When should I declare income as a cross-border commuter?

If you live in a border area and commute daily to work in a neighbouring country, you are considered a cross-border commuter. Regarding your income, the following applies in most neighbouring countries: you must pay tax on your salary in the country where you work; the income remains tax-free in the country where you live. However, your foreign income is included in the progression clause and thus increases the tax rate for your other income.

The information must be provided in "Form N" and "Form N-AUS" or Form N-Gre. Form N-Gre concerns foreign income from employment for cross-border commuters from Baden-Württemberg to Austria, Switzerland, and France.

Tipp

If you are single, work as a cross-border commuter, and have no additional income in Germany, you do not need to worry about the progression clause in Germany.

Exceptions: For France, Austria, and Switzerland, a special cross-border commuter regulation applies under the respective double taxation agreement.

If you work in France or Austria, you do not have to pay taxes there but must declare the wages in your German tax return and pay tax as normal. Civil servants or public sector employees, however, pay tax on their income in the country where they work, as the principle of the paying state applies.

If you work as a cross-border commuter in Switzerland, your employer may deduct a wage tax of 4.5 percent, which is credited against the tax in Germany. If you are a civil servant or public sector employee, you must pay tax on your income entirely in Germany.

Please note that during the coronavirus period, there were special regulations for cross-border commuters, as many employees worked from home and did not commute daily (see also: Double taxation agreements and other agreements in the tax sector). In addition, double taxation agreements are now being amended, or so-called amendment protocols have been agreed, whereby home office days are increasingly considered harmless. In individual cases, it should be carefully checked where the taxation right lies.

(2023): When should I declare income as a cross-border commuter?

Who qualifies for the cross-border commuter regulation (CH)?

The cross-border commuter regulation for Switzerland applies to anyone who lives in Germany and regularly commutes to their workplace in Switzerland. The following regulations apply:

- The taxpayer must not return to their place of residence on more than 60 working days per year.

- The distance between home and workplace is irrelevant.

- Switzerland may levy a payroll tax of up to 4.5% on wages. Allowances and work-related expenses are not taken into account.

- The employee must prove their place of residence to the employer with a so-called certificate of residence from their local tax office (form Gre-1).

- The employer will issue a payroll tax certificate upon request for the withheld payroll tax.

- When taxed in the country of residence, Germany, the payroll tax withheld in Switzerland is credited against the German income tax.

Special features and equitable regulations

Please note that there are special features and equitable regulations for cross-border commuters due to the coronavirus pandemic, as daily commuting was often not possible. Further information can be found on the Federal Ministry of Finance website.

In addition, double taxation agreements are now being amended, or so-called amendment protocols have been agreed, whereby home office days are increasingly considered harmless. In individual cases, it should be carefully checked where the taxation right lies.

(2023): Who qualifies for the cross-border commuter regulation (CH)?

Who qualifies as a cross-border commuter (AUT)?

The cross-border commuter regulation with Austria applies to anyone who lives in Germany and regularly commutes to their workplace in Austria. Two conditions must be met:

- The place of residence and work must be in the border zone, i.e. within 30 km on either side of the border.

- You must return to your place of residence every day in principle.

If you do not return to your place of residence on more than 45 working days per year or work outside the border zone for your employer, this is not a problem (so-called non-return days).

Activities outside the border zone also include activities in a third country.

Lohnsteuer kompakt

Please note that there are special and equitable regulations for cross-border commuters due to the coronavirus pandemic, as daily commuting was often not possible. Further information can be found on the Federal Ministry of Finance website.

(2023): Who qualifies as a cross-border commuter (AUT)?

What is the "Special Cross-Border Commuter Regulation"?

These regulations apply to commuters who live in Germany and commute to work in France, Austria, or Switzerland. This is governed by the respective double taxation agreements. If you work in one of these countries, you must pay tax on your income in Germany, not in the country where you work. However, this only applies if your place of residence and work is in the border zone of the respective country. For France, the border zone is 20 km on either side of the border, for Austria it is 30 km. In Switzerland, there is no such border zone.

There was also a special cross-border commuter regulation with Belgium until 2003. However, since 2004, the general regulation has applied. This means for cross-border commuters to Belgium: The salary is no longer taxed in the country of residence, Germany, but in the country of employment, Belgium. In Germany, the income is exempt from tax but included in the calculation of the tax rate. However, there is a special tax regulation for commuters from Belgium to Germany: Belgium, as the country of residence, exempts the wages taxed in Germany as the country of employment and only includes them in the calculation of the tax rate. However, this income is included in the Belgian municipal tax, which is an additional tax on income tax. To offset this Belgian municipal tax, German income and wage tax on this income is reduced by a flat rate of 8%.

(2023): What is the "Special Cross-Border Commuter Regulation"?

Warum sollte I enter my income as a cross-border commuter in the local currency?

If you receive income in a currency other than Euro as a cross-border commuter, please enter this amount in the foreign currency in your tax return (Form N-Gre). This only applies if you work in Switzerland.

