Caution: Household services are not always deductible

Costs that you have already declared as income-related expenses, business expenses, special expenses, or extraordinary expenses in your tax return cannot also be deducted as household-related services.

You cannot choose how to deduct the costs. If the costs are considered income-related expenses or special expenses, they must be declared as such, the same applies to extraordinary expenses. This applies, for example, to childcare costs, which cannot be deducted as household-related services, even if the maximum amount for childcare costs has already been exceeded.

Also, personal services, such as for a hairdresser or cosmetic treatment, are not considered household-related services, even if they take place in your home.

However, you can declare services listed in the care insurance service catalogue.

Not eligible are works that are not carried out in your private household, for example, if you take your laundry to a dry cleaner.

Craftsman services for which you receive insurance payments (for example, from household or building insurance) cannot be claimed in the tax return. Any insurance payments you receive later must also be included.

There is also no tax deduction for household-related services that do not take place in your private household. This includes, for example, the cleaning of an external office, a second home, or your company. Such expenses are considered business expenses or income-related expenses. However, costs for a cleaner who works both in a home office and in your private home can be proportionately divided. The business part is considered business expenses or income-related expenses, the private part as household-related services.

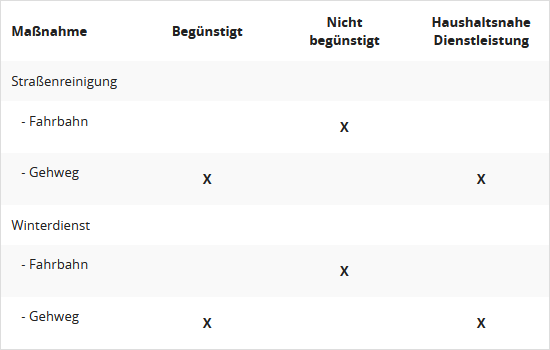

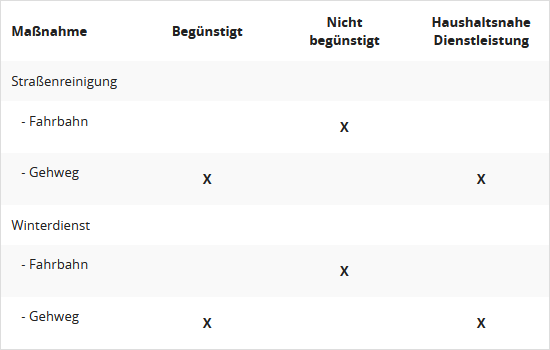

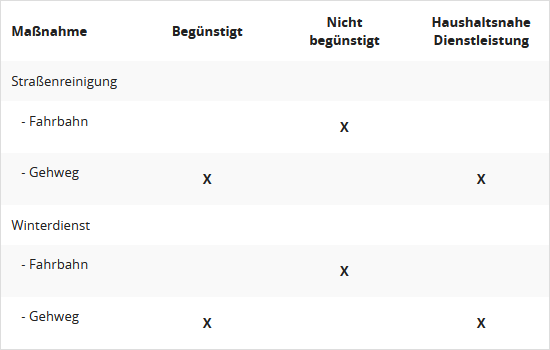

If household-related services are carried out both on private property and on public land, this activity is entirely tax-favoured according to a BFH ruling. This applies, for example, to snow clearing on public pavements, but not on public roads. The costs for winter services in front of your own property are therefore deductible at 20 percent from the tax liability (BFH ruling of 20.3.2014, VI R 55/12).

However, in 2020, the BFH ruled that expenses for street cleaning in front of the property are not tax-favoured as a household-related service according to § 35a para. 2 sentence 1 EStG (BFH ruling of 13.5.2020, VI R 4/18).

Recently, the Federal Ministry of Finance published the following overview regarding the BFH's case law (BMF letter of 1.9.2021, IV C 8 - S 2296-b/21/10002 :001):

TABLE TABLE TABLE TABLE TABLE TABLE

Furthermore, the BMF states: For craftsman services provided by public authorities that benefit not only individual households but all households involved in the public measures, a benefit under § 35a EStG is excluded. There is no spatial-functional connection between the craftsman services and the household of the individual property owner. This applies, for example, to the expansion of the general supply network or the development of a road. This position corresponds to the BFH ruling of 28.4.2020 (VI R 50/17).

(2022): Caution: Household services are not always deductible

Can I also claim the tax reduction as a tenant?

Yes, because you do not need to own the flat to claim the expenses.

Taxpayers who wish to claim tax reductions for household-related services or tradesmen's services do not need to be the client of the measure carried out. Therefore, tenants can also claim costs for services commissioned by the landlord and paid by them as part of the service charges.

