Können hohe Umbaukosten auf fünf Jahre verteilt werden?

Behinderte Menschen sind oftmals mit sehr hohen Aufwendungen belastet, die andere gesunde Menschen nicht haben. Die gilt insbesondere für eine behindertengerechte Umgestaltung des Wohnumfeldes, wie barrierefreie Umbaumaßnahmen in der Wohnung, Einbau eines Treppenlifts, Anbau eines Aufzuges, Bau einer Rollstuhlrampe, Umrüstung des Fahrzeuges usw.

Weil es sich hierbei um unvermeidbare Ausgaben handelt, sind sie als außergewöhnliche Belastungen allgemeiner Art nach § 33 EStG unter Anrechnung einer zumutbaren Belastung absetzbar. Die Ausgaben müssen wegen des steuerlichen Abflussprinzips in voller Höhe im Jahr der Bezahlung in der Steuererklärung angegeben werden.

Der volle Abzug im Jahr der Verausgabung kann allerdings ins Leere laufen, wenn die außergewöhnlichen Belastungen höher sind als der Gesamtbetrag der Einkünfte, von dem sie abgezogen werden sollen. So bringt die steuerliche Absetzbarkeit nicht den gewünschten Entlastungseffekt. Für diesen Fall hat der Bundesfinanzhof eine Billigkeitsregelung angeregt (§ 163 AO): Betroffene sollten die Möglichkeit haben, die hohen Aufwendungen auf mehrere Jahre zu verteilen (BFH-Urteil vom 22.10.2009, VI R 7/09).

Aber die Finanzverwaltung sperrt sich und erklärt immer noch in den Einkommensteuerrichtlinien des Jahres 2015:

"Eine Verteilung auf mehrere Jahre ist nicht zulässig" (R 33.4 Abs. 4 und 5 EStR). Leider hat der Bundesfinanzhof die harte Haltung des Fiskus bestätigt und entschieden, dass außergewöhnliche Belastungen grundsätzlich in dem Jahr absetzbar sind, in dem sie geleistet wurden. Hohe Kosten für den behindertengerechten Wohnungsumbau dürfen nicht aus Billigkeitsgründen auf mehrere Jahre verteilt werden, wenn sie sich im Kalenderjahr, in dem sie verausgabt worden sind, steuerlich nur sehr eingeschränkt auswirken können (BFH-Urteil vom 12.7.2017, VI R 36/15).

(2022): Können hohe Umbaukosten auf fünf Jahre verteilt werden?

Kann ein höherer Km-Kostensatz für Privatfahrten abgesetzt werden?

Menschen mit Behinderung dürfen Aufwendungen für Privatfahrten in einem "angemessenen Rahmen" als außergewöhnliche Belastungen allgemeiner Art nach § 33 EStG absetzen. Diese interessante Steuervergünstigung gibt es zusätzlich zum Behinderten-Pauschbetrag. Für den Umfang der steuerlichen Entlastung kommt es allerdings auf die Art und Schwere der Behinderung an. Hier werden zwei Gruppen unterschieden:

- Menschen mit einem Grad der Behinderung ab 80 oder mit einem GdB ab 70 und dem Merkzeichen "G".

- Menschen mit dem Merkzeichen "aG“, mit dem Merkzeichen "Bl“, mit dem Merkzeichen "TBl“ oder mit dem Merkzeichen "H“.

Mit dem "Behinderten-Pauschbetragsgesetz" ist seit dem 1.1.2021 für die vorgenannten Personen eine behinderungsbedingte Fahrtkostenpauschale im Gesetz festgeschrieben: Diese beträgt für die

- erste Gruppe: 900 Euro,

- zweite Gruppe: 4.500 Euro.

Auf diese Pauschbeträge rechnet das Finanzamt eine zumutbare Belastung an (§ 33 Abs. 2a EStG).

I N F O

Wie werden die Kosten für Umbaumaßnahmen aufgrund einer Behinderung berücksichtigt?

