When can I claim relocation expenses as income-related expenses?

If your move is work-related, you can deduct the resulting costs as income-related expenses. A work-related reason is given in the following cases:

- Your employer relocates.

- You move because you have changed employers.

- Your employer has transferred you.

- You significantly reduce the distance between your home and workplace by moving. The daily travel time should be reduced by at least one hour.

- You move into or out of a company flat.

- You move to the place of work to end a second household.

The Hamburg Fiscal Court recently ruled that moving costs can also be considered work-related if the move leads to a significant improvement in working conditions, without a reduction in travel time or a change of job. This relief can be particularly applicable for the year 2020, which was affected by the COVID-19 pandemic. A move is considered work-related if it is to set up separate workrooms for both spouses in the new home, allowing them to work undisturbed from home. (Judgment of the Hamburg Fiscal Court, 23.02.2023, Case No: 5 K 190/22, Revision VI R 3/23).

(2024): When can I claim relocation expenses as income-related expenses?

What relocation expenses can I deduct?

If your move is work-related, you can claim the following expenses as income-related expenses:

Transport costs

- This includes your expenses for a moving company in full for all moving goods. Fees for no-parking signs at the loading or unloading location can also be deducted as transport costs.

- If you move without a freight forwarder, you can deduct the costs for a rental vehicle including mileage allowance, expenses for using your own vehicle at the travel expense rate, and the cost of packaging materials. If you pay wages to friends who help, you can also deduct these expenses.

Travel expenses

- On the moving day, you can claim travel expenses as for an external activity. If you travel by your own vehicle, you can apply the business travel allowance of 30 cents per kilometre. If you use public transport, the tax office accepts the actual costs incurred with proof.

- During the move, you can also claim meal allowances for yourself and your household members moving with you at the rates for external activities as moving expenses. If you can prove accommodation costs incurred from the days of loading to unloading the moving goods, you can also deduct these.

Double rent payments

- If you have to pay double rent due to the notice period of your old rental apartment, even though you already live in the new apartment, you can deduct the rent payments for the old apartment as income-related expenses from the day you move out until the end of the rental period.

- This also applies to additional costs. If you have already rented the new apartment but are not yet living in it, you can deduct the rent payments for the new apartment as income-related expenses.

Furnishings

- Expenses previously covered by allowances for a cooker or stoves for each room of a flat are included in the newly adjusted allowance for other moving expenses (§ 10 BUKG) from 1.6.2020 and are therefore no longer listed separately. In particular, the abolition of allowances for heating stoves is appropriate, as stove heating is outdated and no longer relevant in practice.

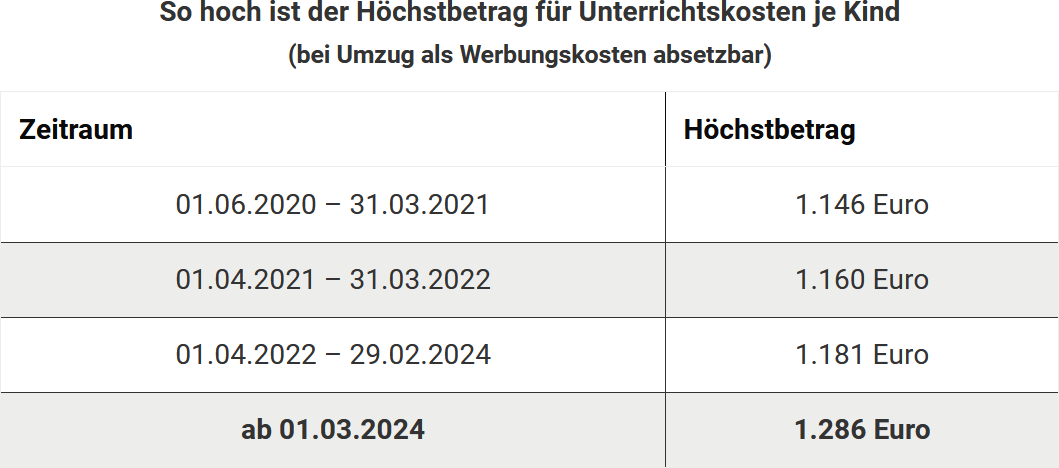

Relocation-related tutoring

- If your children need to change schools and tutoring is required, you can deduct the costs.

