When are pensioners required to submit a tax return?

A pensioner is required to submit a tax return 2023 if their total income exceeds the annual basic allowance. In 2023, the basic allowance is 10,908 Euro for single persons and 21,816 Euro for married couples.

Taxable income for pensioners that must be declared includes private and state pensions (Form R), as well as rental and capital income (Form V and Form KAP) and much more.

Not every Euro of the state pension is part of a pensioner's taxable income. This means that someone receiving a state pension of 1,500 Euro per month does not have to pay tax on the entire annual sum of 18,000 Euro. The amount of the taxable pension depends on the year the employee retired. The taxable portion is 50% of the pension amount for all pensioners from 2004 and for those who retired in 2005, regardless of age.

For pensioners who start receiving a pension in 2023, the taxable portion is 82.5% of the pension amount.

The taxable portion is applied only in the year the pension begins and in the second year of receiving the pension. The remaining amount in the second year is the personal pension allowance, which remains tax-free for life. From the third year onwards, the pension is fully taxable after deducting the personal pension allowance and the standard allowance for income-related expenses of 102 Euro. The constant pension allowance means that pension increases from the third year of receiving the pension are fully taxable.

Example: For Manfred Mustermann, who retired in 2005, the taxable pension is 50 percent. Like all pensioners who retired by 2005, he receives an allowance of 50 percent. This is not taxable and remains unchanged for life.

For Mr Mustermann: If he received a pension of 30,000 Euro in 2005, his allowance is therefore 15,000 Euro. This annual allowance remains constant until the end of his life. The married pensioner Mustermann and his wife have no other income. Therefore, they do not have to submit a tax return. Together, their income is below the basic allowance of 21,816 Euro (2023). If Max Mustermann were single, it would be different. With a taxable annual pension of 15,000 Euro, he would be above the basic allowance of 10,908 Euro (2023) and would therefore have to submit a tax return. If both spouses are above the basic allowance, they must each submit a separate form.

Tipp

Pensioners who have to submit a tax return should also ensure that they claim possible income-related expenses.

(2023): When are pensioners required to submit a tax return?

What is the retirement relief amount?

The old-age tax allowance can be used by pensioners who, in addition to income from pensions, also earn additional income or wages.

Additional income includes, for example:

- Income from renting,

- Capital assets,

- Income from self-employment,

- Income from private sales transactions,

- Income from a Riester pension.

However, the tax office first deducts various amounts (saver's allowance, income-related expenses allowance). The amount of the old-age tax allowance depends on the pensioner's year of birth.