Wenn ein Familienmitglied von einer Behinderung betroffen ist, werden oftmals erhebliche Umbaumaßnahmen in der Wohnung oder am Eigenheim erforderlich, um dem Behinderten trotz gesundheitlicher Einschränkungen weiterhin ein Leben in seiner gewohnten Umgebung zu ermöglichen und ihm den Umzug in ein Pflegeheim zu ersparen.

Solche Aufwendungen für behinderungsbedingte Umbaumaßnahmen können als außergewöhnliche Belastungen absetzbar sein, wenn Sie bestimmte Bedingungen beachten.

Kosten für Umbau der Dusche

Aktuell hat das Finanzgericht Baden-Württemberg die Aufwendungen für den Umbau der Dusche in voller Höhe als außergewöhnliche Belastungen gemäß § 33 EStG anerkannt, wobei allerdings eine zumutbare Belastung anzurechnen ist. Die Aufwendungen für Material und Arbeitslohn stellen Krankheitskosten dar, denn sie dienen unmittelbar der Linderung einer Krankheit (FG Baden-Württemberg vom 19.3.2014, 1 K 3301/12).

Der Fall

Eine alleinstehende Dame leidet an Multipler Sklerose und hat einen Grad der Behinderung von 50. Eine Pflegestufe ist (noch) nicht bescheinigt. In ihrem Eigenheim lässt sie die Dusche behindertengerecht um-bauen: Die Duschwanne wird entfernt und ein bodengleiches Duschelement eingebaut, die Armaturen werden erneuert, die Duschkabine neu gefliest und mit einer Tür versehen. Danach ist die Dusche bodengleich begehbar und mit einem Rollstuhl befahrbar.

Das Finanzgericht hat einen Gegenwert für die neue Dusche nicht angerechnet. Denn nach neuer BFH-Rechtsprechung sind bei behinderungsbedingten Umbaumaßnahmen die Aufwendungen so stark durch die Zwangslage der Behinderung begründet, "dass die Erlangung eines etwaigen Gegenwertes in Anbetracht der Gesamtumstände in den Hintergrund tritt" (BFH-Urteil vom 24.2.2011, BStBl. 2011 II S. 1012).

Des Weiteren bleibt auch ein marktgängiger Vorteil außer Betracht: "Ein Gegenwert, der allein auf der möglichen Nutzung der Umbauten durch nichtbehinderte Familienangehörige beruhen soll, ist kein realer Gegenwert und mithin ungeeignet, ein Abzugsverbot zu begründen" (BFH-Urteil vom 22.10.2009, BStBl. 2010 II S. 280).

Kosten für Einbau eines Fahrstuhls

Aufwendungen für den Einbau eines Fahrstuhls in das eigene Haus wurden bisher nicht als außergewöhnliche Belastungen anerkannt. Nicht anerkannt wurde auch ein Aufzugsturm, der an das bestehende Gebäude angebaut wurde. Begründet wurde dies damit, dass eine solche Baumaßnahme auch für Nichtbehinderte von Vorteil ist und deshalb zu einer Werterhöhung des Gebäudes führt.

Doch nach neuerer BFH-Rechtsprechung spielen die Frage des Gegenwertes und des marktgängigen Vorteils jetzt keine wesentliche Rolle mehr (BFH-Urteil vom 22.10.2009, BStBl. 2010 II S. 280; BFH-Urteil vom 24.2.2011, BStBl. 2011 II S. 1012).

Das Finanzgericht Köln hat die Kosten für den Einbau eines Fahrstuhls in Höhe von 65.000 Euro als außergewöhnliche Belastungen anerkannt, weil der Einbau eines kostengünstigeren Treppenliftes aus technischen Gründen nicht möglich war (FG Köln vom 27.8.2014, 14 K 2517/12, Revision).

