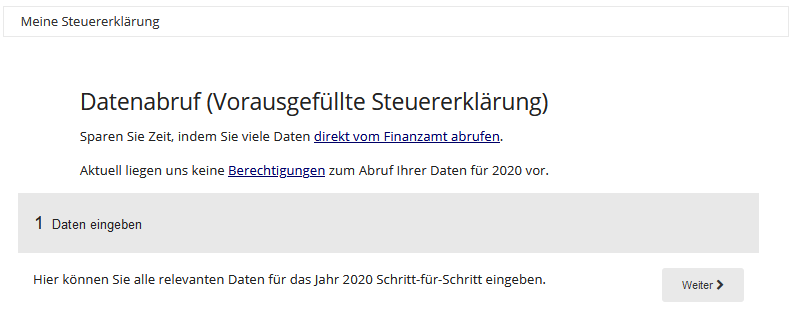

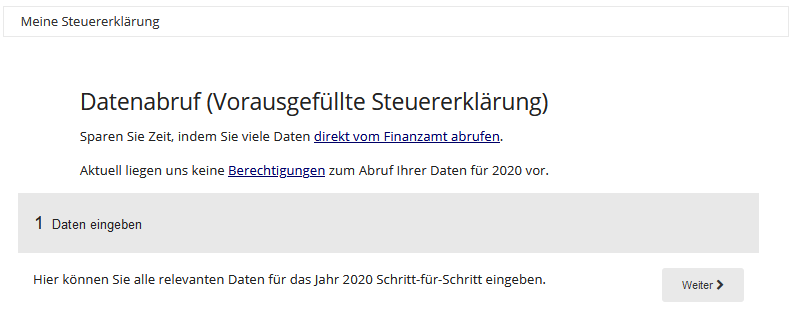

How is the "My Tax Return" page structured?

1 Enter your data

In the section "Enter data" of Lohnsteuer kompakt, the tax interview will be used to collect your data for the tax return. The interview asks the relevant questions by topic and guides you step-by-step through the relevant pages of your tax return.

Do you use electronic data retrieval? Here you can retrieve your electronic data directly from your tax office.

Note: The electronic data retrieval is available from the tax year 2014!

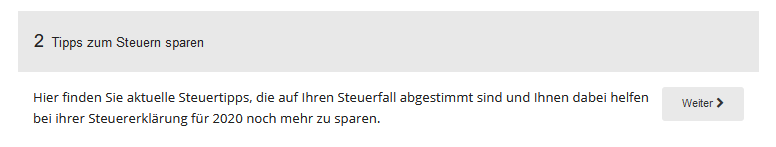

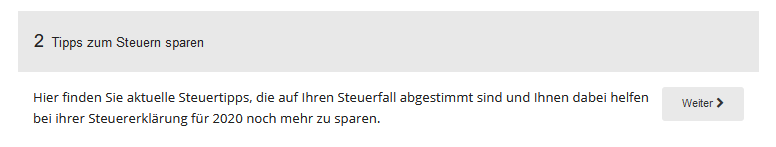

2 Tips for saving taxes

In this section, you will find current tax tips that are tailored to your tax case and will help you to save even more on your tax return.

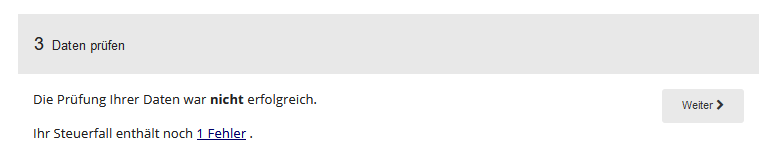

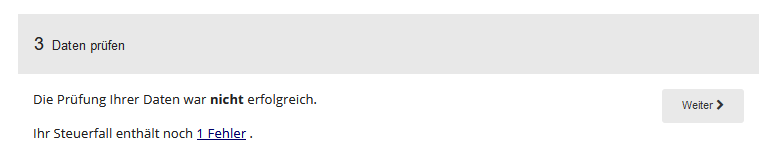

3 Check data

During the data check, the data you entered in the tax return is checked for reliability, for example, whether your personal details are completely entered.

