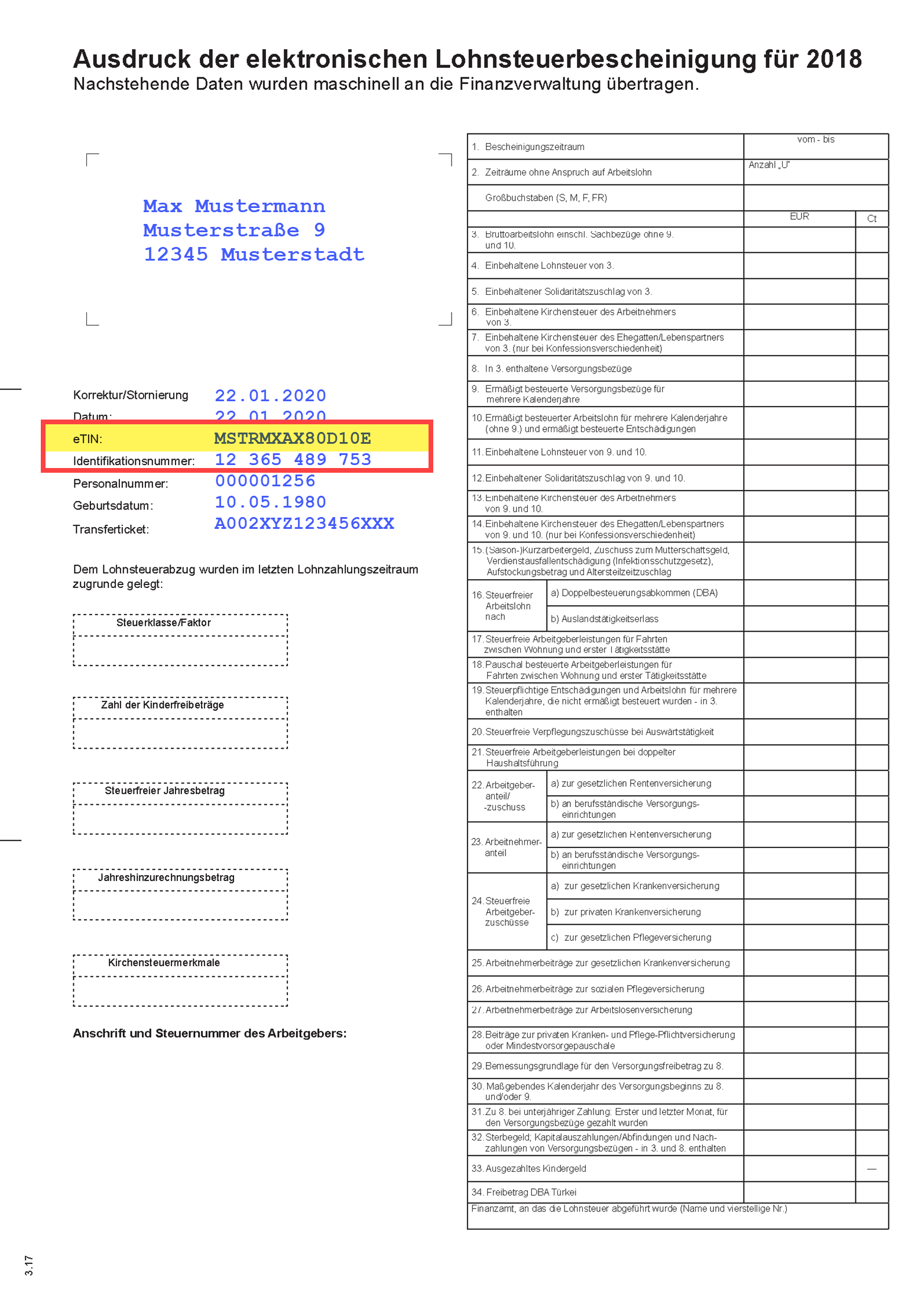

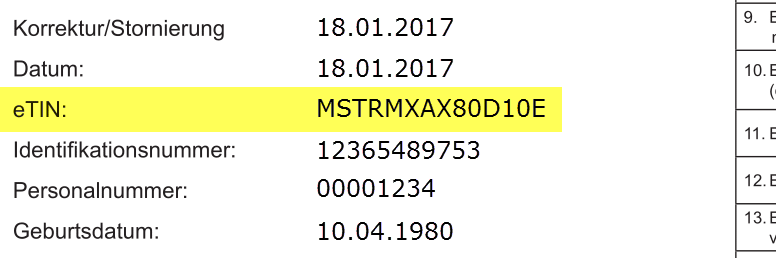

