How much church tax will I save if I leave the church?

Leaving the church reduces your tax burden as you no longer pay church tax. However, the full saving only becomes apparent when you consider the tax benefit of the special expenses deduction. Here you can find out how to calculate your actual savings.

Church tax and special expenses deduction

Church tax is considered a special expense and can be fully deducted in your income tax return. This reduces your taxable income and lowers your income tax. Alternatively, you can claim a general allowance for special expenses, which is 36 Euro for singles and 72 Euro for couples. If your church tax paid exceeds this amount, you benefit from an additional tax advantage.

Example calculation for couples:

- Church tax paid: 600 Euro

- Less allowance: 72 Euro

- Deductible amount: 528 Euro

With a marginal tax rate of 28%, the tax saving is 528 Euro × 28% = 147 Euro. Additionally, the solidarity surcharge is reduced by approximately 8 Euro, so the total tax relief is around 155 Euro.

Actual savings from leaving the church

If you leave the church, the church tax is no longer applicable, but neither is the tax benefit. The actual savings result from the difference:

- Church tax paid: 600 Euro

- Tax relief through deduction: 155 Euro

- Actual savings: 600 Euro – 155 Euro = 445 Euro

Conclusion

The amount of actual savings from leaving the church depends on the church tax you paid, your income, and your marginal tax rate. While church tax is completely eliminated at first glance, you should consider the lost tax benefit of the special expenses deduction. An accurate calculation will help you realistically assess the financial impact of leaving the church.

(2024): How much church tax will I save if I leave the church?

The "special church fee": Obligation to pay church tax for a non-denominational spouse.

In Germany, individuals who are members of a religious community that collects taxes are generally subject to church tax. This applies regardless of the intensity of one's faith or participation in religious life, as formal membership is the determining factor. But what happens in a marriage if only one spouse belongs to a religious community that collects taxes? In such cases, the so-called special church fee may apply, a special form of church tax. This article explains the key regulations and current legal rulings on this topic.

Church tax obligation: Basics of membership

In Germany, church tax is paid by members of a religious community that collects taxes, provided they have their residence or usual place of abode in Germany. Those who do not belong to such a community are exempt from church tax. In practice, however, it often happens that only one spouse in a marriage is subject to church tax. This raises the question of whether and how the non-religious partner is involved in the tax obligation.

Special church fee: Definition and requirements

The special church fee is a specific form of church tax that is levied in interfaith marriages under certain conditions. It applies if:

- the church member spouse does not earn any income,

- the church member spouse has an income, but it is so low that no income tax (and therefore no church tax) is due, or

- the income of the church member spouse leads to church tax, but the comparative calculation results in a higher special church fee.

Basis for calculating the special church fee

The special church fee is calculated based on the joint taxable income of both spouses. The following applies:

- It is only levied in the case of joint assessment, not in the case of individual assessment.

- The basis for assessment is the couple's income, regardless of whether the church member spouse earns an income or not.

- It is only levied from a joint taxable income of 30.000 Euro.

This regulation is based on the assumption that spouses are considered an economic unit. The Federal Constitutional Court (BVerfG) has confirmed this practice as constitutional (BVerfG decision of 28.10.2010, 2 BvR 591/06).

Legal rulings and current developments

European Court of Human Rights (ECHR)

In 2017, the ECHR confirmed that the German practice of collecting church tax and the special church fee in interfaith marriages does not violate the European Convention on Human Rights (ECHR) (ECHR decision of 6.4.2017, complaint no. 10138/11 et al.). The court emphasised that church tax regulations fall within the scope of religious freedom and state legislation.

Saxon Finance Court

In 2019, the Saxon Finance Court declared that the regulations on the special church fee in Saxony for the tax years 2014 and 2015 violated the principle of equal treatment. Spouses were disadvantaged compared to registered civil partnerships without any objective reason (decision of 25.3.2019, 5 K 1549/18).

Federal Finance Court (BFH)

In 2021, the BFH clarified that even in cases where the church member spouse earns an income, the collection of the special church fee is constitutionally unproblematic (BFH decision of 5.10.2021, I B 65/19). This is particularly true if the income of the non-religious partner is significantly higher, leading to an assumed higher standard of living for the church member spouse.

