Steuererklärung für 2022: Das ist neu

Abgabefrist für die Steuererklärung 2022

Zur Abgabe einer Einkommensteuererklärung ist man verpflichtet, wenn ein bestimmter Grund vorliegt. Dann erfolgt eine sog. Pflichtveranlagung oder Veranlagung von Amts wegen.

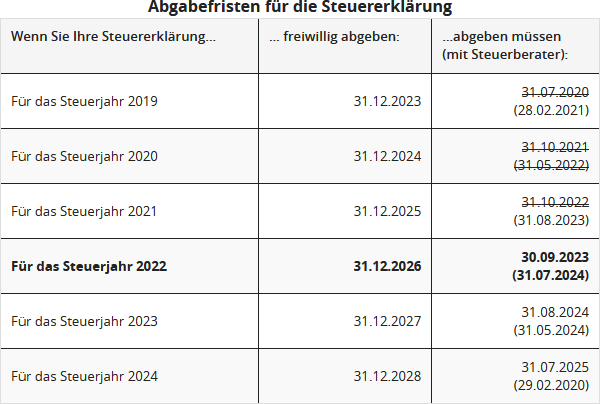

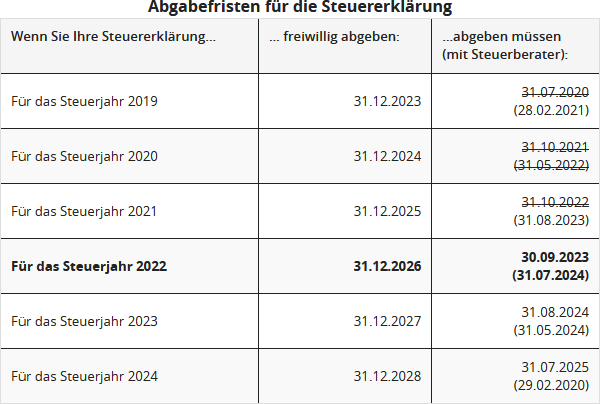

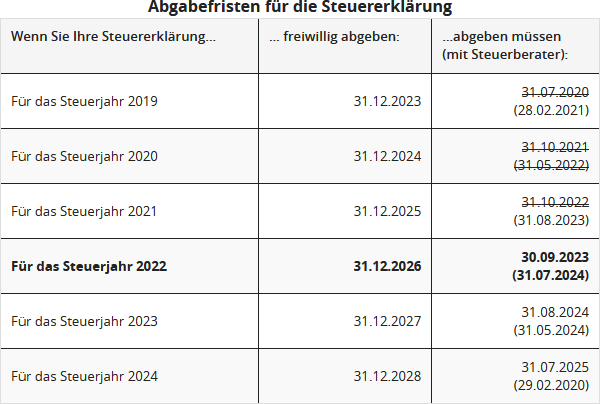

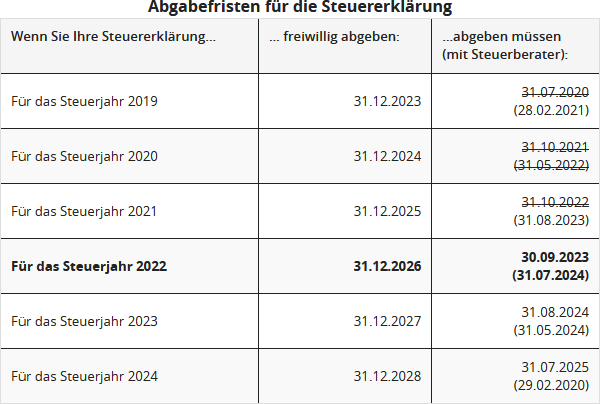

Liegt kein Grund für eine Pflichtveranlagung vor, können Arbeitnehmer, Betriebsrentner und Pensionäre eine Steuererklärung freiwillig abgeben (sog. Antragsveranlagung gemäß § 46 Abs. 2 Nr. 8 EStG). In diesem Fall können Sie sich mit der Abgabe bis zu vier Jahre nach dem Steuerjahr Zeit lassen, für die Steuererklärung 2022 also bis zum 31.12.2026 (§ 169 AO).

Für die Abgabe gelten folgende Fristen:

Verspätungszuschlag bei verspäteter Abgabe

Seit 2019 gelten neue Regeln zur Erhebung von Verspätungszuschlägen, die erstmals für die Steuererklärung des Jahres 2018 gelten. Neben der bisher unveränderten "Kann-Regelung" werden eine "Muss-Regelung" und ein Mindest-Verspätungszuschlag neu eingeführt (§ 152 AO, geändert durch das "Gesetz zur Modernisierung des Besteuerungsverfahrens" vom 18.7.2016).

Niedriger Steuerzinsen rückwirkend ab dem 1.1.2019

Rückwirkend ab dem 1.1.2019 wurde der Zinssatz für Steuernachforderungs- und Steuererstattungszinsen auf 0,15 % pro Monat, d.h. 1,8 % pro Jahr, gesenk.

Der neue Zinssatz für Nachzahlungs- und Erstattungszinsen nach § 233a AO orientiert sich am aktuellen Basiszinssatz nach § 247 BGB (- 0,88 % p.a.) mit einem sachgerechten Zuschlag in Höhe von rund 2,7 Prozentpunkten. Der Zinssatz soll zukünftig wenigstens alle drei Jahre überprüft und mit Wirkung für nachfolgende Verzinsungszeiträume angepasst werden.

Abgabepflicht bei Erhalt von Kurzarbeitergeld

Anlässlich der Corona-Krise wurden die Vorschriften rund um den Bezug von Kurzarbeitergeld mehrfach geändert. So wurde die Dauer für den Bezug von Kurzarbeitergeld auf bis zu 24 Monate verlängert. Auch gibt es Sonderregelungen zur steuerlichen Behandlung der Arbeitgeberzuschüsse zum Kurzarbeitergeld und zum Saison-Kurzarbeitergeld. Was bedeuten die Regelung aber für die Steuererklärung?

Personen, die mehr als 410 Euro Kurzarbeitergeld im Kalenderjahr beziehen, sind zur Abgabe einer Steuererklärung verpflichtet. Wer die Erklärung nicht „freiwillig“ abgibt, sollte bedenken, dass die Finanzämter Informationen über den Bezug von Kurzarbeitergeld per Datenaustausch erhalten, die Steuererklärung dann vielleicht nach einem oder zwei Jahren zwangsweise anfordern und es zu erheblichen Verspätungszuschlägen kommen kann.