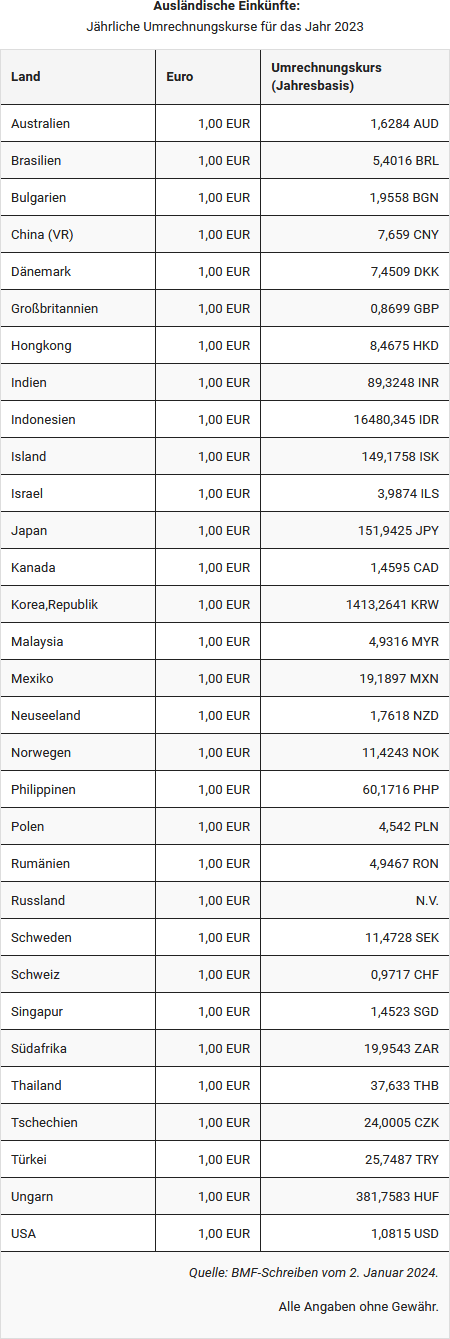

The tax office will convert your income from the foreign currency into Euro using an average exchange rate. The reference rate of the European Central Bank (ECB) or the official VAT conversion rate may also be used. However, you are not permitted to convert your income yourself using an exchange rate.

(2023): Warum sollte I enter my income as a cross-border commuter in the local currency?

What is tax-free wages under DBA/ATE?

This refers to tax-free wages under double taxation agreements (DTA) or the decree on employment abroad (ATE). A DTA specifies how employees working abroad must tax their income to avoid double taxation. Wages for work abroad can be tax-free under the ATE if there is no double taxation agreement with the relevant country and the work lasts for at least three consecutive months. Illness or holidays do not affect the duration of employment but are not counted towards the three-month period.

If your salary is taxable abroad, you will be exempt from tax in Germany under the DTA or ATE. However, income taxed abroad is included in the progression clause in Germany. This means that a total income is calculated from foreign income and other income in Germany. This total income results in a higher tax rate, which is only applied to the income earned in Germany.

Exceptions:

- For France, Austria, and Switzerland, a special cross-border commuter regulation applies under the double taxation agreement. If you work in these countries, the wages are taxed in the country of residence, Germany.

- In Switzerland, the employer may deduct a wage tax of 4.5 percent, which is credited against the tax in Germany.

- Civil servants and public sector employees always tax their income in the country where they work, as the principle of the paying state applies.

Note: The decree on employment abroad has recently been revised. We would like to draw your attention to a particularly important new provision: employees must prove that their wages abroad were subject to a minimum taxation. If you cannot provide proof or if there is no minimum taxation, the decree on employment abroad and thus the tax exemption in Germany do not apply. The new regulations apply to wages and other remuneration paid after 31.12.2022 or received by the employee after this date.

Note: More and more double taxation agreements are currently being amended to give special consideration to home office days. In individual cases, it should therefore be carefully checked where the right of taxation lies.

(2023): What is tax-free wages under DBA/ATE?

How is employment income in foreign currency converted?

If you receive your wages in a foreign currency, you must convert the income into euros for the income tax return. If taxes were withheld abroad, you must also convert these into euros for crediting against the tax liability. The Federal Fiscal Court has clarified how this should be done (BFH ruling of 3.12.2009, BStBl. 2010 II p. 698).

- The conversion is carried out according to the cash basis principle in accordance with § 11 para. 1 EStG at the time of receipt. In the case of wages, this is when the salary is credited to the bank account.

- The conversion of income must be done using the euro reference rate of the European Central Bank, specifically the monthly average rates. These euro reference rates correspond to the VAT conversion rates set monthly by the Federal Ministry of Finance and published in the Federal Tax Gazette I.

The tax authorities do not apply these BFH requirements to cross-border commuters to Switzerland. Instead, they should enter both their wages and the Swiss withholding tax in Swiss francs in their tax return in the "Form N-Gre". The tax offices then convert these amounts on an annual basis - not monthly! - into euros. They use an average annual amount specified by the tax authorities. For 2021, the tax authorities specified the annual conversion rate for the tax assessment as 92.00 EUR for 100 CHF.

For the 2022 tax assessment, the tax authorities announced the conversion rate as 99.00 EUR for 100 CHF. In 2021 it was 92.00 EUR, in 2020 it was 93 EUR (finanzamt-bw.fv-bwl.de). The rate for 2023 was not known at the editorial deadline.

(2023): How is employment income in foreign currency converted?