How much church tax will I save if I leave the church?

Leaving the church reduces your tax burden as you no longer pay church tax. However, the full saving only becomes apparent when you consider the tax benefit of the special expenses deduction. Here you can find out how to calculate your actual savings.

Church tax and special expenses deduction

Church tax is considered a special expense and can be fully deducted in your income tax return. This reduces your taxable income and lowers your income tax. Alternatively, you can claim a general allowance for special expenses, which is 36 Euro for singles and 72 Euro for couples. If your church tax paid exceeds this amount, you benefit from an additional tax advantage.

Example calculation for couples:

- Church tax paid: 600 Euro

- Less allowance: 72 Euro

- Deductible amount: 528 Euro

With a marginal tax rate of 28%, the tax saving is 528 Euro × 28% = 147 Euro. Additionally, the solidarity surcharge is reduced by approximately 8 Euro, so the total tax relief is around 155 Euro.

Actual savings from leaving the church

If you leave the church, the church tax is no longer applicable, but neither is the tax benefit. The actual savings result from the difference:

- Church tax paid: 600 Euro

- Tax relief through deduction: 155 Euro

- Actual savings: 600 Euro – 155 Euro = 445 Euro

Conclusion

The amount of actual savings from leaving the church depends on the church tax you paid, your income, and your marginal tax rate. While church tax is completely eliminated at first glance, you should consider the lost tax benefit of the special expenses deduction. An accurate calculation will help you realistically assess the financial impact of leaving the church.

(2024): How much church tax will I save if I leave the church?

The "special church fee": Obligation to pay church tax for a non-denominational spouse.

In Germany, individuals who are members of a religious community that collects taxes are generally subject to church tax. This applies regardless of the intensity of one's faith or participation in religious life, as formal membership is the determining factor. But what happens in a marriage if only one spouse belongs to a religious community that collects taxes? In such cases, the so-called special church fee may apply, a special form of church tax. This article explains the key regulations and current legal rulings on this topic.

Church tax obligation: Basics of membership

In Germany, church tax is paid by members of a religious community that collects taxes, provided they have their residence or usual place of abode in Germany. Those who do not belong to such a community are exempt from church tax. In practice, however, it often happens that only one spouse in a marriage is subject to church tax. This raises the question of whether and how the non-religious partner is involved in the tax obligation.

Special church fee: Definition and requirements

The special church fee is a specific form of church tax that is levied in interfaith marriages under certain conditions. It applies if:

- the church member spouse does not earn any income,

- the church member spouse has an income, but it is so low that no income tax (and therefore no church tax) is due, or

- the income of the church member spouse leads to church tax, but the comparative calculation results in a higher special church fee.

Basis for calculating the special church fee

The special church fee is calculated based on the joint taxable income of both spouses. The following applies:

- It is only levied in the case of joint assessment, not in the case of individual assessment.

- The basis for assessment is the couple's income, regardless of whether the church member spouse earns an income or not.

- It is only levied from a joint taxable income of 30.000 Euro.

This regulation is based on the assumption that spouses are considered an economic unit. The Federal Constitutional Court (BVerfG) has confirmed this practice as constitutional (BVerfG decision of 28.10.2010, 2 BvR 591/06).

Legal rulings and current developments

European Court of Human Rights (ECHR)

In 2017, the ECHR confirmed that the German practice of collecting church tax and the special church fee in interfaith marriages does not violate the European Convention on Human Rights (ECHR) (ECHR decision of 6.4.2017, complaint no. 10138/11 et al.). The court emphasised that church tax regulations fall within the scope of religious freedom and state legislation.

Saxon Finance Court

In 2019, the Saxon Finance Court declared that the regulations on the special church fee in Saxony for the tax years 2014 and 2015 violated the principle of equal treatment. Spouses were disadvantaged compared to registered civil partnerships without any objective reason (decision of 25.3.2019, 5 K 1549/18).

Federal Finance Court (BFH)

In 2021, the BFH clarified that even in cases where the church member spouse earns an income, the collection of the special church fee is constitutionally unproblematic (BFH decision of 5.10.2021, I B 65/19). This is particularly true if the income of the non-religious partner is significantly higher, leading to an assumed higher standard of living for the church member spouse.