Auch Aufstockungsbeträge unterliegen dem Progressionsvorbehalt (§ 32b Abs. 1 Nr. 1g EStG). Der Arbeitgeber hat sie in die elektronische Lohnsteuerbescheinigung (für das Kalenderjahr 2020) unter der Nummer 15 einzutragen.

Steuerentlastung: Erhöhung des Grundfreibetrages

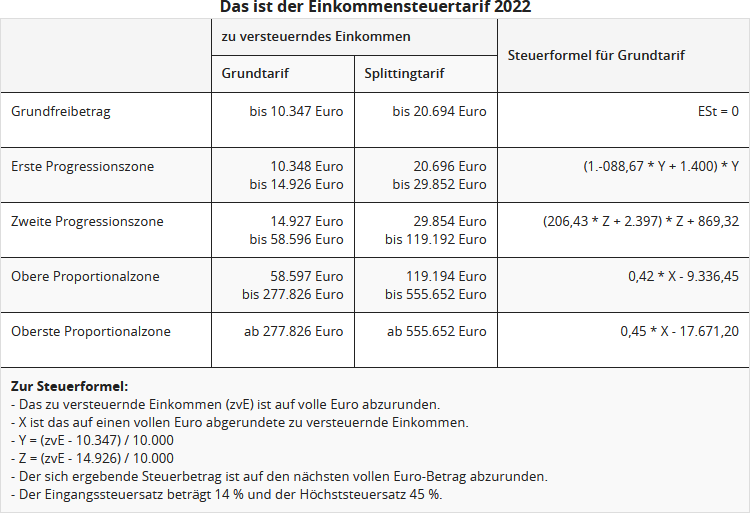

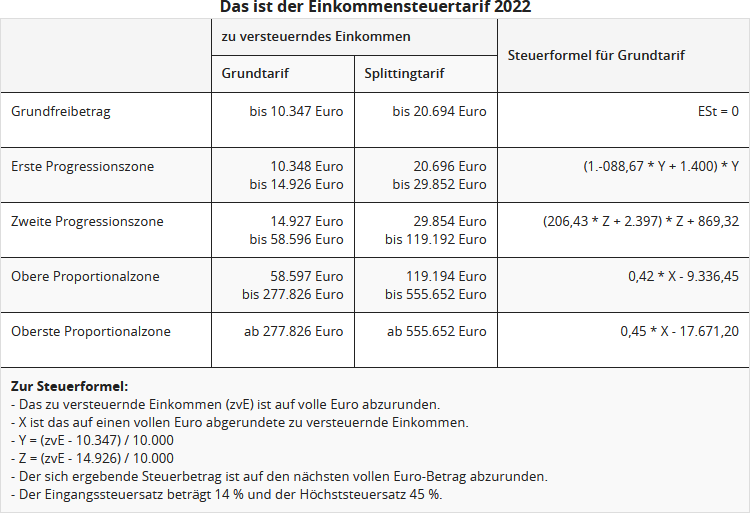

Der steuerliche Grundfreibetrag stellt sicher, dass der Anteil des Einkommens, der für den Lebensunterhalt absolut notwendig ist, nicht mit Steuern belastet wird (Existenzminimum). Zum 1.1.2023 wurde der Grundfreibetrag von 10.347 Euro auf 10.908 angehoben. Zum 1.1.2024 erfolgt voraussichtlich eine weitere Anhebung auf 11.604 Euro (§ 32a EStG).

Abbau der kalten Progression

Zum Ausgleich der kalten Progression und zur Verhinderung einer schleichenden Steuererhöhung werden die Eckwerte des Steuertarifs 2022 um die geschätzte Inflationsrate erhöht, d.h. "nach rechts" verschoben, und zwar um 1,17 Prozent (2021:1,52 Prozent).

Durch diese Anpassung greifen steigende Steuersätze des progressiven Steuertarifs erst bei etwas höherem Einkommen, es bleibt etwas mehr Netto vom Brutto. Ohne diese Anpassung müssten Steuerzahler, deren Einkommen lediglich in Höhe der Inflationsrate steigt, durchschnittlich mehr Steuern zahlen und hätten netto weniger Kaufkraft.

Der neue Einkommensteuertarif 2022

Reichensteuer greift erst bei höherem Einkommen

Seit 2007 gibt es die sog. Reichensteuer, ein Steuerzuschlag von 3 Prozentpunkten für Bestverdiener. Der Spitzensteuersatz beträgt also in der obersten Proportionalzone 45% und greift bei einem zu versteuernden Einkommen im Jahre 2019 ab 265.327 Euro bzw. 530.653 Euro (Ledige / Verheiratete).

Im Jahre 2021 beginnt die oberste Proportionalzone mit dem Steuerzuschlag von 3 Prozent erst ab einem zvE von 274.613 Euro bei Ledigen und 549.225 Euro bei Verheirateten. Ab 2022 beginnt die oberste Proportionalzone bei einem zvE von 277.826 Euro bzw. 555.651 Euro.

