How is the statutory pension taxed?

Since the Retirement Income Act of 2005, state pensions have been taxed according to the principle of deferred taxation. This means that part of the pension is taxable, while the rest remains tax-free. The taxable portion depends on the year of retirement.

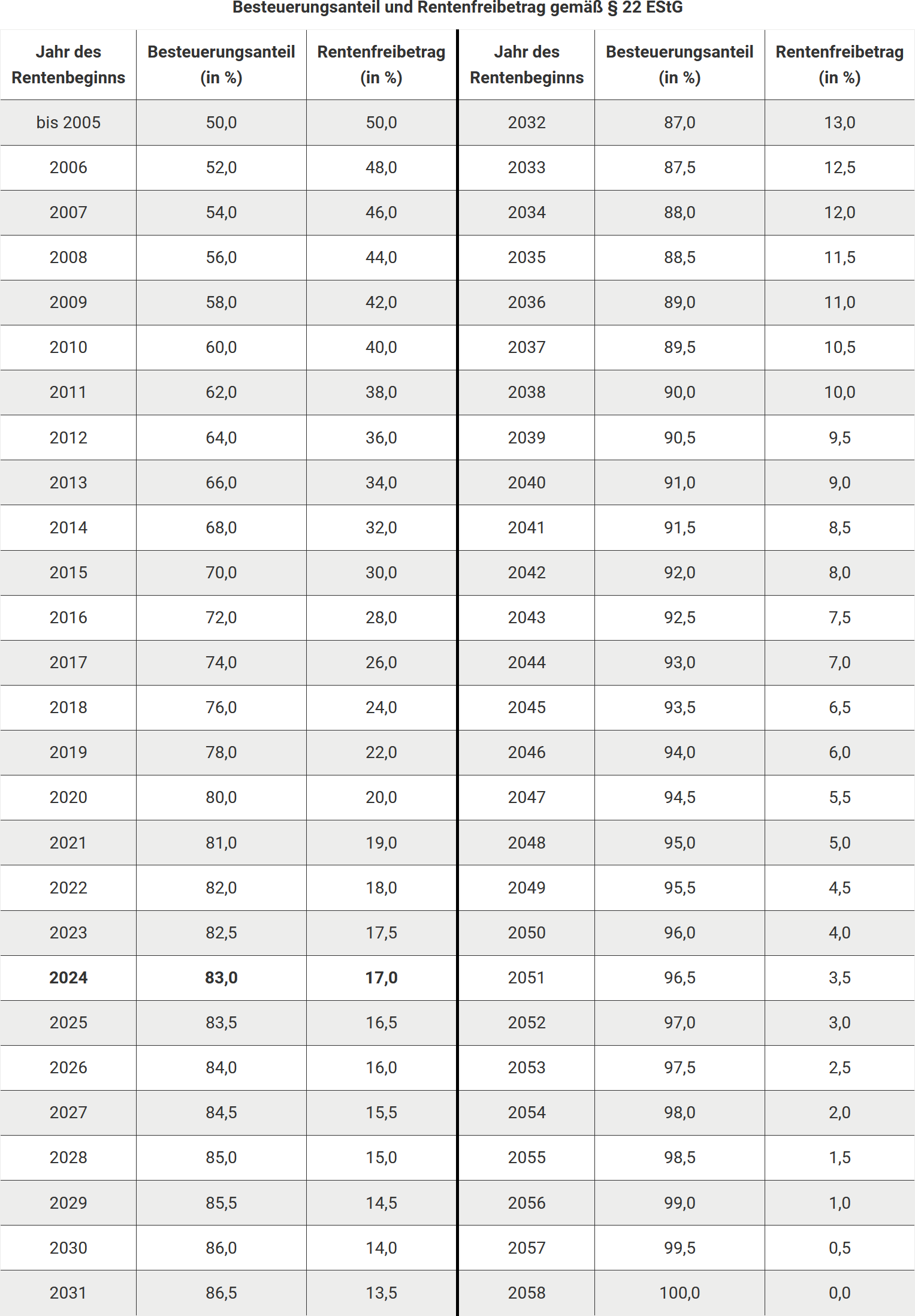

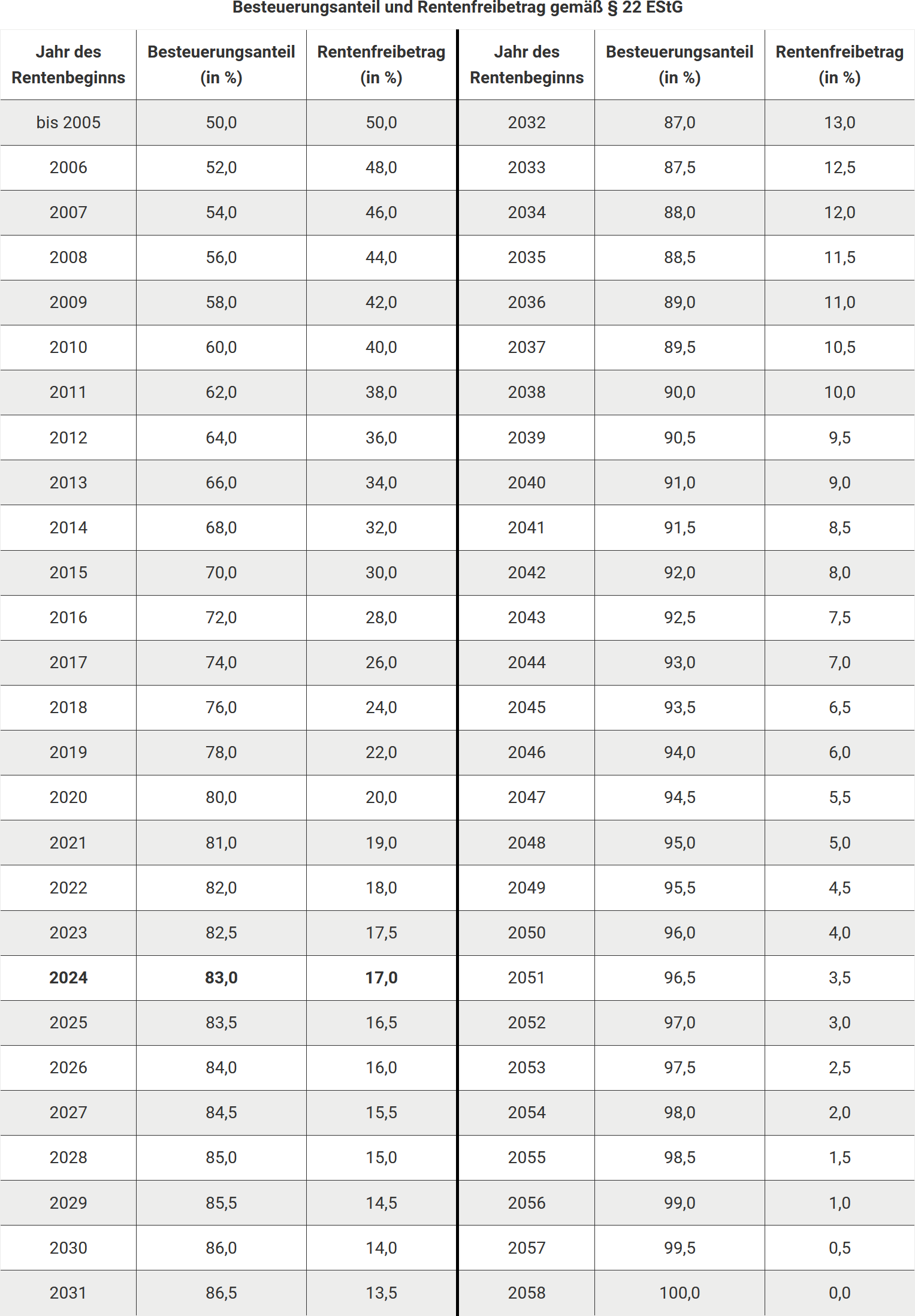

Taxation percentage:

- Retirement before 2005: 50% tax-free portion.

- Retirement 2005 to 2024: The taxable portion increases each year. For 2024, it is 83%.

- Retirement from 2025: The portion increases annually by 0.5 percentage points and reaches 100% from 2058.

Calculation of the pension allowance:

- In the first and second year of retirement, the pension is taxed with the fixed taxable portion.

- From the third year, the pension allowance remains constant and unchanged for life.

- Pension increases are fully taxable from the third year.

Example

Hans Müller retired in 2009 and received a pension of 12.000 Euro in 2023. With a taxable portion of 58%, 6.960 Euro are taxable. His allowance is 5.040 Euro. As long as his income is below the basic allowance of 11.784 Euro (2024), he does not have to submit a tax return.

Income-related expenses:

- The tax office automatically deducts an income-related expenses allowance of 102 Euro.

- Higher expenses (e.g. tax advice or pension advice) can be claimed but must be proven.

Example for 2024

If Mr Müller only retires in 2024 and receives an annual pension of 15.000 Euro, 12.450 Euro would be taxable (83%). Since he exceeds the basic allowance, he would have to submit a tax return.

Important: The pension allowance remains the same even if the pension is adjusted and refers to a fixed amount. Future pension increases must therefore be fully taxed.

(2024): How is the statutory pension taxed?

What does the 2005 Pension Income Act regulate?