If the landlord has commissioned household-related services and tradesmen's services, tenants can claim the amounts paid for service charges as a tax reduction, also within the specified maximum amounts.

With the service charge statement for the flat, you can save a significant amount of tax, as many items can reduce the tax burden as household-related services or tradesmen's services. For service charges, this mainly concerns the items

- Garden maintenance

- House cleaning

- Caretaker activities

- Chimney sweep fees

- Lift maintenance.

Important

To claim their entitlement with the tax office, the tenant needs a certificate from the landlord containing the required information. The "normal" service charge statement usually does not contain the necessary information. The tenant is entitled to receive such a certificate.

Note: If you are renting, you can also claim tax benefits for household-related employment or tradesmen's services if these were commissioned by you and carried out in your flat.

(2022): Can I also claim the tax reduction as a tenant?

Home office: correctly deduct costs for shared use

If you share a home office with your working spouse, civil partner or partner, it is often unclear who can claim which expenses for tax purposes and to what extent. It is clear that the home office costs must first be calculated and allocated to the two users according to the usage ratio.

Next, the personal deduction entitlement must be checked:

- If the home office is the centre of one spouse's entire professional activity, they can deduct their share of the costs in full as business expenses.

- If a spouse uses the home office because no other workplace is available, their share of the costs is only deductible up to the proportional maximum amount of 1.250 Euro. With a 50% usage share, this means up to 625 Euro.

Since 2005, the tax authorities have applied the deduction restriction for the home office on an "object-related" basis. This means that the home office costs can only be deducted once up to 1.250 Euro, regardless of the number of users. So if a couple of teachers share a home office, each cannot deduct the costs up to 1.250 Euro; instead, this maximum amount must be divided according to the usage ratio. It must be checked whether each person meets the personal deduction requirements.

New deduction conditions for shared use

The Federal Fiscal Court has now changed its previous legal opinion and that of the tax authorities in favour of taxpayers: If two people share a home office and each meets the personal deduction requirements (no other workplace), each can deduct their expenses for this up to the maximum amount of 1.250 Euro as business expenses. In future, therefore, the "object-related" view will no longer apply, but a "person-related" view, so that each user can deduct their share of the costs either up to 1.250 Euro, in unlimited amounts or not at all (BFH rulings of 15.12.2016, VI R 53/12 and VI R 86/13).

(2022): Home office: correctly deduct costs for shared use

Pet care is also eligible as a household-related service!

Expenses for household-related services can be deducted directly from the tax liability at 20%, up to a maximum of 4.000 Euro per year (§ 35a para. 2 EStG). Eligible services include the care and support of persons in need of care by outpatient care services or self-employed carers, as well as childcare by self-employed childminders or au pairs in the client's household.

The question is whether pet care is considered a household-related service and whether the corresponding costs are tax-deductible. In any case, the tax authorities clearly reject the tax benefit. The new BMF decree from 2014 states that pet care, grooming, and veterinary costs are not tax-privileged (BMF letter dated 10.1.2014, BStBl. 2014 I p. 75, Annex 1).

Currently, the Federal Fiscal Court has ruled against the tax authorities, stating that the care and supervision of a pet is a household-related service, as pet care has a close connection to the household management of the owner. Therefore, the expenses are tax-privileged according to § 35a EStG (BFH ruling of 3.9.2015, VI R 13/15).

The case: The couple keep a house cat in their flat. During their absence, they hired a pet and house sitter to care for the animal, who charged them 12 EUR per day, totalling 302.90 Euro for the year. The tax office rejected a tax reduction, referring to the above-mentioned BMF letter.

According to the BFH judges, "household-related services" include domestic tasks that are usually carried out by members of the private household or employed persons and occur at regular intervals. Thus, the care and supervision of a pet taken into the household is a household-related service. "Activities such as feeding, grooming, walking, and other pet-related cleaning tasks occur regularly and are typically carried out by the taxpayer or other household members." These are therefore part of the owner's household management.

Lohnsteuer kompakt

However, the costs for pet care and supervision - including travel costs - are only deductible if the care takes place in the household or on the property. There is no tax benefit if the pet is picked up from the home and returned after care (e.g. dog walkers) (see FG Münster of 25.5.2012, 14 K 2289/11).

The BFH has clarified that at least "walking" the pet outside the home is not detrimental to the tax benefit. After all, the tax authorities also grant the tax bonus for "accompanying children, sick, elderly or dependent persons on shopping trips and doctor visits, as well as for small errands" by a domestic help outside the home (BMF letter dated 10.1.2014, BStBl. 2014 I p. 75, para. 13).