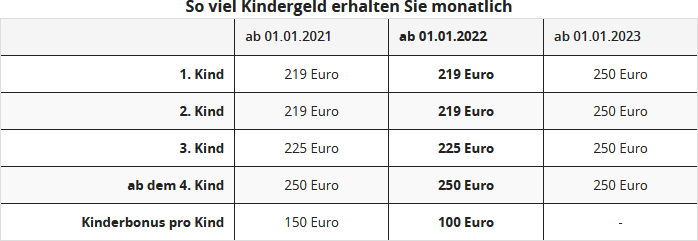

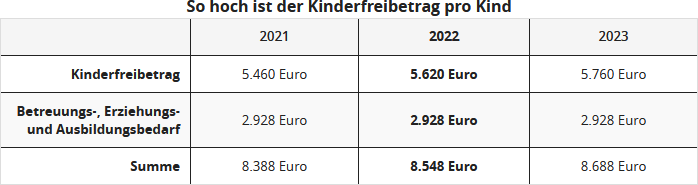

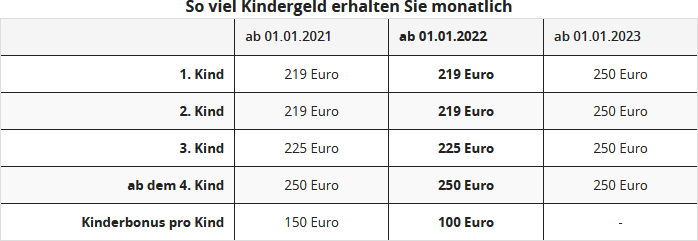

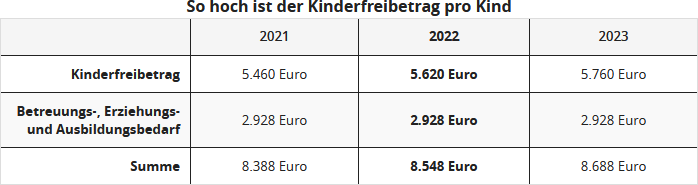

Familienförderung: Erhöhung von Kindergeld und Kinderfreibetrag

Das Kindergeld wurde zuletzt 2021 erhöht. Bereits für 2022 wurde rückwirkend der Kinderfreibetrag von 2.730 Euro auf 2.810 Euro je Elternteil. Der Erziehungsfreibetrag (Freibetrag für Betreuung und Erziehung oder Ausbildung) bleibt wie 2021 bei 1.464 Euro je Elternteil. Für den Kinderfreibetrag sind weitere Erhöhungen zum 1.1.2023 und zum 1.1.2024 ("Inflationsausgleichsgesetz") geplant.

Um Familien besonders zu unterstützen, wird das Kindergeld ab 2023 für die ersten drei Kinder auf jeweils 250 Euro pro Monat erhöht. Die Erhöhung soll bereits zum 1. Januar 2023 erfolgen. Für das erste und zweite Kind bedeutet das eine Erhöhung um 31 Euro monatlich, für das dritte Kind um 25 Euro monatlich. Perspektivisch soll das Kindergeld in Deutschland von einer Kindergrundsicherung abgelöst werden, die diverse Familienleistungen bündeln würde.

Aktuell: Mit dem „Steuerentlastungsgesetz 2022“ wurde im Juli 2022 für jedes Kind ergänzend zum Kindergeld einmalig ein Kinderbonus von 100 Euro ausgezahlt.

Entlastungsbetrag für Alleinerziehende

Seit 2004 steht Alleinerziehenden ein Entlastungsbetrag zu, wenn zu ihrem Haushalt mindestens ein Kind gehört, für das sie Kindergeld oder den steuerlichen Kinderfreibetrag erhalten, und ansonsten im Haushalt keine andere erwachsene Person lebt (§ 24b EStG). Ziel des Entlastungsbetrages ist es, die höheren Kosten für die eigene Lebens- und Haushaltsführung der "echt" Alleinerziehenden abzugelten, die einen gemeinsamen Haushalt nur mit ihren Kindern und keiner anderen erwachsenen Person führen, die tatsächlich oder finanziell zum Haushalt beiträgt.

Seit 2020 wurde der Entlastungsbetrag für Alleinerziehende dauerhaft auf 4.008 Euro angehoben. Der Erhöhungsbetrag von 240 Euro für jedes weiter Kind bleibt unverändert (§ 24b Abs. 2 Satz 3 EStG, geändert durch das "Zweite Corona-Steuerhilfegesetz).

Energiepreispauschale (EPP) für Arneitnehmer und Minijobber

Die Energiepreispauschale über 300 Euro sollte bereits im September 2022 über die Lohnabrechnung des Arbeitgebers ausgezahlt worden sein. Arbeitnehmer, die im September 2022 nicht beschäftigt sind, können in diesem Fall die EPP über die Abgabe einer Einkommensteuererklärung erhalten.

Wenn eine Steuererklärung abgegeben wird und die Anspruchsvoraussetzungen der Energiepreispauschale erfüllt sind, wird die EPP von Amts wegen mit der Einkommensteuerveranlagung 2022 festgesetzt. Ein besonderer Antrag ist dann nicht erforderlich. Dies gilt auch für alle Minijobber, deren Arbeitgebern die EPP nicht mit dem Lohn ausgezahlt haben.

Minijob-Grenze steigt auf 520 Euro

Zum 1.10.2022 wurde der gesetzliche Mindestlohn auf 12 Euro pro Zeitstunde angehoben. Dementsprechend ist auch die Verdienstobergrenze für Minijobs von 450 Euro auf 520 Euro. Ein Minijobber darf also grundsätzlich 6.240 Euro über 12 Monate und in begründetem Ausnahmefall höchstens 7.280 Euro im Jahr verdienen.

Arbeitnehmer-Pauschbetrag erhöht sich auf 1.200 Euro

Mit dem „Steuerentlastungsgesetz 2022“ wurde der Arbeitnehmer-Pauschbetrag rückwirkend ab dem 1.1.2022 von 1.000 Euro auf 1.200 Euro angehoben (§ 9a Nr. 1 EStG). Wenn Sie keine einzelnen Werbungskosten geltend machen, wird ab 2022 ein Betrag von 1.200 Euro pauschal ohne Nachweise angenommen.

Erhöhung der Entfernungspauschale für Fernpendler

Die Pauschale für Fernpendler wude erneut erhöht, und zwar auf 38 Cent ab dem 21. Entfernungskilometer. Für die ersten 20 Km bleibt sie hingegen unverändert bei 30 Cent. Dies gilt rückwirkend ab dem 1.1.2022. Ursprünglich sollte die Erhöhung erst ab dem Jahre 2024 gelten, doch sie wurde nun vorgezogen. Die Anhebung ist vorerst befristet bis zum 31.12.2026.

Homeoffice-Pauschale steuerlich absetzbar

Arbeitnehmer, die zuhause arbeiten und deren Arbeitsplatz nicht die steuerlichen Voraussetzungen für ein Arbeitszimmer erfüllt, können einen Pauschalbetrag von 5 Euro pro Tag als Werbungskosten geltend machen. die Homeoffice-Pauschale ist auf maximal 600 Euro im Jahr begrenzt.

Wichitg: Die Finanzämter sind zwar gehalten, keine Arbeitgeberbescheinigungen über die Anzahl der häuslichen Arbeitstage anzufordern. Doch wer trotz der Pauschale hohe Fahrtkosten für die Wege zur Arbeit geltend macht, wird sich auf Nachfragen seines Finanzamts einstellen müssen.

