Tax return for 2023: What's new

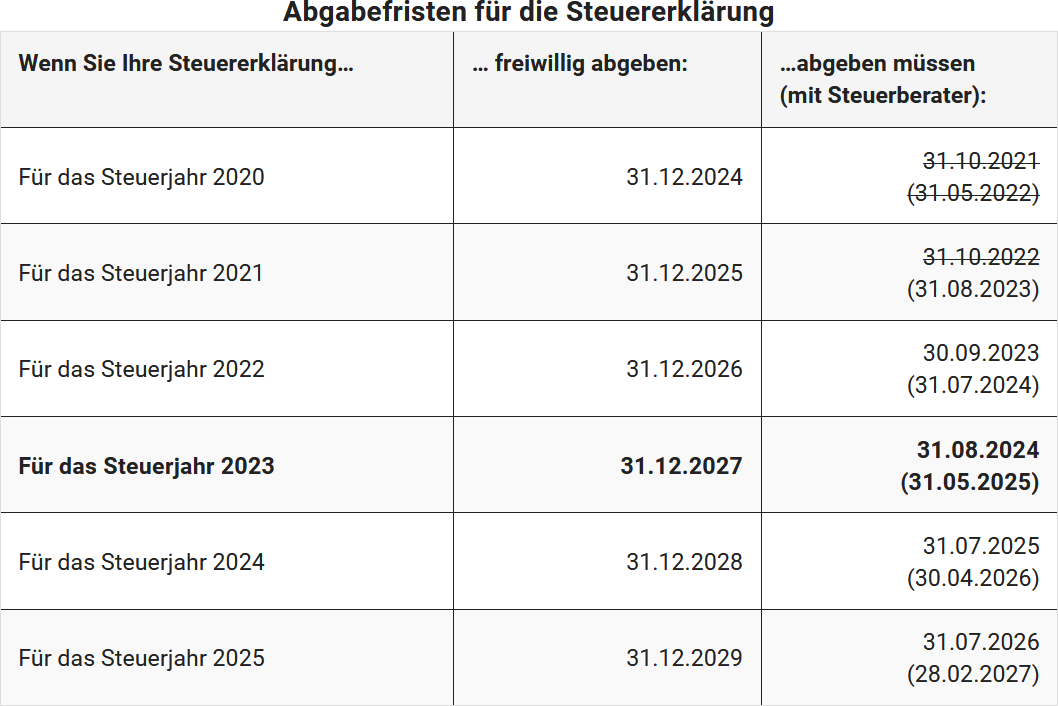

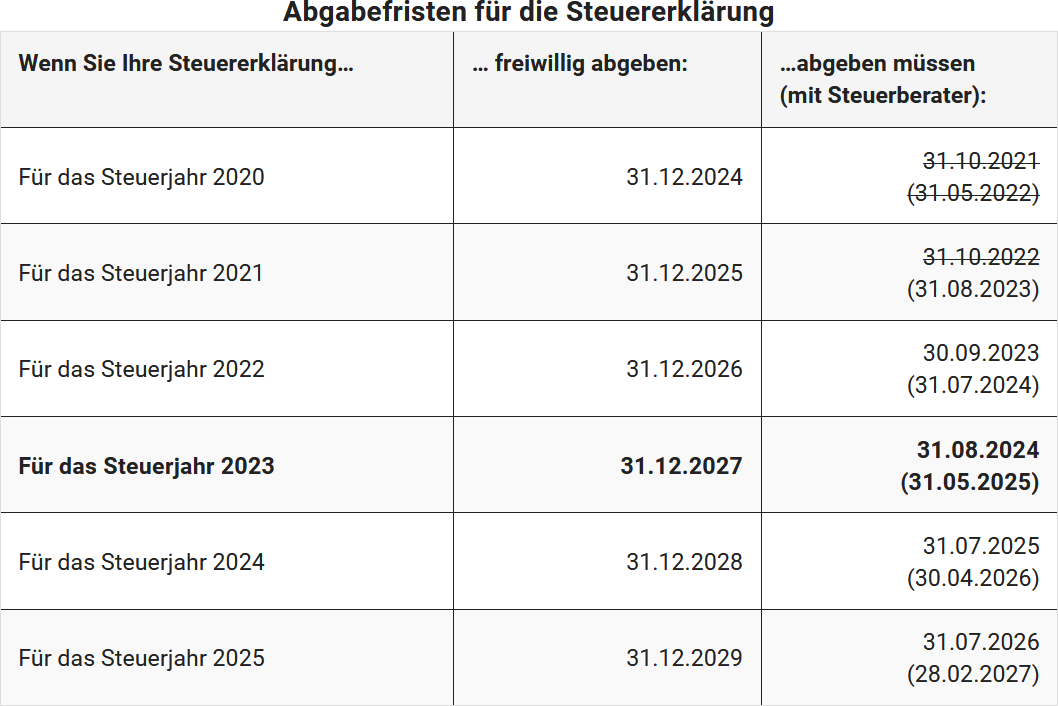

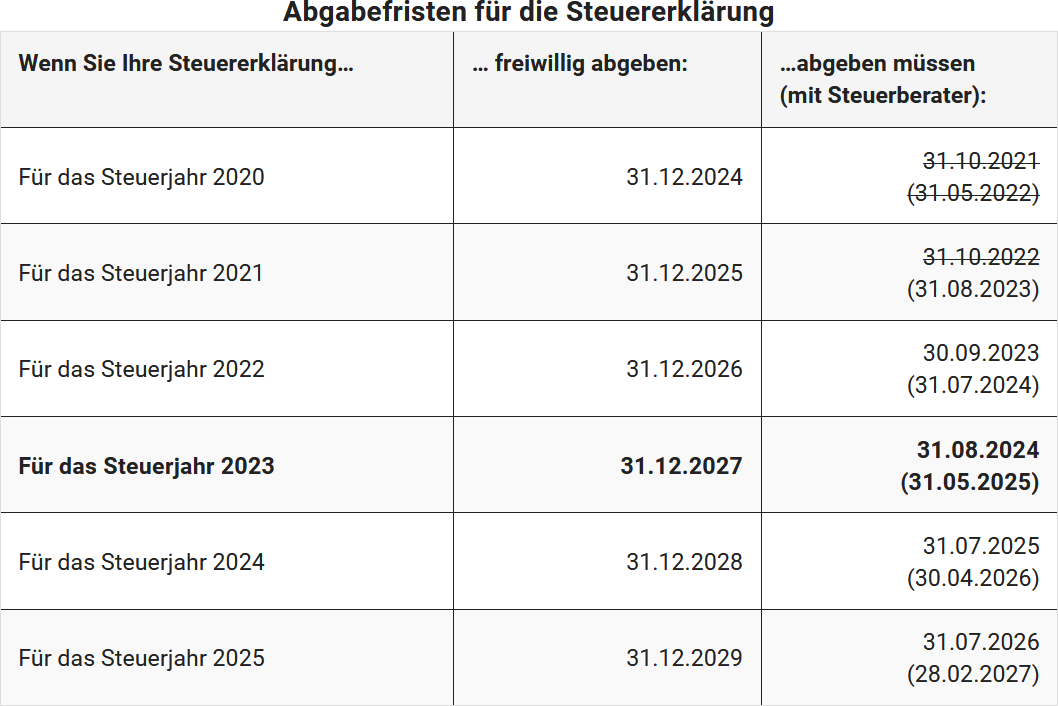

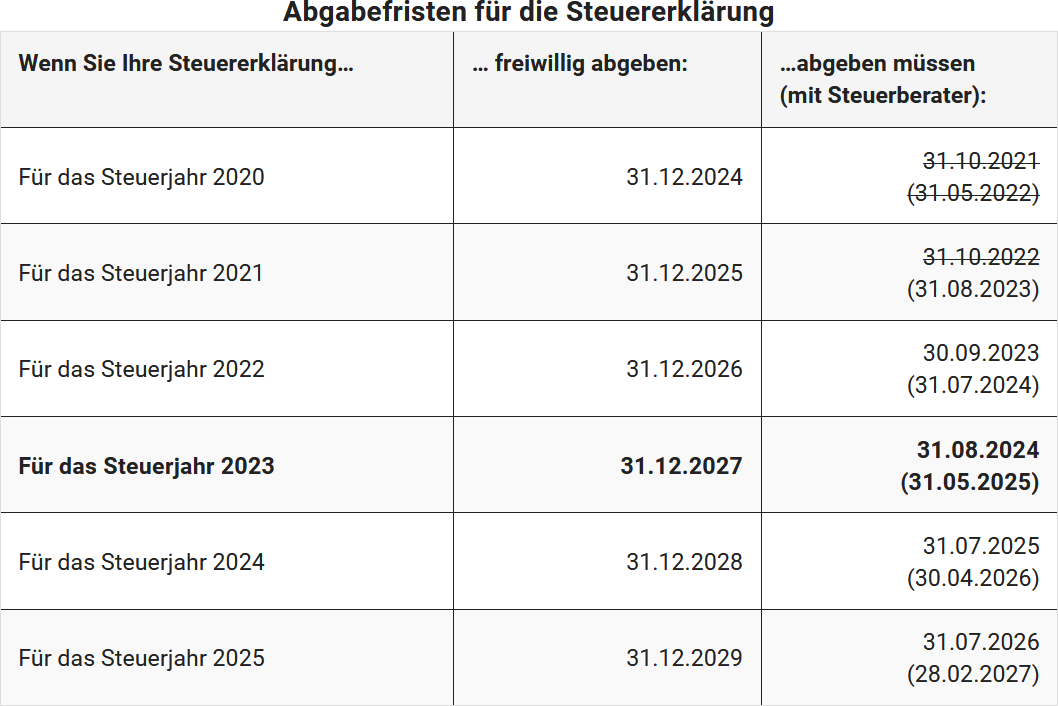

Submission deadline for the 2023 tax return

You are required to submit an income tax return if there is a specific reason. This is known as a mandatory assessment or official assessment.

If there is no reason for a mandatory assessment, employees, occupational pensioners, and retirees can voluntarily submit a tax return (so-called application