What is a statutory annuity?

Annuities are fixed payments linked to a person's lifetime. Annuities and other benefits from statutory pension insurance, the agricultural pension fund, and professional pension schemes are only partially taxable, depending on the year the pension started.

If you received a pension from statutory pension insurance, you can request a „statement for submission to the tax office“ regarding your pension income as a completion aid. This will then be sent to you automatically in subsequent years. If the pension started in 2023, the taxable portion is 82.5%.

No entries regarding the taxable portion are required in the tax return. The tax-free part of the pension is determined in the year following the start of the pension and generally applies for the entire duration of the pension payments. As part of the pension taxation in subsequent years, this is deducted from the annual (gross) pension amount.

Pension increases resulting from regular pension adjustments are fully taxable. The same applies to benefits from private basic pension contracts (so-called Rürup pensions).

Annuities include in particular

- old-age pensions,

- reduced earning capacity pensions,

- disability pensions,

- occupational disability pensions,

- survivor's pensions such as widow's / widower's pensions,

- orphan's pensions, or

- parental pensions.

One-off payments, such as death benefits or settlements of small pensions, must also be declared. If you have been recognised as a victim of National Socialist persecution under Section 1 of the Federal Compensation Act (BEG) and pension periods due to persecution were taken into account in the calculation of your pension from statutory pension insurance, please inform the tax office informally.

Such periods may have been considered under the Act on the Payment of Pensions from Employment in a Ghetto (ZRBG), the Act on the Settlement of National Socialist Injustice in Social Insurance (WGSVG), or the Foreign Pensions Act (FRG). This also applies to widow's / widower's pensions if the deceased was recognised as a victim under Section 1 BEG and the pension payment includes corresponding pension periods. The tax office will check whether this pension is tax-free.

(2023): What is a statutory annuity?

How is the statutory pension taxed?

In 2005, the legislator reformed the taxation of state pensions through the Retirement Income Act. Since then, a fixed portion of the pension is taxable, while the rest remains (for now) tax-free. You must declare your pension income, which is known as deferred taxation. The amount to be taxed depends on the year you started receiving your pension.

For individuals who retired in 2005 or earlier, the tax-free portion was 50 percent. A (personal) allowance is created from the non-taxable pension, allowing these pensioners to use a "pension allowance" of 50 percent from 2005 onwards. This pension allowance remains unchanged for life.

