Das "besondere Kirchgeld": Zahlungspflicht der Kirchensteuer für konfessionslosen Ehegatten.

Kirchensteuerpflicht besteht grundsätzlich nur für Mitglieder einer steuererhebenden Religionsgemeinschaft, die ihren Wohnsitz in Deutschland und im Bereich dieser Religionsgemeinschaft haben. Maßgebend ist die formelle Mitgliedschaft, nicht etwa die Intensität des Glaubens und die Beteiligung am religiösen Leben. Wer also keiner steuererhebenden Religionsgemeinschaft angehört, braucht keine Kirchensteuer zu zahlen. Gilt das aber auch bei Ehegatten?

Es ist keine Seltenheit, dass der gut verdienende Ehepartner - um Kirchensteuer zu sparen - aus der Kirche austritt und der nicht erwerbstätige Ehepartner mit den Kindern weiterhin Mitglied der Kirchengemeinschaft bleibt. Wer aber glaubt, dass nun überhaupt keine Kirchensteuer mehr gezahlt werden muss, der könnte irren.

Verfügt nämlich der kirchenangehörige Ehegatte über kein eigenes Einkommen, kann natürlich keine "Kirchensteuer vom Einkommen" erhoben werden. Doch bei glaubensverschiedenen Ehen erheben die Kirchen das "besondere Kirchgeld" als eine besondere Erhebungsform der Kirchensteuer, wovon vor allem die evangelischen Kirchen Gebrauch machen.

- Das "besondere Kirchgeld" wird von dem kirchenangehörigen Ehepartner verlangt, der über kein oder nur ein geringes Einkommen verfügt und somit keine Kirchensteuer vom Einkommen zahlen muss. In diesem Fall bemisst sich das besondere Kirchgeld nach dem gemeinsamen zu versteuernden Einkommen beider Eheleute. Es wird nur erhoben, wenn das gemeinsame zu versteuernde Einkommen höher ist als 30.000 Euro, und zwar nur bei Zusammenveranlagung, nicht bei Einzelveranlagung für Ehegatten.

- Nach Auffassung des Bundesverfassungsgerichts ist es verfassungsrechtlich in Ordnung, dass sich das "besondere Kirchgeld" nach dem Lebensführungsaufwand des kirchenangehörigen Ehegatten bemisst. Als Hilfsmaßstab wird bei Zusammenveranlagung hierfür das gemeinsame zu versteuernde Einkommen herangezogen. Die Erhebung des besonderen Kirchgeldes ist zulässig, auch wenn das Einkommen nur von dem anderen - konfessionslosen - Ehegatten erzielt wird. In der Ehe als Lebens- und Wirtschaftsgemeinschaft hat jeder Ehegatte am Einkommen des anderen zur Hälfte teil (BVerfG-Beschluss vom 28.10.2010, 2 BvR 591/06).

Aktuell hat der Europäische Gerichtshof für Menschenrechte (EGMR) entschieden, dass die in Deutschland praktizierte Erhebung von Kirchensteuer bzw. des besonderen Kirchgeldes in einer glaubensverschiedenen Ehe nicht die Europäische Menschenrechtskonvention verletzt und damit zulässig ist (EGMR-Beschluss vom 6.4.2017, Beschwerde-Nr. 10138/11 u.a.).

Der Fall: Der Kläger gehört selbst keiner Religionsgemeinschaft an, seine Frau ist Mitglied der Evangelischen Kirche. Das Ehepaar beantragt die Zusammenveranlagung - mit der Folge, dass der Mann für die Kirchensteuer seiner Frau in Höhe von 2.220 Euro aufkommen muss. Dieser Betrag wurde ihm von einer Steuerrückerstattung abgezogen. Er und vier andere Beschwerdeführer machten daher vor dem EGMR geltend,

- dass eine Bemessung der Kirchensteuer beziehungsweise des Kirchgeldes auf Grundlage des gemeinsamen Einkommens von Eheleuten sie in mehrfacher Hinsicht in ihren Rechten aus Art. 9 EMRK (Religionsfreiheit) verletze,

- dass sie zur Zahlung des besonderen Kirchgeldes für ihren Ehepartner herangezogen wurden, ohne selbst Mitglied einer Kirche zu sein,

- dass sie auf die finanzielle Unterstützung durch den Ehepartner angewiesen waren, um das Kirchgeld bezahlen zu können und damit in der Ausübung ihrer Religionsfreiheit vom Ehepartner abhängig waren,

- dass sie zur Zahlung einer unverhältnismäßig hohen Kirchensteuer verpflichtet wurden, weil bei deren Bemessung auch das Einkommen des Ehepartners zugrunde gelegt wurde.

Aktuell hält das Sächsische Finanzgericht die Regelung in Sachsen zum besonderen Kirchgeld in glaubensverschiedener Ehe für unvereinbar mit dem Grundgesetz, weil Ehegatten in den Jahren 2014 und 2015 ohne sachlichen Grund schlechter gestellt würden als eingetragene Lebenspartnerschaften. Die Regelung verstoße gegen den allgemeinen Gleichbehandlungsgrundsatz (Beschluss vom 25.3.2019, 5 K 1549/18).

Aktuell hat das Bayerische Staatsministerium der Finanzen bekannt gegeben, dass in Bayern die Evangelisch-Lutherische Kirche und die Evangelisch-Reformierte Kirche auf die Erhebung des besonderen Kirchgelds verzichten, und zwar rückwirkend ab dem Steuerjahr 2018 (Erlass des Bayerischen Staatsministeriums der Finanzen vom 21.1.2019, BStBl I 2019 S. 213).