assessment according to § 46 para. 2 no. 8 EStG). In this case, you have up to four years after the tax year to submit, so for the 2023 tax return, until 31.12.2027 (§ 169 AO).

The following deadlines apply for submission:

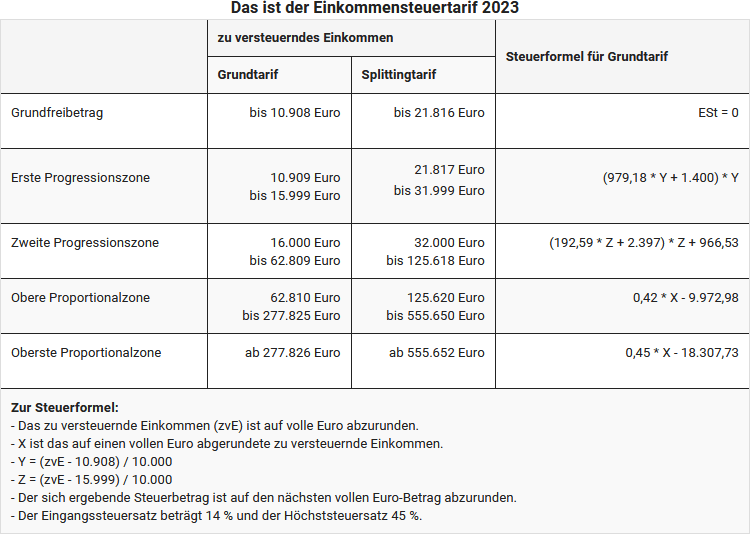

Tax relief: Increase in basic allowance

The tax basic allowance ensures that the portion of income absolutely necessary for living expenses is not taxed (minimum subsistence level). On 1.1.2023, the basic allowance was increased from 10,347 Euro to 10,908 Euro. A further increase to 11,604 Euro is expected on 1.1.2024 (§ 32a EStG).

Reduction of fiscal drag

To prevent a creeping tax increase due to fiscal drag, the tax rate values will be adjusted by 7.2 percent in 2023 and by 6.3 percent in 2024 according to the expected inflation rate. As a result, higher tax rates apply only to slightly higher incomes, allowing taxpayers to retain more net income. The problem of "fiscal drag" arises when wage increases merely offset inflation, leading to disproportionate tax burdens and minimal increases in purchasing power.

