With Lohnsteuer kompakt, you can send messages directly to your tax office. This is particularly helpful if you need to submit additional documents, request an extension, lodge an appeal against your tax assessment, or send a general message. This guide will take you through the process step by step.

What messages can you send to the tax office?

Depending on your request, the following options are available to you:

- Apply for an extension of the deadline: If you are unable to submit your tax return on time and need more time.

- Submit additional documents: Only if explicitly requested by the tax office.

- Lodge an appeal: If you disagree with the tax office's calculation and require corrections.

- Other message: If you have a concern that does not fall into one of the above categories.

Important information:

- To send a message to your tax office, you must always provide your tax number and your tax identification number.

- An extension of the deadline can only be applied for tax returns for the current or immediately preceding tax year, provided they have not yet been submitted to the tax office.

- The submission of additional documents or an appeal is only possible if you have already submitted the tax return using Lohnsteuer kompakt.

- Documents should only be submitted if the tax office explicitly requests them. Otherwise, it is not necessary to send documents unsolicited.

- An other message is only possible if you have created at least one tax return in Lohnsteuer kompakt.

What messages can you send to the tax office?

Step-by-step guide to creating a message

Step 1: Access mailbox

Go to Lohnsteuer kompakt and log in with your credentials.

Open the mailbox and select the "Tax Office" option under "New Message".

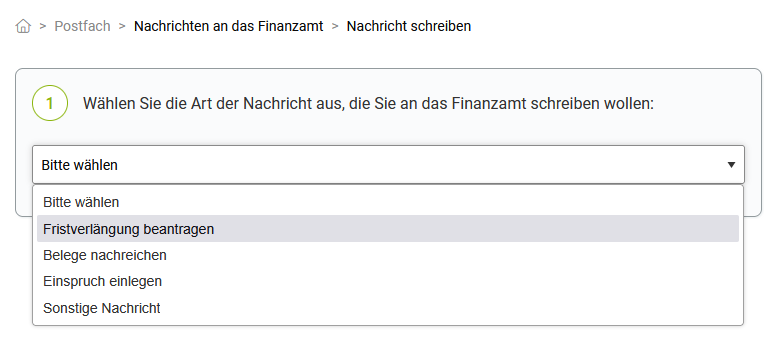

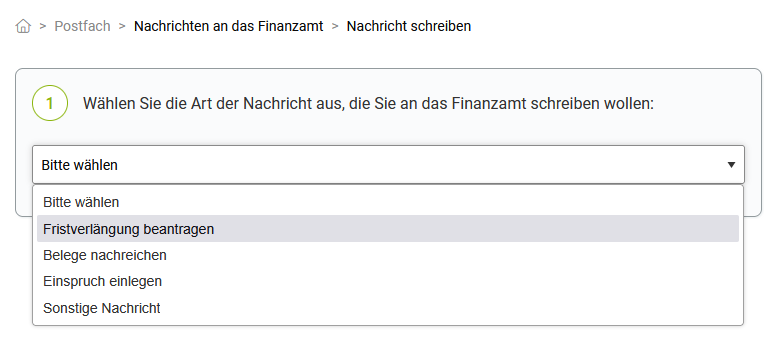

Step 2: Select message type

Select the type of your message:

- Apply for extension: If you cannot submit your tax return on time and need more time.

- Submit documents: If you need to submit documents later because the tax office requests them.

- Lodge an appeal: If you disagree with the tax office's calculation and request corrections.

- Other message: If you have a concern that does not fall into one of the above categories.

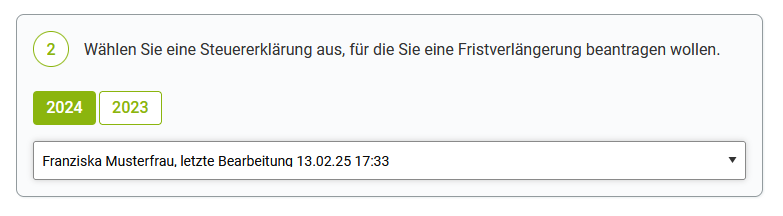

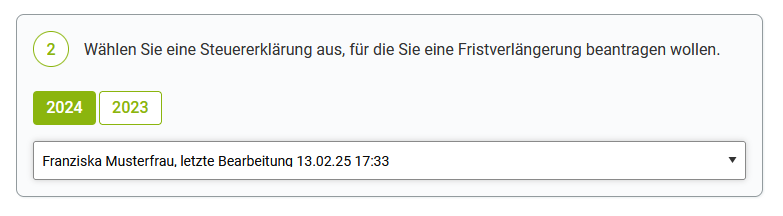

Step 3: Select tax return

Since each message must be assigned to a tax return, select the appropriate tax return from the list.