Regional differences and special regulations

The collection of the special church fee varies depending on the federal state. In Bavaria, the Evangelical Lutheran Church and the Evangelical Reformed Church have completely waived the collection of the special church fee retroactively from the 2018 tax year (decree of the Bavarian State Ministry of Finance of 21.1.2019, BStBl I 2019 p. 213). Such regulations highlight the heterogeneity of church tax collection in Germany.

Conclusion

The special church fee is often a controversial topic, especially in interfaith marriages, and can lead to misunderstandings. It is generally only levied if the church member spouse either has no income or only a low income. The calculation is based on the joint income, which is considered justified by the courts. Differences in collection between federal states, however, require careful examination in individual cases.

(2024): The "special church fee": Obligation to pay church tax for a non-denominational spouse.

What is the bereavement allowance?

Widows, widowers, orphans, and half-orphans can apply for a bereavement allowance of 370 Euro. Ongoing bereavement payments must have been granted to them.

The payments must be made either on the basis of the Federal Pensions Act or another law that declares the provisions of the Federal Pensions Act on bereavement payments applicable. Alternatively, they can be made under the regulations of statutory accident insurance, civil service law in the event of death due to a service accident, or the Federal Compensation Act for damage to life, body, or health.

Please note: An orphan receives the bereavement allowance only once, even if both parents are deceased. If there are several bereaved persons of the same individual (e.g. widow and half-orphan), each bereaved person is entitled to the allowance.

(2024): What is the bereavement allowance?

Where can I find my tax ID number?

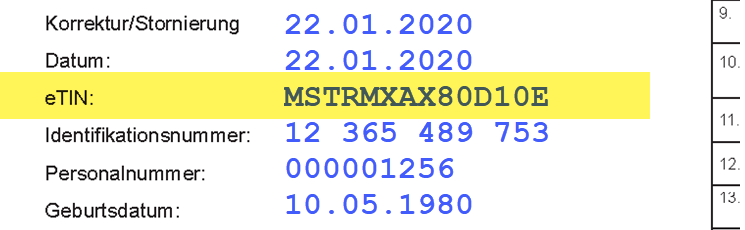

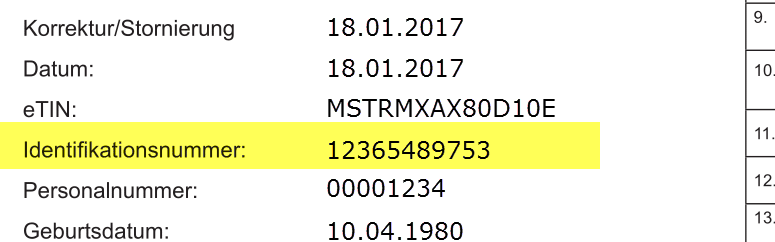

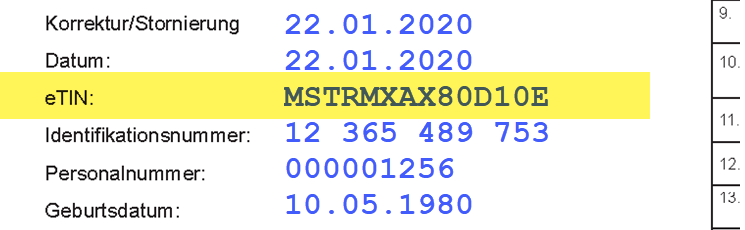

Your tax identification number was sent to you in writing by the Federal Central Tax Office. The eleven-digit number is valid for life. In this letter, the number is referred to as the "Personal Identification Number", but it is often simply called the "Identification Number" and is usually abbreviated as TIN (Tax Identification Number) or Steuer-ID.

You can usually find your identification number

- on your income tax assessment notice or

- on your payslip

The tax ID is not to be confused with the eTIN, which is also found on the payslip and is used by the employer for the transmission of wage data.

After a transition period, the tax identification number is intended to replace the current tax number for income tax. Providing the tax identification number is not a prerequisite for submitting your tax return.

(2024): Where can I find my tax ID number?

When am I required to pay church tax?

