How do I submit my tax return to the tax office?

Your data is transferred securely and electronically encrypted directly to the tax office – either:

- With your personal Elster certificate

- Or with the portal certificate from Lohnsteuer kompakt

Alternatively, you can still submit a paper version with electronic data transfer followed by a signature. In this case, send the signed printout of your tax return along with the required documents by post to your tax office.

Your submission options at a glance:

- Online submission with own certificate

Submit your tax return completely online with your personal Elster certificate. No additional postal delivery is required.

- Online submission with identification

Submit your tax return online without your own certificate. No postal delivery is required here either.

Important note:

The tax authorities no longer accept paper submissions from the 2021 tax year. Please use one of the convenient online submission options.

Further information:

- The choice of submission method does not affect the costs at Lohnsteuer kompakt.

- Lohnsteuer kompakt will automatically inform you which legally required documents must also be submitted by post.

How do I submit my tax return to the tax office?

Who is required to submit a tax return?

Whether you are required to submit an income tax return for the year 2025 depends on your individual circumstances. In many cases, there is no obligation, but there are certain situations where you are required by the tax office to submit one. The legal basis can be found in § 46 Income Tax Act (EStG).

Submission is mandatory if:

- You have received wage replacement benefits (e.g. parental allowance, sickness benefit, unemployment benefit) totalling more than 410 Euro in the year. These are subject to the so-called progression clause.

- You had multiple employments simultaneously, one of which was taxed under tax class VI.

- You and your spouse chose the tax class combination III/V or IV with factor.

- You earned additional income of over 410 Euro – e.g. from self-employment, rental, capital gains without withholding tax or pensions.

- You received a request from the tax office to submit one.

Detailed information on mandatory assessment for employees can be found here: Obligation to submit a tax return.

No obligation to submit if:

- You were employed by one employer only in the year 2025 and were classified in tax class I.

- You received no wage replacement benefits and no additional income.

- None of the above special cases apply to you.

Tip: Voluntary submission is often worthwhile!

Even if you are not obliged, a voluntary submission (so-called application assessment) can be worthwhile. Many employees receive a refund – on average over 1.000 Euro! The reasons are, for example, work-related expenses, special expenses or extraordinary burdens that were not taken into account in the wage tax deduction.

When in doubt: Ask the tax office

If you are unsure whether you need to submit a tax return, contact your local tax office.

Who is required to submit a tax return?

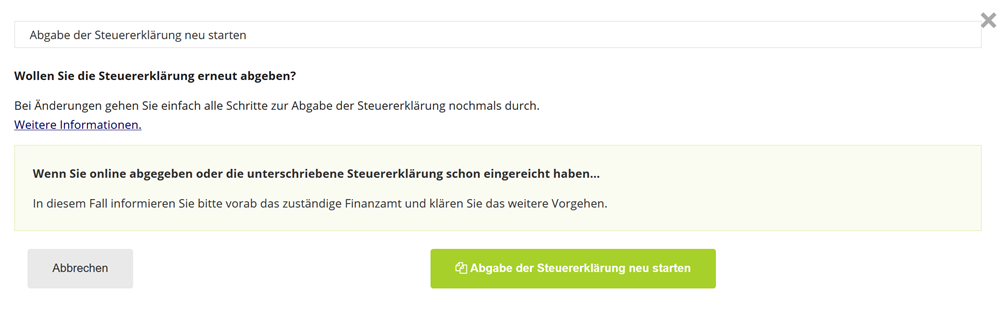

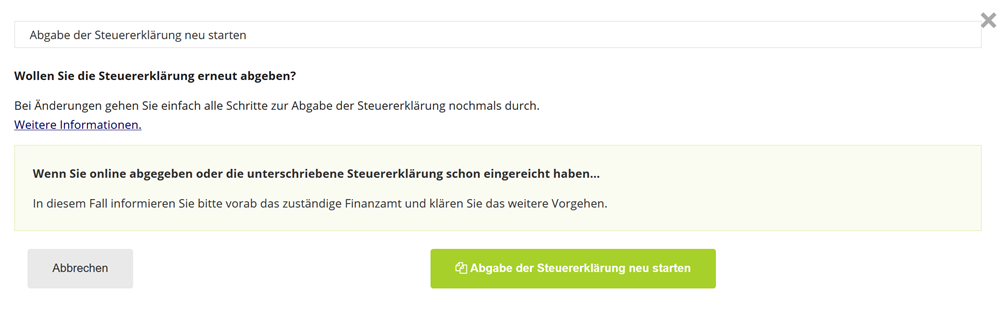

How can I amend data that has already been submitted?

If you have already submitted your tax return electronically to the tax office but need to make some changes, this is not a problem. Simply restart the submission process by clicking on the navigation link "Submit tax return". In the middle section, you will find the button "Restart submission of tax return". If you have already submitted the signed (compressed) tax return, please inform the relevant tax office in advance. Otherwise, you can resubmit your tax return free of charge if there are changes.

Then print out the compressed tax return, sign it, and send it by post to the tax office. The Telenumber can be used to link the electronic tax return with the paper document.

How can I amend data that has already been submitted?