When are pensioners required to submit a tax return?

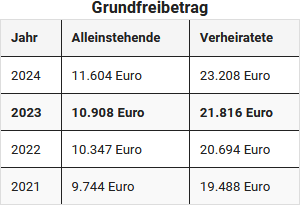

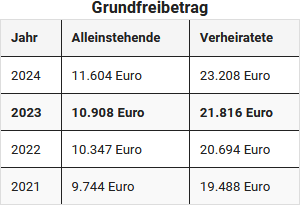

A pensioner is required to submit a tax return 2023 if their total income exceeds the annual basic allowance. In 2023, the basic allowance is 10,908 Euro for single persons and 21,816 Euro for married couples.

Taxable income for pensioners that must be declared includes private and state pensions (Form R), as well as rental and capital income (Form V and Form KAP) and much more.

Not every Euro of the state pension is part of a pensioner's taxable income. This means that someone receiving a state pension of 1,500 Euro per month does not have to pay tax on the entire annual sum of 18,000 Euro. The amount of the taxable pension depends on the year the employee retired. The taxable portion is 50% of the pension amount for all pensioners from 2004 and for those who retired in 2005, regardless of age.

For pensioners who start receiving a pension in 2023, the taxable portion is 82.5% of the pension amount.

The taxable portion is applied only in the year the pension begins and in the second year of receiving the pension. The remaining amount in the second year is the personal pension allowance, which remains tax-free for life. From the third year onwards, the pension is fully taxable after deducting the personal pension allowance and the standard allowance for income-related expenses of 102 Euro. The constant pension allowance means that pension increases from the third year of receiving the pension are fully taxable.

Example: For Manfred Mustermann, who retired in 2005, the taxable pension is 50 percent. Like all pensioners who retired by 2005, he receives an allowance of 50 percent. This is not taxable and remains unchanged for life.

For Mr Mustermann: If he received a pension of 30,000 Euro in 2005, his allowance is therefore 15,000 Euro. This annual allowance remains constant until the end of his life. The married pensioner Mustermann and his wife have no other income. Therefore, they do not have to submit a tax return. Together, their income is below the basic allowance of 21,816 Euro (2023). If Max Mustermann were single, it would be different. With a taxable annual pension of 15,000 Euro, he would be above the basic allowance of 10,908 Euro (2023) and would therefore have to submit a tax return. If both spouses are above the basic allowance, they must each submit a separate form.

Tipp

Pensioners who have to submit a tax return should also ensure that they claim possible income-related expenses.

(2023): When are pensioners required to submit a tax return?

Which income is considered investment income?

With the introduction of the withholding tax, it is generally no longer necessary to submit the KAP form. However, in some cases you must still complete the KAP form:

- the capital gains are not subject to tax deduction (e.g. sale of GmbH shares of less than 1 percent)

- income from foreign accumulating investment funds

- income (interest, dividends, etc.) from foreign accounts or deposits

- interest from private loan agreements

- interest on tax refunds

- sale of endowment life insurance policies (for contracts concluded from 2005)

Note: For certain income, you must also complete the KAP-INV form (for income from investment income not subject to domestic tax deduction) or KAP-BET form (for income from capital assets in participations, if the income and the tax to be credited have been determined separately and uniformly).

Furthermore, the KAP form must be completed in the case of an optional assessment if:

- a loss carryforward from previous years is to be taken into account or a loss offset of income from capital assets is to be made, or

- the saver’s allowance has not been fully utilised, or

- church tax has not been deducted despite church tax liability, or

- foreign taxes are still to be taken into account, or

- to check the amount of the capital gains tax deduction.

If you wish to apply for a so-called favourable tax rate check, you must also complete the KAP form. This may allow you to benefit from a lower tax rate if your individual tax rate is lower than the withholding tax rate of 25 percent.

Hinweis

Losses from worthless shares in the case of pure account write-offs may be offset against income from capital assets, but there is a limit. Losses can only be offset against income from capital assets up to a maximum of 20.000 Euro. Unused losses are then carried forward to subsequent years. Important: In the case of worthless shares, the bank does not carry out a loss offset. It does not include losses in the loss pot. Losses from worthless shares must therefore be included in the tax return.

(2023): Which income is considered investment income?

What information must employees provide?

Income: This section records the information that employees must enter in Form N. This applies to employees, workers, civil servants, and company pensioners. Please enter the data from your income tax statement here.

Expenditure: In the expenditure section, you can claim your work-related expenses. These include, for example, expenses for a home office, travel costs, and training costs.

For married couples, two separate sections for income and expenditure are automatically created.

(2023): What information must employees provide?

Am I required to submit a tax return as an employee?

If you are an employee earning income from employment (Anlage N), your employer deducts income tax, solidarity surcharge, and, if applicable, church tax from your gross salary each month. The taxes are paid directly to the tax office. In theory, everything would be settled from a tax perspective, and you would not need to submit a tax return. This also applies to single employees (tax class I) who have not changed jobs during the year.

Mandatory assessment: You must submit a tax return

However, in many cases, the tax authorities suspect that the monthly tax deductions on income from employment have been too low. Therefore, many employees are legally required to submit a tax return, known as the mandatory assessment.

