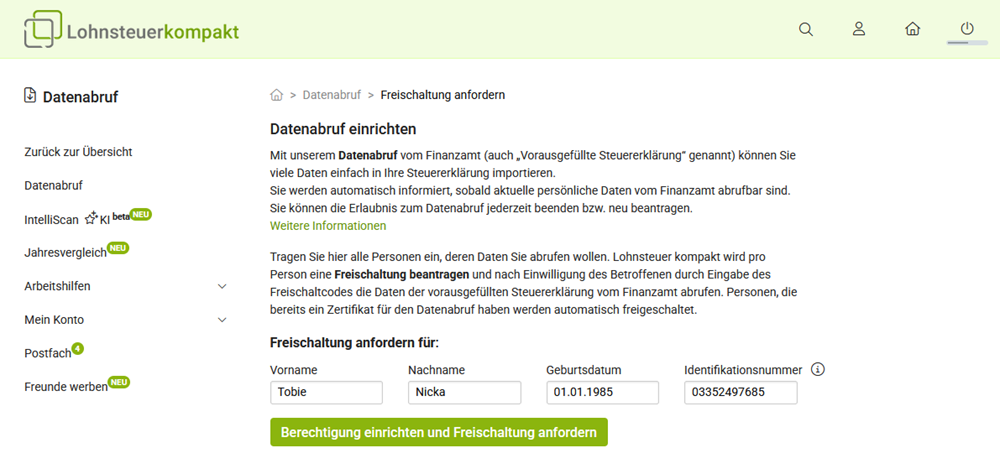

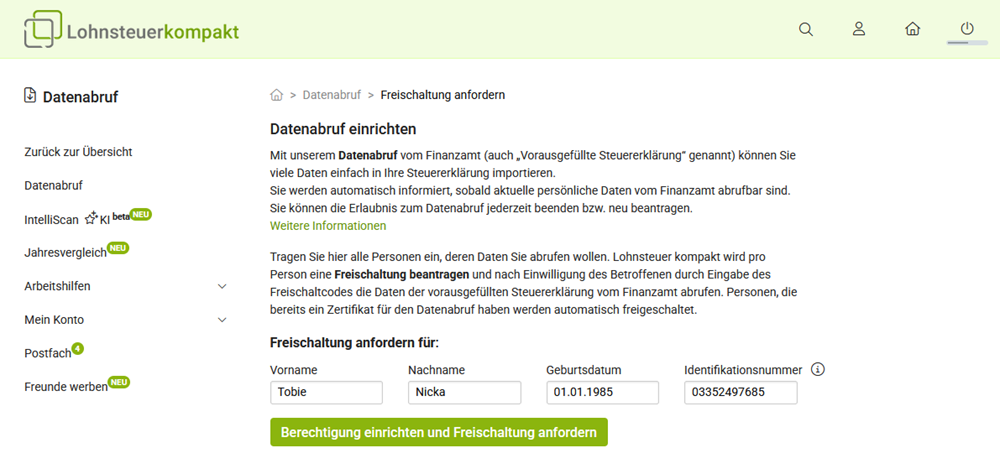

Now enter your first name, last name, date of birth and your identification number to set up permission for electronic data retrieval with Lohnsteuer kompakt and to apply for activation with the tax authorities.

Important: You can only apply for and set up data retrieval for one person at Lohnsteuer kompakt. If you have multiple customer accounts, data retrieval can therefore only be set up and managed in one customer account.

2. Activation for data retrieval

Once the activation has been successfully applied for, a confirmation page will be displayed. What happens next depends on whether you are already registered with ELSTER or not.