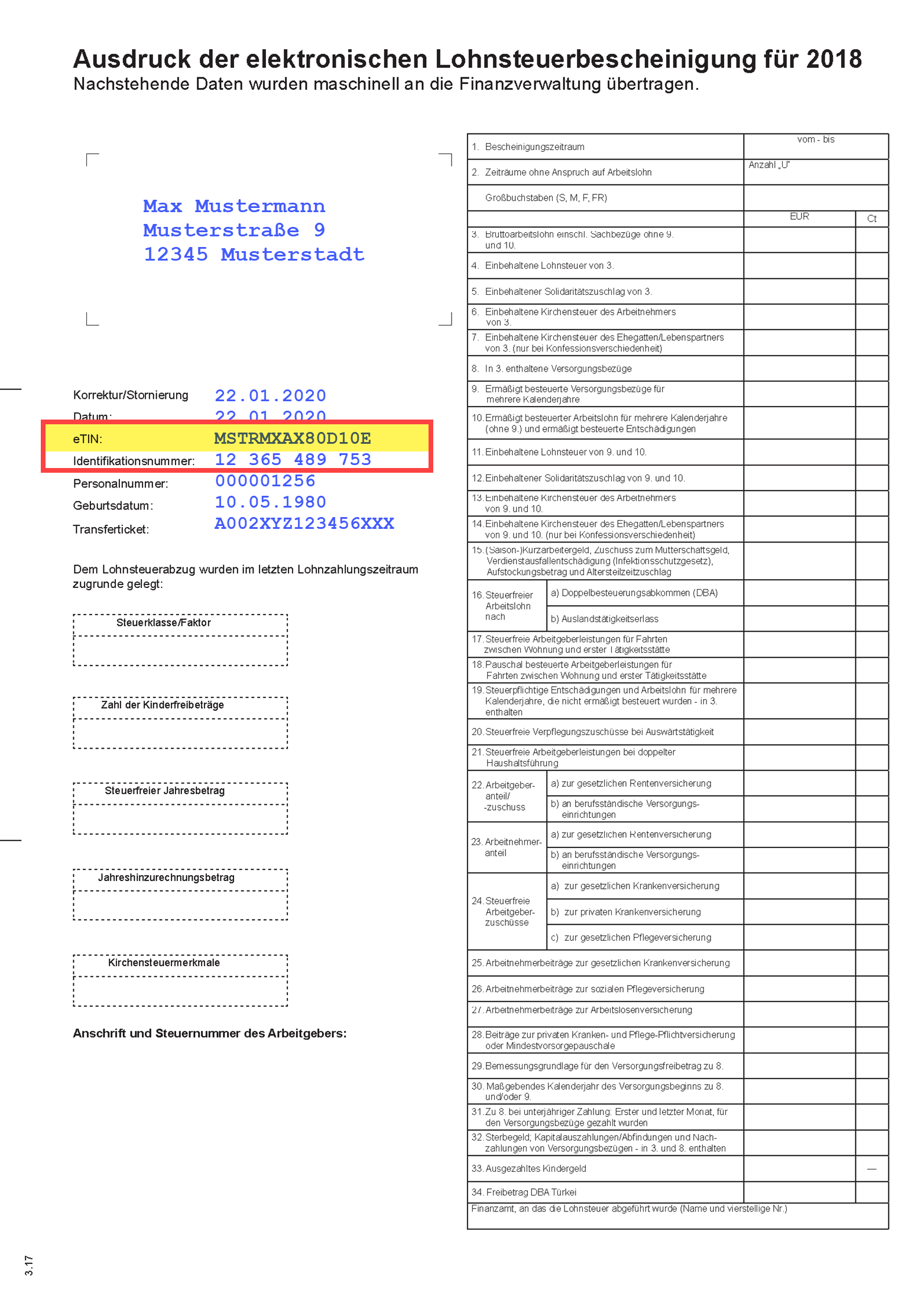

What is the eTIN and where can I find it?

