To what extent can I claim exceptional expenses?

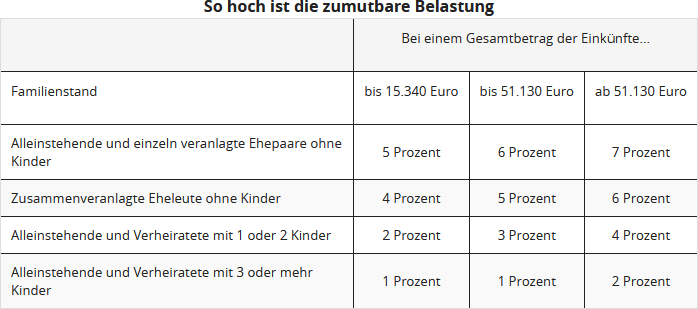

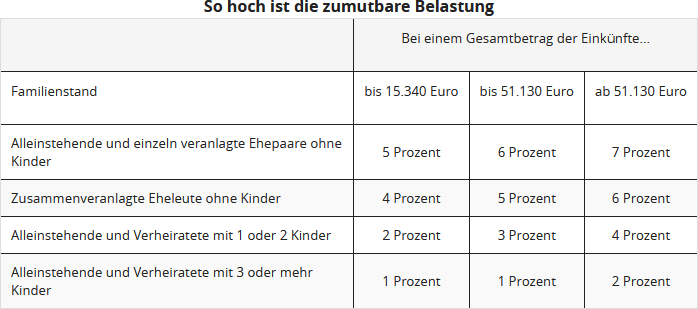

Here you can enter the actual expenses. However, these will not be fully recognised, as your reasonable personal contribution will be deducted. This is based on your income, marital status, and number of children and is calculated by the tax office. The reasonable personal contribution is between one and seven percent of total income. In any case, you should be able to prove the relevant expenses.

If your expenses are below the reasonable personal contribution, it is not worth declaring the costs in the tax return.

Care allowance:

If the care-related expenses are still higher than the care allowance after deducting the personal contribution, enter your care expenses as they actually occurred. However, you must then also be able to prove individually what you spent money on. However, in this way, you can claim more than the care allowance.

Tip

For the tax office, it does not matter when the costs were incurred, but when you paid them. So you should try to consolidate several expense items into one year to increase the total expenses and thus exceed the limit of your reasonable personal contribution.

Is there a large dental bill due, but not until next year? However, if you could already book other expenses under extraordinary burdens for the current year, ask your dentist for an early invoice or a partial invoice. This way, you may be able to claim all expenses that exceed the reasonable burden in the tax return for the current year.

Important

The reasonable burden is only deducted for general extraordinary burdens. Expenses listed under special extraordinary burdens remain uncut.

You can use this table to roughly calculate your reasonable personal contribution:

(2022): To what extent can I claim exceptional expenses?

Who can claim exceptional costs?

Basically, everyone! Anyone with exceptional expenses can claim them in their tax return. This reduces the income tax payable, helping to avoid undue hardship.

If a taxpayer has unavoidable major expenses compared to other taxpayers with similar income, assets, or family status, they can apply to reduce their income tax. To do this, you must enter your exceptional expenses in the tax return.

However, only expenses that exceed a reasonable burden and are actually necessary are considered. The reasonable burden is determined by the taxpayer's income, family status, and number of children.

The percentage is between one and seven per cent of the taxable annual income. If your exceptional expenses exceed this percentage, you can claim the costs in full.

Exceptional expenses can include:

- Funeral costs,

- Care costs, or

- Medical expenses.

However, divorce costs have not been deductible since 2013 due to a change in the law!

In special cases, expenses for maintenance can be considered exceptional expenses. In this case, a reasonable burden is not applied.

The care allowance can be claimed by anyone caring for a close relative. This is an annual amount that is not dependent on a reasonable burden. You will find more detailed information on the individual pages of our tax return about the exceptional expenses you can claim.

Tip

A distinction is made between general and specific exceptional expenses. General exceptional expenses, such as medical and funeral costs, only have a tax-reducing effect once the reasonable personal burden has been exceeded.

Specific exceptional expenses are recognised in full, but usually up to fixed maximum amounts. These include, for example, maintenance for a dependent person or the accommodation of an adult child away from home for education.

(2022): Who can claim exceptional costs?

Can I also claim maintenance payments for my children here?

If you are not entitled to child benefit or allowances for your adult child, you can also claim your maintenance payments for your child in need as extraordinary expenses for the relevant months.

The maximum deductible maintenance amount in 2021 is 9,744 Euro.

(2022): Can I also claim maintenance payments for my children here?

When can legal expenses be deducted?

When it comes to the tax recognition of civil litigation costs, the tax authorities have always been very stingy: such costs were rarely considered "necessary" and were therefore mostly rejected as extraordinary expenses. Only in exceptional cases were such costs recognised, namely when the legal dispute touched on an existentially important area or the core area of human life.

(1) In May 2011, the Federal Fiscal Court abandoned this narrow view and significantly expanded the possibilities for tax deductibility: civil litigation costs should always be considered necessary for legal reasons and thus recognised as extraordinary expenses, regardless of the subject of the litigation, if the legal action or defence has a sufficient chance of success and does not appear frivolous. "Success must be at least as likely as failure" (BFH ruling of 12.5.2011, BStBl. 2011 II p. 1015).

