Bis wann muss ich meine Steuererklärung abgeben?

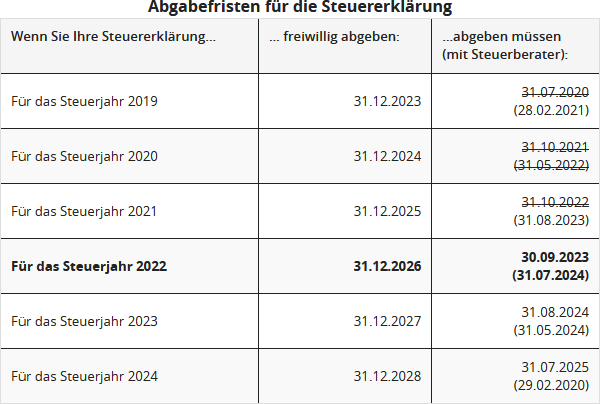

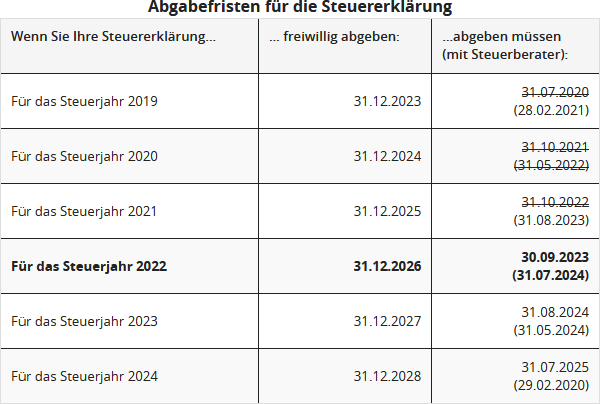

Erstmals für die Steuererklärung 2018 sind die Abgabefristen gesetzlich um zwei Monate verlängert worden. Dies gilt dementsprechend auch für die Steuererklärung 2022:

- Für Bürger, die ihre Steuererklärung selbst anfertigen, verlängert sich die Abgabefrist um 2 Monate vom 31. Mai auf den 31. Juli des Folgejahres (§ 149 Abs. 2 AO). Die Steuererklärung 2022 ist also bis zum 31.7.2023 abzugeben.

- Bürger, die von einem Steuerberater oder Lohnsteuerhilfeverein beraten werden, bekommen ebenfalls zwei Monate mehr Zeit zur Abgabe ihrer Erklärung. Während nach dem bisherigen "Fristenerlass" eine Fristverlängerung über den 31. Dezember des Folgejahres nur aufgrund begründeter Einzelanträge möglich war, besteht nunmehr Zeit bis Ende Februar des Zweitfolgejahres, d.h. für das Jahr 2022 bis zum 28.2.2024 (§ 149 Abs. 3 und 4 AO).

Aber Achtung: Die Finanzverwaltung hat die Möglichkeit der sogenannten Vorweganforderung. Sie müssen also ggf. damit rechnen, Ihre Steuererklärung auch vor den genannten Terminen abgeben zu müssen. Auf jeden Fall drohen bei verspäteten Abgaben hohe Verspätungszuschläge. Deren Festsetzung liegt dann nicht mehr im Ermessen des Finanzbeamten, sondern sind obligatorisch.

Lohnsteuer kompakt

Aufgrund der erheblichen Belastungen durch die Corona-Pandemie wurden die Fristen zur Abgabe der Einkommen-, Körperschaft-, Gewerbe- und Umsatzsteuererklärungen wiederholt verlängert - und abermals jetzt wieder durch das "Vierte Corona-Steuerhilfegesetz".

1. Steuererklärung 2020

Für Steuerzahler, die ihre Steuererklärung selbst erstellen, verlängerte sich die Abgabefrist um 3 Monate vom 31.7.2021 auf den 31.10.2021. Wird die Steuererklärung durch einen Steuerberater oder Lohnsteuerhilfeverein erstellt, endet die neue Abgabefrist 6 Monate später, also am 31.8.2022.

2. Steuererklärung 2021

Für Steuerzahler, die ihre Steuererklärung selbst erstellen, verlängert sich die Abgabefrist um 3 Monate vom 31.7.2022 auf den 31.10.2022. Wird die Steuererklärung durch einen Steuerberater oder Lohnsteuerhilfeverein erstellt, ist die neue Abgabefrist 6 Monate länger und endet statt am 28.2.2023 erst am 31.8.2023.

3. Steuererklärung 2022

Für Steuerzahler, die ihre Steuererklärung selbst erstellen, verlängert sich die Abgabefrist um 2 Monate vom 31.7.2023 auf den 30.9.2023. Wird die Steuererklärung durch einen Steuerberater oder Lohnsteuerhilfeverein erstellt, ist die neue Abgabefrist 5 Monate länger und endet statt am 29.2.2024 am 31.7.2024.