eTIN (electronic Taxpayer Identification Number)

All the information on the income tax statement is reported electronically by the employer to the tax authorities at the end of the year. You receive the income tax statement as proof of this.

Your income tax statement also contains the eTIN, which you must enter in your tax return so that the tax office can assign the data transmitted by the employer to you. The eTIN is increasingly being replaced by the new tax identification number.

(2022): What is the eTIN and where can I find it?

Which tax class applies to whom?

As a taxable employee, you will be assigned to one of six tax classes for the current income tax deduction. The amount of tax deducted mainly depends on your tax class. The tax class depends on your marital status:

Tax class 1

- Single, widowed, divorced, permanently separated couples, and married individuals with a spouse living abroad,

Tax class 2

- Single parents who can claim the single parent allowance,

Tax class 3

- Married individuals whose spouse is either not working or belongs to tax class 5 (provided the spouses live together),

- Widowed in the first year after the death of the spouse (provided the deceased was fully taxable and the spouses lived together).

- Tip: The tax class combination III/V is particularly beneficial if one spouse earns significantly more than the other.

Tax class 4

- Married spouses who live together and are both fully taxable.

Tipp

The tax class choice 4/4 is most favourable for spouses who earn approximately the same amount.

Tax class 5

- Married individuals when the other spouse is in tax class III. (Provided the spouses live together)

Tipp

The tax class combination III/V is particularly beneficial if one spouse earns significantly more than the other.

Tax class 6

- Employees who work for more than one employer.

Since 2010, working couples have had an additional option for tax classes. In addition to the tax class combinations 3/5 and 4/4, there is now also the so-called factor method. With the tax class combination 4-factor/4-factor, allowances are taken into account in the income tax calculation from the outset. This reduces the difference between the income tax paid and the actual tax liability at the end of the year.

Special case: Tax class 0

Employees residing abroad receive the special tax class 0. The wages are then tax-free in Germany due to a double taxation agreement.

(2022): Which tax class applies to whom?

Who receives the inflation adjustment bonus?

If employers grant their employees an inflation bonus (inflation, inflation rate, rate of price increase), this is tax and social security free up to an amount of 3,000 Euro. The condition for tax exemption is that the benefit is granted in addition to the salary already owed. The regulation applies to payments made between 26.10.2022 and 31.12.2024 (§ 3 No. 11c EStG).

Naturally, new regulations often raise questions, such as whether the payment of an inflation bonus is mandatory for employers. And, if it is paid, whether employers must distribute it equally to all employees of the company. The answer to the first question is "No, there is no obligation". The second question was answered by the Parliamentary State Secretary Katja Hessel following an inquiry by Member of Parliament Fritz Güntzler (CDU/CSU) as follows:

"The tax exemption for the inflation bonus decided with § 3 No. 11 EStG does not include a regulation that the bonus must be paid to all employees. It is also a tax allowance that can be paid to employees in instalments within the benefit period" (Bundestag document 20/3987 of 14.10.2022).

Lohnsteuer kompakt

Even though both the basic payment of the inflation bonus and any distribution among employees are at the employer's discretion for tax purposes, different practices may arise from collective or employment law. Employers may not arbitrarily favour certain employees or disadvantage others. If not all employees receive a bonus or if it is paid in varying amounts, there must be objective reasons for the different treatment. Otherwise, the principle of equal treatment applies under employment law.

Lohnsteuer kompakt

Information on the inflation bonus can be found in the official Q&A catalogue of the Federal Ministry of Finance.

(2022): Who receives the inflation adjustment bonus?