(2) In June 2015, the Federal Fiscal Court abandoned its generous case law for the years before 2013 and no longer adheres to its taxpayer-friendly ruling of 12.5.2011. Now the rule is again: civil litigation costs are generally only considered necessary if the event underlying the litigation is also necessary for the taxpayer. This is generally not the case with a civil litigation, so the litigation costs cannot be deducted as extraordinary expenses (BFH ruling of 18.6.2015, VI R 17/14).

(3) Since 2013, the legislator has overturned the BFH's citizen-friendly ruling and stipulated by law that litigation costs can only be deducted as extraordinary expenses under § 33 EStG - taking into account a reasonable burden - in exceptional cases, "if the taxpayer is at risk of losing their livelihood and being unable to meet their essential needs in the usual manner" (§ 33 para. 2 sentence 4 EStG).

Recently, the Rhineland-Palatinate Finance Court ruled that costs incurred due to legal disputes related to the construction of a home are not tax-deductible as extraordinary expenses (ruling of 7.5.2020, 3 K 2036/19).

Tip: The Münster Finance Court recently ruled that legal costs to obtain post-marital maintenance are deductible as income-related expenses if the maintenance recipient declares the maintenance payments as other income under § 22 no. 1a EStG (FG Münster of 3.12.2019, 1 K 494/18 E).

The case: The claimant and her now ex-husband separated in 2012. Both were involved in family court proceedings concerning the divorce, pension rights adjustment, and post-marital maintenance. In 2014, the marriage was dissolved by a court order, and the claimant's former husband was ordered to make monthly maintenance payments. The woman appealed against the court order for higher monthly payments.

In 2015, a court settlement was reached regarding the maintenance amount. In her 2015 income tax return, the claimant declared other income in the amount of the maintenance payments received and claimed the legal costs (court and legal fees) as tax-reducing. The tax office refused to consider them.

According to the judges, the legal costs should be considered as income-related expenses for the maintenance recipient because she taxed the maintenance payments from her ex-husband under § 22 no. 1a EStG. The woman incurred the legal costs to receive (higher) income in the form of maintenance payments in the future. The maintenance payments are to be treated as taxable income under § 22 no. 1a EStG because the ex-husband, as the payer, had the option to deduct his maintenance payments as special expenses under § 10 para. 1a EStG, known as real splitting. The maintenance payments are thus fully equated with other income. Consequently, a deduction for income-related expenses must also be fully possible.

Lohnsteuer kompakt

Since 2013, civil litigation costs can only be deducted as extraordinary expenses under § 33 EStG - taking into account a reasonable burden - in exceptional cases, "if the taxpayer is at risk of losing their livelihood and being unable to meet their essential needs in the usual manner" (§ 33 para. 2 sentence 4 EStG).

It was previously unclear whether the term "livelihood" only referred to "material" living conditions or whether it also included an "immaterial" basis that affects the core area of human life. This includes, among other things, psychological and ideological living conditions. The love for one's own child and their care are social needs that affect the "immaterial" area of a person.

In any case, the Federal Fiscal Court understands livelihood solely as the material basis of the taxpayer's life. Emotional and social needs are not included. The risk of losing a psychological or ideological livelihood is not covered (BFH ruling of 18.5.2017, VI R 9/16).

According to two finance courts, the terms "livelihood" and "essential needs" should also be interpreted in an immaterial sense. Therefore, legal disputes that arise necessarily and affect the "core area of human life" should also be deductible as extraordinary expenses (FG Düsseldorf of 13.3.2018, 13 K 3024/17 E; FG Munich of 7.5.2018, 7 K 257/17).

Recently, the Federal Fiscal Court has decided the contentious issue: livelihood within the meaning of the law is solely the material basis of the taxpayer's life, not their immaterial livelihood. It is also not constitutionally required to interpret the terms livelihood and essential needs in an immaterial sense. Due to the legal amendment from 2013, disputes affecting a "core area of human life" are no longer tax-deductible (BFH rulings of 13.8.2020, VI R 15/18 and VI R 27/18).

Five negative decisions:

- Visitation rights: Legal costs related to a dispute over a father's visitation rights with his child and the return of the child living with the mother abroad to Germany are not deductible as extraordinary expenses under § 33 EStG, even if they affect a "core area of human life" (BFH ruling of 13.8.2020, VI R 15/18).

- Visitation rights: Legal costs incurred by a mother in a legal dispute to prevent the father's visitation rights with his child are not deductible as extraordinary expenses. The case involved prohibiting the father from visiting the child because only then could the child's welfare be ensured (BFH ruling of 13.8.2020, VI R 27/18).

- Child maintenance: Expenses for a maintenance dispute aimed at obtaining higher maintenance payments for the daughter from the child's father are not deductible as extraordinary expenses if the mother's income situation is sufficient without endangering her existence (BFH ruling of 13.8.2020, VI R 27/18).

- Medical liability case: Expenses for a damages claim against a dentist for alleged treatment errors are not deductible as extraordinary expenses if the damages are not necessary to secure the material livelihood (BFH ruling of 13.8.2020, VI R 27/18).

- The Federal Fiscal Court has recently not recognised the costs of a criminal defence for the adolescent child as extraordinary expenses under § 33 EStG (BFH decision of 11.8.2022, VI R 29/20).

(2022): When can legal expenses be deducted?