Recently, the Berlin-Brandenburg Fiscal Court confirmed the negative view on all-day dog care services (dog sitters) (judgment of 7.11.2018, 7 K 7101/16). In this case, the dog sitter picked up the plaintiffs' dog daily from their home for a walk with other dogs. In the afternoon, the dog was returned to the plaintiffs' home. In between, the dog was driven around in the car or cared for on the dog sitter's premises. This arrangement of dog care is no longer comparable to dog care provided by household members. Household members would not leave the home with a dog for a walk and only return in the afternoon.

(2022): Pet care is also eligible as a household-related service!

Which expenses are eligible?

Eligible expenses include gross wages or earnings (for "mini-jobs") and the social security contributions paid by the employer, wage tax including the solidarity surcharge and church tax, accident insurance contributions, and levies under the Expense Reimbursement Act (U 1 and U 2).

(2022): Which expenses are eligible?

Which measures are subsidised and what is the amount of the tax reduction?

As part of household-related services, the work must have been carried out by a self-employed service provider or service agency. Eligible services include, for example:

- cleaning the flat, window cleaning, cleaning the stairwell and other communal areas,

- garden maintenance (e.g. mowing the lawn, trimming hedges),

- services for private moves (minus reimbursements from third parties).

An exemplary list of eligible and non-eligible household-related services and tradesmen's services can also be found in the BMF letter dated 11.09.2016.

The expenses for household-related services provided by self-employed service providers are directly deductible from the tax liability, up to 20.000 Euro with 20 percent, maximum 4.000 Euro per year.

In principle, a prerequisite for the deduction of costs is that they are related to your own household. However, various activities are carried out both on private property and on public land, or they benefit the private household at least indirectly, even if they primarily concern the public area. This includes, for example, cleaning pavements or snow removal.

- In 2014, the Federal Fiscal Court ruled that snow removal on public pavements is considered a privileged household-related activity. The costs for winter services in front of your own property are therefore deductible at 20 percent from the tax liability (BFH ruling of 20.3.2014, VI R 55/12). According to the BFH judges, services are related to the household if they are provided "in the spatial area of the existing household". This includes the flat as well as the associated land. Therefore, the term "household" is to be interpreted spatially-functionally.

- In 2020, however, the BFH ruled that expenses for street cleaning in front of the property are not tax-privileged as household-related services according to § 35a para. 2 sentence 1 EStG (BFH ruling of 13.5.2020, VI R 4/18).

- Currently, the Federal Ministry of Finance has published the following small overview in line with the BFH (BMF letter dated 1.9.2021, IV C 8 - S 2296-b/21/10002 :001):

In principle, a prerequisite for the deduction of costs is that they are related to your own household. However, various activities are carried out both on private property and on public land, or they benefit the private household at least indirectly, even if they primarily concern the public area. This includes, for example, cleaning pavements or snow removal.

- In 2014, the Federal Fiscal Court ruled that snow removal on public pavements is considered a privileged household-related activity. The costs for winter services in front of your own property are therefore deductible at 20 percent from the tax liability (BFH ruling of 20.3.2014, VI R 55/12). According to the BFH judges, services are related to the household if they are provided "in the spatial area of the existing household". This includes the flat as well as the associated land. Therefore, the term "household" is to be interpreted spatially-functionally.

- In 2020, however, the BFH ruled that expenses for street cleaning in front of the property are not tax-privileged as household-related services according to § 35a para. 2 sentence 1 EStG (BFH ruling of 13.5.2020, VI R 4/18).

- Currently, the Federal Ministry of Finance has published the following small overview in line with the BFH (BMF letter dated 1.9.2021, IV C 8 - S 2296-b/21/10002 :001):

Tipp

Currently, the Federal Fiscal Court has denied the tax reduction under § 35a EStG for static calculations by a structural engineer. This also applies if the static calculation was necessary for the execution of a tradesman's service (BFH ruling of 4.11.2021, VI R 29/19).

Müllabfuhrgebühren

Note: The costs for waste collection are currently not considered as household-related services in the tax return. The tax authorities rely on an old ruling by the Cologne Finance Court dated 26.1.2011 (4 K 1483/10, EFG 2011 p. 978 no. 11). The reasoning is that the main service is not performed within the property boundaries of the taxpayers. The actual service is not the collection of the waste, but its subsequent disposal and recycling. The emptying and transport of the waste are merely ancillary services. Currently, the Münster Finance Court has confirmed this view, but has expressly allowed an appeal, which is already pending (ruling of 24.2.2022, 6 K 1946/21 E, appeal under VI R 8/22).

(2022): Which measures are subsidised and what is the amount of the tax reduction?

Requirements for all tax reductions

The service must have been performed in the taxpayer's household. This condition is not met, for example, in the case of

- care and support for sick, elderly, and dependent persons in a day care facility,

- repair of household items at the repair company's premises,

- waste collection (the processing or disposal of waste takes place outside the household)

The household must be located in the European Union or the European Economic Area. If the taxpayer's expenses relate to several households (e.g. main residence and holiday home), the maximum amount is deductible only once in total.

