What are income-related expenses?

Business expenses include all costs incurred in direct connection with your professional activity. You can claim these costs for tax purposes, provided they have not already been reimbursed tax-free by your employer.

These include, among others:

- Travel expenses to work (commuting allowance)

- Professional association (e.g. union fees)

- Work equipment

- Home office

- Training costs

- Application costs

- Relocation costs

- Double household management

- Travel expenses for off-site work

- Account management fees

- Tax consultancy costs

Important

If you do not claim the business expenses individually, the tax office - and also Lohnsteuer kompakt - will automatically apply a flat rate of 1.200 Euro. If the claimed costs are below the flat rate, the flat rate will also be applied.

(2022): What are income-related expenses?

Which work-related expenses can I claim in the tax return?

If you've never heard the term employment expenses, you might mistakenly think it refers to advertising costs. This is incorrect. Employment expenses are costs incurred by an employee in connection with their employment. Work equipment, work clothing, union fees, and travel expenses are examples of the many employment expenses.

The tax office grants every employee a flat rate for their total employment expenses, the employee allowance. This amount is automatically credited and recognised by the tax office. Employees do not need to provide evidence for employment expenses up to this amount. The current employee allowance is 1.200 Euro.

Employment expenses as an employee (e.g. travel expenses and account management fees) can be entered in the "Employee > Employment expenses" section at Lohnsteuer kompakt.

Travel expenses for commuting to work (commuter allowance)

The commuter allowance is 30 cents per one-way kilometre for the first 20 kilometres and 38 cents from the 21st kilometre (in 2021: 35 cents). The relevant employment expenses for commuting to work are calculated as follows: The one-way distance multiplied by the working days in the tax year and then multiplied by the commuter allowance of 30 cents or 38 cents.

Work equipment

At most tax offices, you can claim costs for work equipment up to a total value of 110 Euro without proof. If you have incurred higher expenses, you should be able to present all receipts upon request from the tax office.

Professional associations

Professional associations are interest groups for a profession (e.g. trade unions, civil service associations, employers' associations) that represent the interests of their members in relation to their professional and business activities. The expenses can be claimed in full as employment expenses.

Application costs

If you applied for a job last year, you incurred costs that you should declare in your tax return. If you cannot provide individual receipts for the expenses incurred, you may also claim application costs as a lump sum. The Cologne Tax Court considers 8.70 Euro for elaborate application folders and 2.70 Euro for simple applications, e.g. via the internet, per application to be reasonable (FG Köln Az: 7 K 932/03).

Travel expenses and additional meal allowances

Unlike commuting to work, every kilometre counts on a business trip (temporary employment, driving activity). The business trip allowance is staggered. The additional meal costs associated with a business trip can be deducted by the employee as employment expenses at a precisely defined rate, the so-called meal allowance.

Double household

If your place of work is far from your home and you need to take a second home for this reason, this is considered a double household. Certain costs incurred as a result can be deducted from your taxes.

>>> Further information on individual employment expenses can be found on our input pages when you process your tax return! <<<

(2022): Which work-related expenses can I claim in the tax return?

How do I claim commuting expenses?

Many people exceed the 1,200 Euro limit (employee allowance) just through their commute. This is due to the commuter allowance. You can claim 30 cents for each kilometre you travel to work (35 cents from the 21st kilometre onwards).

For a distance of 20 kilometres, that's 6 Euro per day. With a five-day week, the tax office assumes 230 working days, so in this example, you would already reach 1,380 Euro. You exceed the 1,200 Euro mark with a commute of just under 15 kilometres. For a six-day week, you can count up to 280 days, for a four-day week up to 190. If you were in the office more often, for example because you didn't take any leave, you must provide credible evidence to the tax office.

Important

For the commuter allowance, the daily commute is only counted once. You cannot add up the outward and return journeys. It is different if you work at various locations. Field staff, temporary workers or other employees with changing work locations can claim 30 cents for each kilometre travelled.