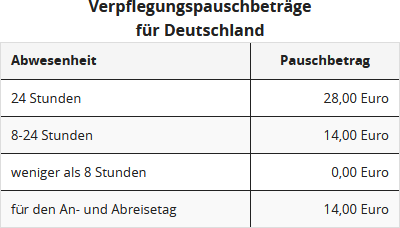

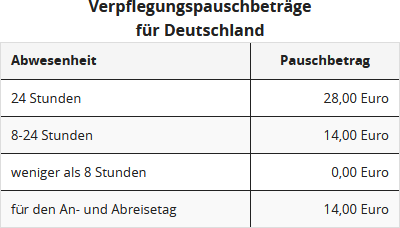

Erhöhung der Verpflegungspauschbeträge

Seit dem 1.1.2020 wurden die Verpflegungspauschbeträge angehoben (§ 9 Abs. 4a Satz 3 EStG, geändert durch das "Gesetz zur weiteren steuerlichen Förderung der Elektromobilität und zur Änderung weiterer steuerlicher Vorschriften" vom 12.12.2019).

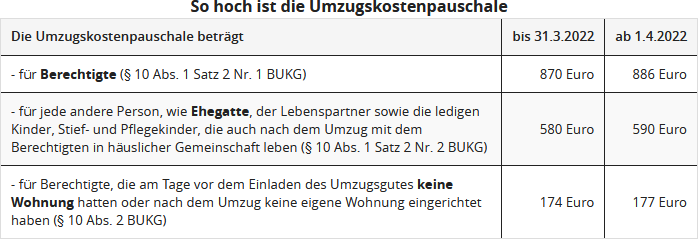

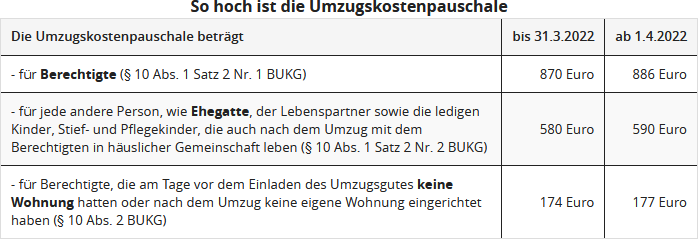

Beruflicher Umzug: Erhöhung der Pauschalen

Bei einem Umzug aus beruflichen Gründen können Sie die Umzugskosten als Werbungskosten absetzen oder vom Arbeitgeber steuerfrei erstattet bekommen. Dazu zählen neben den Transportkosten, Reisekosten, doppelten Mietzahlungen, Maklergebühren für eine Mietwohnung auch sonstige Umzugsauslagen. Während die erstgenannten Kosten in nachgewiesener Höhe absetzbar sind, können sonstige Umzugsauslagen mit einem Pauschbetrag geltend gemacht werden.

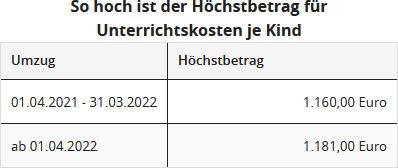

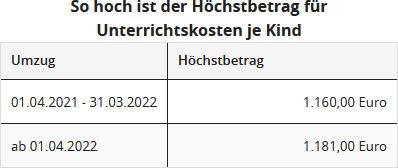

Haben die Kinder infolge des Wohnungswechsels in der Schule Schwierigkeiten, können Sie "Auslagen für zusätzlichen Unterricht der Kinder" bis zu einem bestimmten Höchstbetrag als Werbungskosten absetzen (§ 9 Abs. 2 BUKG 2019).

Rente aus der gesetzlichen Rentenversicherung

Für Rentner, die im Jahre 2022 erstmals Rente bezogen haben, beträgt der Besteuerungsanteil 82% des Rentenbetrages. Der Bruttorentenbetrag ist zu 82 % steuerpflichtig, wobei ein Werbungskosten-Pauschbetrag von 102 Euro abgezogen wird.

Im nachfolgenden Jahr 2022 wird der volle Jahresbetrag der Rente erneut mit dem Besteuerungsanteil von 80 % besteuert. Der verbleibende Anteil der Rente ist dann Ihr persönlicher Rentenfreibetrag, der fortan in gleicher Höhe für die gesamte Laufzeit der Rente gilt. Ab 2023 ist der volle Jahresrentenbetrag nach Abzug des Rentenfreibetrages und des Werbungskosten-Pauschbetrages von 102 Euro zu versteuern.

Pensionen und Betriebsrenten

Versorgungsbezüge sind - anders als Renten aus der gesetzlichen Rentenversicherung - in vollem Umfang als "Einkünfte aus nichtselbstständiger Arbeit" steuerpflichtig und daher in der "Anlage N" anzugeben. Versorgungsbezüge sind seit 2005 begünstigt durch den Versorgungsfreibetrag, den Zuschlag zum Versorgungsfreibetrag sowie den Werbungskosten-Pauschbetrag von 102 Euro.

Wenn Sie im Jahre 2022 in den Ruhestand treten, beträgt zeitlebens der Versorgungsfreibetrag für Sie 14,4 % der Versorgungsbezüge, höchstens 1.080 Euro, und der Zuschlag zum Versorgungsfreibetrag 324 Euro. Mitsamt Werbungskosten-Pauschbetrag von 102 Euro bleiben die Bezüge also bis zu 1.506 Euro steuerfrei - lebenslänglich

Krankenversicherung: Höhere Freigrenzen für Familienversicherung

In der gesetzlichen Kranken- und Pflegeversicherung sind Familienangehörige beitragsfrei mitversichert, wenn ihr Gesamteinkommen regelmäßig im Monat ein Siebtel der monatlichen Bezugsgröße nicht überschreitet. Da die Bezugsgröße sich meist jährlich ändert, ändert sich folglich auch die Einkommensgrenze für die beitragsfreie Versicherung von Familienangehörigen in der gesetzlichen Krankenversicherung. Die Einkommensgrenze für die Familienversicherung liegt 2022 grundsätzlich bei 470 Euro im Monat.

Die Einkommensgrenze darf dreimal im Jahr überschritten werden, ohne dass deswegen die beitragsfreie Familienversicherung verloren geht. Diese Befristung wird aufgehoben und die Regelung unbefristet verlängert. Falls die Einkommensgrenze jedoch mehrfach überschritten wird, besteht die Möglichkeit, sich in der gesetzlichen Krankenversicherung freiwillig zu versichern.

