(2022)

New 2021 meal and accommodation allowances

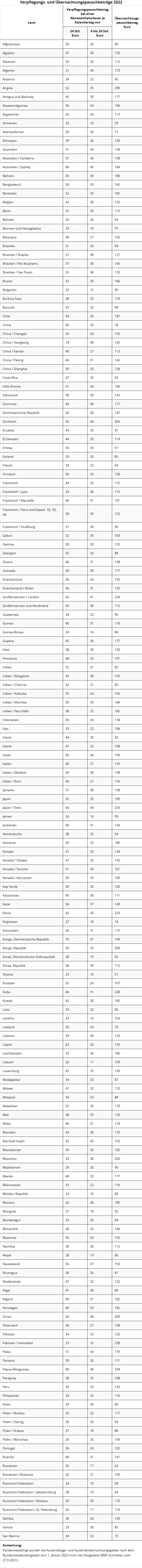

For business-related foreign travel and double housekeeping abroad, the following meal and overnight allowances apply in 2022 (BMF letter dated 03.12.2020, IV C 5-S 2353/19/10010-002).

For employment at an external location or double housekeeping abroad, the following applies:

- The country-specific meal allowances can be claimed by the employee as business expenses or reimbursed tax-free by the employer. It is not possible to claim the actual costs as business expenses.

- The country-specific overnight allowances can no longer be claimed as business expenses since 2008, but the employer may reimburse them tax-free. Only the actual and proven overnight costs are deductible.

For one-day trips abroad, the relevant allowance for the last place of work abroad applies. For multi-day trips in different countries, the following applies to the calculation of meal allowances on the days of arrival and departure as well as on intermediate days (days with 24 hours absence):

- For travel from Germany abroad or from abroad to Germany without work, the relevant allowance for the location reached before 24:00 local time applies.

- For travel from abroad to Germany or from Germany abroad, the relevant allowance for the last place of work applies.

- For intermediate days, the relevant allowance for the location reached by the employee before 24:00 local time usually applies.

- If a further one- or multi-day external activity follows the day of return from a multi-day external activity to the home or first place of work, only the higher meal allowance is to be considered for this day.

Bewertungen des Textes: New 2021 meal and accommodation allowances

2.86

von 5

Anzahl an Bewertungen: 7