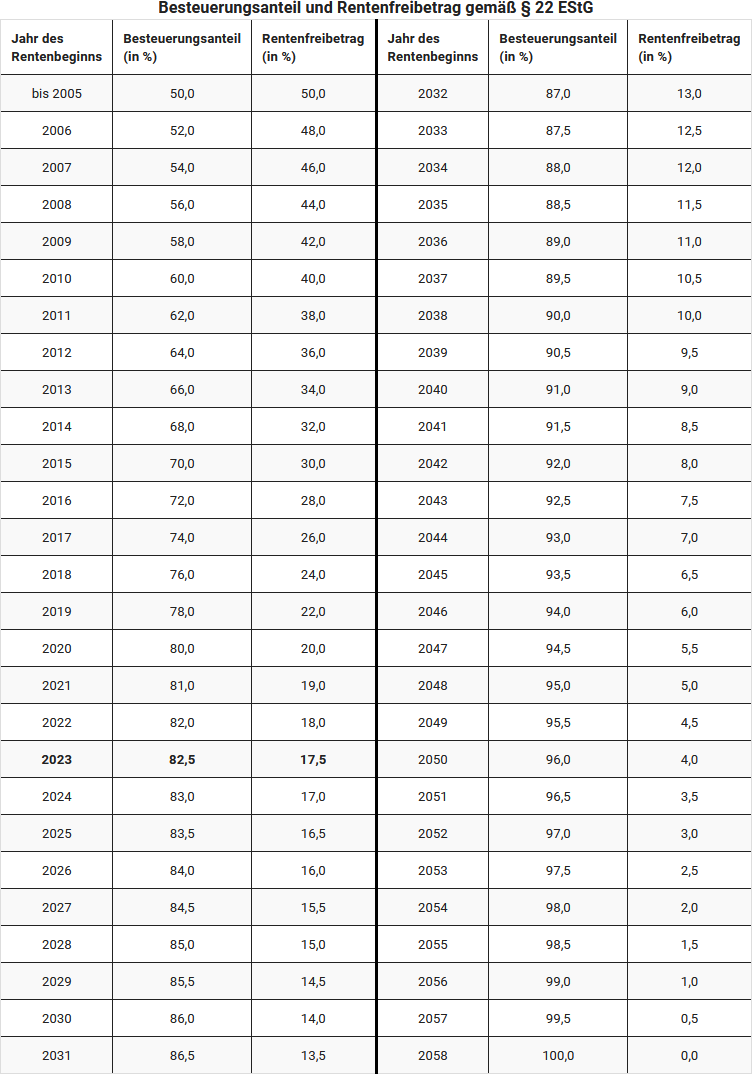

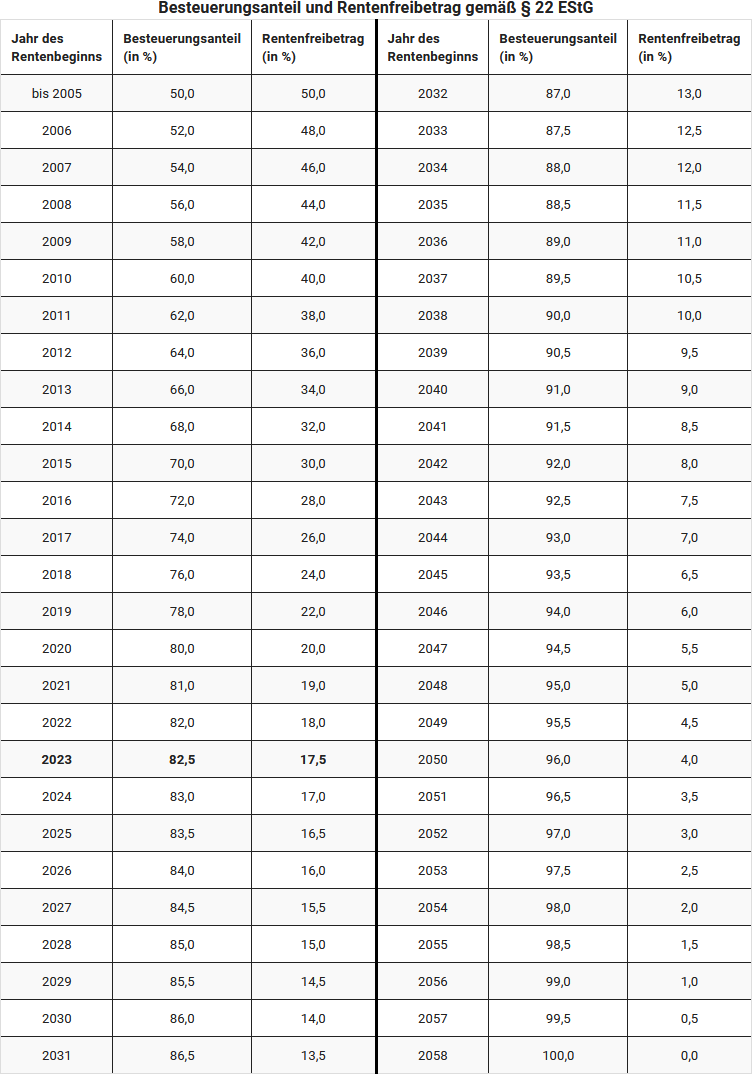

Since 2005, the so-called taxable portion has increased annually by two percentage points, and from 2021 by one percentage point per year. Originally, individuals retiring from 2040 onwards were to fully tax their state pension income. However, due to amended legislation, the taxable portion will increase by only half a percentage point annually from 2023, starting with the 2023 pensioner cohort, and will reach 100 percent for the 2058 cohort for the first time (§ 22 No. 1 letter a double letter aa EStG, amended by the "Growth Opportunities Act").

