(2022)

Soll ich die tatsächlichen Kosten angeben oder den Pflegepauschbetrag nutzen?

Wenn Sie eine hilflose Person unentgeltlich pflegen, können Sie den Pflegepauschbetrag in Anspruch nehmen. Der Pflegepauschbetrag beträgt

- bei Pflegegrad 2: 600 Euro

- bei Pflegegrad 3: 1.100 Euro

- bei Pflegegrad 4 oder 5 oder Hilflosigkeit: 1.800 Euro.

Wenn Sie keine höheren Ausgaben haben als maximal 1.800 Euro, ist das auch die beste Lösung für Sie.

Anders sieht es aus, wenn Sie höhere Ausgaben haben, eine zusätzliche Pflegekraft oder eine Unterbringung in einem Pflegeheim mit finanzieren müssen. Dann lohnt es sich eher, auf den Pflegepauschbetrag (auch auf den Behindertenpauschbetrag) zu verzichten und die tatsächlichen Ausgaben als außergewöhnliche Belastungen geltend zu machen.

Diese Kosten werden dann an im Bereich "Außergewöhnlichen Belastungen" als Pflegekosten (Aufwendungen wegen Pflegebedürftigkeit, Aufwendungen für die Pflege eines Angehörigen oder für die Unterbringung in einem Pflegeheim) ausgewiesen.

Beispiel

Wenn Sie im Jahr ein Einkommen von 30.000 Euro haben, liegt Ihre zumutbare Belastung als Ehepaar mit einem Kind bei 746 Euro. Liegen Sie mit Ihren Ausgaben über diesem Betrag, lohnt es sich, dies anzugeben.

Das kann verschiedene Ausgaben betreffen wie beispielsweise Nahrungsmittel, Wäsche, Reinigung oder die Miete.

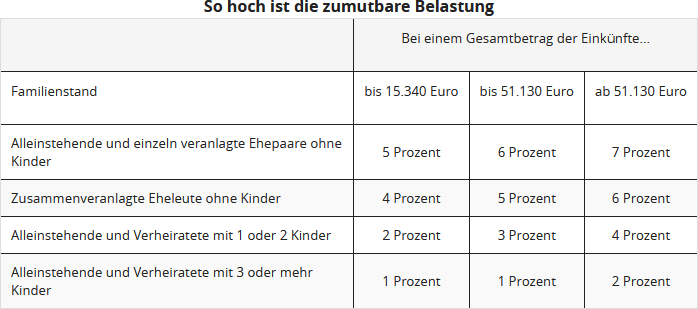

In Ihrer Steuererklärung können Sie die tatsächlichen Ausgaben eintragen. Diese werden jedoch nicht in voller Höhe anerkannt. Denn es wird hiervon noch Ihre zumutbare Eigenbelastung abgezogen. Diese richtet sich nach Ihrem Einkommen, Familienstand und der Zahl Ihrer Kinder und wird vom Finanzamt berechnet. Die zumutbare Eigenbelastung beträgt ein bis sieben Prozent der gesamten Einkünfte.

Tipp

Wenn Sie mit Ihren Ausgaben unter der zumutbaren Eigenbelastung bleiben, lohnt es sich gar nicht, die Kosten in der Steuererklärung anzugeben. Liegen Sie auch nach dem Abzug der Eigenbelastung noch über dem Höchstbetrag, geben Sie Ihre Aufwendungen zur Pflege an, so wie sie tatsächlich angefallen sind. Dann müssen Sie die einzelnen Ausgaben allerdings auch nachweisen können. Der Pflegepauschbetrag kann ohne Einzelnachweise in Anspruch genommen werden.

Rechner

- Einkommensteuer-Rechner: Sie wollen die wahrscheinliche Höhe der Einkommensteuer ganz schnell berechnen? Nutzen Sie unseren Einkommensteuer-Rechner um die aus Ihrem zu versteuernden Einkommen resultierende Steuerlast zu ermitteln.

Bewertungen des Textes: Soll ich die tatsächlichen Kosten angeben oder den Pflegepauschbetrag nutzen?

3.57

von 5

Anzahl an Bewertungen: 7