(2023)

To what extent can I claim exceptional expenses?

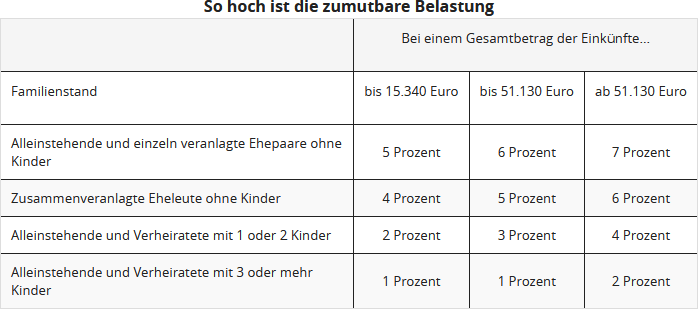

Here you can enter the actual expenses. However, these will not be fully recognised, as your reasonable personal liability will be deducted. This is based on your income, marital status, and the number of children you have, and is calculated by the tax office. The reasonable personal liability is between one and seven percent of total income. In any case, you should be able to prove the relevant expenses.

If your expenses are below the reasonable personal liability, it is not worth declaring the costs in the tax return.

Care allowance:

If the care-related expenses are still higher than the care allowance after deducting the personal liability, enter your care expenses as they actually occurred. However, you must then also be able to prove individually what you spent money on. In this way, you can claim more than the care allowance.

Tip

For the tax office, it does not matter when the costs were incurred, but when you paid them. You should therefore try to consolidate several expense items into one year to increase the total expenses and thus exceed the limit of your reasonable personal liability.

Is there a large dental bill due, but not until next year? However, if you could already book other expenses under extraordinary burdens for the current year, ask your dentist for an early invoice or a partial invoice. This way, you may be able to claim all expenses that exceed the reasonable liability in the tax return for the current year.

Important

The reasonable liability is only deducted for general extraordinary burdens. Expenses listed under special extraordinary burdens remain uncut.

You can use this table to roughly calculate your reasonable personal liability:

Bewertungen des Textes: To what extent can I claim exceptional expenses?

4.66

von 5

Anzahl an Bewertungen: 44