Das besondere Kirchgeld

Das besondere Kirchgeld kommt dann ins Spiel, wenn ein Ehegatte keiner Steuern erhebenden Kirche angehört und der andere kirchensteuerpflichtige Ehegatte

- kein eigenes Einkommen erzielt,

- ein eigenes Einkommen erzielt, das wegen geringer Höhe keine Einkommensteuer und damit auch keine Kircheneinkommensteuer auslöst oder

- ein eigenes Einkommen erzielt, das bereits Kirchensteuer auslöst, aber in Folge der sog. Vergleichsberechnung zur Festsetzung eines höheren besonderen Kirchgeldes führt.

Aktuell hat der Bundesfinanzhof darauf hingewiesen, dass auch in der dritten Fallgruppe die Festsetzung des besonderen Kirchgeldes verfassungsmäßig in Ordnung ist, obwohl aufgrund des eigenen Einkommens bereits eine Kirchensteuer anfällt (BFH-Beschluss vom 5.10.2021, I B 65/19). Der BFH beruft sich dabei auf Entscheidungen des Bundesverfassungsgerichts (z. B. BVerfG-Beschluss vom 28.10.2010, 2 BvR 591/06).

Auch in dieser Fallgruppe bedürfe keiner gesonderten Begründung. Da der Lebensführungsaufwand des kirchensteuerpflichtigen Ehegatten eine Steigerung erfahre, "wenn er eigene Einkünfte hat, der Ehepartner aber über ein deutlich höheres Einkommen verfügt" (so Urteil des FG Köln vom 8.6.2005, 11 K 1389/03).

Es liege weiter auf der Hand, dass die Zulässigkeit der Erhebung des besonderen Kirchgeldes in dieser Fallgruppe eine Regelung erforderlich mache, mit der das Verhältnis des besonderen Kirchgeldes gegenüber der Kircheneinkommensteuer geklärt wird; z. B. eine Regelung zur Vermeidung einer doppelten Belastung mit beiden Steuerarten. Entsprechende Anrechnungsregelungen oder Vergleichsberechnungen sind in den landesgesetzlichen oder kirchlichen Steuerbestimmungen enthalten. Sie sind rechtlich unproblematisch und wurden daher von der Fachgerichtsbarkeit und vom BVerfG verfassungsrechtlich auch nicht beanstandet.

Fazit: Auch in der dritten Fallgruppe darf der Lebensführungsaufwand des kirchenangehörigen Ehegatten mittels besonderen Kirchgeldes besteuert werden. Der Vollständigkeit halber sei darauf hingewiesen, dass das besondere Kirchgeld deutschlandweit nicht einheitlich erhoben wird.

(2022): Das "besondere Kirchgeld": Zahlungspflicht der Kirchensteuer für konfessionslosen Ehegatten.

Wie viel Kirchensteuer spare ich, wenn ich aus der Kirche austrete?

Wenn Sie aus der Kirche austreten würden, würden Sie nicht wirklich die komplette Kirchensteuer sparen, die Ihnen über das Jahr von Ihrem Gehalt abgezogen wird. Sie müssen auch auf den Vorteil verzichten, die Kirchensteuer als Sonderausgaben von Ihrem zu versteuernden Einkommen abzuziehen.

Für das ganze Jahr steht Ihnen ein Sonderausgabenpauschbetrag von 36 Euro (Ehepaare 72 Euro) zu. Die Kirchensteuer können Sie jedoch in voller Höhe als Sonderausgaben geltend machen. So verringern sich Ihr zu versteuerndes Einkommen und auch die Einkommensteuer.

Beispiel: Wenn Sie und Ihr Ehepartner im Jahr 600 Euro Kirchensteuer zahlen, können Sie den Betrag, der über dem Sonderausgabenpauschbetrag liegt, zusätzlich als Sonderausgaben ansetzen (600 Euro Kirchensteuer minus 72 Euro Sonderausgabenpauschbetrag).

528 Euro beim Grenzsteuersatz von 28 Prozent bringen Ihnen dann 147 Euro Einkommensteuer zurück. So verringert sich Ihre Kirchensteuer, die auf Grundlage der Einkommensteuer berechnet wird, ebenso wie der Solidaritätszuschlag (9 Prozent bzw. 5,5 Prozent von 147 Euro). Das macht rund 20 Euro weniger. So bringt Ihnen die Kirchensteuer einen steuerlichen Vorteil von insgesamt 167 Euro.

Diesen Sonderausgaben-Vorteil müssten Sie also von Ihrer Kirchensteuer abziehen, um zu berechnen, was Ihnen ein Kirchenaustritt bringt. In diesem Beispiel würden Sie als Ehepaar 433 Euro gegenüber dem Vorjahr sparen, wenn Sie keine Kirchensteuer zahlen, aber gleichzeitig auch auf die Möglichkeit des Sonderausgabenabzugs verzichten müssten.

(2022): Wie viel Kirchensteuer spare ich, wenn ich aus der Kirche austrete?

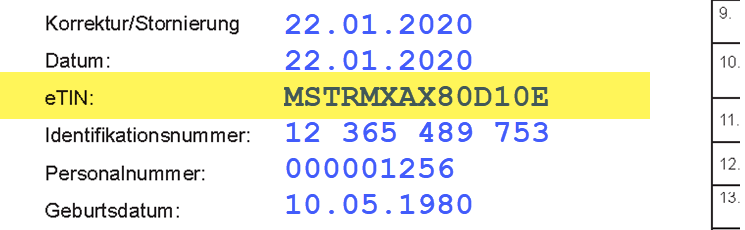

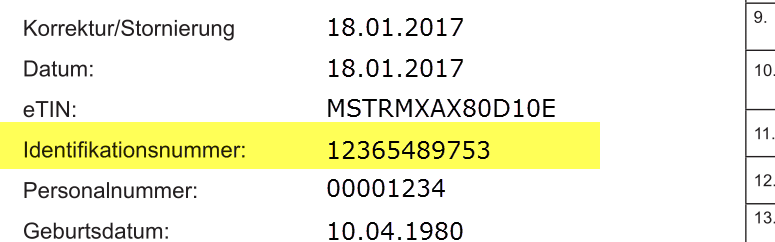

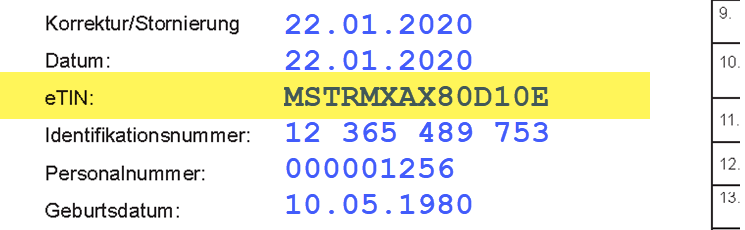

Wo kann ich meine Steuer-Identifikationsnummer finden?