A. You are not registered with ELSTER:

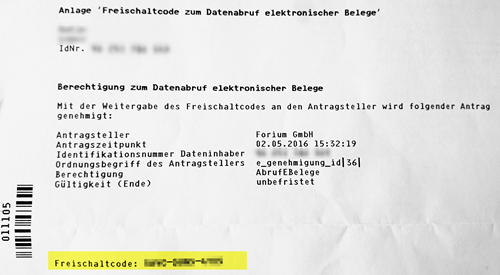

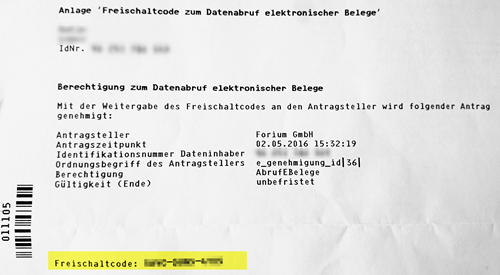

If you are not registered with ELSTER, the activation is very simple and takes place via the letter replacement procedure. You will automatically receive a 12-digit activation code by post ("activation code for electronic document retrieval") from your tax office within a few days.

After receiving the activation code, simply go to the "Data retrieval: Manage permissions" page at Lohnsteuer kompakt. Carefully enter the activation code in the designated field and confirm the entry with "OK".

The tax authorities usually provide your data within the next 48 hours. As soon as the data is available, we will inform you by email. You can then import all data into your tax case via the "My tax return" page. If your tax office provides new data for you, we will automatically notify you in the future.

Important: If the activation code is not entered, the application will expire after a period of 90 days.

The activation code can be entered incorrectly a maximum of 4 times in a row. On the fifth incorrect attempt, the activation code will be deactivated. This means that both the activation code and the corresponding permission application are void. In this case, you must submit a new application.

B. You are already registered with ELSTER:

If you are already registered with ELSTER but have not yet applied for a retrieval code, first log in at My ELSTER. Go to the "Forms & Services" section and then select "Manage certificates". Then select "Consent and retrieval code".

You will receive your retrieval code by post from the tax office in the next few days.

If you already have a retrieval code, you can proceed immediately with the activation for data retrieval by Lohnsteuer kompakt. If you want to authorise forium GmbH as the operator of Lohnsteuer kompakt to retrieve your electronic data, you must proceed as follows:

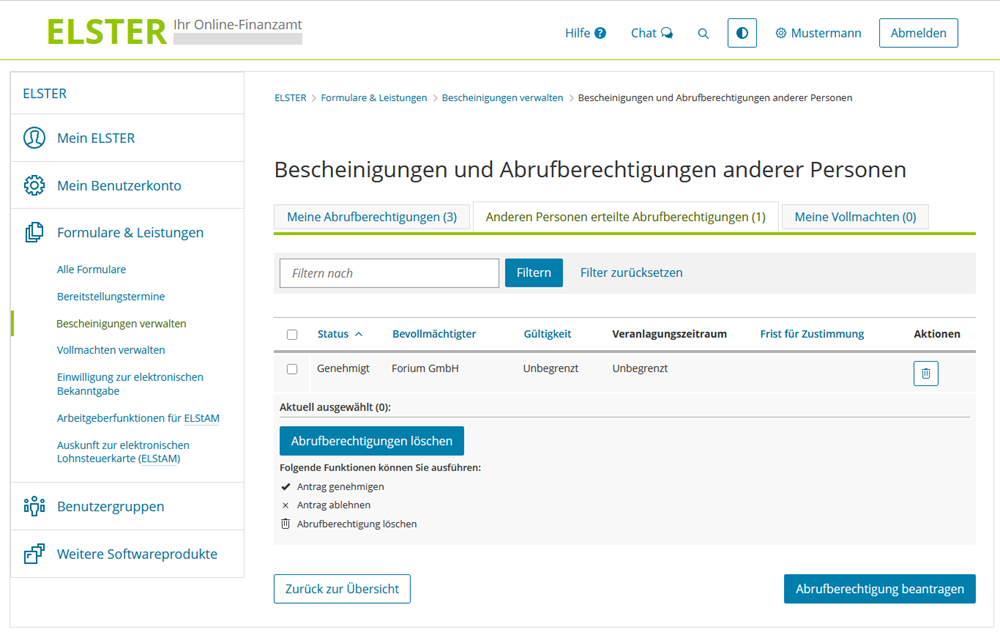

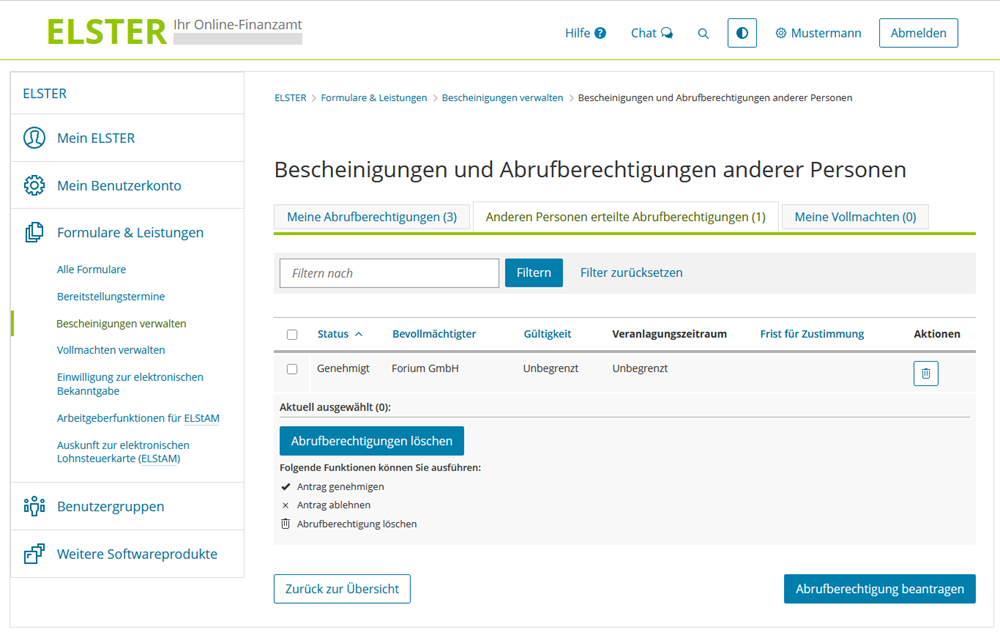

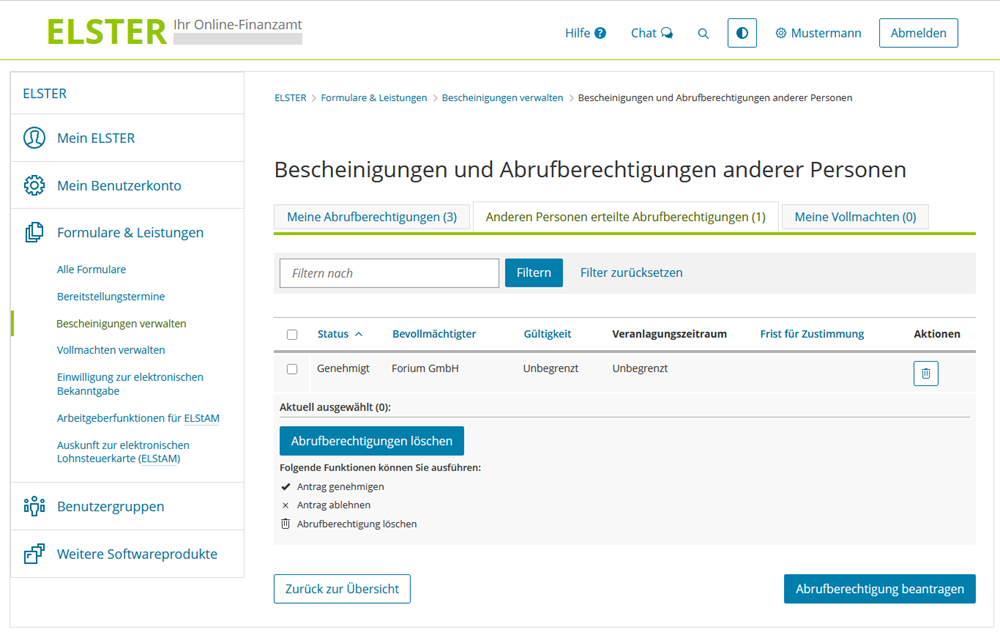

First, access the My Elster portal and log in. Then select the menu item "Forms & Services", then "Manage certificates" and then "Certificates of other persons".