The church tax obligation begins with baptism or upon joining or rejoining the religious community. In this case, you must pay the church tax from the beginning of the following month.

If you change religious communities, the obligation to pay church tax also begins at the start of the following month. However, it only starts once you no longer pay church tax to your previous religious community.

In the Jewish community, the church tax obligation is based on descent and confession.

(2024): When am I required to pay church tax?

Who is required to pay church tax?

If you are a member of one of the following religious communities, you must pay church tax:

- Roman Catholic Church

- Protestant regional churches

- Old Catholic Church

- Jewish religious communities

- Israelite religious communities (e.g. in Baden-Wuerttemberg)

- Free religious communities (e.g. in Baden, Wuerttemberg, Mainz, Offenbach, Palatinate)

- French Church in Berlin (Huguenot Church)

- Mennonite congregation in Hamburg-Altona

- Unitarian religious community of free Protestants in Rhineland-Palatinate

The amount of church tax depends on your place of residence. If you live in Bavaria or Baden-Wuerttemberg, you pay 8 percent, in the other states 9 percent of income tax or wage tax.

(2024): Who is required to pay church tax?

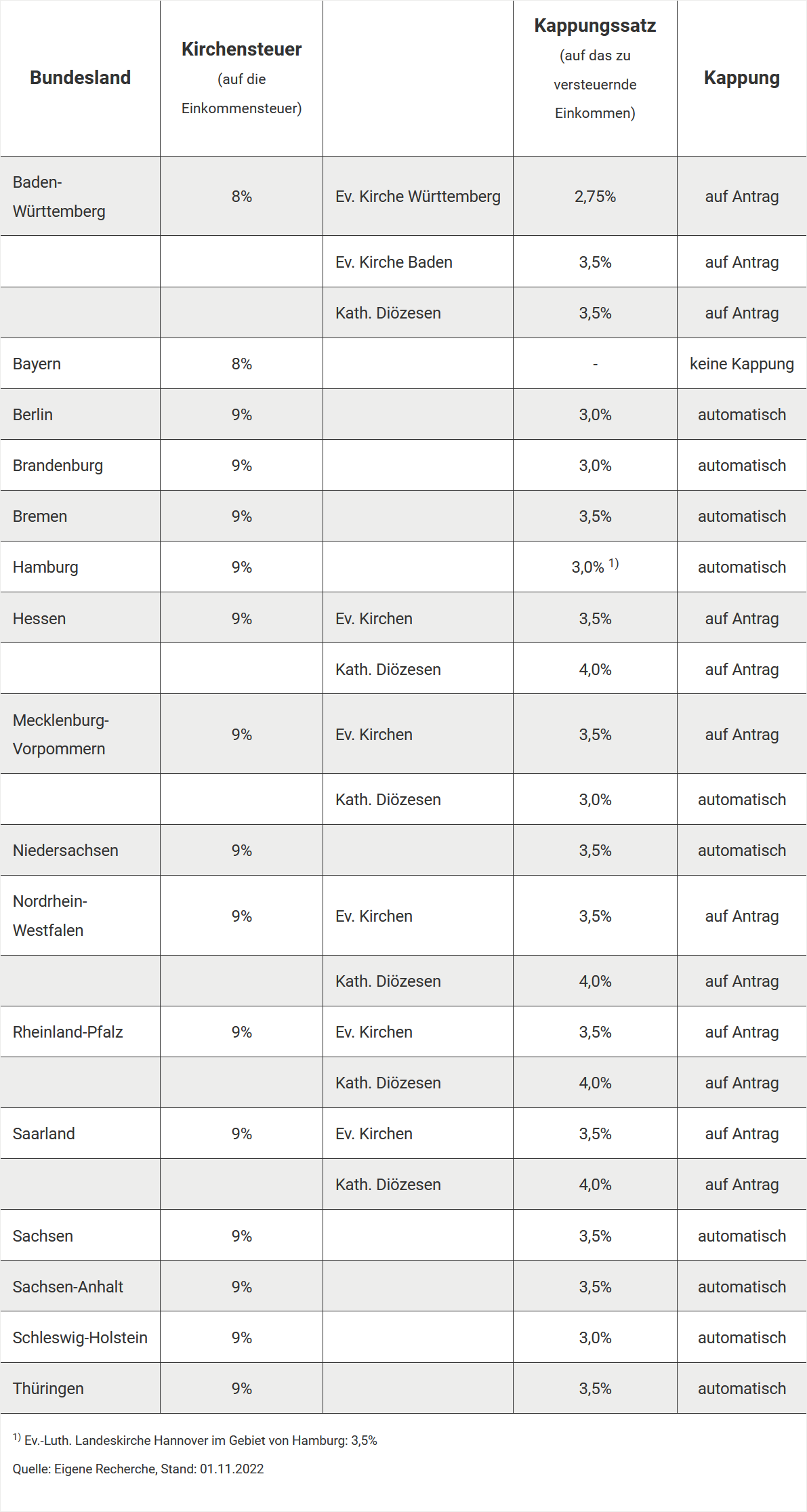

How much is the church tax?

The amount of church tax depends on your place of residence. In Bavaria and Baden-Württemberg, church members pay 8 per cent of the assessed income tax, while in other federal states it is 9 per cent. This percentage calculation also applies to the withholding tax.

If you have children or income from business operations or income taxed under the partial income procedure, the taxable income (zvE) for church tax is calculated separately.

Child allowances and church tax

If child allowances are entered in your electronic wage tax deduction features (ELStAM), the church tax is calculated based on a so-called notional wage tax. This leads to a lower monthly church tax and solidarity surcharge, but not to a reduction in wage tax.

Examples

Without child allowance: Gross monthly salary of 3.000 Euro in tax class IV, monthly church tax in Berlin: 29,63 Euro.

With two child allowances: Gross monthly salary of 3.000 Euro in tax class IV, monthly church tax in Berlin: 11,21 Euro.

Child allowances in the income tax return

In the income tax assessment, child allowances only reduce the taxable income if the tax advantage is higher than the child benefit received. However, for the calculation of church tax and the solidarity surcharge, the child allowances are taken into account "notionally".

Advantage in case of mid-year change

