What is the care allowance?

Many people care for a relative in need of care, either in their home or in their own home. They are often supported by outpatient care services. This selfless care service deserves the highest recognition. It is also honoured for tax purposes:

- The carer can claim the care allowance (§ 33b para. 6 EStG) and additionally deduct the expenses for the care service as extraordinary expenses, with the tax office applying a reasonable burden (§ 33 EStG).

- Alternatively, the carer can claim all expenses as general extraordinary expenses, subject to a reasonable burden, with proof (§ 33 EStG).

The allowance is

- for care level 2: 600 Euro

- for care level 3: 1.100 Euro

- for care level 4 or 5 or helplessness: 1.800 Euro

Tipp

If the care level is determined, changed or ceases for the first time during the calendar year, the care allowance is to be granted according to the highest level determined in the calendar year. The same applies if the person in need of care is "helpless".

The care allowance is based on the personal care and support of persons in need of care who are classified in care levels 2 to 5 in a home environment. Care includes, for example, assistance with daily activities where the person in need of care requires help.

- Activities in this sense include those in the area of personal hygiene (washing, showering, bathing, dental care, combing, shaving, bowel or bladder evacuation), nutrition (preparing food, eating), mobility (getting up and going to bed independently, dressing and undressing, walking, standing, climbing stairs, leaving and returning to the home) and household management (shopping, cooking, cleaning the home, washing up, changing and washing laundry and clothing, heating).

- Supportive or instructive services are also included. As the regulation focuses on personal care, personal care and support in the home of the person in need of care also leads to tax relief.

- The allowance does not exclude the possibility of claiming higher expenses as extraordinary expenses under § 33 EStG with individual proof.

- For the first time, care allowances are also introduced for care levels 2 and 3, without the criterion of "helplessness" being relevant. However, it cannot be ruled out that the legal requirements for "helplessness" may also generally apply to care levels 2 and 3.

- If the person in need of care meets the requirements for "helplessness", there is an entitlement to the highest allowance. However, another allowance cannot be claimed in addition.

- A condition for the granting of the care allowance is the provision of the tax identification number of the person in need of care in the carer's income tax return. This is to ensure that the allowance cannot be claimed in full more than once for the care of the same person in need of care.

- If a person in need of care is cared for by several carers, the care allowance is divided according to the number of carers.

- A condition for the granting of the care allowance is that the carer does not receive any income for their care. Income is generally any payments received by the carer as a result of the care, whether as care remuneration or as reimbursement for the carer's own expenses. BUT: In the case of parents of a disabled child, the care allowance received by the parents for the care of the child is not considered income.

(2022): What is the care allowance?

How can I claim additional care costs?

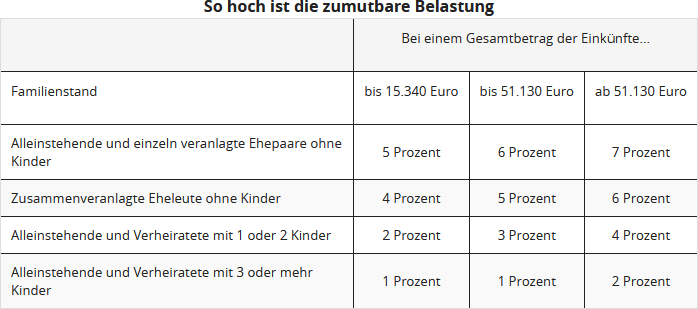

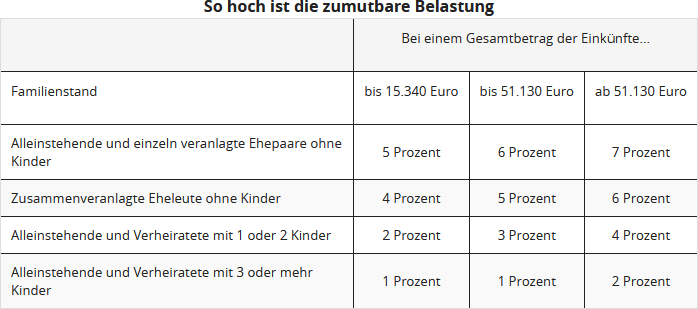

Costs for a carer or costs related to illness and disability can be claimed as general extraordinary expenses instead of taking the care allowance. Here, the deduction is not limited to the care allowance but is possible in unlimited amounts, although the tax office will apply a reasonable burden. The reasonable burden depends on your income, marital status, and the number of children you have, and amounts to one to seven percent of your total income.

