Field help

Gifts

Enter here both the deductible and non-deductible expenses for gifts.

Gifts for business partners

Gifts are generally deductible as business expenses provided that the costs do not exceed 50 Euro per person and year. For entrepreneurs subject to VAT, this amount applies without VAT. For entrepreneurs not entitled to input tax deduction (e.g. small businesses, doctors), VAT is to be included in the exemption limit of 50 Euro.

Exemption limit of 50 Euro

This is an exemption limit, not an allowance. This means that as soon as the expenses for gifts exceed the amount of 50 Euro per person and year, they cannot be deducted as business expenses at all. These non-deductible amounts must also be entered here.

Labelling and packaging costs

- The costs of labelling the gift as an advertisement (e.g. by printing a logo on it) are included when determining the 50-Euro limit.

- Shipping and packaging costs are not taken into account and do not count towards the exemption limit.

Exemptions from the exemption limit

- Business use of the gift: The exemption limit of 50 Euro does not apply if the recipient can only use the gift in his business (according to R 4.10 para. 2 sentence 4 of the Income Tax Regulations (EStR)).

- Gifts to own employees: Business gifts to employees are fully deductible as business expenses and must be entered here.

Documentation obligation

The expenses for gifts must be entered individually and separately from the other business expenses. A separate entry, for example, in a separate account, is required to ensure deductibility.

Hospitality costs

List the non-deductible and the deductible hospitality costs here.

When it comes to hospitality expenses, the tax authorities distinguish between hospitality for "business" reasons and hospitality for "general company" reasons. This affects the degree to which the costs are recognised for tax purposes:

- A business occasion exists for entertaining people outside the company with whom business relationships already exist or with whom they are to be initiated. This also includes visitors to the company, as well as employees of affiliated companies and persons comparable with them i.e. specialist colleagues. The same applies to freelancers and sales representatives. Only 70 % of these hospitality costs are deductible and 30 % are non-deductible. Therefore, the costs must be divided accordingly and both amounts entered here.

- A general company occasion covers hospitality to entertain a company's own employees i.e. people working in-house at the company. "Company" occasions also apply to the expenses incurred by a beverage wholesaler for rounds of drinks paid for at its customers' restaurants/pubs and for customer drinks at breweries. In this case, the costs are 100 % deductible and must therefore be entered in full on the "Other fully deductible business expenses" page. According to the Federal Fiscal Court, the above-mentioned restriction on deductions for hospitality expenses does not apply if a coach driver stops at a service station restaurant and is catered for without charge for "bringing paying customers" (Federal Fiscal Court (BFH) judgement of 26.04.2018, X R 24/17)

Lohnsteuer kompakt: Expenditure for hot and cold beverages, biscuits etc. during company meetings are so-called "courtesies" and can be declared in full as business expenses, deductible on the page "Other fully deductible business expenses".

Lohnsteuer kompakt: The VAT included in the hospitality costs is fully deductible as business expenses and must also be entered under "VAT already paid on goods/services" on the "Other fully deductible business expenses" page.

Note: You must specify the hospitality costs individually and separately from the other business expenses or enter them in a separate account.

Total limited deductible business expenses

The total of non-deductible and deductible operating expenses and business tax is transferred to the overview page "business expenses" to determine the sum of business expenses.

Aufwendungen für ein häusliches Arbeitszimmer (einschließlich AfA und Schuldzinsen)

Enter here the non-deductible and deductible expenses for your home office.

Conditions for the operating cost deduction

A deduction for operating costs is only possible if the home office represents the "centre of the entire business and professional activity". For the self-employed, there are two options:

1. Annual flat rate (simplification rule)

- Flat-rate amount: 1.260 Euro per year (since 2023).

- Advantage: Less documentation required, simple processing.

- Usage: Maximum once per person per year, regardless of the number of activities.

2. Actual costs of the home office

- Deductible costs: rent (on a proportional basis), service charges (heating, electricity, water), renovations, depreciation for furniture, interest on property loans.

- Calculation: Costs are calculated based on the share of the total living space taken up by the home office.

Annual flat rate or actual costs?

- Annual flat rate: Makes sense if actual costs are low or difficult to prove.

- Actual costs: It is advantageous if they exceed the flat rate of 1.260 Euro.

Note: A mixed invoice is not possible.

Peculiarities of a divided home office

- Joint use by spouses: Anyone can apply for the flat rate of 1.260 Euro, provided that the conditions are met.

- Actual costs: Costs are divided proportionately according to usage.

Other business expenses

Enter here both the deductible and non-deductible expenses for other business expenses.