For pensioners who start receiving their pension in 2023, the taxable portion is 82.5% of the pension amount.

The tax office automatically deducts an allowance for advertising costs of 102 Euro without further proof. If you have higher expenses, you should declare them in your tax return to reduce your taxable income. You can declare, for example, tax consultancy costs (for form R), pension advice, or a lawyer if they support you with pension matters. However, you must prove the higher expenses in any case.

Example

Hans Müller retired on 1 January 2009 and received a state pension of 12.000 Euro last year. For Hans Müller, 58 percent of his pension is taxable, and the pension allowance is 42 percent. Thus, Müller would have to declare 6.960 Euro as income to the tax office for the year. However, if he has no other income, he does not have to submit a tax return, as the amount is below the basic allowance of 10.908 Euro (2023).

The lifelong pension allowance for Hans Müller is 5.040 Euro. However, he would only have to tax income above this allowance if it also exceeds the basic allowance.

Income from renting and leasing or capital gains must, however, be added to the income.

If Hans Müller were to receive a pension of 15.000 Euro and retire in 2023, he would have to tax 12.375 Euro (82.5 percent) of his pension and therefore also submit a tax return.

Note: The pension allowance for Müller remains the same for life. Even if his pension income increases due to pension adjustments, only 5.040 Euro would remain tax-free each year in the first example. The allowance refers to a specific amount of money, not a percentage of the respective pension. Thus, Mr Müller must fully tax future pension adjustments.

(2023): How is the statutory pension taxed?

What income-related expenses can I claim as a pensioner?

Even as a pensioner, you can claim expenses related to your pension as income-related expenses in your tax return. If your income-related expenses total less than 102 Euro, it is not worth entering them. The tax office automatically applies an income-related expenses allowance of 102 Euro, which is immediately deducted from your income. This allowance is applied jointly for all pensions and all income that must be declared under other income. It is an annual amount that is not reduced, even if the conditions did not apply for the entire year or if there was no income for the whole year. The income-related expenses allowance is personal and is available to each spouse separately as soon as they have the relevant income.

Tip: If you have higher expenses exceeding the allowance of 102 Euro, it is definitely worth entering them. However, you should also have the evidence ready and attach it to your tax return. If you have expenses for a tax advisor, the tax office will only recognise the costs as income-related expenses if they are related to your pension. Therefore, ask your tax advisor to specify separately in their invoice the part that directly relates to your pension.

As income-related expenses, you can claim, for example, expenses for a

- pension advisor,

- lawyer in pension disputes,

- tax advisor (only for form R), and also

- costs related to applying for a pension (travel expenses, office supplies, postage, telephone costs)

- court fees if the case concerns your pension

- union fees you pay as a pensioner

- flat-rate account maintenance fee of 16 Euro per year

Tip

If you are unsure whether the tax office will recognise a particular expense, simply declare it and attach the evidence. The tax officer will decide.

(2023): What income-related expenses can I claim as a pensioner?

What does the 2005 Pension Income Act regulate?

The Pension Income Act governs the taxation of pensions, affecting everyone, both those who retired in 2005 and all future retirees. The tax burden for new retirees increases each year, but there are also benefits for employees.