On this page, you will find the application from forium GmbH in the permissions overview under "Retrieval permissions granted to other persons". Click on the tick symbol with the green circle to approve the application.

On the next page, simply enter your PIN and retrieval code and then click on "Approve application".

Lohnsteuer kompakt (or forium GmbH) has now been granted permission to retrieve the electronic data stored about you on your behalf. You will automatically receive an email notification as soon as new data is made available at Lohnsteuer kompakt and you can view it in your customer account.

Set up the automatic data retrieval step by step!

How do you activate data retrieval if you are already registered with ELSTER?

If you are registered with ELSTER, you will not receive an activation code by post. In this case, you must activate the data retrieval directly in your ELSTER user account. You will need a so-called retrieval code.

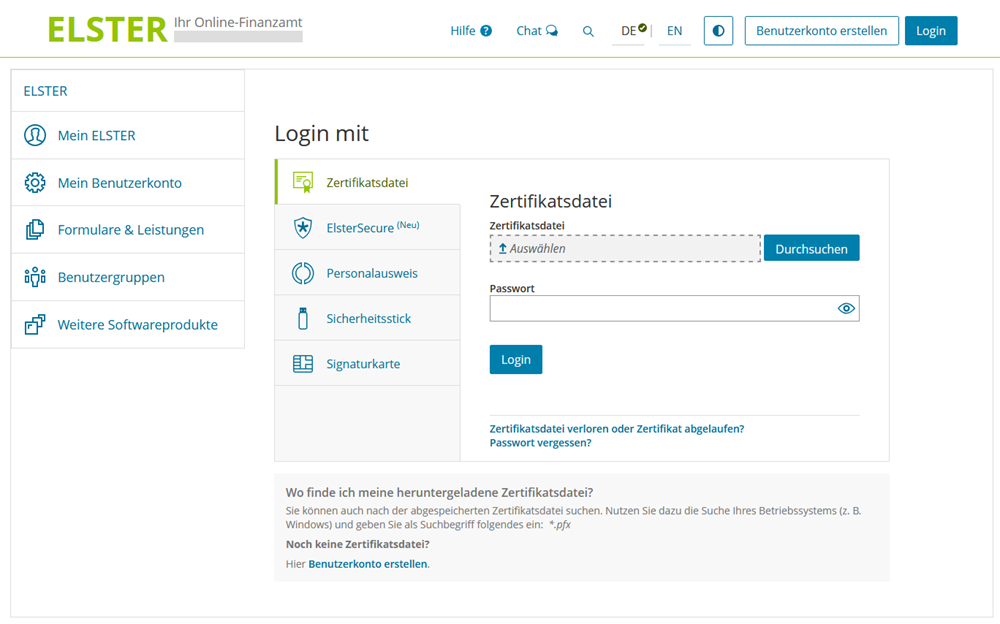

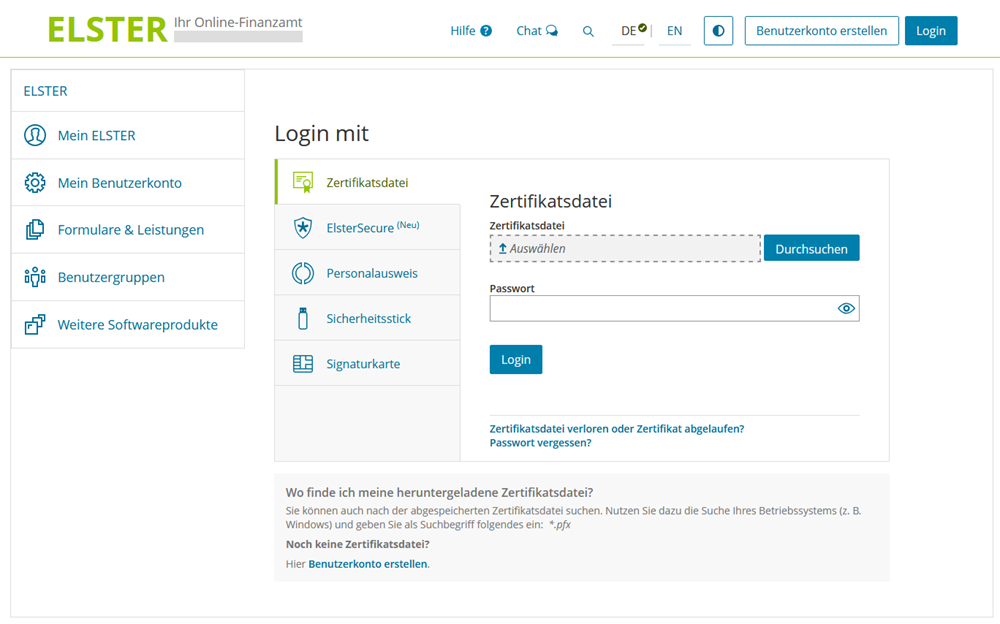

If you do not yet have a retrieval code for ELSTER, first log in to the Mein Elster portal:

Go to the "Forms & Services" section and then select "Manage certificates". Then select "Consent and retrieval code".

You will receive your retrieval code by post from the tax office in the next few days.

Activating data retrieval with retrieval code

If you already have the retrieval code for ELSTER, you can immediately continue with the activation for data retrieval by Lohnsteuer kompakt.

Go to the Mein Elster portal and log in:

- After logging in to Mein ELSTER, select "Forms & Services", then "Manage certificates" and then "Certificates of other persons".

- Under "Retrieval authorisations granted to other persons", you will find the application from forium GmbH. Click on the tick symbol to approve the application.

- On the next page, enter your PIN and the retrieval code and click on "Approve application".

- Lohnsteuer kompakt (forium GmbH) is now authorised to retrieve your electronic data on your behalf.

You will receive an automatic email notification when new data is available for you.

How do you activate data retrieval if you are already registered with ELSTER?

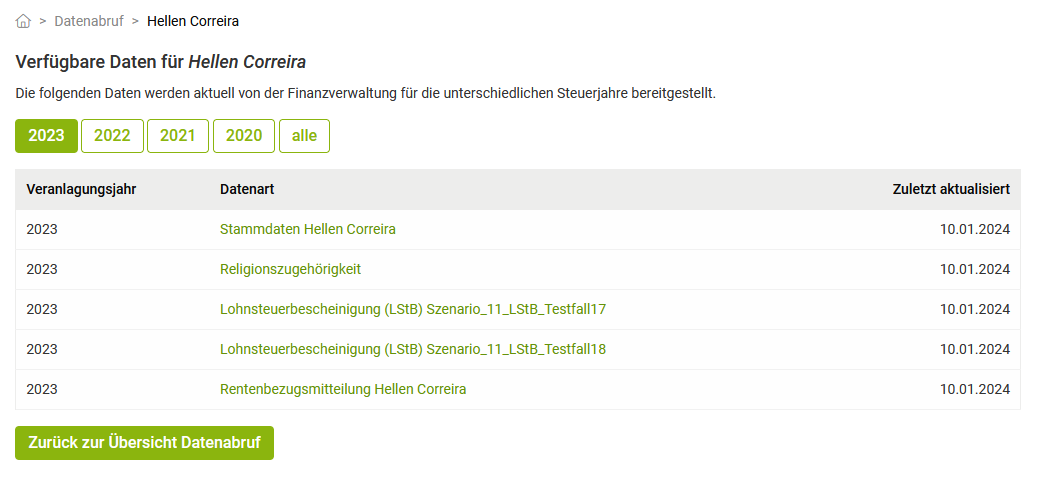

Where can I view my electronically retrieved data?