The Pension Income Act of 2005 regulates the taxation of pensions and affects both pensioners who were already retired in 2005 and future pensioners. The tax burden for new pensioners increases every year, but there are also benefits for employees through tax-advantaged pension schemes.

Tax-advantaged pension schemes

In addition to the statutory pension insurance, private pension insurance is also recognised as a pension scheme, particularly the basic pension or Rürup pension. Contributions to private pension insurance are only tax-advantaged if they provide a lifelong pension. The insured person must be at least 60 years old at the start of the pension. For contracts from 2012 onwards, pension payments may not begin before the age of 62. This ensures that the products are used exclusively for retirement provision.

Taxation of pensions

Since 2005, 50% of pension income has been taxed. Between 2006 and 2020, the taxable portion of pensions increased by two percentage points each year, and from 2021 by only one percentage point per year. However, from 2023, the taxable portion for new pensioners will only increase by half a percentage point annually. Pensions starting from 2024 will have a taxable portion of 83%. The full taxable portion of 100% will be reached for the first time in 2058.

Ruling on double taxation

In May 2021, the Federal Fiscal Court (BFH) ruled that double taxation of pensions is only possible in individual cases. The BFH considers the basic system of pension taxation to be lawful, including the limited deduction of pension contributions and the partial tax exemption of pensions. In November 2023, the Federal Constitutional Court (BVerfG) dismissed the constitutional complaints against the BFH rulings, as they were not sufficiently substantiated.

What does this mean for those affected?

It is likely that the provisional notes in income tax assessments will soon be removed. Anyone who believes that double taxation applies in their case should continue to appeal against current tax assessments and provide a calculation of double taxation. Appropriate evidence, such as insurance records or tax assessments from the contribution phase, must be attached to the appeal.

The BFH is currently re-examining possible double or excessive taxation of pensions (Ref. X R 9/24). Pensioners should therefore maintain or lodge new appeals.

(2024): What does the 2005 Pension Income Act regulate?

What is a statutory annuity?

A statutory annuity is a fixed payment linked to a person's lifetime. This includes old-age, disability, and survivor pensions from the statutory pension insurance, the agricultural pension fund, or professional pension schemes. These pensions are only partially taxed, with the taxable portion depending on the year the pension begins.

Taxable portion and tax-free pension amount

If you retire in 2024, the taxable portion of your pension is 83%. The tax-free part of the pension is determined in the year following the start of the pension and remains unchanged for the entire duration of the pension. However, pension increases due to adjustments are fully taxed.

Notification to the tax office

Pensioners can request a “notification for submission to the tax office” from the statutory pension insurance. This notification contains the relevant data for the tax return and is automatically sent in subsequent years. An additional entry of the taxable portion in the tax return is not required.

Types of annuities

Annuities include in particular:

- Old-age pensions

- Disability pensions

- Occupational disability pensions

- Widow's/widower's pensions

- Orphan's pensions

- Parental pensions

One-off payments such as death benefits or settlements of small pensions must also be declared.

Special regulations for victims of the Nazi regime

If periods of persecution under § 1 of the Federal Compensation Act (BEG) were taken into account in the pension calculation, inform the tax office informally. This also applies to survivor's pensions if the deceased was recognised as a victim. The tax office will check whether these pensions are tax-free.

(2024): What is a statutory annuity?

What income-related expenses can I claim as a pensioner?

Even as a pensioner, you can claim expenses related to your pension as income-related expenses in your tax return. If your income-related expenses total less than 102 Euro, it is not worth entering them. The tax office automatically applies an income-related expenses allowance of 102 Euro, which is immediately deducted from your income. This allowance is applied jointly for all pensions and all income that must be declared under other income. It is an annual amount that is not reduced, even if the conditions did not apply for the entire year or if there was no income for the whole year. The income-related expenses allowance is personal and is available to each spouse separately as soon as they have the relevant income.

Tip: If you have higher expenses exceeding the allowance of 102 Euro, it is definitely worth entering them. However, you should also have the evidence ready and enclose it with your tax return. If you have expenses for a tax advisor, the tax office will only recognise the costs as income-related expenses if they are related to your pension. Therefore, ask your tax advisor to specify separately in their invoice the part that directly relates to your pension.

You can claim the following as income-related expenses:

- pension advisor,

- lawyer in pension disputes,

- tax advisor (only for form R), and also

- costs related to applying for a pension (travel expenses, office supplies, postage, telephone costs)

- court fees if the case concerns your pension

- union fees you pay as a pensioner

- flat-rate account maintenance fee of 16 Euro per year

Tip

If you are unsure whether the tax office will recognise a particular expense, simply declare it and enclose the evidence. The tax officer will decide.

(2024): What income-related expenses can I claim as a pensioner?