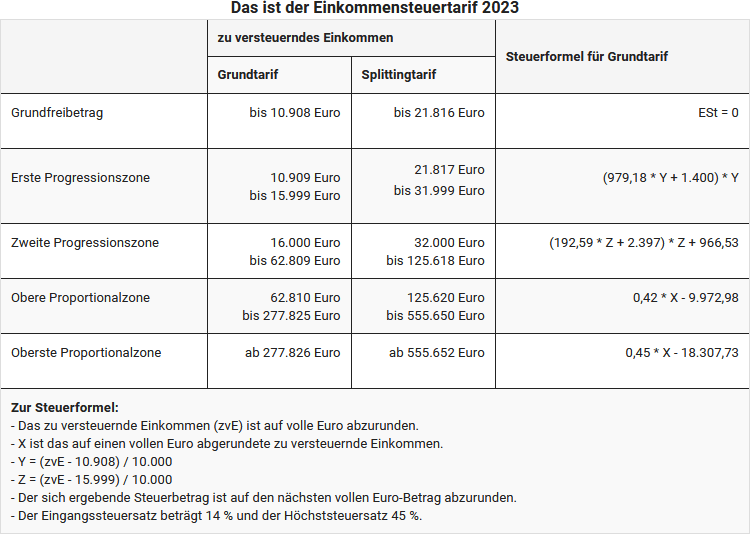

The new income tax rate 2023

Wealth tax applies only to higher incomes

Since 2007, there has been a so-called wealth tax, a tax surcharge of 3 percentage points for top earners. The top tax rate in the highest proportional zone is therefore 45%. In 2023 and 2024, the highest proportional zone with the 3 percent tax surcharge begins at a taxable income of 277,826 Euro for singles and 555,651 Euro for married couples (§ 32a para. 1 no. 5 EStG).

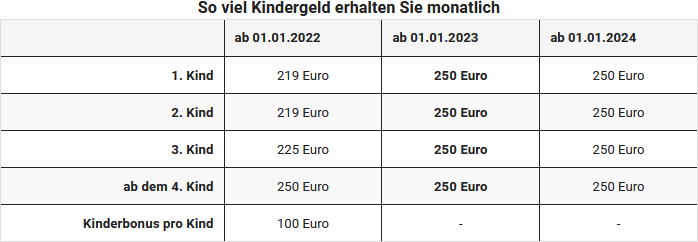

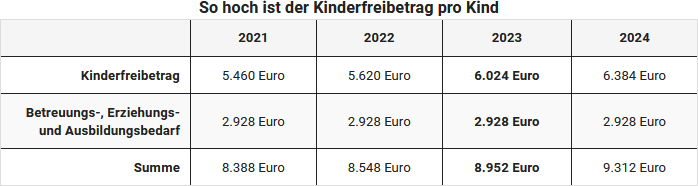

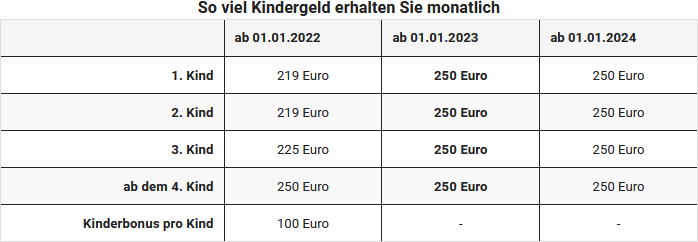

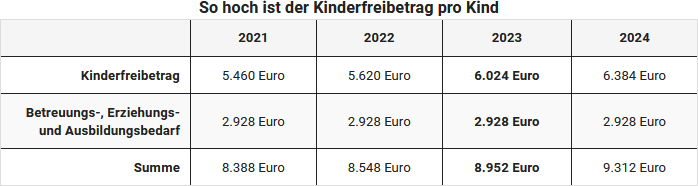

Family support: Increase in child benefit and child allowance

To provide special support to families, child benefit was increased to 250 Euro per month for each child from 2023. The amount is the same for each child and does not increase from the third child onwards as it did previously. The child allowance in 2023 is 6,024 Euro or 3,012 Euro per parent.