Tax-advantaged pension schemes

In addition to the statutory pension insurance, private pension insurance is also recognised as a form of retirement provision, particularly the so-called basic pension or Rürup pension. Contributions to private pension insurance are only tax-advantaged if the insurance provides a lifelong pension for the policyholder. Furthermore, the insured person must be at least 60 years old at the start of the pension. For contracts concluded from 2012 onwards, pension payments may not begin before the age of 62. This ensures that these are retirement products. These pension entitlements must not be transferable, pledgeable, sellable, or capitalisable. In addition, the pensions must be paid out as annuities; lump-sum payments are generally not permitted. However, you can extend these tax-advantaged pension products with additional insurance, such as occupational disability insurance.

Investment products that are not necessarily intended for retirement provision, such as freely available capital investments, including endowment life insurance, are not tax-advantaged. An exception is endowment life insurance policies concluded before 2005 – they remain tax-free.

For pensioners, this means:

Since 2005, 50 per cent of pension income has been taxed. From 2006 to 2020, the taxable portion of pensions increased by two percentage points each year, and from 2021 by only one percentage point per year.

Originally, people retiring from 2040 onwards were to fully tax their statutory pension income. However, from 2023, starting with the 2023 retirement cohort, the taxable portion will no longer increase by 1 percentage point per year, but only by half a percentage point, reaching 100 per cent for the first time in 2058 (§ 22 No. 1 a) aa) EStG, amended by the "Growth Opportunities Act").

For pensioners who start receiving their pension in 2023, the taxable portion is 82.5% of the pension amount.

Also regulated in the Pension Income Act: Temporary pensions, such as disability pensions, and non-temporary pensions, such as old-age pensions, have been treated equally for tax purposes since 2005. Pensions from insurance policies that were tax-advantaged during the accumulation phase are taxable during the payout phase.

Note:

At the end of May 2021, the Federal Fiscal Court published its two rulings on the possible double taxation of pensions. However, the lawsuits filed by the affected pensioners were unsuccessful. The Federal Fiscal Court considers double taxation to be possible only in a few individual cases. It considers the basic system of pension taxation to be lawful, including the limited deduction of pension expenses during working life and the partial tax exemption of pensions during the payout phase. Double taxation is only emerging for later retirement cohorts (Federal Fiscal Court rulings of 19.5.2021, X R 33/19 and X R 20/21). However, the unsuccessful plaintiffs have lodged a constitutional complaint against the two Federal Fiscal Court decisions (Ref. 2 BvR 1143/21 and 2 BvR 1140/21).

The issue is how double taxation is calculated in detail. The Federal Fiscal Court has taken a very schematic view, which only leads to excessive taxation of pensions in individual cases. For the calculation of possible double taxation, the nominal value principle applies. The actual contributions paid and the tax-advantaged pension expenses must be compared with the actual pension payments received later, which are partially exempt. Amounts are neither to be discounted nor adjusted for inflation.

However, some experts, as well as the plaintiffs in case X R 33/19, argued that during the working phase, no pension amounts in cash are acquired, but rather pure pension points. The actual amount of the pension only becomes clear much later. However, the Federal Fiscal Court did not delve into the "depths" of financial and insurance mathematics but compared amounts paid in with amounts paid out. Whether this is correct or whether there is a more favourable calculation for taxpayers will be clarified by the constitutional judges in Karlsruhe.

Currently, the federal and state governments have agreed to issue affected tax assessments on a provisional basis regarding the disputed point. Specifically, tax assessments are issued provisionally with regard to the "taxation of annuities and other benefits from basic provision under § 22 number 1 sentence 3 letter a double letter aa EStG". The provisional note is added to all income tax assessments for assessment periods from 2005 onwards in which an annuity or other benefit from the so-called basic provision is recorded (BMF letter of 30.8.2021, V A 3 - S 0338/19/10006 :001).

This means: Pensioners will now receive income tax assessments with a note on the - partial - provisional nature of the tax assessment. If the Federal Constitutional Court finds that the current taxation of statutory pensions and pensions from professional pension schemes and similar pension schemes is unconstitutionally high, the tax assessments issued now and in the future can be changed without a prior objection.

