When and how can I transfer the BEA allowance?

With an amendment to Section 32 (6) sentence 6 of the Income Tax Act (EStG) from 2021, it has been stipulated that the transfer of the child allowance always also leads to the transfer of the allowance for care, education, or training needs (BEA allowance).

If you are separated from your partner, you can have their allowance transferred to you, or it will already be transferred by law.

However: Although the transfer of the child allowance through a legal fiction (Section 32 (6) sentence 6 EStG) always also leads to the transfer of the BEA allowance, the right to object remains - but only for minor children.

The transfer of the BEA allowance must be made in the "Form Child". The transfer is not possible if the child is registered at the homes of both parents. The parent obliged to pay maintenance, with whom the child is not registered, can object to the transfer of the BEA allowance for minor children if they bear childcare costs or regularly care for the child to a significant extent. If one parent does not sufficiently meet their maintenance obligations (at least 75 percent), the other parent can have the child allowance transferred to them. This also involves the transfer of the BEA allowance.

Example

The parents of Hans (12 years old) are separated. Hans is registered with his mother all year round.

Case 1: The father fulfils less than 75 percent of his maintenance obligation. The mother can have the child allowance transferred to her in this case. The BEA allowance is automatically transferred to the mother as well.

Case 2: The father fulfils his maintenance obligation. In this case, the mother can have the BEA allowance transferred to her, but not the child allowance.

(2024): When and how can I transfer the BEA allowance?

How can the child allowance for a grandchild or stepchild be transferred?

If the grandparents or stepparents have taken the child in, the child allowance can be transferred to them. The BEA allowance (allowance for care, education, or training needs) is automatically transferred to the grandparents or stepparents as well.

Since 2012, it has also been possible to transfer the allowances under certain circumstances if the child does not live with the grandparents. This applies if they have a maintenance obligation towards their grandchildren because the parents are without means.

For the transfer of the allowance, the consent of one parent or, in the case of jointly assessed parents, both partners is required. This consent is given in Form K of the tax return. Consent can be revoked at any time, but not for past calendar years.

(2024): How can the child allowance for a grandchild or stepchild be transferred?

Can I transfer the child allowance / BEA allowance to another person?

In certain cases, you can transfer your half of the child allowance and the half allowance for care, education, or training needs (BEA allowance) to the other parent. This is possible if you are not married, permanently separated, or divorced. However, a mutual agreement is not sufficient.

You, as the custodial parent, can apply for the transfer of the child allowance if the parent obliged to pay maintenance does not fulfil their maintenance obligation to at least 75 percent. In this case, you will receive not only the full child allowance but also the full BEA allowance automatically. Since 2012, the allowance can also be transferred if the other parent is not obliged to pay maintenance due to lack of financial capacity. If you are forced to support the child alone, you are also entitled to the full child and BEA allowance.

Important

Maintenance obligations are not only monetary. If the child lives with the respective parent, they are already fulfilling their maintenance obligation.

Regardless of the maintenance issue, the child allowance can also be transferred if one parent lives permanently abroad or if their residence is unknown.

The BEA allowance can also be transferred. However, due to a ruling by the BFH and a subsequent change in the law, the transfer of the BEA allowance has become very complex.

The previous administrative practice was that for both minor and adult children, the BEA allowance followed the transfer of the child allowance. The practical case was often as follows:

The child lives with parent Anna; parent Bruno does not pay maintenance and does not particularly care for the child. Parent Anna is therefore entitled to both allowances in full upon application.

However, the Federal Fiscal Court ruled that the BEA allowance to which parent Bruno is in principle entitled cannot be transferred to Anna after the child reaches adulthood, even in the event of a breach of maintenance obligations. This means that the single parent is denied half of the BEA allowance for the adult child, even though they bear the child's maintenance costs alone (BFH rulings of 22.4.2020, III R 61/18 and III R 25/19). This seems unfair, and so the legislator reacted: With an amendment to § 32 paragraph 6 sentence 6 EStG, it was stipulated that the transfer of the child allowance always also leads to the transfer of the BEA allowance - but only from 2021 onwards.

Up to this point, it is already quite complicated. But it gets even more complicated! Because the legislator did not change sentence 9 of § 32 para. 6 EStG, which states: "A transfer .... is excluded if the transfer is objected to because the parent with whom the child is not registered bears childcare costs or regularly cares for the child to a significant extent."

This means: Although the transfer of the child allowance by legal fiction (§ 32 para. 6 sentence 6 EStG) always also leads to the transfer of the BEA allowance, the possibility of objection for minor children remains. But which case is affected by this?