Die Steuer-Identifikationsnummer wurde Ihnen schriftlich vom Bundeszentralamt für Steuern mitgeteilt. Die elfstellige Nummer gilt ein Leben lang. In diesem Schreiben wird die Nummer als "Persönliche Identifikationsnummer" bezeichnet, häufig wird sie auch kurz "Identifikationsnummer" genannt und wird in der Regel mit TIN (Tax Identification Number) oder Steuer-ID abgekürzt.

In der Regel finden Sie Ihre Identifikationsnummer auch

- im Einkommensteuerbescheid oder

- auf Ihrer Lohnsteuerbescheinigung

Die Steuer-ID ist nicht zu verwechseln mit der eTIN, die sich ebenfalls in der Lohnsteuerbescheinigung befindet und vom Arbeitgeber für die Datenübermittlung der Lohndaten genutzt wird.

Nach einer Übergangszeit soll die Steuer-Identifikationsnummer die derzeitige Steuernummer für die Einkommensteuer ersetzen. Die Angabe der Steuer-Identifikationsnummer ist keine Voraussetzung für die Abgabe Ihrer Steuererklärung.

(2022): Wo kann ich meine Steuer-Identifikationsnummer finden?

Ab wann muss ich Kirchensteuer zahlen?

Die Kirchensteuerpflicht beginnt mit der Taufe oder durch Eintritt oder Wiedereintritt in die Religionsgemeinschaft. In diesem Fall müssen Sie die Kirchensteuer mit dem Beginn des folgenden Monats zahlen.

Wechseln Sie die Religionsgemeinschaft, dann besteht ebenfalls mit dem Beginn des folgenden Monats die Pflicht zur Zahlung der Kirchensteuer. Sie setzt jedoch erst ein, wenn Sie an Ihre bisherige Religionsgemeinschaft keine Kirchensteuer mehr zahlen.

In der israelitischen Kultusgemeinde begründet sich die Kirchensteuerpflicht aufgrund von Abstammung und Bekenntnis.

(2022): Ab wann muss ich Kirchensteuer zahlen?

Wer muss Kirchensteuer bezahlen?

Wenn Sie Mitglied einer der folgenden Religionsgemeinschaften sind, müssen Sie Kirchensteuer zahlen:

- Römisch-Katholische Kirche

- Evangelische Landeskirchen

- Altkatholische Kirche

- Jüdische Kultusgemeinden

- Israelitische Religionsgemeinschaften (z.B. in Baden-Württemberg)

- Freireligiöse Gemeinden (z.B. in Baden, Württemberg, Mainz, Offenbach, Pfalz)

- Französische Kirche zu Berlin (Hugenottenkirche)

- Mennonitengemeinde in Hamburg-Altona

- Unitarische Religionsgemeinschaft Freier Protestanten in Rheinland-Pfalz

Die Höhe der Kirchensteuer richtet sich nach Ihrem Wohnort. Leben Sie in Bayern oder Baden-Württemberg, zahlen Sie 8 Prozent, in den übrigen Ländern 9 Prozent der Einkommen- oder Lohnsteuer.

(2022): Wer muss Kirchensteuer bezahlen?

Wie hoch ist die Kirchensteuer?

Die Höhe der Kirchensteuer richtet sich nach Ihrem Wohnort. Leben Sie in Bayern oder Baden-Württemberg, zahlen Kirchenangehörige 8 Prozent, in den übrigen Bundesländern 9 Prozent. Grundlage ist die festgesetzte Einkommensteuer. Sie zahlen folglich als Kirchensteuer 8 bzw. 9 Prozent Ihrer Einkommensteuer.

Beachten Sie: Die Kirchensteuer wird mit gleicher prozentualer Höhe auch im Rahmen der Abgeltungsteuer berücksichtigt.

Sollten Sie Kinder haben oder haben Sie in Ihrem zu versteuernden Einkommen (zvE) Einkünfte aus Gewerbebetrieb und/oder Einkünfte, die nach dem sog. Teileinkünfteverfahren versteuert werden, wird das zvE für Zwecke der Kirchensteuer gesondert berechnet.

Sind bei Arbeitnehmern Kinderfreibeträge in ihren elektronischen Lohnsteuerabzugsmerkmalen (ELStAM) eingetragen, errechnet sich die monatliche Kirchensteuer aufgrund einer so genannten fiktiven Lohnsteuer.

Beispiel

Sie leben in Berlin und haben einen Brutto-Monatslohn von 3.000 Euro in der Steuerklasse IV. Ihre monatliche Kirchensteuer beträgt 34,31 Euro. Kirchensteuer mit zwei Kinderfreibeträgen: Sie leben in Berlin und haben einen Brutto-Monatslohn von 3.000 Euro bei Steuerklasse IV. Ihre monatliche Kirchensteuer beträgt nun 16,74 Euro.

