Tax return 2024: What's new

Submission deadline for the 2024 tax return

You are required to submit an income tax return if there is a specific reason. This is known as a mandatory assessment or official assessment.

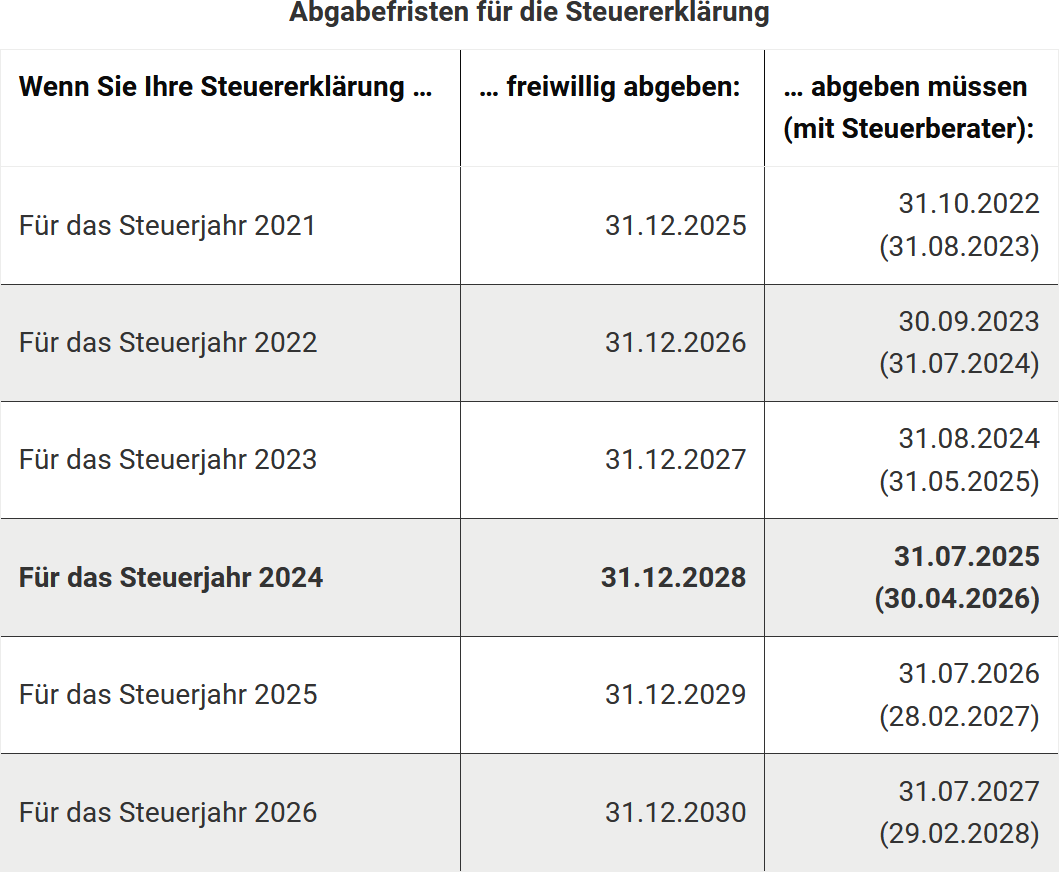

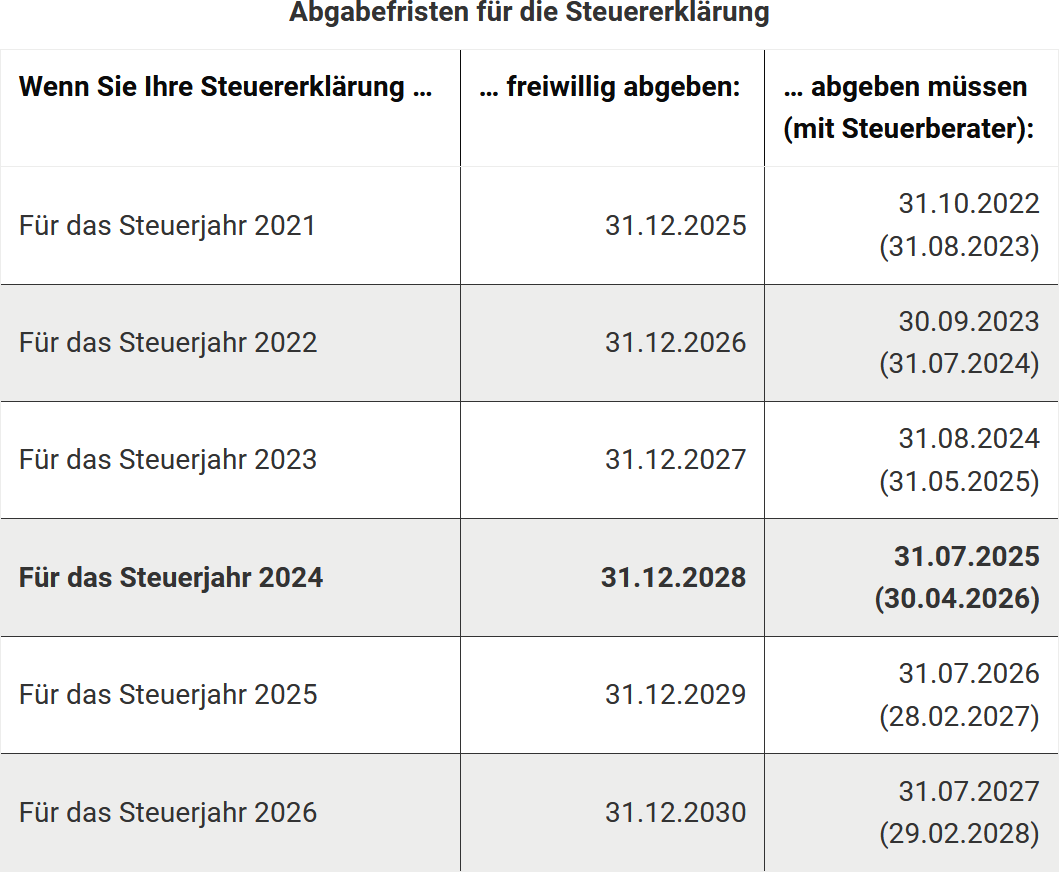

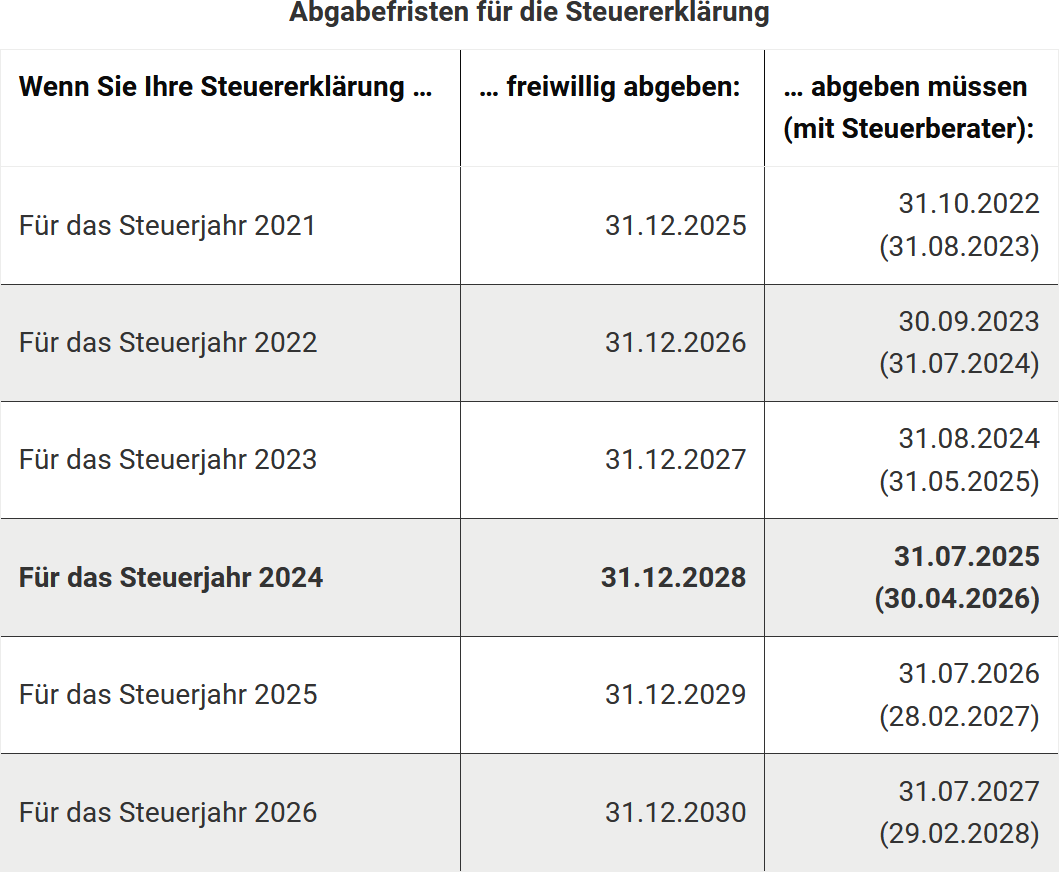