Important: Affected individuals should keep all tax and pension statements, even those from many years ago, regardless of any potential outcome.

(2023): What does the 2005 Pension Income Act regulate?

What does the opening clause mean?

With deferred taxation, there can be unfair over-taxation if a self-employed person has paid contributions to an occupational pension scheme over several years that were higher than the annual maximum contribution in the statutory pension insurance (sum of employer's and employee's share). The maximum amount payable is based on the contribution assessment ceiling.

This is recalculated annually and represents the limit up to which pension insurance contributions must be paid as a proportion of income. For income above the contribution assessment ceiling, you normally do not pay insurance contributions – unless you pay them voluntarily in this context.

The self-employed person has therefore voluntarily paid additional contributions from their already taxed income. As a result, they have earned a higher pension, but on the other hand, they would have to tax it too highly with the usual tax rate. This can be avoided. As a pensioner, they can have their pension divided into a voluntary and a statutory part. However, they must have paid higher voluntary contributions for at least ten years by 31/12/2004.

Tip

If this applies to you, you must apply for the portion of your pension based on these increased contributions to be taxed not at the high tax rate (2023: 82.5 percent of the pension) but at the much more favourable yield rate. The portion of the pension to be taxed at a lower rate is the opening clause, which you can find in the certificate from your pension provider.

Example

If you have been receiving a statutory pension of 1,500 Euro per month since the age of 65 and can prove to the tax office with a certificate from the pension payment office that 30 percent (this is the opening clause) of the pension payment is based on increased contributions, the calculation is as follows:

For 70 percent of the pension: Normal taxation after deduction of the pension allowance: 1,500 Euro x 70 percent = 1,050 Euro x 12 months = 12,600 Euro minus pension allowance of (for example) 42 percent = 7,308 Euro.

For the part for which the opening clause of 30 percent applies, the more favourable yield rate is applied: 1,500 Euro x 30 percent = 450 Euro x 12 months = 5,400 Euro x 18 percent = 972 Euro. In this case, 8,280 Euro would have to be taxed. Without the opening clause, 10,440 Euro would have had to be taxed.