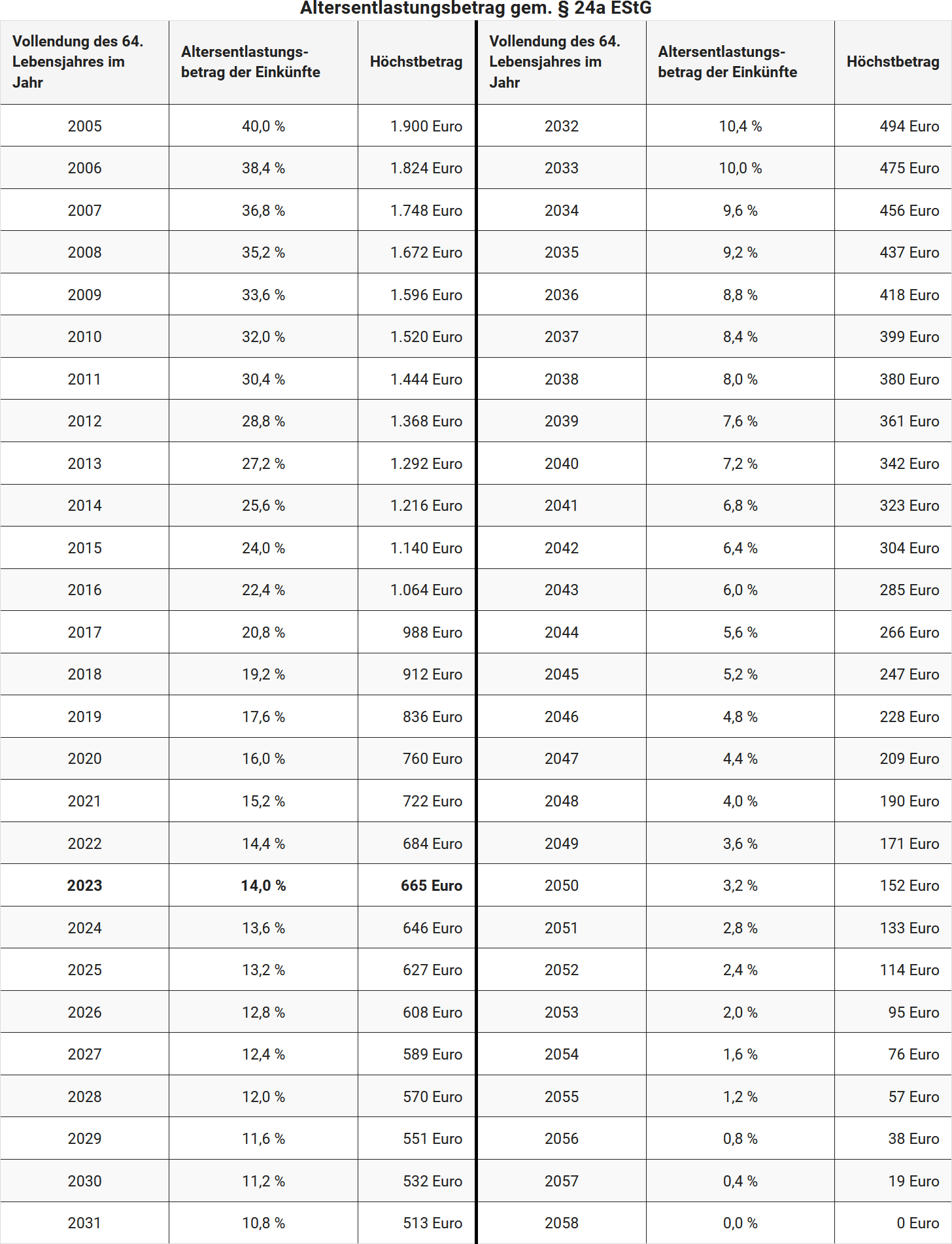

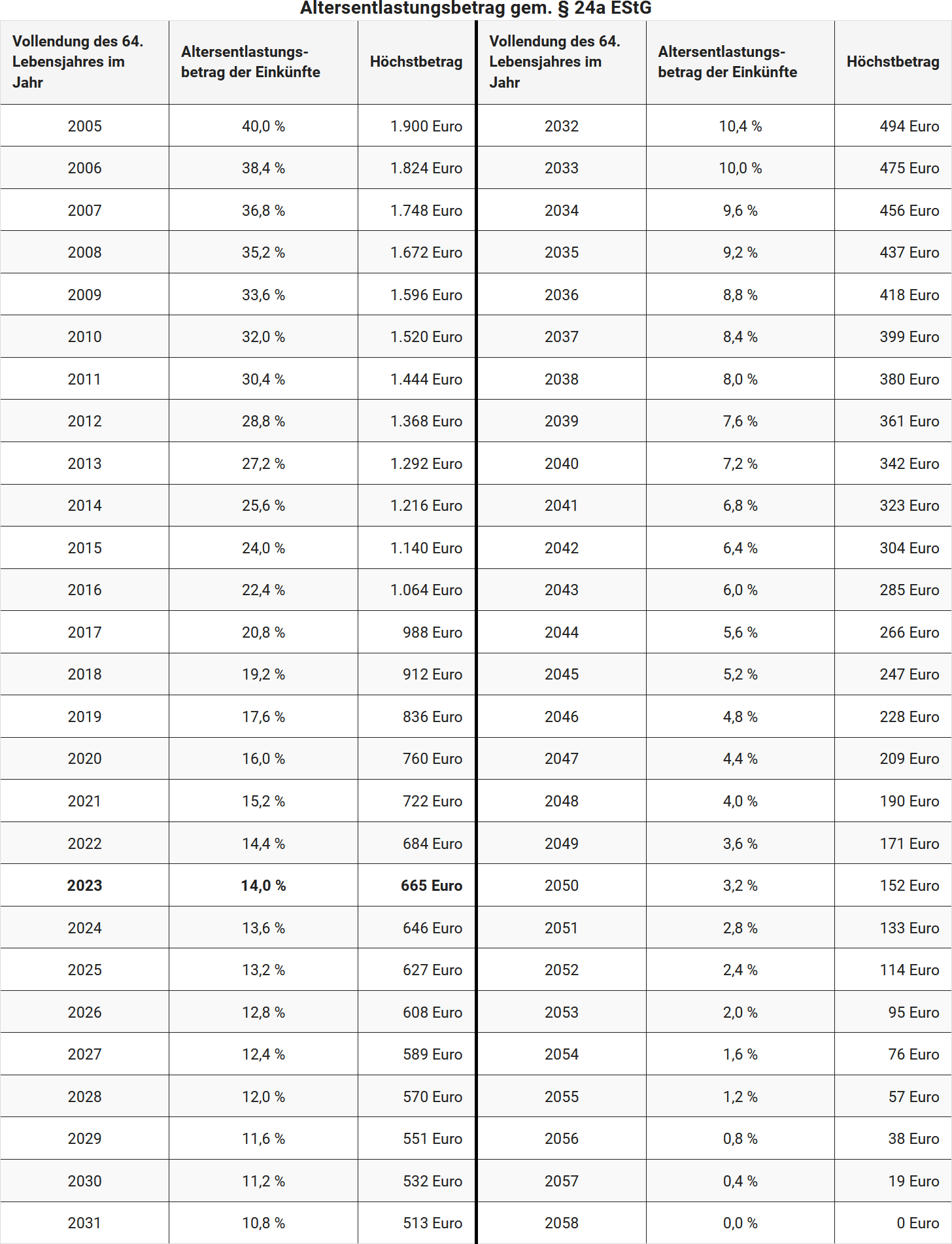

Due to changes in the law, the old-age tax allowance will be reduced more slowly from 2023, and the reduction period has been extended from 2040 to 2058. For pensioners from 2023, the percentage will no longer be reduced by 0.8 percentage points annually, but only by 0.4 percentage points annually. The maximum amount will decrease from 2023 by 19 Euro annually instead of 38 Euro annually (§ 24a sentence 5 EStG, amended by the "Growth Opportunities Act").

For persons who turn 64 in 2022 (born between 2.1.1958 and 1.1.1959), the old-age tax allowance from 2023 is 14.4% of income, up to a maximum of 684 Euro. If you turn 64 in 2023 (born between 2.1.1959 and 1.1.1960), the old-age tax allowance from 2023 is 14.0% (instead of 13.6%), up to a maximum of 646 Euro (instead of 608 Euro).

(2023): What is the retirement relief amount?

Which pensions must be declared in the tax return?

Pensions are generally subject to income tax. There are different tax rules:

- Pensions taxed with the new taxable portion, more precisely: fully taxable after deduction of the personal pension allowance. This applies to all pensions from the statutory pension insurance, the "Rürup" pension, and pensions from professional pension schemes.

- Pensions taxed with the favourable yield percentage. This applies, for example, to pensions from private pension insurance.

- Pensions taxed with the special yield percentage according to § 55 EStDV. This applies to life annuities with a fixed term, e.g. occupational or disability pensions from private insurance.