Ist also in den ELStAM eine "Zahl der Kinderfreibeträge" eingetragen, verringert sich nicht die monatliche Lohnsteuer, sondern nur die monatliche Kirchensteuer sowie der monatliche Solidaritätszuschlag. Das gilt auch dann, wenn Sie während des Jahres Kindergeld erhalten.

In der Einkommensteuerveranlagung senken die Kinderfreibeträge das zu versteuernde Einkommen nur dann, wenn das Kindergeld nicht günstiger ist als der Steuervorteil. Doch zur Berechnung von Kirchensteuer und Soli werden die Kinderfreibeträge "fiktiv" abgezogen.

Vorteil: Auch wenn Kinder nur für einen Teil des Jahres zu berücksichtigen sind, werden für die Berechnung der Kirchensteuer und des Solidaritätszuschlages stets der volle Kinderfreibetrag und BEA-Freibetrag abgezogen. Dies kommt in Betracht bei Beendigung der Berufsausbildung oder Geburt eines Kindes.

(2022): Wie hoch ist die Kirchensteuer?

Welche steuerlichen Vorteile erhalten Behinderte und Hinterbliebene?

Behinderte Menschen können für ihre behinderungsbedingten Aufwendungen entweder den Behinderten-Pauschbetrag in Anspruch nehmen oder die Ausgaben gegen Nachweis als außergewöhnliche Belastungen geltend machen, wobei hier allerdings eine zumutbare Belastung angerechnet wird. Der Behinderten-Pauschbetrag richtet sich nach dem Grad der Behinderung und beträgt 384 Euro bis 7.400 Euro. Mit dem Pauschbetrag sind alle sogenannten typischen Aufwendungen abgegolten. Darüber hinausgehende sogenannte atypische Aufwendungen können Sie als außergewöhnliche Belastungen absetzen. Damit mindern Sie Ihr zu versteuerndes Einkommen.

Hinterbliebene erhalten auf Antrag einen Hinterbliebenen-Pauschbetrag von 370 Euro, wenn ihnen laufende Hinterbliebenenbezüge bewilligt worden sind. Diese müssen laut Paragraf 33 b Abs. 4 EStG geleistet werden, nach dem Bundesversorgungsgesetz oder einem anderen Gesetz, das die Vorschriften des Bundesversorgungsgesetzes über Hinterbliebenenbezüge für entsprechend anwendbar erklärt, nach den Vorschriften über die gesetzliche Unfallversicherung, nach den beamtenrechtlichen Vorschriften an Hinterbliebene eines an den Folgen eines Dienstunfalls verstorbenen Beamten oder nach den Vorschriften des Bundesentschädigungsgesetzes über die Entschädigung für Schäden an Leben, Körper oder Gesundheit.

Der Hinterbliebenen-Pauschbetrag ist ein Jahresbetrag. Er wird auch dann nicht gekürzt, wenn die entsprechenden Voraussetzungen nicht das ganze Jahr über vorlagen.

Bitte beachten Sie: Eine Waise erhält den Hinterbliebenen-Pauschbetrag auch dann nur einmal, wenn beide Elternteile verstorben sind. Bei mehreren Hinterbliebenen derselben Person (z.B. Witwe und Halbwaise) steht der Pauschbetrag jedem Hinterbliebenen zu.

(2022): Welche steuerlichen Vorteile erhalten Behinderte und Hinterbliebene?

Wer erhält den Pauschbetrag für Hinterbliebene?

Hinterbliebene, etwa Witwen und Waisen, haben in bestimmten Fällen Anspruch auf den Hinterbliebenenpauschbetrag von 370 Euro.

Wichtigste Voraussetzung ist, dass der Steuerpflichtige mindestens für einen Monat im jeweiligen Steuerjahr Hinterbliebenenbezüge erhalten hat. Das gilt auch, wenn der Anspruch auf die Bezüge ruht bzw. eine Abfindung mittels Kapitalauszahlung stattgefunden hat.

Die Voraussetzungen für den Hinterbliebenen-Pauschbetrag sind im § 33b Abs. 4 EStG geregelt. Steht der Hinterbliebenen-Pauschbetrag einem Kind zu, kann er auf Antrag auf die Eltern übertragen werden.

Der Hinterbliebenenpauschbetrag wird für folgende Bezugsarten gewährt:

- Bezug nach dem Bundesversorgungsgesetz, dies betrifft vor allem Opfer des Zweiten Weltkriegs

- Bezug nach dem Soldatenversorgungsgesetz

- Bezug nach dem Zivildienstgesetz

- Bezug nach dem Häftlingshilfegesetz

- Unterhalt für Angehörige von Kriegsgefangenen

- Bezug nach dem Gesetz über die Bundespolizei

- Bezug nach dem Gesetz über den Zivilschutzkorps

- Bezug nach dem Gesetz zur Regelung der Rechtsverhältnisse der unter Art. 131 GG fallenden Personen

- Bezug nach dem Gesetz zur Einführung des Bundesversorgungsgesetzes im Saarland

- Bezug nach dem Infektionsschutzgesetz, zum Beispiel bei Tod infolge einer empfohlenen Impfung

- Bezug nach dem Gesetz über die Entschädigung für Opfer von Gewalttaten

- Rente aus der gesetzlichen Unfallversicherung, zum Beispiel bei Tod durch Arbeitsunfall

- Bezüge nach dem Tod eines Beamten aufgrund eines Dienstunfalls

- Bezüge nach dem Bundesentschädigungsgesetz für Schäden an Leben, Körper oder Gesundheit.

Steht der Hinterbliebenen-Pauschbetrag einem Kind zu, kann er auf Antrag auf die Eltern übertragen werden.

(2022): Wer erhält den Pauschbetrag für Hinterbliebene?

Was unterscheidet meine Steuernummer von der Steuer-Identifikationsnummer?

Die Steuernummer ist nicht zu verwechseln mit der lebenslang gültigen und bundeseinheitlich gleichen Steuer-Identifikationsnummer.