4. Steuererklärung 2023

Für Steuerzahler, die ihre Steuererklärung selbst erstellen, verlängert sich die Abgabefrist um 1 Monat vom 31.7.2024 auf den 31.8.2024. Wird die Steuererklärung durch einen Steuerberater oder Lohnsteuerhilfeverein erstellt, ist die neue Abgabefrist 3 Monate länger und endet statt am 28.2.2025 am 31.5.2025.

5. Steuererklärung 2024

Für Steuerzahler, die ihre Steuererklärung selbst erstellen, gibt es keine Verlängerung mehr. Wird die Steuererklärung durch einen Steuerberater oder Lohnsteuerhilfeverein erstellt, ist die neue Abgabefrist aber 2 Monate länger und endet statt am 28.2.2026 am 30.4.2026.

Hinweis: Der Vollständigkeit halber sei darauf hingewiesen, dass sich die oben genannten Fristen jeweils auf den Ablauf des nächstfolgenden Werktags verschieben, wenn ihr Ende auf einen Sonntag, einen gesetzlichen Feiertag oder einen Sonnabend fällt. Beispiel: Der 31. Oktober 2022 ist in einigen Bundesländern ein gesetzlicher Feiertag. Somit verschiebt sich der Fristablauf für die Abgabe der Steuererklärung 2021 in diesen Bundesländern auf den 1. November 2022.

Abgabefristen für die Steuererklärung

Fristverlängerung beantragen

Können Sie jedoch absehen, dass Ihre Steuererklärung auch in den nächsten Wochen nicht fertig wird, bemühen Sie sich besser heute als morgen um eine Fristverlängerung. Diesen Antrag sollte man eigentlich schon vor dem 31. Juli 2023 einreichen und man hat auch keinen Anspruch darauf, dass das Finanzamt ihm stattgibt. Beantragen Sie am besten eine stillschweigende Fristverlängerung, wenn Sie dann nichts mehr hören, ist Ihr Antrag genehmigt. Wichtig ist, dass Sie Gründe für Ihr Anliegen nennen. Dazu zählen beispielsweise ein Umzug, eine Dienstreise, Krankheiten oder fehlende Unterlagen. Akzeptiert das Finanzamt die Verlängerung, haben Sie in der Regel höchstens bis zum 31. Dezember 2024 Zeit.

Steuerberater sorgt für Fristverlängerung

Wenn Sie einen Steuerberater oder Lohnsteuerhilfeverein beauftragt haben, sind Sie fein raus. Dann verlängert sich die Frist automatisch auf den 28. Februar 2024, sofern das Finanzamt nicht ausdrücklich eine frühere Abgabe verlangt. Der Grund für den späteren Termin ist simpel: Den Steuerexperten ist es nicht zuzumuten, die ganze Arbeit in den ersten fünf Monaten des Jahres zu erledigen.

Irgendwann kommt die Mahnung

Lassen Sie nichts von sich hören, wird Ihnen das Finanzamt früher oder später eine Mahnung schicken und Ihnen eine Frist setzen. Diesen Termin sollten Sie ernst nehmen, sonst kann ein Zwangsentgelt festgesetzt werden, außerdem droht ein happiger Versäumniszuschlag. Besser also, Sie melden sich rechtzeitig.

Wer freiwillig abgibt, hat länger Zeit

Wenn Sie zu denjenigen gehören, die nicht zur Abgabe der Steuererklärung verpflichtet sind, muss Sie das alles gar nicht interessieren. Der Fiskus erwartet kein Geld von Ihnen, sondern muss wahrscheinlich welches zurückzahlen. Gerade deshalb tun Sie aber gut daran, die Einkommensteuererklärung nicht auf die lange Bank zu schieben. Von Rechts wegen hätten Sie lange genug Zeit: Bei freiwilliger Veranlagung bleiben grundsätzlich vier Jahre, in denen die Steuererklärung abgegeben werden kann (nicht muss).

Ihre Steuererklärung für 2022 müsste also bis zum 31. Dezember 2026 eingehen – keinen Tag später, sonst ist die ganze Arbeit für die Katz. Besser ist es jedoch, man reizt den Spielraum nicht aus, sondern kümmert sich frühzeitig. Erfahrungsgemäß ist es leichter, die nötigen Unterlagen im Folgejahr zusammenzustellen, als drei Jahre später. Außerdem geht es ums Geld – wer will schon vier Jahre lang auf die Rückzahlung warten?

(2022): Bis wann muss ich meine Steuererklärung abgeben?