Aktuell hat das Finanzgericht Münster entschieden, dass Aufwendungen für die Anlage eines rollstuhlgerechten Weges im Garten eines Einfamilienhauses nicht zwangsläufig sind, wenn sich auf der anderen Seite des Hauses eine Terrasse befindet, die mit dem Rollstuhl erreichbar ist. Folglich sind die Aufwendungen nicht als außergewöhnliche Belastungen abziehbar. Immerhin sind die Lohnkosten als Handwerkerleistung mit 20 Prozent (höchstens 1.200 EUR) von der Steuerschuld abzuziehen (Urteil vom 15.1.2020, 7 K 2740/18 E).

Aufwendungen für medizinisch indizierte Maßnahmen sind typisierend als außergewöhnliche Belastungen zu berücksichtigen, ohne dass es im Einzelfall einer Prüfung der Zwangsläufigkeit des Grundes und der Höhe nach Bedarf. Weiter ist zu beachten, dass nicht nur das medizinisch Notwendige im Sinne einer Mindestversorgung angezeigt ist, sondern jedes diagnostische oder therapeutische Verfahren, das hinreichend gerechtfertigt ist.

Dieser medizinischen Wertung hat die steuerliche Beurteilung zu folgen, es sei denn, es liegt ein offensichtliches Missverhältnis zwischen dem erforderlichen und dem tatsächlichen Aufwand vor. Auch bei Kosten von 65.000 Euro für einen Fahrstuhl liegt hier kein für jedermann offensichtliches Missverhältnis zwischen dem erforderlichen und dem tatsächlichen Aufwand vor. Diese Kosten sind angemessen.

Dies gilt insbesondere dann, wenn der Einbau eines kostengünstigeren Treppenlifts aus technischen Gründen nicht möglich war.

Der Bundesfinanzhof hatte bereits geklärt, dass der Fahrstuhl ein "medizinisches Hilfsmittel im engeren Sinne" darstellt, das ausschließlich von Kranken oder Behinderten angeschafft werde, um ihr Leiden zu lindern. Bei solchen Gegenständen muss nicht vor der Anschaffung ein amtsärztliches Attest eingeholt werden, denn hier kommen nicht die strengen Anforderungen des § 64 Abs. 1 Nr. 2e EStDV zur Anwendung (BFH-Urteil vom 6.2.2014, VI R 61/12).

Tipp

Der volle Abzug im Jahr der Verausgabung kann allerdings ins Leere laufen, wenn die außergewöhnlichen Belastungen höher sind als der Gesamtbetrag der Einkünfte, von dem sie abgezogen werden sollen. So bringt die steuerliche Absetzbarkeit nicht den gewünschten Entlastungseffekt. Es wäre vorteilhafter, wenn hohe Aufwendungen auf mehrere Jahre verteilt werden könnten. Aber: die Finanzverwaltung sperrt sich und erklärt: "Eine Verteilung auf mehrere Jahre ist nicht zulässig" (R 33.4 Abs. 4 und 5 EStR).

Der Bundesfinanzhof hat die harte Haltung des Fiskus bestätigt: Außergewöhnliche Belastungen sind grundsätzlich in dem Jahr absetzbar, in dem sie geleistet wurden. Hohe Kosten für den behindertengerechten Wohnungsumbau dürfen nicht aus Billigkeitsgründen auf mehrere Jahre verteilt werden, wenn sie sich im Kalenderjahr, in dem sie verausgabt worden sind, steuerlich nur sehr eingeschränkt auswirken können (BFH-Urteil vom 12.7.2017, VI R 36/15).

(2022): Wie werden die Kosten für Umbaumaßnahmen aufgrund einer Behinderung berücksichtigt?

Welche neuen Pflegegrade entsprechen der Hilflosigkeit?