For this reason, § 46 EStG regulates numerous cases in which employees are obliged to submit a tax return:

-

You have earned additional income of over 410 Euro during the year that was not subject to wage tax deduction. This includes, for example, fees, pensions, or rental income.

-

You have received wages from several employers simultaneously during the year.

-

You have had a tax allowance (e.g. for work-related expenses, special expenses, extraordinary burdens) entered on your payslip. The allowances are to be reviewed again as part of the tax return. Exception: If it is a disability allowance, a bereavement allowance, or only the number of child allowances, you are not obliged to submit a tax return.

-

You and your spouse both receive wages, and one of you was taxed under tax class V or VI, or you both chose the factor procedure with the tax class combination IV/IV.

- You have received wage replacement benefits (e.g. parental allowance, short-time work allowance, or unemployment benefit) during the year. These income replacement benefits are subject to the progression clause and can increase the personal tax rate on the remaining income.

-

You have received a severance payment or remuneration for work over several years from a former employer, for which the favourable one-fifth rule was applied.

- As divorced or separated parents, you have chosen a different allocation of the training allowance or the disability allowance for the child.

-

You have received special payments and changed employers in the same year, and your new employer did not take into account the values of the previous employer when calculating income tax.

-

Your marriage was divorced during the year, or your partner passed away, and one of the spouses remarries in the same year.

-

You have a spouse with limited tax liability who lives in the EU/EEA and is entered on your payslip.

-

You have your residence or habitual abode abroad and have applied for unlimited tax liability in Germany.

Note: From 1 January 2020, numerous mandatory assessment criteria also apply to employees with limited tax liability (§ 50 para. 2 sentence 2 no. 4c EStG, amended by the "Act on Further Tax Promotion of Electromobility and Amendment of Other Tax Regulations" of 12 December 2019).

(2023): Am I required to submit a tax return as an employee?

Is there an obligation for all non-employees to submit a tax return?

If you do not earn income from employment, you may still be required to submit a tax return under certain conditions.

Self-employed individuals, business owners, landlords, and pensioners must submit a tax return if their income exceeds the basic allowance. A tax return is mandatory for everyone if the total income (income minus income-related expenses and/or business expenses) exceeds the following amounts:

However, it may also be beneficial in other cases for self-employed individuals, business owners, landlords, and pensioners to submit a tax return. For example, if you wish to claim a loss carryforward, you must submit a tax return for the relevant assessment year.

Lohnsteuer kompakt

Since the pension reform in 2005, more and more pensioners have to pay taxes and may need to submit a tax return.

(2023): Is there an obligation for all non-employees to submit a tax return?

Who needs to fill in Form S for the self-employed?

A self-employment is particularly common among freelancers. A freelancer is someone who works independently and is self-responsible, practising a specific professional activity or occupation listed in § 18 para. 1 EStG. Freelance professions require an activity that does not necessarily have to be preceded by a university degree. It only needs to be a scientific type of training. This also includes self-study or knowledge acquired through professional experience. The knowledge must be equivalent to a university degree.

(1) Freelancers are, on the one hand, persons who carry out a specific activity (§ 18 para. 1 no. 1 EStG), namely a

- scientific, artistic, literary, teaching or educational activity.

(2) Freelancers are also persons who practise a specific professional occupation explicitly mentioned in the Income Tax Act (§ 18 para. 1 no. 1 EStG):

- Medical professions: doctors, dentists, alternative practitioners, dental practitioners, physiotherapists.

- Legal and business consulting professions: lawyers, notaries, patent attorneys, auditors, tax consultants, consulting economists and business administrators, sworn accountants, tax agents.

- Technical and scientific professions: surveyors, engineers, architects, commercial chemists, pilots.

- Media professions: journalists, photojournalists, interpreters, translators.

(3) Freelancers can also be persons who practise a similar profession comparable to the listed professional occupations in terms of activity and training. The list of freelance professions in § 18 para. 1 no. 1 EStG is not exhaustive. It is important that the activity is carried out in a leading and self-responsible manner based on one's own expertise. This applies, for example, to the following professions:

- Geriatric nurses, dieticians, occupational therapists, podiatrists, speech therapists, orthoptists, medical pedicurists, state-certified masseurs and therapeutic masseurs, medical bath attendants, paramedics, dental practitioners, midwives, psychological psychotherapists, child and adolescent psychotherapists, IT consultants, business consultants.

- Software engineering, work as a network or software administrator and supervisor (BFH rulings of 22.9.2009, VIII R 31/07, VIII R 63/06, VIII R 79/06).

(4) Activities that are not considered freelance work and do not constitute a business operation fall under other self-employment. A characteristic here is also personal work performance. However, other self-employment is usually carried out occasionally and only exceptionally on a long-term basis (§ 18 para. 1 no. 3 EStG):

- Executors, asset managers, supervisory boards, property managers, insolvency administrators, trustees, carers, estate administrators, arbitrators, interviewers for state statistical offices, childminders, legal guardians, etc.

The distinction between business and self-employment is often difficult, as freelance work is also generally not without the intention of making a profit. Many activities therefore fall under both the characteristics of freelance work and those of a business. In these cases, the decisive criterion is the intellectual, creative work that is the focus of freelance work.

(2023): Who needs to fill in Form S for the self-employed?