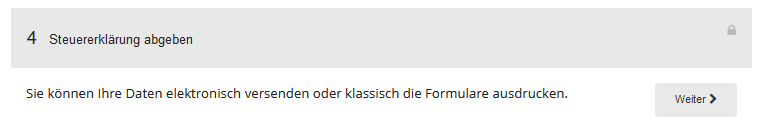

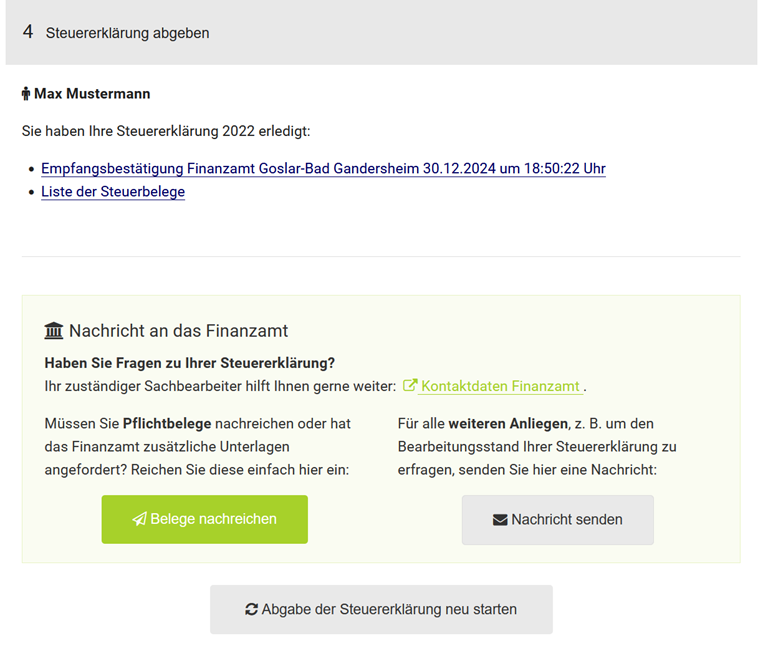

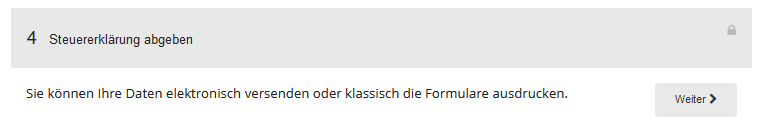

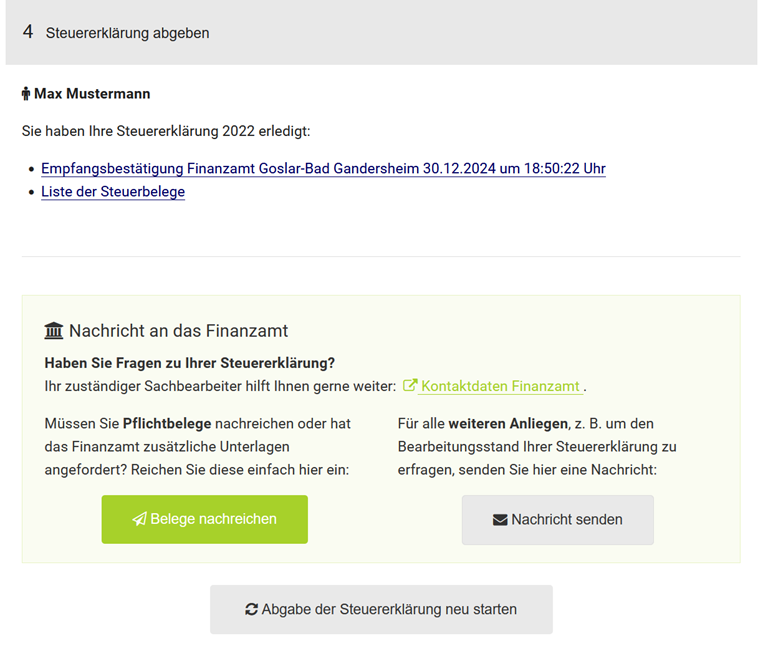

4 Submit your tax return

If you want to submit your tax return, you will find the link to the "Submission" page here.