The basic data, such as name, address and tax number, will be automatically transferred if they are stored in the selected tax return.

Notes:

- An extension can only be applied for tax returns for the current or the immediately preceding tax year, provided they have not yet been submitted.

- You should only use the option "Submit documents" if the tax office explicitly requests documents.

- For appeals, you can only select tax returns that have already been submitted.

- For an other message, you can select any tax return.

Example: Do you want to submit documents for your 2023 income tax return? Then select this from the list.

Step 4: Compose message and enter data

Fill in the mandatory fields, including Name, Tax ID and Tax Office.

Enter the subject and message, e.g. a reason if you wish to lodge an appeal against your tax assessment.

If necessary, upload PDF documents as attachments.

Important:

- You can only send unencrypted PDF files to the tax office (max. 10 MB per PDF file, max. 100 pages per PDF).

- Larger uploads are automatically compressed if possible, so that sending large files via Lohnsteuer kompakt is still possible.

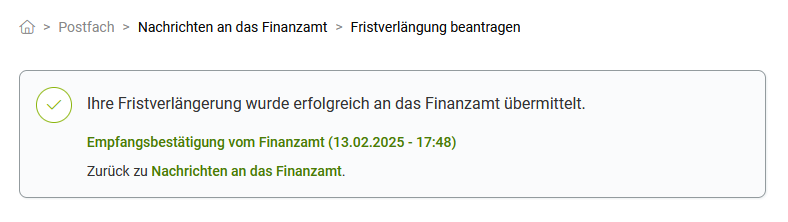

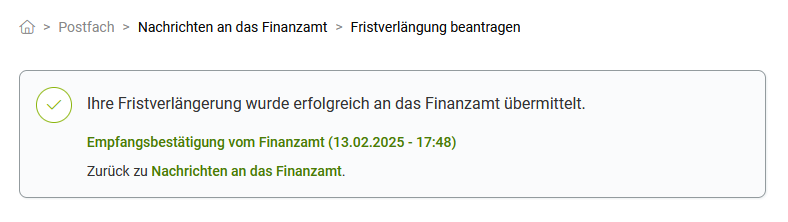

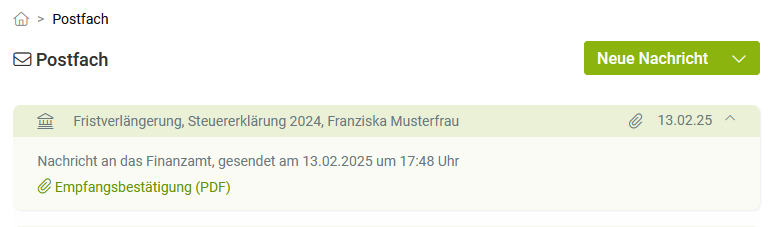

Step 5: Review and send

- Carefully check all details.

- Confirm the sending of your message.

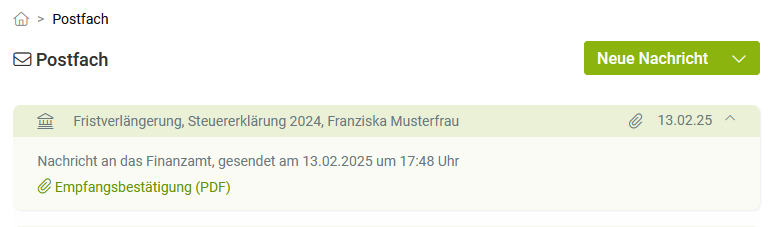

- You will receive a confirmation of sending and receipt.

- You can also retrieve the confirmation of sending and receipt at any time later in your mailbox.

Step-by-step guide to creating a message

Example texts for your message

Example 1: Application for an Extension

Dear Sir or Madam,

I hereby apply for an extension for submitting my income tax return 2024 until 30.09.2025. The reason: I am still missing necessary documents.

Kind regards

Max Mustermann

Example 2: Appeal Against the Tax Assessment

Dear Sir or Madam,

I hereby appeal against my income tax assessment for 2024. The reason: The work-related expenses were not correctly taken into account.

I request a re-examination of the assessment.

Kind regards

Max Mustermann

Example 3: Submission of Documents

Dear Sir or Madam,

I am submitting the missing documents for my income tax return 2024. Please add them to my tax file.

Kind regards

Max

Example texts for your message