- Pensions fully taxable as "other income". This mainly concerns the state-subsidised Riester pension and the non-compliant use of Riester contracts, as well as benefits from occupational pension schemes whose contributions remained tax-free, e.g. from pension funds, pension schemes, and direct insurance.

- Pensions fully taxable as "income from employment". This applies to civil service pensions, company pensions from a direct commitment or support fund, as well as corresponding survivor benefits. These pensions are not to be entered in "Anlage R", but in "Anlage N".

- Pensions that are fully tax-free, e.g. pension from statutory accident insurance. You do not need to declare these pensions in the tax return.

Pensions belong in Anlage N

Pensions, e.g. company pensions, for which you have received a pay-as-you-earn tax certificate, please enter in Anlage N.

(2023): Which pensions must be declared in the tax return?

Next stage for retirement at 67 begins!

Graduated age limits

In 2023, those born in 1958 reach the statutory retirement age of 65, but within a context of graduated age limits. From 2012, the standard retirement age was gradually raised from 65 to 67, starting with an increase of one month per birth year, rising to two months per year from 2024. This means that the 1946 birth cohort was the last to retire at 65 without deductions in 2011. For those who reached the retirement age of 65 in 2012, the start of their pension was delayed by one month. For example, someone born on 15/02/1947 received their pension from 01/04/2012 instead of 01/03/2012.