Tip

You can also claim care services as household-related services. This way, you can receive a tax reduction of 20 percent of your costs, up to a maximum of 4.000 Euro, if you pay for a carer for yourself or a relative, or if an outpatient care service assists with the care.

(2022): How can I claim additional care costs?

Should I declare the actual costs or use the care allowance?

If you provide unpaid care for a person in need, you can claim the care allowance. The care allowance is

- for care level 2: 600 Euro

- for care level 3: 1.100 Euro

- for care level 4 or 5 or helplessness: 1.800 Euro.

If you do not have higher expenses than a maximum of 1.800 Euro, this is also the best solution for you.

It is different if you have higher expenses, need to co-finance an additional carer or accommodation in a care home. In that case, it is more worthwhile to forgo the care allowance (also the disability allowance) and claim the actual expenses as extraordinary burdens.

These costs are then shown in the "Extraordinary Burdens" section as care costs (expenses due to care needs, expenses for caring for a relative or for accommodation in a care home).

Example

If you have an income of 30.000 Euro per year, your reasonable burden as a married couple with one child is 746 Euro. If your expenses exceed this amount, it is worthwhile to declare them.

This can include various expenses such as food, laundry, cleaning or rent.

In your tax return, you can enter the actual expenses. However, these are not recognised in full. This is because your reasonable personal burden is deducted from this. This depends on your income, marital status and the number of your children and is calculated by the tax office. The reasonable personal burden is one to seven percent of the total income.

Tip

If your expenses are below the reasonable personal burden, it is not worthwhile to declare the costs in the tax return. If you are still above the maximum amount after deducting the personal burden, declare your care expenses as they actually occurred. However, you must then be able to prove the individual expenses. The care allowance can be claimed without individual proof.

(2022): Should I declare the actual costs or use the care allowance?

Which new care levels correspond to the condition of being helpless?

Disabled individuals are entitled to a disability allowance, which varies according to the degree of disability. In cases of helplessness (mark "H") and blindness (mark "Bl"), the disability allowance is 7,400 Euro from 2021, regardless of the degree of disability (until 2020: 3,700 Euro; § 33b EStG).

Until 2016, the classification as a person in need of severe care in care level III according to the decision of the care fund was equivalent to the mark "H" (§ 65 Abs. 2 EStDV).

Carers who look after a person in need of care at home are entitled to the carer's allowance. From 2021, the carer's allowance for home care will be doubled for care level 4 or 5, and a new allowance will be introduced for care levels 2 and 3. The allowance amounts to

- for care level 2: 600 Euro

- for care level 3: 1.100 Euro

- for care level 4 or 5 or helplessness: 1.800 Euro

Since 2017, the assessment of care needs has been significantly more differentiated into five care levels instead of the previous three care levels. The focus is on the actual support needs, measured by the degree of independence, regardless of whether someone has a mental or physical impairment. Physical, mental, and psychological impairments are recorded and included in the assessment of care needs.

All individuals in need of care who have previously received benefits from the care insurance have been transferred to the new system without a new assessment since 1 January 2017. They do not need to apply for classification into a new care level. Previously, for tax purposes, care level III was equivalent to the mark "H" (helpless) in the severely disabled pass.

Since 2017, the classification into care levels 4 and 5 is equivalent to the mark "H". If the person in need of care has care level 4 or 5,

- the person in need of care receives the increased disability allowance of 7.400 Euro and

- the carer receives the carer's allowance for home care (BMF letter of 19.08.2016).

The new care level 4 applies to the previous care level III and the previous care level II with significantly reduced everyday competence. The new care level 5 applies to the previous care level III with significantly reduced everyday competence and the hardship cases of care level III.

(2022): Which new care levels correspond to the condition of being helpless?

What is the difference between requiring care and being helpless?

Tax law distinguishes between "in need of care" and "helpless":

a) In need of care

Persons are considered in need of care if they "require significant or greater assistance for ordinary and regularly recurring activities in daily life due to a physical, mental, or emotional illness or disability, on a long-term basis, expected to last at least six months" (§ 14 SGB XI).

