Diskriminierung: Entschädigung des Arbeitgebers vollkommen steuerfrei

Nach dem Allgemeinen Gleichbehandlungsgesetz (AGG) sind Benachteiligungen aus Gründen der Rasse oder wegen der ethnischen Herkunft, des Geschlechts, der Religion oder Weltanschauung, einer Behinderung, des Alters oder der sexuellen Identität verboten (§ 1 AGG). Bei einem Verstoß gegen das Benachteiligungsverbot ist der Arbeitgeber verpflichtet, den hierdurch entstandenen Schaden zu ersetzen. Der so Benachteiligte kann eine angemessene Entschädigung in Geld verlangen (§ 15 Abs. 2 AGG). Die Frage ist, wie eine solche Entschädigung steuerlich zu behandeln ist. Aktuell hat das Finanzgericht Rheinland-Pfalz entschieden, dass eine Entschädigung, die ein Arbeitgeber seinem Arbeitnehmer wegen Diskriminierung, Mobbings oder sexueller Belästigung zahlen muss, steuerfrei und eben kein steuerpflichtiger Arbeitslohn ist. Dies gilt auch dann, wenn der Arbeitgeber die behauptete Benachteiligung bestritten und sich lediglich in einem gerichtlichen Vergleich zur Zahlung bereit erklärt hat. Steuerfrei bedeutet, dass die Zahlung nicht sozialversicherungspflichtig ist (FG Rheinland-Pfalz vom 21.3.2017, 5 K 1594/14).

Der Fall: Eine Arbeitnehmerin hat gegen die ordentliche Kündigung ihres Arbeitsverhältnisses "aus personenbedingten Gründen" Kündigungsschutzklage erhoben, mit der sie auch eine Entschädigung wegen Benachteiligung aufgrund ihrer Behinderung begehrte. Wenige Wochen vor der Kündigung hatte das Amt für soziale Angelegenheiten eine Körperbehinderung von 30 % festgestellt.

Vor dem Arbeitsgericht Kaiserslautern schlossen die Mitarbeiterin und ihr Arbeitgeber sodann einen Vergleich, in dem "eine Entschädigung gemäß § 15 AGG" i.H.v. 10.000 Euro vereinbart und das Arbeitsverhältnis einvernehmlich beendet wurde. Das Finanzamt wollte die Entschädigung als steuerpflichtigen Arbeitslohn behandeln.

Nach Auffassung der Finanzrichter ist dem beim Arbeitsgericht geschlossenen Vergleich zu entnehmen, dass es sich bei der Zahlung nicht um Ersatz für entstandene materielle Schäden i.S.d. § 15 Abs. 1 AGG (z.B. entgehenden Arbeitslohn) gehandelt hat, sondern um den Ausgleich immaterieller Schäden i.S.d. § 15 Abs. 2 AGG wegen einer Diskriminierung der Klägerin als Behinderte. Eine solche Entschädigungszahlung sei steuerfrei und nicht als Arbeitslohn zu qualifizieren. Der Arbeitgeber der Klägerin habe die Benachteiligung zwar bestritten.

Im Wege des Vergleichs sei er jedoch bereit gewesen, eine Entschädigung wegen (nur) behaupteter Benachteiligung zu zahlen. Solche Einnahmen hätten keinen Lohncharakter und seien daher steuerfrei.

Lohnsteuer kompakt

Die Entschädigung ist nicht nur steuer- und sozialversicherungsfrei, sie wird auch nicht in den Progressionsvorbehalt einbezogen, sodass sie nicht zu einem höheren Steuersatz für das übrige Einkommen führt.

Altersdiskriminierende Besoldung?

Das Bundesverwaltungsgericht hat soeben jungen Beamten eine Entschädigung wegen altersdiskriminierender Besoldung zugesprochen, weil ihre Besoldung gegen das Verbot der Benachteiligung wegen Alters verstoßen hat. Das Gericht hat den Anspruch auf Entschädigung aus § 15 Abs. 2 AGG hergeleitet (BVerwG-Urteile vom 6.4.2017, 2 C 11.16 und 2 C 12.16). Die Besoldungsregeln benachteiligten jüngere Beamte allein wegen ihres Lebensalters (EuGH-Urteil vom 19.6.2014, C-501/12).

(2022): Diskriminierung: Entschädigung des Arbeitgebers vollkommen steuerfrei

So sparen Sie mit einem Freibetrag in den ELStAM!

Wer hohe Werbungskosten, Sonderausgaben oder Verluste aus einer anderen Einkunftsart (z.B. Vermietung, Gewerbebetrieb, Kapitalvermögen etc.) hat, bezahlt jeden Monat von seinem Gehalt zu viel Lohnsteuer.

Erst mit der Erledigung der Einkommensteuererklärung können Sie dann die zu viel bezahlte Lohnsteuer im Rahmen der Steuererklärung vom Finanzamt zurückfordern.

Mit einem Antrag auf Lohnsteuerermäßigung können Sie sich vom Finanzamt für verschiedene steuerliche Abzugsbeträge und für Ihre voraussichtlichen Aufwendungen einen Freibetrag in den elektronischen Lohnsteuerabzugsmerkmalen (ELStAM) eintragen lassen. Bei der Lohn- und Gehaltsabrechnung kürzt dann der Arbeitgeber Ihren Bruttoarbeitslohn um den monatlichen Freibetrag. Somit wird auch die Lohnsteuer nur vom gekürzten Bruttoarbeitslohn berechnet. So zahlen Sie mit einem Freibetrag schon während des Jahres weniger Steuern und auch weniger Solidaritätszuschlag und Kirchensteuer.

(2022): So sparen Sie mit einem Freibetrag in den ELStAM!

Wie kann ich den Kinderfreibetrag in den ELStAM eintragen lassen?

Der Kinderfreibetrag wird zwar erst nachträglich gewährt, Sie können ihn jedoch in Ihren elektronischen Lohnsteuerabzugsmerkmalen (ELStAM) eintragen lassen. Zwar zahlen Sie dann nicht weniger Einkommensteuer voraus. Die unterjährige Belastung kann dennoch sinken. Denn der Kinderfreibetrag wird zur Berechnung von Kirchensteuer und Solidaritätszuschlag berücksichtigt, die dadurch geringer ausfallen. Sie müssen den Freibetrag bei Ihrem Finanzamt eintragen lassen. Dafür sollten Sie die folgenden Unterlagen mitbringen:

- Personalausweis oder Reisepass

- Lohnsteuerbescheinigung

- Abstammungsurkunde

- ggf. Vaterschaftsanerkennungsurkunde, wenn Sie nicht verheiratet sind

- ggf. Lebensbescheinigung für Kinder, die an einem anderen Wohnort gemeldet sind

Die Lebensbescheinigung darf nicht älter als drei Jahre sein. Wer die Lebensbescheinigung nicht vorlegen kann, z.B. weil das Kind im Ausland lebt, muss sich an sein Finanzamt wenden. Dort trägt der Finanzbeamte den Kinderfreibetrag ein.

