Claim tax relief for VDU glasses?

As we age, a "normal" pair of glasses with distance and near vision sections becomes unsuitable for computer work, as the intermediate distance to the screen is not adequately covered. For this, there are special work glasses with two different dioptres, where the upper part considers the distance to the screen and the lower part the distance to the keyboard. Since these glasses do not include a distance vision section, they are not suitable as everyday glasses. The question is whether the costs of computer glasses can be deducted as work-related expenses.

- Unfortunately, no. The Federal Fiscal Court has ruled that computer work glasses are not work equipment, but a medical aid. Since the glasses are used to correct visual impairment and thus remedy a physical defect, the costs are considered part of private life and are therefore not tax-deductible. This applies even if the remedy of the defect is also in the professional interest. The costs cannot be deducted as work-related expenses even if the glasses are worn exclusively at the workplace. It also does not matter that the glasses are "not suitable as ordinary corrective glasses" according to a medical certificate (BFH ruling of 20.7.2005, VI R 50/03).

- The costs for computer work glasses can be deducted as work-related expenses if the visual impairment is due to a typical occupational disease or a work accident. Otherwise, the costs for the glasses can always be deducted as extraordinary expenses according to § 33 EStG - however, subject to the deductible burden.

However, for employees who regularly work on a PC and need special computer work glasses, the employer must cover the costs due to occupational health and safety regulations. This is stipulated in § 6 of the Screen Work Regulation and § 3 para. 3 of the Occupational Health and Safety Act. For the employer, the costs are deductible as business expenses, and for the employee, there is no taxable benefit in kind (R 19.3 para. 2 no. 2 LStR).

Lohnsteuer kompakt

If the employer covers the costs, the tax authorities have set a hurdle: the deduction of business expenses by the employer and the tax exemption for the employee are only to be granted if the necessity of the visual aid is certified by an ophthalmologist and this medical prescription is issued before the purchase of the glasses.

Reason: Only an ophthalmologist is considered a "qualified person" according to § 6 para. 1 of the Screen Work Regulation, not an optician. This means that there is no legal obligation for the employer to cover the costs of special visual aids if only an optician certifies the necessity (SenFin. Berlin of 28.9.2009, III B-S 2332-10/2008).

Recently, the Federal Ministry of Finance announced that the provision or subsidy for computer work glasses is not tax and social security-free according to § 3 no. 34 EStG if the conditions of R 19.3 para. 2 no. 2 Income Tax Guidelines are not met (BMF letter of 20.4.2021, BStBl 2021 I p. 700, para. 34). The tax exemption in § 3 no. 34 EStG only applies to behavioural prevention services (prevention courses certified by health insurance companies) and occupational health promotion services provided by employers that meet the requirements of § 20b and the GKV Prevention Guide in terms of purpose, target orientation, and quality. Since the guide does not include entitlements to computer glasses, the tax exemption under § 3 no. 34 EStG is also excluded.

However, regardless of § 3 no. 34 EStG, employer services for occupational health promotion are fully tax and social security-free if they are provided in the employer's predominant interest. This includes "computer work glasses on medical prescription to ensure sufficient vision in the distance ranges of the computer workstation. If there is no medical prescription, § 3 no. 34 EStG does not apply" (BMF letter of 20.4.2021, BStBl 2021 I p. 700, para. 37).

Conclusion: An employer's subsidy can remain tax-free if the condition "medical prescription" is met.

(2022): Claim tax relief for VDU glasses?

Which costs can I deduct?

When purchasing new work-related items, you can deduct not only the pure purchase costs but also the following expenses:

- VAT,

- postage and packaging costs, and

- travel expenses (trips to purchase and to gather information before purchasing).

Immediate depreciation: If the purchase costs do not exceed the limit of 800 Euro (excluding VAT) or 952 Euro (including 19% VAT), you can deduct your expenses in full as business expenses in the year of purchase.

Depreciation for wear and tear (AfA): If the purchase costs exceed 800 Euro (excluding VAT) or 952 Euro (including 19% VAT), you must spread the costs over the expected useful life. You can then only claim the annual depreciation (AfA) as business expenses. Please note that you must specify the depreciation to the exact month in the year of purchase. The delivery date is decisive.

