To what extent can I claim exceptional expenses?

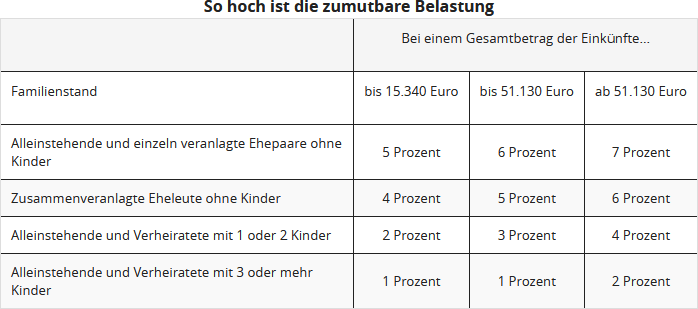

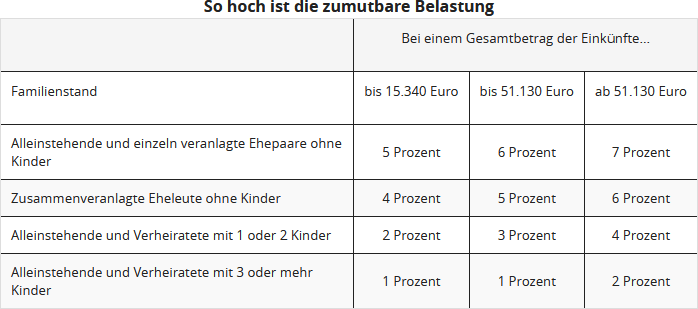

Here you can enter the actual expenses. However, these will not be fully recognised, as your reasonable personal liability will be deducted. This depends on your income, marital status, and the number of children you have, and is calculated by the tax office. The reasonable personal liability is between one and seven percent of total income. In any case, you should be able to prove the relevant expenses.

If your expenses are below the reasonable personal liability, it is not worth declaring the costs in the tax return.

Care allowance:

If the care-related expenses are still higher than the care allowance after deducting the personal liability, enter your care expenses as they actually occurred. However, you must then also be able to prove individually what you spent money on. In this way, you can claim more than the care allowance.

Tip

For the tax office, it does not matter when the costs were incurred, but when you paid them. You should therefore try to consolidate several expense items into one year to increase the total expenses and thus exceed the limit of your reasonable personal liability.

Is there a large dental bill due, but not until next year? However, if you could already book other expenses under extraordinary burdens for the current year, ask your dentist for an early invoice or a partial invoice. This way, you may be able to claim all expenses that exceed the reasonable liability in the tax return for the current year.

Important

The reasonable liability is only deducted for general extraordinary burdens. Expenses listed under special extraordinary burdens remain uncut.

You can use this table to roughly calculate your reasonable personal liability:

(2024): To what extent can I claim exceptional expenses?

Who can claim exceptional costs?

Basically, everyone! Anyone with exceptional expenses can claim them in their tax return. This reduces the income tax payable, helping to avoid undue hardship.

If a taxpayer has unavoidable major expenses compared to other taxpayers with similar income, assets, or family status, they can apply to reduce their income tax. To do this, you must enter your exceptional expenses in the tax return.

However, only expenses that exceed a reasonable burden and are actually necessary are considered. The reasonable burden is determined by the taxpayer's income, family status, and number of children.

The percentage is between one and seven per cent of the taxable annual income. If your exceptional expenses exceed this percentage, you can claim the costs in full.

Exceptional expenses can include:

- Funeral costs,

- Care costs, or

- Medical expenses.

However, divorce costs have not been deductible since 2013 due to a change in the law!

In special cases, expenses for maintenance can be considered exceptional expenses. In this case, a reasonable burden is not applied.

The care allowance can be claimed by anyone caring for a close relative. This is an annual amount that is not dependent on a reasonable burden. On the individual pages of our tax return, you will find more detailed information on the respective exceptional expenses you can claim.

Tipp

A distinction is made between general and specific exceptional expenses. General exceptional expenses, such as medical and funeral costs, only have a tax-reducing effect once the reasonable personal burden has been exceeded.