Auch Eltern volljähriger Kinder müssen sich für die Eintragung von Freibeträgen an das Finanzamt wenden.

(2022): Wie kann ich den Kinderfreibetrag in den ELStAM eintragen lassen?

Wie lasse ich Freibeträge oder Änderungen in den ELStAM eintragen?

Steuerzahler, die einen Freibetrag in ihren elektronischen Lohnsteuerabzugsmerkmalen (ELStAM) eintragen möchten, wenden sich an das Finanzamt. Falls Sie einen Lohnsteuerfreibetrag für hohe Werbungskosten berücksichtigen lassen wollen, können Sie einen entsprechenden Antrag stellen. Gleiches gilt für die antragsgebundenen Abzugsmerkmale, wie Berücksichtigung volljähriger Kinder, Pflegekinder, Steuerklasse II für Alleinerziehende.

Auch wenn Sie bereits im Vorjahr einen solchen Freibetrag genutzt und die Verhältnisse sich nicht wesentlich geändert haben, ist ein erneuter Antrag für das neue Jahr erforderlich. Nur ein bereits eingetragener Behinderten-Pauschbetrag wird auch ohne erneuten Antrag weiterhin berücksichtigt. Gleiches gilt, wenn der Behinderten-Pauschbetrag für ein Kind auf die Eltern übertragen wurde.

Falls die gespeicherten ELStAM nicht korrekt sind, müssen Sie eine Berichtigung beim zuständigen Wohnsitzfinanzamt beantragen. Hierzu verwenden Sie das Formular "Korrekturantrag zu den elektronischen Lohnsteuerabzugsmerkmalen", das Sie beim Finanzamt oder im Internet erhalten.

Vorsicht

Seit dem 1.1.2016 ist der Lohnsteuerfreibetrag im Regelfall für zwei Jahre gültig. Wenn sich innerhalb der zwei Jahre die Verhältnisse zu Ihren Gunsten verändern, können Sie den Freibetrag beim Finanzamt ändern lassen. Falls sich jedoch die Verhältnisse zu Ihren Ungunsten ändern, sind Sie verpflichtet, den Freibetrag ändern zu lassen. Eine Änderung kann sich zum Beispiel ergeben bei Arbeitgeberwechsel, wenn sich die Entfernung zur Arbeits- oder Tätigkeitsstätte wesentlich erhöht oder verringert oder eine doppelte Haushaltsführung begründet wird oder wegfällt (§ 39a Abs. 1 Satz 4-5 EStG).

(2022): Wie lasse ich Freibeträge oder Änderungen in den ELStAM eintragen?

Wer bekommt die Inflationsausgleichsprämie?

Wenn Arbeitgeber ihren Mitarbeitern eine so genannte Inflationsausgleichsprämie gewähren (Inflation, Inflationsrate, Teuerungsrate), bleibt diese bis zu einem Betrag von 3.000 Euro steuer- und sozialversicherungsfrei. Voraussetzung für die Steuerfreiheit ist, dass die Leistung zusätzlich zum ohnehin geschuldeten Arbeitslohn gewährt wird. Die Regelung gilt für Zahlungen, die vom 26.10.2022 bis zum 31.12.2024 gewährt werden (§ 3 Nr. 11c EStG).

Naturgemäß kommen nach entsprechenden Neuregelungen immer wieder Fragen auf, so unter anderem, ob die Zahlung einer Inflationsausgleichsprämie für Arbeitgeber verpflichtend ist. Und, falls diese gezahlt wird, ob Arbeitgeber diese gleichmäßig an alle Arbeitnehmer des jeweiligen Unternehmens leisten müssen. Zur ersten Frage lautet die Antwort "Nein, es besteht keine Verpflichtung". Die zweite Frage hat die Parlamentarische Staatssekretärin Katja Hessel nach der Anfrage des Abgeordneten Fritz Güntzler (CDU/CSU) wie folgt beantwortet:

"Die mit § 3 Nr. 11 EStG beschlossene Steuerfreiheit der Inflationsausgleichsprämie sieht keine Regelung vor, dass die Prämie an alle Arbeitnehmerinnen und Arbeitnehmer ausgezahlt werden muss. Zudem handelt es sich dabei um einen steuerlichen Freibetrag, der innerhalb des Begünstigungszeitraums auch in Teilbeträgen an die Arbeitnehmerinnen und Arbeitnehmer ausgezahlt werden kann" (Bundestags-Drucksache 20/3987 vom 14.10.2022).

Lohnsteuer kompakt

Auch wenn sowohl die grundsätzliche Zahlung der Inflationsausgleichsprämie als auch eine eventuelle Verteilung unter den Arbeitnehmern - steuerlich - im freien Belieben des Arbeitgebers stehen, können sich aus dem Tarif- oder dem Arbeitsrecht abweichende Handhabungen ergeben. So dürfen Arbeitgeber nicht willkürlich bestimmte Arbeitnehmer begünstigen bzw. andere benachteiligen. Sofern nicht alle Arbeitnehmer eine Prämie erhalten oder diese ihrer Höhe nach differenziert gezahlt wird, müssen objektive Gründe für die unterschiedliche Behandlung vorliegen. Ansonsten gilt arbeitsrechtlich der Gleichbehandlungsgrundsatz.

Lohnsteuer kompakt

Informationen zur Inflationsausgleichsprämie finden Sie im offiziellen Fragen-Antworten-Katalog des Bundesfinanzministeriums.

(2022): Wer bekommt die Inflationsausgleichsprämie?

Eigene Kündigung: Unterliegt die Abfindung der Fünftelregelung?

Die vorzeitige Beendigung des Arbeitsverhältnisses durch den Arbeitgeber ist für den betroffenen Mitarbeiter meist schmerzlich. Zur gütlichen Trennung wird der Mitarbeiter daher häufig mit einem goldenen Handschlag verabschiedet. Zum Ausgleich für den Verlust des Arbeitsplatzes wird eine Abfindung, die zudem bei der Versteuerung steuerbegünstigt berücksichtigt wird. Gilt dies aber auch bei einer eigenen Kündigung?