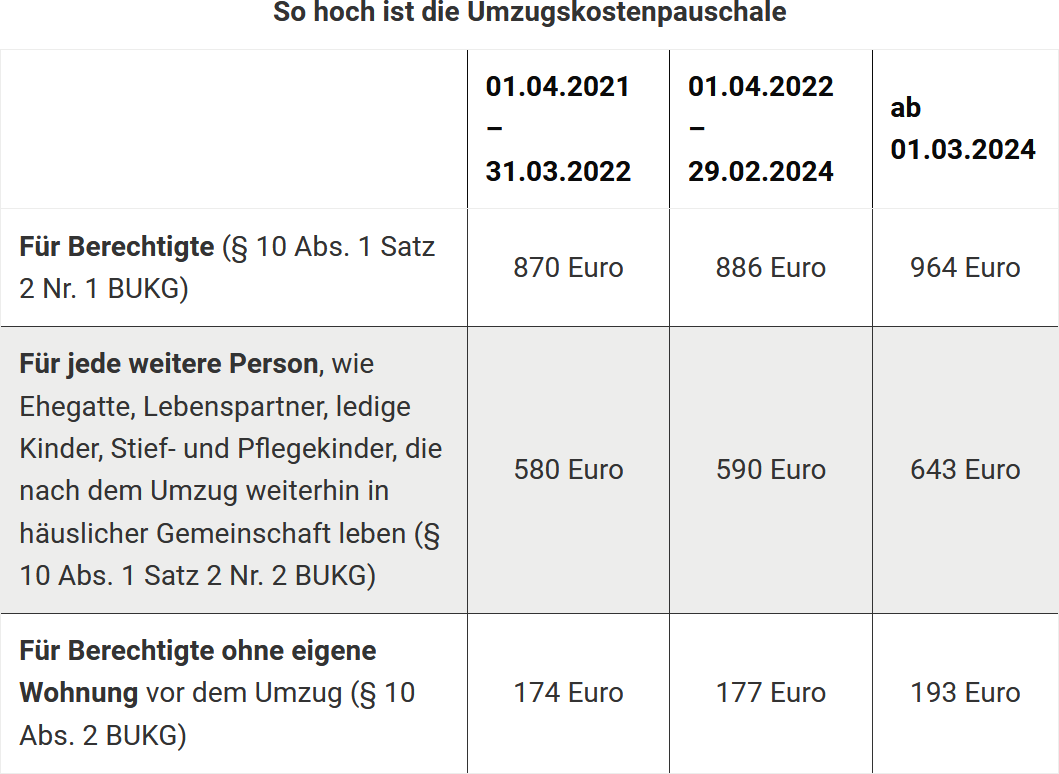

Moving expense allowance for "other moving expenses"

- In addition to these actual costs, there is a moving expense allowance (lump sum for other moving expenses) for which no receipts are required. A table and detailed explanation are provided in the following section.

(2024): What relocation expenses can I deduct?

What is the relocation allowance?