Was ist die Steuernummer?

Die Steuernummer wird vom Finanzamt an jede steuerpflichtige natürliche oder juristische Person vergeben und ist einem Steuerpflichtigen eindeutig zugeordnet. Eine Person kann mehrere Steuernummern in seinem Leben haben. Wer beispielsweise umzieht und dadurch in den Zuständigkeitsbereich eines anderen Finanzamtes gehört, wer heiratet oder eine Selbständigkeit anmeldet, erhält eine neue Steuernummer.

Früher richteten sich die Steuernummern an länderbezogenen Codes aus und bestanden je nach Bundesland aus zehn oder elf Ziffern. Im Laufe der Einführung des so genannten ELSTER-Verfahrens (ELektronische STeuerERklärung) wurde das Standardschema der Steuernummer jedoch bundesweit vereinheitlicht und hat nun 13 Ziffern.

Wo finde ich die Steuernummer?

Nach Einreichen der ersten Einkommensteuererklärung oder bei der Anmeldung einer selbständigen bzw. gewerblichen Tätigkeit wird die Nummer durch das zuständige Finanzamt ermittelt. Sie kann aber auch eigeninitiativ beantragt werden. Auf dem Einkommensteuerbescheid ist die Steuernummer links oben zu finden.

Wofür brauche ich die Steuernummer?

Die Steuernummer ist bei der Einreichung der Steuererklärung oder bei der Anmeldung einer selbständigen bzw. gewerblichen Tätigkeit, ebenso wie im Zahlungsverkehr anzugeben. Freiberufler und Gewerbetreibende müssen sie, sofern sie keine Umsatzsteueridentifikationsnummer haben, in ihrer Rechnung ausweisen. Zukünftig wird die Steuernummer von der Steueridentifikationsnummer abgelöst. Bisher existieren aber beide Nummern parallel.

Was ist die Steuer-Identifiktationsnummer?

Die steuerliche Identifikationsnummer (IdNr. oder auch Steuer-ID) ist seit 2008 eine bundeseinheitliche und dauerhafte Identifikationsnummer von in Deutschland gemeldeten Bürgern für Steuerzwecke. Sie ist ein Leben lang gültig. Kinder erhalten sie bereits nach der Geburt.

Die Identifikationsnummer ändert sich weder bei einem Ortswechsel noch bei einem Wechsel des zuständigen Finanzamts. Die Daten werden erst gelöscht, wenn sie von den Behörden nicht mehr benötigt werden, spätestens jedoch 20 Jahre nach dem Tod des Steuerpflichtigen.

Die Steuer-ID ist auch für das Kindergeld, für die Freistellungsaufträge bei allen Bankverbindungen in Deutschland, für die Gewährung des Pflege-Pauschbetrags sowie für den steuerlichen Abzug von Unterhaltsleistungen nötig und wird im Übrigen immer häufiger abgefragt.

(2022): Was unterscheidet meine Steuernummer von der Steuer-Identifikationsnummer?

Woher bekomme ich eine neue Steuer-Identifikationsnummer?

Um eine neue Steuer-Identifikationsnummer zu erhalten, müssen Sie sich schriftlich an das Bundeszentralamt für Steuern wenden. Dazu nutzen Sie folgende Adresse:

Bundeszentralamt für Steuern, 53221 Bonn,

bzw. per E-Mail: [email protected].

Sie müssen dem Amt dazu folgende persönliche Daten mitteilen:

- Name und Vorname

- Anschrift (Straße, Hausnummer, Postleitzahl und Ort)

- Geburtsdatum und -ort

Ihre Nummer wird Ihnen dann schriftlich mitgeteilt. Aus Gründen des Datenschutzes ist nicht möglich, Ihnen die Nummer telefonisch oder per E-Mail mitzuteilen.

Tipp

Die Nummer finden Sie in der Regel aber auch in Ihrer Lohnsteuerbescheinigung oder Ihrem letzten Einkommensteuerbescheid.

(2022): Woher bekomme ich eine neue Steuer-Identifikationsnummer?

Ab wann muss man nach einem Kirchenaustritt keine Kirchensteuer mehr zahlen?

Die Kirchensteuerpflicht endet:

- mit Ablauf des Kalendermonats, wenn der Wohnsitz oder gewöhnliche Aufenthalt in Deutschland aufgegeben wurde.

- mit dem Ablauf des Sterbemonats, wenn das Kirchenmitglied stirbt.

- wenn das Kirchenmitglied den Kirchenaustritt erklärt. Für die Austrittserklärung sind in den verschiedenen Bundesländern unterschiedliche Stellen zuständig, in den meisten erfolgt sie vor dem Standesamt, ansonsten vor dem Amtsgericht; nur im Bundesland Bremen auch bei der Kirche. Abhängig vom Bundesland gilt der Kirchenaustritt ab dem Kalendermonat, in dem der Kirchenaustritt erklärt wurde, oder aber ab dem darauffolgenden Kalendermonat.

Hinweis

Früher gab es in einigen Bundesländern den sog. "Reuemonat", d.h. die Kirchensteuerpflicht endete erst einen Monat nach dem Austrittsmonat. Dies galt für Berlin, Brandenburg, Bremen, Hamburg, Hessen, Mecklenburg-Vorpommern, Sachsen, Schleswig-Holstein, Thüringen.

Doch inzwischen wurde der Reuemonat zur Vereinheitlichung der kirchensteuerlichen Regelungen im Bundesgebiet abgeschafft, d.h. der Kirchenaustritt wird in dem Kalendermonat wirksam in dem er erklärt wurde.

Nach dem Kirchenaustritt informiert die Meldebehörde automatisch das zuständige Finanzamt, damit dieses die elektronischen Lohnsteuerabzugsmerkmale (ELStAM) ändert. Für die Zeit nach Ihrem Kirchenaustritt wird also bei der monatlichen Gehaltsabrechnung keine Kirchensteuer mehr einbehalten.