Example

A minor child lives with the mother. The father fulfils his maintenance obligation, so the mother cannot have half of the child allowance transferred. However, the mother believes that the father does not care for the child and applies for the transfer of the BEA allowance.

The father can object if he proves that he also bears childcare costs or cares for the child to a significant extent. In this case, the child allowance and BEA allowance remain half for each parent. This transfer with the corresponding right of objection is only available for minor children.

The question is when care is provided "to a significant extent". The law does not further explain the criterion of regular care "to a significant extent". However, the BFH has clarified what is meant by care "to a significant extent":

- This is the case if the time spent caring for the child by the parent obliged to pay maintenance amounts to an average of 10% per year, with other indicators in this case regularly being negligible (BFH ruling of 8.11.2017, III R 2/16).

- According to the BFH, the extent of care requires an overall assessment taking into account all objective circumstances of the individual case. The assessment may depend on a variety of factors that naturally vary in weight depending on the case. These include, in particular, the frequency and length of contact between the objecting parent and the child, which are in turn influenced by the child's age and the distance between the parents' residences. For reasons of simplification, the BFH arrives at the aforementioned limit of 10% of the time spent caring for the child.

If the child lives with grandparents or a stepparent, the child allowance and BEA allowance can also be transferred to them. This requires the application of one parent. This transfer can be revoked at any time with regard to future years. Parents who are jointly assessed may only transfer allowances to the grandparents together. In this case, please enclose the "Form K" with your tax return.

(2024): Can I transfer the child allowance / BEA allowance to another person?

What impact does my child's stay abroad have on the child allowance?

The child allowance and the BEA allowance (for care, education or training) are independent of the child's place of residence, as long as the parents are fully liable to income tax in Germany.

However, the child's place of residence affects the amount of the allowance: depending on the country, the allowance may be reduced by one, two or three quarters. The Federal Ministry of Finance classifies countries into groups to take into account the cost of living. This country grouping affects the child allowance, the BEA allowance, the training allowance and childcare costs.

Short-term stays abroad, such as holidays, do not lead to a reduction in the allowance, nor do temporary stays for training purposes.

For children living in the EU or EEA, there is still an entitlement to child benefit, provided that no comparable benefits are received abroad. Outside the EU and EEA, child benefit is only possible if the child retains a residence or stay in Germany.

The Federal Fiscal Court has ruled that a child who lives outside the EU or EEA for more than a year only retains their residence in Germany if:

- They have permanently suitable rooms available at their parents' home,

- They can use them at any time, and

- They regularly use the home during non-term times (holidays) (BFH ruling of 28.4.2022, III R 12/20).

Tip

For the retention of a residence in Germany during multi-year stays abroad, short visits to the parents are generally not sufficient. Financial difficulties of the child for home visits cannot compensate for missing stays in Germany during the holidays (BFH ruling of 25.9.2014, III R 10/14). The decisive factor is whether the child regularly spends the holidays at home with the parents. To prove this, parents and child should keep evidence (including train or flight tickets, passport copies and study plans).

Tip

The Federal Fiscal Court has ruled that a child does not give up their residence at the parents' home if a study abroad (e.g. in Australia or the USA) is initially planned for only one year. The entitlement to child benefit remains in this case.

In the case of a multi-year stay abroad, the child only retains their residence in Germany if they spend the majority of the non-term time in Germany (BFH ruling of 21.6.2023, III R 11/21).

If the child decides during the first year to stay abroad longer, the stricter criteria apply only from the time of the extension. Child benefit remains for the first year, even if the child does not return to Germany during this time.

The decisive factor is whether the child spends more than half of the free time in Germany after the extension. Missing home visits due to lack of money or travel restrictions can jeopardise the entitlement to child benefit, as the Bremen Finance Court emphasised (ruling of 7.3.2023, 2 K 27/21).

Note: For the sake of good order, it should be noted that there are special features regarding child benefit in connection with countries with which a social security agreement exists (e.g. Turkey).

(2024): What impact does my child's stay abroad have on the child allowance?

What is the child allowance?

Child benefit and child allowance are tax reliefs for expenses incurred by parents due to their children. The entitlement to child benefit exists automatically from birth but must be applied for in writing. It is not the children who are entitled to child benefit, but the parents or guardians responsible for the child's welfare.

