Will I receive confirmation of receipt for submitting my tax return?

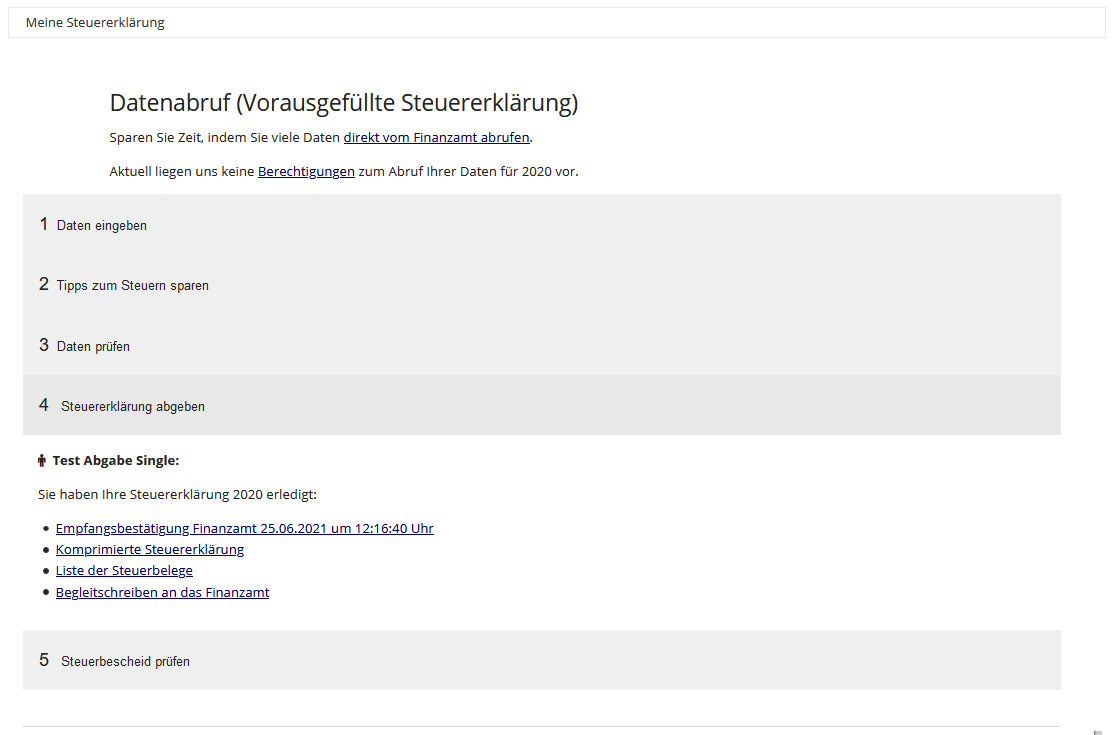

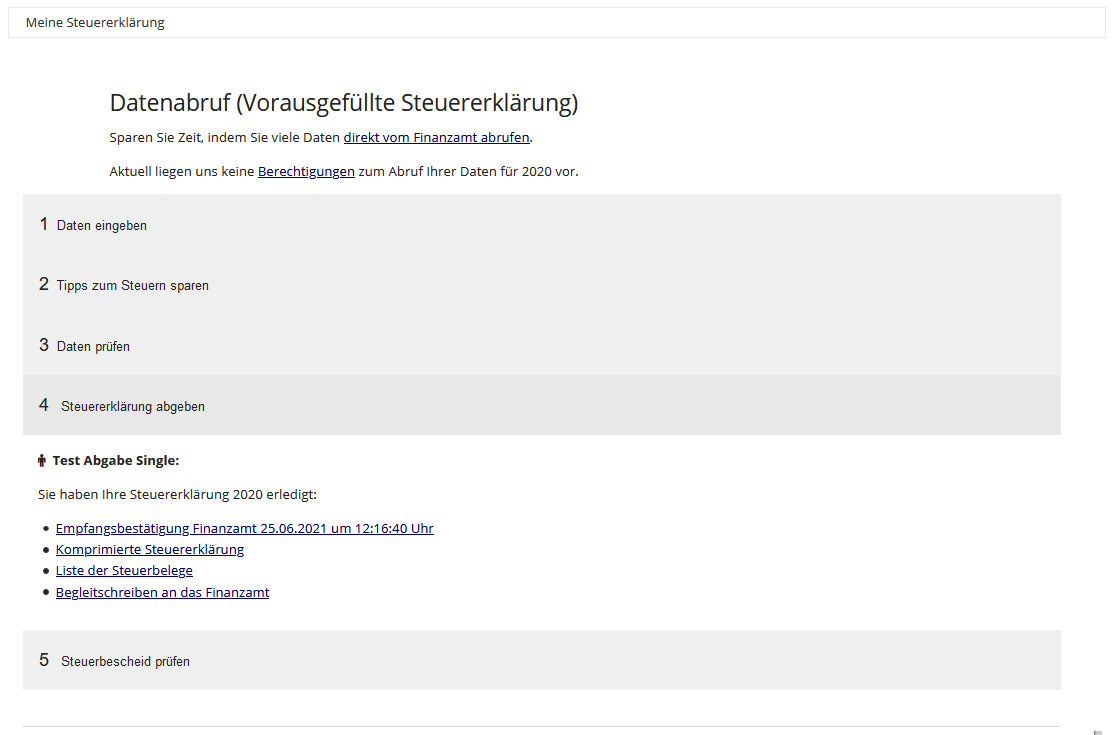

After you have electronically submitted your tax return to your tax office using Lohnsteuer kompakt, you will receive an acknowledgement of receipt, which includes the following information:

- Transfer ticket

- Tele number

- Submission date

The acknowledgement of receipt is also available in your personal area on Lohnsteuer kompakt along with the compressed tax return as a PDF file after electronic submission.

With the transfer ticket and tele number, the tax office confirms the electronic receipt of your tax data.

If you choose paper submission with electronic data transfer, the tax return will only be processed at the tax office once you have printed, signed, and submitted the tax return by post.

Will I receive confirmation of receipt for submitting my tax return?

What data is stored by Lohnsteuer kompakt?

After electronic transmission, Lohnsteuer kompakt saves the confirmation of data receipt (transmission report) for you as well as the compressed tax return, which is generated after transmission to the tax authorities as proof of the correct electronic transmission of your data.

Both documents are stored in encrypted form for data protection reasons, but can be viewed at any time in the personal data section.

What data is stored by Lohnsteuer kompakt?

How long may it take the tax office to process the tax return?

Unfortunately, there is no deadline by which the tax office must process your tax return! Based on experience, as a rule, it can take between 2 and 3 months to process your tax return.

In case of doubt, it may be advisable to call the person responsible for processing your tax return.

Important: The tax office cannot take as long as it wants to process your tax return. If more than six months have passed since you submitted your tax return without the tax office taking action, you have an option to file a so-called objection of failure to act. You can file this objection with your tax office (sect. 347 para. 1 sentence 2 of the Fiscal Code (AO)).

How long may it take the tax office to process the tax return?

How can I change data that has already been sent?

If you have already submitted your tax return electronically to the tax office, but still need to change some of the information, this is not a problem. Just send the data to the tax office again.

By means of the individual telenumber (Telenummer), the new data is permanently linked to the compressed tax return that is then also newly created. This means that the tax officer can only process the data you sent that matches the tax return you submitted. The data sent before - no matter how much - is automatically deleted.

Always submit the compressed tax return to your tax office that corresponds to the last data sent via ELSTER. Only then it is guaranteed that the tax officer can retrieve the data for your tax case from the servers of the tax office.

How can I change data that has already been sent?