Special regulations for long-term insured persons

From 01/07/2014, individuals with at least 45 contribution years can receive their pension at 63 without deductions. For those born between 1953 and 1964, the retirement age of 63 is gradually raised to 65, with an increase of two months per birth year from 2016. In 2023, individuals born in 1960 can receive their pension at 63 years and 16 months, provided they have 45 insurance years. Insured persons born on or after 01/01/1964 can only claim the pension without deductions at 65 with 45 contribution years.

Pension for long-term insured persons

Individuals with 35 contribution years can claim the "pension for long-term insured persons" early at 63, but must accept lifelong deductions. The number of deduction months increases for pensions starting at 63, but only for those born from 1949 onwards. In 2023, those born in 1960 can receive their pension at 63 with a lifelong deduction of 12.0%.

Pension for severely disabled persons

The pension for severely disabled persons can be claimed at 64 years and 4 months without deductions. At 61 years and 4 months, a pension with a deduction of 10.8% is possible. Protection applies to those born before 1 January 1964 and who were severely disabled on 1 January 2007; in this case, they can retire at 63 without deductions. An early pension with a 10.8% deduction is possible from the age of 60.

Disability pension

In the case of full disability, the disability pension can be claimed before the standard retirement age without deductions. In 2023, the disability pension begins at 64 years and 10 months, with deductions of 0.3% per month for earlier claims, up to a maximum of 10.8%.

Widow's or widower's pension

The age limit for the large widow's or widower's pension was gradually raised from 45 to 47, starting in 2012. In 2023, the age limit is 45 years and 12 months, equivalent to 46 years. Widows or widowers under 45 receive the small widow's or widower's pension, which is converted to the large pension upon reaching 46.

Pension taxation

Pension taxation begins in the year the pension starts and in the second year of receipt. In 2023, the taxable portion of the pension is 82.5 Euro. The remaining amount in the second year is set as the personal pension allowance and remains tax-free for life. From the third year, the pension is fully taxable, after deducting the personal pension allowance and a standard allowance for income-related expenses of 102 Euro.

(2023): Next stage for retirement at 67 begins!

Pensioners: Tax exemption for the basic pension supplement

Since 1 January 2021, there has been a basic pension for long-term insurance in the statutory pension scheme. This is not a new type of pension, but merely a supplement to the statutory pension (introduced with the "Act on the Introduction of the Basic Pension for Long-Term Insurance in the Statutory Pension Scheme with Below-Average Income and for Further Measures to Increase Retirement Income" - Basic Pension Act - of 12 August 2020).

- The calculation of the individual basic pension supplement is based on a legally defined calculation method. An income test is carried out to determine the basic pension requirement. If the income exceeds legally defined income allowances, the basic pension supplement is reduced. An entitlement to a basic pension supplement may therefore vary in amount in individual years due to the income test.

- The introduction of the basic pension supplement aimed to strengthen confidence in the basic promise of the welfare state to provide security and in the performance of the statutory pension scheme. Against this background, it should also be ensured from a tax perspective that the basic pension supplement, which recognises the lifetime achievement of the entitled person, is not reduced.

Neu

Retroactively from 2021, the portion of the pension paid due to the basic pension supplement is tax-free. This means that the basic pension supplement is fully available without tax deductions and can contribute in full to securing the livelihood (§ 3 No. 14a EStG, inserted by the "Annual Tax Act 2022").

In many cases, a basic pension supplement was already paid in 2021. Consequently, this partial amount was reported to the tax authorities in the pension reference notification for 2021 and treated as taxable. For the retroactive tax exemption, the statutory pension insurance providers are now required to submit corrected pension reference notifications to the tax office, indicating the amount of the tax-free basic pension supplement.

If an income tax return has already been submitted for 2021 and the tax assessment has even become final, the tax office will now correct it. However, the change will only be made to the extent resulting from the corrected pension reference notification. Other amendment regulations remain unaffected (§ 52 para. 4 sentences 5 to 8 EStG).

(2023): Pensioners: Tax exemption for the basic pension supplement

Which pensions do not need to be declared in the tax return?

Pensions are generally subject to income tax.

However, some types of pensions are completely tax-free and do not need to be declared. These include:

- Pensions from statutory accident insurance (e.g. occupational injury pensions),

- War and disability pensions,

- Monetary pensions paid directly as compensation for suffering under Nazi or GDR injustice.

Compensation pensions for increased needs, loss of maintenance and services, as well as pain and suffering pensions, are not considered income.

(2023): Which pensions do not need to be declared in the tax return?

Which pensions are taxable?