The following persons are considered in need of care:

- Persons classified in one of the three care levels (until 2016) or one of the five care grades (from 2017) according to the Care Insurance Act §§ 14, 15 SGB XI.

- Persons with a significant impairment of everyday competence, so-called dementia patients (according to § 45a SGB XI).

- Persons with a severely disabled pass with the mark "H" or "Bl".

- Other persons receiving outpatient care with care costs invoiced separately by a recognised care service.

- Persons in a retirement or nursing home for whom care services of care rate level 0 are invoiced separately (BFH ruling of 10.5.2007, BStBl. 2007 II p. 764).

Proof is provided by the notice from the social care insurance fund or a private insurance company, the notice from the pension office or a comparable authority with the relevant determinations, or the severely disabled pass with the mark "H" or "Bl".

Lohnsteuer kompakt

The reasons for the need for care are irrelevant. It does not matter whether it is due to an accident, illness, disability, or simply age-related.

b) Helplessness

Helpless are "persons who permanently require external help for a number of frequently and regularly recurring activities to secure their personal existence in the course of each day" (§ 33b para. 6 EStG).

Helpless persons possess a severely disabled pass with the mark "H" (helpless) or "Bl" (blind). The mark "H" was equivalent to care level III until 2016. Proof is provided by the severely disabled pass with the marks "H" or "Bl" and the notice from the pension office with the relevant determination or the notice from the social care insurance fund or the insurance company (§ 65 para. 2 EStDV).

Since 2017, the classification of care needs has been much more differentiated into five care grades instead of the previous three care levels. The focus is on the actual support needs, measured by the degree of independence, regardless of whether someone has a mental or physical impairment. Physical, mental, and psychological impairments are recorded and included in the assessment of care needs (§ 14 SGB XI).

All persons previously receiving care insurance benefits are transferred to the new system from 1.1.2017 without a new assessment. They do not need to apply for classification into a new care grade.

Since 2017, the classification into care grades 4 and 5 is equivalent to the mark "H". Persons with care grade 4 or 5 are entitled to the increased disability allowance of 7.400 Euro (BMF letter of 19.8.2016, IV C 8-S 2286/07/10004).

Note: The new care grade 4 applies to the previous care level III and care level II with significantly impaired everyday competence. The new care grade 5 applies to the previous care level III with significantly impaired everyday competence and the hardship cases of care level III.

Conclusion: Persons in care level III (until 2016) or from 2017 with care grade 4 or 5 are both "in need of care" and "helpless". Persons in care levels I and II or with care grades 1 to 3 are only "in need of care", not "helpless".

- Expenses due to care needs in care level I, II or 0 are deductible as general extraordinary expenses under § 33 EStG, insofar as they exceed the care allowance received from statutory or private care insurance. The expenses must be proven and are reduced by the reasonable burden by the tax office. In this case, the carer cannot receive the care allowance under § 33b para. 6 EStG.

- Expenses due to helplessness or care needs in care level III are also deductible as general extraordinary expenses under § 33 EStG, insofar as they exceed the care allowance received. Instead, the increased disability allowance of 7.400 Euro can be claimed. The carer can receive the care allowance under § 33b para. 6 EStG if they do not receive any income for the care.

(2022): What is the difference between requiring care and being helpless?

What applies to people with dementia?

Dementia is the most common and consequential psychiatric illness in old age. It is estimated that over 1.1 million people in Germany currently suffer from moderate to severe dementia, about two-thirds of them from Alzheimer's disease. Approximately 11,000 people are newly diagnosed each year. As a cure for dementia is not yet possible, the focus of care for these individuals is on support and nursing.

About 60 per cent of all people with dementia are cared for at home by their relatives. Families are often supported by outpatient nursing services. However, family and outpatient care are often overwhelmed, as caring for people with dementia involves special challenges. It requires a great deal of time, attention, and energy.

The diagnosis of dementia is by far the most common reason for admission to a care home. Well over half of the people living in nursing homes suffer from dementia.

Lohnsteuer kompakt

The reasons for the need for care do not matter. It is irrelevant whether this is due to an accident, illness, or disability, or simply age-related.

(2022): What applies to people with dementia?

Who can apply for the nursing care allowance?

Entitlement to a care allowance is granted to those who care for a person in need of care in their own home or the home of the person in need of care.