Regional differences and special regulations

The collection of the special church fee varies depending on the federal state. In Bavaria, the Evangelical Lutheran Church and the Evangelical Reformed Church have completely waived the collection of the special church fee retroactively from the 2018 tax year (decree of the Bavarian State Ministry of Finance of 21.1.2019, BStBl I 2019 p. 213). Such regulations highlight the heterogeneity of church tax collection in Germany.

Conclusion

The special church fee is often a controversial topic, especially in interfaith marriages, and can lead to misunderstandings. It is generally only levied if the church member spouse either has no income or only a low income. The calculation is based on the joint income, which is considered justified by the courts. Differences in collection between federal states, however, require careful examination in individual cases.

(2024): The "special church fee": Obligation to pay church tax for a non-denominational spouse.

How can I reduce my church tax by claiming child benefit?

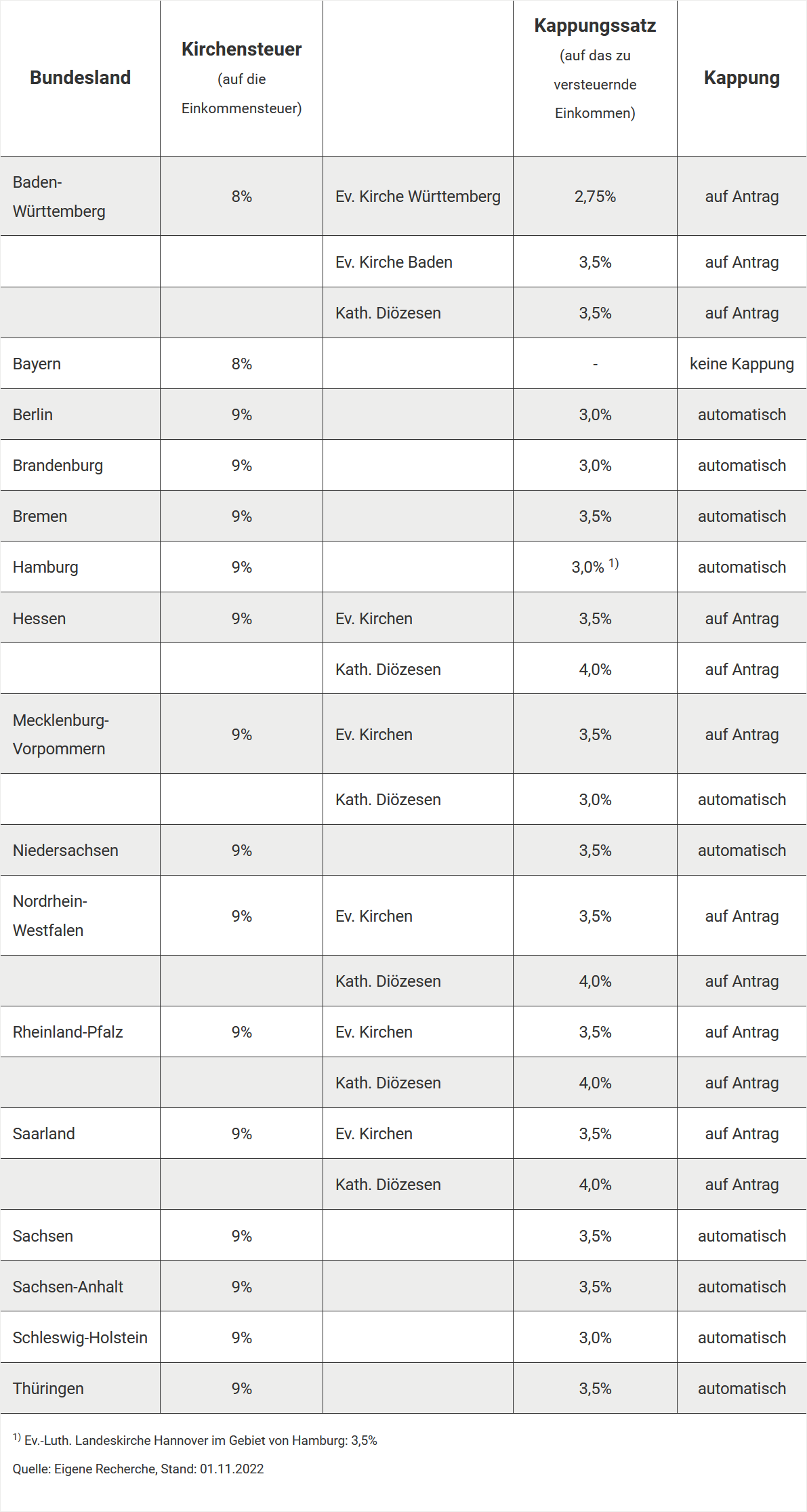

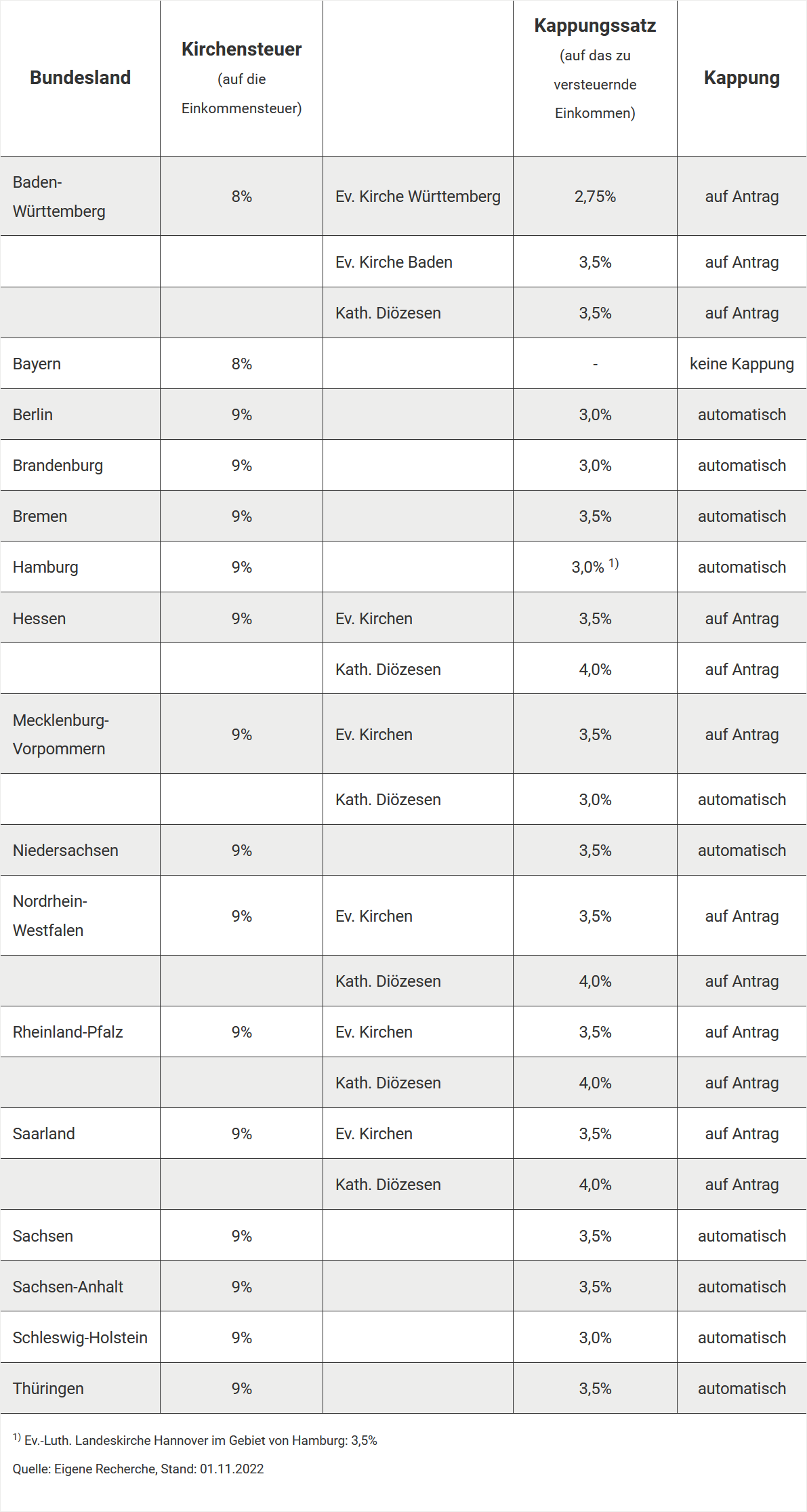

The amount of church tax depends on your place of residence. In Bavaria and Baden-Württemberg, church members pay 8 percent of the assessed income tax, while in other federal states it is 9 percent.