Die Abfindung ist eine Entschädigung im Sinne des § 24 Nr. 1a EStG und gehört damit zu den "außerordentlichen Einkünften". Und für diese außerordentlichen Einkünfte gibt es eine Steuervergünstigung: die ermäßigte Besteuerung nach der sog. Fünftelregelung (§ 34 EStG). Dafür ist allerdings u.a. erforderlich, dass es sich um ein "besonderes Ereignis" handelt. Dies ist dann anzunehmen, wenn die Beendigung oder Änderung des Vertrags vom Arbeitgeber ausgeht oder wenn der Arbeitnehmer beim Abschluss einer Aufhebungsvereinbarung unter einem nicht unerheblichen rechtlichen, wirtschaftlichen oder tatsächlichen Druck oder zumindest in einer Konfliktlage zur Vermeidung von Streitigkeiten gehandelt hat.

Achtung: Nicht gewährt wird die Steuervergünstigung, wenn Sie die Vertragsauflösung aus eigenem Antrieb herbeigeführt haben, also ohne jegliche Veranlassung durch den Arbeitgeber selbst gekündigt haben.

Aktuell hat das Finanzgericht Münster aber in einem Fall entschieden, dass eine Abfindung auch dann mittels Fünftelregelung gemäß § 34 Abs. 2 EStG steuerbegünstigt ist, wenn der Arbeitnehmer den Aufhebungsvertrag auf eigene Initiative hin abgeschlossen hat. Hier stand der Arbeitnehmer beim Abschluss des Auflösungsvertrages unter dem von der BFH-Rechtsprechung geforderten nicht unerheblichen tatsächlichen Druck, denn er handelte in einer Konfliktlage zur Vermeidung von Streitigkeiten über die weitere Fortsetzung des Arbeitsverhältnisses und über die von ihm begehrte Höhergruppierung (FG Münster vom 17.3.2017, 1 K 3037/14 E, Revision IX R 16/17).

Nach Auffassung der Finanzrichter ist es für die Steuervergünstigung unschädlich, dass der Arbeitnehmer auf den Arbeitgeber zugegangen war und den Abschluss eines Auflösungsvertrages mit Abfindungsregelung eingefordert hatte. Für die Annahme einer Konfliktsituation reiche es aus, dass überhaupt eine gegensätzliche Interessenlage zwischen Arbeitgeber und Arbeitnehmer bestand, beide Konfliktparteien zur Entstehung des Konflikts beigetragen haben und die Parteien den Konflikt im Konsens lösen.

Diese Voraussetzungen seien erfüllt, weil hier beide Parteien durch die Auflösungsvereinbarung ihre Interessenkonflikte bezüglich eines vorzeitigen Ausscheidens aus dem Dienst und bezüglich einer Höhergruppierung bereinigt hätten.

Aktuell hat der BFH die Sichtweise geteilt und die Revision der Finanzverwaltung zurückgewiesen. Danach gilt: Zahlt der Arbeitgeber einem Arbeitnehmer im Zuge der (einvernehmlichen) Auflösung des Arbeitsverhältnisses eine Abfindung, sind tatsächliche Feststellungen zu der Frage, ob der Arbeitnehmer dabei unter tatsächlichem Druck stand, regelmäßig entbehrlich (BFH-Urteil vom 13.03.2018,IX R 16/17, BStBl 2018 II S. 709

(2022): Eigene Kündigung: Unterliegt die Abfindung der Fünftelregelung?

Wie hoch ist die Kirchensteuer?

Die Höhe der Kirchensteuer richtet sich nach Ihrem Wohnort. Leben Sie in Bayern oder Baden-Württemberg, zahlen Kirchenangehörige 8 Prozent, in den übrigen Ländern 9 Prozent. Grundlage ist die festgesetzte Einkommensteuer. Sie zahlen folglich als Kirchensteuer 8 bzw. 9 Prozent Ihrer Einkommensteuer.

Beachten Sie: Die Kirchensteuer wird mit gleicher prozentualer Höhe auch im Rahmen der Abgeltungsteuer berücksichtigt. Sollten Sie Kinder haben oder haben Sie in Ihrem zu versteuernden Einkommen (zvE) Einkünfte aus Gewerbebetrieb und/oder Einkünfte, die nach dem sog. Teileinkünfteverfahren versteuert werden, wird das zu zvE für Zwecke der Kirchensteuer gesondert berechnet. Sind bei Arbeitnehmern Kinderfreibeträge in ihren elektronischen Lohnsteuerabzugsmerkmalen (ELStAM) eingetragen, errechnet sich die monatliche Kirchensteuer aufgrund einer so genannten fiktiven Lohnsteuer.

Kirchensteuer und Kinder

Kirchensteuer ohne Kinderfreibetrag: Sie leben in Berlin und haben einen Brutto-Monatslohn von 3.000 Euro in der Steuerklasse IV. Ihre monatliche Kirchensteuer beträgt 37,11 Euro.

Kirchensteuer mit zwei Kinderfreibeträgen: Sie leben in Berlin und haben einen Brutto-Monatslohn von 3.000 Euro bei Steuerklasse IV. Ihre monatliche Kirchensteuer beträgt nun 20,39 Euro.

Ist also in den ELStAM (Elektronische LohnSteuer Abzugs Merkmale) eine "Zahl der Kinderfreibeträge" eingetragen, verringert sich nicht die monatliche Lohnsteuer, sondern nur die monatliche Kirchensteuer sowie der monatliche Solidaritätszuschlag. Das gilt auch dann, wenn Sie während des Jahres Kindergeld erhalten.

In der Einkommensteuerveranlagung senken die Kinderfreibeträge das zu versteuernde Einkommen nur dann, wenn das Kindergeld nicht günstiger ist als der Steuervorteil. Doch zur Berechnung von Kirchensteuer und Soli werden die Kinderfreibeträge "fiktiv" abgezogen.

Vorteil: Auch wenn Kinder nur für einen Teil des Jahres zu berücksichtigen sind, werden für die Berechnung der Kirchensteuer und des Solidaritätszuschlages stets der volle Kinderfreibetrag und BEA-Freibetrag abgezogen. Dies kommt in Betracht bei Beendigung der Berufsausbildung oder Geburt eines Kindes.

(2022): Wie hoch ist die Kirchensteuer?

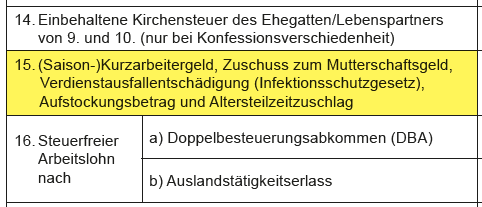

Wie werden Kurzarbeitergeld und Mutterschaftsgeld besteuert?

