(2023)

Can tutoring for your own children be deducted after a move?

If children require tutoring after a work-related move, the costs can be deducted as income-related expenses up to a maximum amount.

The tax office does not automatically recognise your proven expenses up to this maximum amount.

Until 31/05/2020, the following regulation applies: Your tuition costs are initially fully recognised up to half of the maximum amount and beyond that at 75%, until the second half of the maximum amount is exhausted. However, the maximum amount must not be exceeded in total.

The Maier family moved from Hamburg to Berlin on 15/01/2020. Additional tuition costs of 1.500 Euro were incurred for their daughter. Initially, 1.022,50 Euro, i.e. half of 2.045 Euro, are deductible. Of the remaining amount of 477,50 Euro (1.500 Euro minus 1.022,50 Euro), a further 358 Euro can be deducted (75 percent of 477,50 Euro).

In total, the Maier family can claim tuition costs of 1.380 Euro in the income tax return 2023.

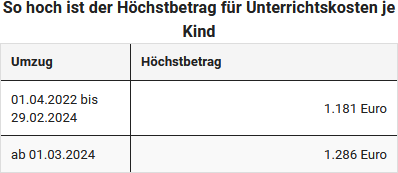

Currently, for moves from 01/06/2020, the tax deductibility of tuition costs is newly regulated (due to the "Act on the Modernisation of the Civil Service Remuneration Structure" of 09/12/2019). As before, the deductible maximum amount is announced by the Federal Ministry of Finance and adjusted from time to time (BMF letter of 20/05/2020, IV C 5-S 2353/20/10004). Currently, the Federal Ministry of Finance has increased the allowances and maximum amounts for work-related moves from 1 April 2022 (BMF letter of 21/07/2021, IV C 5-S 2353/20/10004 :002).

The necessity must be proven in an appropriate manner, e.g. by a certificate from the school. New is that the necessity is now assumed to be given already in the case of a move-related change of federal state. The reason for the regulation is the different teaching and framework plans of the previous school compared to those of the new school.

Tax tip: You should be aware of the following detail: In the past, the day you completed the move was decisive. If the furniture was loaded on 28/02 and unloaded on 01/03, you were entitled to the higher amounts. This is now different: For the calculation of the allowances, the day before the removal goods are loaded is decisive (BMF letter of 20/05/2020).