Child benefit

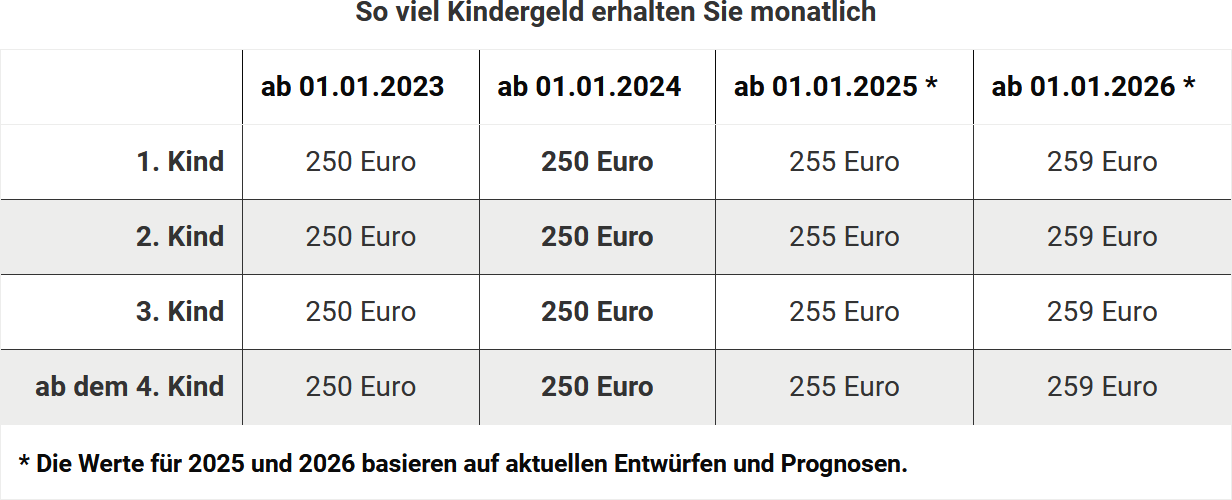

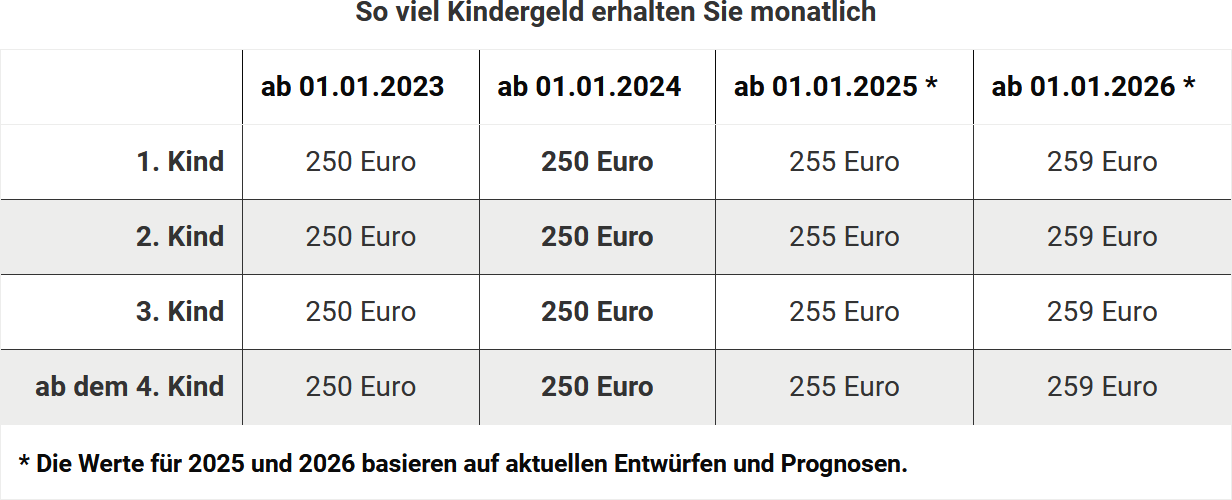

Child benefit is a monthly payment that parents usually receive from the family benefits office. Child benefit is not taxable. The amount of child benefit depends on the number of children.