Please note: Church tax is also taken into account at the same rate for capital gains tax. For employees with child allowances in the electronic wage tax deduction features (ELStAM), church tax is calculated based on a so-called notional wage tax.

Beispiel

Church tax without child allowance: You live in Berlin and have a gross monthly salary of 3.000 Euro in tax class IV. Your monthly church tax is 29.63 Euro.

Church tax with two child allowances: You live in Berlin and have a gross monthly salary of 3.000 Euro in tax class IV. Your monthly church tax is now 11.21 Euro.

Important: Child allowances do not reduce the monthly income tax, but only reduce the monthly church tax and solidarity surcharge. This also applies if you receive child benefit at the same time.

Child allowances in the income tax return

In the income tax assessment, child allowances only reduce the taxable income if the tax advantage is greater than the child benefit received. However, for the calculation of church tax and the solidarity surcharge, the allowances are taken into account "notionally".

Advantage in case of mid-year change

Even if children are only to be considered for part of the year (e.g. in the case of birth or end of education), the full child allowance is always deducted for church tax and the solidarity surcharge.

(2024): How can I reduce my church tax by claiming child benefit?

Who is required to pay church tax?

If you are a member of one of the following religious communities, you must pay church tax:

- Roman Catholic Church

- Protestant regional churches

- Old Catholic Church

- Jewish religious communities

- Israelite religious communities (e.g. in Baden-Wuerttemberg)

- Free religious communities (e.g. in Baden, Wuerttemberg, Mainz, Offenbach, Palatinate)

- French Church in Berlin (Huguenot Church)

- Mennonite congregation in Hamburg-Altona

- Unitarian religious community of free Protestants in Rhineland-Palatinate

The amount of church tax depends on your place of residence. If you live in Bavaria or Baden-Wuerttemberg, you pay 8 percent, in the other states 9 percent of income tax or wage tax.

(2024): Who is required to pay church tax?

When am I required to pay church tax?

The church tax obligation begins with baptism or upon joining or rejoining the religious community. In this case, you must pay the church tax from the beginning of the following month.

If you change religious communities, the obligation to pay church tax also begins at the start of the following month. However, it only starts once you no longer pay church tax to your previous religious community.

In the Jewish community, the church tax obligation is based on descent and confession.

(2024): When am I required to pay church tax?

How much is the church tax?

The amount of church tax depends on your place of residence. In Bavaria and Baden-Württemberg, church members pay 8 per cent of the assessed income tax, while in other federal states it is 9 per cent. This percentage calculation also applies to the withholding tax.

If you have children or income from business operations or income taxed under the partial income procedure, the taxable income (zvE) for church tax is calculated separately.

Child allowances and church tax

If child allowances are entered in your electronic wage tax deduction features (ELStAM), the church tax is calculated based on a so-called notional wage tax. This leads to a lower monthly church tax and solidarity surcharge, but not to a reduction in wage tax.

Examples

Without child allowance: Gross monthly salary of 3.000 Euro in tax class IV, monthly church tax in Berlin: 29,63 Euro.

With two child allowances: Gross monthly salary of 3.000 Euro in tax class IV, monthly church tax in Berlin: 11,21 Euro.

Child allowances in the income tax return

In the income tax assessment, child allowances only reduce the taxable income if the tax advantage is higher than the child benefit received. However, for the calculation of church tax and the solidarity surcharge, the child allowances are taken into account "notionally".

Advantage in case of mid-year change

Even if children are only considered for part of the year (e.g. at birth or end of vocational training), the full child allowance and BEA allowance are deducted for the calculation of church tax and the solidarity surcharge.

(2024): How much is the church tax?

When can I deduct church tax as special expenses?

If you are a member of a church, you can deduct the church tax as special expenses. Prepaid or additional church tax can also be claimed for tax purposes.