Not eligible are expenses that have already been taken into account for tax reduction under other provisions of the Income Tax Act as business expenses, income-related expenses, special expenses, or extraordinary burdens.

Special feature for apartment owners: Apartment owners who use their apartment themselves receive the tax reduction even if the community or the administrator is the employer or client. This is done proportionally according to their co-ownership share.

Müllabfuhrgebühren

The costs for waste collection are currently not considered as household-related services in the tax return. The tax authorities rely on an old ruling by the Cologne Fiscal Court dated 26.1.2011 (4 K 1483/10, EFG 2011 p. 978 no. 11).

The reasoning is said to be that the main service is not performed within the property boundaries of the taxpayers. The actual service is not the collection of the waste, but its subsequent disposal and processing. The emptying and transport of the waste are merely ancillary services. The Münster Fiscal Court has currently confirmed this view but has explicitly allowed an appeal, which is already pending (judgment of 24.2.2022, 6 K 1946/21 E, appeal under VI R 8/22).

(2022): Requirements for all tax reductions

What evidence is required?

To receive the tax reduction, you must observe one condition:

You must obtain an invoice from the service provider as proof of expenditure, and you may only pay this invoice by bank transfer to their account. Ensure that the invoice separates labour and material costs. Only labour costs, as well as machine and travel costs including the VAT on them, are eligible for tax benefits. However, VAT does not need to be shown separately; you may add it to the labour costs.

It is not necessary to attach the bank statement to the tax return. However, in case of doubt, the tax officer may request it. Amounts paid by standing order, direct debit, or online banking are recognised in conjunction with the bank statement. Cash payments are not recognised.

The condition of bank transfer still applies. Invoices paid in cash will not be recognised.

Household-related services also include home care and support for persons in need of care by mobile care services or self-employed carers. Since 2009, it is no longer necessary to prove the need for care and a care level (until 2016) or a care grade (from 2017).

Fehlende Bescheinigung 2022: Kein Problem!

If you do not yet have a current service charge statement or a separate certificate according to § 35 a EStG for 2022 from your property management, this is not a problem. It is permissible to claim the total expenses for the tax year in which the statement is received by the tenant. You therefore take the most recent service charge statement you have – presumably from 2021 – and claim these costs in the tax year 2022. All tenants and property owners who have not yet received the current certificate according to § 35 a EStG for 2022 can proceed in this way!

All private individuals who have commissioned craftsmen or service providers claim the expenses in the tax year in which they paid the corresponding invoice themselves.

Tipp

In 2019, the Federal Fiscal Court unfortunately ruled against the generous stance of the tax authorities that the tax reduction according to § 35a EStG is only granted for expenses incurred by a taxpayer for their own accommodation in a home or for their own care. However, the tax benefit is excluded for expenses incurred for another person, i.e. when children cover the costs for their parents (BFH ruling of 3.4.2019, VI R 19/17).

A few months after the BFH ruling, the Berlin-Brandenburg Fiscal Court also dealt with the assumption of care costs for a parent. This time, however, it was not about covering the costs for inpatient care, i.e. accommodation in a home, but about covering the costs for outpatient care. The FG ruled as follows: § 35a EStG favours - if at all - only expenses for the outpatient care of relatives in the taxpayer's own household (i.e. the carer's), not for the outpatient care of relatives in their household (BFH ruling of 11.12.2019, 3 K 3210/19). However, a revision was explicitly allowed at that time. And now the positive BFH ruling is available.

Currently, the Federal Fiscal Court has ruled as follows: The tax reduction according to § 35a para. 2 sentence 2 first half-sentence EStG can also be claimed by taxpayers who incur expenses for the outpatient care and support of a third party. Consequently, children can deduct the costs for outpatient care of their parents if they have borne the costs. This also applies if the care and support services are not provided in the taxpayer's own household but in the household of the person being cared for or supported (BFH ruling of 12.4.2022, VI R 2/20).

However, the BFH also complicates matters, as it upholds its above-mentioned ruling from 2019. It distinguishes between covering the costs for inpatient care (= still not deductible) and covering the costs for outpatient care (= deductible), where in the second case it depends on who concluded the care contract. Only if the payer, usually daughter or son, is contractually obliged, i.e. pays for their own debt, are the costs deductible. However, if payment is made for the debt of the person being cared for, i.e. father or mother, because they concluded the care contract, it is a tax-irrelevant third-party expense.

(2022): What evidence is required?

Is a separate work corner also tax-deductible?