Even if children are only considered for part of the year (e.g. at birth or end of vocational training), the full child allowance and BEA allowance are deducted for the calculation of church tax and the solidarity surcharge.

(2024): How much is the church tax?

What is the difference between my tax number and the tax identification number?

The tax number should not be confused with the permanent and nationwide tax identification number.

What is the tax number?

The tax number is issued by the tax office to each taxable individual or legal entity and is uniquely assigned to a taxpayer. A person may have several tax numbers during their lifetime. For example, if someone moves and falls under the jurisdiction of a different tax office, gets married, or registers as self-employed, they will receive a new tax number.

Previously, tax numbers were based on state-specific codes and consisted of ten or eleven digits, depending on the federal state. With the introduction of the so-called ELSTER procedure (ELektronische STeuerERklärung), the standard scheme for tax numbers was standardised nationwide and now has 13 digits.

Where can I find the tax number?

After submitting the first income tax return or registering a self-employed or business activity, the number is issued by the relevant tax office. However, it can also be applied for independently. The tax number can be found at the top left of the income tax assessment notice.

What do I need the tax number for?

The tax number must be provided when submitting a tax return or registering a self-employed or business activity, as well as in payment transactions. Freelancers and business owners must include it on their invoices if they do not have a VAT identification number. In the future, the tax number will be replaced by the tax identification number. However, both numbers currently exist in parallel.

What is the tax identification number?

The tax identification number (IdNr. or tax ID) has been a nationwide and permanent identification number for citizens registered in Germany for tax purposes since 2008. It is valid for life. Children receive it shortly after birth.

The identification number does not change if you move or change the responsible tax office. The data is deleted only when it is no longer needed by the authorities, but no later than 20 years after the taxpayer's death.

The tax ID is also required for child benefit, exemption orders for all bank accounts in Germany, the granting of the care allowance, and the tax deduction of maintenance payments, and is increasingly being requested.

(2024): What is the difference between my tax number and the tax identification number?

What tax benefits are available for disabled persons and bereaved family members?