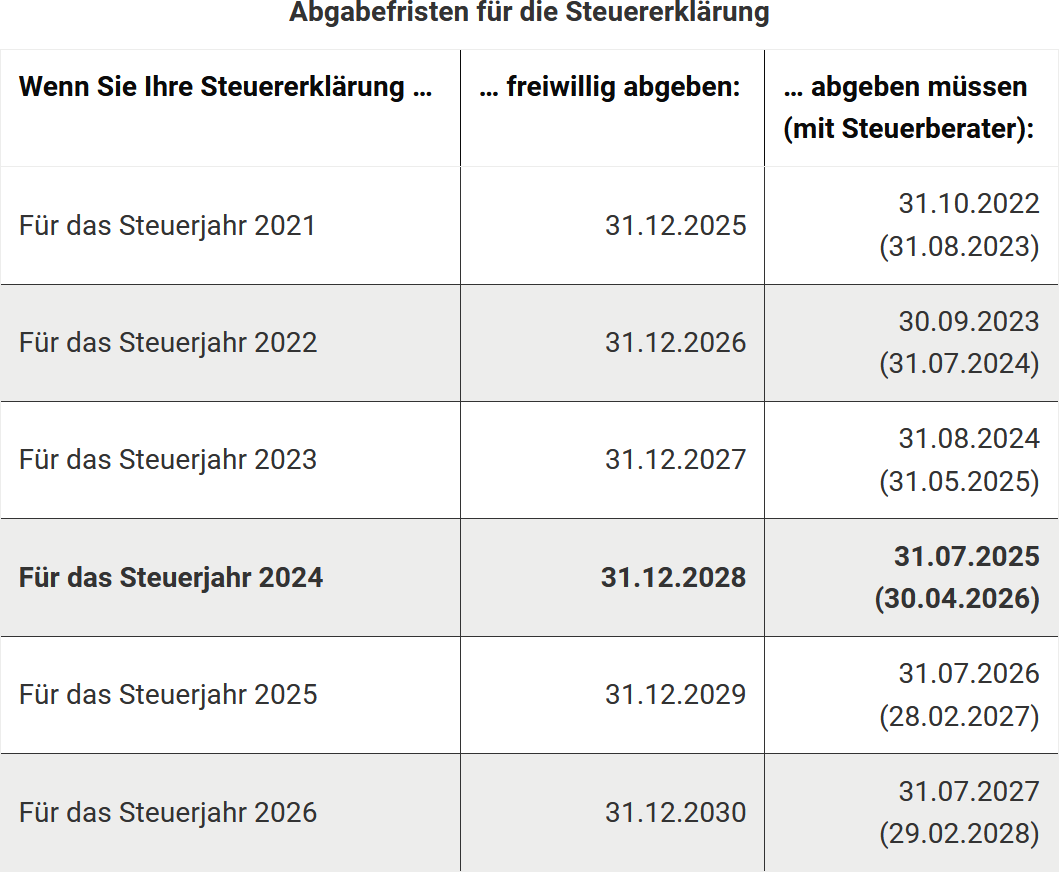

The tax return for 2024 must be submitted by 31 July 2025 in the case of a mandatory submission, with an extension until 30 April 2026 if a tax advisor is engaged. For voluntary submissions (application assessment, § 46 para. 2 no. 8 EStG), you have until 31 December 2028 without any late fees (§ 169 AO).

The following deadlines apply:

Tax relief: Increase in basic allowance

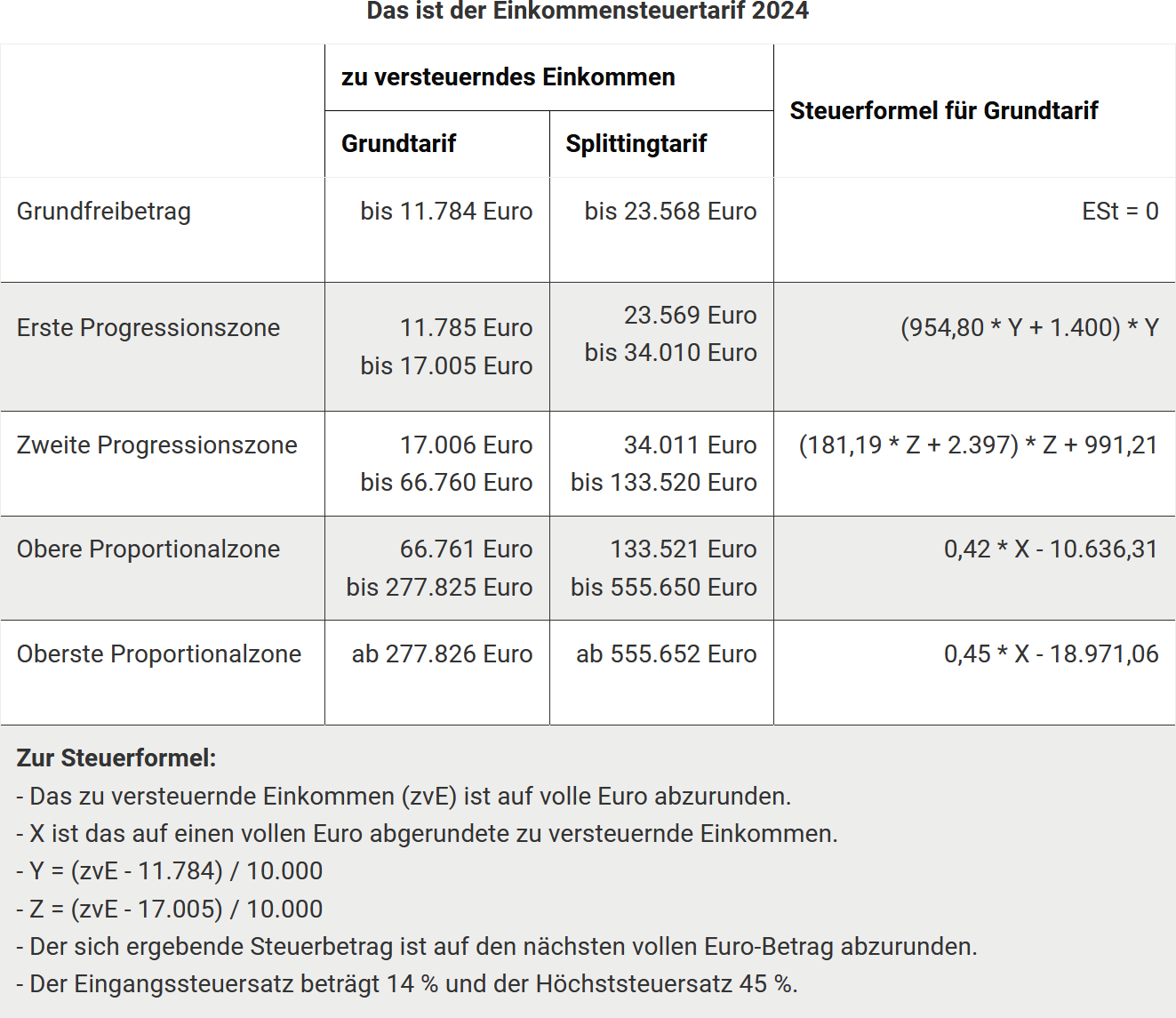

The tax basic allowance ensures that the portion of income absolutely necessary for living expenses is not taxed (minimum subsistence level). As of 1 January 2024, the basic allowance has been increased to 11,784 Euro. Further increases are planned for 2025 (12,084 Euro) and 2026 (12,336 Euro) ("Tax Development Act", § 32a EStG).

Is the allowance for 2023 and 2024 too low?

The basic allowance is 10,908 Euro in 2023 and is expected to be 11,784 Euro in 2024. The Schleswig-Holstein Finance Court ruled that these amounts are not unconstitutional but allowed an appeal (BFH, III R 26/24). The plaintiffs criticised that the tax basic allowance is below social benefits (e.g. citizens' income), which constitutes a violation of the constitutionally protected minimum subsistence level.

Practical tip: Objections to tax assessments for 2023 and 2024 can be suspended (§ 363 para. 2 AO).

Reduction of fiscal drag

To avoid a creeping tax increase, the key figures of the tax rate will be adjusted by 6.3% (2024), 2.5% (2025) and 2% (2026). As a result, higher tax rates will only apply to higher incomes.

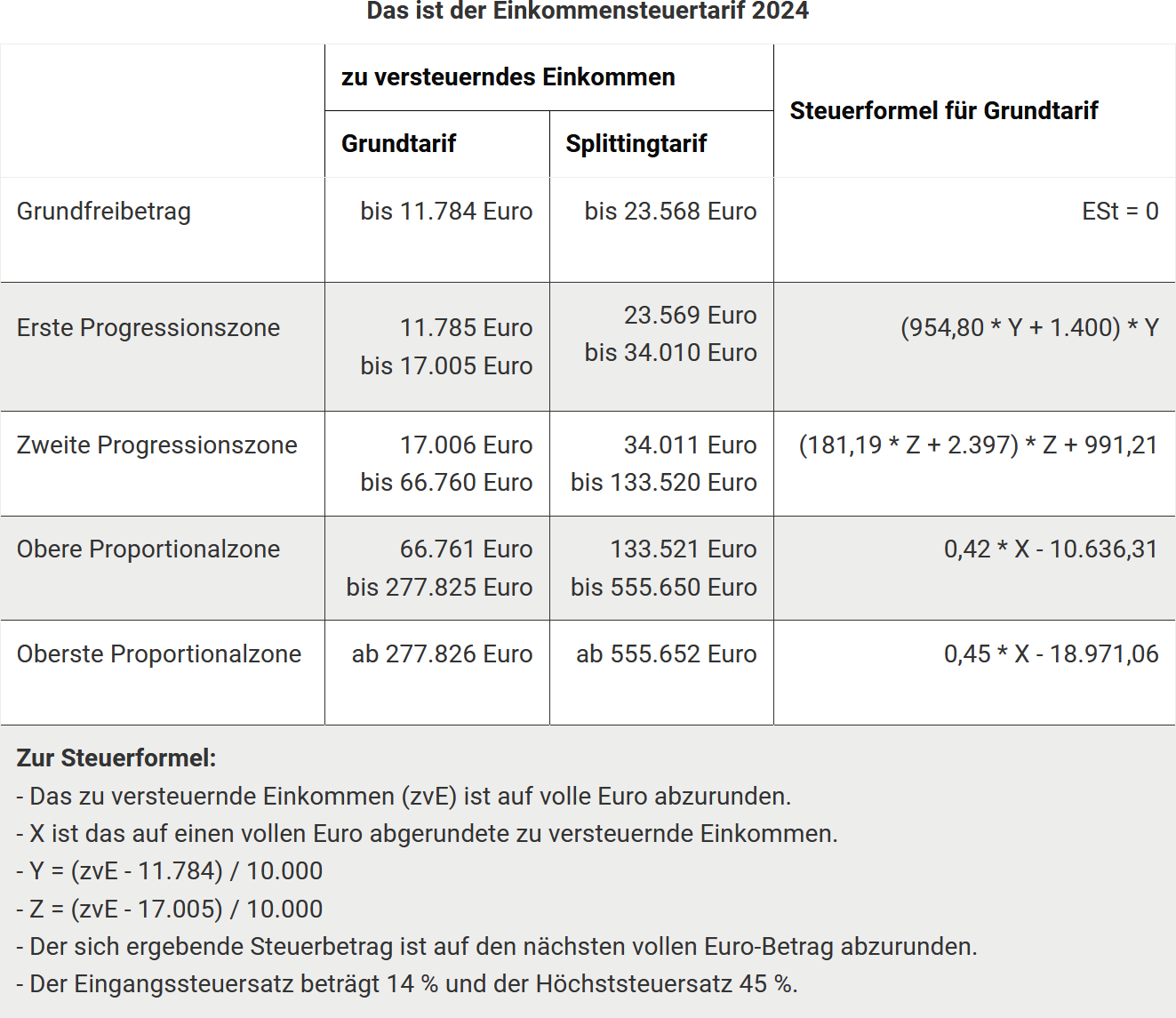

The new income tax rate 2024

Wealth tax applies only at higher income levels

Since 2007, there has been a so-called wealth tax, a tax surcharge of 3 percentage points for top earners. The top tax rate is therefore 45% in the highest proportional zone. The wealth tax remains unchanged from 2024: For taxable income of 277,826 Euro (single) or 555,651 Euro (married), the top tax rate of 45% applies (§ 32a para. 1 no. 5 EStG).