Steuererleichterungen für Spendenorganisationen

Für Spenden zur Hilfe für von der Corona-Krise Betroffene – egal in welcher Höhe – reicht der vereinfachte Zuwendungsnachweis. Dies soll den Verwaltungsaufwand für die geförderten Organisationen reduzieren. (BMF-Erlass vom 9.4.2020, IV C 4 -S 2223/19/10003).

Bei Spenden zur Unterstützung der Geflüchteten und Zurückgebliebenen des Ukraine-Krieges handelt es sich um die Förderung mildtätiger Zwecke. Spenden sind als Sonderausgaben absetzbar, und zwar bis in Höhe von 20 % des Gesamtbetrags der Einkünfte. Zuwendungen, die diesen Höchstbetrag übersteigen, können in das Folgejahr vorgetragen und dort im Rahmen des Höchstbetrages berücksichtigt werden. Dieser Spendenvortrag gilt zeitlich unbegrenzt (§ 10b Abs. 1 Nr. 1 EStG).

Grundsätzlich gilt: Ohne Zuwendungsbestätigung keine Steuerermäßigung! Spenden müssen also immer mit einer formellen Zuwendungsbestätigung nach amtlich vorgeschriebenem Muster nachgewiesen werden, um den begehrten Steuerabzug zu erreichen. Doch für Spenden zugunsten der Geflüchteten gilt im Zeitraum vom 24.2. bis 31.12.2022 ein vereinfachter Spendennachweis. Bei Spenden im Katastrophenfall genügt der Bareinzahlungsbeleg oder die Buchungsbestätigung einer Bank, z.B. Kontoauszug, Lastschrifteinzugsbeleg oder PC-Ausdruck bei Online-Banking. Die Höhe des Spendenbetrages spielt keine Rolle.

Unterhalt bedürftiger Personen: Erhöhung des Unterhaltshöchstbetrages

Zum 1.1.2022 wurde der Unterhaltshöchstbetrag 10.347 Euro angehoben. Der Unterhaltshöchstbetrag wird häufig nicht in dieser Höhe gewährt, sondern gekürzt. Und zwar um ein Zwölftel für jeden vollen Kalendermonat, in dem die Voraussetzungen nicht gegeben sind, um eigene Einkünfte und Bezüge des Unterhaltsempfänger, die über den Anrechnungsfreibetrag von 624 Euro hinausgehen, sowie um ein, zwei oder drei Viertel, wenn der Unterhaltsempfänger in einem Land mit niedrigerem Lebensstandard lebt.

(2022): Steuererklärung für 2022: Das ist neu

Welche Einkunftsarten und Anlagen werden von Lohnsteuer kompakt 2022 unterstützt?

Programmumfang nach § 87c AO

Die Einkommensteuererklärung kann mit dieser Software nur für in Deutschland unbeschränkt steuerpflichtige Personen erstellt werden. Wenn Sie in Deutschland nur beschränkt steuerpflichtig (§ 1 Abs. 4 EStG) sind, ist eine Erstellung Ihrer Einkommensteuererklärung mit dieser Anwendung nicht möglich.

Die neueste Version für das Steuerjahr 2022 unterstützt Sie bei der Erstellung der Steuererklärung in folgenden Bereichen:

- Steuerhauptformular - Einkommensteuererklärung für (unbeschränkt) steuerpflichtige Personen

- Anlage Sonderausgaben

- Anlage Außergewöhnliche Belastungen

- Anlage WA-ESt - Weitere Angaben und Anträge in Fällen mit Auslandsbezug

- Anlage Kind - Angaben zur steuerlichen Berücksichtigung der Kinder

- Anlage VOR - Vorsorgeaufwand

- Anlage AV - Riester-Rente (Altersvorsorgebeiträge als Sonderausgaben nach § 10a EStG)

- Anlage N - Einkünfte aus nichtselbständiger Arbeit

- inklusive Werbungskosten bei Reisetätigkeit/Auswärtstätigkeit

- Anlage N-AUS - Ausländische Einkünfte aus nichtselbständiger Arbeit

- Anlage R - Renten und andere Leistungen aus Altersvorsorgeverträgen

- Anlage R-AUS - Renten und andere Leistungen aus ausländischen Versicherungen / ausländischen Rentenverträgen /ausländischen betrieblichen Versorgungseinrichtungen

- Anlage R-AV/bAV - Leistungen aus inländischen Altersvorsorgeverträgen und aus der inländischen betrieblichen Altersversorgung

- Anlage V - Einkünfte aus Vermietung und Verpachtung

- Anlage KAP - Einkünfte aus Kapitalvermögen (zunächst Zins- und Dividendenerträge)

- Anlage KAP-BET - Erträge und anrechenbare Steuern aus Beteiligungen

- Anlage KAP-INV - Erklärung von Investmentfonds, die nicht dem inländischen Steuerabzug unterlagen

- Anlage S - Einkünfte aus selbständiger Arbeit

- Einkünfte aus Gesellschaften nach § 15 EStG sowie aus Wagniskapitalgesellschaften können derzeit leider nicht erfasst werden.

- Anlage G - Einkünfte aus Gewerbebetrieb

- Einkünfte aus Gesellschaften nach § 15b EStG (Steuerstundungsmodelle), Einkünfte aus der Veräußerung an eine REIT-AG sowie Einkünfte aus gewerblicher Tierzucht, Termingeschäften oder Beteiligungen können nicht erfasst werden.

- Anlage Corona - Corona-Soforthilfen, Überbrückungshilfen und vergleichbare Zuschüsse

- Anlage EÜR - Einnahmen-Überschussrechnung

- Die Einnahmenüberschussrechnung (nach § 4 Abs. 3 EStG) ist die einfachste Art der Gewinnermittlung

- Anlage SO - Sonstige Einkünfte

- Anlage SO 1. Teil: Hier können erhaltene Unterhaltszahlungen, wiederkehrende Bezüge, Leistungen und Abgeordnetenbezüge erfasst werden.

- Anlage SO 2. Teil: Hier können Einkünfte aus privaten Veräußerungsgeschäften (Grundstücke, Wirtschaftsgüter) angegeben werden.