Disabled individuals can either claim the disability allowance for their disability-related expenses or deduct the expenses as extraordinary burdens with proof, although a reasonable burden is deducted in this case. The disability allowance depends on the degree of disability and ranges from 384 Euro to 7.400 Euro. The allowance covers all so-called typical expenses. Additional so-called atypical expenses can be deducted as extraordinary burdens. This reduces your taxable income.

Bereaved individuals receive a bereavement allowance of 370 Euro upon application if they have been granted ongoing bereavement payments. These must be made according to Section 33 b (4) of the Income Tax Act, under the Federal Pensions Act or another law that declares the provisions of the Federal Pensions Act on bereavement payments to be applicable, under the statutory accident insurance regulations, under the civil service regulations to bereaved relatives of a civil servant who died as a result of a service accident, or under the Federal Compensation Act regulations on compensation for damage to life, body, or health.

The bereavement allowance is an annual amount. It is not reduced even if the relevant conditions did not apply throughout the year.

Please note: An orphan receives the bereavement allowance only once, even if both parents are deceased. If there are several bereaved individuals of the same person (e.g. widow and half-orphan), the allowance is granted to each bereaved individual.

(2024): What tax benefits are available for disabled persons and bereaved family members?

Which expenses are covered by the disability allowance?

Many expenses typically incurred by disabled individuals are covered by the disability allowance. These include costs incurred to manage ordinary and regularly recurring tasks in daily life. This also includes care expenses, regardless of whether the care is provided at home or in a care home, or what level of care is required.

Tip

If the total of your expenses is higher than the allowance, you should waive it and instead deduct your costs as extraordinary expenses. However, you must note that extraordinary expenses are only recognised if they exceed the reasonable burden.

Also covered are the costs for medication, remedies and assistance, as well as the personal contribution for using public transport. Expenses for home dialysis are also included.

(2024): Which expenses are covered by the disability allowance?

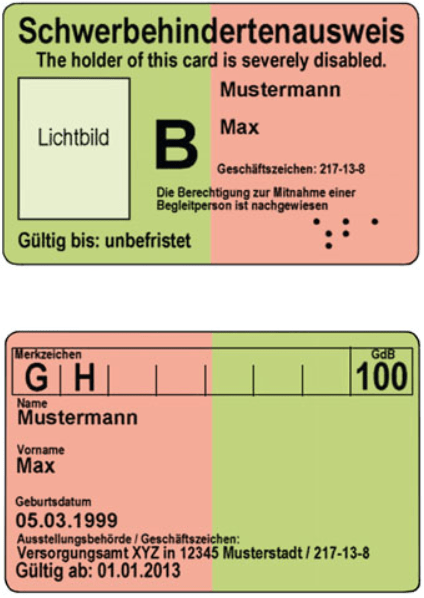

How is a disability verified?

Proof of disability is provided by the pensions office. From a disability level of 50 percent, you will receive a severely disabled pass; up to a level of 45, the office issues a notice of assessment. The tax office is bound by these notices.

If you receive a pension or other benefits due to your disability, the pension statement or similar documents are usually sufficient as proof.

For the granting of the increased allowance for helpless or blind persons, the note "H" or "Bl" must be entered in the severely disabled pass. For helpless persons, the care fund's notice of classification as a care recipient of care level III (until 2016) or the granting of care level 4 or 5 (from 2017) is also sufficient.

(2024): How is a disability verified?

What are atypical expenses that are tax deductible?

There are costs that arise due to the disability but do not occur regularly. These atypical expenses are not covered by the disability allowance and can therefore be declared separately as extraordinary expenses of a general nature in the tax return.

Examples of such expenses include conversion measures in the home or in a vehicle due to the disability, as well as expenses for travel assistance on holiday, relocation costs, costs for household services, and medical, treatment, or convalescence costs.

All expenses declared as extraordinary expenses in the tax return are reduced by the reasonable burden by the tax office. This amount depends on marital status and the level of income.

(2024): What are atypical expenses that are tax deductible?

Who is entitled to the bereavement allowance?

Bereaved family members, such as widows and orphans, are entitled to the bereavement allowance of 370 Euro in certain cases.

The main requirement is that the taxpayer received bereavement payments for at least one month in the relevant tax year. This also applies if the entitlement to the payments is suspended or if a severance payment has been made in the form of a lump sum.