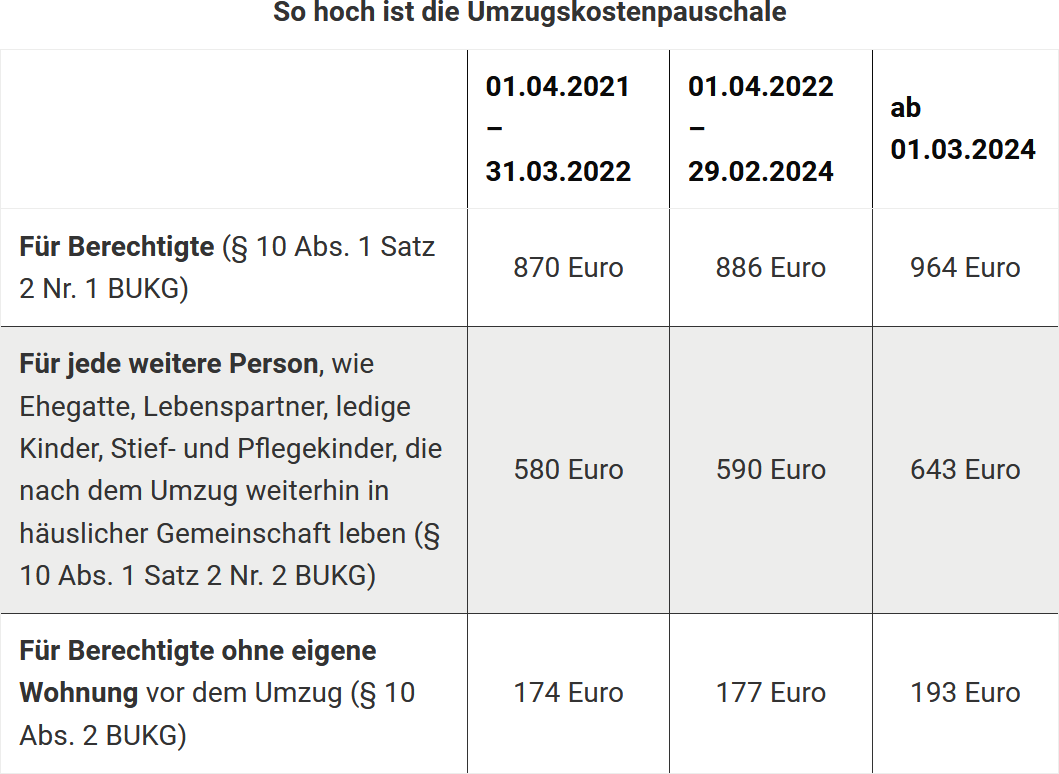

For a work-related move, you can deduct the moving expenses as income-related expenses or have them reimbursed tax-free by your employer. Moving expenses include transport costs, travel expenses, double rent payments, estate agent fees for a rental property, and other moving expenses.

While the aforementioned costs can be deducted in the amount proven, other moving expenses can be claimed with a lump sum for other moving expenses.

The Federal Ministry of Finance has recently increased the moving expense allowances for work-related moves from 1 April 2022 (BMF letter dated 21.7.2021, IV C 5 - S 2353/20/10004).

Lohnsteuer kompakt

There is one detail you should be aware of: For moves, the day before the loading of the removal goods is decisive for calculating the allowances.

The moving allowance covers:

- Tips for removal men and other helpers. This also includes, for example, inviting friends to a meal as a thank you for their help with the move.

- Professional assembly and disassembly of lamps, fitted kitchens, and other electrical appliances.

- Professional installation and alteration of curtains, blinds, and their fittings.

- Re-registration fees.

- Advertisements for house hunting.

- Costs for cosmetic repairs in the old flat, provided you are contractually obliged to cover them (but not cosmetic repairs in the new flat, as these are privately incurred).