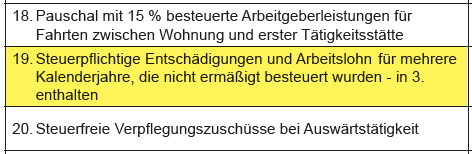

Das Kurzarbeitergeld wird, sowie das Mutterschaftsgeld, zwar nicht besteuert, es unterliegt jedoch dem Progressionsvorbehalt. So kann sich ein Bezug von Kurzarbeit in der Steuerveranlagung negativ für den Arbeitnehmer auswirken. Der Progressionsvorbehalt führt dazu, dass die steuerfreien Lohnersatzleistungen dem zu versteuernden Einkommen hinzugerechnet werden. Für diesen Betrag wird ein besonderer Steuersatz ermittelt. Und mit dem besonderen Steuersatz wird dann das zu versteuernde Einkommen - ohne die Lohnersatzleistungen - besteuert.

Wie erhöhen Lohnersatzleistungen meinen Steuersatz?

Lohnersatzleistungen wie das Kurzarbeitergeld oder der Zuschuss zum Mutterschaftsgeld erhalten Sie zwar steuerfrei ausgezahlt. Jedoch wirken sich diese Leistungen im Progressionsvorbehalt aus. Das heißt, die steuerfreien Einnahmen werden zur Ermittlung Ihres persönlichen Steuersatzes Ihrem Einkommen zugerechnet. Aufgrund des nun höheren Einkommens ergibt sich ein höherer Steuersatz, mit dem dann Ihr restliches Einkommen versteuert wird. So kann es also sein, dass Sie Steuern nachzahlen müssen bzw. eine geringere Rückerstattung erhalten als im Vorjahr ohne die Lohnersatzleistung.

Beispiel

Eine alleinerziehende Mutter hat ein Jahreseinkommen von 26.000 Euro brutto. Dazu erhält sie 6.000 Euro Elterngeld. Das macht ein Gesamteinkommen von 32.000 Euro. Dafür würde die Einkommensteuer rund 5.706 Euro betragen, was einem Steuersatz von 17,83 Prozent entspricht. Mit diesem Steuersatz wird aber nur das Einkommen ohne Elterngeld besteuert, sodass die Steuer 4.636 Euro beträgt.

Ohne Progressionsvorbehalt würde die Steuer für ein Einkommen von 26.000 Euro nur 3.911 Euro betragen. Das bedeutet: Für das eigentlich steuerfreie Elterngeld von 6.000 Euro müssen doch 725 Euro mehr an Steuern gezahlt werden. Außerdem erhöhen sich ggf. die Kirchensteuer und (bei hohen Einkommen) der Solidaritätszuschlag.

Ohne Progressionsvorbehalt würde die Steuer für ein Einkommen von 26.000 Euro nur 3.911 Euro betragen. Das bedeutet: Für das eigentlich steuerfreie Elterngeld von 6.000 Euro müssen doch 725 Euro mehr an Steuern gezahlt werden. Obendrein erhöhen sich ggf. die Kirchensteuer und (bei hohen Einkommen) der Solidaritätszuschlag.

Auf diese Weise wird auch Einkommen versteuert, das unter dem Grundfreibetrag liegt und somit eigentlich steuerfrei bleibt. Übersteigt das eigentliche Einkommen inklusive Lohnersatzleistung den Grundfreibetrag, kann der erhöhte Steuersatz angewandt werden. Bleibt das Einkommen jedoch auch mit Lohnersatzleistungen unter dem Grundfreibetrag, muss es nicht versteuert werden. Beziehen Sie innerhalb eines Jahres nur Lohnersatzeinkommen, bleibt alles steuerfrei und der Progressionsvorbehalt wird nicht angewandt.

Tipp: Wenn Sie nachträglich eine Lohnersatzleistung zurückzahlen müssen, etwa weil Sie vorher zu viel Arbeitslosengeld erhalten haben, sollten Sie eine Steuererklärung abgeben. Denn hier entsteht eine negative Progression, weil die zurückgezahlte Lohnersatzleistung Ihren Steuersatz reduzieren kann. Haben Sie jedoch im betreffenden Jahr kein zu versteuerndes Einkommen, lohnt es sich nicht, die zurückgezahlte Lohnersatzleistung nachzureichen, weil dies steuerlich keine Auswirkungen für Sie hat.

Tipp: Viele Arbeitgeber stocken das Kurzarbeitergeld auf 80, 90 oder gar 95 Prozent auf. Bisher ist dieser Aufstockungsbetrag zum Kurzarbeitergeld wie Arbeitslohn steuerpflichtig. Im Sozialversicherungsrecht rechnen solche Zuschüsse bis zu 80 Prozent des letzten Nettogehalts nicht zum Arbeitsentgelt und sind daher sozialversicherungsfrei (§ 1 Abs. 1 Nr. 8 SvEV).

Aktuell werden die Zuschüsse des Arbeitgebers zum Kurzarbeitergeld und zum Saison-Kurzarbeitergeld coronabedingt steuerfrei gestellt, soweit sie zusammen mit dem Kurzarbeitergeld 80 Prozent des Unterschiedsbetrages zwischen dem Soll-Entgelt und dem Ist-Entgelt nicht übersteigen. Diese Regelung gilt befristet vom 1.3.2020 bis zum 30.06.2022. Mit der Steuerbefreiung wird die vielfach in Tarifverträgen vereinbarte, aber auch aufgrund der Corona-Krise freiwillige Aufstockung des Kurzarbeitergeldes durch den Arbeitgeber gefördert (§ 3 Nr. 28a EStG-neu).

Die Aufstockungsbeträge unterliegen - wie das Kurzarbeitergeld selbst - dem Progressionsvorbehalt, soweit sie steuerfrei sind bzw. waren (§ 32b Abs. 1 Nr. 1 g EStG).

(2022): Wie werden Kurzarbeitergeld und Mutterschaftsgeld besteuert?

Gibt es auch Lohnersatzleistungen, die ich nicht in meiner Lohnsteuerbescheinigung finde?

Ja. Die Lohnersatzleistungen, die Sie nicht von Ihrem Arbeitgeber erhalten, werden auch nicht auf Ihrer Lohnsteuerbescheinigung ausgewiesen.

Zu den Lohn- bzw. Einkommensersatzleistungen zählen insbesondere

- Arbeitslosengeld I,

- Kurzarbeitergeld und Saison-Kurzarbeitergeld,

- Insolvenzgeld bei Insolvenz des Arbeitgebers,

- Elterngeld nach dem Bundeselterngeld- und Elternzeitgesetz,

- Mutterschaftsgeld, Zuschuss zum Mutterschaftsgeld,

- Kranken-, Verletzten- und Übergangsgeld für Behinderte oder vergleichbare Lohnersatzleistungen,

- Aufstockungsbeträge sowie Altersteilzeitzuschläge nach dem Altersteilzeitgesetz bzw. Beamtenrecht,

- Zuschüsse zum Arbeitsentgelt für ältere Arbeitnehmer durch die Agentur für Arbeit.