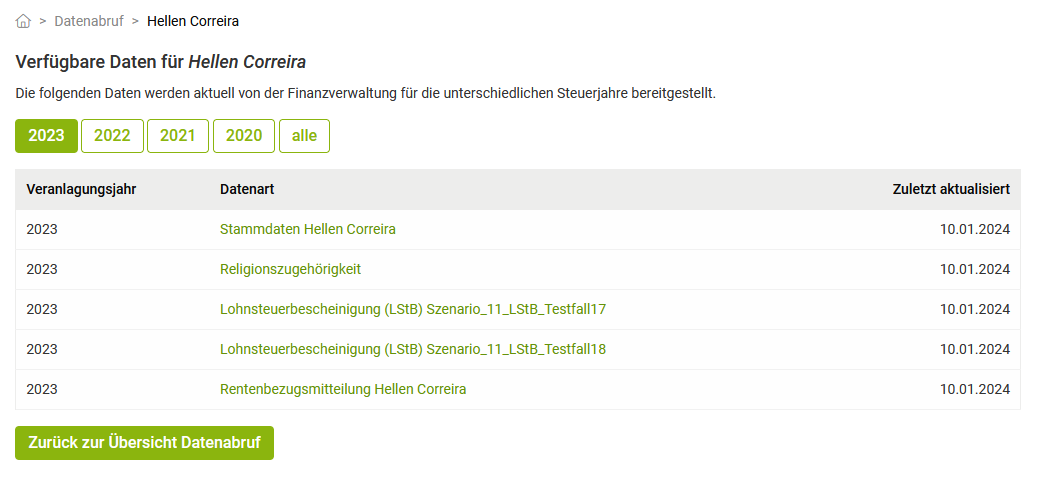

With Lohnsteuer kompakt, you can retrieve data electronically and view it online or download it as a PDF file. After logging in to Lohnsteuer kompakt, go to "Data retrieval".

In the overview, you can see for whom permissions for data retrieval have already been entered. Clicking in the "Data" column opens a list of the provided data.

Where can I view my electronically retrieved data?

How does manual data retrieval work?

For manual data retrieval, you need a signature certificate, the associated password, and a retrieval code. You can apply for these at www.elster.de. If you already have them, you can start the manual data retrieval and immediately access the electronic data to use in your tax return.

This is how manual data retrieval works step-by-step:

- After logging in, open "My tax return > Data retrieval".

- Click on the "Start manual data retrieval" button.

- On the next page, select your certificate, enter the associated password and the retrieval code you have already received from ELSTER.

- Now just click on "Retrieve data" and the relevant electronic data will be requested from the tax authorities.

How does manual data retrieval work?

How does the automatic data retrieval for third parties work?

You can also use Lohnsteuer kompakt to set up electronic data retrieval as part of the pre-filled tax return for other individuals, such as your spouse, partner, or children. However, due to the confidentiality of tax data, the other person must explicitly authorise you to do so.

In your customer account, go to "Settings", select "Data retrieval" and click on "Set up automatic data retrieval for another person".

Enter the first name, last name, date of birth, and tax identification number of the person whose data you wish to retrieve electronically via Lohnsteuer kompakt in the future.

The person (spouse, partner, child) will shortly receive a letter with an activation code by post from the tax office. Once the person has passed the activation code on to you, enter it in your customer account at Lohnsteuer kompakt – you can now also retrieve data for this person.

Note: The authorisation for data retrieval can be revoked at any time in our customer account and data already retrieved can be deleted.

How does the automatic data retrieval for third parties work?