Most pensions are subject to tax. This includes old-age pensions and disability pensions, (large and small) widow's or widower's pensions, orphan's pensions, company pensions (from direct insurance), and pensions from life insurance policies. Different tax regulations apply depending on the type of pension.

You do not need to pay tax on a pension received from statutory accident insurance (employers' liability insurance association), a war pension, a pension for severely disabled persons, a reparation pension, a compensation pension for loss of maintenance under section 844 (2) BGB, a thalidomide pension, a pension for victims of SED injustice, a compensation pension for HIV-infected or AIDS sufferers, or a lifelong lottery pension.

(2023): Which pensions are taxable?

Which allowances can pensioners use?

Pensioners who submit an income tax return can enter various allowances and incurred costs to reduce their taxable income.

Personal pension allowance

The pension allowance is determined in the second full year of receiving the pension. In the year the pension begins and in the second year, the pension is taxed at the so-called taxable rate. The remaining amount in the second year is the personal pension allowance, which remains tax-free for life. From the third year, the pension is fully taxable after deducting the personal pension allowance and the standard allowance for income-related expenses of 102 Euro.

Allowance for civil servants and company pensioners

Like the pension allowance, the allowance for civil servants and company pensioners is gradually reduced to zero percent. This allowance only applies to pensions and company pensions from direct commitments and support funds. In addition, pensioners receive a supplement to the allowance, which also decreases over time.

Note: Due to amended laws, from 2023 the allowance for civil servants and company pensioners will be reduced more slowly than initially planned. Starting with the 2023 pensioner cohort, the applicable percentage will be reduced annually by 0.4 percentage points instead of 0.8. The maximum amount will decrease annually by 30 Euro instead of 60 Euro, and the supplement to the allowance by 9 Euro instead of 18 Euro. From 2058, the pension income will be fully taxable (§ 19 Abs. 2 Satz 3 EStG, amended by the "Growth Opportunities Act").

Here are the figures for pension start in 2023:

For retirement in 2023, the allowance is 14.0% of the pension income, up to a maximum of 1,050 Euro, and the supplement to the allowance is 315 Euro.

Including the standard allowance for income-related expenses of 102 Euro, the income is tax-free up to 1,467 Euro – for life.

Old-age relief amount

The old-age relief amount can be used by pensioners who earn additional or wage income alongside their pension. Additional income includes, for example, income from rental, capital assets, self-employment, private sales transactions or Riester pensions. However, the tax office first deducts various amounts (saver's allowance, income-related expenses). The amount of the old-age relief depends on the pensioner's year of birth.

Note: Due to amended laws, the old-age relief amount will be reduced more slowly from 2023 than previously planned. Starting with the 2023 pensioner cohort, the applicable percentage will be reduced annually by 0.4 percentage points instead of 0.8. The maximum amount will decrease annually by 19 Euro instead of 38 Euro (§ 24a Satz 5 EStG, amended by the "Growth Opportunities Act").

If you turned 64 in 2022 (born between 2.1.1958 and 1.1.1959), you will receive an old-age relief amount of 14.4% of your income, up to a maximum of 684 Euro, for life from 2023.

If you turn 64 in 2023 (born between 2.1.1959 and 1.1.1960), the old-age relief amount will be 14.0%, up to a maximum of 646 Euro, for life from 2023.

Standard allowance for income-related expenses

For the pension, every taxpayer receives a standard allowance for income-related expenses of 102 Euro per year.

Special expenses

Contributions to statutory health and long-term care insurance can also be entered as special expenses in the "Anlage Vorsorgeaufwand" by pensioners. Pensioners receive a health insurance subsidy from their pension insurance provider, which must be deducted from the contributions. Donations can be deducted as special expenses for tax purposes. The collected donation receipts thus reduce the taxable income. If you do not donate or have no other special expenses, the tax office deducts a flat rate of 36 Euro.

Extraordinary burdens

Especially for older and sick people, extraordinary burdens can arise that reduce taxable income. This could be the cost of nursing home accommodation, employing a household help, or hiring a tradesperson. But also medical expenses, such as medication, glasses or dental prostheses, can be claimed by pensioners.

Mini job

If a pensioner (over 65 years) takes on a mini job, this income is tax-free for them.

Tip

If, as a pensioner, you remain below the basic tax allowance of 10,908 Euro (2023) with the various allowances, flat rates and deductible costs, you do not have to pay any tax on your income. For married couples, the amount is doubled.

(2023): Which allowances can pensioners use?