Family support 2024

Child benefit and child allowance

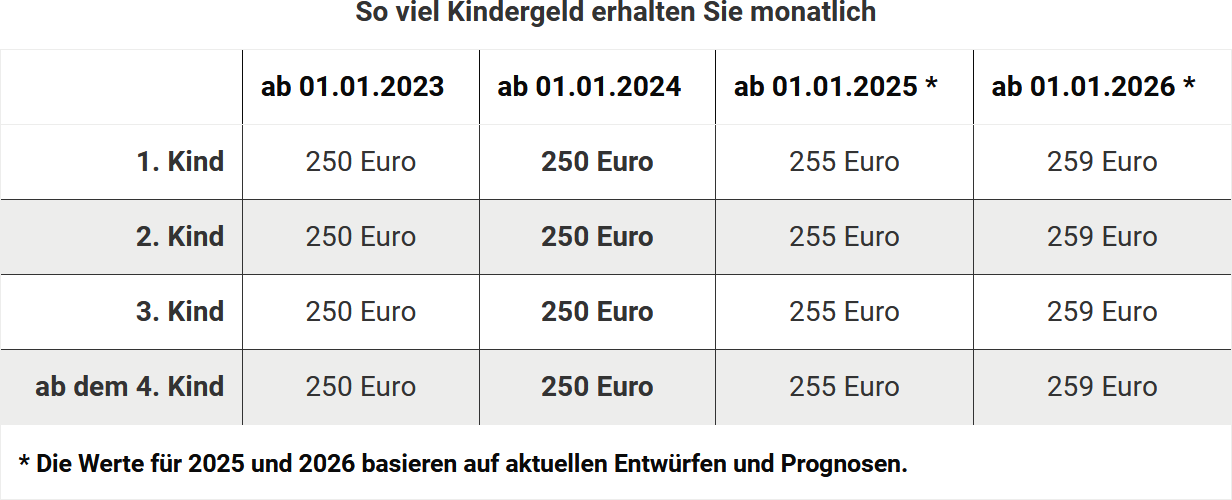

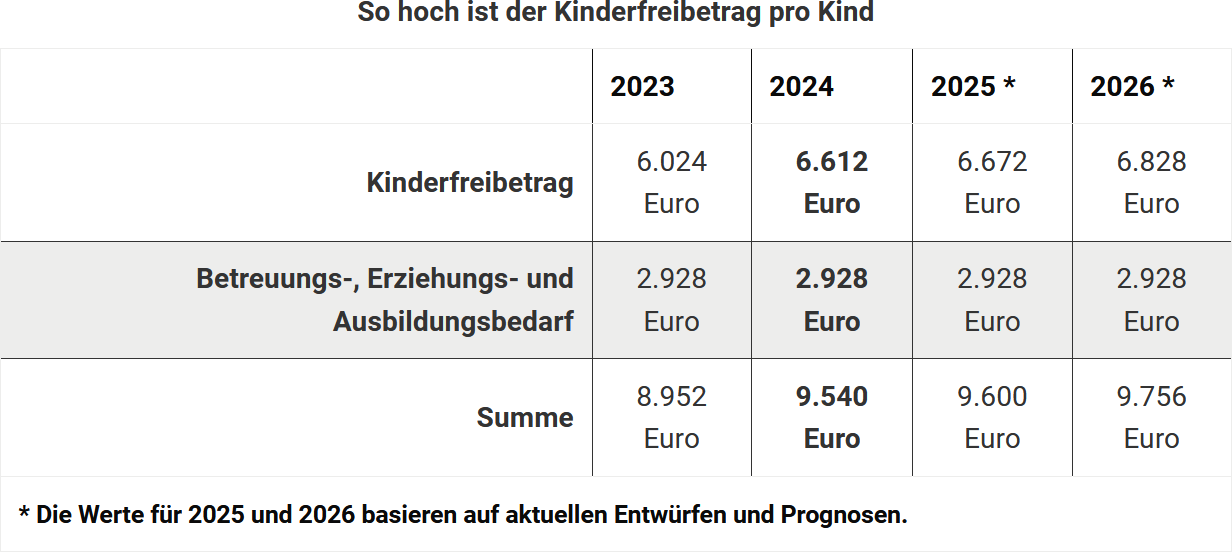

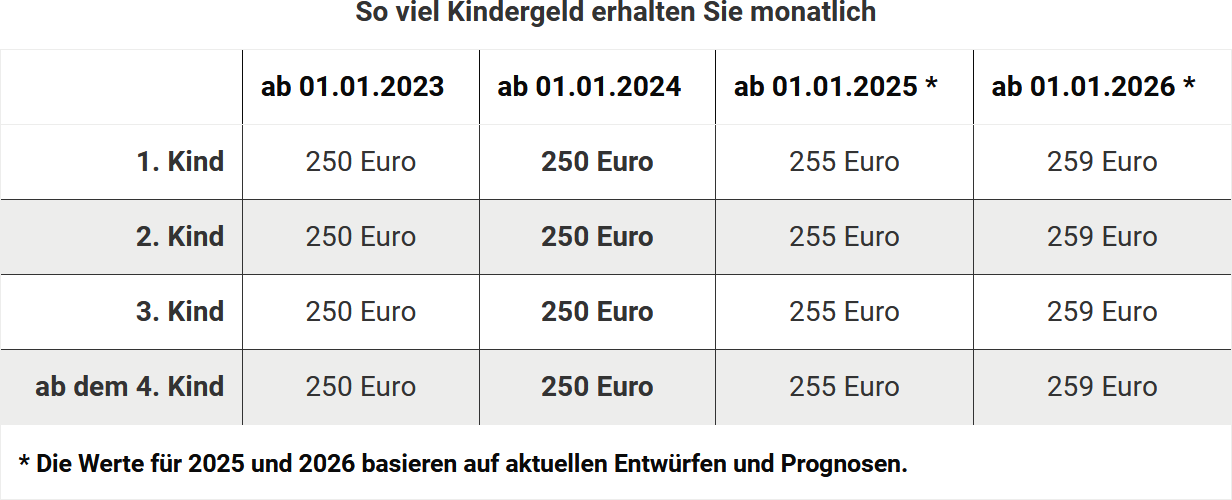

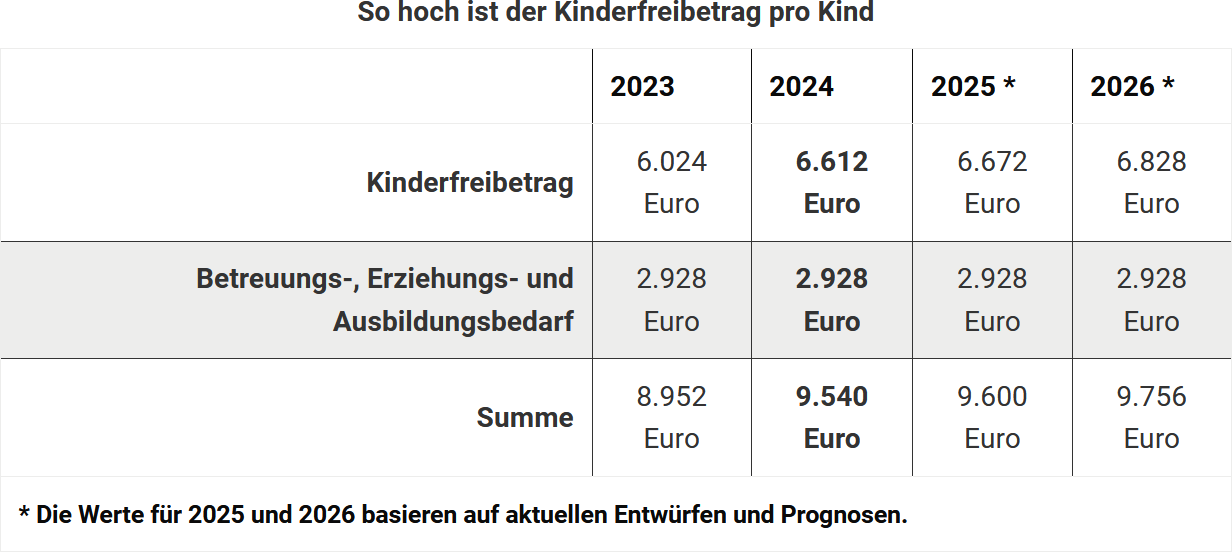

Child benefit remains at 250 Euro per month per child. From 2025, child benefit will be increased to 255 Euro. The child allowance for 2024 has been increased to 6,612 Euro (3,306 Euro per parent). The child's tax identification number remains a prerequisite for child benefit and child allowance.

Training allowance

The training allowance has been 1,200 Euro since 2023. It is reduced if the child does not meet the requirements for the entire year or lives in a country with a lower standard of living.

Relief amount for single parents

The relief amount for single parents was increased to 4,260 Euro in 2023. The increase of 240 Euro for each additional child remains unchanged (§ 24b EStG).