- Anlage Unterhalt - Unterhaltsleistungen an bedürftige Personen (im Rahmen der außergewöhnlichen Belastungen)

- Anlage FW - Steuerbegünstigung zur Förderung des Wohneigentums und Vorkostenabzug (nach §10e EStG)

- Anlage Energetische Maßnahmen - Aufwendungen für energetische Maßnahmen bei zu eigenen Wohnzwecken genutzten Gebäuden

- Anlage Mobilitätsprämie - Angaben zum Antrag auf Mobilitätsprämie

Wir werden Sie regelmäßig in unserem Newsletter und auf Facebook sowie Twitter zu den aktuellen Updates auf dem Laufenden halten.

Folgende Anlagen zur Einkommensteuererklärung stehen nicht zur Verfügung:

- Anlage AUS - Ausländische Einkünfte

- Anlage N-GRE - Grenzgänger in Baden-Württemberg (Arbeitsplatz in F, CH, A)

- Anlage L - Einkünfte aus Land- und Forstwirtschaft

- Anlage Forstwirtschaft - Tarifbegünstigte Einkünfte aus Holznutzungen (zu Anlage L)

- Anlage WEIN - Nichtbuchführende Weinbaubetriebe (zu Anlage L)

(2022): Welche Einkunftsarten und Anlagen werden von Lohnsteuer kompakt 2022 unterstützt?

Muss ich meine Angaben speichern?

Nein, Sie müssen die Daten, die Sie bei Lohnsteuer kompakt in die Steuererklärung eingeben, nicht noch einmal speichern.

Sobald Sie ein Eingabefeld verlassen, wird dieses automatisch im Hintergrund gespeichert. Nachdem Sie eine Seite ausgefüllt haben, gelangen Sie durch Klicken des "Weiter"-Buttons am unteren rechten Rand der Seite zum nächsten Schritt. Alle Einträge, die Sie bereits gemacht haben, können Sie natürlich später wieder ändern. Nutzen Sie dafür einfach die Navigation, um zu der gewünschten Stelle zu springen.

(2022): Muss ich meine Angaben speichern?

Bis wann muss ich meine Steuererklärung abgeben?

Erstmals für die Steuererklärung 2018 sind die Abgabefristen gesetzlich um zwei Monate verlängert worden. Dies gilt dementsprechend auch für die Steuererklärung 2022:

- Für Bürger, die ihre Steuererklärung selbst anfertigen, verlängert sich die Abgabefrist um 2 Monate vom 31. Mai auf den 31. Juli des Folgejahres (§ 149 Abs. 2 AO). Die Steuererklärung 2022 ist also bis zum 31.7.2023 abzugeben.

- Bürger, die von einem Steuerberater oder Lohnsteuerhilfeverein beraten werden, bekommen ebenfalls zwei Monate mehr Zeit zur Abgabe ihrer Erklärung. Während nach dem bisherigen "Fristenerlass" eine Fristverlängerung über den 31. Dezember des Folgejahres nur aufgrund begründeter Einzelanträge möglich war, besteht nunmehr Zeit bis Ende Februar des Zweitfolgejahres, d.h. für das Jahr 2022 bis zum 28.2.2024 (§ 149 Abs. 3 und 4 AO).

Aber Achtung: Die Finanzverwaltung hat die Möglichkeit der sogenannten Vorweganforderung. Sie müssen also ggf. damit rechnen, Ihre Steuererklärung auch vor den genannten Terminen abgeben zu müssen. Auf jeden Fall drohen bei verspäteten Abgaben hohe Verspätungszuschläge. Deren Festsetzung liegt dann nicht mehr im Ermessen des Finanzbeamten, sondern sind obligatorisch.

Lohnsteuer kompakt

Aufgrund der erheblichen Belastungen durch die Corona-Pandemie wurden die Fristen zur Abgabe der Einkommen-, Körperschaft-, Gewerbe- und Umsatzsteuererklärungen wiederholt verlängert - und abermals jetzt wieder durch das "Vierte Corona-Steuerhilfegesetz".

1. Steuererklärung 2020

Für Steuerzahler, die ihre Steuererklärung selbst erstellen, verlängerte sich die Abgabefrist um 3 Monate vom 31.7.2021 auf den 31.10.2021. Wird die Steuererklärung durch einen Steuerberater oder Lohnsteuerhilfeverein erstellt, endet die neue Abgabefrist 6 Monate später, also am 31.8.2022.

2. Steuererklärung 2021

Für Steuerzahler, die ihre Steuererklärung selbst erstellen, verlängert sich die Abgabefrist um 3 Monate vom 31.7.2022 auf den 31.10.2022. Wird die Steuererklärung durch einen Steuerberater oder Lohnsteuerhilfeverein erstellt, ist die neue Abgabefrist 6 Monate länger und endet statt am 28.2.2023 erst am 31.8.2023.

3. Steuererklärung 2022

Für Steuerzahler, die ihre Steuererklärung selbst erstellen, verlängert sich die Abgabefrist um 2 Monate vom 31.7.2023 auf den 30.9.2023. Wird die Steuererklärung durch einen Steuerberater oder Lohnsteuerhilfeverein erstellt, ist die neue Abgabefrist 5 Monate länger und endet statt am 29.2.2024 am 31.7.2024.

4. Steuererklärung 2023

Für Steuerzahler, die ihre Steuererklärung selbst erstellen, verlängert sich die Abgabefrist um 1 Monat vom 31.7.2024 auf den 31.8.2024. Wird die Steuererklärung durch einen Steuerberater oder Lohnsteuerhilfeverein erstellt, ist die neue Abgabefrist 3 Monate länger und endet statt am 28.2.2025 am 31.5.2025.

5. Steuererklärung 2024

Für Steuerzahler, die ihre Steuererklärung selbst erstellen, gibt es keine Verlängerung mehr. Wird die Steuererklärung durch einen Steuerberater oder Lohnsteuerhilfeverein erstellt, ist die neue Abgabefrist aber 2 Monate länger und endet statt am 28.2.2026 am 30.4.2026.

Hinweis: Der Vollständigkeit halber sei darauf hingewiesen, dass sich die oben genannten Fristen jeweils auf den Ablauf des nächstfolgenden Werktags verschieben, wenn ihr Ende auf einen Sonntag, einen gesetzlichen Feiertag oder einen Sonnabend fällt. Beispiel: Der 31. Oktober 2022 ist in einigen Bundesländern ein gesetzlicher Feiertag. Somit verschiebt sich der Fristablauf für die Abgabe der Steuererklärung 2021 in diesen Bundesländern auf den 1. November 2022.