Das kostet Sie der Kirchenaustritt - Austrittsgebühren

In Berlin, Brandenburg und Bremen ist der Austritt kostenlos. In den anderen Bundesländern müssen Sie zwischen 10 und 60 Euro Gebühren für die Bescheinigung über den Kirchenaustritt bezahlen.

(2022): Ab wann muss man nach einem Kirchenaustritt keine Kirchensteuer mehr zahlen?

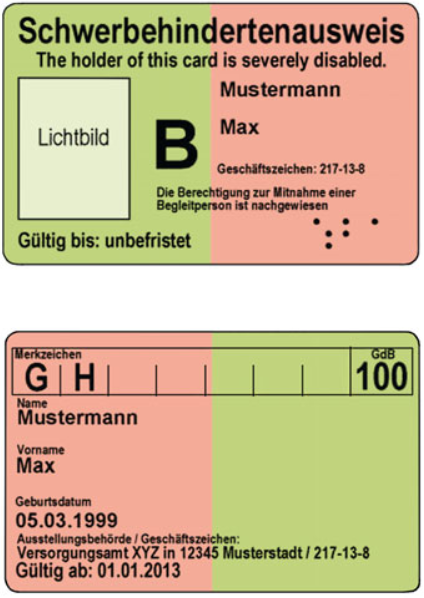

Wer bekommt den Pauschbetrag für Behinderte?

Sie können den Behinderten-Pauschbetrag erhalten, wenn Sie einen bestimmten Grad der Behinderung nachweisen können. Dabei gilt als behindert, wer länger als sechs Monate körperlich, geistig oder seelisch in seinem Gesundheitszustand beeinträchtigt ist.

Festgestellt wird der Grad der Behinderung im Regelfall durch das Versorgungsamt. Ab einem Grad der Behinderung von 50 erhalten Sie einen Schwerbehindertenausweis, bis zu einem Grad von 45 stellt das Amt einen Feststellungsbescheid aus. An diese Bescheide ist das Finanzamt gebunden.

Sie können den Behinderten-Pauschbetrag für sich selbst, Ihren behinderten Ehegatten oder Ihr behindertes Kind in Anspruch nehmen. Eine Übertragung des Pauschbetrages von behinderten Eltern bzw. Geschwistern ist nicht möglich.

Tipp: Bei einer rückwirkenden Feststellung des Grades der Behinderung für mehrere Jahre können Sie für die Jahre, für die Ihnen ein Grad der Behinderung anerkannt wird, den Pauschbetrag nachträglich geltend machen. Sie sollten aber möglichst umgehend nach Feststellung des Grades der Behinderung ihre steuerlichen Ansprüche anmelden, da es bestimmte Fristen zu beachten gibt.

Lohnsteuer kompakt

Der Behinderten-Pauschbetrag ist ein Jahresbetrag. Er wird in voller Höhe auch dann gewährt, wenn die Behinderung während des Jahres eintritt oder wegfällt. Wird der GdB während des Jahres herauf- oder herabgesetzt, richtet sich der Jahresbetrag nach dem höheren GdB (R 33b Abs. 7 EStR).

Treten mehrere Behinderungen aus verschiedenen Gründen auf, wird jeweils die Behinderung zugrunde gelegt, die zum höchsten Pauschbetrag führt. Der Behinderten-Pauschbetrag wirkt sich in vollem Umfang steuermindernd aus, denn eine zumutbare Belastung wird nicht angerechnet.

Die Frage ist, ob zusätzlich zum Behinderten-Pauschbetrag pflegebedingte Aufwendungen als außergewöhnliche Belastungen nach § 33 EStG absetzbar sind oder ob dafür auf den Pauschbetrag verzichtet werden muss. Seit 2008 gilt folgende Regelung:

Falls Sie den Behinderten-Pauschbetrag gemäß § 33b Abs. 3 EStG in Anspruch nehmen, werden pflegebedingte Aufwendungen nicht zusätzlich als außergewöhnliche Belastungen nach § 33 EStG anerkannt. Es gilt das "Entweder-Oder-Prinzip" (R 33.3 Abs. 4 EStR 2008).

Sie müssen sich also entscheiden: Entweder beantragen Sie den Behinderten-Pauschbetrag, oder Sie machen die pflegebedingten Kosten gegen Nachweis als außergewöhnliche Belastungen geltend. Beim Nachweis muss das Pflegegeld von der Pflegeversicherung angerechnet werden, und vom verbleibenden Betrag zieht das Finanzamt noch die zumutbare Belastung ab. Damit also die Berücksichtigung gemäß § 33 EStG vorteilhafter ist, müssen die Aufwendungen höher sein als der Behinderten-Pauschbetrag, das erhaltene Pflegegeld und die zumutbare Belastung.

Aber keine Regel oder Ausnahme:

Folgende besondere Ausgaben können Sie zum Beispiel neben dem Pauschbetrag ansetzen:

- außerordentliche Krankheitskosten, die durch einen akuten Anlass verursacht werden, zum Beispiel Kosten einer Operation, einer Heilbehandlung, Arznei- und Arztkosten,

- Ausgaben für eine Heilkur, die aufgrund eines vor Kurantritt ausgestellten amtsärztlichen Attestes durchgeführt wird (die ärztliche Bescheinigung eines Medizinischen Dienstes der Krankenversicherung steht dem amtsärztlichen Attest gleich),

- behinderungsbedingte Umrüstungskosten für ein Auto,

- behinderungsbedingte Umbaukosten der Wohnung,

- behinderungsbedingte Fahrtkostenpauschale (ab dem Jahr 2021):

Bis einschließlich zum Jahr 2020 konnten Fahrtkosten im Zusammenhang mit einer Behinderung mit 0,30 Euro je gefahrenen Kilometer bis zu bestimmten Höchstbeträgen berücksichtigt werden. Diese Berücksichtigung erforderte regelmäßig auch einen Nachweis der gefahrenen Kilometer. Auf diesen Nachweis wird ab dem Jahr 2021 verzichtet.