Child benefit remains at 250 Euro per month per child. The child allowance for 2024 has been increased to 6,612 Euro (3,306 Euro per parent). The child's tax identification number remains a prerequisite for child benefit and child allowance.

New tax benefits for children living abroad

From 2024, tax benefits such as the child allowance, the BEA allowance (care, education, training) and the training allowance will no longer be reduced if the child lives in an EU or EEA country. A reduction will only apply to children in non-EU countries. Depending on the country, the allowance may be reduced by up to three quarters. This change is based on a ruling by the European Court of Justice (ECJ) to prevent discrimination in family benefits within the EU.

Minijob limit rises to 538 Euro

The Minijob limit increased to 538 Euro per month in 2024. In 2025, it will be raised to 556 Euro. These adjustments follow the increases in the minimum wage, which rose to 12.41 Euro per hour from 2024.

Employees

Flat rate for income-related expenses remains at 1,230 Euro

The employee allowance was increased from 1,200 Euro to 1,230 Euro on 1 January 2023 (§ 9a no. 1 EStG). If you do not claim individual income-related expenses, an amount of 1,230 Euro will also be applied in 2024. No proof is required.

Home office and study: New regulations from 2023

Since 2023, costs for a home office can be deducted if it is the professional centre, either in actual amount or at a flat rate of up to 1,260 Euro. If the home office is not used as a centre, a daily allowance of 6 Euro can be claimed for up to 210 days.

The allowances apply uniformly for the entire year and are offset against the employee allowance. Home office days must be documented.

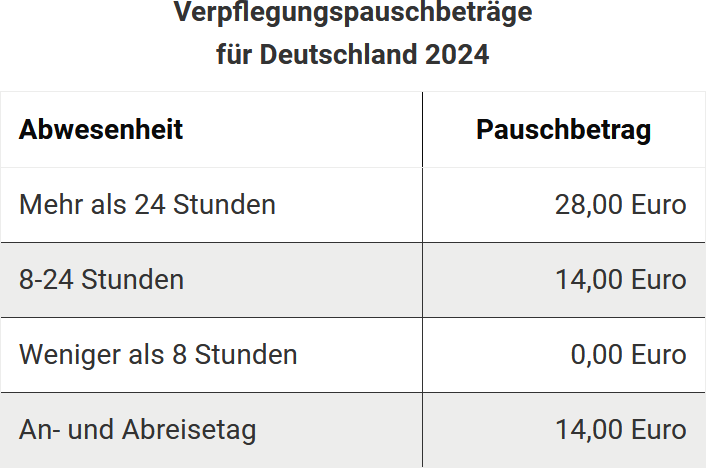

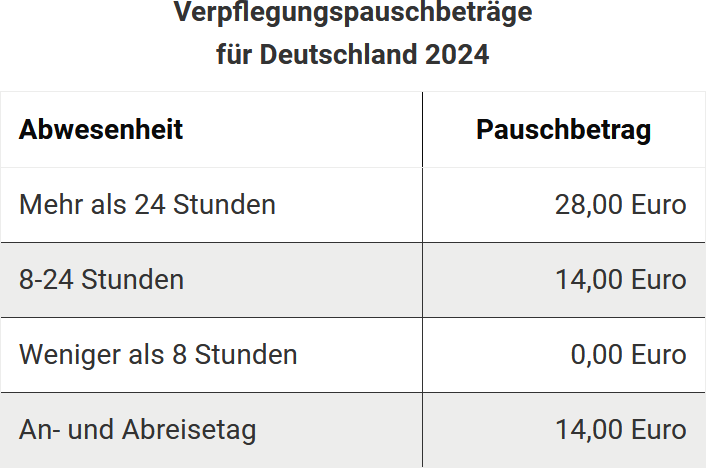

Meal allowances

The Federal Ministry of Finance has published new country-specific meal and overnight allowances for business trips abroad for 2024. Employees can deduct the meal allowances as income-related expenses or have them reimbursed tax-free by their employer. Overnight allowances may only be reimbursed tax-free by the employer, but actual overnight costs can be deducted if proven.

Allowances have been adjusted for countries such as Australia, Brazil, Canada, Italy, Spain and others. These apply from 2024 for business trips abroad and double housekeeping.

New overnight allowance for truck drivers

Since 1 January 2020, truck drivers who sleep in the cab of their lorry can claim an overnight allowance of 8 Euro per calendar day in addition to the meal allowance as income-related expenses. From 1 January 2024, this allowance has been increased to 9 Euro (§ 9 para. 1 sentence 3 no. 5b EStG). This still applies to expenses such as the use of showers, toilets or cleaning the sleeping cabin.