Important: From 2023, the child's tax identification number is required for both the application for child benefit and the registration of the child allowance in the tax return to prevent misuse.

Increase in training allowance

From 2023, the training allowance will increase from 924 Euro to 1,200 Euro for parents whose children are in school or vocational training and receive child benefit or child allowances. This amount is reduced by one twelfth per month if the conditions are not met for the entire month. There is also a reduction if the child lives in a country with a lower standard of living, depending on the country group classification.

Relief amount for single parents

Single parents are entitled to a relief amount if at least one child for whom they receive child benefit or the child allowance belongs to their household and no other adult lives in the household (§ 24b EStG). The aim of the relief amount is to compensate for the higher costs of living and household management for "genuinely" single parents who run a household only with their children and no other adult who actually or financially contributes to the household.

In 2023, the relief amount for single parents was increased to 4,260 Euro. The increase of 240 Euro for each additional child remains unchanged (§ 24b para. 2 sentence 3 EStG, amended by the "Second Corona Tax Assistance Act").

Minijob limit rises to 520 Euro

On 1.10.2022, the statutory minimum wage was increased to 12 Euro per hour. Accordingly, the earnings limit for minijobs was raised from 450 Euro to 520 Euro. A minijobber may therefore earn 6,240 Euro over 12 months and in justified exceptional cases up to 7,280 Euro per year.

On 1.1.2024, the minimum wage is to rise to 12.41 Euro per hour and on 1.1.2025 to 12.82 Euro per hour. This will increase the minijob limit to 538 Euro (2024) and 556 Euro (2025).

Employee allowance increases to 1,230 Euro

The employee allowance was increased from 1,200 Euro to 1,230 Euro on 1.1.2023 (§ 9a no. 1 EStG). If you do not claim individual work-related expenses, an amount of 1,230 Euro will be assumed as a lump sum without proof from 2023.

Increase in travel allowance for long-distance commuters

The allowance for long-distance commuters has been increased again to 38 cents from the 21st kilometre. For the first 20 km, it remains unchanged at 30 cents. This applies retroactively from 1.1.2022. Originally, the increase was to apply from 2024, but it has now been brought forward. The increase is initially limited until 31.12.2026.

Home office and study: New regulations from 2023

From 1 January 2023, the tax regulations for expenses related to "home office" and "homework" have been adjusted. There are two scenarios to consider:

A. The study is the "centre" of professional activity:

Costs for a home office can be deducted as business expenses or operating costs either at the actual amount or with an annual flat rate of 1,260 Euro. It must be a "genuine" home office used exclusively for work.

B. No "centre," but work is done at home:

For each day on which the work is carried out "predominantly" at home and no first place of work is visited, a daily allowance of 6 Euro can be deducted for a maximum of 210 days per year, totalling 1,260 Euro. It does not matter whether the workplace is in a separate room or a work corner.

Other important points:

- The annual or daily allowance can only be applied uniformly for the entire year.

- The daily allowance is offset against the employee allowance of 1,230 Euro.

- Records of the days claimed are required.

These changes take into account the changing world of work, particularly the increase in home office work, and provide an opportunity to deduct the costs associated with this work for tax purposes.

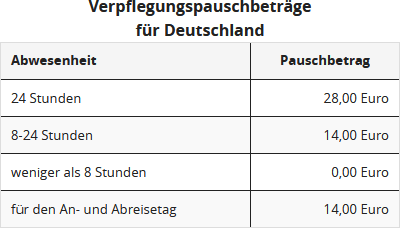

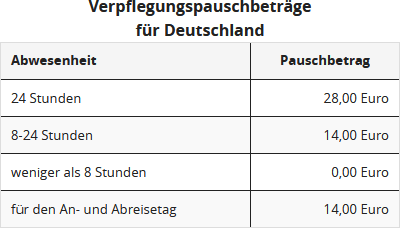

Increase in meal allowances

On 1.1.2023, the meal allowances were increased (§ 9 para. 4a sentence 3 EStG, amended by the "Act on Further Tax Promotion of Electromobility and Amendment of Other Tax Regulations" of 12.12.2019). A further increase is planned for 1.1.2024.