Following a landmark ruling by the Federal Fiscal Court, a home office is not recognised for tax purposes if the room is also used privately. The room costs cannot be divided into a business and private share and then considered based on the business usage share. Therefore, a work corner in the living room or bedroom does not qualify for a partial deduction of work-related expenses, nor does a room used occasionally for work (BFH ruling of 27.7.2015, GrS 1/14).

Building on this, the Federal Fiscal Court clarified that a study or office is not deductible if the work area is separated and the other part of the room is used privately (BFH ruling of 17.2.2016, X R 32/11).

The case: A business owner uses a room in his house for his office work. Part of this room is equipped with a desk and office shelves. In the other part of this room, separated by a shelf, there is a sofa, a coffee table, as well as a dining table with several chairs and a television. As there is private use, the office costs are not deductible as business expenses, even partially.

The separation is not sufficient to create two rooms from a single room. Moreover, the term "study" implies that the room is used exclusively or almost exclusively for income-generating purposes. Therefore, a partial deduction of expenses for mixed-use rooms is already excluded for this reason.

Lohnsteuer kompakt

The COVID-19 pandemic has changed the working world. Many employees, but also self-employed individuals, now carry out their work from home (home office). However, they do not always have a separate room that is accepted as a study for tax purposes. Normally, expenses for a home office are only recognised as work-related expenses or business expenses if this room is separate in the home and used exclusively or almost exclusively for professional or business purposes. However, even those who do not have a separate room incur expenses for heating, electricity, or water due to their work at home.

And now they also receive tax relief: Employees and self-employed individuals who work from home and whose workspace does not meet the tax requirements for a study can claim a flat rate of 5 Euro per day as work-related expenses or business expenses. A maximum of 600 Euro per year is deductible.

(2022): Is a separate work corner also tax-deductible?

If you use the home office for two types of income!

If you use the home office for multiple activities across different types of income, the deductibility of the office costs must be checked separately for each type of income.

- First, check for each activity for which you use the home office whether an "alternative workplace" is available or whether the home office is the "centre" of the respective activity.

- Then determine the proportion of time you use the home office for each type of income, e.g. 50% for self-employment and 50% for employment.

- Next, allocate the home office costs according to the proportion of use, regardless of whether the expenses are deductible for this type of income. For example, for self-employment, 50% of the costs are deductible up to 1.250 Euro if "no other workplace is available", or even unlimited if the home office is the "centre of activity". The other 50% of the costs are not deductible for employment because another workplace is available at the employer's premises.

- The question is whether in this case the maximum deduction amount must also be divided, so that for self-employment the 50% cost share is only recognised up to 625 Euro, or whether it is deductible up to 1.250 Euro.

Currently, the Federal Fiscal Court has ruled that the statutory maximum amount of 1.250 Euro is not to be divided. "A division of the maximum amount by creating partial maximum amounts for the different types of income is not permitted." Thus, if the home office is used for both employment and self-employment, the corresponding share of the home office costs can be deducted as business expenses up to 1.250 Euro - and not just 625 Euro (BFH ruling of 25.4.2017, VIII R 52/13).

Example

Mr Schmitt is a civil servant with a fixed workplace. He uses the home office for his main job for about 3 hours a week and also for about 6 hours for a part-time self-employed writing activity. The home office costs amount to 3.000 Euro per year.

Costs of 2.000 Euro (2/3) are attributable to the part-time job, which are deductible up to 1.250 Euro. The cost share of 1.000 Euro (1/3) for the main job is not recognised.

(2022): If you use the home office for two types of income!

What is the amount of the tax reduction?

If the domestic help is employed in a regular employment relationship and you pay normal contributions to statutory social insurance, you are entitled to an exceptionally high tax reduction.

Expenses are deductible from the tax liability up to 20.000 Euro at 20 percent, maximum 4.000 Euro per year.

If the employment relationship does not exist for the entire year, the maximum amount of 4.000 Euro is not reduced by one twelfth for each full calendar month in which the conditions are not met.

(2022): What is the amount of the tax reduction?

Office costs: Double maximum amount for two people?

Since 2005, the tax authorities have applied the deduction restriction for home offices on an object-related basis. This means that the home office costs can only be deducted once up to 1.250 Euro, regardless of the number of users. So, if a couple of teachers share a home office, each cannot deduct costs up to 1,250 Euro; instead, this maximum amount must be divided according to the usage ratio.

It must be checked whether each person meets the personal deduction requirements. The argument against a doubling or multiplication of the maximum amount is that the room costs are not higher with multiple users than with use by just one person (BMF letter dated 2.3.2011, BStBl. 2011 I p. 195, para. 21). According to previous legal regulations, a couple of teachers using two small rooms of 14 sqm each as home offices could deduct the costs twice up to 1.250 Euro as business expenses. However, if the couple uses one room of 28 sqm together, the costs can only be deducted once up to 1,250 Euro, i.e. each spouse can only deduct 625 Euro as business expenses. This seems unfair.