If you are a member of a religious community that does not levy church tax, you can deduct payments to them “as church tax” – i.e. 8 or 9 percent of income tax, depending on the federal state. However, the church must be recognised as a public corporation in at least one federal state. A receipt is required. Examples of such religious communities include the New Apostolic Church, the Evangelical Free Churches, the Greek Orthodox Metropolis, the Independent Evangelical Lutheran Church, the Methodist Episcopal Church, the Salvation Army, and Jehovah's Witnesses.

Payments that exceed the corresponding church tax can be claimed as donations for church purposes.

Under new legislation, church tax payments to religious communities in an EU/EEA state are also recognised as special expenses.

If the religious community is not recognised as a public corporation, you can deduct your contributions up to 20 percent of the total income as donations for "the promotion of religious purposes". You must enter this information in the “Donations” section. This applies, for example, to the Old Buddhist Community.

The Scientology Church is not a religious community.

(2024): When can I deduct church tax as special expenses?

From when do you no longer have to pay church tax after leaving the church?

Church tax liability ends:

- at the end of the calendar month if the place of residence or usual abode in Germany has been given up.

- at the end of the month of death if the church member dies.

- when the church member declares their resignation from the church. Different authorities are responsible for the declaration of resignation in the various federal states; in most cases, it is made at the registry office, otherwise at the district court; only in the federal state of Bremen also at the church. Depending on the federal state, the resignation from the church is effective from the calendar month in which the resignation was declared, or from the following calendar month.

Note

In the past, there was a so-called "month of repentance" in some federal states, i.e. church tax liability ended one month after the month of resignation. This applied to Berlin, Brandenburg, Bremen, Hamburg, Hesse, Mecklenburg-Western Pomerania, Saxony, Schleswig-Holstein, Thuringia.

However, the month of repentance has now been abolished to standardise church tax regulations across Germany, i.e. the resignation from the church becomes effective in the calendar month in which it was declared.

After resigning from the church, the registration office automatically informs the relevant tax office so that it can change the electronic wage tax deduction features (ELStAM). Therefore, no church tax will be deducted from your monthly salary after your resignation.

The cost of resigning from the church - resignation fees

In Berlin, Brandenburg and Bremen, resignation is free of charge. In the other federal states, you have to pay between 10 and 60 Euro for the certificate of resignation from the church.

(2024): From when do you no longer have to pay church tax after leaving the church?

What is the advantage of capping the church tax?

If you belong to a religious community that collects taxes, you are obliged to pay church tax. The church tax is a supplementary levy on income tax and is generally based on your place of residence.

- 8 per cent of the assessed income tax in Bavaria and Baden-Württemberg

- 9 per cent in all other federal states

The basis for calculation is always the assessed income tax, not the taxable income. The higher the income tax, the higher the church tax.

Example (2024):

- Income tax: 52.397 Euro

- Church tax (9 per cent): 4.715 Euro

Capping of church tax for high incomes

For high incomes, the church tax can sometimes be disproportionately high. To limit this, the church tax laws of the federal states provide for the possibility of so-called capping. The reduced church tax resulting from this is referred to as the capping tax.

As part of the capping, the church tax is no longer calculated as a percentage of the income tax but is capped at a fixed percentage of the taxable income. This percentage – the so-called capping rate – varies depending on the federal state and ranges between 2.75 per cent and 4.00 per cent.

Example (Berlin, 2024):

- Taxable income: 150.000 Euro

- Income tax: 52.397 Euro

- Normal church tax (9 per cent): 4.715 Euro

- Capping rate Berlin: 3 per cent

- Capping tax (limit): 4.500 Euro

Result: In this case, the capping results in a saving of 215 Euro on the church tax.

Automatic or requested capping?

Whether church tax capping occurs automatically or requires a separate application depends on the federal state. In some states, the capping tax is automatically taken into account in the tax calculation. In others, an application to the relevant church is necessary.

Application for church tax capping

In federal states without automatic capping, you must submit an informal application for capping tax. The application should be addressed to your relevant diocese (for Catholic denomination) or regional church (for Protestant denomination).

You should enclose a copy of your latest income tax assessment with the application. This is the only way to check whether capping can be granted and how high the maximum church tax (i.e. the capping tax) may be.

Note: The capping is not processed through the tax office but directly through the church.

Conclusion: The capping tax can lead to significant relief for high incomes. Check whether your federal state provides for automatic capping or whether you need to take action yourself.

(2024): What is the advantage of capping the church tax?