Examples of periods over which a work-related item is depreciated:

- Office furniture: 13 years

- Typewriter: 9 years

- Telephone system: 8 years

- Fax machines: 6 years

- Car: 6 years

- Shredder: 8 years

The depreciation period is specified in the so-called AfA tables of the Federal Ministry of Finance.

If you purchase several items, the 800 Euro limit applies to each item individually if it can be used independently.

Tip

If you cannot provide proof for the purchase of certain work-related items, you can hope for the non-objection limit of 110 Euro. Up to this amount, the tax office generally waives the requirement to present receipts. In this case, however, you should still specify the work-related items with the purchase prices. However, you have no legal claim to this!

By the way, you can not only deduct work-related items that you have purchased new from your taxes. You can also claim the purchase of used items as business expenses. However, you must also provide proof of purchase here, especially if you bought the item from a private individual, a receipt is sufficient as proof. The 800 Euro limit also applies to the purchase of used items.

You can also deduct items that have been gifted to you or that you have inherited if you use them for work purposes. From this point on, you can deduct the amount that the donor or testator could have deducted if they had used the item for work purposes. The decisive factor is the residual value of the item at the time of work-related use.

Lohnsteuer kompakt

Current: Since 1 January 2021, there has been a particularly advantageous new regulation for all types of computers and software: The Federal Ministry of Finance has very generously stipulated that the normal useful life is generally one year.

This means: The purchase costs of computers and software can now always be deducted in full as business expenses or operating costs in the year of purchase, regardless of the amount (BMF letter of 26 February 2021, IV C 3-S 2190/21/10002:013).

(2022): Which costs can I deduct?

Is there a standard allowance for additional work-related items?

Many tax offices accept an allowance for additional work-related items. This allowance is a tolerance limit, meaning the expenses do not need to be proven with individual receipts. However, there is no legal entitlement to an allowance for work-related items. The tax officer can always remove expenses for work-related items without proof.

Most tax offices do not require receipts if you claim work-related items as business expenses up to an amount of 110 Euro. However, you have no legal entitlement to this "allowance".

(2022): Is there a standard allowance for additional work-related items?

How can I depreciate work-related items?

If you spend more than 800 Euro (excluding VAT) or 952 Euro (including 19% VAT) on a work-related item, you must spread the costs over the expected useful life, i.e. depreciate them. Each year, you can then only claim the respective depreciation (AfA) as income-related expenses. Employees use straight-line depreciation for this. The depreciation period is set out in the so-called AfA tables of the Federal Ministry of Finance.

Depreciation periods for various work-related items:

- Mobile devices: 5 years

- Photo, film, video, and audio equipment: 7 years

- Typewriters: 9 years

- Office furniture: 13 years

- Safes: 23 years

- Cars: 6 years

For the year in which you purchased the work-related item, the calculated AfA amount can only be deducted on a monthly basis. One twelfth for each month.

Lohnsteuer kompakt

Current: Since 1 January 2021, there has been a particularly advantageous new regulation for all types of computers and software: The Federal Ministry of Finance has very generously stipulated that the normal useful life is generally one year. This means that the purchase costs of computers and software can now always be fully deducted as income-related expenses or business expenses in the year of purchase, regardless of the amount (BMF letter of 26 February 2021, IV C 3-S 2190/21/10002:013).

(2022): How can I depreciate work-related items?

How can I claim work clothing as work-related items?

You can deduct expenses for work clothing from your taxes. However, you must note that not all clothing worn during your job is considered work clothing. If the clothing can also be worn outside of work, it is not considered work clothing for tax purposes. If private use of the clothing is possible (as with everyday clothing), you cannot deduct the expenses as work-related costs.

Work clothing must be typical workwear that is designed and necessary for professional use due to its nature and characteristics.

The following work clothing is recognised:

- Protective clothing of any kind (e.g. work coats, lab coats, work shoes, work boots, safety shoes),

- Uniforms and service clothing with service badges,

- Official attire (judges, prosecutors, lawyers, clergy)

- Sportswear for sports teachers

- Colour-coded suits and costumes for airline employees,

- White work clothing for doctors,

You can deduct the actual proven purchase costs for tax purposes. If the conditions for the deductibility of work clothing are met, you can also claim the cleaning costs.