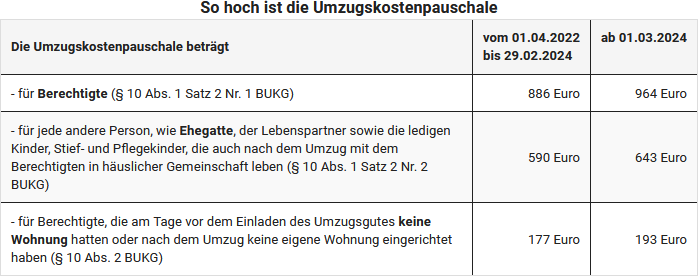

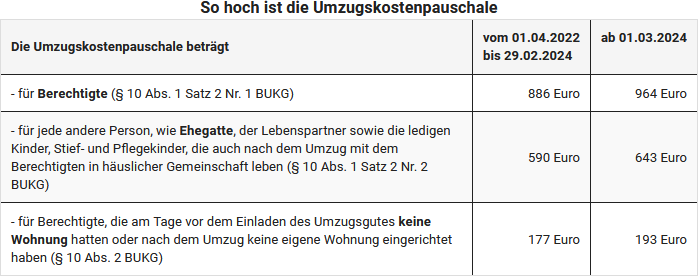

Job-related relocation: Increase in allowances

If you move for work-related reasons, you can deduct the relocation costs as business expenses or have them reimbursed tax-free by your employer. These include transport costs, travel expenses, double rent payments, estate agent fees for a rented flat, and other relocation expenses. While the first-mentioned costs can be deducted at the proven amount, other relocation expenses can be claimed with a flat rate.

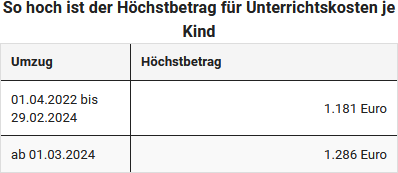

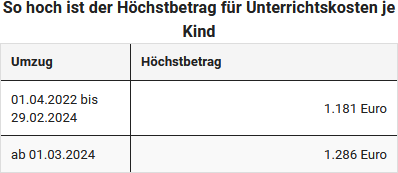

If children have difficulties at school due to the move, you can deduct "expenses for additional tuition for children" as business expenses up to a certain maximum amount (§ 9 para. 2 BUKG 2019).

Capital gains: Saver's allowance increased to 1,000 Euro

The saver’s allowance, which exempts part of the capital gains from tax, will be increased from 2023. For singles, it will rise from 801 Euro to 1,000 Euro, and for married couples from 1,602 Euro to 2,000 Euro. This amount allows capital gains up to the specified limit to be received without withholding tax. The increase is part of the "Annual Tax Act 2022".

Capital gains: Cross-spouse loss offset now possible

Retroactively from 2022, it is permitted to offset unbalanced losses from capital assets across spouses in the income tax assessment. Previously, this was only possible within the framework of the capital gains tax deduction if a joint exemption order was in place. Now, unbalanced losses can be determined separately for each spouse until 31 December. This change was introduced in the "Annual Tax Act 2022".

Rental: Temporary introduction of declining balance depreciation

From 1 October 2023, a declining balance depreciation of 6 percent of the residual value will be introduced for rented residential buildings to promote housing construction and support the construction industry. This measure is a response to the acute housing shortage and high construction costs. It applies if construction begins between 1.10.2023 and 30.9.2029 or the purchase contract is concluded and the building is acquired by the end of the year of completion.

Rental: No prohibition on shorter depreciation periods

Taxpayers have the option to base the depreciation period for buildings on an actually shorter useful life if they can justify this. The Federal Fiscal Court allows various suitable methods to prove a shorter useful life, including the model calculation of the remaining useful life, which is accepted contrary to the tax authorities. (BFH ruling of 28.7.2021, IX R 25/19).

Rental: Increase in linear depreciation

From 1 January 2023, linear depreciation for residential buildings completed from this date will be increased from 2 percent to 3 percent. As a result, all buildings will be depreciated over a period of 33 years, regardless of their actual useful life. This measure supports a climate-friendly new building offensive and does not affect the usually longer useful life of residential buildings, which often exceeds 50 years. (§ 7 para. 4 sentence 1 no. 2a EStG, inserted by the "Annual Tax Act 2022" of 16.12.2022).