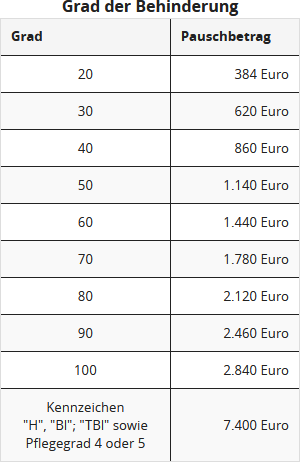

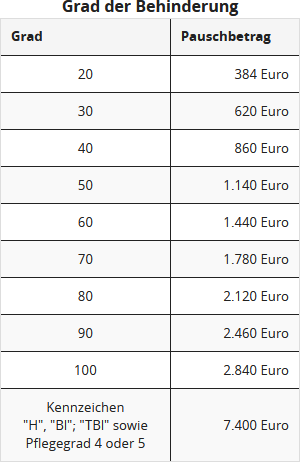

Behinderte Menschen haben Anspruch auf einen Behinderten-Pauschbetrag, der je nach Grad der Behinderung unterschiedlich hoch ist. Bei Hilflosigkeit (Merkzeichen "H") und Blindheit (Merkzeichen "Bl") beträgt der Behinderten-Pauschbetrag unabhängig vom Grad der Behinderung ab 2021 7.400 Euro (bis 2020: 3.700 Euro; § 33b EStG).

Gleichgestellt mit dem Merkzeichen "H" ist bis 2016 die Einstufung als Schwerstpflegebedürftiger in Pflegestufe III gemäß Bescheid der Pflegekasse (§ 65 Abs. 2 EStDV).

Pflegepersonen, die einen Pflegebedürftigen zu Hause betreuen, haben Anspruch auf den Pflege-Pauschbetrag. Ab 2021 wird der Pflege-Pauschbetrag für häusliche Pflege beim Pflegegrad 4 oder 5 verdoppelt und ein Pauschbetrag für die Pflegegrade 2 und 3 neu eingeführt. Der Pauschbetrag beträgt

- bei Pflegegrad 2: 600 Euro

- bei Pflegegrad 3: 1.100 Euro

- bei Pflegegrad 4 oder 5 oder Hilflosigkeit: 1.800 Euro

Seit 2017 erfolgt die Einstufung der Pflegebedürftigkeit - statt bisher in drei Pflegestufen - wesentlich differenzierter in fünf Pflegegrade. Im Mittelpunkt steht der tatsächliche Unterstützungsbedarf, gemessen am Grad der Selbständigkeit - unabhängig davon, ob jemand an einer geistigen oder körperlichen Einschränkung leidet. Dabei werden körperliche, geistige und psychische Einschränkungen erfasst und in die Bewertung der Pflegebedürftigkeit einbezogen.

Alle Pflegebedürftigen, die bisher Leistungen der Pflegeversicherung erhalten, werden seit dem 1.1.2017 ohne erneute Begutachtung in das neue System übergeleitet. Sie müssen also keinen Antrag auf Einstufung in einen neuen Pflegegrad stellen. Bisher war - vor allem für steuerliche Zwecke - die Pflegestufe III dem Merkzeichen "H" (hilfsbedürftig) im Schwerbehindertenausweis gleichgestellt.

Seit 2017 steht dem Merkzeichen "H" die Einstufung in die Pflegegrade 4 und 5 gleich. Wenn also der Pflegebedürftige den Pflegegrad 4 oder 5 hat, bekommt

- der Pflegebedürftige den erhöhten Behinderten-Pauschbetrag von 7.400 Euro und

- die Pflegeperson bei häuslicher Pflege den Pflege-Pauschbetrag (BMF-Schreiben vom 19.8.2016).

Der neue Pflegegrad 4 gilt für die bisherige Pflegestufe III sowie für die bisherige Pflegestufe II mit erheblich eingeschränkter Alltagskompetenz. Der neue Pflegegrad 5 betrifft die bisherige Pflegestufe III mit erheblich eingeschränkter Alltagskompetenz und die Härtefälle der Pflegestufe III.

(2022): Welche neuen Pflegegrade entsprechen der Hilflosigkeit?

Wer bekommt den Pauschbetrag für Behinderte?