Black suits and other service clothing

In previous rulings, the Federal Fiscal Court has recognised the following civilian clothing as work clothing: black suit for an undertaker (BFH ruling of 30.9.1970, I R 33/69), black suit and black trousers for a head waiter (BFH ruling of 9.3.1979, VI R 171/77), black suit for a Catholic clergyman (BFH ruling of 10.11.1989, VI R 159/86). Currently,

the Federal Fiscal Court has changed its previous legal opinion and no longer recognises a black suit for a funeral orator as work clothing. The ruling will also affect other professional groups. A black suit that does not differ in any way from what a large part of the population wears as formal clothing on special occasions is not typical work clothing. The clothing can be used at any time for private formal occasions. This applies to all professions, including certain professional groups such as funeral orators, undertakers, Catholic clergy, and head waiters (BFH ruling of 16.3.2022, VIII R 33/18).

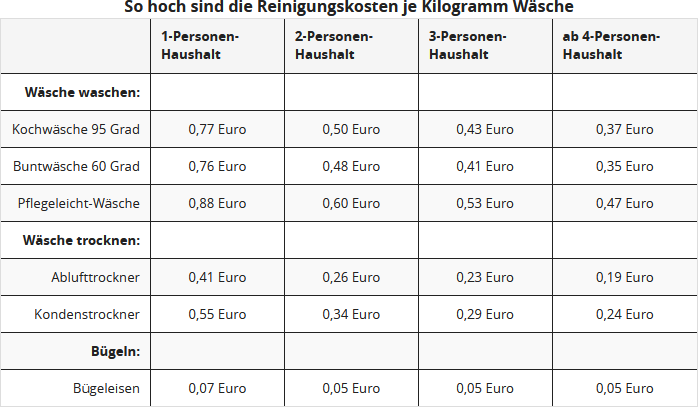

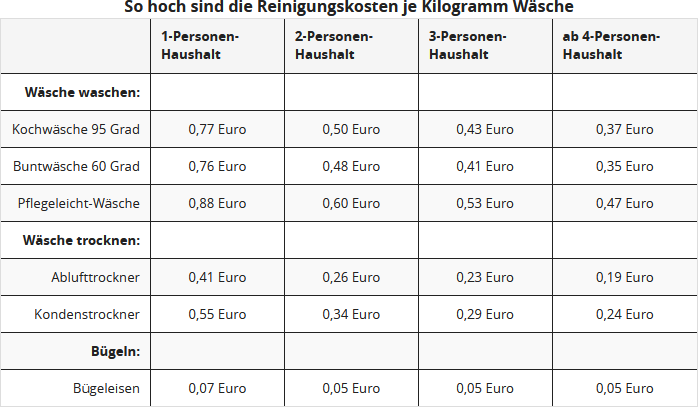

If you wash your work clothing yourself, you can estimate the costs. For the cleaning of work clothing, the tax authorities and the courts recognise the use of consumer association experience values (ruling of the Baden-Württemberg Finance Court, 3 K 202/04). The Consumer Associations Working Group e.V., Bonn, has determined the costs for a wash cycle based on one kg of laundry (as of Dec 2002):

To calculate the proportional annual costs for the care of "typical work clothing" from the table, multiply the above amounts (Euro/kg) in the respective treatment type by the annual amount (kg) of typical work clothing to be cleaned. Example: As a single person, with 40 wash cycles per year, each with 3 kg of boil wash at 0.77 Euro and 2 kg of easy-care wash at 0.88 Euro, you come to a total of 163 Euro deductible cleaning costs (92.40 Euro plus 70.40 Euro).

Important: The average calculation includes the purchase price of the washing machine, a maintenance allowance, and operating costs such as electricity, water, and detergent. According to the BFH, an annual flat rate for cleaning costs is not permitted.

(2022): How can I claim work clothing as work-related items?

How can I claim a computer as a tax deduction?

If you use your computer for both private and professional purposes, you can claim a portion of the costs as business expenses for tax purposes. The ten per cent rule does not apply to computers, which states that an item is only recognised as a work-related item if it is used at least 90 per cent for work purposes. The amount you can deduct for the computer depends on the actual usage time for professional and private purposes.

Beispiel

You use your computer for six hours a week for work and four hours for private purposes. Then 60 per cent of the expenses for your computer and peripherals are deductible.

If you can credibly demonstrate that the computer is used almost exclusively for work (at least 90 per cent), you can claim the full costs. If proof is difficult or impossible, the proportion of work-related use is estimated at 50 per cent, meaning you can deduct half of the costs. A computer is used privately if you handle private correspondence, online banking, or gaming on it. Examples of work-related use include completing work tasks at home (including research tasks), acquiring necessary basic IT knowledge, training, or writing job applications.