New special depreciation for rental housing

From 1 January 2023, the special depreciation under § 7b EStG, created for new rental housing, will be renewed. It applies to rental housing for which the building application is submitted between 1.1.2023 and 31.12.2026 or a corresponding building notice is issued. In the first four years, the 7b special depreciation amounts to 5% of the acquisition or production costs up to the eligible assessment basis. In addition, linear depreciation of 2% per year can be deducted. The benefit applies to acquisition or production costs of up to 2,500 Euro per square metre of living space and for buildings whose construction costs do not exceed 4,800 Euro per square metre of living space. The subsidised property must be rented for at least 10 years, and there is no rent cap. (§ 7b para. 2 and 3 and § 52 para. 15a EStG, inserted by the "Annual Tax Act 2022" of 16.12.2022).

Pension from statutory pension insurance

For pensioners who received a pension for the first time in 2023, the taxable portion is 82.5% of the pension amount. The gross pension amount is 82.5% taxable, with a deduction of 102 Euro for the advertising costs allowance.

In the following year 2023, the full annual pension amount will again be taxed at the rate of 82.5%. The remaining portion of the pension is then your personal pension allowance, which applies in the same amount for the entire duration of the pension. From 2023, the full annual pension amount is taxable after deduction of the pension allowance and the advertising costs allowance of 102 Euro.

Pensions and occupational pensions

Benefits are - unlike pensions from statutory pension insurance - fully taxable as "income from employment" and must therefore be declared in "Anlage N". Benefits have been subject to the benefits allowance, the supplement to the benefits allowance, and the advertising costs allowance of 102 Euro since 2005.

From 2023, the calculation of the benefits allowance will change. The reduction rate will be reduced from 0.8 percentage points to 0.4 percentage points per year, and the maximum amounts will decrease more slowly. When retiring in 2023, the benefits allowance will increase to 14.0% (instead of 13.6%) of the benefits, up to a maximum of 1,050 Euro (instead of 1,020 Euro), and the supplement to the benefits allowance will be 315 Euro (instead of 306 Euro). Together with an advertising costs allowance of 102 Euro, the benefits will remain tax-free for life up to 1,467 Euro (instead of 1,428 Euro).

From 2058, benefits will be fully taxable (§ 19 para. 2 sentence 3 EStG, amended by the "Growth Opportunities Act").

Health insurance: Higher thresholds for family insurance

In statutory health and nursing care insurance, family members are co-insured free of charge if their total monthly income does not exceed the income limit of 520 Euro (from 1.10.2022). Until 30.9.2022, the income exemption limit could be exceeded three times a year, but since 1.10.2022, only twice a year. This means that the maximum permissible earnings of a minijobber are generally 6,240 Euro per year and can reach up to 7,280 Euro in exceptional cases.

Tax relief for charitable organisations

Donations to help those affected by the Corona crisis do not require extensive proof and are deductible in any amount. Donations to support refugees from the Ukraine war are considered special expenses, deductible up to 20% of income. Excess amounts can be carried forward to the following year. For donations to refugees, a simplified donation receipt without a limit applies from 24.2. to 31.12.2022. (BMF decree of 9.4.2020, IV C 4 -S 2223/19/10003).

Support for dependants: Increase in maximum maintenance amount

On 1.1.2023, the maximum maintenance amount was increased to 10,908 Euro. The maximum maintenance amount is often not granted at this level but is reduced. Namely by one twelfth for each full calendar month in which the conditions are not met, by own income and benefits of the maintenance recipient that exceed the allowance of 624 Euro, and by one, two, or three quarters if the maintenance recipient lives in a country with a lower standard of living.

(2023): Tax return for 2023: What's new

What is the deadline for submitting my tax return?

Since 2018, the submission deadlines have been legally extended by two months:

- For citizens who prepare their tax return themselves, the submission deadline is extended by 2 months from 31 May to 31 July of the following year (§ 149 para. 2 AO).