Wichtig: Sämtliche Lohn- bzw. Einkommensersatzleistungen, die dem Progressionsvorbehalt unterliegen sind seit 2015 ausschließlich im Steuerhauptformular und nicht mehr auf der Anlage N einzutragen. Sie finden den Bereich bei Lohnsteuer kompakt unter "Sonstige Angaben > Einkommensersatzleistungen".

(2022): Gibt es auch Lohnersatzleistungen, die ich nicht in meiner Lohnsteuerbescheinigung finde?

Was kann ich absetzen bei Leistungen meines Arbeitgebers für Fahrten zur Arbeit?

Zahlt Ihnen Ihr Chef einen steuerfreien Fahrtkostenzuschuss für die Fahrten zur Arbeit?

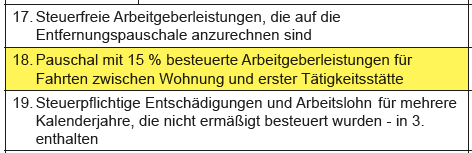

Grundsätzlich gilt: Ein solcher Zuschuss des Arbeitgebers ist steuerpflichtig, kann aber vom Arbeitgeber pauschal mit 15 Prozent versteuert werden (zur Neuregelung einer Pauschalbesteuerung mit 25 Prozent siehe den Hinweis unten). Der pauschal versteuerte Betrag ist sozialversicherungsfrei. Der Arbeitgeber muss den pauschal versteuerten Betrag in der Lohnsteuerbescheinigung vermerken, und Sie müssen diesen Betrag als Fahrtkostenersatz in Ihrer Steuererklärung (Anlage N, Rückseite) eintragen.

Das Finanzamt vermindert dementsprechend die abzugsfähigen Fahrtkosten und erkennt nur die verbleibenden Fahrtkosten als Werbungskosten an. Überlässt der Arbeitgeber Ihnen für die Fahrten ein Job-Ticket, so handelt es sich hierbei um eine Sachzuwendung. Sofern der Kostenbeitrag des Arbeitgebers nicht mehr als 50 Euro im Monat beträgt, bleibt dieser Betrag steuer- und sozialversicherungsfrei.

Neu seit 2019:

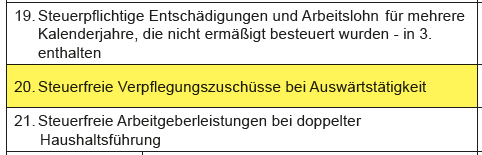

Seit dem 1.1.2019 sind Arbeitgeberleistungen - Zuschüsse und Jobtickets - an Arbeitnehmer unter nachfolgenden Bedingungen für folgende Fahrten steuer- und sozialversicherungsfrei:

- Fahrten zwischen Wohnung und erster Tätigkeitsstätte,

- Fahrten zu einem vom Arbeitgeber dauerhaft festgelegten Sammelpunkt (z.B. gleichbleibender Treffpunkt, bestimmter Parkplatz, Bus- oder Bahndepot, Fährhafen),

- Fahrten zu einem weiträumigen Tätigkeitsgebiet (z.B. Forstgebiet, Hafengelände, nicht jedoch Werksgelände) gemäß § 9 Abs. 1 Nr. 4a Satz 3 EStG.

(§ 3 Nr. 15 EStG 2019, eingeführt durch das "Gesetz zur Vermeidung von Umsatzsteuerausfällen beim Handel mit Waren im Internet und zur Änderung weiterer steuerlicher Vorschriften" vom 11.12.2018).

Welche Verkehrsmittel sind begünstigt?

- Arbeitgeberleistungen für die o.g. Fahrten des Arbeitnehmers mit öffentlichen Verkehrsmitteln im Linienverkehr, d.h. Personenfernverkehr (1. Alternative). Dies gilt nur für Arbeitnehmer in einem aktiven Beschäftigungsverhältnis sowie für die beim Entleiher beschäftigten Leiharbeitnehmer. Privatfahrten sind nicht begünstigt. Zum Personenfernverkehr (öffentliche Verkehrsmittel im Linienverkehr) gehören Fernzüge der Deutschen Bahn (ICE, IC, EC), Fernbusse auf festgelegten Linien oder Routen und mit festgelegten Haltepunkten, vergleichbare Hochgeschwindigkeitszüge und schnellfahrende Fernzüge anderer Anbieter (z.B. TGV, Thalys).

- Arbeitgeberleistungen für die o.g. Fahrten sowie auch für private Fahrten des Arbeitnehmers im öffentlichen Personennahverkehr (2. Alternative). Dies gilt für alle Arbeitnehmer oder Leiharbeitnehmer. Die Nutzung des öffentlichen Personennahverkehrs ist unabhängig von der Art der Fahrten begünstigt, also auch bei Privatfahrten des Arbeitnehmers. Damit ist - anders als im Personenfernverkehr - bei Fahrberechtigungen, die nur eine Nutzung des Personennahverkehrs ermöglichen, keine weitere Prüfung zur Art der Nutzung vorzunehmen. Zum öffentlichen Personennahverkehr gehört die allgemein zugängliche Beförderung von Personen im Linienverkehr, die überwiegend dazu bestimmt ist, die Verkehrsnachfrage im Stadt-, Vorort- oder Regionalverkehr zu befriedigen. Als öffentlicher Personennahverkehr gelten aus Vereinfachungsgründen alle öffentlichen Verkehrsmittel, die nicht Personenfernverkehr sind. Soweit Taxen ausnahmsweise im Linienverkehr nach Maßgabe der genehmigten Nahverkehrspläne eingesetzt werden (z.B. zur Verdichtung, Ergänzung oder zum Ersatz anderer öffentlicher Verkehrsmittel) und von der Fahrberechtigung mitumfasst sind oder gegen einen geringen Aufpreis genutzt werden dürfen, gehören sie zum Personennahverkehr.

Fahrtkostenzuschüsse für Fahrten mit eigenem Pkw sind ab 2019 steuerpflichtig, können aber vom Arbeitgeber pauschal mit 15 % versteuert werden. Der pauschal versteuerte Betrag ist sozialversicherungsfrei (§ 40 Abs. 2 Satz 2 EStG). Der pauschal versteuerte Fahrtkostenzuschuss erhöht nicht das Bruttogehalt, das in der Lohnsteuerbescheinigung ausgewiesen ist. Nur wenn der Fahrtkostenzuschuss nicht pauschal versteuert wird, wird er dem Bruttogehalt hinzugerechnet und normal versteuert.

Die Pauschalversteuerung ist nur zulässig, wenn der Zuschuss zusätzlich zum ohnehin geschuldeten Gehalt gezahlt wird und nicht Gehalt in Fahrtkostenzuschuss umgewandelt wird. Oftmals aber ist es möglich, statt einer Gehaltserhöhung Fahrtkostenzuschüsse zu zahlen.