Currently, the Federal Fiscal Court has changed its previous legal opinion and that of the tax authorities in favour of taxpayers: If two people share a home office and each meets the personal deduction requirements (no other workplace), each can deduct their expenses up to the maximum amount of 1.250 Euro as business expenses or operating costs. Thus, the "object-related" view no longer applies, but a "person-related" view, so each user can deduct their cost share either up to 1.250 Euro, unlimited or not at all (BFH rulings of 15.12.2016, VI R 53/12 and VI R 86/13).

- The BFH judges have obviously looked at the law correctly for the first time and found that "the wording does not provide a basis for reducing the deduction amount of 1.250 Euro for the taxpayer (proportionately) because another taxpayer also uses the home office exclusively for business or professional activities. The law does not provide for a division of the deduction amount among several taxpayers in the case of joint use of a home office." The wording of the law does not indicate that the taxpayer should only be entitled to the deduction amount of 1.250 Euro in full if they use the home office alone. There are no indications that an exception to individual taxation should be made when considering costs for a professionally used home office. Aha!

- If spouses share a home office with joint ownership, the costs are generally allocated half to each spouse. If both meet the conditions for the limited deduction, each is entitled to a deduction of up to 1.250 Euro. The same applies to a jointly rented flat by spouses or partners. The rent payments are then considered to be made on behalf of each spouse/partner. The actual usage of the home office is therefore not relevant.

- The case: A couple of teachers share the home office in their family house. The costs amount to 3,000 Euro, so each has a share of 1,500 Euro. The tax office and the tax court recognise the costs in total with 1,250 Euro and consider a share of 625 Euro as business expenses for each spouse. However, the BFH now accepts a cost share of 1,250 Euro for each spouse.

Example

The Steuerle couple share a home office in their own home. For Mrs Steuerle, it is the professional centre of her work, while Mr Steuerle uses it for a secondary job. The home office costs amount to 10.000 Euro in total, which are allocated half to each.

Mrs Steuerle can fully deduct her cost share of 5.000 Euro as business expenses or operating costs. For Mr Steuerle, the deduction limit of 1,250 Euro applies. Previously, due to the object-related application, his cost share of 5.000 Euro was only recognised with 625 Euro (half of 1.250 Euro). According to the new legal situation, 1.250 Euro are deductible.

By the way: The previous object-related application of the maximum deduction amount is also illogical for another reason: If you use two home offices at two different locations, e.g. at your place of residence and at an external place of work, the costs are only deductible up to 1.250 Euro in total. The same applies if you change the home office during the year or set up another room as a home office. This is then again a person-related application, isn't it?

(2022): Office costs: Double maximum amount for two people?

Are the costs for waste collection also included in the eligible expenses?

Although the waste is generated in the household and collected from there, the actual service provided by the waste collection is not the emptying of the bins, but the transport and disposal or recycling of the waste.

This takes place outside the taxpayer's household and is therefore not eligible for benefits.

(2022): Are the costs for waste collection also included in the eligible expenses?

Can I deduct the costs for a tradesperson in addition to the costs for my cleaner?

Yes, you can claim the invoice for craftsmen's services (wages) and the wages for your domestic help simultaneously in the tax return. In addition to the wages for domestic help, you can also deduct the wages for craftsmen up to 6.000 Euro at 20 percent, a maximum of 1.200 Euro per year, directly from the tax liability.

Tax benefits apply not only to regular renovation work but also to one-off maintenance and modernisation measures - and not just in the flat, but also on the property. The benefits apply not only to work that could usually be done by household members but also to work that can only be carried out by professionals, e.g. repairing a washing machine. The important thing is that the repair of the machine takes place in your household.

(2022): Can I deduct the costs for a tradesperson in addition to the costs for my cleaner?

What is the difference between employment and services?

A household-based employment relationship exists if you or the homeowners' association have employed someone to carry out household-related activities for the homeowners' association. The homeowners' association is the employer of this person.

A household-based service exists if household-related activities are carried out by a company. The homeowners' association is the client of the service.

(2022): What is the difference between employment and services?

When is employment in a private household subject to social insurance contributions?

There can be various reasons for employment subject to social insurance contributions for a domestic help:

- Wages over 520 Euro/month

- Multiple mini-jobs with total wages over 450 Euro/month or 520 Euro/month (from 1.10.2022).

In principle, there are no special features for the taxation and social contributions of household-related wages. As in the commercial sector, the employer must withhold income tax according to the employee's electronic income tax deduction characteristics (ELStAM) and pay it to the tax office.