Die behinderungsbedingte Fahrtkostenpauschale beträgt:

- 900 Euro: bei Menschen mit einem Grad der Behinderung von mindestens 80 oder einem Grad der Behinderung von mindestens 70 und dem Merkzeichen „G“ für gehbehindert

- 4.500 Euro: bei Menschen mit außergewöhnlicher Gebehinderung (Merkzeichen „aG“), Blinden (Merkzeichen „BI“), Taubblinden (Merkzeichen „TBI“, hilflosen Menschen (Merkzeichen „H“) oder Menschen für die der Pflegegrad 4 oder 5 festgestellt wurde.

Folgende Besonderheit ist bei der Berücksichtigung der behinderungsbedingten Fahrtkostenpauschale zu beachten:

Die behinderungsbedingten Fahrtkosten sind Teil der allgemeinen außergewöhnlichen Belastungen. Von der Gesamtsumme der außergewöhnlichen Belastungen, wozu auch die behinderungsbedingte Fahrtkostenpauschale hinzugerechnet wird, wird bei der Berechnung Ihrer Einkommensteuer noch die Minderung um die zumutbare Belastung vorgenommen.

(2022): Wer bekommt den Pauschbetrag für Behinderte?

Wann gilt eine Gütergemeinschaft?

In der Gütergemeinschaft gibt es unterschiedliche Arten der Vermögensmassen: das Gesamtgut beider Partner sowie das Sondergut und das Vorbehaltsgut jedes einzelnen Partners. Diese besondere Regelung des ehelichen Güterstands ist kompliziert und wird eher selten vereinbart.

Ohne Ehevertrag gilt Zugewinngemeinschaft. Ohne Ehevertrag oder andere Absprachen gelten automatisch die gesetzlichen Regelungen. Das betrifft zum Beispiel den gesetzlichen Güterstand einer Ehe - die Zugewinngemeinschaft. Das bedeutet: Was der einzelne schon mit in die Verbindung gebracht hat, bleibt seins; es gilt der Grundsatz der Vermögenstrennung. Hieraus ergibt sich auch, dass ein Partner nicht für die Schulden des anderen aufkommen muss. Was im Laufe der Ehe zu dem ursprünglichen Vermögen der einzelnen Eheleute dazu kommt, ist der Zugewinn. Da dieser bei beiden Partnern unterschiedlich hoch sein kann, wird er im Scheidungsverfahren aufgeteilt, das ist der so genannte Zugewinnausgleich.

Will man einen anderen Güterstand als die Zugewinngemeinschaft vereinbaren, z.B. die Gütergemeinschaft oder die Gütertrennung, muss man das in einem Ehevertrag regeln. Man kann auch bestimmte Teile des Vermögens aus dem Zugewinn ausschließen, z.B. den Betrieb eines Selbständigen, damit dieser bei einer Scheidung seine Firma durch den Zugewinnausgleich nicht gefährden muss.

(2022): Wann gilt eine Gütergemeinschaft?