Child allowance

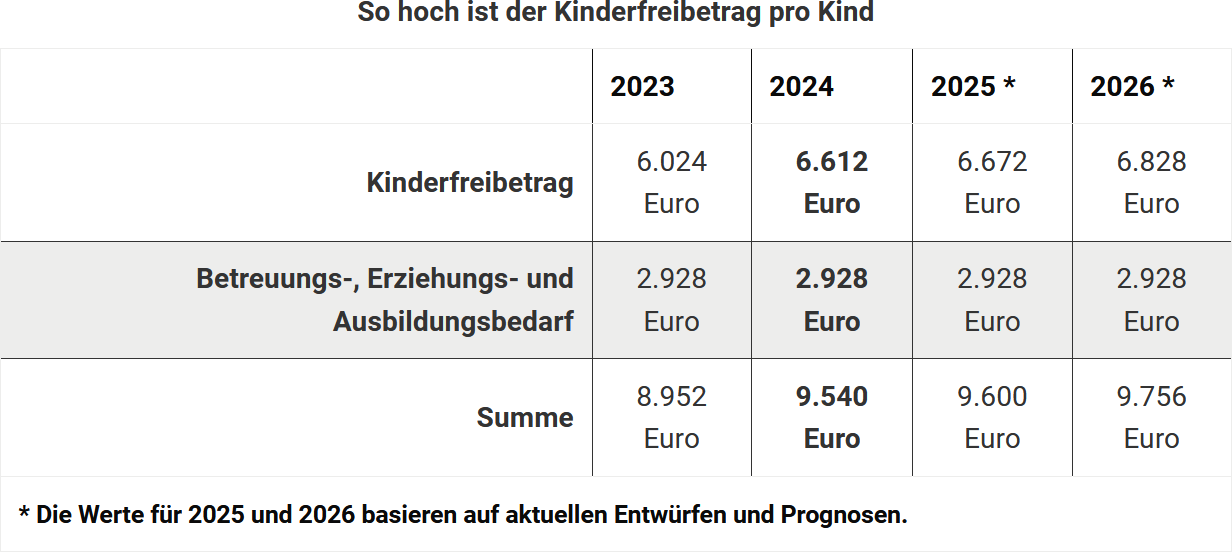

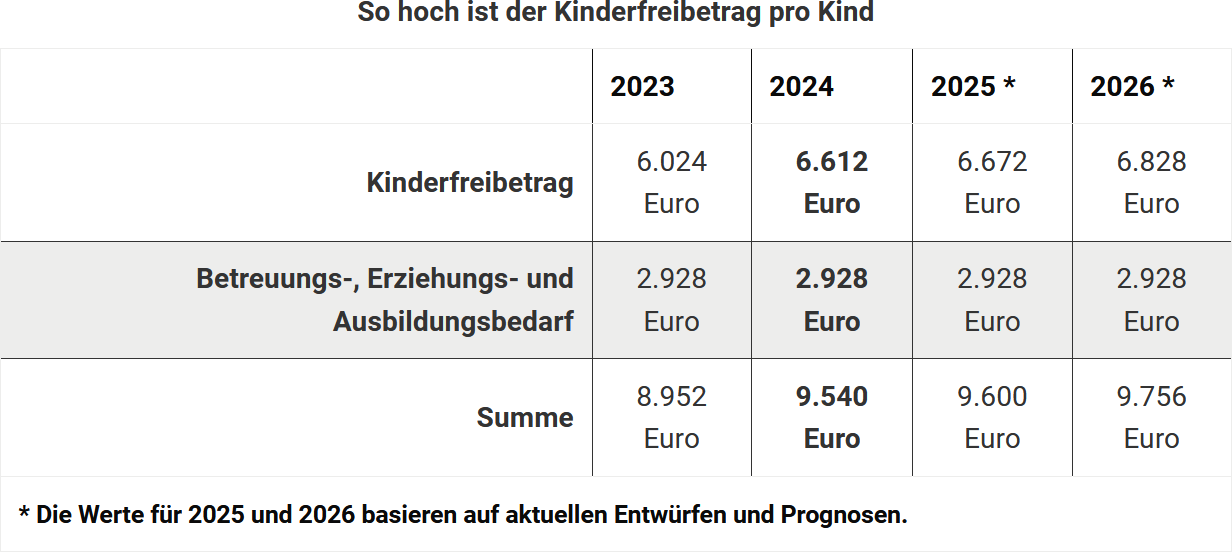

In contrast to child benefit, the child allowance is not paid out. The allowance is deducted from taxable income, thereby reducing income tax. The child benefit already paid monthly is an advance payment on the child allowance. In 2023, the child allowance is 6.024 Euro for jointly assessed parents, otherwise 3.012 Euro per parent. The BEA allowance (for care, education, and training needs) is 2.928 Euro.

Child benefit and child allowance are linked. The tax office automatically determines whether child benefit or the child allowance is more favourable for the taxpayer at the end of a tax year through a favourable assessment.

Entitlement to child allowance or child benefit

Parents are entitled to the child allowance from the birth of the child until the

- 18th birthday.

- 25th birthday if the child is still in education or training or doing voluntary service.

If the child is disabled and unable to support themselves, the entitlement to child benefit or child allowance is unlimited.

(2024): What is the child allowance?