If you employ a domestic help subject to social insurance contributions or a self-employed service provider, you can claim 20 percent of the costs, up to a maximum of 4.000 Euro per year. This also applies to care and support services for a dependent relative.

Example

If you have registered a domestic help subject to social insurance contributions, the tax office will deduct 20 percent of the annual expenditure of 12.000 Euro from the tax liability, i.e. 2.400 Euro.

(2022): When is employment in a private household subject to social insurance contributions?

What additional levies are incurred on top of earnings?

For a household help in minor employment, the employer must pay a flat rate of 12% on the wages, consisting of 5% each for statutory pension and health insurance, and 2% for tax. Additionally, the following contributions are payable in 2019:

- U1 levy for sickness and convalescence expenses: 0.9%

- U2 levy for maternity expenses: 0.29%

- Contribution to statutory accident insurance of 1.6% of wages.

- Private households do not have to pay the U3 levy for insolvency payments.

For household employees in minor employment, the private employer must use the so-called household cheque. The household cheque offers you significant relief - which you must use! And only by using the household cheque procedure can you benefit from the tax reduction under § 35a EStG. With the household cheque, you can easily register your household help in minor employment with the Minijob Centre (Deutsche Rentenversicherung Knappschaft-Bahn-See) and at the same time grant a direct debit authorisation for the deduction of social contributions.

The Minijob Centre will issue an employer's business number if not already available, calculate the additional costs (flat rate, levies, accident insurance) and debit the total amount from your account twice a year by direct debit: for the first half of the year on 31 July and for the second half of the year on 31 January of the following year.

(2022): What additional levies are incurred on top of earnings?

Home-related services: Are costs for emergency call systems tax-privileged?

In its new directive, the tax authorities have specified when the costs for an emergency call system are considered a household-related service. Household-related services also include care and support services. The tax benefit can also be claimed by people living in a retirement home, nursing home, or residential care facility. Expenses for household-related services are generally deductible from the tax liability up to 20.000 Euro at 20%, maximum 4.000 Euro per year (§ 35a para. 2 EStG).

A privileged form is assisted living in a retirement residence in a private apartment. In assisted living, the provider offers a package of general support services in addition to accommodation through a so-called care contract, including help and support in emergencies. A care fee is usually payable for this emergency call system, even if no services are used.

The question is whether the care fee can be claimed for the tax benefit according to § 35a EStG.

Currently, the tax authorities state in their new directive when a tax reduction according to § 35a EStG can be granted for the costs of an emergency call system - and make a small but significant distinction (BMF directive of 9.11.2016, para. 11):

- Tax-favoured are the costs for an emergency call system if the on-call service is provided as part of "assisted living" in a retirement home. The care fee can thus be deducted directly from the tax liability at 20%.

- Not tax-favoured are the costs for an emergency call system outside of "assisted living" in a retirement home.

Since the care fee includes the provision of a 24-hour on-call service, emergency assistance, household support in case of illness, and care in the event of a short-term illness, these services are comparable to "household help". The mere provision of the services constitutes a household-related service.

The on-call service ensures that a resident who is in the spatial area of their household can receive help in an emergency. Such an on-call service is typically provided by family members living together in a household. Therefore, these are "household-related services". These are also provided in the household of the elderly. It is irrelevant that the emergency call centre is located outside the household (BFH ruling of 3.9.2015, VI R 18/14).

Note:

For the tax benefit, a contract for the provision of household-related services is sufficient. It does not depend on the actual use of the services. The certainty of receiving immediate help in an emergency gives older citizens a high sense of security. Thus, the 24-hour emergency call and the provision of services for the care of elderly people are valuable services, and the costs in the form of a flat rate are tax-deductible.

The Berlin-Brandenburg Finance Court ruled on 13.09.2017 (7 K 7128/17) as follows: Flat fees for connection to an emergency call centre located outside the property at a security company for the event of a burglary/robbery, fire, or gas leak in the taxpayer's home are not tax-favoured as household-related services if the emergency call centre is not even near the taxpayer's household and there is therefore no required direct spatial connection between the place of service and the household.

Lohnsteuer kompakt

Currently: the Baden-Württemberg Finance Court also ruled against the tax authorities that the costs for an emergency call system are tax-favoured even if the elderly live alone in their household. They may also deduct the costs as household-related services according to § 35a para. 2 EStG at 20% directly from the tax liability. Since household members usually call for help when needed, the emergency call system replaces household monitoring for those living alone (FG Baden-Württemberg of 11.6.2021, 5 K 2380/19, revision allowed).

(2022): Home-related services: Are costs for emergency call systems tax-privileged?

Tax bonus for locksmith services?