Note: For the transmission of your tax return to the relevant tax office, you first have to pay and thus activate your tax return.

After you have submitted your tax return electronically, here you will find the confirmation of receipt (Empfangsbestätigung) from the tax office (with telenumber (Telenummer) and transfer ticket (Transferticket)) along with all important documents related to your tax return that you can download.

Send documents to the tax office

In all federal states, you have the option to submit additional documents to the tax authorities electronically. However, you should not submit any receipts without being requested to do so. The tax authorities explicitly state that you should only submit receipts after being requested to do so by the tax office.

For more information, see the section "Send documents to the tax office".

Restarting the tax return submission process

If you find an error after submitting the tax return, here you can reset an already completed submission and start the submission process again.

If you make any changes, simply go through all the steps for submitting your tax return again. The tax office does not start processing until the signed tax return has been received. If you have already completed the submission, you can reset the submission process by clicking on the button "Restart submission of the tax return" and go through the submission process again.

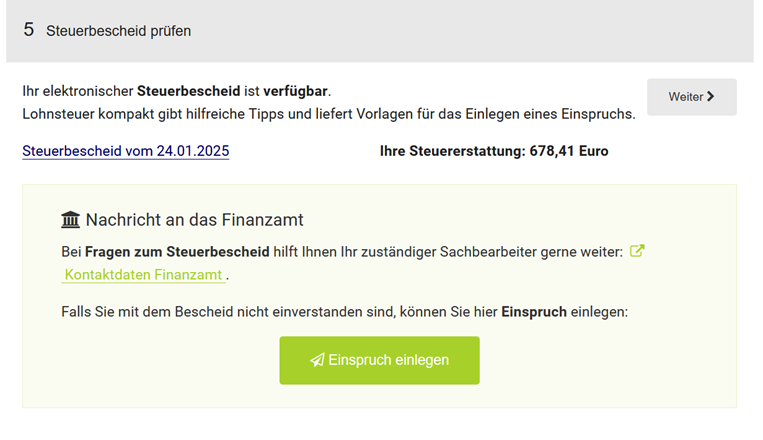

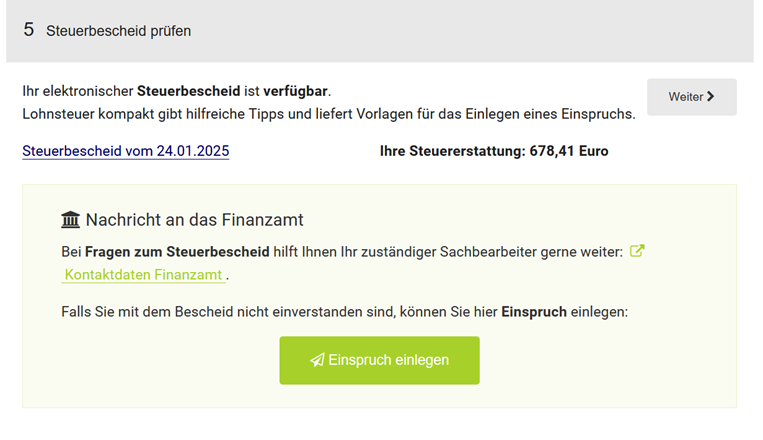

5 Check tax assessment notice

Here you can check your electronic tax assessment notice and file direct objections in case of any deviations.

As soon as the tax authorities provide the electronic tax assessment for collection via ELSTER, you will receive an automatic e-mail notification from Lohnsteuer kompakt. Lohnsteuer kompakt gives helpful tips and provides templates for filing an objection.

Note: The review of the tax assessment notice will be available from 2012 and must be activated for a fee.

Information about your tax office

Here you will find the current postal address and contact details (telephone, fax, e-mail) of your relevant tax office, which you have previously specified in the entry field. The address of the tax office is automatically added to the address field when the generating sample letters are requested.

On the basis of our client's tax returns, we can also give you a statement about the average processing time of a tax return at your tax office!

If you have any questions about the processing status, you have the relevant contact data directly available. Here you also have the possibility to rate your tax office.