Representation costs

Expenses that affect the private lifestyle of the taxpayer or other persons are generally not deductible as business expenses. Representation expenses that are, however, incurred for business reasons are only deductible in accordance with sect. 4 para. 5 no. 7 of the Income Tax Act (EStG) "provided that they are not considered unreasonable according to generally accepted standards".

Examples of unreasonable expenses:

- Luxurious vehicles without a clear business reason

- Excessively lavish furnishing of business premises

Fines, administrative fines, warning fines or financial penalties

Fines, administrative fines, warning fines or financial penalties imposed by courts or authorities in Germany or by institutions of the European Communities are not deductible as business expenses.

Exceptions apply to:

- Fees from countries outside the European Communities: These may be deductible as business expenses.

- Fine penalties from abroad: Fines imposed by a foreign court are deductible if they "contradict essential principles of the German legal system".

Document all expenses for other business expenses precisely, and record the distinction between business and private expenses. This will help you avoid queries from the tax office and facilitate correct tax classification.

Additional meal expenses

Enter here the deductible meals allowances incurred in connection with external work, business trips or double household running for company-related reasons.

- Travel expenses to be indicated separately on the page "Vehicle costs and other travel expenses".

- Accommodation costs and additional travel expenses must be entered on the page "Other unlimited deductible business expenses".

- Travel expenses for employees are entered on the page "General operating expenses" under "Expenses for own personnel".

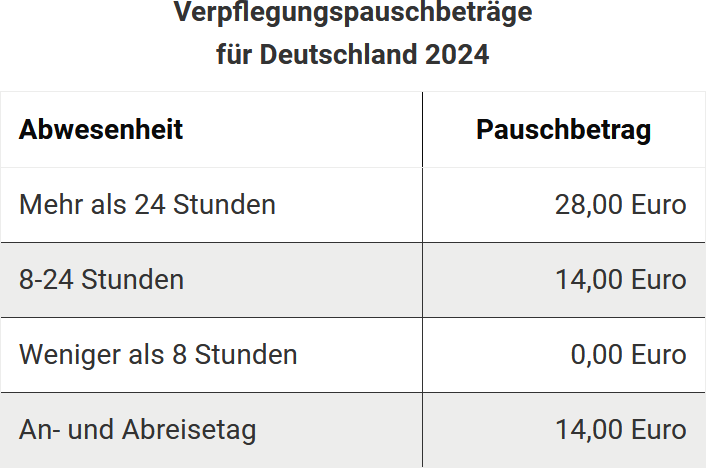

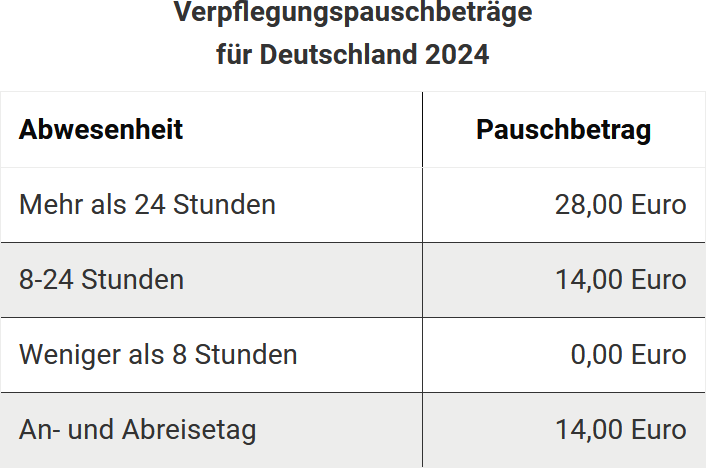

You can only deduct a flat-rate amount for additional meals expenses, not the actual costs. The amount of the flat rates depends on the duration of your absence from your home and company. The meal allowance for business trips within Germany with an absence duration of

For business trips abroad, you can deduct the country-specific meal allowances.

If an external work assignment begins on one day and ends on the following day after more than 8 hours without overnight accommodation, a meal allowance of 14 Euro is granted for the day with the prevailing absence (sect. 9 para. 4a no. 3 of the Income Tax Act (EStG)).

Daily allowance for working at home

In this field, enter the daily allowance of 6 Euro for each calendar day on which you carried out your business or professional activity mainly in your home and were not at your primary place of business on that day. A maximum of 1.260 Euro (= 210 days x 6 Euro per day) can be claimed per year.

Requirements for the daily allowance:

- You work mainly in the home and do not attend your business premises on that day.

- The flat rate can be deducted even if there is no separate room for home office.

The daily allowance can not be deducted if:

- you claim accommodation costs for the flat as part of a double household.

- you deduct actual expenses or the annual flat rate for a home office.