Nicht begünstigt sind folgende Verkehrsmittel:

- für konkrete Anlässe speziell gemietete bzw. gecharterte Busse oder Bahnen,

- Taxen im Gelegenheitsverkehr, die nicht auf konzessionierten Linien oder Routen fahren,

- Luftverkehr.

Welche Arbeitgeberleistungen sind begünstigt?

Die Steuerbefreiung umfasst

- Arbeitgeberleistungen in Form von unentgeltlichen oder verbilligt überlassenen Fahrberechtigungen (Sachbezüge, Job-Ticket),

- Zuschüsse (Barlohn) des Arbeitgebers zu den von den Arbeitnehmern selbst erworbenen Fahrberechtigungen.

Begünstigt sind insbesondere Fahrberechtigungen in Form von Einzel/Mehrfahrtenfahrscheinen, Zeitkarten (z.B. Monats-, Jahrestickets, Bahncard 100), allgemeine Freifahrberechtigungen, Freifahrberechtigungen für bestimmte Tage (z.B. bei Smogalarm) oder Ermäßigungskarten (z.B. Bahncard 25).

Steuerfrei sind auch Preisvorteile von Fremdfirmen und Konzernunternehmen (Zuschüsse und Sachbezüge), die mit Rücksicht auf das Dienstverhältnis gewährt werden und als Arbeitslohn zu behandeln wären (gemäß BMF-Schreiben vom 20.1.2015, BStBl. 2015 I S. 143).

Preisvorteile, die Arbeitnehmern von dritter Seite eingeräumt werden, gehören zum steuerpflichtigen Arbeitslohn, wenn sie sich für den Arbeitnehmer als Frucht seiner Arbeit für den Arbeitgeber darstellen und im Zusammenhang mit dem Dienstverhältnis stehen, oder wenn der Arbeitgeber an der Verschaffung dieser Preisvorteile aktiv mitgewirkt hat.

Solche Preisvorteile sind steuer- und sozialversicherungsfrei, wenn die Fremdfirma ein überwiegend eigenwirtschaftliches Interesse an der Rabattgewährung hat, die Fremdfirma den Preisvorteil auch fremden Dritten üblicherweise im normalen Geschäftsverkehr einräumt, z.B. Mengenrabatte, oder die Vorteilsgewährung im ganz überwiegenden Interesse des Arbeitgebers liegt.

Der geldwerte Vorteil eines Job-Tickets wird nicht mehr auf die 50-Euro-Freigrenze für Sachbezüge angerechnet. Diese Vergünstigung kann nun anderweitig genutzt werden (§ 8 Abs. 2 Satz 11 EStG). Bei Mitarbeitern von Verkehrsunternehmen wird die steuerfreie Freifahrtberechtigung nicht mehr auf den Personalrabattfreibetrag von 1.080 EUR angerechnet (§ 8 Abs. 3 EStG).

Erhalten Sie vom Arbeitgeber einen Zuschuss für die Fahrten zur Arbeit mit dem eigenen Pkw, bleibt es bei der bisherigen Regelung, d.h. der Zuschuss kann vom Arbeitgeber pauschal mit 15 % versteuert werden (§ 40 Abs. 2 Satz 2 EStG).

Lohnsteuer kompakt

Seit dem 1.1.2019 kann der Arbeitgeber für Jobtickets und Zuschüsse, die nicht nach § 3 Nr. 15 EStG steuerfrei sind, eine weitere Form der Pauschalbesteuerung wählen:

Die Besteuerung mit einem Pauschalsteuersatz von 25 Prozent, dafür aber ohne Minderung der Entfernungspauschale (§ 40 Abs. 2 Satz 2 Nr. 2 EStG, geändert durch das "Gesetz zur weiteren steuerlichen Förderung der Elektromobilität und zur Änderung weiterer steuerlicher Vorschriften" vom 12.12.2019).

Zuweilen kann dies günstiger sein als die Besteuerung mit 15 Prozent. Welche Form vorteilhafter ist, kommt aber auf den Einzelfall an. Die Entfernungspauschale greift nur dann, wenn sie den Arbeitnehmerpauschbetrag von 1.200 Euro pro Jahr übersteigt (vorausgesetzt, es gibt keine weiteren Werbungskosten). Bei eher geringen Distanzen dürfte es deshalb Sinn ergeben, die Pauschalbesteuerung mit 15 % zu wählen, da in diesen Fällen die Kürzung der Entfernungspauschale nicht bzw. weniger ins Gewicht fällt.

Bekomme ich auch die Entfernungspauschale, wenn ich einen Firmenwagen nutze?

Sie können die Entfernungspauschale auch dann geltend machen, wenn Sie einen Firmenwagen für den Weg zur Arbeit nutzen. Dabei müssen Sie jedoch folgende Besonderheiten beachten: Für die Fahrten zwischen Wohnung und Arbeitsstätte müssen Sie einen Zuschlagswert zum privaten Nutzungswert versteuern. Dieser beträgt für Fahrten zur Arbeit monatlich 0,03 Prozent des Listenpreises pro Entfernungskilometer und wird dem privaten Nutzungswert von monatlich 1 Prozent des Listenpreises hinzugerechnet.

Im Gegenzug dürfen Sie dann wie jeder Arbeitnehmer die Entfernungspauschale von 0,30 Euro pro Entfernungskilometer (0,38 Euro ab dem 21.Entfernungskilometer ) als Werbungskosten geltend machen. Versteuert Ihr Arbeitgeber jedoch den steuerpflichtigen Nutzungswert für den Firmenwagen pauschal mit 15 Prozent, müssen Sie den monatlich pauschal versteuerten Betrag von Ihren Werbungskosten abziehen und können nur noch den Rest als Werbungskosten geltend machen.

(2022): Was kann ich absetzen bei Leistungen meines Arbeitgebers für Fahrten zur Arbeit?

Was sind Versorgungsbezüge?

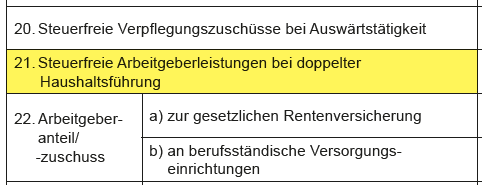

Versorgungsbezüge sind nach der Definition in § 229 SGB V der Rente vergleichbare Einnahmen (Versorgungsbezüge), soweit sie wegen einer Einschränkung der Erwerbsfähigkeit oder zur Alters- oder Hinterbliebenenversorgung erzielt werden.