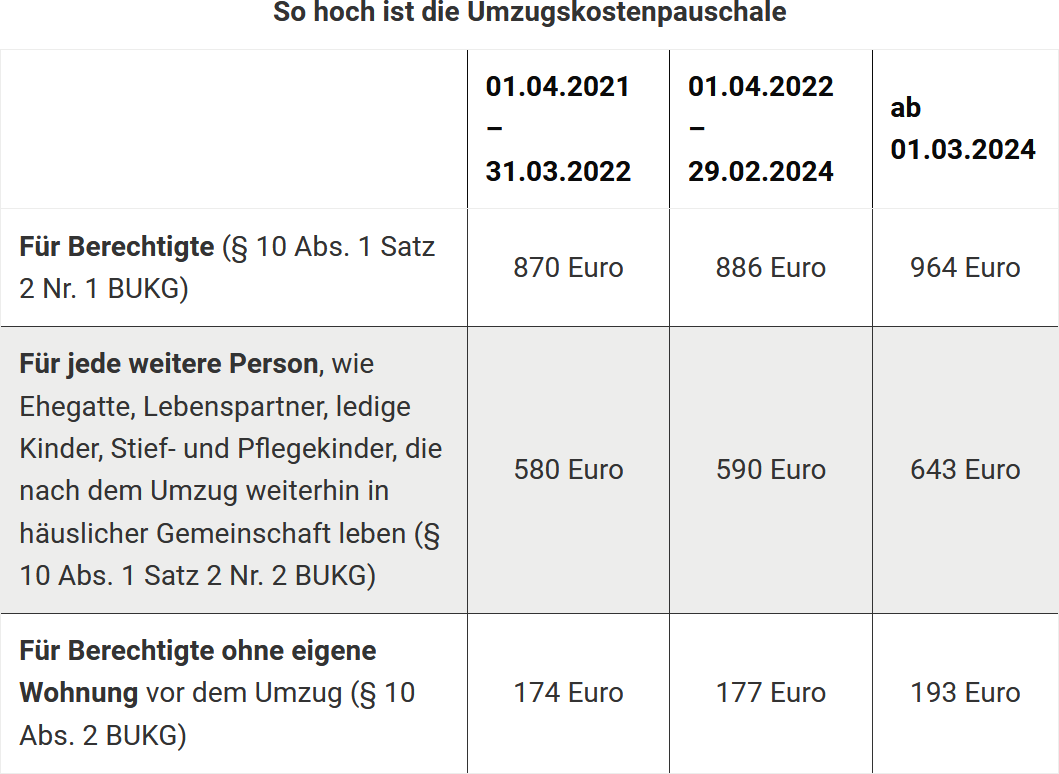

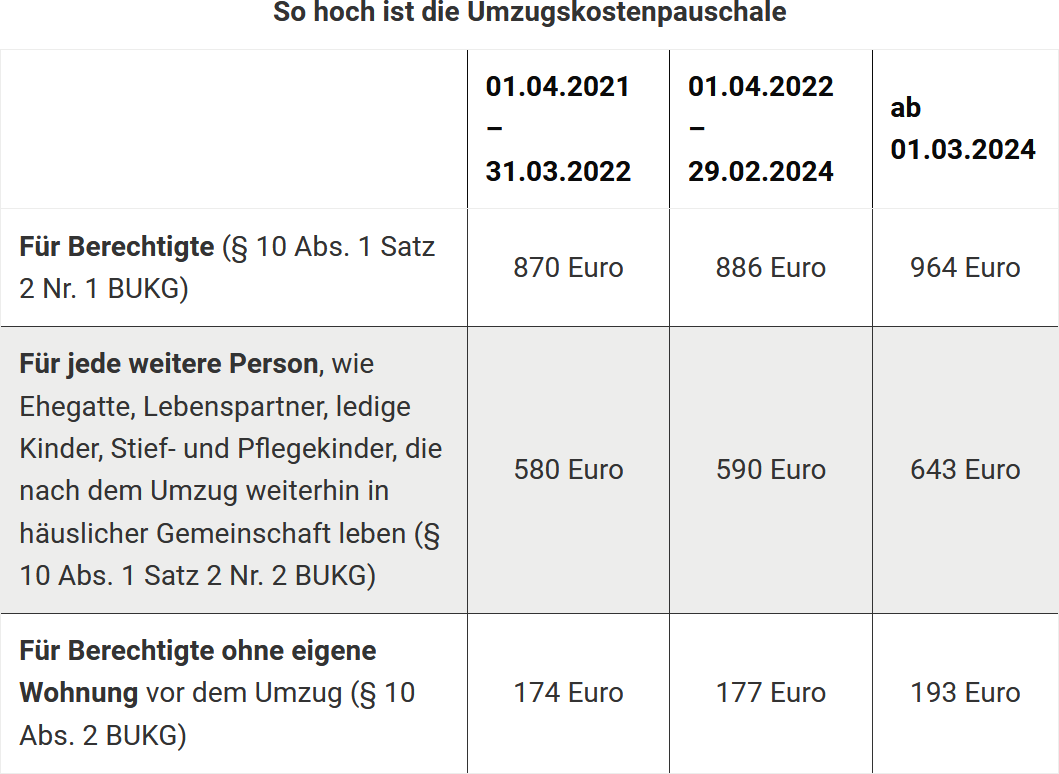

Relocation costs

If you move for work-related reasons, you can deduct relocation costs as income-related expenses or have them reimbursed tax-free by your employer. These include transport, travel and rental costs as well as estate agent fees. Other relocation expenses can be claimed as a lump sum. Since 1 June 2020, there has been a uniform allowance, regardless of family status, which will be increased again on 1 March 2024:

- For eligible persons: 964 Euro

- For each additional person (e.g. spouse, children): 643 Euro

- For unfurnished accommodation: 193 Euro

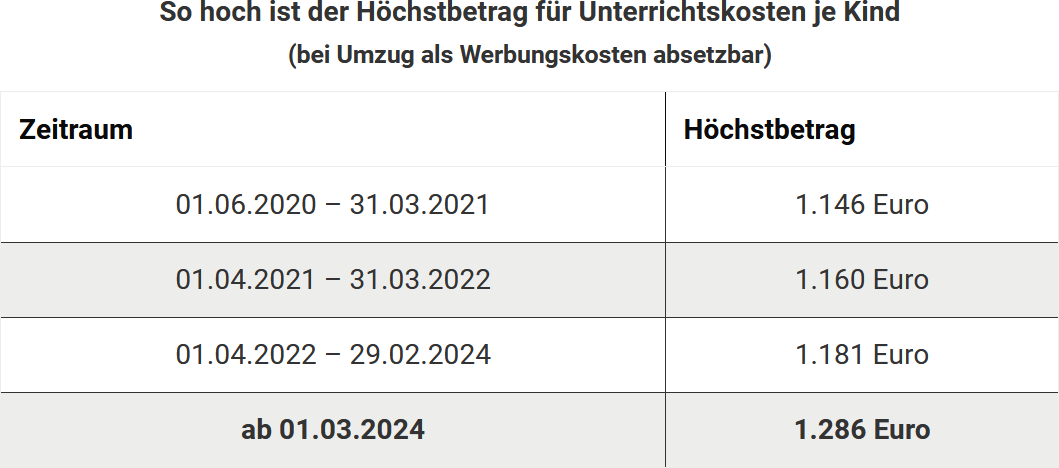

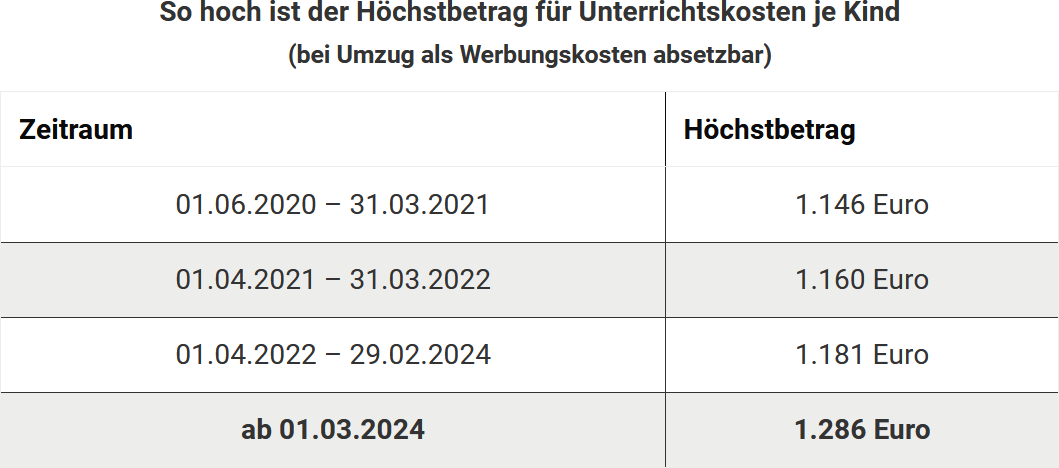

Tuition costs for children after a move can also be deducted up to 1,286 Euro.

Capital gains

Increase in saver’s allowance since 2023

The saver’s allowance was increased to 1,000 Euro for singles and 2,000 Euro for married couples in 2023. Exemption orders are automatically adjusted by the banks. If you have not yet issued an exemption order, you should do so to avoid unnecessary tax deductions. Deduction of actual income-related expenses remains excluded.

Advance flat rate for accumulating funds 2024

For accumulating funds that do not distribute earnings, investors must pay tax on an advance flat rate annually. This is not based on actual profits but amounts to 70% of the Bundesbank's base interest rate multiplied by the fund value at the beginning of the year. For 2024, the base interest rate is 2.29%, resulting in an advance flat rate of 1.603%. The advance flat rate is deemed to have accrued on 2 January 2025.

Changes for pensioners

Taxation of pensions

For pensioners who receive a pension for the first time in 2024, the taxable portion is 83%. An income-related expenses allowance of 102 Euro is deducted.

Taxation of pensions

Pension payments are still fully taxable. The pension allowance decreases annually, for retirees from 2024 it is 13.6%, maximum 1,020 Euro.

Constitutional complaint regarding double taxation of pensions rejected

The Federal Constitutional Court has rejected the constitutional complaints against the double taxation of pensions. The Federal Fiscal Court (BFH) ruled in 2021 that pension taxation is largely constitutional and that double taxation could only affect future pension cohorts. Affected persons must prove double taxation themselves. The tax authorities are expected to remove the provisional notes in tax assessments. Those affected should lodge an objection and submit the relevant calculations.

No deduction for study costs

Pensioners cannot deduct costs for a home office for their pension administration, as no active work is required for this. For freelance work, the cost deduction can be made if the home office is the centre of activity. Alternatively, a daily allowance of 6 Euro is possible. For pensioners, the home office is not deductible, as pensions are paid without active employment.