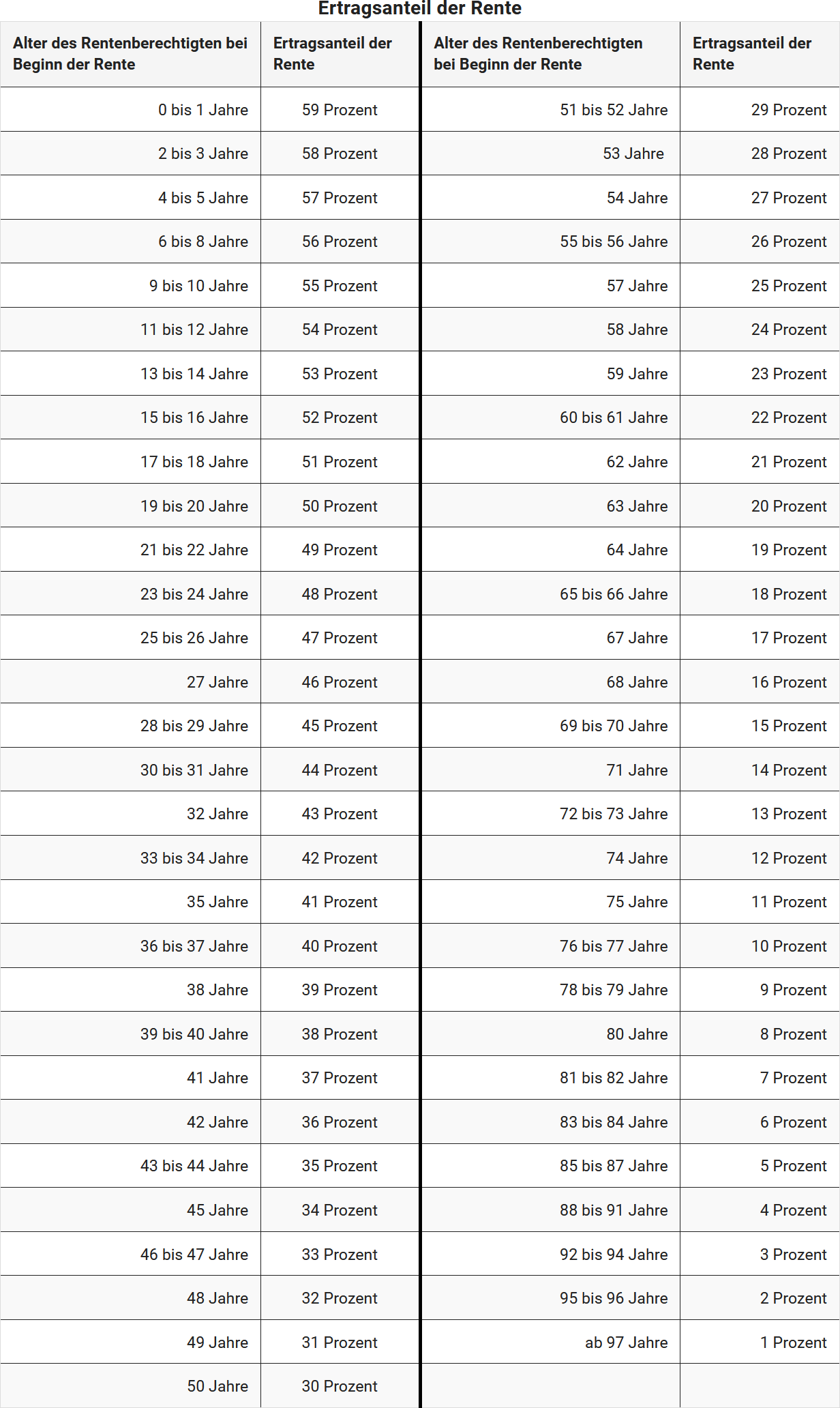

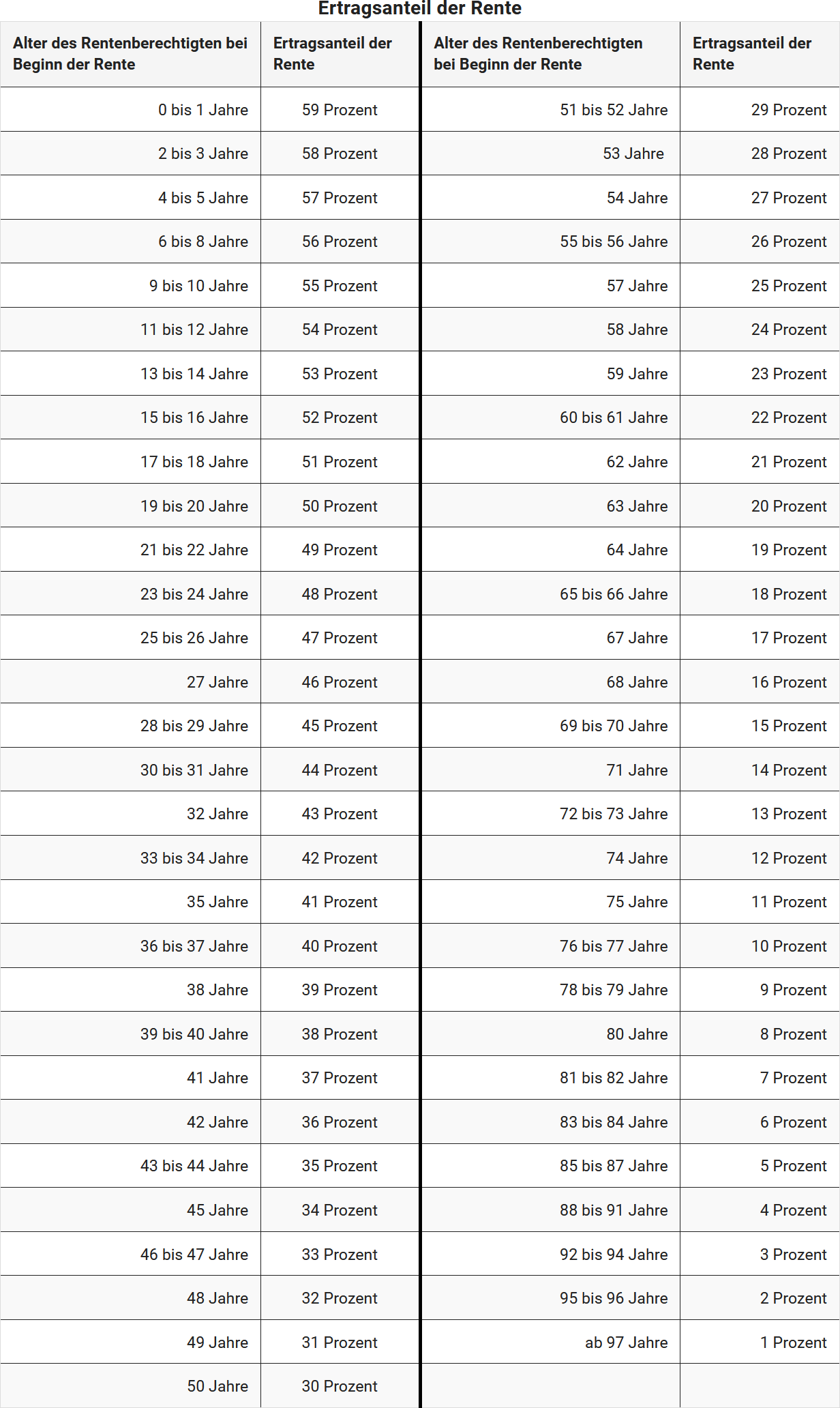

The yield rate depends on the age of the pensioner at the start of the pension payment, for example, it is 19 percent for 64-year-olds, 18 percent for 65 to 66-year-olds, and 17 percent for 67-year-olds.

The following table shows the yield rate depending on the age at the start of the pension; this is automatically calculated by Lohnsteuer kompakt:

Double taxation of pensions

In May 2021, the Federal Fiscal Court (BFH) published rulings on the possible double taxation of pensions (BFH rulings of 19/5/2021, X R 33/19 and X R 20/21). These affect all those who were already pensioners in 2005 and all future pensioners. The BFH has ruled that double taxation is only possible in a few cases. This means that the way pensions are taxed is generally accepted.

However, there are some disagreements about how exactly double taxation should be calculated. The BFH uses a simple method that focuses on the actual contributions and the later pension payments. Some experts and plaintiffs prefer a more complex method that takes the actual pension amount into account at a later date.

The good news is that the federal and state governments have decided to make tax assessments provisional regarding the disputed taxation of pensions. This means that pensioners now receive tax assessments stating that the tax assessment is provisional. If the Federal Constitutional Court decides that the current taxation is too high, tax assessments can be changed even without a prior objection (BMF letter of 30/8/2021, V A 3 - S 0338/19/10006 :001).

It is important to note that affected pensioners should keep all tax and pension statements, regardless of the final court decision.

(2023): What does the opening clause mean?

Sichern Sie sich einfach die volle Steuererstattung, die Ihnen zusteht!

Nur Lohnsteuer kompakt bietet Ihnen:

- Persönliche Steuertipps im Wert von 312 Euro (Durchschnitt)

- Verständliche Eingabehilfen und Erklärungen

- Import aus jeder beliebigen anderen Steuersoftware

- Schnelle Antworten bei Fragen

Jetzt kostenlos testen