Zu den Versorgungsbezügen gehören:

- Renten der Versicherungs- und Versorgungseinrichtungen, die für Angehörige bestimmter Berufe errichtet sind (z.B. der Ärzte, Architekten, Rechtsanwälte),

- Renten der betrieblichen Altersversorgung einschließlich der Zusatzversorgung im öffentlichen Dienst und der hüttenknappschaftlichen Zusatzversorgung,

- Bezüge aus der Versorgung der Abgeordneten, Parlamentarischen Staatssekretäre und Minister,

- Versorgungsbezüge aus einem öffentlich-rechtlichen Dienstverhältnis oder aus einem Arbeitsverhältnis mit Anspruch auf Versorgung nach beamtenrechtlichen Vorschriften oder Grundsätzen.

(2022): Was sind Versorgungsbezüge?

Sind meine Versorgungsbezüge steuerpflichtig?

Versorgungsbezüge (Ruhegehalt, Witwengeld, Waisengeld, Unterhaltsbeitrag oder gleichartige Bezüge) sind nach dem Einkommensteuergesetz Einkünfte aus nichtselbständiger Arbeit und unterliegen bei der Auszahlung dem Lohnsteuerabzugsverfahren.

Anstelle der Lohnsteuerkarte kann die Pensionsstelle seit dem Jahr 2013 mittels Ihrer steuerlichen Identifikationsnummer sowie Ihres Geburtsdatums Ihre Lohnsteuerabzugsmerkmale elektronisch von einer Datenbank der Finanzverwaltung per ELSTAM (Elektronische LohnSteuerAbzugsMerkmale) abrufen.

Die Versteuerung von Versorgungsbezügen erfolgt grundsätzlich genauso wie die der Dienstbezüge. Der einzige Unterschied liegt darin, dass ein zusätzlicher Versorgungsfreibetrag gewährt wird.

Seit dem 01.01.2005 ist die Versteuerung der Alterseinkünfte (Versorgungsbezüge und Renten) durch das Alterseinkünftegesetz – AltEinkG – neu geregelt worden. Kernelement des Alterseinkünftegesetzes ist der Übergang von der Besteuerung der während der Erwerbsphase in die Altersvorsorge eingezahlten Beiträge („vorgelagerte“ Besteuerung) zur Besteuerung der Leistungen in der Auszahlungsphase („nachgelagerte“ Besteuerung). Dies erfolgt schrittweise in der bis zum Jahr 2040 vorgesehenen Übergangszeit; danach werden die Beamtenpensionen und Renten steuerlich gleichbehandelt werden.

Der bisher gewährte Versorgungsfreibetrag wird jährlich gesenkt, d.h. je später der Versorgungsbeginn, desto niedriger ist der zu berücksichtigende Freibetrag, bis bei einem Versorgungsbeginn ab dem Jahr 2040 kein Versorgungsfreibetrag mehr zusteht. Die Werbungskostenpauschale beträgt wie bei den Renteneinkünften 102 Euro.

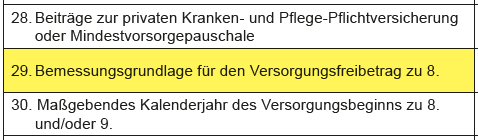

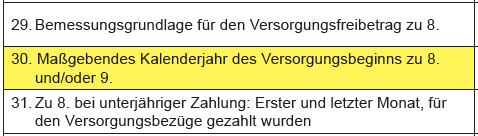

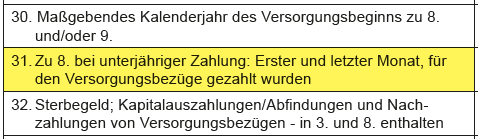

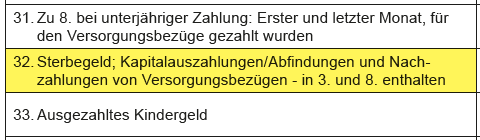

Entscheidend für die Höhe des (lebenslang) zu gewährenden Freibetrages und des ergänzenden Zuschlags zum Versorgungsfreibetrag ist das Jahr des Versorgungsbeginns. Der maßgebende Prozentsatz, der Höchstbetrag des Versorgungsfreibetrages und der Zuschlag zum Versorgungsfreibetrag ergeben sich aus der in § 19 Abs. 2 Einkommenssteuergesetz (EStG) genannten Tabelle.

Der Versorgungsfreibetrag und der Zuschlag zum Versorgungsfreibetrag gelten für die gesamte Laufzeit des Versorgungsbezugs. Regelmäßige Anpassungen des Versorgungsbezugs führen nicht zu einer Neuberechnung.

Eine Neuberechnung ist jedoch vorzunehmen, wenn sich der Versorgungsbezug wegen Anwendung von Anrechnungs-, Ruhens-, Erhöhungs-, oder Kürzungsregelungen erhöht oder vermindert. Im Kalenderjahr der Änderung sind der höchste Versorgungsfreibetrag und Zuschlag zum Versorgungsfreibetrag maßgebend.

(2022): Sind meine Versorgungsbezüge steuerpflichtig?

Abfindung: Das Wichtigste zur Fünftelregelung

Die vorzeitige Beendigung des Arbeitsverhältnisses durch den Arbeitgeber ist für den betroffenen Mitarbeiter meist schmerzlich. Zur gütlichen Trennung wird der Mitarbeiter daher häufig mit einem goldenen Handschlag verabschiedet. Zum Ausgleich für den Verlust des Arbeitsplatzes wird eine Abfindung, die zudem bei der Versteuerung steuerbegünstigt berücksichtigt wird.

Von welcher Abfindungssumme ist auszugehen?

Nach § 1a Kündigungsschutzgesetz (KSchG) haben alle Mitarbeiter bei einer betriebsbedingten Kündigung Anspruch auf eine Abfindung. Ein freiwilliges Abfindungsangebot muss zusammen mit der Kündigung an den Mitarbeiter weitergeleitet werden. Voraussetzung zum Erhalt der Abfindung ist jedoch, dass der Arbeitnehmer nicht gegen die Kündigung klagt. Die Höhe der Abfindung orientiert sich an der Anzahl an Beschäftigtenjahren im Unternehmen.

Pro Beschäftigungsjahr besteht üblicherweise Anspruch auf einen halben Monatslohn. Bei einer zehnjährigen Unternehmenstätigkeit besteht somit Anspruch auf eine Summe, die dem Gehalt von fünf Monatslöhnen entspricht. Hinzu kommen Ansprüche aus Sachleistungen des Arbeitgebers. Wurden also Dienstfahrzeug oder Dienst- Laptop zur Verfügung gestellt, ist davon der Nutzungswert bei der Berechnung der Abfindungshöhe hinzuzurechnen. Sicherlich sind auch niedrigere oder höhere Abfindungen möglich, doch handelt es sich dann in der Regel nicht mehr um eine betriebsbedingte Kündigung, sondern um einen Abwicklungs- beziehungsweise Abfindungsvertrag.

