When are relocation costs recognised despite a small reduction in commuting time?

Recently, the Cologne Tax Court issued a remarkable ruling in favour of taxpayers: Although the required travel time saving of at least 1 hour was not nearly achieved, a move was recognised as work-related and the moving costs as deductible expenses.

Moving costs are tax-deductible as work-related expenses if there are work-related reasons for the move, e.g. change of employer, transfer, taking up or vacating a company flat, etc. A move is also work-related without a change of job if the move reduces the total daily commuting time by at least one hour.

But did you know that a move can still be work-related even if the travel time saving is less than one hour per day? This can indeed be the case if the move leads to an "otherwise significant improvement in working conditions". When might this occur?

In the case in question, before the move, the journey by underground (8 minutes) and the walking times including waiting times took a total of 20 minutes per journey, i.e. 40 minutes per working day. After the move, the workplace was less than a 5-minute walk away. The work-related reason was that the accessibility of the workplace without public transport led to a significant improvement in working conditions (Cologne Tax Court, 24.2.2016, 3 K 3502/13). The reasoning of the Cologne tax judges is very interesting and extremely taxpayer-friendly:

"In assessing whether a move has led to a significant improvement in working conditions despite a time saving of less than one hour, other factors must also be taken into account. For those who do not have to use public transport in a big city and can walk to work, the time pressure and stress of having to arrive on time are eliminated, especially if the employee does not have flexible working hours.

In the case, the teacher also had to carry considerable luggage - books, teaching materials and a laptop - in a rucksack on her journeys, which she could not store at school. As the travel time before her move was mainly spent on walking and waiting at stops or traffic lights, the shortening of the walking time in particular made transporting the heavy luggage much more convenient.

The well-known inconveniences of getting on and off trams with luggage during rush hours were completely eliminated as a result of the move. The fact that the teacher could be scheduled more flexibly in the regular timetable and the substitution plan after the move, or could even come to school for just one hour on her days off, is also part of her working conditions. Whether the school could have demanded this from her beforehand is irrelevant. This does not call into question the work-related reason."

Whether such friendliness will stand up before the Federal Fiscal Court remains to be seen. Another noteworthy aspect: The fact that the move was related to the purchase and occupation of an owner-occupied flat does not, according to the tax judges, prevent the work-related reason for the move. This private motive is overridden by the primary work-related reason.

Lohnsteuer kompakt

Are you tired of commuting long distances to work every day and now want to move closer to your workplace? Expenses for looking for a suitable flat, such as advertising costs and viewing trips, can also be claimed as (unsuccessful) moving costs if the search is unsuccessful and the move does not actually take place.

The only requirement is that a daily travel time saving of at least one hour would have resulted if the move had taken place (Düsseldorf Tax Court, 24.3.1994, EFG 1994 p. 652).

(2022): When are relocation costs recognised despite a small reduction in commuting time?

When can I claim relocation expenses as income-related expenses?

If your move is work-related, you can deduct the resulting costs as income-related expenses. A work-related reason is given in the following cases, for example:

- Your employer relocates.

- You move because you have changed employer.

- Your employer has transferred you.

- You significantly reduce the distance between your home and workplace by moving. The daily travel time should be reduced by at least one hour.

- You move into or out of a company flat.

- You move to the place of work to end a second household.

(2022): When can I claim relocation expenses as income-related expenses?

What relocation expenses can I deduct?

If your move is work-related, you can claim the following expenses as income-related expenses:

Transport costs

- This includes your expenses for a moving company in full for all moving goods. Fees for no-parking signs at the loading or unloading point can also be deducted as transport costs.

- If you move without a freight forwarder, you can deduct the costs for a rental vehicle including mileage allowance, expenses for using your own vehicle at the travel expense rate, and the cost of packaging materials. If you pay wages to friends who help, you can also deduct these expenses.

Travel expenses

- On the moving day, you can claim travel expenses as for an external activity. If you travel by your own vehicle, you can apply the business travel allowance of 30 cents per kilometre. If you travel by public transport, the tax office accepts the actual costs incurred with proof.

- For the duration of the move, you can also claim meal allowances for yourself and your household members moving with you at the rates for external activity as moving expenses. If you can prove overnight costs incurred from the days of loading to unloading the moving goods, you can also deduct these.

Double rent payments

- If you have to pay double rent due to the notice period of your old rented flat, even though you already live in the new flat, you can deduct the rent payments for the old flat as income-related expenses from the day you move out until the end of the tenancy.

- This also applies to additional costs. If you have already rented the new flat but are not yet living in it, you can deduct the rent payments for the new flat as income-related expenses.

Furnishings

- Expenses previously covered by flat rates for a cooker or stoves for each room in a flat are included in the newly adjusted flat rate for other moving expenses (§ 10 BUKG) from 1.6.2020 and are therefore no longer listed separately. In particular, the abolition of the flat rates for heating stoves is appropriate, as stove heating is no longer up-to-date and is practically irrelevant.

Relocation-related tutoring

- If your children need to change schools and tutoring is required, you can deduct the costs.