Support for dependants

Maximum maintenance amount

The maximum maintenance amount was increased to 11,784 Euro in 2024 and will be reduced if the maintenance recipient earns income over 624 Euro.

Harmless asset limit remains low

If you support dependants, you can claim the payments for tax purposes under certain conditions (§ 33a para. 1 EStG). An asset value of up to 15,500 Euro is considered harmless. Certain assets, such as owner-occupied houses or items whose sale would be tantamount to a giveaway, are considered exempt assets.

A recent ruling by the Federal Fiscal Court (BFH) has determined that the asset limit of 15,500 Euro still applies in 2019. In the case, the plaintiff won because maintenance payments are not immediately considered assets (BFH ruling of 29 February 2024, VI R 21/21). An advance maintenance payment of 500 Euro for January 2019 was not counted as the son's assets, as it was only received in 2019, reducing his assets to 15,450 Euro as of 1 January 2019.

Other tax changes

Health insurance: family insurance

Family members are co-insured free of charge if their monthly income does not exceed 505 Euro.

Tax relief for donations

Donations for Corona or Ukraine aid are deductible as special expenses up to 20% of income.

Tax relief after the 2024 floods

The Whitsun floods 2024 in the Saarland and other flood damage in Bavaria and Baden-Württemberg often lead to significant financial burdens. The state responds with tax relief, including tax deferrals, special depreciation for replacements and simplified proof for donations. Farmers and businesses also receive support through special disaster decrees. These measures help those affected to cope financially with the consequences of the disasters.

Medical expenses: Are dietary costs for coeliac disease deductible?

According to the BFH (decision of 4 November 2021, VI R 48/18), additional costs for a gluten-free diet for coeliac disease are not deductible as extraordinary expenses, as they replace usual food. A constitutional complaint has been filed against this decision (Ref. 2 BvR 1554/23).

Practical tip: The Federal Constitutional Court is also examining whether medical expenses must generally be reduced by the reasonable personal contribution (proceedings 2 BvR 1554/23 and 2 BvR 1579/22).

Business identification number: Allocation from November 2024

Since November 2024, the business identification number (W-IdNr.) has been issued by the Federal Central Tax Office (BZSt) and is to be completed by 2026. It is used to uniquely identify all businesses in Germany and to simplify official communication. The W-IdNr. is issued automatically, no application is required.

Note: The tax number and IdNr. will remain in place. Further information and FAQs at www.bzst.de.

Tax assessments: Extension of the notification presumption to four days

From 1 January 2025, the notification presumption period for tax assessments will be extended from three to four days (§ 122 para. 2 no. 1 AO). This applies to both postal and electronic notices to take into account longer postal delivery times due to the "Postal Law Modernisation Act".

Practical tip: If the fourth day falls on a weekend or public holiday, the notification is postponed to the next working day (§ 108 para. 3 AO).

(2024): Tax return 2024: What's new

Which types of income and forms are supported by Lohnsteuer kompakt in 2024?

Programme scope according to § 87c AO

The income tax return can only be prepared with this software for persons with unlimited tax liability in Germany. If you are subject to limited tax liability in Germany (§ 1 para. 4 EStG), it is not possible to prepare your income tax return with this application.

The latest version for the tax year 2024 supports you in preparing the tax return in the following areas:

- Main tax form - Income tax return for (unlimited) taxpayers

- Form Special Expenses

- Form Extraordinary Expenses

- Form WA-ESt - Further information and applications in cases with foreign reference

- Form Child - Information on the tax consideration of children

- Form VOR - Pension expenses

- Form AV - Riester pension (pension contributions as special expenses according to § 10a EStG)

- Form N - Income from employment

- including travel expenses for business trips/temporary employment

- Form N - Double household (New from 2023)

- Form N-AUS - Foreign income from employment

- Form R - Pensions and other benefits from pension contracts

- Form R-AUS - Pensions and other benefits from foreign insurance / foreign pension contracts / foreign company pension schemes

- Form R-AV/bAV - Benefits from domestic pension contracts and domestic company pensions

- Form V - Income from renting and leasing

- Form V-FeWo - Income from renting and leasing of holiday homes and short-term rentals

Form V – Other – Additional income from renting and leasing

- Form KAP - Income from capital assets (initially interest and dividend income)

- Form KAP-BET - Income and creditable taxes from participations

- Form KAP-INV - Declaration of investment funds not subject to domestic tax deduction

- Form S - Income from self-employment

- Note: Income from partnerships according to § 15 EStG and from venture capital companies cannot currently be recorded.

- Form G - Income from business

- Note: Income from partnerships according to § 15b EStG (tax deferral models), income from sales to a REIT-AG, and income from commercial animal breeding, futures transactions, or participations cannot be recorded.

- Form Corona - Corona emergency aid, bridging aid and comparable subsidies

- Form EÜR - Income surplus calculation

- The income surplus calculation (according to § 4 para. 3 EStG) is the simplest form of profit determination

- Form SO - Other income

- Form SO Part 1: Maintenance payments received, recurring payments, benefits, and parliamentary allowances can be recorded here.

- Form SO Part 2: Income from private sales transactions (real estate, assets) can be entered here.

- Form AUS - Foreign income (New from 2023)

- Note: Flat-rate taxed foreign income, additional taxation according to §§ 7 to 13 AStG, family foundations according to § 15 AStG, crediting of foreign taxes on special remuneration according to § 50d para. 10 sentence 5 EStG cannot be recorded.

- Form Maintenance - Maintenance payments to dependants (as part of extraordinary expenses)

- Form FW - Tax relief for the promotion of home ownership and deduction of preliminary costs (according to §10e EStG)

- Form Energy Measures - Expenses for energy measures in buildings used for own residential purposes

- Form Mobility Premium - Information on the application for the mobility premium

We will keep you regularly updated on the latest updates in our newsletter and on Facebook and Twitter.

The following Forms to the income tax return are not available:

- Form N-GRE - Cross-border commuters in Baden-Württemberg (workplace in F, CH, A)

- Form L - Income from agriculture and forestry

- Form Forestry - Income from timber use subject to preferential tax rates (to Form L)

- Form WEIN - Non-accounting wine-growing businesses (to Form L)

(2024): Which types of income and forms are supported by Lohnsteuer kompakt in 2024?

Am I required to save my data?

No, you do not need to save the data you enter in the tax return at Lohnsteuer kompakt again.

As soon as you leave an input field, it is automatically saved in the background. Once you have completed a page, click the "Next" button at the bottom right of the page to proceed to the next step. You can, of course, change any entries you have already made later. Simply use the navigation to jump to the desired section.

(2024): Am I required to save my data?

What is the deadline for submitting my tax return?

Submission deadlines for the 2024 tax return

Self-prepared tax return:

The regular submission deadline is 31 July 2025. There is no automatic extension for 2024.

Prepared by a tax advisor or income tax assistance association:

In this case, the deadline is automatically extended to 30 April 2026.

Submission deadlines for the tax return

Early request by the tax office

The tax office may request an earlier submission in individual cases. In this case, be sure to meet the individually set deadline to avoid late fees.

Application for deadline extension

If you cannot submit the return on time, apply for an extension before 31 July 2025. Approval is at the discretion of the tax office and should be well justified (e.g. illness, stay abroad, missing documents).

Consequences of missing the deadline

After the deadline, you will usually receive a reminder with a new submission date. If you still do not submit, fines and penalties may be imposed.

Deadline for voluntary submission

For a voluntary tax return (without obligation to submit), the deadline is 31 December 2028. However, early submission can lead to a faster tax refund.

(2024): What is the deadline for submitting my tax return?

Who is required to submit a tax return?

In some cases, submitting a tax return is legally mandatory.