The allowance amounts to

- for care level 2: 600 Euro

- for care level 3: 1.100 Euro

- for care level 4 or 5 or helplessness: 1.800 Euro

The care allowance is intended to compensate you for burdens that are often difficult to prove. For this reason, you can receive the care allowance without proof, provided the conditions are demonstrably met. It is important that you care for the person in need of care in their home or your own home. The person must be a relative, such as a spouse, children, parents, parents-in-law, fiancé(e) or foster children.

It is also recognised if you care for a partner or registered partner. A personal relationship may also exist with other people to whom you are not related, such as friends or neighbours.

Example

You care for your father, who is in need of care (care level 4 or 5), together with your mother. You and your mother are each entitled to a care allowance of 900 Euro. Unfortunately, this also applies if your mother does not file a tax return and therefore cannot use this allowance to reduce her tax.

If you share the care of the helpless person with someone else, the care allowance is divided equally between you. It does not matter who does most of the care work or whether both carers actually claim the allowance in their tax returns. If there are two carers, each receives half of the allowance.

Tip

If, in addition to providing care, you also provide financial support to the person in need, you can claim a tax reduction of up to 10.347 Euro for maintenance in 2022 under extraordinary burdens. However, this is only possible if no one is entitled to child benefit or the child allowance for the person you are caring for. This amount is not an allowance, but a maximum amount. Maintenance payments generally have to be proven, but this is not necessary if the person being supported lives in your household.

(2022): Who can apply for the nursing care allowance?

What special features apply to care and support services?

Household-related services also include home care and support for individuals in need of care by mobile care services or self-employed carers, either in the household of the carer or the person in need of care.

Such care and support services can be deducted as household-related services up to 20.000 Euro with 20 percent, a maximum of 4.000 Euro per year, from the tax liability.

Unlike before 2008, proof of care needs and a distinction between care levels or grades are not required. It is sufficient if services for basic care, i.e. direct personal care (body care, nutrition, and mobility) or support, are used.

Note

In 2019, the Federal Fiscal Court unfortunately ruled against the generous stance of the tax authorities, deciding that the tax reduction according to § 35a EStG is only granted for expenses incurred by a taxpayer for their own accommodation in a home or for their own care. However, the tax benefit is excluded for expenses incurred for another person, i.e. if children cover the costs for their parents (BFH ruling of 3.4.2019, VI R 19/17).

A few months after the BFH ruling, the Berlin-Brandenburg Fiscal Court also dealt with the assumption of care costs for a parent. However, this time it was not about covering the costs for residential care, i.e. accommodation in a home, but about covering the costs for outpatient care. The FG decided as follows: § 35a EStG favours - if at all - only expenses for outpatient care of relatives in the taxpayer's own household (i.e. the carer's), not for outpatient care of relatives in their household (BFH ruling of 11.12.2019, 3 K 3210/19). However, a revision was explicitly allowed at that time. And now the positive BFH ruling is available.

Currently, the Federal Fiscal Court has ruled as follows: The tax reduction according to § 35a para. 2 sentence 2 first half-sentence EStG can also be claimed by taxpayers who incur expenses for the outpatient care and support of a third party. Consequently, children can deduct the costs for outpatient care of their parents if they have borne the costs. This also applies if the care and support services are not provided in the taxpayer's own household but in the household of the person being cared for or supported (BFH ruling of 12.4.2022, VI R 2/20).

However, the BFH also adds a complication, as it upholds its aforementioned ruling from 2019. It distinguishes between covering the costs for residential care (= still not deductible) and covering the costs for outpatient care (= deductible), where in the second case it depends on who signed the care contract. Only if the payer, usually a daughter or son, is contractually obliged, i.e. pays off their own debt, are the costs deductible. If, on the other hand, payment is made on the debt of the person being cared for, i.e. father or mother, because they signed the care contract, it is a tax-irrelevant third-party expense.

(2022): What special features apply to care and support services?

Sichern Sie sich einfach die volle Steuererstattung, die Ihnen zusteht!

Nur Lohnsteuer kompakt bietet Ihnen:

- Persönliche Steuertipps im Wert von 312 Euro (Durchschnitt)

- Verständliche Eingabehilfen und Erklärungen

- Import aus jeder beliebigen anderen Steuersoftware

- Schnelle Antworten bei Fragen

Jetzt kostenlos testen