How does the online submission with identification work?

With online submission with identification, Lohnsteuer kompakt digitally signs your tax return on your behalf.

The electronic document is transmitted directly to the tax authorities via a secure internet channel and processed as a legally valid tax return. This is also the usual procedure when tax advisors submit their clients' tax returns to the tax office.

For security reasons, you must digitally identify yourself to use this submission option to prevent misuse. Identification is legally required under section 87d of the Fiscal Code.

Identification and activation of the submission option can be done in one of the following ways:

(1) Identification via data retrieval from the tax office

If you have activated electronic data retrieval in Lohnsteuer kompakt, the tax return can be submitted immediately. The master data of the tax account holder (e.g. name, address, date of birth, tax identification number) stored by the tax authorities is checked against the information in the tax return for identification purposes. Activation of data retrieval at the tax office is a one-time process and takes up to 2 weeks.

(2) Identification via PayPal

If you used PayPal for payment, the PayPal status "verified" is used for identification in conjunction with the data stored with PayPal (name, address). After successful payment with PayPal in conjunction with the PayPal status "verified", the online submission is immediately available to you.

(3) Identification via customer service

Customer service conducts an identity check after copies of the German identity card, residence permit or passport have been uploaded. The copies must show the front and back of the document as well as the current address. If the address is missing, a registration certificate or a copy of a utility bill showing the current address is required. In addition, the customer must upload a selfie with the ID card, showing them together with the ID card.

Other restrictions:

- A maximum of two tax returns per tax year can be submitted without your own certificate.

How does the online submission with identification work?