Sample letters

In this area, you will find sample letters and applications on various tax issues. The templates contain suitable standard text and placeholders for the required data so that you can easily create an individual document.

Online tax calculators

Unfortunately, it is not easy to keep an overview of the necessary information in the tax world. Every year, various changes are decided upon: Newly introduced regulations, such as changed deductions, can lead to uncertainty and disorientation among those affected. Our free tax calculators give you quick answers to your questions.

The online tax calculator from Lohnsteuer kompakt gives you a quick overview of the expected tax burden, your actual net salary or the state subsidy for your private pension plan.

How is the "My Tax Return" page structured?

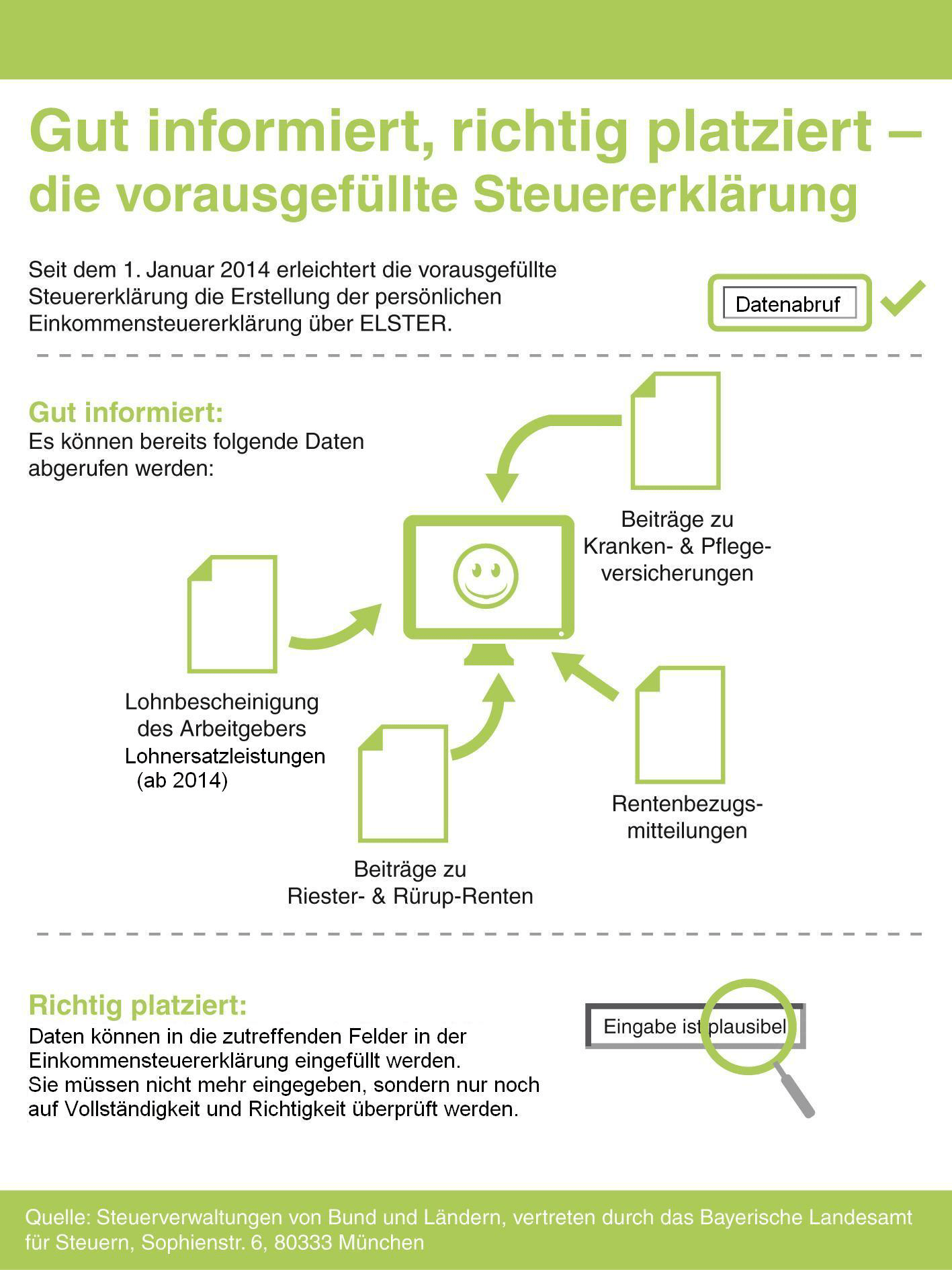

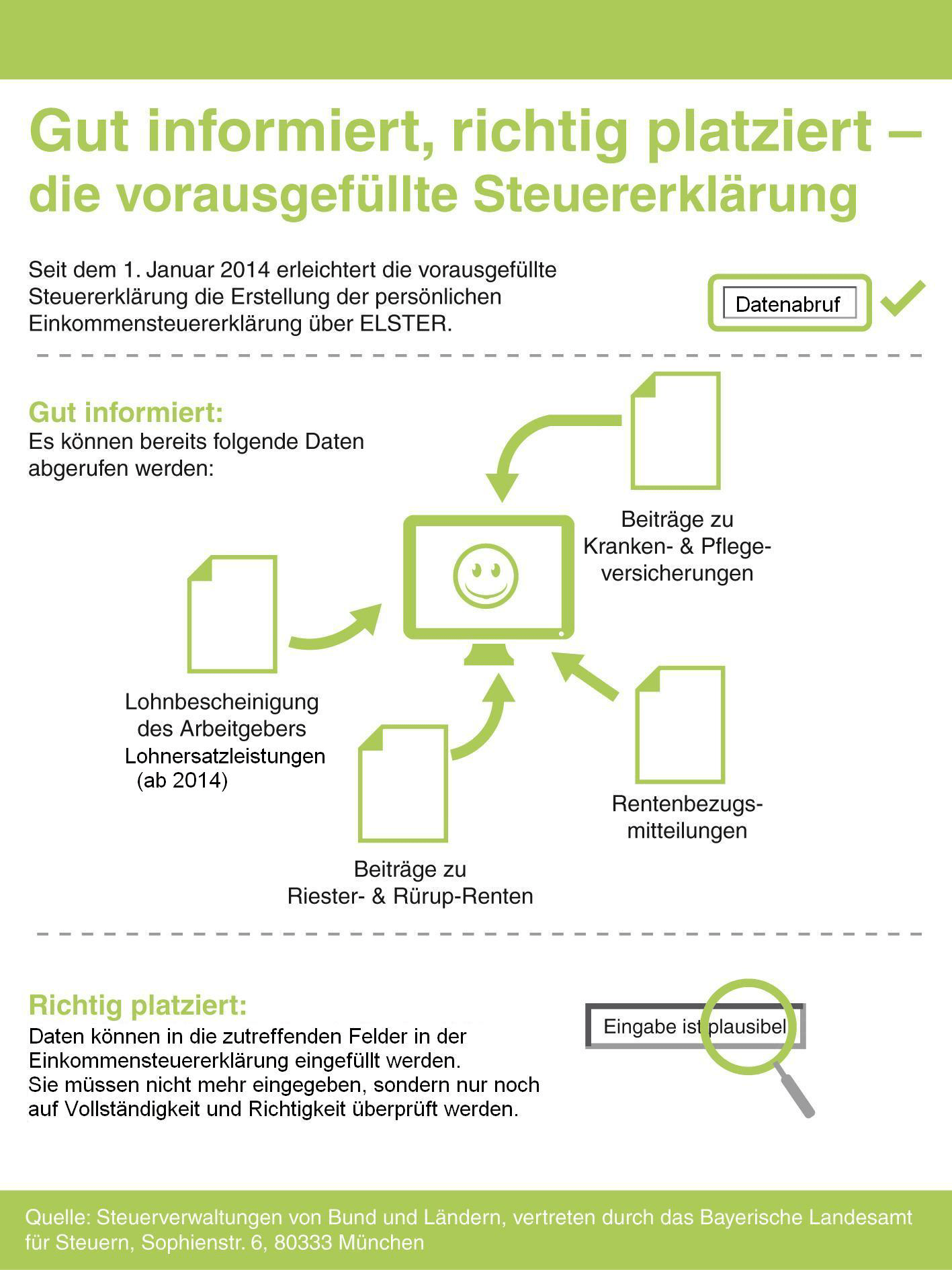

What is the purpose of data retrieval?