The obligation to submit mainly affects employees with additional income or special wage tax situations.

Typical cases in which you must submit a tax return:

- You received wage replacement benefits of more than 410 Euro in the year – for example, parental allowance, sickness benefit or unemployment benefit.

- You had multiple employers at the same time (tax class VI).

- You and your spouse chose the tax class combination III/V or IV with factor method.

- In addition to your salary, you earned additional income over 410 Euro – e.g. from rental, pension or self-employment.

- You were requested by the tax office to submit a return.

What is the deadline?

If you are obliged to submit and you complete your tax return yourself, the following deadline applies for the tax year 2024:

Submission deadline: 31 July 2025

Tip:

If you are unsure whether you need to submit a tax return, it is best to ask your local tax office.

(2024): Who is required to submit a tax return?

Who is not required to submit a tax return?

Submitting a tax return is voluntary if you are not legally obliged to do so.

This applies to many employees, especially if:

- You are in tax class I and have only income from your employment.

- You are married and have chosen the IV/IV tax class combination (without the so-called factor procedure).

In these cases, your income is usually already fully taxed. You do not have to submit a tax return and the tax office will not ask you to do so.

Why voluntary submission is still worthwhile

Even if you are not obliged: In 9 out of 10 cases, there is a refund! This is because too much tax is often withheld during the year, which you can reclaim by submitting a tax return.

This means: The state owes you money – not the other way around. A tax refund is very likely!

Assessment on request – the voluntary tax return

If you voluntarily submit a tax return, this is referred to in tax law as assessment on request. You have plenty of time for this:

For the tax year 2024: You can submit the return until 31 December 2028.

This way, you can still secure a possible refund years later.

(2024): Who is not required to submit a tax return?

Who is subject to unlimited tax liability?

Fully liable to tax under Section 1 of the Income Tax Act (EStG) are:

- individuals who have a residence or their usual place of abode in Germany, and

- German nationals abroad who are paid from public funds. This includes, for example, members of a German embassy abroad.

While the second point is clear, the first point needs to be examined more closely:

- Individuals are basically all people, regardless of age.

- A person has a "residence" where they live (Section 8 of the Fiscal Code (AO)). It does not matter whether the residence is a suburban villa or just a furnished room in a shared flat. A taxpayer can also have multiple residences, for example in Germany and abroad.

- The term "usual place of abode" is used when someone stays in Germany for at least six consecutive months (Section 9 AO). Short interruptions during this period are possible.

(2024): Who is subject to unlimited tax liability?

Who is subject to limited tax liability?

Limited income tax liability under Section 1 (4) EStG applies to individuals who

- do not have a residence or habitual abode in Germany,

- have certain domestic income as defined in Section 49 EStG, and

- are not subject to unlimited income tax liability on application according to Section 1 (3) EStG (cross-border commuters) or

- extended unlimited income tax liability according to Section 1 (2) EStG.

For them, the tax is collected through tax deduction or by means of an assessment for limited tax liability.

Note: Special regulations apply to cross-border commuters from France, Austria, and Switzerland.

Numerous personal and family-related tax benefits are not taken into account in the assessment for limited tax liability, including:

- Spouse splitting (joint assessment) cannot be claimed.

- Widow's splitting in the year following the bereavement is not granted (Section 32a (6) EStG).

- Extraordinary burdens cannot be claimed for tax purposes (Sections 33, 33a, 33b EStG).

- A disability allowance and care allowance are not available to you (Section 33b EStG).

- Child allowance and allowances for care, education, and training are not granted (Section 32 EStG).

- The relief amount for single parents is not available to you (Section 24b EStG).

- The tax reduction for domestic help, household-related services, and craftsmen's services in a flat in the EU/EEA abroad has not been granted since 2009 (Section 35a EStG).

- Business expenses are generally only deductible if proven and if they are directly economically related to domestic income.

- However, the flat rate for business expenses of 1.230 Euro for income from employment is also taken into account if no higher business expenses related to the income are proven.

- For pension income, at least the flat rate for business expenses of 102 Euro is taken into account.

(2024): Who is subject to limited tax liability?

Ehegattensplitting for registered civil partnerships

The Federal Constitutional Court has ruled:

Registered civil partnerships are also entitled to joint tax assessment with the splitting tariff. The unequal treatment of same-sex marriages and "normal" marriages in spouse splitting is unconstitutional (BVerfG ruling of 7.5.2013, 2 BvR 909/06).

The legislator was obliged to amend the legal situation retroactively from 1.8.2001 - the day the Civil Partnership Act came into force. A new general clause was added to the Income Tax Act:

"The provisions of this Act for spouses and marriages also apply to civil partners and civil partnerships" (§ 2 para. 8 EStG).

The new regulation applies to all still open tax cases in which income tax has not yet been definitively assessed (§ 52 para. 2a EStG).

Further equalisation will take place from 1.1.2015 with the "Act to Revise the Civil Partnership Law" of 15.12.2004. This law further expands the legal equality of same-sex civil partners with spouses.

Please select "Same-sex marriage/civil partnership" as your marital status in Lohnsteuer kompakt.

Order for same-sex married couples

For same-sex married couples and registered civil partners who wish to submit a joint tax return (=joint assessment), the tax authorities have specified who should be entered as the taxable person:

- Enter the partner first in the tax return whose surname comes first in alphabetical order.

- If the surnames are the same, the alphabetical order of the first names decides.

- If the first names are also identical, the older partner should be entered as the taxpayer.

(2024): Ehegattensplitting for registered civil partnerships

Who is entitled to the widow's pension splitting (grace splitting)?

After the death of a spouse, many face financial and tax challenges. The so-called widow's allowance (grace allowance) helps during this difficult time by allowing the tax splitting rate in the year following the death. But who is entitled to the widow's allowance and how exactly does this special tax regulation work?

Conditions for the widow's allowance (grace allowance)

Who is entitled to the widow's allowance is clearly regulated. For the tax authorities to recognise the grace allowance, the following conditions must be met:

- At the time of death, the conditions for joint assessment must have been met. This means: Both spouses had their residence in Germany and were not permanently separated.

- A separation before the death of the spouse excludes the widow's allowance – even if a joint assessment was made for the year of death.

Important: Even the actual separation of the spouses before the death means that there is no entitlement to the widow's allowance. Mere joint assessment in the year of death is not sufficient (BFH ruling of 27.2.1998, BStBl. 1998 II p. 350; H 184a EStR).

How does the widow's allowance work in practice?

After the death of the spouse, the surviving spouse is assessed individually in the following year – in accordance with § 25 EStG.

However: Once and for the last time, the splitting rate is applied in the year after the death – even though it is formally an individual assessment. This is regulated in § 32a para. 6 no. 1 EStG.

Those entitled to the widow's allowance benefit from the more favourable tax classes and a reduced tax rate – and are thus not immediately financially burdened after the loss.

Purpose and advantage of the widow's allowance

The purpose of the widow's allowance (grace allowance) is to reduce the tax burden of the surviving spouse in the first year after the partner's death. Without this regulation, the switch to individual assessment would immediately lead to higher taxes – an additional hardship in an already stressful situation.

With the widow's allowance, the surviving spouse initially remains in a more favourable tax position, leaving more financial leeway for reorientation.

Conclusion: Who benefits from the widow's allowance?

In summary: Those entitled to the widow's allowance must have been in a legally recognised marriage at the time of death, without permanent separation. In the first year after the death, the splitting rate is granted for the last time – an important tax concession in a difficult phase of life.

Tip: Lohnsteuer kompakt automatically takes the widow's allowance (grace allowance) into account once the conditions are met. It is still worth checking the details in the tax assessment notice carefully.

(2024): Who is entitled to the widow's pension splitting (grace splitting)?