Sie können den Behinderten-Pauschbetrag erhalten, wenn Sie einen bestimmten Grad der Behinderung nachweisen können. Dabei gilt als behindert, wer länger als sechs Monate körperlich, geistig oder seelisch in seinem Gesundheitszustand beeinträchtigt ist.

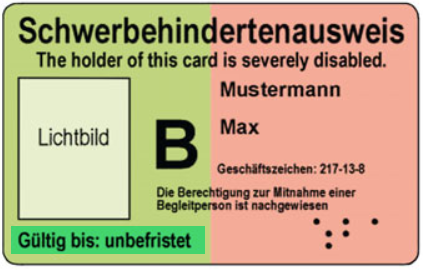

Festgestellt wird der Grad der Behinderung im Regelfall durch das Versorgungsamt. Ab einem Grad der Behinderung von 50 erhalten Sie einen Schwerbehindertenausweis, bis zu einem Grad von 45 stellt das Amt einen Feststellungsbescheid aus. An diese Bescheide ist das Finanzamt gebunden.

Sie können den Behinderten-Pauschbetrag für sich selbst, Ihren behinderten Ehegatten oder Ihr behindertes Kind in Anspruch nehmen. Eine Übertragung des Pauschbetrages von behinderten Eltern bzw. Geschwistern ist nicht möglich.

Tipp: Bei einer rückwirkenden Feststellung des Grades der Behinderung für mehrere Jahre können Sie für die Jahre, für die Ihnen ein Grad der Behinderung anerkannt wird, den Pauschbetrag nachträglich geltend machen. Sie sollten aber möglichst umgehend nach Feststellung des Grades der Behinderung ihre steuerlichen Ansprüche anmelden, da es bestimmte Fristen zu beachten gibt.

Lohnsteuer kompakt

Der Behinderten-Pauschbetrag ist ein Jahresbetrag. Er wird in voller Höhe auch dann gewährt, wenn die Behinderung während des Jahres eintritt oder wegfällt. Wird der GdB während des Jahres herauf- oder herabgesetzt, richtet sich der Jahresbetrag nach dem höheren GdB (R 33b Abs. 7 EStR).

Treten mehrere Behinderungen aus verschiedenen Gründen auf, wird jeweils die Behinderung zugrunde gelegt, die zum höchsten Pauschbetrag führt. Der Behinderten-Pauschbetrag wirkt sich in vollem Umfang steuermindernd aus, denn eine zumutbare Belastung wird nicht angerechnet.

Die Frage ist, ob zusätzlich zum Behinderten-Pauschbetrag pflegebedingte Aufwendungen als außergewöhnliche Belastungen nach § 33 EStG absetzbar sind oder ob dafür auf den Pauschbetrag verzichtet werden muss. Seit 2008 gilt folgende Regelung:

Falls Sie den Behinderten-Pauschbetrag gemäß § 33b Abs. 3 EStG in Anspruch nehmen, werden pflegebedingte Aufwendungen nicht zusätzlich als außergewöhnliche Belastungen nach § 33 EStG anerkannt. Es gilt das "Entweder-Oder-Prinzip" (R 33.3 Abs. 4 EStR 2008).

Sie müssen sich also entscheiden: Entweder beantragen Sie den Behinderten-Pauschbetrag, oder Sie machen die pflegebedingten Kosten gegen Nachweis als außergewöhnliche Belastungen geltend. Beim Nachweis muss das Pflegegeld von der Pflegeversicherung angerechnet werden, und vom verbleibenden Betrag zieht das Finanzamt noch die zumutbare Belastung ab. Damit also die Berücksichtigung gemäß § 33 EStG vorteilhafter ist, müssen die Aufwendungen höher sein als der Behinderten-Pauschbetrag, das erhaltene Pflegegeld und die zumutbare Belastung.