Data retrieval is a service offered by Lohnsteuer kompakt. Through data retrieval, you can access personal data stored about you at your tax office and import it directly into your tax return. The tax authorities also refer to the data provided as the "pre-filled tax return" (VaSt). (More information at: What is electronic data retrieval?)

Once you have set up the service, you will immediately know what data the tax office has about you. Note: Data can only be retrieved for the last 4 tax years, i.e. in the year 2026 you can retrieve data for 2025, 2024, 2023 and 2022.

You can then transfer the provided data with just a few clicks into your income tax return with Lohnsteuer kompakt. This means you do not have to enter the data yourself. Your data is transferred directly into the corresponding fields of the income tax return, thus largely avoiding input errors. You only need to check the transferred data for accuracy.

This gives you more time for additions that can really save taxes, such as expenses for craftsmen's services, work-related expenses or special expenses.

What is the purpose of data retrieval?

How do I submit my tax return?

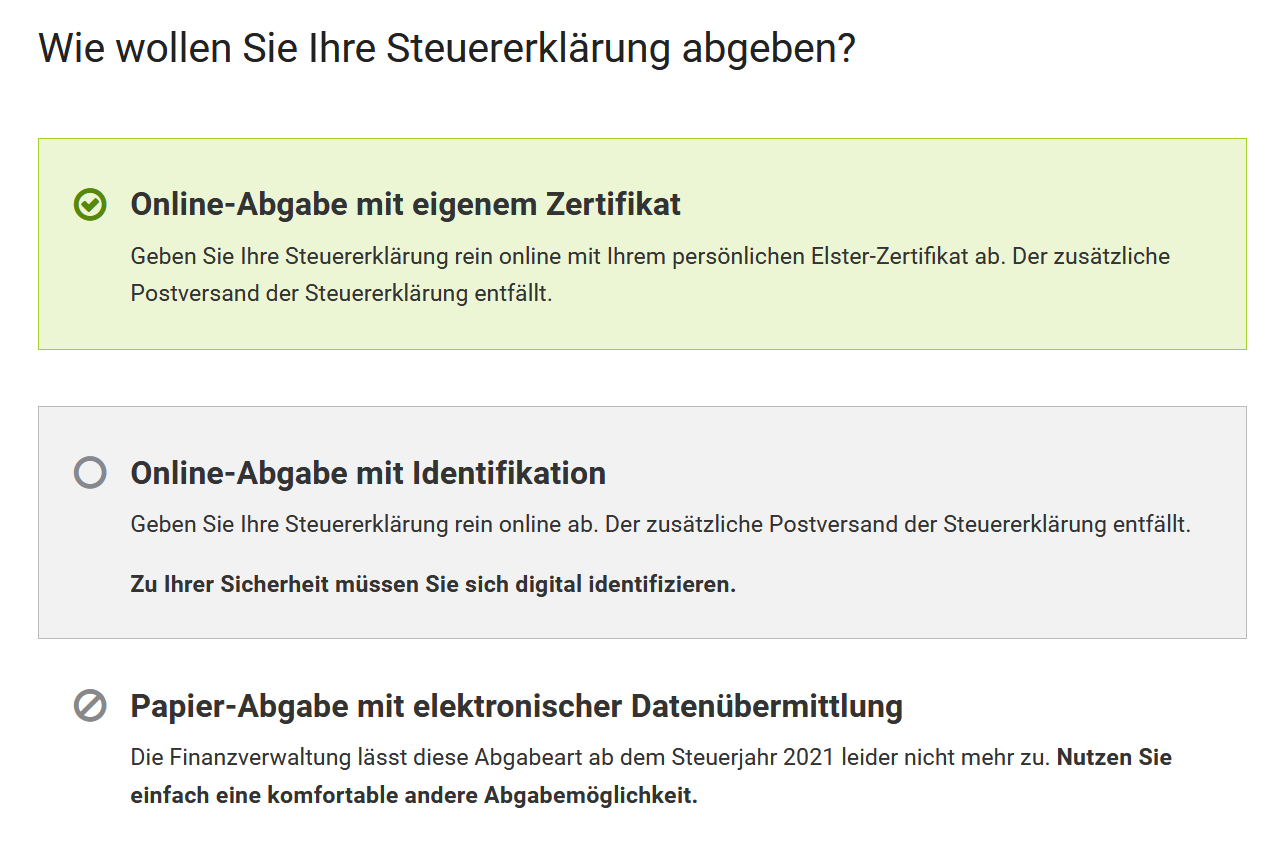

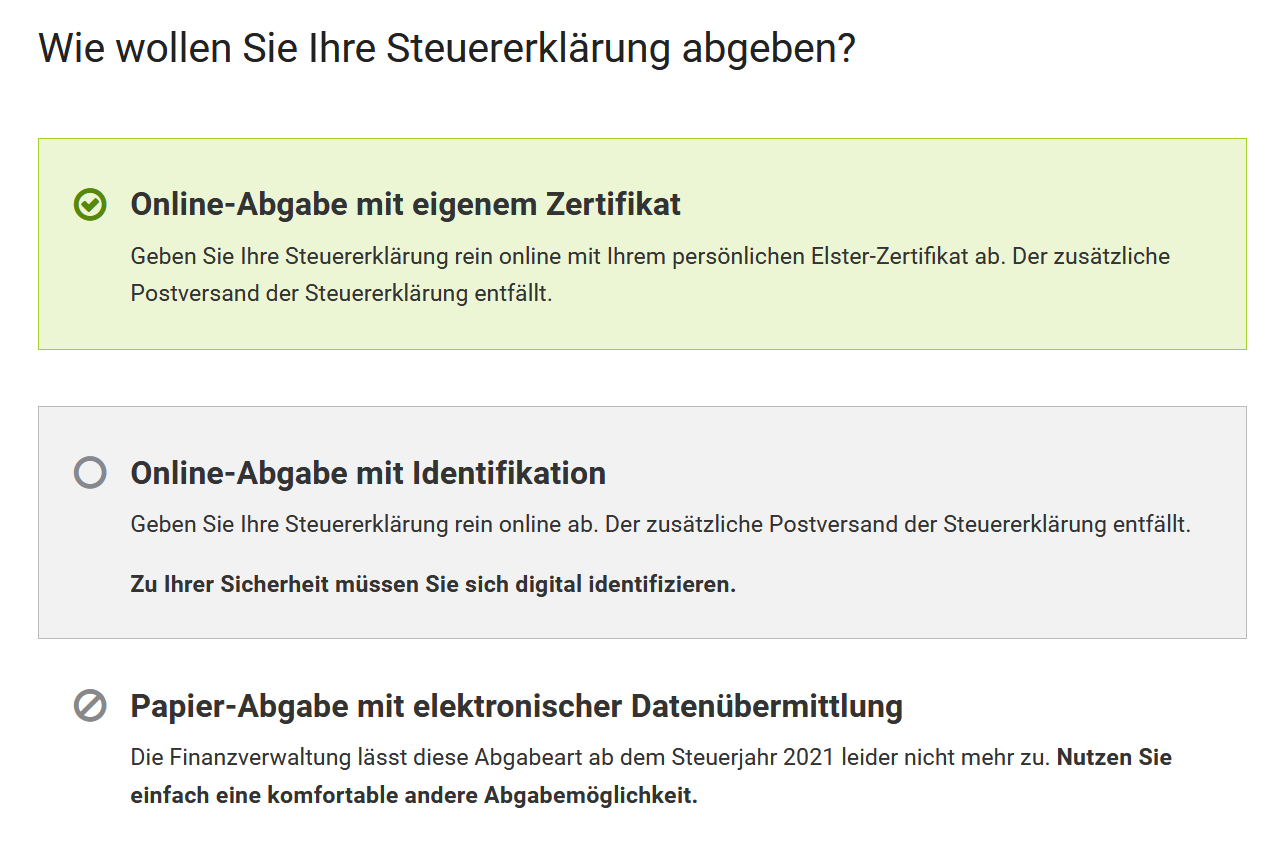

For the current tax year, the following submission methods are available to you:

1. Online submission with Elster certificate

You submit your tax return completely online with your personal Elster certificate.