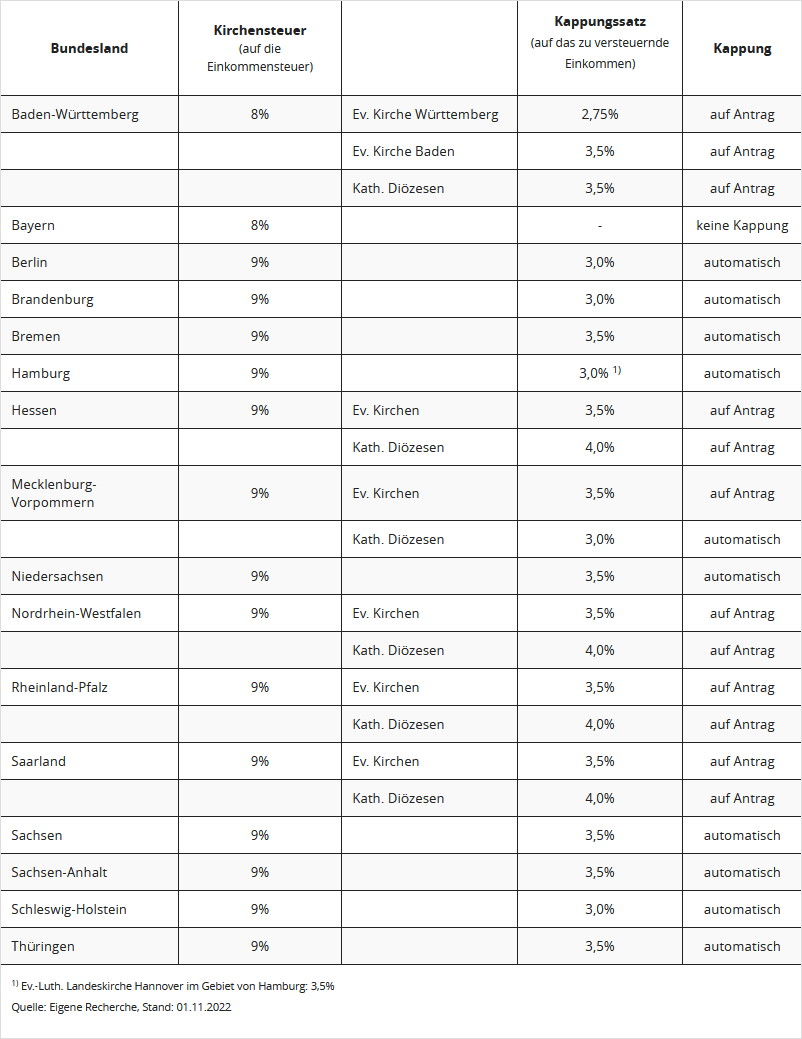

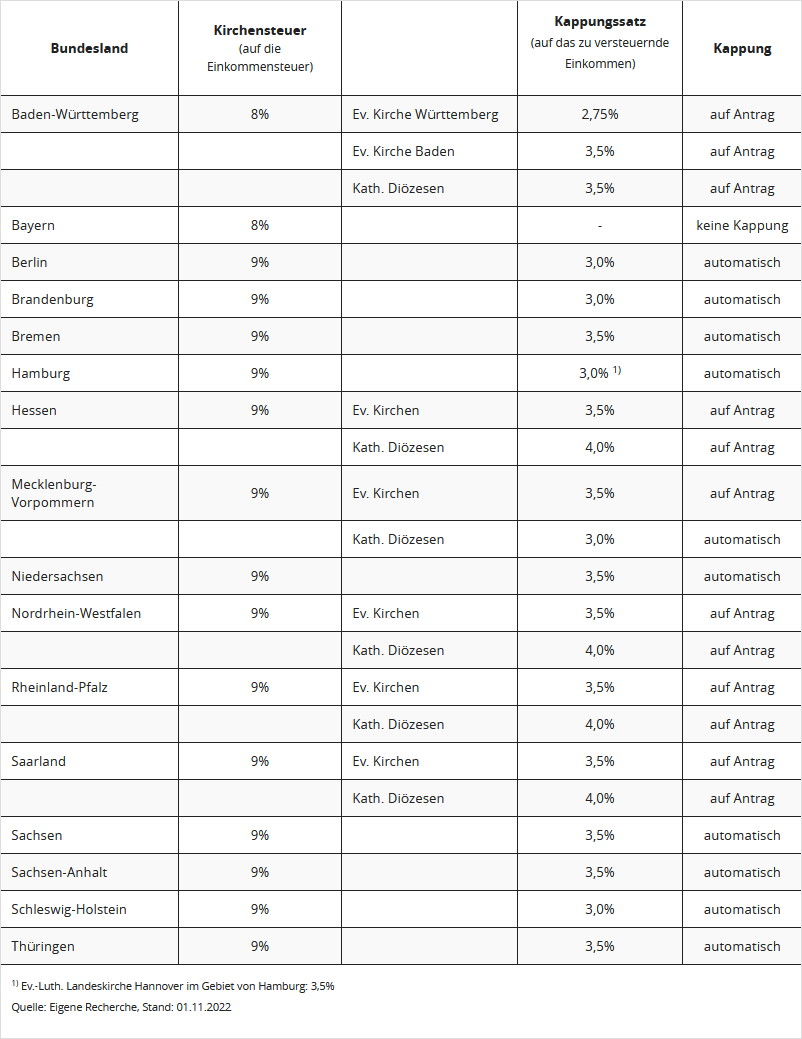

Welchen Vorteil bringt die Kappung der Kirchensteuer?

Die Höhe der Kirchensteuer richtet sich nach Ihrem Wohnort. Leben Sie in Bayern oder Baden-Württemberg zahlen Sie 8 Prozent, in den übrigen Bundesländern 9 Prozent. Grundlage ist die festgesetzte Einkommensteuer. Sie zahlen also als Kirchensteuer 9 Prozent Ihrer Einkommensteuer.

Je höher Ihr Einkommen, desto höher die Einkommensteuer und desto höher auch die Kirchensteuer. Es gibt jedoch die Möglichkeit, die Kappung der Kirchensteuer zu beantragen. Das bedeutet: Die Kirchensteuer wird nicht mehr von der Bemessungsgrundlage "Einkommensteuer", sondern vom "zu versteuernden Einkommen" berechnet. Der Kappungssatz ist in den einzelnen Bundesländern unterschiedlich und beträgt je nach Bundesland zwischen 2,75 bis 4 Prozent des zu versteuernden Einkommens.

Die meisten Kirchensteuergesetze sehen bei hohem Einkommen eine Kappung der Einkommensteuer vor. Sie sollten jedoch prüfen, ob die Kappung in Ihrem Bundesland automatisch oder nur auf Antrag gewährt wird. Es gibt unterschiedliche Regelungen:

- Eine Kappung ohne Antrag erfolgt automatisch in den Bundesländern Berlin, Brandenburg, Bremen, Hamburg, Mecklenburg-Vorpommern, Niedersachsen, Sachsen, Sachsen-Anhalt, Schleswig-Holstein und Thüringen.

- Die Kappung nur mit Antrag gibt es in Baden-Württemberg, Hessen, Nordrhein-Westfalen, Rheinland-Pfalz und im Saarland.

- In Bayern ist keine Kappung der Kirchensteuer möglich.

Prüfen Sie, ob bei Ihrem Einkommen eine Kappung bereits sinnvoll ist. Ist dies der Fall dann richten Sie einen (formlosen) Antrag auf Kappung der Kirchensteuer (plus Kopie des letzten Steuerbescheids) an Ihre Diözese oder Landeskirche.

Beispiel:

In Berlin gilt ein Kappungssatz von 3 Prozent. Also ist die Kirchensteuer auf 3 Prozent des zu versteuernden Einkommens begrenzt.

2020 zu versteuerndes Einkommen: 150.000 Euro

darauf entfallende Einkommensteuer nach dem Grundtarif: 53.863 Euro

zu zahlende Kirchensteuer (9 Prozent): 4.848 Euro.

Bei einer Kappung auf 3 Prozent des Einkommens müssten nur 4.500 Euro Kirchensteuer gezahlt werden.

(2022): Welchen Vorteil bringt die Kappung der Kirchensteuer?