Steuerliche Behandlung der Fünftelregelung

Seit dem Steueränderungsgesetz 2001 muss die Berücksichtigung der Fünftelregelung jetzt nicht mehr beantragt werden. Das Finanzamt prüft automatisch, ob für Sie die normale Besteuerung oder die ermäßigte Besteuerung nach der Fünftelregelung günstiger ist.

Wichtig: Falls eine Abfindung oder eine Vergütung für mehrjährige Tätigkeit vom Arbeitgeber nach der Fünftelregelung versteuert wurde, sind Sie verpflichtet, eine Steuererklärung abzugeben.

So wird die Steuerschuld mit Fünftelregelung berechnet

- Der steuerpflichtige Teil der außerordentlichen Einkünfte (Abfindung, Jubiläumszuwendung, Vergütung für mehrjährige Tätigkeit usw.) wird aus dem zu versteuernden Einkommen herausgerechnet.

- Für das verbleibende zu versteuernde Einkommen wird die Einkommensteuer nach geltenden Steuertarif ermittelt.

- Die Abfindung durch 5 dividiert und ein Fünftel wird dem restlichen zu versteuernden Einkommen hinzugerechnet.

- Für die Summe wird wiederum die Einkommensteuer nach dem Steuertarif berechnet.

- Zwischen beiden Steuerbeträgen wird die Differenz gebildet und diese mit 5 multipliziert.

- Das Ergebnis ist die Einkommensteuer auf die außerordentlichen Einkünfte.

Beispiel

Ein verheirateter Arbeitnehmer erhält im Jahr 2022 eine Abfindung von 50.000 Euro. Das zu versteuernde Einkommen beträgt 70.000 Euro. Das zu versteuernde Einkommen wird um ein Fünftel der Abfindung (also 10.000 Euro) erhöht:

- Einkommensteuer (Splittingtarif) auf 70.000: 13.024 Euro

- Einkommensteuer (Splittingtarif) auf 80.000: 16.354 Euro

- Differenz 3.330 Euro

- Einkommensteuer auf die Abfindung: (3.330 Euro x 5 =) 16.650 Euro

- Einkommensteuer gesamt: (13.024 Euro + 16.650 Euro=) 29.674 Euro

Gilt die Fünftelregelung aber auch bei einer eigenen Kündigung?

Das Finanzgericht Münster hat 2017 entschieden, dass eine Abfindung auch dann mittels Fünftelregelung gemäß § 34 Abs. 2 EStG steuerbegünstigt ist, wenn der Arbeitnehmer den Aufhebungsvertrag auf eigene Initiative hin abgeschlossen hat. Im verhandelten Fall stand der Arbeitnehmer beim Abschluss des Auflösungsvertrages unter dem von der BFH-Rechtsprechung geforderten nicht unerheblichen tatsächlichen Druck, denn er handelte in einer Konfliktlage zur Vermeidung von Streitigkeiten über die weitere Fortsetzung des Arbeitsverhältnisses und über die von ihm begehrte Höhergruppierung (FG Münster vom 17.3.2017, 1 K 3037/14 E).

Aktuell hat der BFH die Sichtweise geteilt und die Revision der Finanzverwaltung zurückgewiesen. Danach gilt: Zahlt der Arbeitgeber einem Arbeitnehmer im Zuge der (einvernehmlichen) Auflösung des Arbeitsverhältnisses eine Abfindung, sind tatsächliche Feststellungen zu der Frage, ob der Arbeitnehmer dabei unter tatsächlichem Druck stand, regelmäßig entbehrlich (BFH-Urteil vom 13.03.2018,IX R 16/17, BStBl 2018 II S. 709

(2022): Abfindung: Das Wichtigste zur Fünftelregelung

Wann wird eine Abfindung nach der Fünftelregelung besteuert?

Bei vorzeitiger Beendigung des Arbeitsverhältnisses werden die betroffenen Mitarbeiter im Allgemeinen mit einer Abfindung verabschiedet. Solche Zahlungen sind seit 2006 leider nicht mehr durch einen Steuerfreibetrag begünstigt, wohl aber noch durch die Fünftelregelung (gemäß § 34 EStG).

Um in den Genuss der ermäßigten Besteuerung nach der Fünftelregelung zu kommen, muss die Abfindung zusammengeballt in einem Jahr gezahlt werden, und das Jahreseinkommen mit Abfindung muss höher sein als das Einkommen bei ungestörter Fortsetzung des Arbeitsverhältnisses. Dann soll mit der Steuervergünstigung die Progressionswirkung des Einkommensteuertarifs abgemildert werden.

Aktuell hat der Bundesfinanzhof entschieden, dass bei einem Bruttogehalt im Vorjahr von rund 140.000 Euro eine Abfindung in Höhe von "nur" 43.000 Euro nicht ermäßigt besteuert werden darf. Deshalb kommt die Fünftelregelung nicht zum Zuge. Denn beim Vergleich der Einkünfte aus dem Vorjahr mit den Einkünften im Jahr der Abfindung ergeben sich keine höheren Einkünfte, damit keine progressionssteigernde Wirkung und somit kein steuerlicher Nachteil, der ausgeglichen werden müsste (BFH-Urteil vom 8.4.2014, IX R 33/13).

Im Rahmen der Vergleichsberechnung sind zwei Größen einander gegenüberzustellen: die "Ist-Größe", also das, was Sie in dem betreffenden Jahr mitsamt der Abfindung erhalten haben, und die "Soll-Größe", nämlich die Einkünfte, die Sie bei ungestörter Fortsetzung des Arbeitsverhältnisses erhalten hätten. Dabei können Sie das Einkommen des Vorjahres zugrunde legen. Übersteigt die Abfindung die bis Jahresende entgehenden Einnahmen nicht, können weitere Einnahmen einbezogen werden, die Sie sonst nicht bezogen hätten, z. B. Arbeitslosengeld.

(2022): Wann wird eine Abfindung nach der Fünftelregelung besteuert?

Was sind Vergütungen für eine mehrjährige Tätigkeit?

Eine Nachzahlung oder Vorauszahlung für eine mehrjährige Tätigkeit (z.B. Abfindungen) kann im Jahr der Zahlung mit der Fünftelmethode ermäßigt besteuert werden. Entscheidend ist, dass sich die Tätigkeit auf zwei Kalenderjahre erstreckt.

Mit der sogenannten Fünftelregelung werden außerordentliche Einkünfte im deutschen Steuerrecht begünstigt (§ 34 EStG). Bei diesen sog. "tarifbegünstigten Einkünften" handelt es sich um Einkünfte, die über mehrere Jahre erwirtschaftet wurden, aber in einem einzelnen Jahr realisiert und besteuert werden

(2022): Was sind Vergütungen für eine mehrjährige Tätigkeit?