Aber keine Regel oder Ausnahme:

Folgende besondere Ausgaben können Sie zum Beispiel neben dem Pauschbetrag ansetzen:

- außerordentliche Krankheitskosten, die durch einen akuten Anlass verursacht werden, zum Beispiel Kosten einer Operation, einer Heilbehandlung, Arznei- und Arztkosten,

- Ausgaben für eine Heilkur, die aufgrund eines vor Kurantritt ausgestellten amtsärztlichen Attestes durchgeführt wird (die ärztliche Bescheinigung eines Medizinischen Dienstes der Krankenversicherung steht dem amtsärztlichen Attest gleich),

- behinderungsbedingte Umrüstungskosten für ein Auto,

- behinderungsbedingte Umbaukosten der Wohnung,

- behinderungsbedingte Fahrtkostenpauschale (ab dem Jahr 2021):

Bis einschließlich zum Jahr 2020 konnten Fahrtkosten im Zusammenhang mit einer Behinderung mit 0,30 Euro je gefahrenen Kilometer bis zu bestimmten Höchstbeträgen berücksichtigt werden. Diese Berücksichtigung erforderte regelmäßig auch einen Nachweis der gefahrenen Kilometer. Auf diesen Nachweis wird ab dem Jahr 2021 verzichtet.

Die behinderungsbedingte Fahrtkostenpauschale beträgt:

- 900 Euro: bei Menschen mit einem Grad der Behinderung von mindestens 80 oder einem Grad der Behinderung von mindestens 70 und dem Merkzeichen „G“ für gehbehindert

- 4.500 Euro: bei Menschen mit außergewöhnlicher Gebehinderung (Merkzeichen „aG“), Blinden (Merkzeichen „BI“), Taubblinden (Merkzeichen „TBI“, hilflosen Menschen (Merkzeichen „H“) oder Menschen für die der Pflegegrad 4 oder 5 festgestellt wurde.

Folgende Besonderheit ist bei der Berücksichtigung der behinderungsbedingten Fahrtkostenpauschale zu beachten:

Die behinderungsbedingten Fahrtkosten sind Teil der allgemeinen außergewöhnlichen Belastungen. Von der Gesamtsumme der außergewöhnlichen Belastungen, wozu auch die behinderungsbedingte Fahrtkostenpauschale hinzugerechnet wird, wird bei der Berechnung Ihrer Einkommensteuer noch die Minderung um die zumutbare Belastung vorgenommen.

(2022): Wer bekommt den Pauschbetrag für Behinderte?

Wie wird eine Behinderung nachgewiesen?

Der Nachweis der Behinderung erfolgt durch das Versorgungsamt. Ab einem Behinderungsgrad von 50 Prozent erhalten Sie einen Schwerbehindertenausweis, bis zu einem Grad von 45 stellt das Amt einen Feststellungsbescheid aus. An diese Bescheide ist das Finanzamt gebunden.

Sollten Sie aufgrund Ihrer Behinderung eine Rente oder andere Bezüge erhalten, reichen in der Regel auch der Rentenausweis oder ähnliche Bescheide als Nachweise aus.

Für die Gewährung des erhöhten Pauschbetrages für Hilflose bzw. Blinde, muss im Schwerbehindertenausweis der Vermerk „H“ bzw. “Bl“ eingetragen sein. Bei hilflosen Personen ist auch der Bescheid der Pflegekasse über die Einstufung als Pflegebedürftiger der Pflegestufe III (bis 2016) bzw. die Zuerkennung des Pflegegrades 4 oder 5 (ab 2017) ausreichend.

(2022): Wie wird eine Behinderung nachgewiesen?

Welche Ausgaben sind mit dem Pauschbetrag für Behinderte abgegolten?

Viele Aufwendungen, die behinderten Menschen typischerweise entstehen, sind mit dem Behinderten-Pauschbetrag abgegolten. Dazu zählen Kosten, die anfallen, um gewöhnliche und regelmäßig wiederkehrende Verrichtungen im Alltag zu bewältigen. Außerdem zählen dazu Aufwendungen für die Pflege, wobei es irrelevant ist, ob diese zu Hause oder in einem Heim erfolgt oder welche Pflegestufe vorliegt.

