Are financial settlements to avoid pension rights adjustments deductible?

In the event of a divorce, a pension rights adjustment is usually carried out to fairly distribute the pension entitlements acquired during the marriage between the spouses. Since the structural reform in 2009, these entitlements have been split equally. The pension rights adjustment is carried out in favour of the spouse who was able to build up less of their own pension provision.

However, the spouses can exclude the pension rights adjustment in whole or in part, which can include both the statutory pension rights adjustment and claims under pension law. The person entitled to the adjustment can request a settlement, which is paid to the pension provider or directly to them.

The Federal Ministry of Finance has commented on the income tax treatment of compensation payments to avoid the pension rights adjustment. The following regulations apply when avoiding the statutory pension rights adjustment:

- The person liable for the adjustment can, upon application, deduct payments to avoid the pension rights adjustment as special expenses if the person entitled to the adjustment agrees (§ 10 para. 1a no. 3 EStG).

- The person entitled to the adjustment must tax the payments received in accordance with the special expenses deduction of the payer.

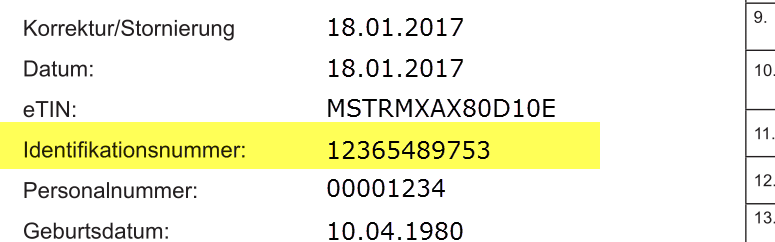

The deduction of special expenses is subject to certain conditions and requires the consent of both parties. The tax identification number of the person entitled to the adjustment must be provided in Appendix U of the income tax return.

The information relates exclusively to compensation payments to avoid the statutory pension rights adjustment. There are also payments under pension law and pension law adjustments, which may have different tax implications.

(2023): Are financial settlements to avoid pension rights adjustments deductible?