It doesn't matter whether you travel to work by car, bike or public transport. However, there is a maximum amount of 4,500 Euro per year. Only if you use your own car will travel costs above this be recognised. The tax office also does not require you to use the shortest route. If you save significant time on a longer route, you can also state this in your tax return.

Lohnsteuer kompakt

Journeys to work, specifically to the primary workplace, are deductible with the commuter allowance of 30 cents per kilometre; since 2022, 38 cents apply from the 21st kilometre. In principle, every employee is required to state the exact number of days they actually travelled to work in their tax return, as the allowance is only granted for these days. To check whether the number of declared working days is plausible, holiday and sick days must also be declared. Since 2020, business travel days and homeworking days have also been queried.

However, it can be very tedious to determine the exact number of working days. Who keeps a daily tally? And then there are employees who also visit the workplace at weekends, sometimes unexpectedly. Therefore, the tax offices established so-called non-capture limits decades ago. They generally accepted 220 to 230 journeys for a five-day week and 260 to 280 journeys for a six-day week between home and workplace. It should be noted that these are internal limits of the tax offices, and there is no legal entitlement to their application, even though the Munich Tax Court ruled a few years ago that the tax offices should accept 230 days (FG Munich of 12.12.2008, 13 K 4371/07).

So far, so good. But Corona has changed everything. Countless employees were and still are working from home and do not travel to the office or workplace daily. They can claim a flat rate of 5 Euro per day as income-related expenses for these days or even the costs for a home office. However, due to the lack of journeys, they may not claim travel costs. And this is precisely where the tax offices are increasingly focusing, demanding a certificate from the employer stating the actual working days and, above all, the days on which the primary workplace was visited. The rule that 220 or 230 journeys per year are accepted no longer applies without exception for the Corona years!

(2022): How do I claim commuting expenses?

How do you claim expenses for business trips?

If your employer sends you on a business trip (off-site work), they will usually cover the costs. If not, you can claim expenses for travel, accommodation, meals, and possibly additional costs such as parking fees or luggage transport as work-related expenses.

It becomes interesting when business trips are combined with personal leisure, for example, if you do not travel home immediately after a conference but add a few days of personal holiday. In this case, you can claim the travel costs proportionally. If you were on a business trip for two days and on holiday for two days, the tax office accepts 50 percent of the travel costs. If the business portion is significantly higher at 90 percent, you can claim the full costs.

Be careful, the tax office usually wants to see a detailed breakdown of the costs. If your employer paid for the flights and hotel, you must not include these items in your tax return.

Business trip

Even if the company pays the travel expenses, they usually do not cover meals. If you are working off-site for more than 8 hours a day or are engaged in so-called travel work, such as a lorry or bus driver, you can claim a meal allowance. The amount depends on the duration of your absence. For an absence of between 8 and 24 hours, there is a flat rate of 14 Euro, and for longer absences, 28 Euro per day.

Lorry drivers can claim an overnight allowance of 8 Euro per calendar day as work-related expenses - in addition to the "normal" meal allowance. This applies to the day of arrival or departure and each calendar day with a 24-hour absence during off-site work in Germany or abroad (§ 9 Abs. 1 Satz 3 Nr. 5b EStG, introduced by the "Act on Further Tax Promotion of Electric Mobility and Amendment of Other Tax Regulations").

(2022): How do you claim expenses for business trips?

What expenses can be claimed for a second household?

If you need to maintain a second home for work reasons, you can claim the associated costs as part of a dual household. This is possible, for example, if you are transferred, your company relocates, or you start a new job. You can also deduct your expenses if you move for personal reasons but want to keep a home near your workplace. It is not necessarily crucial that the second home is closer to the workplace, but it must be more accessible.

It does not matter whether you live in your own flat, a shared flat, a furnished room, or a hotel. If your primary residence is a room in your parents' house, you are at a disadvantage. It is different if you have your own flat in your parents' house and pay rent for it.