Abgabefristen für die Steuererklärung

Fristverlängerung beantragen

Können Sie jedoch absehen, dass Ihre Steuererklärung auch in den nächsten Wochen nicht fertig wird, bemühen Sie sich besser heute als morgen um eine Fristverlängerung. Diesen Antrag sollte man eigentlich schon vor dem 31. Juli 2023 einreichen und man hat auch keinen Anspruch darauf, dass das Finanzamt ihm stattgibt. Beantragen Sie am besten eine stillschweigende Fristverlängerung, wenn Sie dann nichts mehr hören, ist Ihr Antrag genehmigt. Wichtig ist, dass Sie Gründe für Ihr Anliegen nennen. Dazu zählen beispielsweise ein Umzug, eine Dienstreise, Krankheiten oder fehlende Unterlagen. Akzeptiert das Finanzamt die Verlängerung, haben Sie in der Regel höchstens bis zum 31. Dezember 2024 Zeit.

Steuerberater sorgt für Fristverlängerung

Wenn Sie einen Steuerberater oder Lohnsteuerhilfeverein beauftragt haben, sind Sie fein raus. Dann verlängert sich die Frist automatisch auf den 28. Februar 2024, sofern das Finanzamt nicht ausdrücklich eine frühere Abgabe verlangt. Der Grund für den späteren Termin ist simpel: Den Steuerexperten ist es nicht zuzumuten, die ganze Arbeit in den ersten fünf Monaten des Jahres zu erledigen.

Irgendwann kommt die Mahnung

Lassen Sie nichts von sich hören, wird Ihnen das Finanzamt früher oder später eine Mahnung schicken und Ihnen eine Frist setzen. Diesen Termin sollten Sie ernst nehmen, sonst kann ein Zwangsentgelt festgesetzt werden, außerdem droht ein happiger Versäumniszuschlag. Besser also, Sie melden sich rechtzeitig.

Wer freiwillig abgibt, hat länger Zeit

Wenn Sie zu denjenigen gehören, die nicht zur Abgabe der Steuererklärung verpflichtet sind, muss Sie das alles gar nicht interessieren. Der Fiskus erwartet kein Geld von Ihnen, sondern muss wahrscheinlich welches zurückzahlen. Gerade deshalb tun Sie aber gut daran, die Einkommensteuererklärung nicht auf die lange Bank zu schieben. Von Rechts wegen hätten Sie lange genug Zeit: Bei freiwilliger Veranlagung bleiben grundsätzlich vier Jahre, in denen die Steuererklärung abgegeben werden kann (nicht muss).

Ihre Steuererklärung für 2022 müsste also bis zum 31. Dezember 2026 eingehen – keinen Tag später, sonst ist die ganze Arbeit für die Katz. Besser ist es jedoch, man reizt den Spielraum nicht aus, sondern kümmert sich frühzeitig. Erfahrungsgemäß ist es leichter, die nötigen Unterlagen im Folgejahr zusammenzustellen, als drei Jahre später. Außerdem geht es ums Geld – wer will schon vier Jahre lang auf die Rückzahlung warten?

(2022): Bis wann muss ich meine Steuererklärung abgeben?

Wer muss keine Steuererklärung abgeben?

Die Abgabe der Steuererklärung ist immer dann freiwillig, wenn man nicht per Gesetz zur Abgabe (siehe unten) verpflichtet ist. Das trifft insbesondere auf Arbeitnehmer in der Steuerklasse I zu, die nur Einnahmen aus ihrer Anstellung als Arbeitnehmer haben. Das gilt aber auch für Verheiratete mit der Steuerklassenkombination IV/IV - es darf aber nicht das Faktorverfahren genutzt werden.

Ihre Einkünfte sind bereits versteuert und Sie können sich unter Umständen die Formulare für das Finanzamt sparen. Auch das Finanzamt fordert Sie in diesen Fällen nicht zur Abgabe der Steuererklärung auf. Allerdings erhalten gerade diese Arbeitnehmer in 9 von 10 Fällen zu viel gezahlte Steuern vom Finanzamt zurück.

Der Fiskus erwartet also kein Geld von Ihnen, sondern muss wahrscheinlich welches an Sie zurückzahlen. Es ist fast immer eine Steuererstattung drin.

Antragsveranlagung: Sie geben freiwillig Ihre Steuererklärung ab

Wenn Sie eine Steuererklärung beim Finanzamt abgeben, obwohl Sie das nicht müssen, nennt sich das im Steuerrecht Antragsveranlagung. Bei einer Antragsveranlagung bleiben grundsätzlich vier Jahre Zeit, die Steuererklärung abzugeben und sich die Steuererstattung zu sichern.

(2022): Wer muss keine Steuererklärung abgeben?

Wer ist unbeschränkt steuerpflichtig?

Unbeschränkt steuerpflichtig sind nach §1 EStG:

- natürliche Personen, die im Inland einen Wohnsitz oder ihren gewöhnlichen Aufenthalt haben und

- deutsche Staatsangehörige im Ausland, die von einer öffentlichen Kasse bezahlt werden. Hierzu gehören beispielsweise Angehörige einer deutschen Botschaft im Ausland.

Während der 2. Punkt eindeutig ist, muss man den 1. Punkt genauer betrachten:

- Natürliche Personen sind grundsätzlich alle Menschen - unabhängig vom Alter.

- Den "Wohnsitz" hat eine Person dort, wo sie wohnt (§8 AO). Es spielt beim Wohnsitz keine Rolle, ob es sich um eine Vorstadtvilla oder nur um ein möbliertes Zimmer zur Untermiete handelt. Ein Steuerpflichtiger kann auch mehrere Wohnsitze haben, zum Beispiel in Deutschland und im Ausland.

- Vom "gewöhnliche Aufenthalt" spricht man, wenn sich jemand mindestens sechs Monate am Stück in Deutschland aufhält (§9 AO). Kurze Unterbrechungen während dieses Zeitraumes sind aber durchaus möglich.

(2022): Wer ist unbeschränkt steuerpflichtig?

Wer ist beschränkt steuerpflichtig?

Beschränkt einkommensteuerpflichtig nach § 1 Absatz 4 EStG sind Personen, die

- in Deutschland weder Ihren Wohnsitz noch einen gewöhnlichen Aufenthalt haben,

- bestimmte inländische Einkünfte im Sinne des § 49 EStG haben und

- nicht auf Antrag unbeschränkt einkommensteuerpflichtig gemäß § 1 Abs. 3 EStG (Grenzpendler) oder

- erweitert unbeschränkt einkommensteuerpflichtig gemäß § 1 Abs. 2 EStG sind.