The conditions for the bereavement allowance are regulated in § 33b para. 4 EStG. If the bereavement allowance is due to a child, it can be transferred to the parents upon request.

The bereavement allowance is granted for the following types of payments:

- Payments under the Federal Pensions Act, mainly for victims of the Second World War

- Payments under the Military Pensions Act

- Payments under the Civil Service Act

- Payments under the Prisoner Assistance Act

- Support for relatives of prisoners of war

- Payments under the Federal Police Act

- Payments under the Civil Defence Corps Act

- Payments under the Act regulating the legal status of persons covered by Article 131 of the Basic Law

- Payments under the Act introducing the Federal Pensions Act in Saarland

- Payments under the Infection Protection Act, for example in the event of death following a recommended vaccination

- Payments under the Act on Compensation for Victims of Violent Crimes

- Pension from statutory accident insurance, for example in the event of death due to an industrial accident

- Payments following the death of a civil servant as a result of an occupational accident

- Payments under the Federal Compensation Act for damage to life, body or health.

If the bereavement allowance is due to a child, it can be transferred to the parents upon request.

(2024): Who is entitled to the bereavement allowance?

From when do you no longer have to pay church tax after leaving the church?

Church tax liability ends:

- at the end of the calendar month if the place of residence or usual abode in Germany has been given up.

- at the end of the month of death if the church member dies.

- when the church member declares their resignation from the church. Different authorities are responsible for the declaration of resignation in the various federal states; in most cases, it is made at the registry office, otherwise at the district court; only in the federal state of Bremen also at the church. Depending on the federal state, the resignation from the church is effective from the calendar month in which the resignation was declared, or from the following calendar month.

Note

In the past, there was a so-called "month of repentance" in some federal states, i.e. church tax liability ended one month after the month of resignation. This applied to Berlin, Brandenburg, Bremen, Hamburg, Hesse, Mecklenburg-Western Pomerania, Saxony, Schleswig-Holstein, Thuringia.

However, the month of repentance has now been abolished to standardise church tax regulations across Germany, i.e. the resignation from the church becomes effective in the calendar month in which it was declared.

After resigning from the church, the registration office automatically informs the relevant tax office so that it can change the electronic wage tax deduction features (ELStAM). Therefore, no church tax will be deducted from your monthly salary after your resignation.

The cost of resigning from the church - resignation fees

In Berlin, Brandenburg and Bremen, resignation is free of charge. In the other federal states, you have to pay between 10 and 60 Euro for the certificate of resignation from the church.

(2024): From when do you no longer have to pay church tax after leaving the church?

Where can I obtain a new tax ID number?

To obtain a new tax identification number, you must contact the Federal Central Tax Office in writing. Please use the following address:

Bundeszentralamt für Steuern, 53221 Bonn,

or by email: [email protected].

You must provide the office with the following personal data:

- First name and surname

- Address (street, house number, postcode and city)

- Date and place of birth

Your number will then be sent to you in writing. For data protection reasons, it is not possible to provide the number by telephone or email.

Tip

However, you can usually find the number on your pay slip or your most recent income tax assessment.

(2024): Where can I obtain a new tax ID number?

Who receives the disability allowance?

You can receive the disability allowance if you can prove a certain degree of disability. A person is considered disabled if their physical, mental, or emotional health is impaired for more than six months.

The degree of disability is usually determined by the pension office. From a degree of disability of 50, you receive a severely disabled pass; up to a degree of 45, the office issues a notice of determination. The tax office is bound by these notices.

You can claim the disability allowance for yourself, your disabled spouse, or your disabled child. The allowance cannot be transferred from disabled parents or siblings.

Tip: If the degree of disability is determined retroactively for several years, you can claim the allowance retroactively for the years for which a degree of disability is recognised. However, you should register your tax claims as soon as possible after the degree of disability is determined, as certain deadlines must be observed.

Lohnsteuer kompakt

The disability allowance is an annual amount. It is granted in full even if the disability occurs or ceases during the year. If the degree of disability is increased or decreased during the year, the annual amount is based on the higher degree of disability (R 33b para. 7 EStR).