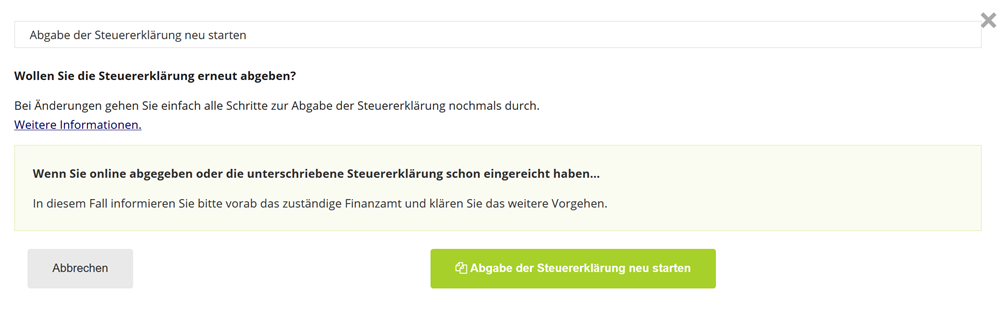

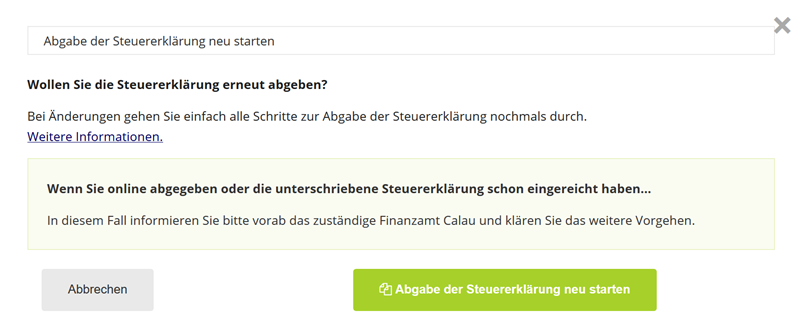

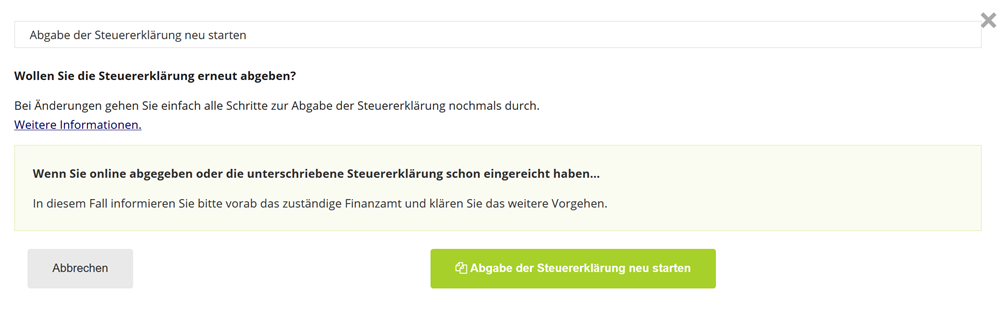

Do you want to resubmit your income tax return?

Case 1: Tax return not yet submitted to the tax office

If you have found an error in your tax return, this is generally not a problem. You can change your tax return at any time on Lohnsteuer kompakt and resubmit it electronically to your tax office. The tax office will process the latest version. For your tax return to be processed, it is necessary to send the printed and signed declaration to the tax office. Only then will the data you transmitted via ELSTER be retrieved and processed by the tax officer. If you do not send your tax return to the tax office, your data will be automatically deleted after six months at the latest.

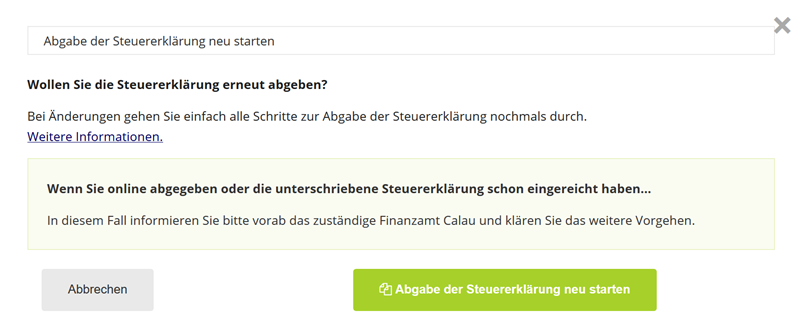

Case 2: Signed tax return already sent to the tax office

In this case, you can easily resubmit your tax return online to your tax office and then submit the updated compressed declaration with your signature. It is sufficient to include a written note to your tax office. You can find a corresponding cover letter in our sample letters ("Resubmission of income tax return").

If you have already submitted the signed tax return, it is best to inform the relevant tax office in advance by telephone that you wish to submit a corrected version of your tax return. This will prevent the resubmission of the tax return from overlapping with the tax office's issuance of the tax assessment notice.

Case 3: Tax return submitted purely online

In this case, you can also resubmit your tax return electronically certified to your tax office. It is best to inform the relevant tax office in advance by telephone that you wish to submit a corrected version of your tax return. This will prevent the resubmission of the tax return from overlapping with the tax office's issuance of the tax assessment notice.

Case 4: Tax assessment notice from your tax office already received

If you have already received the tax assessment notice from your tax office, you must lodge an objection to the tax assessment notice. Only then can your tax assessment be corrected. We also offer a corresponding sample letter for this ("Objection due to error").

If you have any further questions, please contact our customer service ([email protected]). If you wish, we will also call you back.

Do you want to resubmit your income tax return?