Tipp

Ist die Summe Ihrer Aufwendungen höher als der Pauschbetrag, sollten Sie auf diesen verzichten und stattdessen Ihre Kosten als außergewöhnliche Belastungen absetzen. Hierbei müssen sie aber beachten, dass außergewöhnliche Belastungen nur anerkannt werden, wenn sie die zumutbare Belastung übersteigen.

Abgegolten sind auch die Kosten für Medikamente, Heilmittel und Hilfsleistungen sowie die Eigenbeteiligung zur Nutzung öffentlicher Verkehrsmittel. Auch die Aufwendungen für eine Heimdialyse fallen hierunter.

(2022): Welche Ausgaben sind mit dem Pauschbetrag für Behinderte abgegolten?

Wann gilt eine Person als hilflos?

Hilflose Personen erhalten einen erhöhten Behinderten-Pauschbetrag von 7.400 Euro. Laut Einkommensteuergesetz gilt eine Person dann als hilflos, „wenn sie für eine Reihe von häufig und regelmäßig wiederkehrenden Verrichtungen zur Sicherung ihrer persönlichen Existenz im Ablauf eines jeden Tages fremder Hilfe dauernd bedarf“ (33b Abs. 6 Satz 3 EStG). Diese Hilfe kann zum Beispiel beim An- und Ausziehen, beim Essen und bei der Körperpflege erfolgen.

Den Pauschbetrag gibt es nicht bei vorübergehender Hilflosigkeit, sondern nur, wenn der Zustand für länger als sechs Monate andauert.

Nachweis der Hilflosigkeit

Der Nachweis der Hilflosigkeit erfolgt mit dem Schwerbehindertenausweis, in dem das Merkzeichen „H“ eingetragen ist. Als Nachweis kann auch der Bescheid des Versorgungsamtes dienen, auf dem die entsprechenden Freistellungen vermerkt sind. Dem Merkzeichen 'H' entspricht der Pflegegrad 4 oder 5 (ab 2017).

Tipp: Der erhöhte Behinderten-Pauschbetrag ist vom Grad der Behinderung unabhängig, kann also auch bei einem Grad der Behinderung von unter 50 erfolgen.

Im Jahre 2017 wurde das Merkzeichen "TBl" (Taubblinde) neu im Sozialrecht eingeführt, um eine Gleichstellung mit dem Merkzeichen "Bl" zu verdeutlichen. Die Erweiterung ist deklaratorisch, weil Menschen mit dem Merkzeichen "Bl" und/oder dem Merkzeichen "TBl" immer auch das Merkzeichen "H" erhalten.

(2022): Wann gilt eine Person als hilflos?

Wann liegt Blindheit vor?

Blinde Personen erhalten den erhöhten Behinderten-Pauschbetrag von 7.400 Euro pro Jahr. Blindheit liegt vor, wenn man auf dem besseren Auge nicht mehr als zwei Prozent Sehkraft besitzt.

Gehörlose erhalten den erhöhten Behinderten-Pauschbetrag nicht.

Der Nachweis der Hilflosigkeit erfolgt mit dem Schwerbehindertenausweis, in dem das Merkzeichen „Bl“ eingetragen ist. Als Nachweis kann auch der Bescheid des Versorgungsamtes dienen, auf dem die entsprechenden Feststellungen vermerkt sind.

Hinweis

Im Jahre 2017 wurde das Merkzeichen "TBl" (Taubblinde) neu im Sozialrecht eingeführt, um eine Gleichstellung mit dem Merkzeichen "Bl" zu verdeutlichen. Die Erweiterung ist deklaratorisch, weil Menschen mit dem Merkzeichen "Bl" und/oder dem Merkzeichen "TBl" immer auch das Merkzeichen "H" erhalten.

(2022): Wann liegt Blindheit vor?