If multiple disabilities occur for different reasons, the disability that leads to the highest allowance is used. The disability allowance has a full tax-reducing effect, as no reasonable burden is deducted.

The question is whether care-related expenses can be deducted as extraordinary expenses under § 33 EStG in addition to the disability allowance, or whether the allowance must be waived for this. Since 2008, the following regulation applies:

If you claim the disability allowance under § 33b para. 3 EStG, care-related expenses are not additionally recognised as extraordinary expenses under § 33 EStG. The "either-or principle" applies (R 33.3 para. 4 EStR 2008).

You must decide: Either you apply for the disability allowance, or you claim the care-related costs as extraordinary expenses with proof. When providing proof, the care allowance from the care insurance must be deducted, and the tax office will also deduct the reasonable burden from the remaining amount. For consideration under § 33 EStG to be more advantageous, the expenses must be higher than the disability allowance, the care allowance received, and the reasonable burden.

But no rule or exception:

You can, for example, claim the following special expenses in addition to the allowance:

- extraordinary medical expenses caused by an acute event, such as costs of an operation, medical treatment, medication, and doctor’s fees,

- expenses for a health cure carried out based on a medical certificate issued before the start of the cure (the medical certificate from a medical service of the health insurance is equivalent to the official medical certificate),

- disability-related conversion costs for a car,

- disability-related renovation costs for the home,

- disability-related travel allowance (from 2021):

Up to and including 2020, travel costs related to a disability could be considered at 0.30 Euro per kilometre driven up to certain maximum amounts. This consideration regularly required proof of the kilometres driven. This proof is no longer required from 2021.

The disability-related travel allowance is:

- 900 Euro: for people with a degree of disability of at least 80 or a degree of disability of at least 70 and the mark "G" for walking disabled

- 4.500 Euro: for people with exceptional walking disability (mark "aG"), blind people (mark "BI"), deafblind people (mark "TBI"), helpless people (mark "H") or people for whom care level 4 or 5 has been determined.

The following special feature must be observed when considering the disability-related travel allowance:

Disability-related travel costs are part of the general extraordinary expenses. When calculating your income tax, the reduction by the reasonable burden is deducted from the total amount of extraordinary expenses, which also includes the disability-related travel allowance.

(2024): Who receives the disability allowance?

What is the advantage of capping the church tax?