- Citizens who are advised by a tax advisor or income tax assistance association also receive two more months to submit their return. While under the previous "deadline decree" an extension beyond 31 December of the following year was only possible based on justified individual applications, there is now time until the end of February of the second following year.

But beware: The tax authorities have the option of the so-called advance request. You may therefore have to submit your tax return before the dates mentioned. In any case, high late fees are threatened for late submissions. Their imposition is no longer at the discretion of the tax officer but is mandatory.

Postponement of submission deadlines due to the coronavirus pandemic

Due to the significant burdens caused by the coronavirus pandemic, the deadlines for submitting income, corporation, trade, and VAT returns have been repeatedly extended, most recently by the "Fourth Coronavirus Tax Assistance Act".

1. Tax return 2020

For taxpayers who prepare their tax return themselves, the submission deadline was extended by 3 months from 31.7.2021 to 31.10.2021. If the tax return is prepared by a tax advisor or income tax assistance association, the new submission deadline is 6 months later, i.e. on 31.8.2022.

2. Tax return 2021

For taxpayers who prepare their tax return themselves, the submission deadline is extended by 3 months from 31.7.2022 to 31.10.2022. If the tax return is prepared by a tax advisor or income tax assistance association, the new submission deadline is 6 months longer and ends instead of 28.2.2023 on 31.8.2023.

3. Tax return 2022

For taxpayers who prepare their tax return themselves, the submission deadline is extended by 2 months from 31.7.2023 to 30.9.2023. If the tax return is prepared by a tax advisor or income tax assistance association, the new submission deadline is 5 months longer and ends instead of 29.2.2024 on 31.7.2024.

4. Tax return 2023

For taxpayers who prepare their tax return themselves, the submission deadline is extended by 1 month from 31.7.2024 to 31.8.2024. If the tax return is prepared by a tax advisor or income tax assistance association, the new submission deadline is 3 months longer and ends instead of 28.2.2025 on 31.5.2025.

5. Tax return 2024

For taxpayers who prepare their tax return themselves, there is no longer an extension. If the tax return is prepared by a tax advisor or income tax assistance association, the new submission deadline is 2 months longer and ends instead of 28.2.2026 on 30.4.2026.

Note: For the sake of completeness, it should be noted that the above deadlines are each postponed to the end of the next working day if they fall on a Sunday, a public holiday, or a Saturday. Example: 31 October 2022 is a public holiday in some federal states. Therefore, the deadline for submitting the 2021 tax return in these federal states is postponed to 1 November 2022.

Submission deadlines for the tax return

Apply for an extension

However, if you can foresee that your tax return will not be ready in the next few weeks, it is better to apply for an extension sooner rather than later. This application should actually be submitted before 31 July 2024 and there is no entitlement for the tax office to approve it. It is best to apply for a tacit extension; if you do not hear anything further, your application has been approved. It is important that you provide reasons for your request. These include, for example, a move, a business trip, illness, or missing documents. If the tax office accepts the extension, you usually have until 31 December 2025 at the latest.

Tax advisor ensures extension

If you have commissioned a tax advisor or income tax assistance association, you are in luck. The deadline is then automatically extended to 28 February 2025, unless the tax office explicitly requests an earlier submission. The reason for the later date is simple: it is unreasonable to expect tax experts to do all the work in the first five months of the year.

Eventually, a reminder will come

If you do not respond, the tax office will sooner or later send you a reminder and set a deadline. You should take this date seriously, otherwise, a compulsory fee may be imposed, and a hefty penalty for missing the deadline is also threatened. It is better to get in touch in good time.

Voluntary submissions have more time

If you are one of those who are not obliged to submit a tax return, none of this concerns you. The tax office does not expect money from you but probably has to refund some. For this very reason, however, it is a good idea not to put off the income tax return. Legally, you have plenty of time: for voluntary assessment, there are generally four years in which the tax return can (but does not have to) be submitted.

Your tax return for 2023 must therefore be received by 31 December 2027 – not a day later, otherwise all the work is for nothing. However, it is better not to exhaust the leeway but to take care of it early. Experience shows that it is easier to gather the necessary documents in the following year than three years later. Moreover, it is about money – who wants to wait four years for the refund?

(2023): What is the deadline for submitting my tax return?