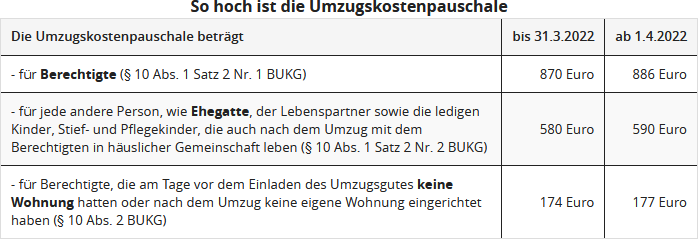

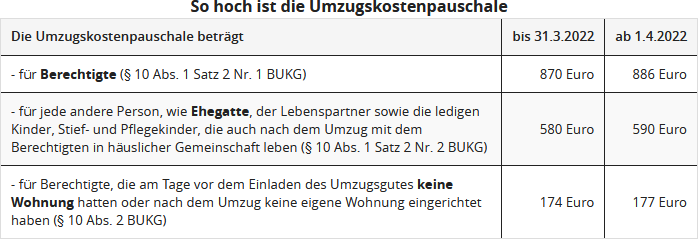

Moving expense allowance for "other moving expenses"

- In addition to these actual costs, there is a moving expense allowance (flat rate for other moving expenses) for which no receipts are required. A table and detailed explanation are provided in the following section.

(2022): What relocation expenses can I deduct?

What costs are covered by the relocation allowance?

If you move for work-related reasons, you can deduct the moving expenses as income-related expenses or have them reimbursed tax-free by your employer. These include transport costs, travel expenses, double rent payments, estate agent fees for a rented flat, and other moving expenses.

While the aforementioned costs can be deducted in the amount proven, other moving expenses can be claimed with a flat rate - the so-called flat rate for other moving expenses, also known as the moving expense allowance.

The Federal Ministry of Finance has recently increased the moving expense allowances for work-related moves as of 1 April 2022 (BMF letter dated 21 July 2021, IV C 5 - S 2353/20/10004).

The moving allowance covers

- Tips for the removal men and other helpers. This also includes, for example, inviting your friends to a meal as a thank you for their help with the move.

- Professional assembly and disassembly of lights, fitted kitchens, and other electrical appliances.

- Professional installation and alteration of curtains, blinds, and their fittings.

- Fees for re-registration.

- Advertisements for house hunting, etc.

- Costs for cosmetic repairs in the old flat, provided you are contractually obliged to cover them (but not cosmetic repairs in the new flat, as these are privately incurred).

(2022): What costs are covered by the relocation allowance?

Is it possible to claim tutoring for your own children after a move?

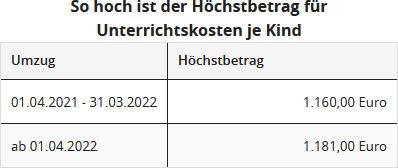

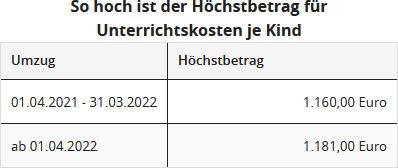

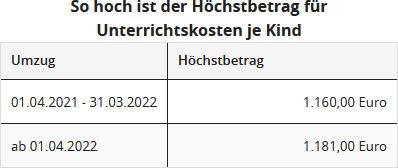

If children require tutoring after a work-related move, the costs can be deducted as income-related expenses up to a maximum amount.

The tax office does not automatically recognise your proven expenses up to this maximum amount.

Until 31/05/2020, the following regulation applies: Your tuition costs are initially fully recognised up to half of the maximum amount and beyond that at 75%, until the second half of the maximum amount is exhausted. However, the maximum amount must not be exceeded in total.

Example

The Maier family moved from Hamburg to Berlin on 15/01/2020. Additional tuition costs of 1.500 Euro were incurred for their daughter. Initially, 1.022,50 Euro, i.e. half of 2.045 Euro, are deductible. Of the amount not yet considered, 477,50 Euro (1.500 Euro minus 1.022,50 Euro), a further 358 Euro are deductible (75 percent of 477,50 Euro).

In total, the Maier family can claim tuition costs of 1.380 Euro in the income tax return 2022.

Currently, for moves from 01/06/2020, the tax deductibility of tuition costs is newly regulated (due to the "Act on the Modernisation of the Civil Service Remuneration Structure" of 09/12/2019). As before, the deductible maximum amount is announced by the Federal Ministry of Finance and adjusted from time to time (BMF letter of 20/05/2020, IV C 5-S 2353/20/10004). Currently, the Federal Ministry of Finance has increased the allowances and maximum amounts for work-related moves from 1 April 2022 (BMF letter of 21/07/2021, IV C 5-S 2353/20/10004 :002).

The necessity must be proven in an appropriate manner, e.g. by a certificate from the school. New is that the necessity is now assumed to be given already in the case of a move-related change of federal state. The reason for the regulation is the different teaching and framework plans of the previous school compared to those of the new school.

Tax tip: You should be aware of the following detail: In the past, the day you completed the move was decisive. If the furniture was loaded on 28/02 and unloaded on 01/03, you were entitled to the higher amounts. This is now different: For the calculation of the allowances, the day before the removal goods are loaded is decisive (BMF letter of 20/05/2020).

(2022): Is it possible to claim tutoring for your own children after a move?