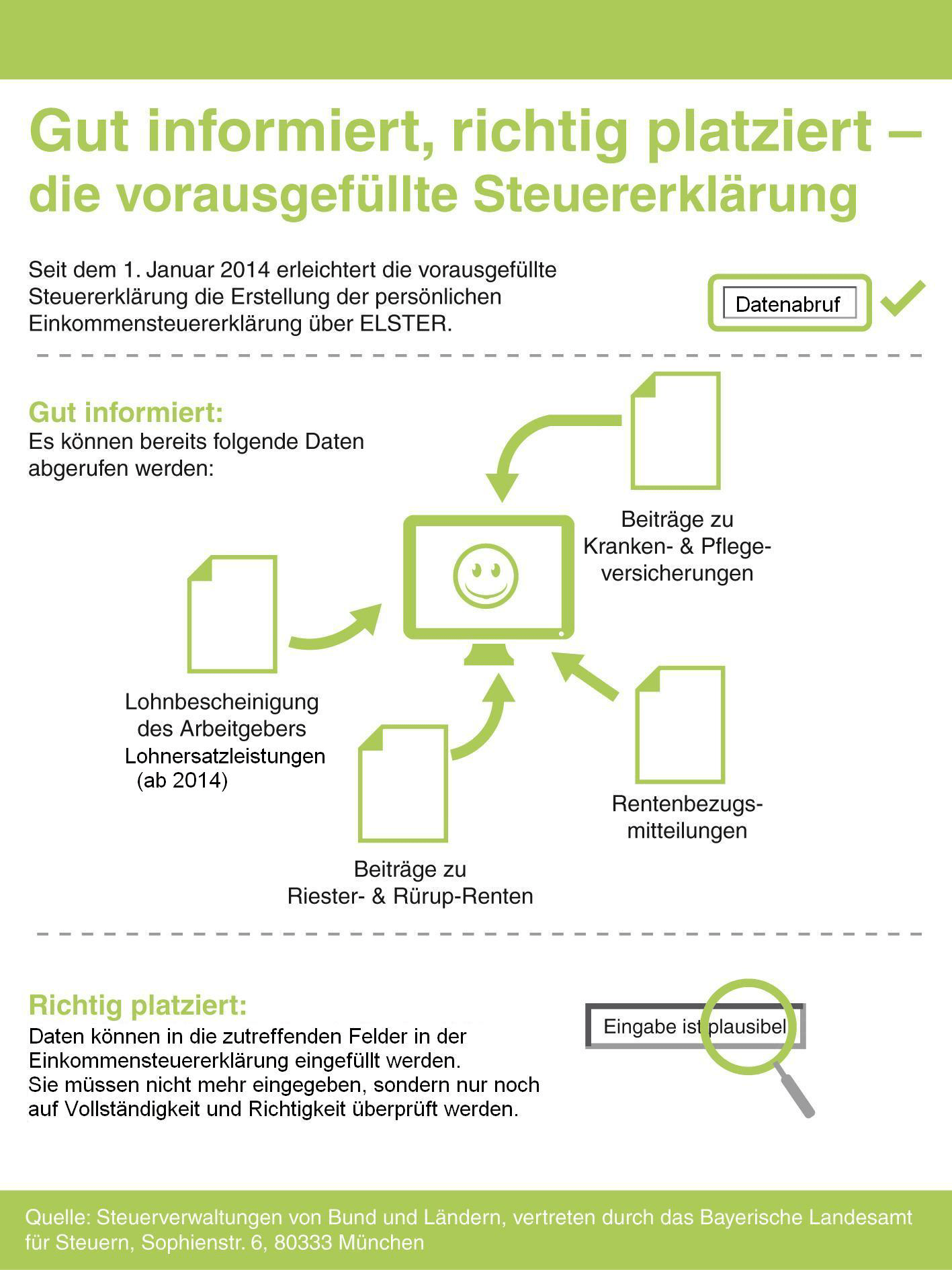

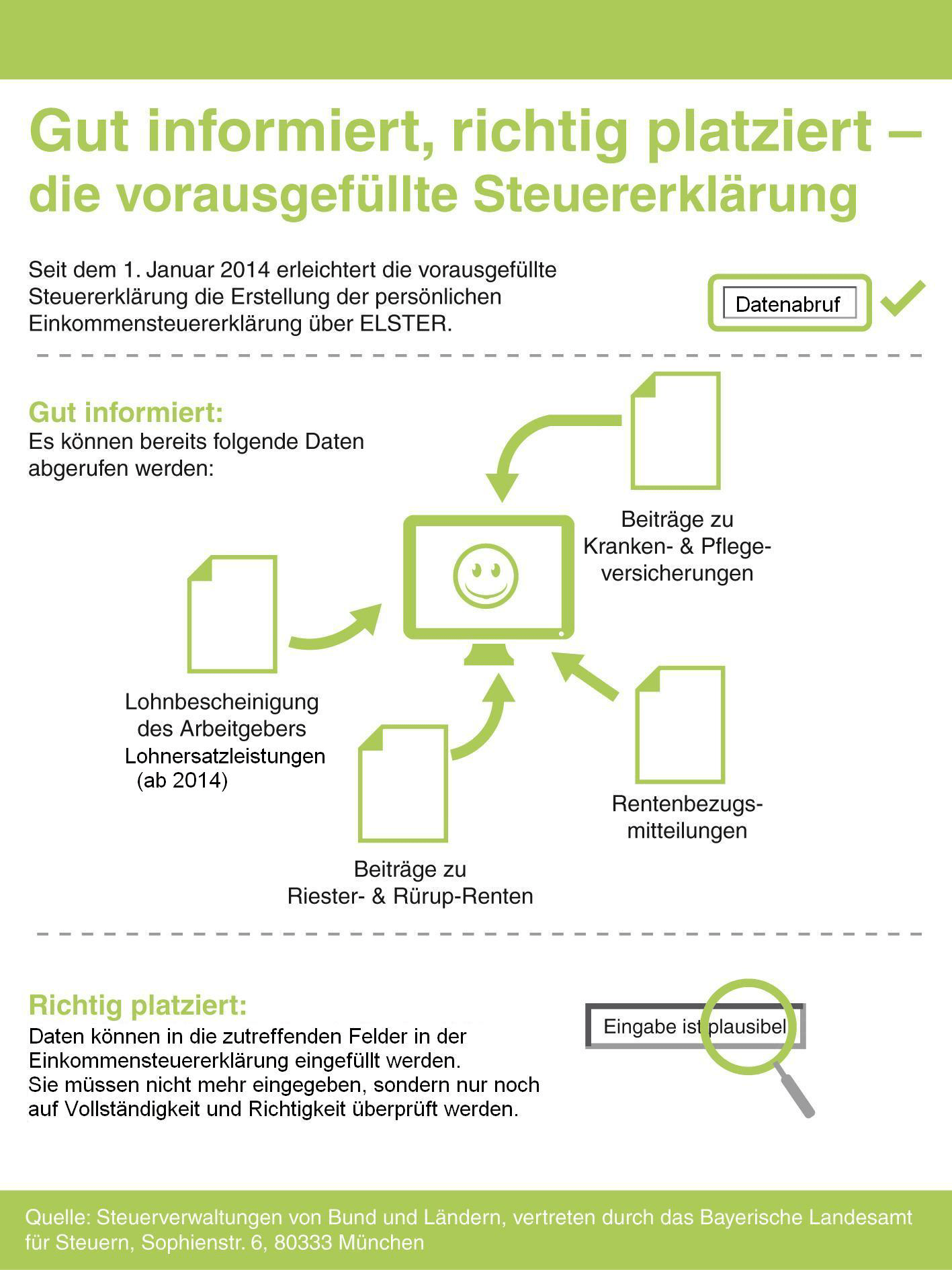

How does data retrieval assist with online tax returns?

Data retrieval is a service offered by Lohnsteuer kompakt. Through data retrieval, you can access personal data stored about you at your tax office and import it directly into your tax return. The tax authorities also refer to the data provided as the "pre-filled tax return" (VaSt). (More information at: What is data retrieval?)

Once you have activated data retrieval in Lohnsteuer kompakt, you can immediately use the online submission for your tax return. The master data of the tax account holder (e.g. name, address, date of birth, tax identification number) stored by the tax authorities is checked against the information in the tax return for identification purposes.

Additionally, the data provided can be transferred to your income tax return in Lohnsteuer kompakt with just a few clicks. You do not need to enter the data yourself, and many fields are automatically filled with the correct values from the data retrieval, thus largely avoiding input errors. You only need to check the transferred data for accuracy.

How does data retrieval assist with online tax returns?