The front door clicks shut behind you – and suddenly you're standing outside without a key. You need a locksmith. Unscrupulous companies exploit the emergency situation and demand exorbitant amounts. The question is whether at least the tax office provides some relief. Are these household-related services, which can be deducted directly from the tax liability at 20%, up to a maximum of 4.000 Euro per year (§ 35a para. 2 EStG)?

Currently, the Federal Government, represented by Parliamentary State Secretary Dr Meister, states that expenses for a locksmith to open the front door may be tax-privileged as a household-related service. This "depends on the service provided in the specific individual case. The term 'in the household' is to be interpreted spatially-functionally" (BT-Drucksache 18/11220 of 17.2.2017, question 19). The question was clear and simple, but the answer is unclear and convoluted. It is undisputed that the locksmith's service is provided in the spatial area of the household, which is defined by the property boundaries. And this includes the front door or flat door.

Never pay cash

It would have been more helpful if Dr Meister had pointed out a problem: The tax benefit is only available if an invoice is issued and paid by bank transfer. That's the theory. But in practice, locksmiths usually want immediate payment, preferably in cash. You can consider yourself lucky if the locksmith at least issues a receipt (but the tax office does not accept cash receipts!). It's better to be persistent and insist on a bank transfer. You can also offer the locksmith an immediate transfer via online banking – once you're back in the flat.

(2022): Tax bonus for locksmith services?

Is a shared workspace a sufficient other workplace?

The term shared workspace does not refer to a lifeguard's workplace, but rather one or more desks in the company that are used by several employees on their office days as needed. Increasingly, employees are allowed to work from home on some days and only need to be present in the office on other days.

Alternatively, field staff carry out their work at clients' premises and their administrative tasks in the office. These employees often no longer have their own desk or office in the company. There are usually fewer desks than potential users. This can lead to a scramble for the last available desk. The question is whether employees can claim their home office for tax purposes because "no other workplace" is available to them in the company.

The Federal Fiscal Court has ruled that a shared workspace is generally "another workplace," but only if the employee can "actually use it to the extent and in the manner specifically required." If the use of the shared workspace is restricted, so that the employee has to carry out part of their work in their home office, home office costs up to 1.250 Euro per year can be deducted as business expenses (BFH ruling of 16.9.2015, IX R 19/14, published on 3.2.2016).

It must be checked whether a sufficient number of shared workspaces are available under the actual circumstances. If there is not a separate workspace for each user, it must be clarified whether, for example, official usage schedules or the possibility of private arrangements ensure that the employee can complete all their office work in the company office.

Lohnsteuer kompakt

This ruling is relevant for all employees who, as part of modern office concepts, do not have a fixed workplace in the company and can choose their workspace freely when present. The tax judges sardonically point out in another ruling that "the taxpayer cannot be expected to 'try their luck' at different times of the day in search of a free desk or to compete with colleagues in the morning for the last available workspace" (FG Düsseldorf of 23.4.2013, 10 K 822/12 E).

However, it always depends on the individual case, and there is a recent negative ruling. The Hesse Fiscal Court recently decided that an employee has a workplace available at their employer's premises even if it is only a case of "desk sharing" (ruling of 30.7.2020, 3 K 1220/19).

The case: The claimant was employed as an IT project manager. In his income tax return, he claimed 1,250 Euro for a home office as business expenses. He based this on a concept from his employer. This concept includes the desk-sharing principle, whereby "due to the demand-oriented provision of workspaces, fixed allocation of individual workspaces to specific employees usually does not occur; this requires employees to share workspaces as a rule." The tax office did not recognise the expenses. The judges of the fiscal court agreed with this.

Reasoning: "Another workplace" within the meaning of the Income Tax Act is generally any workplace suitable for carrying out office work. Thus, a room shared with other people can also be another workplace in this sense. This also applies if the workplace in an open-plan office is not individually assigned to the taxpayer. The same applies to a shared workspace. It is not necessary to have access to the other workplace at all times. A shared workspace can therefore be available as another workplace within the meaning of § 4 (5) sentence 1 no. 6 b) sentence 2 EStG if, under the actual circumstances, a sufficient number of shared workspaces, possibly supplemented by employer-organised official usage schedules, ensure that the employee can carry out their work to the required extent there.

(2022): Is a shared workspace a sufficient other workplace?

Sichern Sie sich einfach die volle Steuererstattung, die Ihnen zusteht!

Nur Lohnsteuer kompakt bietet Ihnen:

- Persönliche Steuertipps im Wert von 312 Euro (Durchschnitt)

- Verständliche Eingabehilfen und Erklärungen

- Import aus jeder beliebigen anderen Steuersoftware

- Schnelle Antworten bei Fragen

Jetzt kostenlos testen