Bei ihnen wird die Steuer durch Steuerabzug oder im Wege der Veranlagung zur beschränkten Steuerpflicht erhoben.

Hinweis: Für Grenzgängern aus Frankreich, Österreich und der Schweiz gelten Sonderregelungen.

Zahlreiche personen- und familienbezogenen Steuervergünstigungen werden bei der Veranlagung zur beschränkten Steuerpflicht nicht berücksichtigt, u.a.:

- Das Ehegattensplitting (Zusammenveranlagung) kann nicht in Anspruch genommen werden.

- Das Gnadensplitting für Verwitwete im Jahr nach dem Sterbefall wird nicht gewährt (§ 32a Abs. 6 EStG).

- Außergewöhnliche Belastungen können steuerlich nicht geltend gemacht werden (§§ 33, 33a, 33b EStG).

- Ein Behinderten-Pauschbetrag und Pflege-Pauschbetrag bleiben Ihnen verwehrt (§ 33b EStG).

- Kinderfreibetrag sowie Freibeträge für Betreuung, Erziehung und Ausbildung werden nicht gewährt (§ 32 EStG).

- Der Entlastungsbetrag für Alleinerziehende steht Ihnen nicht zu (§ 24b EStG).

- Die Steuerermäßigung für Haushaltshilfen, haushaltsnahe Dienstleistungen und Handwerkerleistungen in einer Wohnung (§ 35a EStG) im EU-/EWR-Ausland wird ab 2009 nicht gewährt.

- Werbungskosten sind grundsätzlich nur in nachgewiesener Höhe absetzbar, wenn sie in unmittelbarem wirtschaftlichen Zusammenhang mit inländischen Einkünften stehen.

- Die Werbungskostenpauschale über 1.000 Euro für Einkünfte aus nichtselbständiger Arbeit wird allerdings auch berücksichtigt, wenn keine höheren mit den Einkünften im wirtschaftlichen Zusammenhang stehenden Werbungskosten nachgewiesen werden.

- Bei Renteneinkünften wird mindestens der Werbungskostenpauschbetrag über 102 Euro berücksichtigt.

(2022): Wer ist beschränkt steuerpflichtig?

Ehegattensplitting für eingetragene Lebenspartnerschaften

Das Bundesverfassungsgericht hat entschieden:

Auch eingetragene Lebenspartnerschaften haben Anspruch auf die steuerliche Zusammenveranlagung mit dem Splittingtarif. Die Ungleichbehandlung von Homo-Ehen und "normalen" Ehen beim Ehegattensplitting ist verfassungswidrig (BVerfG-Urteil vom 7.5.2013, 2 BvR 909/06).

Der Gesetzgeber wurde verpflichtet, die Rechtslage rückwirkend ab dem 1.8.2001 - dem Tag, an dem das Lebenspartnerschaftsgesetz in Kraft getreten ist - zu ändern. Und so wurde im Einkommensteuergesetz eine neue Generalnorm einfügt:

"Die Regelungen dieses Gesetzes zu Ehegatten und Ehen sind auch auf Lebenspartner und Lebenspartnerschaften anzuwenden" (§ 2 Abs. 8 EStG).

Die Neuregelung gilt in allen noch offenen Steuerfällen, in denen die Einkommensteuer noch nicht bestandskräftig festgesetzt wurde (§ 52 Abs. 2a EStG).

Eine weitergehende Gleichstellung erfolgt ab dem 1.1.2015 mit dem "Gesetz zur Überarbeitung des Lebenspartnerschafrechts" vom 15.12.2004. Mit diesem Gesetz wird die rechtliche Gleichstellung gleichgeschlechtlicher Lebenspartner mit Ehegatten weiter ausgebaut.

Bitte wählen Sie bei Lohnsteuer kompakt als Familienstand "Gleichgeschlechtliche Ehe/Lebenspartnerschaft".

Reihenfolge bei gleichgeschlechtlichen Ehepaaren

Für gleichgeschlechtliche Ehepaare und eingetragene Lebenspartner, die eine gemeinsame Steuererklärung (=Zusammenveranlagung) abgeben wollen, hat die Finanzverwaltung festgelegt, wer als steuerpflichtige Person anzugeben ist:

- Tragen Sie den Partner zuerst in der Steuererklärung ein, der nach alphabetischer Reihenfolge des Nachnamens zuerst kommt.

- Bei Namensgleichheit entscheidet die alphabetische Reihenfolge des Vornamens.

- Ist auch der Vorname identisch, ist der ältere der Partner als Steuerpflichtiger zu erfassen.

(2022): Ehegattensplitting für eingetragene Lebenspartnerschaften

Wer hat Anspruch auf das Gnadensplitting / Witwensplitting?

Im Jahr nach dem Tod eines Ehepartners besteht die Möglichkeit, noch einmal die Zusammenveranlagung mit dem verstorbenen Ehepartner zu wählen, wenn die Voraussetzungen für die Zusammenveranlagung zum Todeszeitpunkt vorgelegen haben. Gnadensplitting wird auch Witwensplitting genannt.

Der überlebende Ehegatte wählt zwar die Einzelveranlagung für Ledige nach § 25 EStG, bei der aber ausnahmsweise und letztmals der günstige Splittingtarif angewandt wird (sog. Gnadensplitting nach § 32a Abs. 6 Nr. 1 EStG). Bedingung für das Gnadensplitting / Witwensplitting aber ist, dass die Voraussetzungen der Ehegattenbesteuerung "im Zeitpunkt des Todes" vorlagen. Das bedeutet, dass beide Eheleute in Deutschland gewohnt und nicht dauernd getrennt gelebt haben.

Falls Sie sich vor dem Tod Ihres Ehegatten von ihm getrennt haben sollten, wäre diese Voraussetzung nicht erfüllt. Allein die Zusammenveranlagung für das Sterbejahr genügt für das Gnadensplitting nicht (BFH-Urteil vom 27.2.1998, BStBl. 1998 II S. 350; H 184a EStR).

Hinweis: Durch die Gewährung des Splittingtarifs soll vermieden werden, dass beim Tod eines Ehegatten für den Überlebenden eine steuerliche Schlechterstellung eintritt.

(2022): Wer hat Anspruch auf das Gnadensplitting / Witwensplitting?