The costs for a dual household are varied: Firstly, there are the expenses for the flat itself, such as rent, utility costs, and possibly renovation expenses or estate agent fees. Then there are expenses for necessary furnishings.

For a dual household in Germany, the actual accommodation expenses can be deducted up to a maximum of 1.000 Euro per month with proof.

In the first three months, you can also claim a meal allowance for each day of absence. This is 28 Euro for each full calendar day. On arrival and departure days (home trips), a meal allowance of 14 Euro each has been granted since 2014, regardless of the length of absence.

An important item is the travel costs for family home trips. Once a week, you can claim the distance allowance of 30 cents per kilometre or 38 cents from the 21st kilometre for the journey between the second home and the main residence. If you use public transport, the actual costs can be deducted with proof, provided they are higher than the distance allowance on an annual basis. If you use a plane or ferry, the actual costs can always be additionally deducted as income-related expenses. If you do not travel home at a weekend, you can claim the costs for a telephone call of up to 15 minutes instead of the home trip. However, this only applies if family members live in your main home.

Note: The Federal Fiscal Court has recently ruled against the tax authorities that the costs for the necessary furnishing of the second home as part of a work-related dual household do not count as accommodation costs, the deduction of which is limited to 1.000 Euro per month. Instead, expenses for furnishings and household items - if necessary - are fully deductible as other necessary additional expenses due to a dual household in accordance with § 9 para. 1 sentence 3 no. 5 EStG (BFH ruling of 4.4.2019, VI R 18/17).

Lohnsteuer kompakt

Currently, the tax authorities have announced a welcome simplification rule: If the purchase costs for the furnishings and equipment of the second home - excluding work equipment - do not exceed a total of 5.000 Euro including VAT, it is assumed for simplification purposes that these costs are considered "necessary" or not excessive and are recognised as income-related expenses without further examination (BMF letter of 25.11.2020, BStBl 2020 I p. 1228, para. 108).

(2022): What expenses can be claimed for a second household?

Which relocation expenses can you deduct?

Whether you acquire a second home at your place of work or move with your family, if your relocation is for professional reasons, the associated costs are deductible as work-related expenses. You do not need to change jobs or cities; it is sufficient if your daily commute is reduced by a total of one hour due to the move.

You can deduct proven costs for property searches, removals, cosmetic repairs, and possibly double rent payments until the end of the notice period for your old home. For moving trips with your own car, you can claim the kilometres travelled at a rate of 30 cents/km.

For smaller expenses such as tips for removal helpers or the installation of a fitted kitchen, there is a relocation allowance. You can claim this in any case, even if you managed the entire move on your own. This is not possible for dual housekeeping.

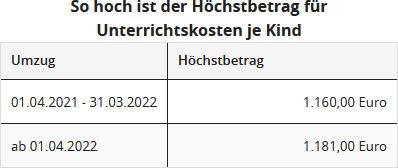

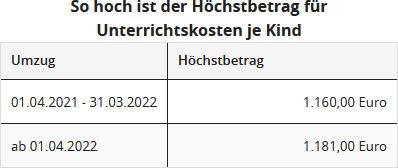

The Federal Ministry of Finance has recently increased the relocation allowances as of 1 April 2022. Since 1 June 2020, relocation allowances have been calculated slightly differently than before:

The day before the removal goods are loaded is decisive for determining the allowances.

If tutoring is required for children due to the move, you can also deduct these costs from your taxes.

(2022): Which relocation expenses can you deduct?

Do you also claim expenses for work equipment?

Many items that you purchase for your job can be deducted from your taxes.

Professional books, software, or work clothing can be considered work-related items, as can computers, printers, or smartphones. However, work-related items are fully deductible only if they are used almost exclusively for work. This does not mean you cannot send a personal email from your work laptop, but the private usage should not exceed ten per cent. Otherwise, you can at least claim part of the costs. If you use your smartphone equally for work and private calls, you can claim 50 per cent of the purchase price.