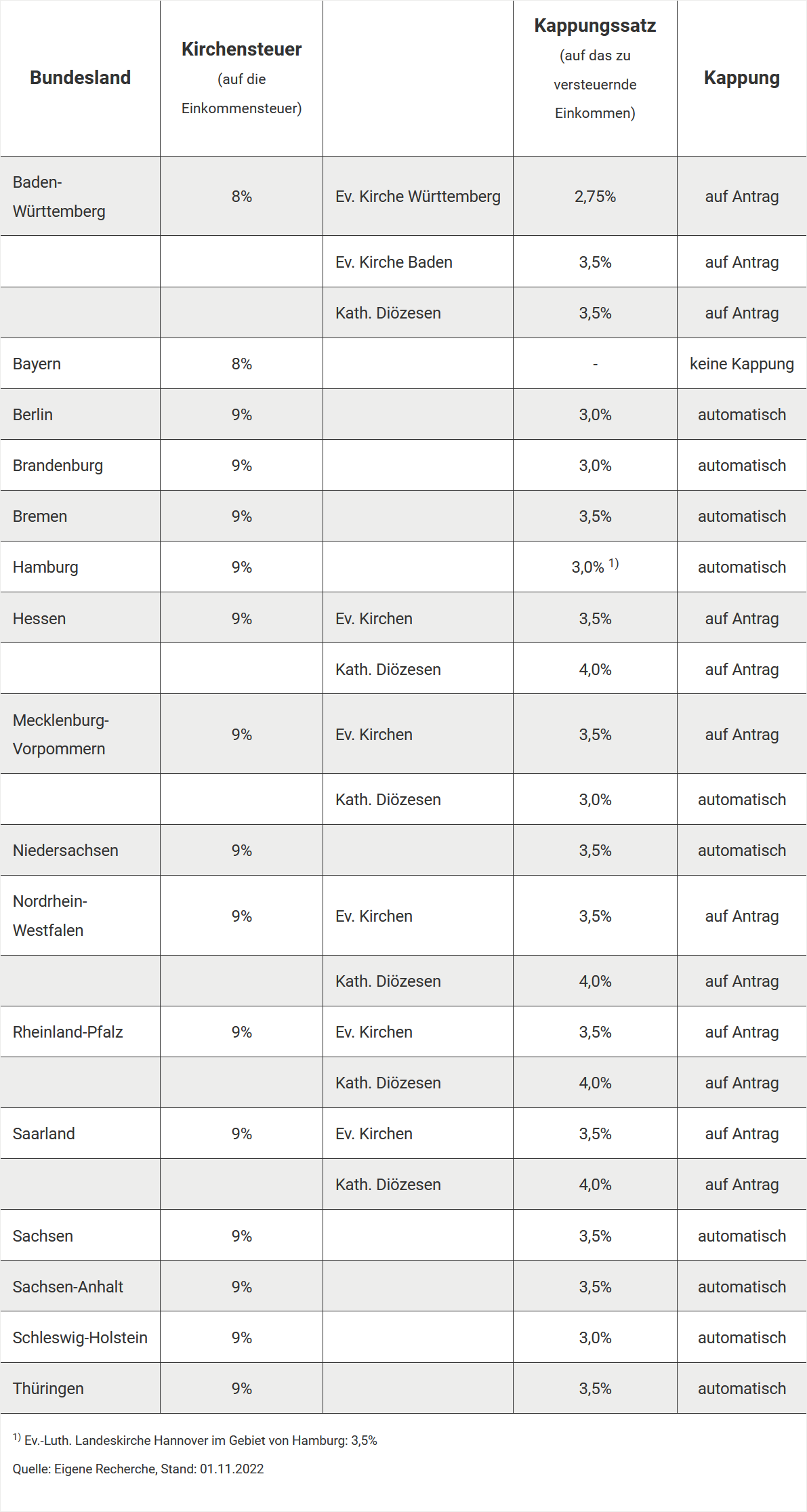

If you belong to a religious community that collects taxes, you are obliged to pay church tax. The church tax is a supplementary levy on income tax and is generally based on your place of residence.

- 8 per cent of the assessed income tax in Bavaria and Baden-Württemberg

- 9 per cent in all other federal states

The basis for calculation is always the assessed income tax, not the taxable income. The higher the income tax, the higher the church tax.

Example (2024):

- Income tax: 52.397 Euro

- Church tax (9 per cent): 4.715 Euro

Capping of church tax for high incomes

For high incomes, the church tax can sometimes be disproportionately high. To limit this, the church tax laws of the federal states provide for the possibility of so-called capping. The reduced church tax resulting from this is referred to as the capping tax.

As part of the capping, the church tax is no longer calculated as a percentage of the income tax but is capped at a fixed percentage of the taxable income. This percentage – the so-called capping rate – varies depending on the federal state and ranges between 2.75 per cent and 4.00 per cent.

Example (Berlin, 2024):

- Taxable income: 150.000 Euro

- Income tax: 52.397 Euro

- Normal church tax (9 per cent): 4.715 Euro

- Capping rate Berlin: 3 per cent

- Capping tax (limit): 4.500 Euro

Result: In this case, the capping results in a saving of 215 Euro on the church tax.

Automatic or requested capping?

Whether church tax capping occurs automatically or requires a separate application depends on the federal state. In some states, the capping tax is automatically taken into account in the tax calculation. In others, an application to the relevant church is necessary.

Application for church tax capping

In federal states without automatic capping, you must submit an informal application for capping tax. The application should be addressed to your relevant diocese (for Catholic denomination) or regional church (for Protestant denomination).

You should enclose a copy of your latest income tax assessment with the application. This is the only way to check whether capping can be granted and how high the maximum church tax (i.e. the capping tax) may be.

Note: The capping is not processed through the tax office but directly through the church.

Conclusion: The capping tax can lead to significant relief for high incomes. Check whether your federal state provides for automatic capping or whether you need to take action yourself.

(2024): What is the advantage of capping the church tax?