What is data verification?

During the data validation, the information you have entered in the tax return is checked for plausibility, e.g. whether your personal details are complete.

This is particularly important for electronic submission, as only complete and consistent information can be transmitted.

If errors occur during the data validation, they must be corrected first. Then, run the validation again. Once all errors have been eliminated, you can submit your tax return electronically to the tax office.

What is data verification?

What should I do if the verification of my data has failed?

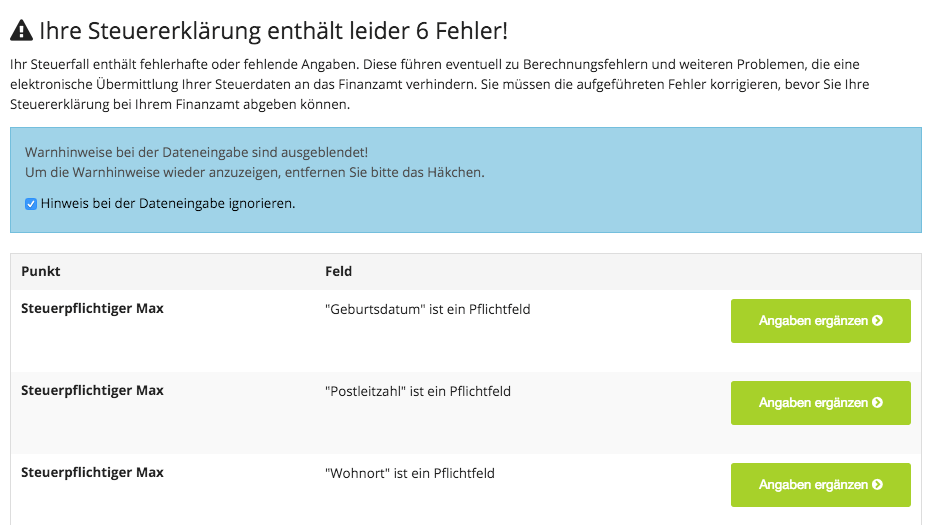

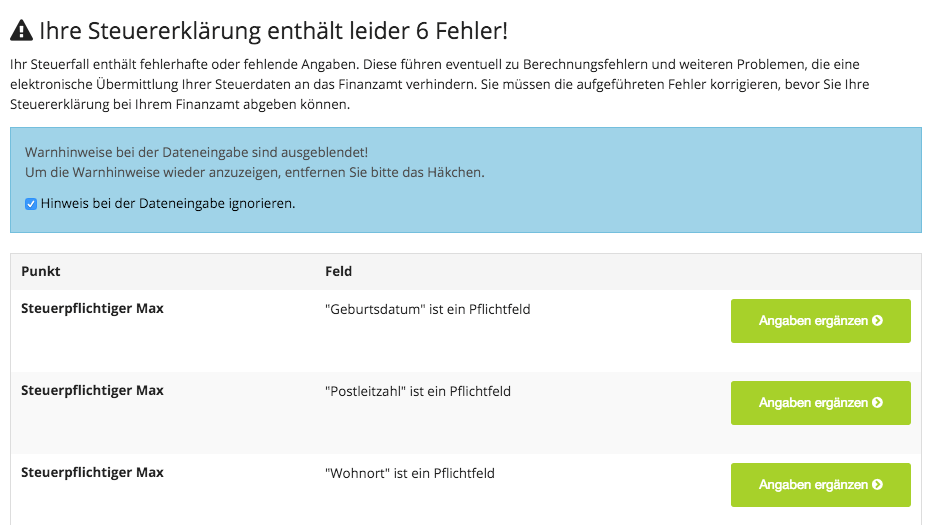

If you receive the message "... Error!", there are one or more errors in your data. In this case, Lohnsteuer kompakt will provide you with information about which data caused issues.

Simply click on the relevant link and enter any missing data or correct the incorrect entries. In some cases, multiple entries you have made will be checked for plausibility. In this case, the input fields may be on different pages. Usually, the error description will indicate where the fields to be checked are located.

Then check the data again. Once all errors have been corrected, you can submit your tax return to the tax office via ELSTER.

What should I do if the verification of my data has failed?

What should I do if a technical error occurs?

If an "Internal Error" occurs, please contact our customer service with the following information ([email protected]):

- Are you seeing an error message? If so, please provide a brief description.

- Date and time when the error occurred

- Browser used (Microsoft Edge, Firefox, Chrome, Opera, etc., including version number if known)

- Operating system used (Windows 11, Windows 10, Linux, Apple, etc.)

We recommend using the latest Mozilla Firefox or Google Chrome for working with Lohnsteuer kompakt.

What should I do if a technical error occurs?