Specific exceptional expenses are recognised in full, but usually up to fixed maximum amounts. This includes, for example, maintenance for a dependent person or the external accommodation of an adult child for training purposes.

(2024): Who can claim exceptional costs?

Can I claim maintenance payments for children over 18?

Yes, you can claim maintenance payments for adult children if you are not entitled to child benefit or the corresponding allowances. The condition is that the child is in need, meaning they have little or no income of their own. If their own income exceeds 624 Euro per year, the deductible amount will be reduced.

No entitlement to child benefit

Maintenance payments can only be claimed for months in which there is no entitlement to child benefit or child allowances. This also applies if the child is in initial training, provided that the need is proven.

Maximum amount for maintenance payments 2024

The deductible maximum amount for maintenance payments in 2024 is 11,784 Euro. Income and earnings of the child that exceed this amount reduce the deductible maintenance payments.

(2024): Can I claim maintenance payments for children over 18?

When are legal expenses deductible?

Legal costs are generally only tax-deductible as exceptional expenses under § 33 EStG in exceptional cases. The tax office usually accepts legal costs only if the legal dispute concerns an existentially important area or the core area of human life.

Previous case law

- BFH ruling of 2011: In May 2011, the Federal Fiscal Court (BFH) ruled that civil litigation costs are considered unavoidable regardless of the subject matter of the case if the legal action or defence has a reasonable chance of success and does not appear frivolous. It was sufficient if success was at least as likely as failure (BFH ruling of 12.5.2011, BStBl. 2011 II p. 1015).

- Change from 2015: In June 2015, the BFH returned to a more restrictive interpretation. According to this, legal costs are only unavoidable if the event underlying the legal action is also unavoidable. Civil litigation costs are therefore generally not deductible as exceptional expenses (BFH ruling of 18.6.2015, VI R 17/14).

Legal regulation since 2013

Since 2013, civil litigation costs are only deductible if the taxpayer risks losing their means of subsistence and can no longer meet their basic needs (§ 33 para. 2 sentence 4 EStG). These are very strict conditions. It is not enough for the legal dispute to concern an important area of life; the loss of material means of subsistence must be a concrete threat.

Distinction: Material vs. immaterial means of subsistence

The Federal Fiscal Court has ruled that means of subsistence refers only to material means. Immaterial values such as emotional or social needs are not included (BFH ruling of 18.5.2017, VI R 9/16). Therefore, legal costs concerning the core area of human life, such as disputes over child access rights, are no longer deductible (BFH rulings of 13.8.2020, VI R 15/18 and VI R 27/18).

Examples of non-deductible legal costs:

- Father's access rights: Legal costs for arranging access rights for a child living abroad are not deductible as they do not pose a material existential threat (BFH ruling of 13.8.2020, VI R 15/18).

- Maintenance disputes: Legal costs to obtain higher child maintenance are not deductible if there is no existential threat (BFH ruling of 13.8.2020, VI R 27/18).

- Medical liability cases: Expenses for compensation claims due to medical errors are not deductible as exceptional expenses if they are not intended to secure material existence (BFH ruling of 13.8.2020, VI R 27/18).

- Child's criminal defence: Legal costs for the criminal defence of an adolescent child are also not deductible (BFH decision of 11.8.2022, VI R 29/20).

Exceptions

However, some courts have recognised legal costs as exceptional expenses in exceptional cases:

- Reversal of a forestry business: The Lower Saxony Finance Court ruled that legal costs of 17.740 Euro are deductible as exceptional expenses if the reversal of a gratuitous transfer of a forestry business is threatened, which would lead to an existential threat (FG Niedersachsen of 15.5.2024, 9 K 28/23; appeal VI R 22/24).

Practical tip

- Material existential threat: Legal costs are only deductible if the taxpayer can prove that their material existence is threatened. Immaterial values such as child welfare or emotional stress are not taken into account for tax purposes.

- Preliminary check: In disputes, those affected should always check whether the legal dispute has existential material implications before claiming legal costs as exceptional expenses.

(2024): When are legal expenses deductible?