The same applies to the desk where you handle both work and private matters. If the price including VAT is up to 800 Euro net, it is considered a "low-value asset". This is beneficial for you, as you can fully deduct the purchase price as business expenses in the year of purchase. For more expensive items, the costs are spread over the entire period of use and must be depreciated annually. The so-called depreciation tables provide further details.

The issue of work clothing is critical. Uniforms that you pay for yourself but can only wear at your workplace are deductible, and you can also claim the cleaning costs – even if you clean the clothes at home in the washing machine. However, for normal suits or costumes, the tax office assumes that they are not work-specific. Even if you usually wear jeans, you cannot deduct your office outfit.

Lohnsteuer kompakt

Retroactively from 1 January 2021, there is a particularly advantageous new regulation for computers of all kinds and for software: The Federal Ministry of Finance has very generously stipulated that the standard service life is generally one year. This means that the acquisition costs can now always be fully deducted as business expenses in the year of purchase, regardless of the amount (BMF letter of 26 February 2021, IV C 3-S 2190/21/10002:013).

(2022): Do you also claim expenses for work equipment?

What costs for a home office can be deducted?

Work and private life are not always strictly separated: If you work regularly or always from home, you can deduct the cost of a home office from your taxes. Provided you have one, as a desk or work area only separated by a room divider does not qualify as a separate office. If you occasionally work from home instead of going to the office, you cannot claim this.

Urteil: Raumteiler begründet kein Arbeitszimmer

The Federal Fiscal Court (BFH) had to decide whether a room divider is sufficient to establish a "home office". The case: A self-employed architect had separated an area in the living room with a sideboard. He used this area almost exclusively for business purposes. He believed that a sideboard was enough to equate the separated area with a home office. The case eventually went to the BFH.

The judges disagreed. A home office must be separated from the rest of the flat by walls and doors. It must also be used mainly for business purposes (BFH ruling of 22.3.2016, Ref. VIII R 10/12).

The situation is different if your employer does not provide you with a permanent workplace. This applies, for example, to field staff or teachers who do not usually have their own office at school. You can claim up to 1.250 Euro per year. If the home office is the centre of your professional activity, you can also claim the full costs.

Recognised costs include proportional rent as well as operating costs, such as electricity and heating, insurance or cleaning. If you have had expenses for room furnishings, such as a new carpet, desk or office chair, you can also fully deduct these.

If you declare a room as an office, it must be a purely work-related room. Anything that indicates private use, such as a guest bed, TV or wardrobe, will make the tax office sceptical – if they check.

(2022): What costs for a home office can be deducted?

Can I also claim job application expenses?

Employment expenses are incurred not only when you have a job but also when you are looking for one. All expenses related to job hunting can be claimed in your tax return.

This includes office supplies and postage as well as job advertisements, photos, or application training. If you do not wish to itemise all application costs, you can simply claim an allowance of 2.50 Euro for each electronic application, and 8.50 Euro for a traditional application folder.

You can also claim travel to job interviews, either with the ticket price paid or at 30 cents per kilometre if you use your own car. If you need to book a hotel, you can also deduct this, as well as the meal allowance.

(2022): Can I also claim job application expenses?

What other work-related expenses are there?

Some items can be claimed at a flat rate without proof: If you use your private mobile phone or landline for work, you can claim 20 percent of the phone bill – but there's a limit of 20 Euro per month. The same applies to the internet connection. If you pay 30 Euro for a flat rate, you can claim 6 Euro per month.

For the current account where your salary is paid, you can claim a flat rate of 16 Euro for account management fees.

Finally, you can also claim tax advisory costs as work-related expenses – but only those related to your employment. If your tax advisor handles the "Anlage Kind" or the main form, this is not deductible. An exception applies to tax advisory costs up to 100 Euro. They do not need to be itemised. If you use tax software, you can claim the purchase price in full as work-related expenses.

(2022): What other work-related expenses are there?