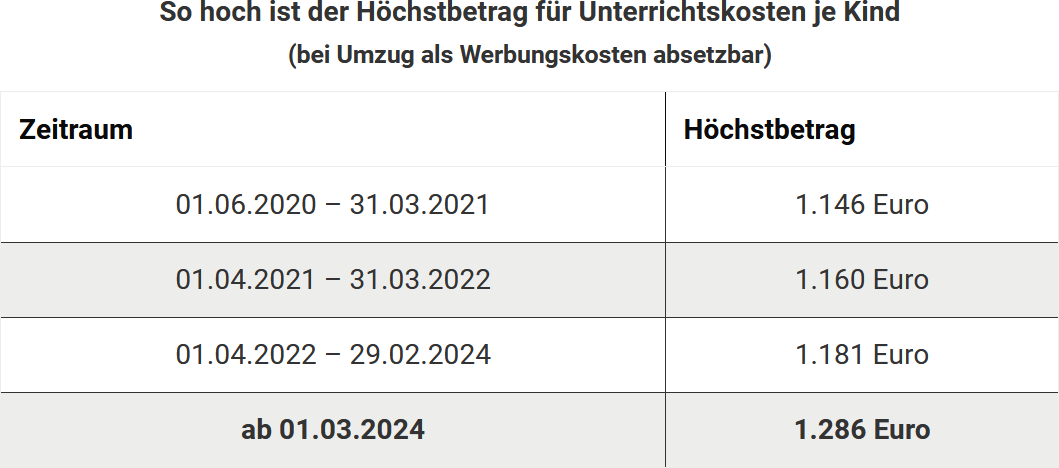

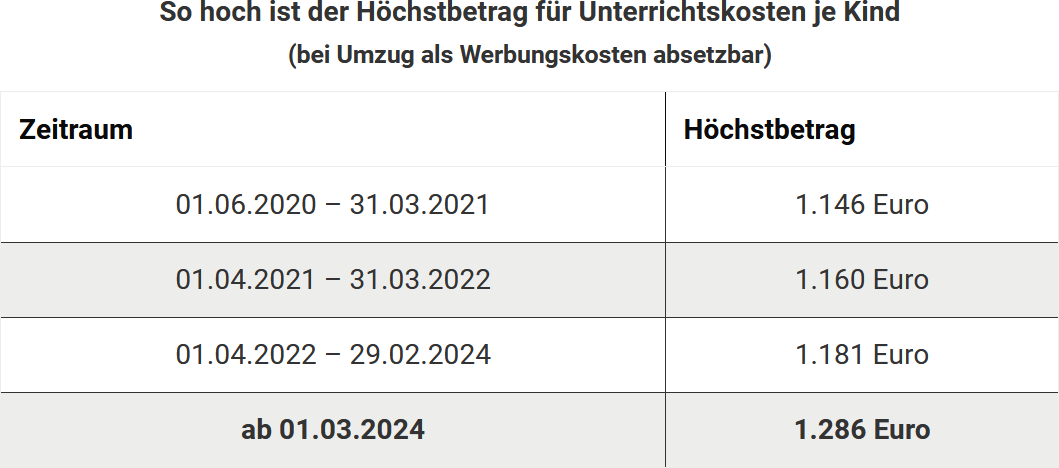

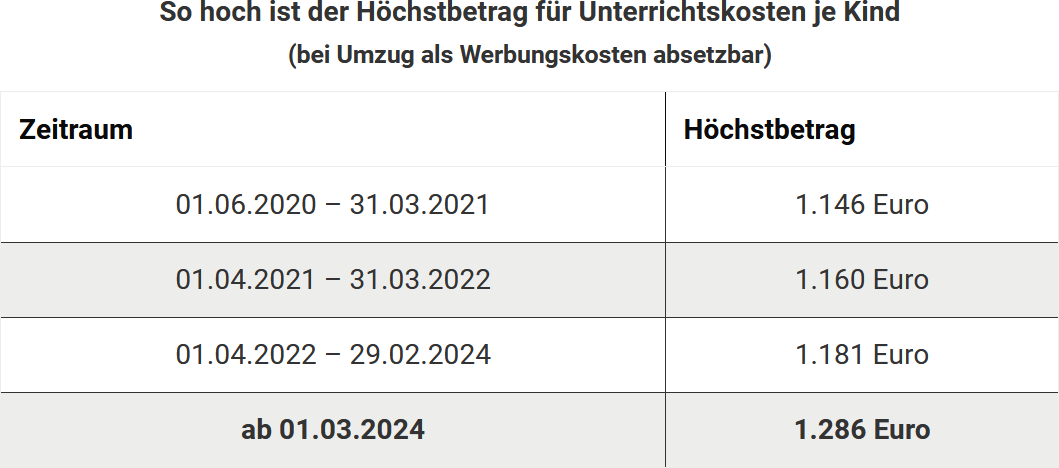

If children require tutoring after a work-related move, the costs can be deducted as income-related expenses up to a maximum amount. This maximum amount will also be increased.

(2024): What is the relocation allowance?