- No printing, no signature, no postal delivery required

- Requirement: Valid Elster certificate

- Tip: Particularly suitable for users who regularly submit their tax return electronically

2. Online submission with identification

Even without your own certificate, a fully electronic submission is possible – after a one-time digital identification.

- No postal delivery required

- Required: One-time identification (e.g. via ID card or account verification)

- Note: Ideal for users without their own Elster certificate

How do I submit my tax return?

What is the deadline for submitting the tax return?

If you prepare your tax return for the year 2025 yourself – for example, with Lohnsteuer kompakt – the following legal deadline applies:

Submission deadline: 31 July 2026

Your tax return must be received by the tax office by this date.

The deadline is legally regulated in Section 149, Paragraph 2 of the Fiscal Code (AO). If you miss the deadline, a late fee may be imposed according to Section 152 AO.

If you miss the deadline, a late fee may be incurred.

Apply for an extension – but in good time!

- An extension is possible if you are obliged to submit.

- The application must be submitted before 31 July 2026.

- As a rule, an extension is granted until 30 September 2026.

Basis: Section 109 AO (Extension of deadline by the tax office in individual cases)

Voluntary submission: More time for your return

If you are not obliged to submit, you can submit your tax return voluntarily – and even up to four years retroactively.

For the tax year 2025, this means: Voluntary submission possible until 31 December 2029

Legal basis: Section 169, Paragraph 2, Sentence 1, No. 2 AO.

Tip: Contact the tax office if in doubt

Are you unsure whether you are obliged to submit? Then ask your relevant tax office. They will provide you with reliable information.

What is the deadline for submitting the tax return?

Who is required to submit a tax return?

Whether you are required to submit an income tax return for the year 2025 depends on your personal situation. In many cases, there is no obligation – however, there are exceptions. The legal basis is § 46 Income Tax Act (EStG).

When is there an obligation to submit?

A tax return is mandatory if:

- You received wage replacement benefits (e.g. parental allowance, sickness benefit, unemployment benefit) of over 410 Euro per year (progression clause),

- You had multiple simultaneous employments where one was taxed under tax class VI,

- You and your spouse or civil partner chose the tax class combination III/V or IV with factor,

- You had additional income of over 410 Euro (e.g. from self-employment, rental, capital gains without withholding tax or pensions),

- You were requested to submit by the tax office.

Detailed information on the mandatory assessment for employees can be found here: Obligation to submit a tax return.

When is there no obligation to submit?

Submission is generally not required if:

- You were employed by one employer only in 2025,

- You were classified in tax class I,

- You had no wage replacement benefits or additional income,

- none of the special cases mentioned apply.

Tip: Voluntary submission can be worthwhile

Even without an obligation, a so-called application assessment can be worthwhile. Many employees receive an average refund of over 1.000 Euro – for example, due to work-related expenses, special expenses or exceptional burdens that were not taken into account in the wage tax deduction.

When in doubt: Ask the tax office

If you are unsure whether you need to submit, your local tax office can help.

Who is required to submit a tax return?

How does the search of Lohnsteuer kompakt work?

If you need help with a specific topic, simply use the search function of Lohnsteuer kompakt. Enter your search term in the search box and click on “Search”.

Search results and functions:

- You will receive an overview of all texts containing the search term.

- The search considers:

- Your entered data,

- visible and not yet visible input fields,

- help texts and advisory texts.

- Simply select the appropriate text from the list of results.

Tips for better search results:

- Combine multiple search terms to get more accurate results. Only texts containing all terms will be displayed.

- If no results are displayed:

- Check the spelling of your search terms.

- Use fewer or more general keywords.

- Capitalisation does not matter. Whether you enter “Sonderausgaben” or “sonderausgaben” – the results remain the same.

How does the search of Lohnsteuer kompakt work?