For the initial purchase, you must combine all computer components required for the operation of the PC and depreciate them together over the usage period if the purchase costs exceed 800 Euro (excluding VAT) or 952 Euro (including 19 per cent VAT). Computer, monitor, keyboard, and mouse constitute a single, independently usable asset "computer". The depreciation period for computers, notebooks, and peripherals is three years. An exception is devices that can also be used independently, such as all-in-one devices that are simultaneously printers, faxes, copiers, and scanners. If the purchase price is below the 800 Euro limit, you can deduct the entire cost immediately.

Work-related application programs and system software with purchase costs of up to 800 Euro (excluding VAT) can be fully deducted as business expenses immediately. If a program is more expensive, you must spread the purchase costs over the years of expected use, i.e., "depreciate" them. The usage and depreciation period is three years. Pay particular attention when purchasing work-related software that it can be deducted as business expenses even if the computer is not recognised. If you purchase additional computer components at a later date, you must add the costs to the remaining value of the PC and distribute the sum over the remaining useful life. If your computer has already been depreciated, you should fully deduct the costs if the purchase price does not exceed 800 Euro net. Otherwise, you can also depreciate the devices or software separately. If you replace existing components with new ones, you can deduct the purchase costs as maintenance expenses in full and regardless of the purchase price in the year of purchase.

Tipp

In addition to computers, software, and peripherals, expenses for computer accessories such as printer paper, toner cartridges, printer cartridges, CD/DVD blanks, USB sticks, cables, or batteries are also deductible.

The depreciation period is specified in the so-called AfA tables of the Federal Ministry of Finance.

Lohnsteuer kompakt

Current: Since 1 January 2021, there has been a particularly advantageous new regulation for all types of computers and software: The Federal Ministry of Finance has very generously stipulated that the normal service life is generally one year. This means that the purchase costs of computers and software can now always be fully deducted as business expenses or operating costs in the year of purchase, regardless of the amount (BMF letter of 26 February 2021, IV C 3-S 2190/21/10002:013).

(2022): How can I claim a computer as a tax deduction?

When can I claim professional literature?

If you use professional literature for your work, you can deduct the expenses for books, journals, and newspapers. Professional books with a clear title indicating their professional use are readily accepted.

For general educational books, proving professional use is more difficult. However, you should know that a rejection by the tax office with the reason that it is not a professional book is not sufficient. The actual use of the book is paramount. You must prove to the tax officer that you use the book professionally. You can also deduct magazines as professional literature (professional magazine, professional journals) if they are professional journals that provide work-related information.

The deductibility of magazines is complicated by the fact that many magazines cover a wide range of topics and do not exclusively provide work-related information. In such cases, the magazines are not recognised. A similar issue arises with the deductibility of newspapers.

You cannot deduct typical daily newspapers due to their broad range of topics. However, non-typical daily newspapers, such as the Handelsblatt, can be deducted if you can prove predominantly professional use. Of course, you must also provide evidence of the expenses for professional literature. If you have not collected the relevant receipts, you can enter the amount of 110 Euro without proof.

However, this is not an allowance to which you are legally entitled, but merely a non-objection limit. Up to this amount, tax officers are supposed to waive receipts. The non-objection limit applies to work-related items in general. So, if you have already used the 110 Euro for work clothing, proof of expenses for professional literature is required.

(2022): When can I claim professional literature?

What work-related items can I deduct?

As work-related items, you can deduct objects from tax that you use almost exclusively for professional purposes or, if you are self-employed, for business purposes. You can claim the costs as income-related expenses or business expenses. Not all work-related items are always recognised by the tax office. The more specialised an item is, the higher the chance it will be recognised.

Whether you can deduct an item from tax depends on your profession and the item itself. The condition that you use an item almost exclusively for professional purposes is met if you use it for at least 90% for professional purposes. In this case, you can deduct the item in full as income-related expenses.

Until 2009, the all-or-nothing principle generally applied: either the costs were fully recognised or not at all. It was not permissible to allocate costs according to their use for professional purposes - e.g. 70%. However, the Federal Fiscal Court overturned the prohibition on allocation and deduction under § 12 No. 1 EStG in September 2009. The Grand Senate of the BFH came to the conclusion, after closer examination, that it had been mistaken for about 30 years and that the prohibition on allocation and deduction could not be derived from the law (§ 12 No. 1 EStG).

This means that today, in many cases, cost allocation of expenses is possible, which was previously refused with this - incorrect - argument. Costs can be allocated according to objective criteria if the professional usage shares are established and are not of minor importance (BFH ruling of 21.9.2009, GrS 1/06, BStBl. 2010 II p. 672).

The following items (examples) can be deducted as income-related expenses depending on the occupational group:

- Typical work clothing

- Computer and software

- Specialist literature (trade magazine, trade magazines, professional journal, professional journals)

- Desk and office chair

- Filing cabinet

- Briefcase

- Photocopier

- Calculator

- Tools

- Telephone, fax, mobile phone costs

- Office supplies (stationery, pens, paper, files, etc.)

If you pay no more than 800 Euro (net) or 952 Euro (incl. 19% VAT) for a work-related item, you can deduct the entire cost in the year of payment as income-related expenses. However, the item must be independently usable. This is not the case, for example, with a monitor, printer, or scanner. These can only be used together with a computer. If you spend more on an item, you must spread the costs over the expected useful life.

Lohnsteuer kompakt

Current: Since 1.1.2021, there has been a particularly advantageous new regulation for all types of computers and software: The Federal Ministry of Finance has very generously stipulated that the normal business use is generally one year. This means that the purchase costs of computers and software can now always be fully deducted as income-related expenses or business expenses in the year of purchase, regardless of the amount (BMF letter of 26.2.2021, IV C 3-S 2190/21/10002:013).

(2022): What work-related items can I deduct?

Can I claim wear and tear on "normal" clothing for tax purposes?

Expenses for "normal" clothing are not deductible as income-related expenses if this clothing is subject to normal dirt and wear during work.

However, if the dirt, damage, or premature wear is due to a specific professional or business incident, the costs for cleaning, repair, or replacement are deductible as income-related expenses (BFH ruling of 24.7.1981, BStBl. 1981 II p. 781; FG Thuringia of 4.11.1999, EFG 2000 p. 211).

When replacing an item of clothing, the residual value of the damaged item is deductible.

(2022): Can I claim wear and tear on "normal" clothing for tax purposes?

What is the non-assessment limit?

Many tax officials may deny their existence. And taxpayers cannot rely on benefiting from them, as there is no legal entitlement to the non-invocation limit.

Non-invocation limits are amounts – usually small sums – in the tax return that tax officials generally do not scrutinise closely and accept without evidence.

Here are some examples:

- Working days for travel allowance: For a 5-day week, you can state 230 working days per year and for a 6-day week, 280 days.

- Work-related items: You can usually claim costs up to 110 Euro for the purchase and maintenance of work-related items (purchase and cleaning of work clothing) in your tax return without receipts.

Note

Journeys to work, specifically to the primary workplace, are deductible with the commuter allowance. In principle, every employee is required to state the exact number of days they actually travelled to work in their tax return (Form N), as the allowance is only granted for these days. To check whether the number of working days declared is plausible, holiday and sick days must also be declared. Since 2020, business travel days and home working days have also been queried in Form N.

However, it can be very tedious to determine the exact number of working days. Who keeps a daily tally? And then there are employees who also visit the workplace at weekends, sometimes unexpectedly. Therefore, the tax offices established so-called non-invocation limits decades ago. They generally accepted 220 to 230 journeys for a five-day week and 260 to 280 journeys for a six-day week between home and workplace. It should be noted that these are internal limits of the tax offices, and there is no legal entitlement to their application, even though the Munich Tax Court ruled a few years ago that the tax offices should accept 230 days (FG Munich of 12.12.2008, 13 K 4371/07).

So far, so good. But Covid has changed everything. Countless employees were and still are working from home and do not travel to the office or workplace daily. They can claim a flat rate of 5 Euro per day as business expenses for these days or even the costs for a home office. However, due to the lack of journeys, they may not claim travel expenses.

And this is precisely where the tax offices are increasingly intervening, demanding a certificate from the employer stating the actual working days and, above all, the days on which the primary workplace was visited. The rule that 220 or 230 journeys per year are accepted no longer applies automatically!

(2022): What is the non-assessment limit?